Global Radar Sensors Market By Type Outlook (Imaging, Non-Imaging), By Range (Short, Medium, Long), By End-User (Automotive, Traffic Monitoring, Aerospace & Defence, Industrial, Security & Surveillance, Weather Monitoring, Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 120696

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

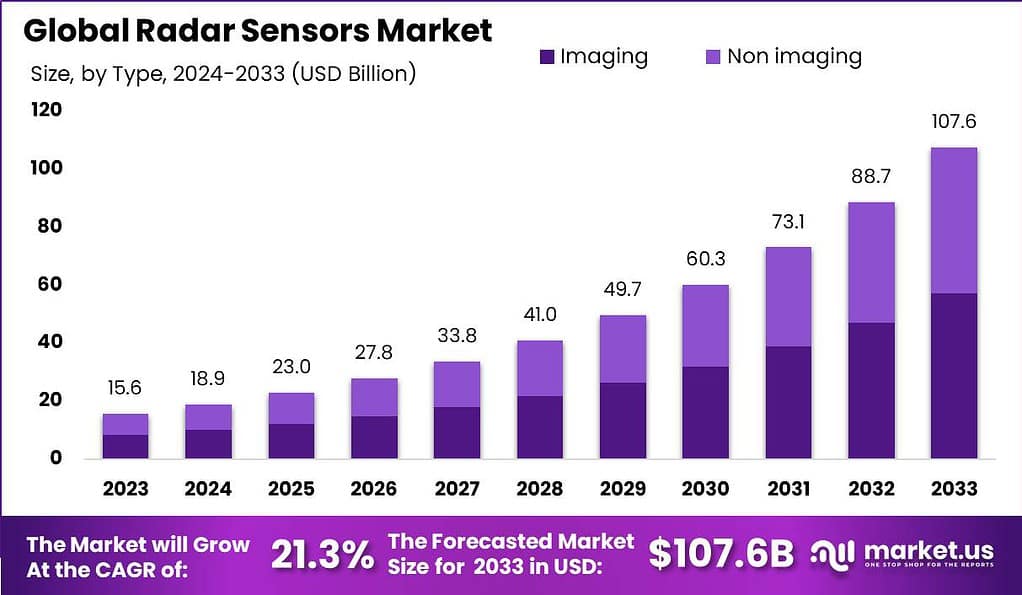

The Global Radar Sensors Market size is expected to be worth around USD 107.6 Billion By 2033, from USD 15.6 Billion in 2023, growing at a CAGR of 21.3% during the forecast period from 2024 to 2033.

Radar sensors are advanced devices that use radio waves to detect and measure the distance, speed, and direction of objects in their vicinity. These sensors emit radio waves and analyze the echo signals that bounce back from objects, allowing them to create detailed maps of their surroundings. Radar sensors are commonly used in various applications such as automotive systems, industrial automation, surveillance, and weather monitoring.

The radar sensors market has been experiencing significant growth due to the increasing demand for advanced driver assistance systems (ADAS) and autonomous vehicles. In the automotive sector, radar sensors are crucial for functions like collision avoidance, adaptive cruise control, and blind spot detection. The rising focus on safety and the development of self-driving technologies have fueled the adoption of radar sensors in the automotive industry.

As cars become more advanced, the demand for radar sensors in safety and driver assistance systems is rising. In industries, these sensors are valued for their accuracy and reliability in harsh environments, contributing to safety and operational efficiency. The development of smart cities and autonomous vehicles are significant trends driving the market growth, as these technologies rely heavily on precise and reliable sensors like radar to function effectively.

Furthermore, industries such as aerospace, defense, and marine are also utilizing radar sensors for applications like air traffic control, military surveillance, and ship navigation. The ability of radar sensors to operate in challenging environmental conditions, such as low visibility or adverse weather, makes them highly reliable and suitable for demanding applications.

The radar sensors market is expected to continue its growth trajectory in the coming years. Factors such as the increasing integration of radar sensors in various industries, advancements in sensor technology, and the development of 5G networks for improved connectivity are driving market expansion. Additionally, the rising investments in research and development and the growing demand for smart cities and infrastructure are expected to further boost the adoption of radar sensors in the future.

