Global Automotive Logistics Market Size, Share, Growth Analysis By Activity (Warehousing, Transportation (Roadways, Airways, Maritime, Railways)), By Type (Finished Vehicle, Automobile Parts), By Distribution (Domestic, International), By Logistic Solution (Inbound, Outbound, Reverse, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143056

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

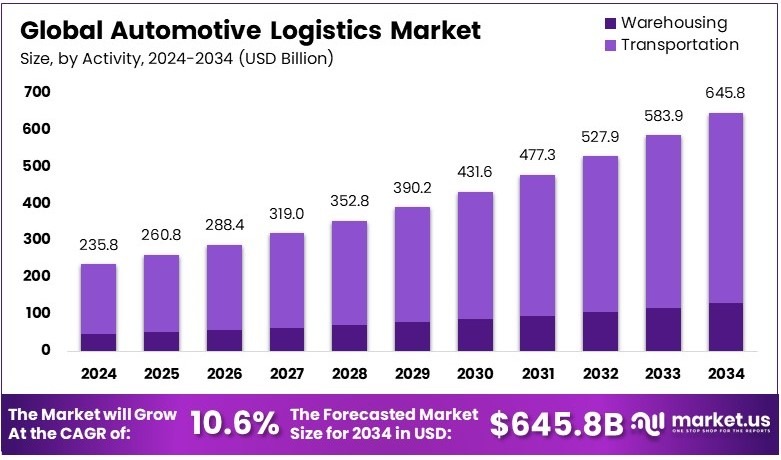

The Global Automotive Logistics Market size is expected to be worth around USD 645.8 Billion by 2034, from USD 235.8 Billion in 2024, growing at a CAGR of 10.6% during the forecast period from 2025 to 2034.

Automotive logistics refers to the transportation, storage, and distribution of vehicles and auto parts. It includes inbound logistics (moving parts to manufacturers) and outbound logistics (delivering finished vehicles to dealerships). Supply chain efficiency is key to reducing costs and ensuring timely delivery of products.

The automotive logistics market includes companies that manage the transportation and distribution of vehicles and parts. Growth is driven by globalization, rising vehicle demand, and advancements in supply chain technology. Key players invest in automation, digital tracking, and sustainable logistics solutions to improve efficiency.

According to recent market trends, automotive logistics is growing steadily due to increased global trade and new trade deals. For instance, the USMCA agreement changed rules for vehicle parts, reducing U.S. imports of engines by around 431,853 units and transmissions by 55,195 units in 2022. Consequently, regional supply chains are gaining importance.

In addition, the automotive logistics market is becoming more competitive. For example, nearly 900 Chinese automotive suppliers attended the Automechanika trade fair in Frankfurt in September 2024, showcasing products alongside electric vehicle manufacturers like BYD and Geely. This highlights China’s ambition to expand within Europe’s automotive logistics sector.

Similarly, logistics providers have new opportunities due to these market shifts. Specifically, companies able to manage complex supply chains across countries like the U.S., Mexico, and Canada will benefit. Thus, logistics firms investing in cross-border operations can gain market share by offering specialized services that meet new trade requirements.

However, market saturation in automotive logistics remains moderate, offering room for growth in regions with increasing trade activity. On the flip side, major logistics companies, such as DHL and XPO Logistics, already dominate busy markets. Therefore, smaller companies should consider niche services or less crowded markets to compete effectively.

Finally, government regulations strongly impact automotive logistics, shaping trade flows and business decisions. For instance, the USMCA encourages companies to source components regionally, reducing reliance on distant markets. As a result, logistics companies that adapt quickly to regulatory changes can significantly increase profits and market position in North America.

Key Takeaways

- The Automotive Logistics Market was valued at USD 235.8 billion in 2024 and is expected to reach USD 645.8 billion by 2034, with a CAGR of 10.6%.

- In 2024, Transportation led the activity segment with 82.6%, driven by the need for efficient vehicle and parts distribution.

