Global Automotive Data Logger Market Size, Share, Growth Analysis By Connection Type (USB, SD Card, Bluetooth/Wi-Fi), By Component Type (Hardware, Software), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Off-Highway Vehicles, Two-Wheelers & Micromobility), By Propulsion (ICE Vehicles, Hybrid Vehicles, Battery Electric Vehicles, Others), By Application (Post-Sales, Pre-Sales), By End Market (OEMS, Service Stations, Regulatory Bodies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168823

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Connection Type Analysis

- By Component Type Analysis

- By Vehicle Type Analysis

- By Propulsion Analysis

- By Application Analysis

- By End Market Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Automotive Data Logger Company Insights

- Recent Developments

- Report Scope

Report Overview

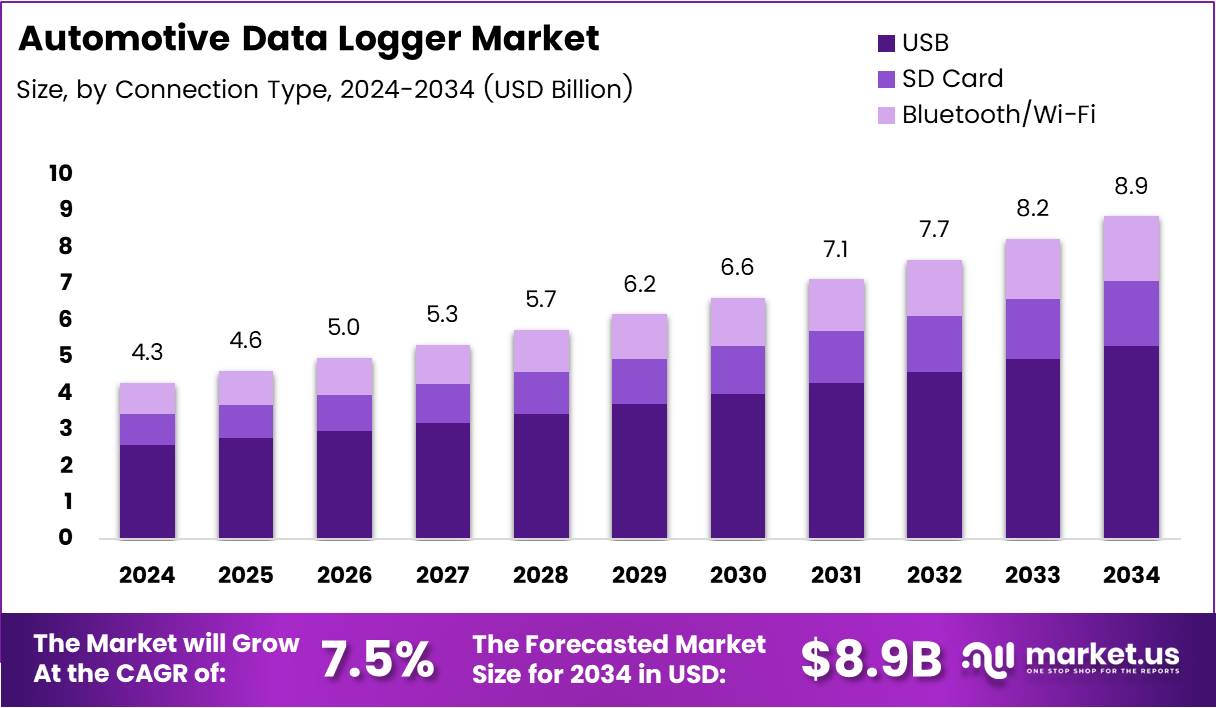

The Global Automotive Data Logger Market size is expected to be worth around USD 8.9 Billion by 2034 from USD 4.3 Billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034. This market represents a critical infrastructure supporting modern vehicle diagnostics and performance monitoring systems.

Automotive data loggers serve as intelligent recording devices that capture, store, and transmit vehicle operational parameters continuously. These systems monitor engine performance, fuel efficiency, driver behavior, and safety metrics across multiple vehicle platforms. Consequently, they enable manufacturers and fleet operators to optimize vehicle performance effectively.