Key Takeaways

- The radar sensor market size is estimated to reach USD 107.5 billion in the year 2033 with a CAGR of 21.3% during the forecast period and was valued at USD 15.6 billion in the year 2023.

- Based on the type outlook, the imaging segment has dominated the market with a share of 53.2% in the year 2023.

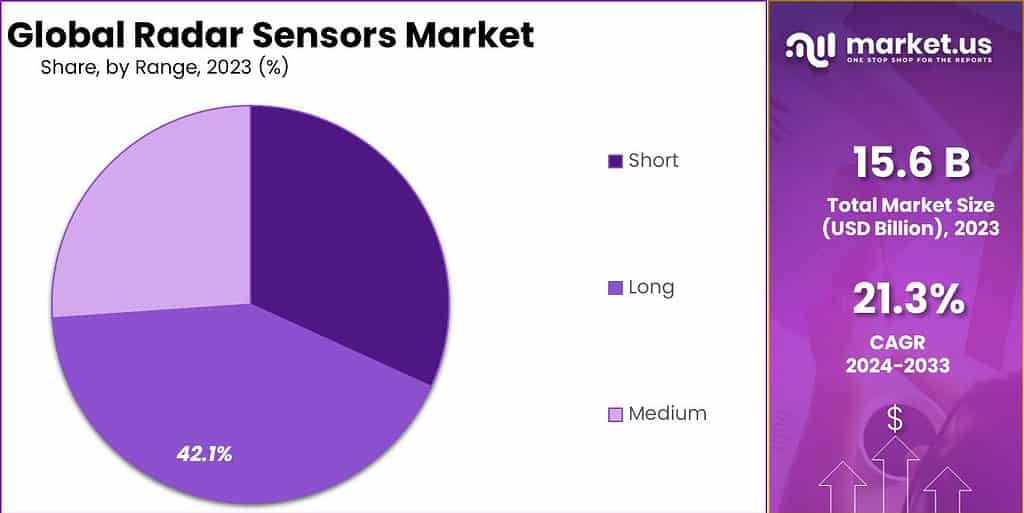

- Based on the range, the long-range segment has dominated the market with a share of 42.1% in the year 2023.

- Based on the end user, the traffic monitoring aerospace & defense segment has dominated the market with a share of 20.3% in the year 2023.

