Global Automotive Autonomous Emergency Braking System Market Size, Share, Growth Analysis By System (High Speed AEB, Low Speed AEB), By Component Technology (Radar-based AEB, Camera-based AEB, LiDAR-based AEB, Sensor Fusion AEB (Radar+ Camera), Ultrasonic-based AEB), By Operating Speed Class (High-Speed AEB (More Than 40 Kmph), Low-Speed AEB (Less Than 40 Kmph), Pedestrian AEB, Junction or Intersection AEB), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177304

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

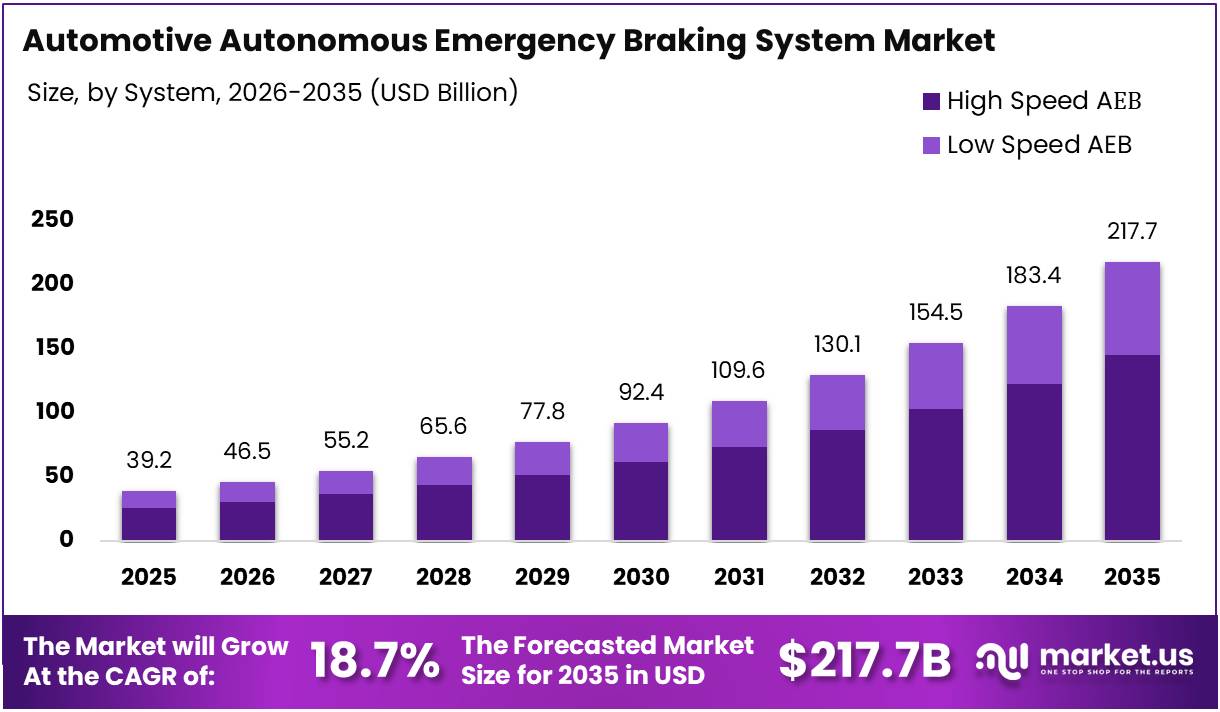

The Global Automotive Autonomous Emergency Braking System Market size is expected to be worth around USD 217.7 Billion by 2035 from USD 39.2 Billion in 2025, growing at a CAGR of 18.7% during the forecast period 2026 to 2035.

The Automotive Autonomous Emergency Braking System represents a critical active safety technology that automatically applies brakes when collision risk is detected. This advanced driver assistance system uses sensors to monitor the vehicle’s surroundings and intervenes when the driver fails to respond. Consequently, it serves as a vital defense mechanism against rear-end and pedestrian collisions.