The market demonstrates robust expansion driven by regulatory compliance requirements and technological advancements in connected mobility. Moreover, increasing adoption of electric vehicles and autonomous driving technologies creates substantial demand for sophisticated data capture solutions. Integration with telematics platforms further enhances market potential significantly.

Hardware components dominate the technology landscape, representing critical elements in data acquisition architectures. Meanwhile, software solutions are gaining traction through cloud-based analytics and artificial intelligence integration. Additionally, post-sales applications lead usage scenarios, supporting maintenance optimization and warranty management processes.

Passenger cars constitute the largest vehicle segment, reflecting widespread consumer adoption of connected car technologies. Furthermore, internal combustion engine vehicles maintain market leadership despite growing electric vehicle penetration. USB connectivity remains the preferred interface standard due to reliability and universal compatibility.

Government investments in vehicle safety standards and emission monitoring programs accelerate market adoption globally. Similarly, regulatory mandates for fleet management and driver safety monitoring drive commercial vehicle deployments. Industry collaborations between automotive OEMs and technology providers foster innovation in data logging capabilities.

According to the MITRE Corporation, as of 2023, 10 out of 14 key Advanced Driver-Assistance Systems features had surpassed 50% market penetration in the U.S., with five features achieving penetration between 91% and 94%. According to The Autopian, a typical connected vehicle can generate up to 25 gigabytes of data per hour from over 100 different data points including location, diagnostics, driver-assistance, and infotainment systems.

Key Takeaways

- Global Automotive Data Logger Market expected to reach USD 8.9 Billion by 2034 from USD 4.3 Billion in 2024, growing at 7.5% CAGR.

- USB connection type leads with a 45.8% market share.

- Hardware component segment dominates with 68.9% share.

- Passenger Cars hold the largest vehicle share at 52.5%.

- ICE Vehicles lead propulsion with 59.6% share.

- Post-Sales applications account for 66.2% market share.

