Global Automotive Ancillaries Product Market Size, Share, Growth Analysis By Component (Engine Transmission and Suspension Components, Electrical Parts, Sheet Metal Parts and Body and Chassis, Cleaning, Maintenance and Repair Products, Others), By Application (Passenger Vehicle, Commercial Vehicle), By Distribution Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159877

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

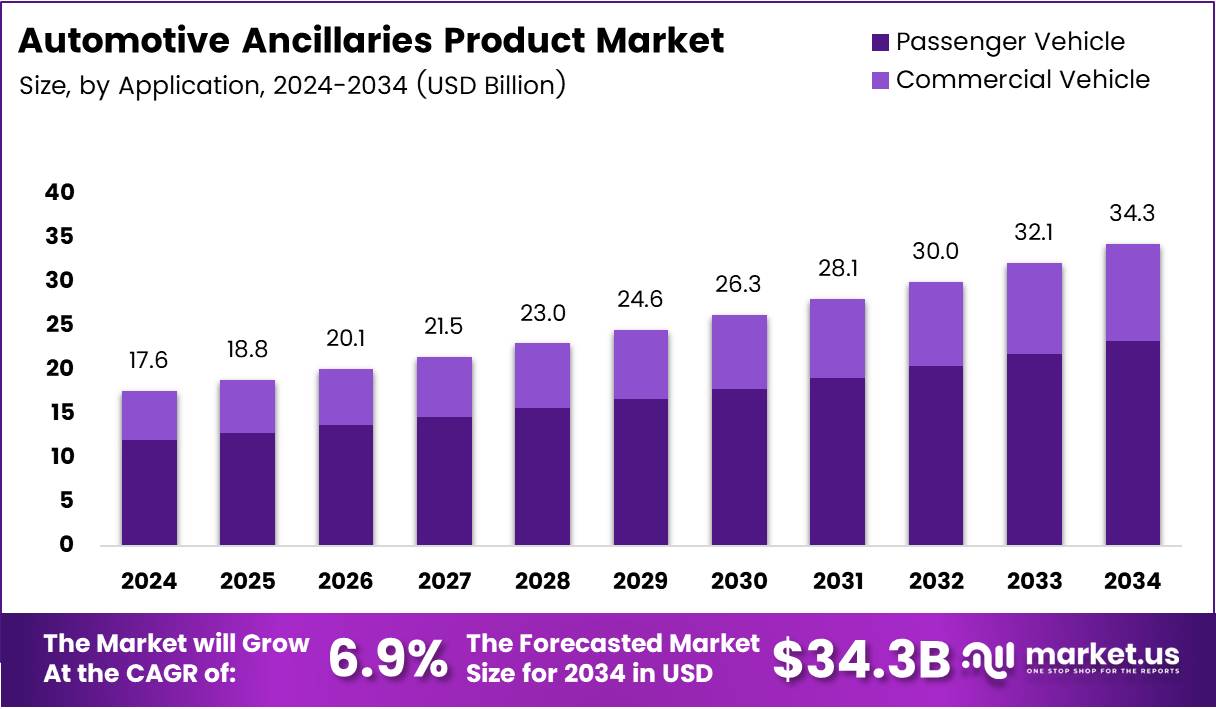

The Global Automotive Ancillaries Product Market size is expected to be worth around USD 37.0 Billion by 2034, from USD 17.6 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

The Automotive Ancillaries Product segment forms the backbone of the automotive ecosystem, supplying essential components that enhance vehicle efficiency and performance. These include filters, brake systems, batteries, and lighting solutions. As global mobility trends evolve, ancillary suppliers are adapting through innovation and integration of smart, lightweight, and sustainable materials.

Furthermore, growing emphasis on electrification and automation is transforming the ancillary value chain. Manufacturers are now focusing on energy-efficient products, embedded sensors, and digital connectivity to align with next-gen vehicles. This shift not only boosts demand for intelligent ancillaries but also fosters partnerships between OEMs and component innovators to ensure long-term competitiveness.

In parallel, the Automotive Ancillaries Product Market is witnessing steady expansion, driven by rising vehicle production, replacement demand, and aftermarket services. Emerging markets in Asia-Pacific are leading growth due to industrialization and increasing consumer mobility. Moreover, supply chain localization initiatives are encouraging domestic manufacturing and reducing import dependencies across key automotive hubs.