- In 2024, Automobile Parts dominated the type segment with 70.7%, owing to high demand for spare parts and aftermarket services.

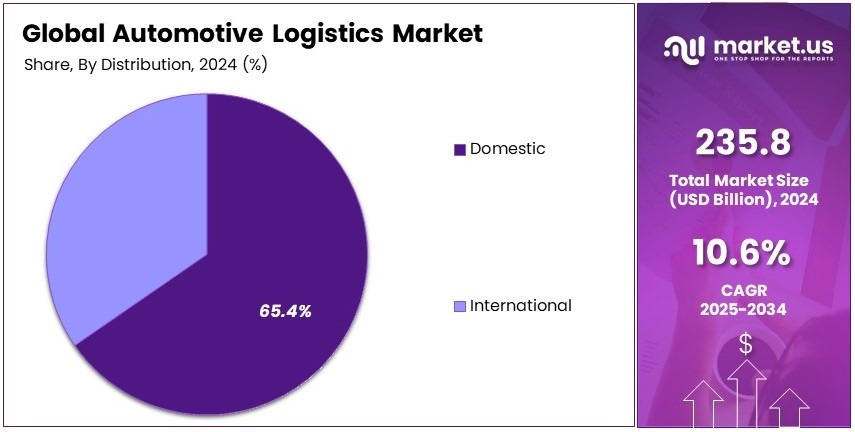

- In 2024, Domestic Distribution accounted for 65.4%, as localized supply chains improved delivery efficiency and reduced costs.

- In 2024, Inbound Logistics held 44.8% in logistic solutions, reflecting increased focus on streamlined supply chain management.

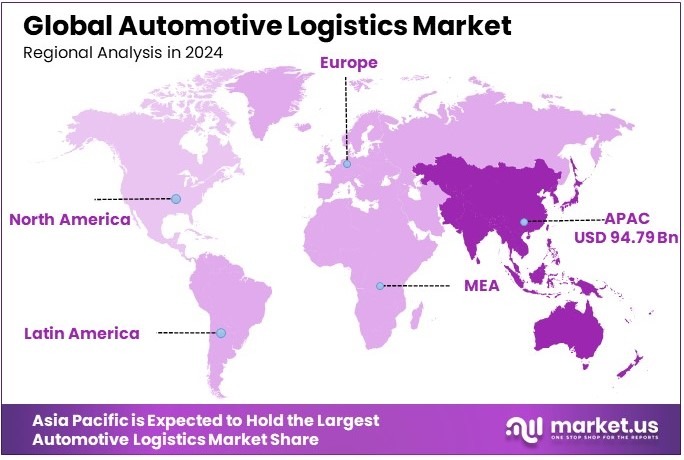

- In 2024, Asia Pacific led with 40.2%, contributing USD 94.79 billion, due to the region’s growing automotive production and export activities.

Activity Analysis

Transportation dominates with 82.6% due to its critical role in moving goods efficiently across distances.

In the Automotive Logistics Market, the Activity segment is overwhelmingly led by Transportation, which captures a substantial 82.6% share. This dominance is largely due to the essential role transportation plays in the logistics chain, enabling the efficient movement of automotive parts and finished vehicles across various geographies. The effectiveness of transportation directly impacts the overall speed and efficiency of the automotive supply chain.

Within this sub-segment, Roadways are the backbone, providing flexible route management and last-mile delivery crucial for automotive logistics. Airways offer the fastest shipping options for time-sensitive deliveries, while Maritime routes are cost-effective for bulk shipments. Railways are favored for their reliability and capacity to transport large volumes over land with relatively low environmental impact.

Type Analysis

Automobile Parts lead with 70.7% as they are essential for manufacturing and after-sales services.

The Type segment in Automotive Logistics is dominated by Automobile Parts, which constitute 70.7% of this market. This high percentage is reflective of the continuous need for parts in both the production of new vehicles and the after-sales market for replacements and upgrades. The efficient logistics of automobile parts is critical to maintaining production lines and minimizing downtime in manufacturing.