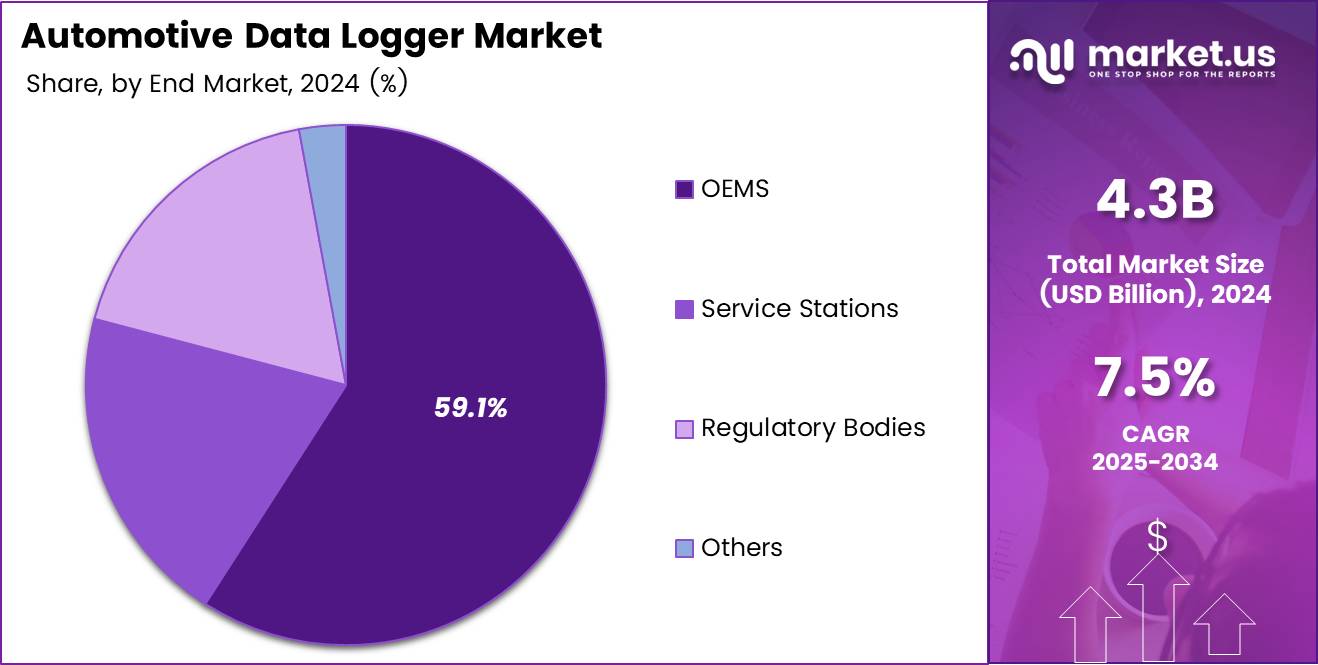

- OEMs dominate end market with 59.1% share.

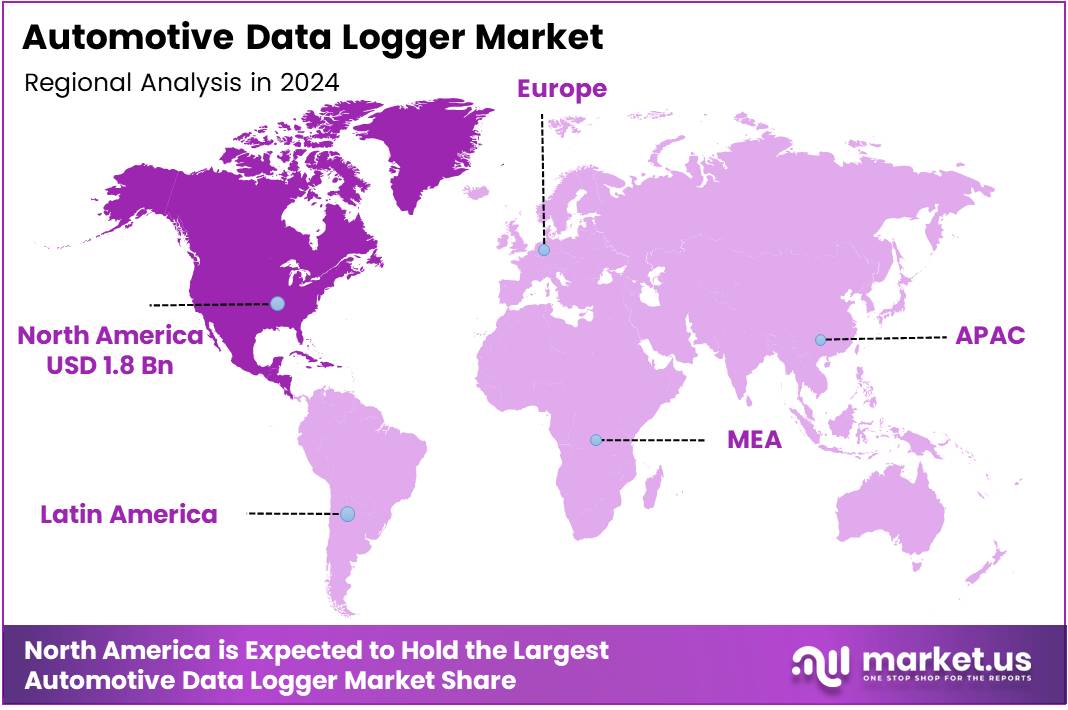

- North America leads regionally with 43.70% share valued at USD 1.8 Billion.

By Connection Type Analysis

USB dominates with 45.8% due to its universal compatibility and reliable data transfer capabilities.

In 2024, USB held a dominant market position in the By Connection Type segment of Automotive Data Logger Market, with a 45.8% share. This leadership stems from widespread adoption across automotive platforms and cost-effective implementation. USB interfaces provide stable, high-speed data transfer without requiring complex network configurations. Additionally, backward compatibility ensures seamless integration with existing vehicle architectures and aftermarket diagnostic tools.

SD Card connectivity offers portable storage solutions enabling offline data collection and analysis. This technology appeals to applications requiring physical data transfer and extended storage capacity. Fleet operators prefer SD cards for their durability and ease of replacement in harsh operational environments. Furthermore, this interface supports legacy systems lacking advanced wireless capabilities effectively.