Government incentives and infrastructure investments are further catalyzing growth. Policies promoting electric vehicle adoption and sustainable manufacturing are reshaping industry priorities. Additionally, stringent emission norms are pushing suppliers to develop eco-friendly ancillaries, including low-friction components and lightweight assemblies that comply with global standards and sustainability goals.

With evolving consumer preferences, companies are investing in R&D to enhance product lifespan, safety, and performance. Aftermarket expansion, coupled with digitized service platforms, is opening new revenue streams. The transition from ICE to EV platforms also presents significant opportunities for ancillary players to innovate in thermal management, battery safety, and electronic integration.

According to the International Organization of Motor Vehicle Manufacturers (OICA), 93.9 million vehicles were produced globally in 2023, while 90.1 million units were registered. This robust production base underscores strong demand for ancillary products supporting assembly, maintenance, and upgrades. Consequently, the market is poised for sustained growth aligned with automotive modernization.

Key Takeaways

- The Global Automotive Ancillaries Product Market is projected to reach USD 37.0 Billion by 2034, growing from USD 17.6 Billion in 2024 at a CAGR of 6.9% (2025–2034).

- In 2024, Engine Transmission and Suspension Components dominated the By Component segment with a 37.8% share, driven by demand for high-performance and fuel-efficient systems.

- The By Application segment was led by Passenger Vehicles with a 67.3% share in 2024, supported by rising urbanization, higher disposable incomes, and advanced in-vehicle technologies.

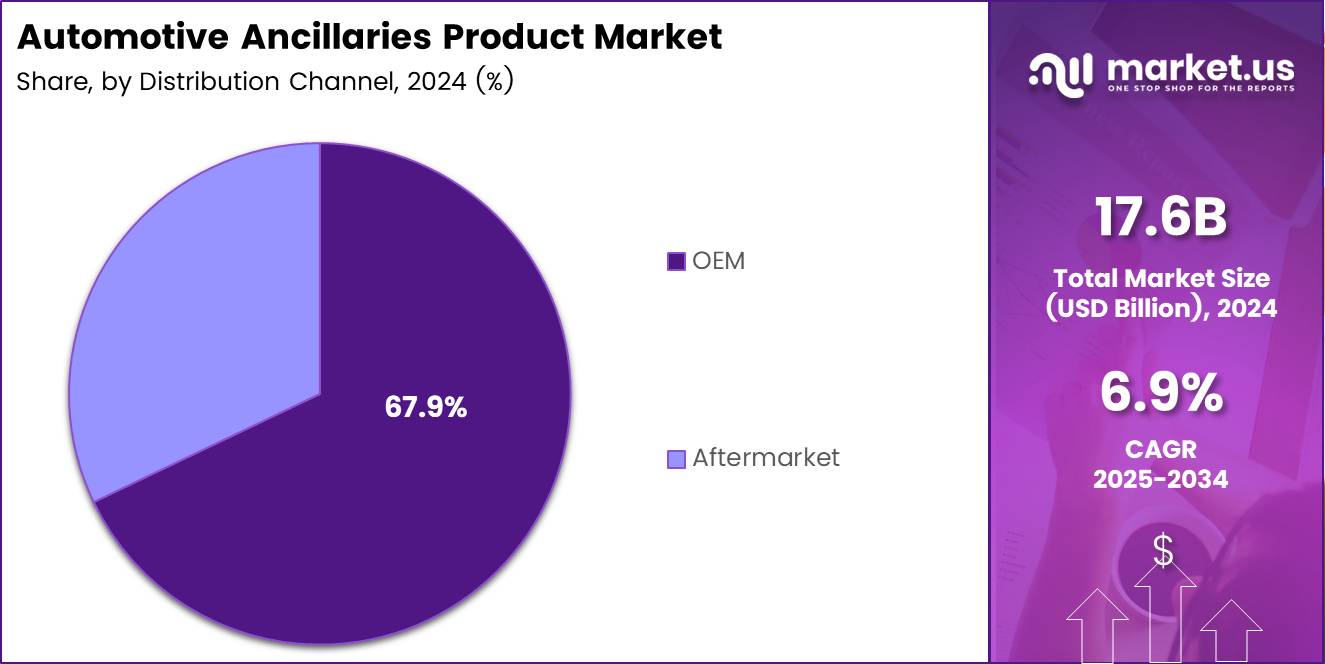

- In the By Distribution Channel segment, OEM accounted for a 67.9% share in 2024, reflecting strong partnerships, quality assurance, and compliance with international standards.