Finished Vehicle logistics, though smaller, is vital for delivering new vehicles to dealerships and directly to consumers, often requiring specialized handling and storage solutions to maintain vehicle condition and value.

Distribution Analysis

Domestic distribution leads with 65.4% due to strong internal manufacturing and consumption patterns.

Distribution within the Automotive Logistics Market is predominantly Domestic, making up 65.4% of the market. This segment’s strength is driven by robust internal manufacturing and consumption demands within countries. Domestic logistics are crucial for linking various components of the automotive industry, from parts suppliers to assembly plants and finally to marketplaces.

International Distribution, while smaller, is essential for expanding reach beyond local markets, enabling manufacturers to tap into global demand and source parts from international suppliers, thereby integrating global supply chains.

Logistic Solution Analysis

Inbound logistics dominate with 44.8% due to their importance in supplying production lines.

In Logistic Solutions, Inbound logistics take the forefront, accounting for 44.8% of the market. This segment’s prominence is due to the critical role it plays in ensuring the timely supply of materials and parts to production facilities, directly influencing manufacturing efficiency and output.

Outbound logistics, responsible for the distribution of finished products to consumers and dealers, is crucial for maintaining market supply and customer satisfaction. Reverse logistics has become increasingly relevant for recycling and reusing automotive components, reflecting growing environmental concerns.

‘Others’ in Logistic Solutions cater to specialized needs such as vehicle returns, transfers between facilities, and direct deliveries to large customers.

Key Market Segments

By Activity

- Warehousing

- Transportation

- Roadways

- Airways

- Maritime

- Railways

By Type

- Finished Vehicle

- Automobile Parts

By Distribution

- Domestic

- International

By Logistic Solution

- Inbound

- Outbound

- Reverse

- Others

Driving Factors

Global Supply Chain Expansion and Digital Transformation Drive Market Growth

The automotive logistics market is expanding due to the growing complexity of global supply chains. As vehicle production rises, automakers are sourcing components from different regions, increasing the need for efficient logistics solutions. Manufacturers and suppliers rely on seamless transportation networks to ensure timely delivery of parts and vehicles.

The demand for just-in-time (JIT) logistics is also fueling market growth. Automakers aim to reduce inventory costs by receiving parts exactly when needed. This requires advanced logistics planning and real-time tracking to avoid delays. Companies that provide JIT and lean manufacturing logistics solutions are gaining traction.

Connected logistics technologies are transforming the industry. Real-time tracking systems allow manufacturers and logistics providers to monitor shipments, reduce transit times, and optimize routes. Enhanced visibility helps minimize disruptions and improves supply chain efficiency.

Additionally, the adoption of electric and autonomous delivery vehicles is changing logistics operations. EVs are helping reduce fuel costs and emissions, while autonomous trucks are enhancing long-haul transportation efficiency. As more companies invest in these technologies, logistics operations become more cost-effective and sustainable.

Restraining Factors

Fuel Costs and Workforce Shortages Restrain Market Growth

High fuel costs remain a major challenge for automotive logistics providers. Rising fuel prices directly impact transportation expenses, reducing profit margins. Logistics companies must find cost-saving strategies, such as optimizing routes and adopting fuel-efficient vehicles, to stay competitive.

Cross-border trade regulations also create obstacles. Automotive logistics involves moving vehicles and parts between different countries, but tariffs, customs duties, and compliance requirements can slow down shipments. Companies must navigate complex regulatory frameworks to maintain efficiency in international logistics.

Another key issue is the shortage of skilled truck drivers and logistics professionals. The industry faces a declining workforce, leading to delays and higher labor costs. Training new drivers takes time, making it difficult to fill workforce gaps. This shortage affects supply chain reliability and increases delivery times.

Volatility in raw material prices further complicates logistics planning. Fluctuations in the cost of steel, aluminum, and other automotive materials impact production schedules. This unpredictability forces logistics providers to adjust transportation plans frequently, increasing operational challenges.