AEB systems function through integrated sensor networks including radar, cameras, LiDAR, and ultrasonic devices. These technologies work collectively to identify potential hazards and calculate appropriate braking force. Moreover, the system operates independently of driver input, providing crucial milliseconds that can prevent or mitigate accidents.

The market experiences robust expansion driven by stringent global vehicle safety regulations mandating AEB installation. Governments worldwide increasingly require autonomous braking as standard equipment across vehicle segments. Additionally, New Car Assessment Programs actively promote AEB integration through higher safety ratings for equipped vehicles.

Rising urbanization and traffic density significantly contribute to market growth trajectories. Cities face mounting challenges with congested roads and vulnerable road users requiring enhanced protection. Therefore, automotive manufacturers prioritize AEB deployment to address these evolving safety concerns and regulatory requirements.

Commercial vehicle adoption presents substantial growth opportunities as fleet operators emphasize safety compliance. Integration with connected vehicle ecosystems and V2X communication platforms further enhances system capabilities. However, technical limitations in detecting complex scenarios under adverse weather conditions pose implementation challenges.

According to V4Safety Project, AEB systems demonstrated approximately 89.7% effectiveness in crash avoidance in simulated car-pedestrian crossing scenarios using reconstructed accident cases. Furthermore, research published in MDPI indicates that AEB can reduce rear-end collisions under 50 km/h by approximately 38%, as evidenced by European NCAP and Australian NCAP testing referenced in 2025 research.

According to MITRE, AEB effectiveness improved significantly from approximately 46% in models 2015-2017 to approximately 52% for models 2021-2023. This continuous performance enhancement reflects ongoing technological advancements in sensor fusion algorithms and detection capabilities. Consequently, the market trajectory points toward widespread adoption across passenger and commercial vehicle segments globally.

Key Takeaways

- Global Automotive Autonomous Emergency Braking System Market valued at USD 39.2 Billion in 2025, projected to reach USD 217.7 Billion by 2035