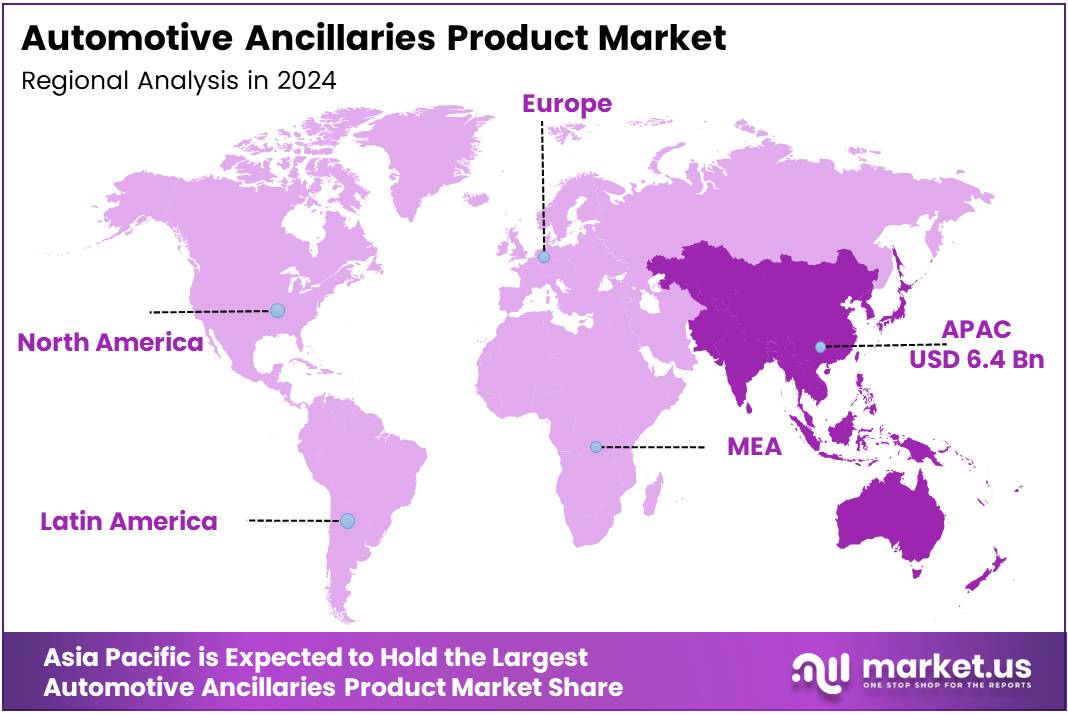

- Asia Pacific emerged as the leading regional market, commanding a 36.9% share valued at USD 6.4 Billion, propelled by robust production, aftermarket growth, and industrial expansion

By Component Analysis

Engine Transmission and Suspension Components dominate with 37.8% due to their critical role in vehicle performance and durability.

In 2024, Engine Transmission and Suspension Components held a dominant market position in the By Component segment of the Automotive Ancillaries Product Market, with a 37.8% share. This segment leads due to rising demand for high-performance vehicles, improved efficiency standards, and continuous innovation in drivetrain systems supporting fuel economy and safety.

Electrical Parts are gaining prominence with growing electrification trends in vehicles. As automakers increasingly adopt advanced driver assistance and infotainment systems, demand for sophisticated electrical components such as sensors, alternators, and wiring harnesses is surging. These elements are vital for supporting modern vehicle architectures and digital transformation across mobility ecosystems.

Sheet Metal Parts and Body and Chassis remain essential as automakers emphasize lightweight construction and structural strength. Increasing use of high-strength steel and aluminum enhances crashworthiness and fuel efficiency. Furthermore, manufacturers are integrating modular chassis systems, enabling flexible designs and faster production cycles, which fosters steady demand for these components globally.

Cleaning, Maintenance and Repair Products experience steady growth driven by rising vehicle ownership and aftermarket care trends. With consumers focusing on vehicle longevity and preventive maintenance, demand for lubricants, filters, and detailing solutions continues to expand. Moreover, awareness regarding vehicle hygiene and sustainability reinforces product adoption.

Others include diverse ancillary items supporting vehicle assembly and operation. These encompass fittings, rubber parts, and fasteners used in various subsystems. Although contributing a smaller portion, this category plays a supportive role in ensuring seamless manufacturing and enhancing overall automotive performance through precision-engineered auxiliary products.

