Global Automation Outsourcing Market Size, Share Analysis Report By Component (Solution, Services), By Business Function (Information Technology (IT), Sales and Marketing, Operations, Finance, Human Resources (HR), By Type (Rule-based Automation, Knowledge-based Automation), By Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By Industry (Banking, Financial Services, and Insurance (BFSI), Telecom and IT, Retail and Consumer goods, Healthcare and Life Sciences, Manufacturing, Government and Defense, Energy and Utilities, Media and Entertainment, Transportation and Logistics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152495

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

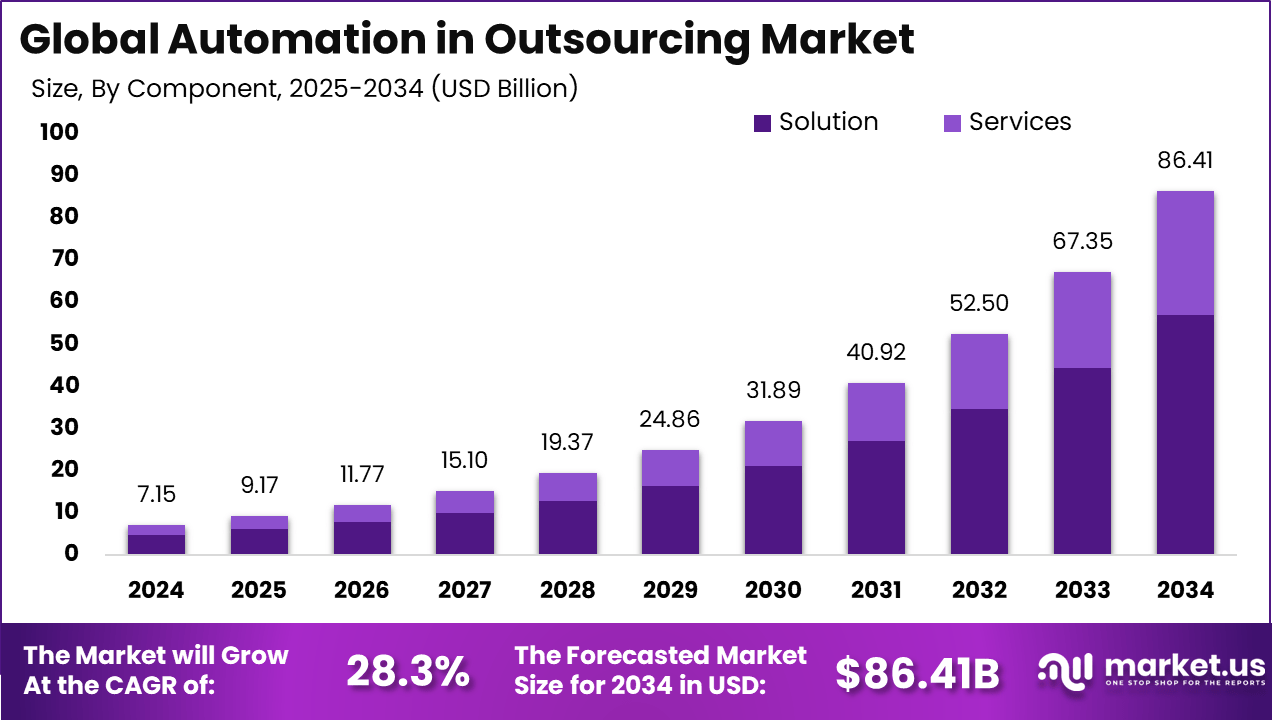

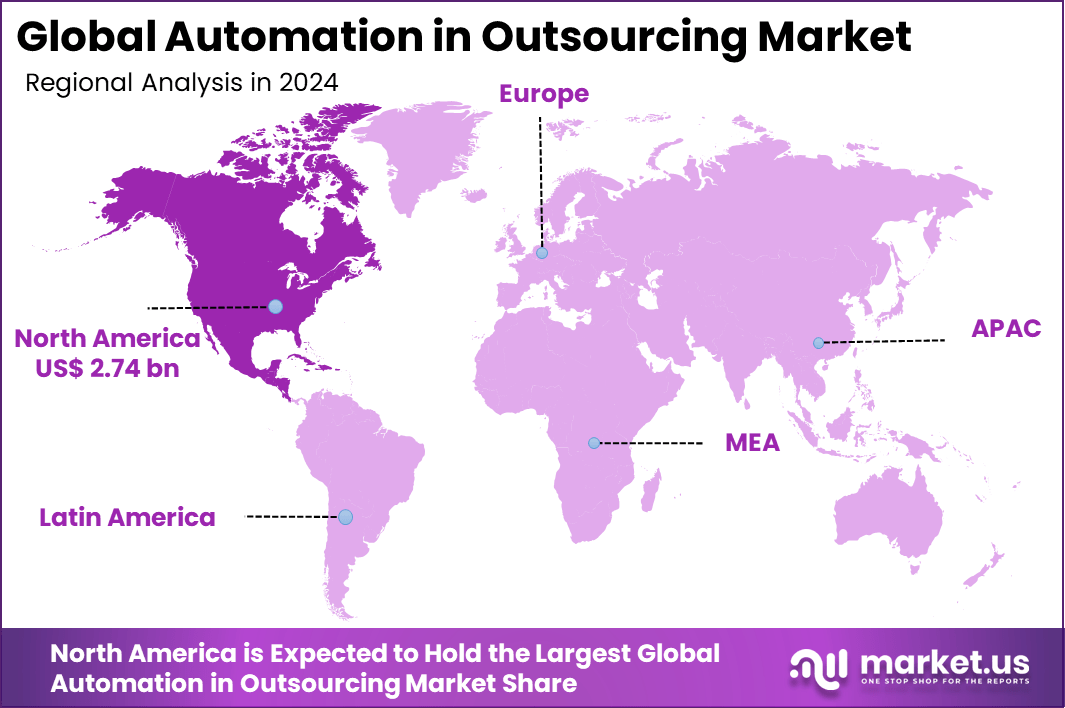

The Global Automation Outsourcing Market size is expected to be worth around USD 86.41 billion by 2034, from USD 7.15 billion in 2024, growing at a CAGR of 28.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.4% share, holding USD 2.74 billion in revenue.

The Automation Outsourcing Market refers to the segment of global outsourcing services where organizations delegate automation tasks such as robotic process automation (RPA), intelligent process automation, and IT process automation to specialized third-party providers. This market has grown as enterprises recognize that automation requires expertise in deployment, management, and continuous optimization.

For instance, in June 2025, The Hackett Group revealed significant advancements in AI-driven procurement outsourcing services, highlighting how automation is transforming the procurement process. Their research shows that organizations adopting AI in outsourcing have achieved major gains in efficiency, cost reduction, and decision-making speed.

Market Scope and Forecast

Report Features Description Market Value (2024) USD 7.15 Bn Forecast Revenue (2034) USD 86.41 Bn CAGR (2025-2034) 28.3% Largest market in 2024 North America [38.4% market share] The top driving factors behind this market include the rising complexity of enterprise IT systems and the increasing need for operational efficiency. As automation technologies advance, organizations depend more on external partners to streamline deployment, achieve scalability, and ensure resilience. The rising use of cloud-based platforms and managed services helps firms cut risks, lower costs, and automate processes by outsourcing infrastructure.

The increasing adoption of technologies such as RPA, artificial intelligence, cloud-native platforms, and intelligent process automation is transforming the market. These advanced technologies, implemented through outsourcing providers, deliver faster deployment, reduced errors, and improved monitoring. Service providers use AI-driven analytics to optimize processes and enhance operational outcomes over time.

The key reasons for adopting these technologies include the ability to scale quickly, achieve greater process accuracy, reduce costs, and ensure compliance. Outsourcing providers bring specialized skills, governance frameworks, and security standards that internal teams often cannot match at scale. This makes outsourcing an attractive option for enterprises aiming for predictable costs and minimized operational risks.