- Market growing at a CAGR of 18.7% during the forecast period 2026-2035

- High Speed AEB segment dominates By System category with 66.9% market share

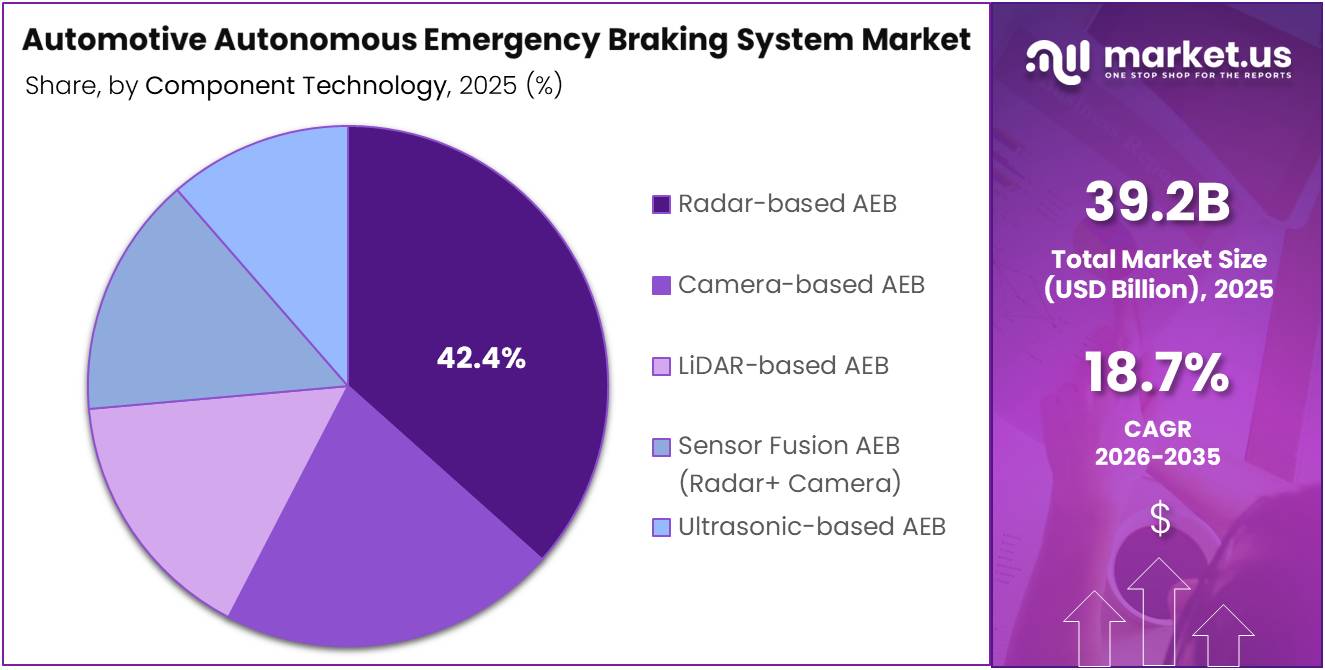

- Radar-based AEB leads By Component Technology segment capturing 36.6% share

- High-Speed AEB (More Than 40 Kmph) holds 44.7% share in By Operating Speed Class segment

- Passenger Vehicles segment commands dominant 81.5% market share in By Vehicle Type category

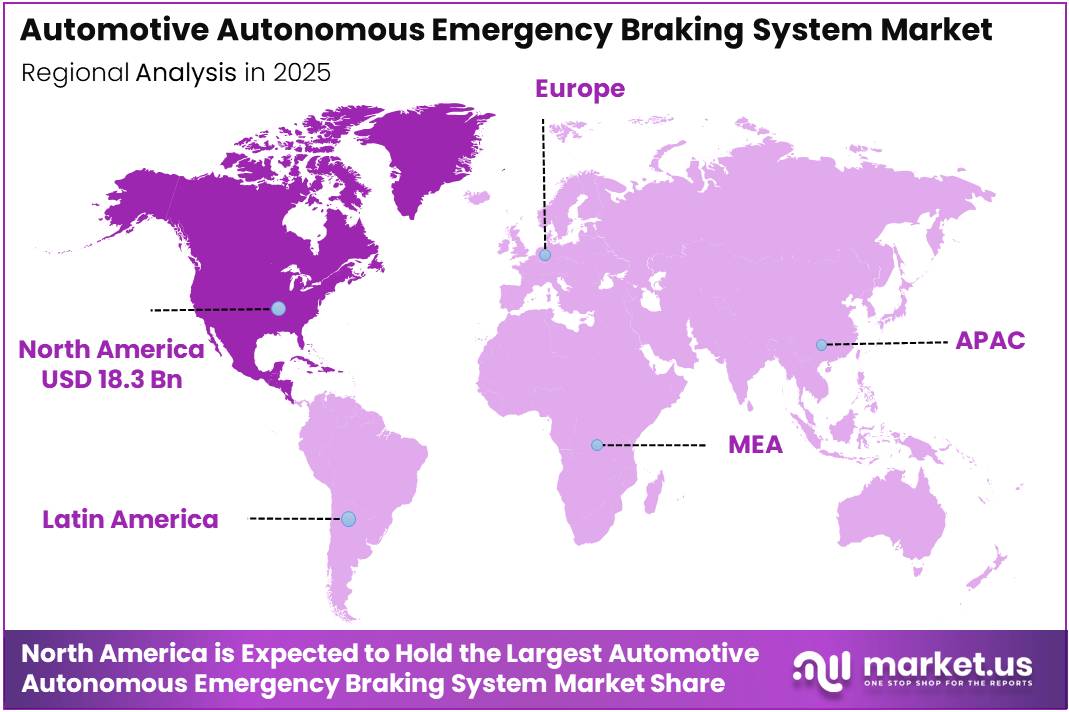

- North America leads regional market with 46.90% share, valued at USD 18.3 Billion

System Analysis

High Speed AEB dominates with 66.9% due to regulatory focus on highway collision prevention.