Growth Opportunities

AI, Multimodal Transport, and Digital Platforms Provide Growth Opportunities

Artificial intelligence (AI) is transforming automotive logistics. Predictive analytics help optimize supply chain management by forecasting demand, reducing delays, and improving inventory planning. AI-driven automation enhances decision-making, increasing overall efficiency.

Multimodal transport solutions are also creating new opportunities. By combining road, rail, air, and sea transportation, logistics companies can reduce costs and improve delivery times. This approach is particularly beneficial for long-distance automotive shipments, where flexibility is key.

Sustainable logistics solutions are gaining traction. Companies are focusing on carbon-neutral shipping methods, including electric trucks, alternative fuels, and eco-friendly packaging. As environmental regulations tighten, automakers and logistics providers investing in green logistics will gain a competitive edge.

Digital freight brokerage platforms are further enhancing logistics efficiency. These platforms connect shippers with transport providers, allowing for better route optimization and cost savings. As more logistics operations shift to digital solutions, companies can improve supply chain visibility and reduce operational inefficiencies.

Emerging Trends

Blockchain, IoT, and Last-Mile Delivery Are Latest Trending Factors

Blockchain technology is revolutionizing automotive logistics by enhancing security and transparency. By enabling tamper-proof transaction records, blockchain ensures trust between suppliers, manufacturers, and logistics providers. This reduces fraud and improves supply chain traceability.

IoT-based tracking solutions are also gaining momentum. RFID tags and GPS-enabled sensors allow real-time monitoring of vehicles and shipments. Logistics providers can track temperature-sensitive components, reduce losses, and enhance delivery accuracy with IoT-driven solutions.

Warehouse automation is another growing trend. Companies are adopting autonomous warehouse management systems to streamline parts distribution. Robotics and AI-powered inventory tracking improve efficiency, reducing storage costs and delivery times.

Last-mile delivery innovations are also transforming the market. The use of electric vehicles (EVs) and drones for spare parts distribution is increasing. These solutions help speed up deliveries while reducing carbon footprints. Automakers and logistics firms are investing in these technologies to enhance customer service and operational efficiency.

Regional Analysis

Asia Pacific Dominates with 40.2% Market Share

Asia Pacific leads the Automotive Logistics Market with a 40.2% share, totaling USD 94.79 billion. This region’s dominance is underpinned by its extensive automotive manufacturing base and the swift expansion of automotive markets in countries like China, India, and Japan.

Key factors driving this high market share include robust economic growth, increasing vehicle production and sales, and a well-established network of suppliers and distributors. The region’s strategic geographic location also facilitates efficient international trade, supporting both inbound and outbound logistics.

The future influence of Asia Pacific in the Automotive Logistics Market appears promising. The region is likely to maintain its lead due to ongoing investments in infrastructure development, technological advancements in logistics, and increasing demand for efficient supply chain solutions. The rise in electric vehicle production and the integration of digital technologies in logistics processes are expected to further enhance the market’s growth.

Regional Mentions:

- North America: North America is a significant player in the Automotive Logistics Market, characterized by advanced logistics technologies and high automation levels. The region’s strong regulatory framework and established automotive industry support its steady market presence.

- Europe: Europe remains competitive in the Automotive Logistics Market, driven by its focus on sustainability and high-efficiency logistics operations. The region benefits from stringent environmental regulations that promote innovative logistics solutions.

- Middle East & Africa: The Middle East and Africa are gaining momentum in the Automotive Logistics Market, spurred by infrastructural developments and government initiatives to diversify economies away from oil dependency, enhancing their logistics capabilities.

- Latin America: Latin America is witnessing growth in the Automotive Logistics Market due to increasing vehicle production and improvements in logistical infrastructure. The region’s focus on enhancing trade agreements and modernizing transportation networks supports this growth.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Automotive Logistics Market is highly competitive, with major global logistics companies managing the transportation and supply chain operations for automotive manufacturers. The top four players in this industry are DHL, Kuehne+Nagel, DSV, and Nippon Express Holdings. These companies dominate the market due to their extensive global networks, advanced logistics technology, and strong relationships with automakers.