Bluetooth and Wi-Fi technologies enable wireless data transmission and real-time monitoring capabilities. These connections facilitate cloud integration and remote diagnostics through mobile applications. Modern vehicles increasingly adopt wireless protocols for enhanced user convenience and reduced physical interface requirements. Moreover, wireless solutions support over-the-air updates and continuous connectivity for advanced telematics platforms.

By Component Type Analysis

Hardware dominates with 68.9% due to fundamental role in physical data acquisition and sensor integration.

In 2024, Hardware held a dominant market position in the By Component Type segment of Automotive Data Logger Market, with a 68.9% share. Physical devices including sensors, processors, and storage modules constitute essential infrastructure for data collection. These components withstand automotive environmental challenges including temperature extremes, vibrations, and electromagnetic interference. Additionally, hardware innovations drive miniaturization and enhanced processing capabilities continuously.

Software solutions provide critical functionality for data processing, storage management, and analytics capabilities. Advanced algorithms enable real-time diagnostics, pattern recognition, and predictive maintenance insights. Cloud-based platforms facilitate centralized data management and multi-vehicle fleet monitoring effectively. Furthermore, artificial intelligence integration enhances automated decision-making and anomaly detection processes significantly.

By Vehicle Type Analysis

Passenger Cars dominate with 52.5% due to massive production volumes and consumer demand for connected features.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type segment of Automotive Data Logger Market, with a 52.5% share. Consumer vehicles drive adoption through integrated infotainment systems, driver assistance features, and insurance telematics programs. Personal vehicle owners increasingly demand connectivity features supporting navigation, entertainment, and safety monitoring. Additionally, automakers differentiate products through advanced data-driven services and personalized driving experiences.

Light Commercial Vehicles utilize data loggers for fleet management, route optimization, and driver behavior monitoring. These applications reduce operational costs through fuel efficiency improvements and maintenance scheduling optimization. Small business operators benefit from affordable telematics solutions supporting delivery and service operations. Moreover, last-mile logistics providers rely on continuous data capture for performance tracking.

Medium and Heavy Commercial Vehicles require robust data logging for regulatory compliance and asset management. Long-haul trucking operations monitor engine hours, cargo conditions, and driver compliance with safety regulations. Fleet managers leverage comprehensive data analytics to optimize vehicle utilization and reduce downtime. Furthermore, commercial vehicle manufacturers integrate advanced diagnostics supporting warranty management processes.

Off-Highway Vehicles including construction and agricultural equipment benefit from specialized data logging capabilities. These applications monitor equipment performance under extreme operating conditions and demanding workloads. Construction companies track machine utilization, maintenance intervals, and operator productivity through customized data solutions. Additionally, agricultural equipment integrates precision farming data with vehicle performance metrics effectively.

Two-Wheelers and Micromobility vehicles represent emerging segments adopting compact data logging technologies. Urban mobility solutions including e-scooters and motorcycles integrate tracking for theft prevention and usage analytics. Manufacturers develop lightweight, cost-effective logging solutions suitable for space-constrained vehicle platforms. Moreover, shared mobility operators require continuous monitoring for asset management and user safety.

By Propulsion Analysis

ICE Vehicles dominate with 59.6% due to existing market base and established diagnostic protocols.

In 2024, ICE Vehicles held a dominant market position in the By Propulsion segment of Automotive Data Logger Market, with a 59.6% share. Traditional combustion engines generate extensive operational data requiring continuous monitoring for performance optimization. Established diagnostic standards and protocols support widespread data logger implementation across gasoline and diesel vehicles. Additionally, emission compliance requirements drive mandatory data collection in numerous regulatory jurisdictions globally.

Hybrid Vehicles combine electric and combustion powertrains, generating complex data streams from dual propulsion systems. These vehicles require sophisticated logging capabilities monitoring energy flow, battery health, and regenerative braking performance. Automakers optimize hybrid system efficiency through detailed analysis of power management and component interactions. Furthermore, warranty programs depend on comprehensive data capture for drivetrain component protection.

Battery Electric Vehicles demand advanced data logging for battery management, charging behavior, and range optimization. Electric powertrains generate unique datasets including cell voltage, thermal management, and energy consumption patterns. Manufacturers rely on detailed battery analytics for safety monitoring and performance degradation prediction. Moreover, charging infrastructure integration requires continuous data exchange supporting smart grid applications.