In 2025, High Speed AEB held a dominant market position in the By System segment of Automotive Autonomous Emergency Braking System Market, with a 66.9% share. This segment addresses collision scenarios occurring at speeds exceeding 40 kmph, primarily on highways and expressways. Moreover, regulatory bodies worldwide mandate high-speed AEB installation for enhanced occupant protection during severe impact situations.

Low Speed AEB serves critical functions in urban environments where congestion and pedestrian interactions occur frequently. This system operates effectively at speeds below 40 kmph, preventing parking lot collisions and low-impact accidents. Additionally, it provides essential protection for vulnerable road users in densely populated areas where traffic moves slowly.

Component Technology Analysis

Radar-based AEB dominates with 36.6% due to superior performance in diverse weather conditions.

In 2025, Radar-based AEB held a dominant market position in the By Component Technology segment of Automotive Autonomous Emergency Braking System Market, with a 36.6% share. Radar technology offers exceptional range detection and operates reliably across varying weather conditions including fog and rain. Consequently, automotive manufacturers prefer radar sensors for their robustness and proven effectiveness in collision detection.

Camera-based AEB utilizes optical recognition to identify vehicles, pedestrians, and road markings with high precision. This technology excels in object classification and lane detection capabilities essential for comprehensive safety systems. However, performance may deteriorate under poor lighting conditions or when cameras become obscured by environmental factors.

LiDAR-based AEB provides three-dimensional mapping capabilities enabling precise distance measurement and object detection. This advanced technology generates detailed environmental representations supporting sophisticated braking algorithms. Moreover, LiDAR integration increases as autonomous driving development progresses, though cost considerations currently limit widespread adoption.

Sensor Fusion AEB (Radar + Camera) combines complementary strengths of multiple sensor types for enhanced detection accuracy. This approach mitigates individual sensor limitations while improving overall system reliability and performance. Additionally, sensor fusion represents the industry trajectory toward comprehensive safety solutions addressing diverse driving scenarios effectively.

Ultrasonic-based AEB specializes in short-range detection suitable for low-speed parking and maneuvering applications. These sensors excel at identifying obstacles in close proximity during parking operations and tight space navigation. Therefore, ultrasonic technology complements other sensor types within comprehensive AEB architectures for complete environmental awareness.

Operating Speed Class Analysis

High-Speed AEB (More Than 40 Kmph) dominates with 44.7% due to highway safety prioritization.

In 2025, High-Speed AEB (More Than 40 Kmph) held a dominant market position in the By Operating Speed Class segment of Automotive Autonomous Emergency Braking System Market, with a 44.7% share. This category addresses the most severe collision scenarios occurring on highways and high-speed roadways. Moreover, regulatory frameworks emphasize high-speed AEB capabilities for reducing fatality rates in high-impact accidents.

Low-Speed AEB (Less Than 40 Kmph) focuses on urban driving environments where frequent stop-and-go traffic occurs. This system prevents minor collisions in congested areas, parking facilities, and residential zones effectively. Additionally, low-speed AEB reduces insurance claims and vehicle repair costs associated with common urban driving incidents.

Pedestrian AEB specifically targets vulnerable road user protection through advanced detection algorithms and rapid response capabilities. This technology identifies pedestrians crossing streets and activates emergency braking to prevent or mitigate injuries. Consequently, pedestrian AEB receives strong regulatory support as cities prioritize pedestrian safety and accident reduction initiatives.

Junction or Intersection AEB addresses collision scenarios at road intersections where turning movements create complex hazard situations. This system monitors crossing traffic and activates braking when collision risk emerges during turning maneuvers. Therefore, junction AEB represents a critical safety feature as intersection accidents account for significant injury statistics globally.