DHL is a leader in the automotive logistics industry, offering specialized supply chain solutions for vehicle manufacturers and parts suppliers. It provides end-to-end logistics, including warehousing, transportation, and just-in-time delivery services. Its use of digital tracking and automation improves efficiency in automotive supply chains.

Kuehne+Nagel is a major logistics provider with expertise in multimodal transportation, including road, sea, and air freight. It helps automakers reduce costs by optimizing supply chain operations and offering sustainable logistics solutions. The company is known for its strong presence in international automotive trade.

DSV plays a crucial role in global automotive logistics, offering flexible transport and supply chain management services. It specializes in contract logistics, helping car manufacturers streamline production by ensuring timely delivery of essential parts. DSV’s focus on digitalization enhances supply chain visibility and efficiency.

Nippon Express Holdings is a key player in Asia’s automotive logistics market. It provides comprehensive logistics solutions, including finished vehicle transport, component distribution, and warehousing. Its strong network in Japan and other Asian markets makes it a preferred logistics partner for regional and international automakers.

These companies continue to dominate by expanding their global reach, adopting smart logistics technologies, and improving sustainability efforts. Their role in the automotive industry is expected to grow as supply chains become more complex and demand for faster, more efficient logistics services increases.

Major Companies in the Market

- Kintetsu World Express, Inc.

- BLG Logistics Group AG & Co. KG

- CMA CGM Group

- DHL

- DSV

- Expeditors International of Washington, Inc.

- CEVA Logistics

- Hellmann Worldwide Logistics SE & Co. KG

- LOGISTEED

- Imperial

- Kerry Logistics Network Limited

- Kuehne+Nagel

- Nippon Express Holdings

- Penske Automotive Group, Inc.

- Ryder System, Inc.

- Others

Recent Developments

- Roadrunner Transportation Systems: On November 2024, Roadrunner Transportation Systems received a significant investment, with executive chairman and CEO Chris Jamroz and Milwaukee investor Ted Kellner acquiring over 80% of the company. The capital infusion will support strategic mergers and acquisitions, focusing on strengthening less-than-truckload (LTL) services and expanding route networks.

- DSV A/S: On October 2024, DSV A/S announced its acquisition of Schenker, Deutsche Bahn’s logistics arm. This acquisition is expected to boost DSV’s earnings by 15% by 2028, with over 30% of this increase attributed to Schenker. The deal emphasizes DSV’s focus on expanding its global logistics network and service offerings.

Report Scope

Report Features Description Market Value (2024) USD 235.8 Billion Forecast Revenue (2034) USD 645.8 Billion CAGR (2025-2034) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Activity (Warehousing, Transportation (Roadways, Airways, Maritime, Railways)), By Type (Finished Vehicle, Automobile Parts), By Distribution (Domestic, International), By Logistic Solution (Inbound, Outbound, Reverse, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kintetsu World Express, Inc., BLG LOGISTICS GROUP AG & Co. KG, CMA CGM Group, DHL, DSV, Expeditors International of Washington, Inc., CEVA Logistics, Hellmann Worldwide Logistics SE & Co. KG, LOGISTEED, Imperial, KERRY LOGISTICS NETWORK LIMITED, Kuehne+Nagel, NIPPON EXPRESS HOLDINGS, Penske Automotive Group, Inc., Ryder System, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Logistics MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Logistics MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kintetsu World Express, Inc.

- BLG LOGISTICS GROUP AG & Co. KG

- CMA CGM Group

- DHL

- DSV

- Expeditors International of Washington, Inc.

- CEVA Logistics

- Hellmann Worldwide Logistics SE & Co. KG

- LOGISTEED

- Imperial

- KERRY LOGISTICS NETWORK LIMITED

- Kuehne+Nagel

- NIPPON EXPRESS HOLDINGS

- Penske Automotive Group, Inc.

- Ryder System, Inc.

- Others