Others category includes fuel cell vehicles and alternative propulsion technologies requiring specialized monitoring solutions. Emerging powertrain architectures demand flexible data logging platforms supporting diverse sensor configurations. Research and development programs utilize advanced data capture for prototype testing and validation processes. Additionally, niche vehicle segments require customized logging solutions addressing unique operational requirements.

By Application Analysis

Post-Sales dominates with 66.2% due to extensive aftermarket service and warranty management requirements.

In 2024, Post-Sales held a dominant market position in the By Application segment of Automotive Data Logger Market, with a 66.2% share. Service centers utilize data loggers for diagnostic troubleshooting, repair verification, and maintenance scheduling optimization. Warranty administrators analyze vehicle data determining claim validity and identifying component failure patterns. Additionally, fleet operators deploy aftermarket solutions monitoring vehicle health and optimizing replacement cycles.

Pre-Sales applications support vehicle development, validation testing, and quality assurance during manufacturing processes. Engineering teams capture extensive performance data during prototype testing and durability validation programs. Automotive manufacturers monitor production line vehicles ensuring quality standards before customer delivery. Furthermore, homologation testing requires comprehensive data collection demonstrating regulatory compliance across multiple jurisdictions.

By End Market Analysis

OEMs dominate with 59.1% due to factory-installed systems and integrated vehicle architecture development.

In 2024, OEMs held a dominant market position in the By End Market segment of Automotive Data Logger Market, with a 59.1% share. Vehicle manufacturers integrate data logging capabilities during design phases ensuring seamless system compatibility. Factory-installed solutions provide superior integration with vehicle control units and proprietary diagnostic protocols. Additionally, automakers leverage collected data for product improvement, warranty optimization, and customer service enhancement.

Service Stations deploy aftermarket data logging tools supporting repair diagnostics and maintenance verification processes. Independent service providers require universal diagnostic solutions compatible across multiple vehicle brands and model years. These facilities invest in professional-grade equipment enabling comprehensive vehicle system analysis. Moreover, data logger adoption improves repair accuracy and reduces diagnostic time significantly.

Regulatory Bodies utilize data logging for emissions verification, safety compliance monitoring, and accident investigation. Government agencies mandate data collection supporting environmental protection programs and traffic safety initiatives. Vehicle inspection programs increasingly require electronic data submission demonstrating compliance with regulatory standards. Furthermore, transportation authorities analyze aggregated vehicle data supporting infrastructure planning and policy development.

Others category includes insurance companies, fleet management providers, and research institutions deploying specialized logging solutions. Insurance telematics programs monitor driver behavior supporting usage-based premium calculation and risk assessment. Academic researchers utilize vehicle data studying transportation patterns, energy consumption, and autonomous driving algorithm development. Additionally, mobility service providers integrate data logging supporting operational optimization and customer experience enhancement.

Key Market Segments

By Connection Type

- USB

- SD Card

- Bluetooth/Wi-Fi

By Component Type

- Hardware

- Software

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Off-Highway Vehicles

- Two-Wheelers & Micromobility

By Propulsion

- ICE Vehicles

- Hybrid Vehicles

- Battery Electric Vehicles

- Others

By Application

- Post-Sales

- Pre-Sales

By End Market

- OEMs

- Service Stations

- Regulatory Bodies

- Others

Drivers

Rising Integration of Advanced Driver-Assistance Systems (ADAS) Requiring High-Fidelity Data Capture

Advanced safety systems demand continuous, high-resolution data capture supporting real-time decision-making and performance validation. Modern ADAS features including automatic emergency braking, lane-keeping assistance, and adaptive cruise control generate massive datasets requiring sophisticated logging capabilities. Automotive manufacturers must validate system performance across diverse driving scenarios and environmental conditions comprehensively. Consequently, regulatory requirements mandate extensive data collection proving safety system effectiveness before market approval.