Vehicle Type Analysis

Passenger Vehicles dominates with 81.5% due to regulatory mandates and consumer safety awareness.

In 2025, Passenger Vehicles held a dominant market position in the By Vehicle Type segment of Automotive Autonomous Emergency Braking System Market, with an 81.5% share. This segment benefits from stringent safety regulations requiring AEB installation across new passenger car models globally. Moreover, consumers increasingly demand advanced safety features when purchasing vehicles, driving widespread AEB adoption in passenger segments.

Commercial Vehicles represent a growing market segment as fleet operators prioritize driver safety and liability reduction. These vehicles face unique challenges including longer braking distances and larger blind spots requiring specialized AEB calibration. Additionally, commercial vehicle AEB adoption accelerates through regulatory pressure and corporate responsibility initiatives focused on road safety improvements.

Key Market Segments

By System

- High Speed AEB

- Low Speed AEB

By Component Technology

- Radar-based AEB

- Camera-based AEB

- LiDAR-based AEB

- Sensor Fusion AEB (Radar+ Camera)

- Ultrasonic-based AEB

By Operating Speed Class

- High-Speed AEB (More Than 40 Kmph)

- Low-Speed AEB (Less Than 40 Kmph)

- Pedestrian AEB

- Junction or Intersection AEB

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Drivers

Mandatory Inclusion of AEB Under Global Vehicle Safety and NCAP Regulations Drives Market Expansion

Governments worldwide implement stringent safety regulations mandating AEB installation across new vehicle models to reduce traffic fatalities. Regulatory frameworks in Europe, North America, and Asia enforce compliance timelines requiring automakers to integrate autonomous braking systems. Consequently, mandatory AEB adoption creates substantial market demand as manufacturers align production with evolving safety standards and certification requirements.

New Car Assessment Programs globally award higher safety ratings to vehicles equipped with advanced AEB capabilities. These ratings significantly influence consumer purchasing decisions and manufacturer competitiveness in key markets. Moreover, NCAP testing protocols continuously evolve, incorporating pedestrian detection and intersection scenarios, thereby driving continuous technological improvement and broader system deployment.

Rising emphasis on reducing collision severity through active safety technologies positions AEB as fundamental accident prevention infrastructure. Automakers increasingly integrate AEB as core ADAS features across vehicle platforms, moving beyond premium segments to mainstream models. Additionally, urban traffic density elevates demand for automated braking solutions capable of managing complex driving environments effectively.

Restraints

Technical Limitations in Detecting Complex Road Users and Edge-Case Scenarios Hinder Market Growth

AEB systems encounter significant challenges detecting non-standard road users including motorcyclists, cyclists, and pedestrians in unconventional positions. Edge-case scenarios involving unusual object shapes, erratic movements, or obscured visibility reduce detection accuracy and system effectiveness. Therefore, these technical limitations create reliability concerns among consumers and automotive manufacturers regarding comprehensive safety coverage across diverse driving situations.

System reliability challenges under poor weather, lighting, and road conditions substantially impact AEB performance and user confidence. Heavy rain, snow, fog, and darkness degrade sensor capabilities, particularly for camera-based and LiDAR systems. Moreover, dirty sensors, extreme temperatures, and complex urban environments with numerous reflective surfaces introduce false positives or detection failures.

Addressing these environmental and technical constraints requires continuous sensor technology advancement and sophisticated algorithm development. Manufacturers invest heavily in sensor fusion approaches combining multiple detection technologies to mitigate individual sensor weaknesses. Additionally, ongoing calibration requirements and system maintenance considerations add complexity to AEB deployment across diverse geographic regions and climatic conditions.

Growth Factors

Wider Adoption of AEB in Commercial Vehicles for Fleet Safety Compliance Accelerates Market Expansion

Commercial vehicle operators increasingly deploy AEB systems to enhance fleet safety records and reduce accident-related costs significantly. Corporate fleet managers recognize autonomous braking technology as essential for driver protection and liability management across operations. Consequently, regulatory bodies introduce commercial vehicle-specific AEB mandates, creating substantial growth opportunities within trucking, delivery, and public transportation sectors.