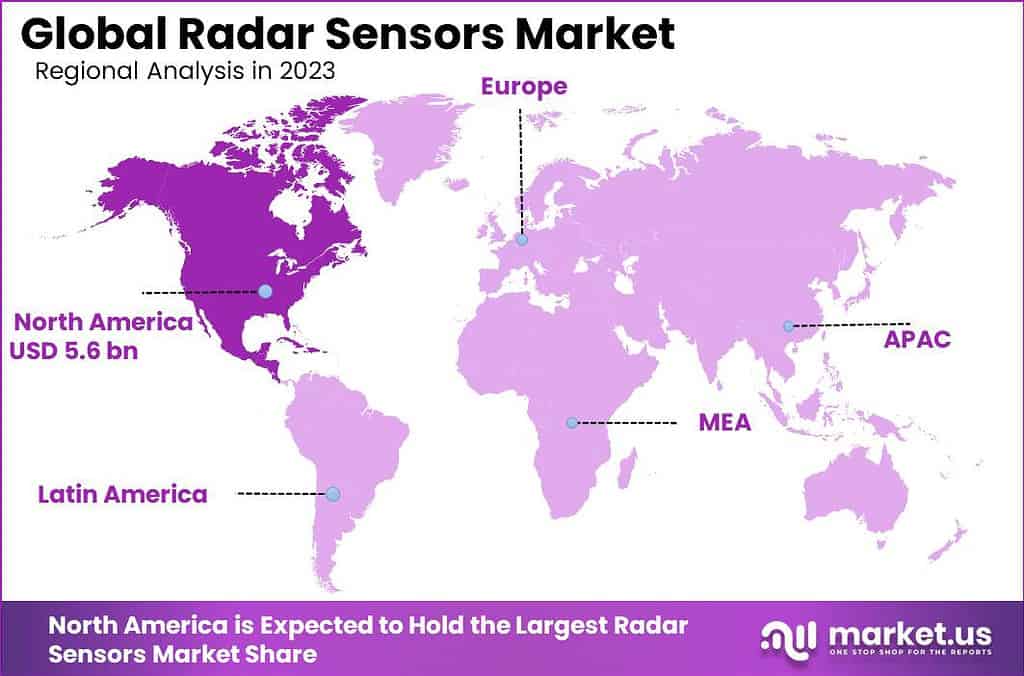

- In 2023, North America held a dominant position in the radar sensors market, capturing more than a 36.2% share.

Type Analysis

Based on the type outlook, the market is segmented into imaging and non-imaging segments, where the imaging segment has dominated the market with a share of 53.2% in the year 2023. This segment’s leadership can be primarily attributed to its advanced capabilities in providing high-resolution images that are essential for numerous applications.

Imaging radar sensors are capable of not only detecting the presence of objects but also providing detailed visual representations. This feature is critical in sectors such as automotive, where precise imaging is necessary for the functionality of advanced driver-assistance systems (ADAS), including pedestrian detection, lane change assistance, and adaptive cruise control.

Furthermore, the adoption of imaging radar sensors has been spurred by their utility in other sophisticated applications such as aerospace for monitoring air traffic, and in security for surveillance purposes. The technology’s ability to operate effectively under various weather conditions and in different lighting environments enhances its appeal, particularly in critical safety and operational roles.

The continued development and integration of AI and machine learning with imaging radar technology are expected to further drive the growth of this segment, as these enhancements enable smarter, more adaptive, and responsive sensor systems. As industries continue to evolve towards more automated and safety-conscious operations, the demand for imaging radar sensors is projected to grow.

Innovations that allow for more detailed and accurate environmental perception are critical, ensuring that this segment remains at the forefront of the radar sensors market. This trend is reflected in the substantial market share of the imaging segment, emphasizing its pivotal role in the broader adoption of radar sensor technology.

Range Analysis

Based on the rage, the market is segmented into short, medium, and long, where the long-range segment has dominated the market with a share of 42.1% in the year 2023. This segment’s significant market share is largely due to its essential role in applications requiring detection and monitoring over extensive distances.

Long-range radar sensors are particularly valued in the automotive industry, where they are critical for features such as adaptive cruise control and collision avoidance systems. These sensors can detect vehicles and other obstacles at significant distances, providing the necessary reaction time for safety features to engage effectively.

Additionally, the long-range radar sensors are indispensable in the aerospace and defense sectors, where the ability to monitor large areas from a distance is crucial for surveillance, reconnaissance, and missile defense systems. Their capability to perform under various weather conditions and during different times of the day makes them highly reliable for critical operations in these sectors.

The ongoing advancements in radar technology, which improve the accuracy and reliability of long-range sensors, are expected to further boost their adoption. As industries increasingly prioritize safety and efficiency, the demand for long-range radar sensors is projected to continue growing. This trend highlights the segment’s crucial role in driving forward the overall radar sensors market, supported by its broad application scope and the ongoing technological enhancements.

End User Analysis

Based on the end user, the market is segmented into Automotive, Traffic Monitoring Aerospace & Defense, Industrial, Security & Surveillance, Weather Monitoring, and Other segments. Among these, the traffic monitoring aerospace & defense segment has dominated the market with a share of 20.3% in the year 2023.

This prominence is primarily attributed to the critical application of radar sensors in both traffic management systems and various aerospace and defense mechanisms. In traffic monitoring, radar sensors are pivotal for managing and controlling traffic flows, detecting vehicle speeds, and ensuring overall road safety. Their ability to deliver real-time data and withstand various environmental conditions makes them indispensable for modern traffic management systems.