Vehicle development programs increasingly rely on detailed sensor fusion data optimizing algorithm performance and reliability. Data loggers capture inputs from cameras, radar, lidar, and ultrasonic sensors supporting engineering analysis and refinement. Additionally, real-world deployment data enables continuous improvement through over-the-air software updates. Therefore, ADAS proliferation directly accelerates automotive data logger adoption across passenger and commercial vehicle segments.

Restraints

High Implementation and Maintenance Costs of Sophisticated Data Logging Systems

Advanced data logging infrastructure requires substantial capital investment in hardware, software, and integration services. Small and medium-sized fleet operators face budget constraints limiting adoption of comprehensive telematics solutions. Additionally, ongoing maintenance costs including software licenses, cloud storage fees, and technical support create financial burdens. Organizations must balance implementation expenses against uncertain return on investment timelines.

Complex data management challenges arise from large-scale, multi-source vehicle data requiring specialized expertise and infrastructure. Processing massive datasets demands significant computational resources and data storage capacity investments. Furthermore, ensuring data security and privacy compliance adds additional cost layers for system operators. Consequently, smaller market participants struggle competing against established players possessing greater financial resources and technical capabilities.

Growth Factors

Emerging Demand for Real-Time Diagnostics and Predictive Maintenance Solutions

Fleet operators increasingly adopt predictive maintenance strategies reducing vehicle downtime and repair costs significantly. Real-time monitoring enables proactive component replacement before catastrophic failures occur during operations. Advanced analytics identify performance degradation patterns predicting maintenance requirements with improved accuracy. Therefore, data-driven maintenance optimization delivers substantial operational cost savings and productivity improvements.

Expansion of usage-based insurance models requires continuous vehicle data supporting risk assessment and premium calculation. Insurance providers leverage driving behavior analytics offering personalized pricing and incentivizing safer driving practices. Additionally, development of cloud-integrated automotive analytics platforms enables centralized data management across distributed vehicle fleets. Rising adoption of autonomous and semi-autonomous vehicle testing programs generates unprecedented data logging requirements supporting algorithm training and validation processes.

Emerging Trends

Shift Toward AI-Enhanced Data Processing for Faster Insight Generation

Artificial intelligence technologies enable automated pattern recognition and anomaly detection within massive vehicle datasets. Machine learning algorithms identify complex relationships between operational parameters predicting failure modes and optimization opportunities. Consequently, AI-driven analytics reduce manual data analysis requirements accelerating decision-making processes. Vehicle manufacturers integrate intelligent processing capabilities directly within data logger hardware enabling edge computing applications.

Increasing use of edge computing in vehicle data acquisition reduces latency and bandwidth requirements significantly. Over-the-air data logging and firmware update capabilities enable continuous system improvement without physical access requirements. Furthermore, adoption of cybersecurity-focused data logger architectures protects modern vehicles against emerging digital threats. Advanced encryption and authentication protocols ensure data integrity throughout collection, transmission, and storage processes.

Regional Analysis

North America Dominates the Automotive Data Logger Market with a Market Share of 43.70%, Valued at USD 1.8 Billion

North America leads the global automotive data logger market with a 43.70% share, valued at USD 1.8 Billion, driven by stringent regulatory requirements and advanced vehicle technology adoption. The region benefits from strong automotive manufacturing presence and extensive fleet management operations. Additionally, high penetration of connected vehicle technologies and insurance telematics programs accelerates market expansion. Government mandates for emission monitoring and safety compliance further support data logger deployment across commercial vehicle segments.

Europe Automotive Data Logger Market Trends

Europe demonstrates strong market performance driven by rigorous emission standards and vehicle safety regulations. The region leads in electric vehicle adoption and sustainable mobility initiatives requiring comprehensive data monitoring. Furthermore, European automotive manufacturers pioneer advanced driver assistance technologies demanding sophisticated data logging capabilities. Strong privacy regulations influence data management practices and system architecture design across the regional market.

Asia Pacific Automotive Data Logger Market Trends

Asia Pacific exhibits rapid market growth fueled by expanding automotive production and increasing vehicle electrification. China, Japan, and India represent major manufacturing hubs deploying advanced telematics solutions across diverse vehicle segments. Additionally, government investments in intelligent transportation systems and connected vehicle infrastructure accelerate technology adoption. Growing commercial vehicle fleets and logistics operations drive demand for fleet management and monitoring solutions throughout the region.