Integration of AEB with connected vehicle and V2X safety ecosystems represents transformative growth potential for collision avoidance capabilities. Vehicle-to-everything communication enables predictive braking based on data from surrounding vehicles, infrastructure, and pedestrian devices. Moreover, connected AEB systems leverage real-time traffic information, weather conditions, and road hazards to optimize braking responses.

Expansion of AEB applications for vulnerable road user protection drives market diversification beyond traditional vehicle-to-vehicle collision scenarios. Advanced systems now incorporate pedestrian detection, cyclist recognition, and intersection monitoring functionalities addressing urban safety challenges. Additionally, growing demand for AEB in electrified and software-defined vehicles aligns with automotive industry electrification trends and over-the-air update capabilities.

Emerging Trends

Rapid Advancement in Sensor Fusion Algorithms for Improved Braking Accuracy Reshapes Market Landscape

Sophisticated sensor fusion algorithms combine data from radar, cameras, LiDAR, and ultrasonic sensors to achieve superior detection accuracy. Machine learning techniques enable AEB systems to continuously improve performance through pattern recognition and predictive analytics. Therefore, manufacturers invest substantially in artificial intelligence integration, enhancing system reliability across diverse driving conditions and complex scenarios.

Increasing focus on pedestrian, cyclist, and intersection AEB functions reflects evolving regulatory priorities and urban safety concerns. Advanced algorithms now distinguish between different vulnerable road user types, adjusting braking responses accordingly for optimal protection. Moreover, intersection AEB addresses turning collision scenarios, significantly expanding system applicability beyond straightforward rear-end collision prevention.

Use of over-the-air updates to enhance AEB performance post-deployment represents a paradigm shift in automotive safety technology management. Software-defined vehicles enable manufacturers to refine braking algorithms, update detection parameters, and introduce new functionalities remotely. Additionally, alignment of AEB development with higher levels of vehicle automation creates synergies between active safety and autonomous driving technologies.

Regional Analysis

North America Dominates the Automotive Autonomous Emergency Braking System Market with a Market Share of 46.90%, Valued at USD 18.3 Billion

North America leads the global market driven by stringent federal safety regulations and strong consumer demand for advanced safety features. The region benefits from established automotive manufacturing infrastructure and early adoption of ADAS technologies across vehicle segments. Moreover, NHTSA regulations mandate AEB installation, while insurance incentives encourage consumer acceptance. The market share of 46.90% and valuation of USD 18.3 Billion reflect the region’s commitment to road safety innovation.

Europe Automotive Autonomous Emergency Braking System Market Trends

Europe demonstrates robust AEB adoption supported by comprehensive Euro NCAP testing protocols and EU safety directives. The region’s automotive manufacturers lead technological innovation in sensor fusion and pedestrian detection capabilities. Additionally, dense urban environments and strong pedestrian protection regulations drive advanced AEB deployment across passenger and commercial vehicle categories throughout European markets.

Asia Pacific Automotive Autonomous Emergency Braking System Market Trends

Asia Pacific experiences rapid market growth fueled by expanding automotive production and increasing vehicle safety awareness among consumers. China, Japan, and South Korea implement progressive safety standards requiring AEB integration across vehicle categories. Moreover, rising urbanization and traffic congestion in major Asian cities create substantial demand for automated collision avoidance technologies.

Middle East & Africa Automotive Autonomous Emergency Braking System Market Trends

Middle East and Africa represent emerging markets with growing recognition of active safety technology benefits for reducing traffic fatalities. Premium vehicle segments demonstrate higher AEB adoption rates while regulatory frameworks gradually evolve toward mandatory installation requirements. Additionally, infrastructure development and rising vehicle ownership create opportunities for safety technology penetration across the region.