By Application Analysis

Passenger Vehicle dominates with 67.3% due to increased consumer demand and expanding personal mobility trends.

In 2024, Passenger Vehicle held a dominant market position in the By Application segment of the Automotive Ancillaries Product Market, with a 67.3% share. The segment benefits from growing urbanization, rising disposable incomes, and consumer preference for comfort. Innovations in infotainment, connectivity, and safety systems further accelerate ancillary demand.

Commercial Vehicle demand is supported by robust logistics growth, construction activities, and e-commerce expansion. As fleets modernize for efficiency and emission compliance, ancillary suppliers are introducing durable and cost-effective components. Enhanced focus on uptime, reliability, and fuel economy sustains steady traction across light and heavy commercial categories.

By Distribution Channel Analysis

OEM dominates with 67.9% due to strong integration with vehicle manufacturers and high-quality component demand.

In 2024, OEM held a dominant market position in the By Distribution Channel segment of the Automotive Ancillaries Product Market, with a 67.9% share. Automakers increasingly rely on established suppliers for consistent quality and technological compatibility. Collaborative innovation and compliance with global standards strengthen OEM partnerships across emerging and mature markets.

Aftermarket distribution remains vital, catering to vehicle servicing and replacement needs post-sale. Expanding vehicle parc and consumer inclination toward cost-effective repairs drive this channel’s growth. Additionally, digital platforms and e-commerce channels enhance accessibility, enabling consumers to source certified components conveniently while ensuring long-term vehicle maintenance.

Key Market Segments

By Component

- Engine Transmission and Suspension Components

- Electrical Parts

- Sheet Metal Parts and Body and Chassis

- Cleaning, Maintenance and Repair Products

- Others

By Application

- Passenger Vehicle

- Commercial Vehicle

By Distribution Channel

- OEM

- Aftermarket

Drivers

Rising Demand for Electric Vehicles Drives Automotive Ancillaries Market Growth

The automotive ancillaries market is experiencing significant momentum as electric vehicle adoption accelerates worldwide. This shift creates substantial demand for specialized components like battery management systems, thermal control units, and charging infrastructure accessories. Manufacturers are responding by developing innovative ancillary products tailored specifically for EV platforms.

The global automotive aftermarket continues expanding, driven by growing vehicle ownership and increasing consumer preference for customization. Vehicle owners are investing more in performance upgrades, aesthetic enhancements, and comfort-improving accessories. This trend strengthens the aftermarket segment, creating sustained demand for diverse ancillary products across different vehicle categories.

Lightweight materials are becoming essential in modern vehicle manufacturing as automakers pursue improved fuel efficiency and reduced emissions. Ancillary component manufacturers are increasingly adopting advanced materials like carbon fiber composites, high-strength aluminum alloys, and engineering plastics. These materials help reduce overall vehicle weight while maintaining structural integrity and performance standards.

Government safety regulations worldwide are becoming progressively stringent, mandating advanced safety features and protective systems. This regulatory environment drives consistent demand for safety-related ancillary products including advanced braking systems, airbag components, sensor modules, and electronic stability systems. Manufacturers must continuously innovate to meet evolving safety standards across different markets.

Restraints

Volatility in Raw Material Prices Restrains Market Expansion

Raw material price fluctuations present significant challenges for automotive ancillary manufacturers. Steel, aluminum, rubber, and plastic resins experience unpredictable pricing cycles influenced by global supply-demand dynamics and geopolitical factors. These variations directly impact production costs, squeezing profit margins and complicating pricing strategies for manufacturers operating on tight budgets.

Advanced manufacturing technologies for automotive ancillaries require substantial upfront capital investment. Setting up automated production lines, implementing quality control systems, and adopting precision manufacturing equipment demands significant financial resources. Smaller manufacturers often struggle to make these investments, limiting their competitive capabilities and market participation opportunities.

Supply chain disruptions continue affecting the automotive ancillaries sector, causing delays in component availability and production schedules. Global logistics challenges, shipping constraints, and regional manufacturing bottlenecks create unpredictability in material sourcing. These disruptions force manufacturers to maintain higher inventory levels, increasing working capital requirements and operational complexities.

Environmental compliance requirements are becoming increasingly demanding across major automotive markets. Manufacturers face mounting pressure to reduce emissions, manage waste responsibly, and adopt sustainable production practices.

Meeting these standards requires significant investment in pollution control equipment, waste treatment facilities, and process modifications. The compliance burden particularly affects smaller manufacturers with limited resources, potentially forcing some players out of competitive markets.