Similarly, in the aerospace and defense sector, radar sensors are crucial for surveillance, navigation, and security. They play a key role in national defense systems, including border surveillance and missile defense. Their reliability in long-range detection and durability in harsh conditions are valued for maintaining high levels of security and operational efficiency in sensitive environments.

The ongoing advancements in radar technology, such as the integration of artificial intelligence and machine learning, have significantly enhanced the capabilities of radar sensors in these sectors. As the demands for improved traffic management solutions and heightened security measures in aerospace and defense continue to rise, the adoption of sophisticated radar sensors is expected to grow. This trend underscores the segment’s leadership in the radar sensors market, highlighting its vital role in supporting critical infrastructure and national security initiatives.

Key Market Segments

By Type Outlook

- Imaging

- Non-Imaging

By Range

- Short

- Medium

- Long

By End-User

- Automotive

- Traffic Monitoring Aerospace & Defence

- Industrial

- Security & Surveillance

- Weather Monitoring

- Other

Key Driver

Increasing Applications in Automotive Safety

One of the primary drivers of the radar sensors market in 2023 is their increasing application in automotive safety. The demand for radar sensors in vehicles is driven by their ability to enhance safety features such as adaptive cruise control, collision avoidance systems, and blind spot detection. These sensors are integral to advanced driver-assistance systems (ADAS), which are becoming standard in new vehicles due to stringent safety regulations and consumer demand for safer driving experiences. The growth in the electric vehicle market, which heavily relies on these advanced technologies, further amplifies this demand.

Major Restraint

High Costs and Complexity

Despite the growing adoption, the high costs associated with advanced radar technologies pose a significant restraint on the market. The complexity of integrating these sensors with existing systems in vehicles or industrial setups adds to the overall expenses, making it challenging for adoption in lower-end applications or in developing markets where cost sensitivity is higher. Additionally, the need for continuous development to keep up with evolving technological standards increases investment requirements, potentially slowing down the market expansion.

Significant Opportunity

Expansion into Emerging Markets

There’s a substantial opportunity for the radar sensors market to expand into emerging markets, especially in regions that are currently undergoing rapid industrialization and urbanization. As these economies develop, there’s an increasing need for sophisticated traffic management systems, advanced industrial automation, and enhanced security measures-all areas where radar technology can play a crucial role. Additionally, as automotive markets in these regions grow, the demand for vehicles equipped with ADAS is expected to rise, further driving the demand for radar sensors.

Key Challenge

Cybersecurity Risks

The integration of radar sensors into critical systems brings about significant cybersecurity risks, which is a major challenge for the market. These sensors, when connected to networks, can become entry points for cyber-attacks. Concerns over data privacy and the potential for hacking can hinder their adoption, especially in sectors like automotive and traffic management where the implications of a security breach are particularly severe. Ensuring the security of these systems and maintaining consumer trust is crucial for the continued growth of the radar sensors market.

Latest Trends

Integration of Radar sensors in railways

A prominent trend influencing the radar sensor market is the integration of radar sensors in railroads, which is being driven by an increasing emphasis on enhancing operational intelligence, efficiency, and safety. In addition to giving real-time data on track conditions, train location, and obstacle identification, radar sensors have special features that enhance conventional railway signaling and monitoring systems.

Railway collision avoidance systems, where radar technology can detect and track approaching trains, objects, and pedestrians along the track, are one of the major uses of radar sensors in railways. Radar sensors are crucial in averting collisions and raising general safety standards as they can trigger automated braking and issue early warnings. Radar sensors also enable sophisticated ship positioning and navigation systems, giving precise position data even in inclement weather or in isolated locations with little infrastructure.

This minimizes travel times, increases operational effectiveness, and maximizes resource use for rail operators. Radar sensors also support predictive maintenance programs by keeping an eye on track conditions, spotting possible flaws or obstructions, and facilitating proactive maintenance procedures to prevent service interruptions and boost asset dependability.

In the end, the industry’s rising emphasis on safety, efficiency, and innovation is reflected in the integration of radar sensors into railways. Radar sensor solutions are expected to be crucial to the development of rail transportation in the future as rail networks strive to upgrade and implement smarter, more connected technology.