Latin America Automotive Autonomous Emergency Braking System Market Trends

Latin America shows increasing AEB adoption driven by automotive manufacturers introducing global safety platforms to regional markets. Brazil and Mexico lead implementation efforts as regulatory bodies consider safety mandates aligned with international standards. Furthermore, growing middle-class vehicle ownership and safety consciousness support gradual market expansion throughout Latin American countries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Robert Bosch GmbH maintains market leadership through comprehensive AEB portfolios integrating advanced radar and camera technologies across vehicle segments. The company leverages extensive automotive supply chain relationships and continuous innovation in sensor fusion algorithms. Moreover, Bosch’s global manufacturing footprint enables cost-effective production and rapid technology deployment supporting OEM partnerships worldwide. Their investment in artificial intelligence enhances predictive braking capabilities and system reliability significantly.

Continental AG delivers cutting-edge AEB solutions emphasizing modular architecture and scalability across passenger and commercial vehicle applications. The company focuses on integrated safety systems combining AEB with electronic stability control and adaptive cruise control functionalities. Additionally, Continental’s software expertise enables over-the-air update capabilities and connected vehicle integration. Their strong presence in European markets supports compliance with stringent safety regulations and NCAP requirements.

ZF Friedrichshafen AG specializes in comprehensive active safety systems featuring advanced sensor technologies and intelligent braking actuation mechanisms. The company’s recent strategic partnership with Samsung’s Harman strengthens connected vehicle and autonomous driving capabilities significantly. Furthermore, ZF’s portfolio encompasses complete AEB solutions from perception sensors through brake-by-wire systems. Their engineering excellence positions them competitively in commercial vehicle safety applications requiring specialized calibration.

Hyundai Mobis expands AEB technology development supporting parent company requirements while serving global automotive manufacturers competitively. The company invests substantially in LiDAR integration and artificial intelligence algorithms enhancing pedestrian and cyclist detection accuracy. Moreover, Hyundai Mobis focuses on cost optimization strategies enabling AEB deployment across mainstream vehicle segments. Their Asian manufacturing presence supports regional market growth and technology localization initiatives effectively.

Key players

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Delphi Automotive LLP

- Hyundai Mobis

- Aisin Seiki Co. Ltd

- Hitachi Automotive System Ltd.

- Mando Corporation

- Netradyne

- Valeo S.A.

Recent Developments

- December 2025 – Samsung’s Harman acquired the driver assistance arm from ZF Group in a transaction valued at €1.5 billion, significantly strengthening its autonomous vehicle technology portfolio and expanding capabilities in advanced driver assistance systems including AEB integration.

- January 2025 – Netradyne raised $90 Million in Series D funding led by Point72 Private Investments, accelerating development of AI-powered driver safety solutions and expanding commercial vehicle AEB applications across fleet management sectors globally.

Report Scope

Report Features Description Market Value (2025) USD 39.2 Billion Forecast Revenue (2035) USD 217.7 Billion CAGR (2026-2035) 18.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By System (High Speed AEB, Low Speed AEB), By Component Technology (Radar-based AEB, Camera-based AEB, LiDAR-based AEB, Sensor Fusion AEB (Radar+ Camera), Ultrasonic-based AEB), By Operating Speed Class (High-Speed AEB (More Than 40 Kmph), Low-Speed AEB (Less Than 40 Kmph), Pedestrian AEB, Junction or Intersection AEB), By Vehicle Type (Passenger Vehicles, Commercial Vehicles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Delphi Automotive LLP, Hyundai Mobis, Aisin Seiki Co. Ltd, Hitachi Automotive System Ltd., Mando Corporation, Netradyne, Valeo S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Autonomous Emergency Braking System MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Autonomous Emergency Braking System MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Delphi Automotive LLP

- Hyundai Mobis

- Aisin Seiki Co. Ltd

- Hitachi Automotive System Ltd.

- Mando Corporation

- Netradyne

- Valeo S.A.