Growth Factors

Development of Smart Ancillaries with IoT Features Creates Growth Opportunities

Smart automotive ancillaries incorporating Internet of Things technology represent a transformative growth opportunity. Connected components enable real-time monitoring, predictive maintenance alerts, and performance optimization through data analytics.

Manufacturers developing intelligent sensors, connected diagnostic tools, and cloud-integrated systems are positioning themselves for substantial market expansion as vehicles become increasingly digitalized.

Advanced driver assistance systems adoption continues accelerating as safety consciousness grows among consumers and regulators. ADAS-related ancillary components including radar sensors, camera modules, lidar units, and processing systems present lucrative opportunities for suppliers. The gradual progression toward autonomous driving further amplifies demand for sophisticated sensing and computing ancillaries across all vehicle segments.

Shared mobility services and commercial fleet operations create distinctive opportunities for ancillary suppliers. Fleet operators prioritize durability, maintenance efficiency, and total cost of ownership, driving demand for premium-quality ancillary products. The growing fleet maintenance services sector requires consistent supply of reliable components, creating stable revenue streams for established suppliers with proven track records.

Emerging economies present significant aftermarket penetration opportunities as vehicle populations expand rapidly. Markets in Asia-Pacific, Latin America, and Africa show increasing vehicle ownership alongside developing service infrastructure. Local and international suppliers can capitalize on growing replacement demand, expanding distribution networks, and rising consumer spending on vehicle maintenance and upgrades in these high-growth regions.

Emerging Trends

Rising Preference for 3D-Printed Components Shapes Market Trends

Additive manufacturing is revolutionizing automotive ancillary production, enabling rapid prototyping, customization, and on-demand manufacturing. 3D printing technology allows manufacturers to produce complex geometries, reduce tooling costs, and minimize inventory requirements. This trend particularly benefits niche applications, spare parts production, and customized components where traditional manufacturing proves economically challenging.

Sustainability considerations are driving significant shifts toward eco-friendly ancillary materials. Manufacturers increasingly utilize recyclable plastics, bio-based composites, and responsibly sourced materials responding to environmental regulations and consumer preferences. This transition toward sustainable materials requires supply chain restructuring and material science innovation but offers differentiation opportunities for forward-thinking manufacturers.

Strategic collaborations between original equipment manufacturers and ancillary suppliers are intensifying. These partnerships facilitate co-development of integrated solutions, ensure quality consistency, and optimize supply chain efficiency. Joint ventures and long-term agreements provide ancillary suppliers with business stability while helping OEMs secure reliable component sources amid increasing technical complexity.

Digital transformation is reshaping spare parts distribution through e-commerce platforms and online marketplaces. Manufacturers and distributors are establishing direct-to-consumer channels, implementing digital cataloging systems, and utilizing data analytics for inventory optimization.

These digital platforms improve accessibility for end-users, reduce distribution costs, and enable better demand forecasting, fundamentally changing traditional distribution models in the automotive ancillaries sector.

Regional Analysis

Asia Pacific Dominates the Automotive Ancillaries Product Market with a Market Share of 36.9%, Valued at USD 6.4 Billion

The Asia Pacific region leads the global automotive ancillaries product market with a commanding market share of 36.9%, valued at USD 6.4 Billion. This dominance is fueled by robust automotive production, expanding aftermarket demand, and rapid industrialization across emerging economies such as China, India, and Japan.

Increasing vehicle sales, coupled with growing consumer interest in customization and performance enhancement, continue to accelerate market growth. Additionally, the region’s strong manufacturing capabilities and expanding distribution networks further solidify its leadership position.

North America Automotive Ancillaries Product Market Trends

North America holds a significant position in the global automotive ancillaries product market, supported by high vehicle ownership rates and strong consumer spending on automotive upgrades and maintenance.

The region benefits from advanced automotive technologies, a mature aftermarket ecosystem, and growing demand for electric and hybrid vehicles. Rising focus on vehicle safety, efficiency, and sustainability continues to drive the need for innovative ancillary products across the United States and Canada, ensuring steady market expansion.

Europe Automotive Ancillaries Product Market Trends

Europe remains a key contributor to the automotive ancillaries product market, underpinned by its reputation for engineering excellence and stringent regulatory standards.