Regional Analysis

In 2023, North America held a dominant position in the radar sensors market, capturing more than a 36.2% share. This leadership is largely attributed to advanced technological integration across various industries, including automotive and aerospace, which heavily utilize radar sensors for enhanced safety and operational efficiency.

The demand for Radar Sensors in North America was valued at USD 5.6 billion in 2023 and is anticipated to grow significantly in the forecast period. The region’s commitment to upgrading automotive safety measures, coupled with strict regulatory standards requiring vehicles to be equipped with advanced driver-assistance systems (ADAS), significantly drives the demand for radar sensors. Furthermore, the presence of key industry players who continuously innovate and develop new radar sensor technologies contributes to the robust market growth in North America.

These companies are pioneering developments in long-range radar sensors and other advanced applications, which are critical for both national defense and civilian sectors, including weather monitoring and traffic management systems. The strong growth is also supported by increasing investments in autonomous driving technologies and the expansion of smart city projects, which further leverage the capabilities of radar sensors to enhance urban mobility and infrastructure safety. These factors collectively ensure that North Australia maintains a leading position in the radar sensors market

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

There are many businesses in the market, making the market more competitive. To improve their market penetration and solidify their position in the sector, these major players have used a variety of tactics, including agreements, geographical expansion, mergers and acquisitions, product range development, and partnerships.

Top Key Players in the Market

- Lockheed Martin Corporation

- Robert Bosch GmbH

- Socionext America Inc.

- Infineon Technologies AG

- Continental AG

- ZF Friedrichshafen AG

- DENSO CORPORATION

- HELLA GmbH & Co. KGaA

- Oculi Corp

- SICK AG

- Other Key Players

Recent Developments

- In January 2024, Texas Instruments launched a radar sensor chip for automobile safety and autonomy. It aids in enabling a higher level of autonomy by improvising the sensor fusion and decision-making in ADAS.

- In September 2024, Mobileye and Valeo formed a partnership to launch an imaging radar in the automobile industry, thus enabling a more intelligent vehicle.

Report Scope

Report Features Description Market Value (2023) USD 15.6 Bn Forecast Revenue (2033) USD 107.6 Bn CAGR (2024-2033) 21.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type Outlook (Imaging, Non-Imaging), By Range (Short, Medium, Long), By End-User (Automotive, Traffic Monitoring, Aerospace & Defence, Industrial, Security & Surveillance, Weather Monitoring, Other) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Lockheed Martin Corporation, Robert Bosch GmbH, Socionext America Inc., Infineon Technologies AG, Continental AG, ZF Friedrichshafen AG, DENSO CORPORATION, HELLA GmbH & Co. KGaA, Oculi Corp, SICK AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are radar sensors?Radar sensors are electronic devices that use radio waves to detect objects, measure their distance, speed, and other characteristics. They are commonly used in applications like automotive safety systems, weather monitoring, and defense.

How big is Radar Sensors Market?The Global Radar Sensors Market size is expected to be worth around USD 107.6 Billion By 2033, from USD 15.6 Billion in 2023, growing at a CAGR of 21.3% during the forecast period from 2024 to 2033.

What drives the growth of the radar sensors market?Key growth drivers include advancements in radar technology, increased demand for automotive safety systems, rising investments in defense, and the growing use of radar sensors in industrial automation and consumer electronics.

What challenges does the radar sensors market face?The primary challenges are the high cost of radar sensors, which can limit their adoption, and the significant investments required for research and development.

Which regions lead the radar sensors market?North America has a significant market share due to technological advancements, while Asia-Pacific is the fastest-growing region, driven by increasing demand in automotive and consumer electronics sectors.

-

-

- Lockheed Martin Corporation

- Robert Bosch GmbH

- Socionext America Inc.

- Infineon Technologies AG

- Continental AG

- ZF Friedrichshafen AG

- DENSO CORPORATION

- HELLA GmbH & Co. KGaA

- Oculi Corp

- SICK AG

- Other Key Players