Middle East and Africa Automotive Data Logger Market Trends

Middle East and Africa show emerging market potential driven by commercial fleet modernization and regulatory developments. The region’s harsh operating environments demand robust data logging solutions supporting equipment reliability and maintenance optimization. Additionally, government initiatives promoting road safety and emission controls gradually increase data logger adoption. Growing logistics and transportation sectors create opportunities for fleet telematics and vehicle monitoring applications.

Latin America Automotive Data Logger Market Trends

Latin America presents developing market opportunities influenced by commercial vehicle growth and regulatory evolution. Brazil and Mexico lead regional adoption through automotive manufacturing expansion and fleet management modernization. Additionally, increasing insurance telematics programs and usage-based insurance models drive consumer vehicle data logger deployment. Economic development and infrastructure investments gradually support advanced vehicle technology adoption across the region.

Key Automotive Data Logger Company Insights

The global Automotive Data Logger Market in 2024 features several prominent players driving technological innovation and market expansion. Robert Bosch GmbH maintains strong market presence through comprehensive automotive electronics portfolio and extensive OEM partnerships globally. The company leverages deep automotive domain expertise developing integrated data acquisition solutions supporting vehicle development and diagnostics applications.

Vector Informatik GmbH specializes in automotive electronics development tools and embedded systems solutions serving engineering and testing applications. The company provides sophisticated data logging platforms supporting vehicle network analysis, calibration, and validation processes. Their solutions enable automotive manufacturers and suppliers to optimize vehicle electronic architectures and software systems efficiently.

Continental AG delivers advanced telematics and fleet management solutions integrated with broader automotive technology portfolio. The company combines sensor technologies, connectivity platforms, and data analytics capabilities supporting comprehensive vehicle monitoring applications. Their market position benefits from strong relationships with global automotive manufacturers and extensive aftermarket service network.

Racelogic Ltd focuses on specialized vehicle testing and data acquisition systems serving motorsports and automotive engineering applications. The company provides high-precision GPS-based data loggers and performance measurement tools supporting vehicle dynamics analysis and development testing requirements effectively.

Key Companies

- Robert Bosch GmbH

- Vector Informatik GmbH

- Continental AG

- Racelogic Ltd

- TTTech Auto AG

- National Instruments Corp.

- Intrepid Control Systems Inc.

- Ipetronik GmbH & Co. KG

- NSM Solutions

Recent Developments

- In January 2025, NXP Semiconductors announced an all-cash agreement worth approximately USD 625 million to acquire Vienna-based TTTech Auto. This strategic acquisition strengthens NXP’s automotive software and systems integration capabilities supporting advanced vehicle architecture development.

- In June 2025, NXP completed its acquisition of TTTech Auto, integrating the company’s automotive software expertise into its semiconductor portfolio. This consolidation enhances NXP’s position in safety-critical automotive systems and data management solutions.

- In January 2024, Intrepid Control Systems unveiled the neoVI CONNECT at CES 2024 as a ruggedized IP67 standalone vehicle data logger and gateway module. This product delivers robust data acquisition capabilities designed for harsh automotive environments and field deployment applications.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Billion Forecast Revenue (2034) USD 8.9 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Connection Type (USB, SD Card, Bluetooth/Wi-Fi), By Component Type (Hardware, Software), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Off-Highway Vehicles, Two-Wheelers & Micromobility), By Propulsion (ICE Vehicles, Hybrid Vehicles, Battery Electric Vehicles, Others), By Application (Post-Sales, Pre-Sales), By End Market (OEMS, Service Stations, Regulatory Bodies, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Robert Bosch GmbH, Vector Informatik GmbH, Continental AG, Racelogic Ltd, TT Tech Auto AG, National Instruments Corp., Intrepid Control Systems Inc., Ipetronik GmbH & Co. KG, NSM Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Data Logger MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Data Logger MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Vector Informatik GmbH

- Continental AG

- Racelogic Ltd

- TTTech Auto AG

- National Instruments Corp.

- Intrepid Control Systems Inc.

- Ipetronik GmbH & Co. KG

- NSM Solutions