Countries such as Germany, France, and Italy play a crucial role in shaping market trends through advanced automotive manufacturing and technological innovation. The growing adoption of electric vehicles and smart automotive solutions is fostering demand for specialized ancillary components, positioning Europe as a hub for high-quality and sustainable automotive products.

Middle East and Africa Automotive Ancillaries Product Market Trends

The Middle East and Africa region is gradually emerging as an attractive market for automotive ancillaries, driven by increasing vehicle imports, economic diversification, and infrastructure development.

Rising automotive demand in Gulf Cooperation Council (GCC) countries, along with a growing emphasis on aftermarket servicing, is propelling product adoption. As modernization accelerates and awareness of vehicle maintenance improves, the region is expected to witness consistent growth in ancillary product consumption.

Latin America Automotive Ancillaries Product Market Trends

Latin America is experiencing steady growth in the automotive ancillaries product market, supported by rising vehicle production and aftermarket activities in key countries such as Brazil and Mexico. Economic stabilization and increasing consumer focus on vehicle performance and longevity are driving demand for ancillary products. Investments in supply chain efficiency, distribution networks, and service centers are further strengthening the region’s market outlook, paving the way for sustained expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Ancillaries Product Company Insights

In 2024, the global Automotive Ancillaries Product Market continued to witness strong participation from key players focusing on innovation, sustainability, and efficiency enhancement. Each of these companies adopted strategies centered around technological integration, product diversification, and global expansion to maintain competitiveness and capture emerging opportunities.

Duncan Engineering Ltd showcased significant progress by leveraging its expertise in pneumatic and hydraulic components. The company’s emphasis on precision engineering and reliability helped it strengthen partnerships with leading automobile manufacturers, especially within commercial and passenger vehicle categories. Its continuous focus on localized manufacturing and cost optimization further boosted its market presence.

AISIN CORPORATION maintained a strong foothold through its advanced drivetrain, braking, and engine component systems. The company capitalized on the growing shift toward electrification, offering next-generation components compatible with hybrid and electric vehicles. Its strong R&D infrastructure supported innovation in lightweight materials, aligning with global emission standards.

Nippon expanded its product portfolio with a focus on high-performance ancillary products that meet evolving automotive standards. Its strategic collaborations across Asia and Europe helped enhance manufacturing efficiency and ensure consistent quality. By integrating automation in production, the company improved scalability and reduced operational costs.

ZF Friedrichshafen AG continued to dominate through its technological leadership in driveline and chassis technology. The company’s investments in autonomous and electric mobility solutions positioned it as a frontrunner in intelligent vehicle systems. Its robust aftermarket services and digital platforms supported long-term client relationships across regions.

Top Key Players in the Market

- Duncan Engineering Ltd

- AISIN CORPORATION

- Nippon

- ZF Friedrichshafen AG

- Lear Corporation

- Continental AG

- Robert Bosch GmbH

- Uno Minda

Recent Developments

- In August 2025, Infineon successfully completed the acquisition of Marvell’s Automotive Ethernet business, strengthening its foothold in the in-vehicle networking segment. This strategic move enhances Infineon’s capabilities in advanced connectivity solutions, supporting next-generation software-defined and autonomous vehicles.

- In September 2025, TVS Motor Company announced the acquisition of Italy’s Engines Engineering, marking a key step in its global expansion strategy. The company also set up a Global Centre of Excellence in Bologna to drive innovation, design, and technology development for future mobility solutions.

- In January 2025, American Axle & Manufacturing (AAM) completed a $1.4 billion acquisition of GKN Automotive, signaling a major shift in the automotive manufacturing landscape. The deal reinforces AAM’s leadership in driveline systems and boosts its capacity for electrified vehicle production and integration.

Report Scope

Report Features Description Market Value (2024) USD 17.6 Billion Forecast Revenue (2034) USD 37.0 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Engine Transmission and Suspension Components, Electrical Parts, Sheet Metal Parts and Body and Chassis, Cleaning, Maintenance and Repair Products, Others), By Application (Passenger Vehicle, Commercial Vehicle), By Distribution Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Duncan Engineering Ltd, AISIN CORPORATION, Nippon, ZF Friedrichshafen AG, Lear Corporation, Continental AG, Robert Bosch GmbH, Uno Minda Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Ancillaries Product MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Ancillaries Product MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Duncan Engineering Ltd

- AISIN CORPORATION

- Nippon

- ZF Friedrichshafen AG

- Lear Corporation

- Continental AG

- Robert Bosch GmbH

- Uno Minda