Key Takeaway

- The market is projected to grow sharply from USD 7.15 billion in 2024 to approximately USD 86.41 billion by 2034, achieving a strong CAGR of 28.3%, driven by rising demand for cost-efficient, scalable automation across business processes.

- North America led the global market in 2024, holding over 38.4% share and generating around USD 2.74 billion in revenue, fueled by advanced digital infrastructure and early adoption of outsourced automation.

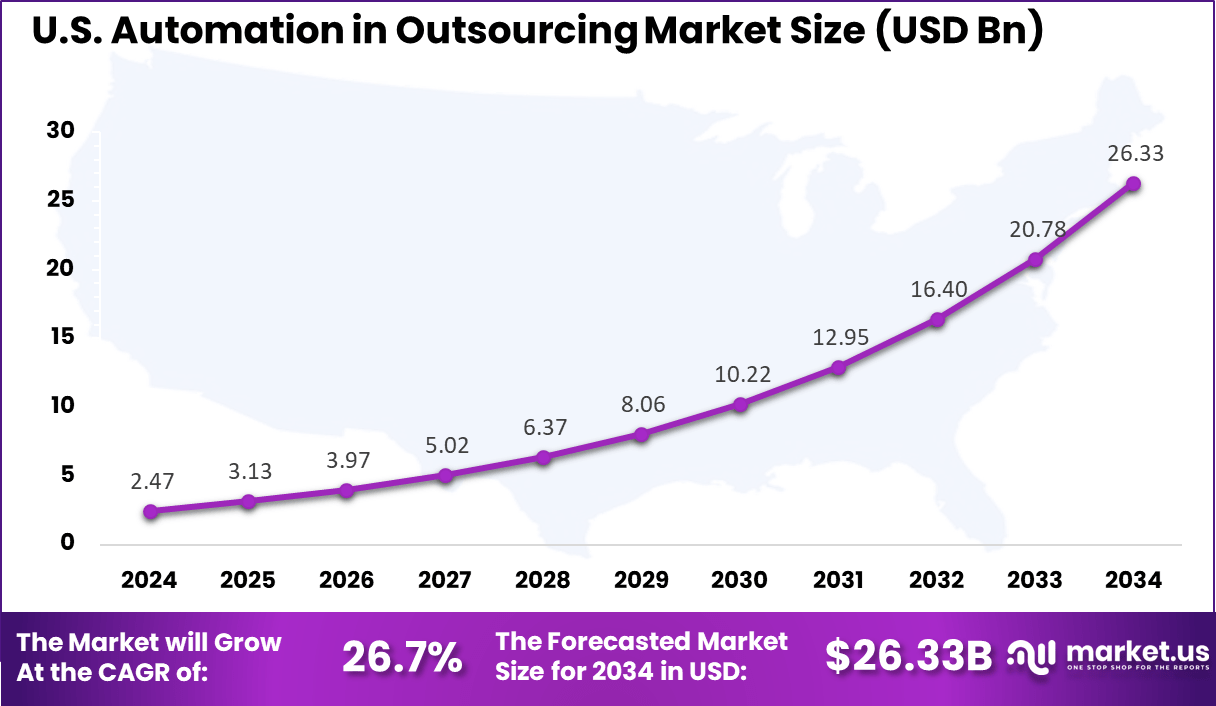

- The U.S. market alone accounted for about USD 2.47 billion in 2024, with an expected CAGR of 26.7%, reflecting high enterprise investments in automation to enhance productivity and reduce operational costs.

- By component, Solutions dominated with a 66.1% share, highlighting enterprise preference for end-to-end automation platforms and managed services over standalone tools.

- Across business functions, Information Technology (IT) held the largest share at 32.5%, as companies increasingly outsource IT process automation to specialized providers.

- By type, Rule-based Automation accounted for a commanding 78.1% share, reflecting strong demand for robotic process automation (RPA) in repetitive, rules-driven tasks.

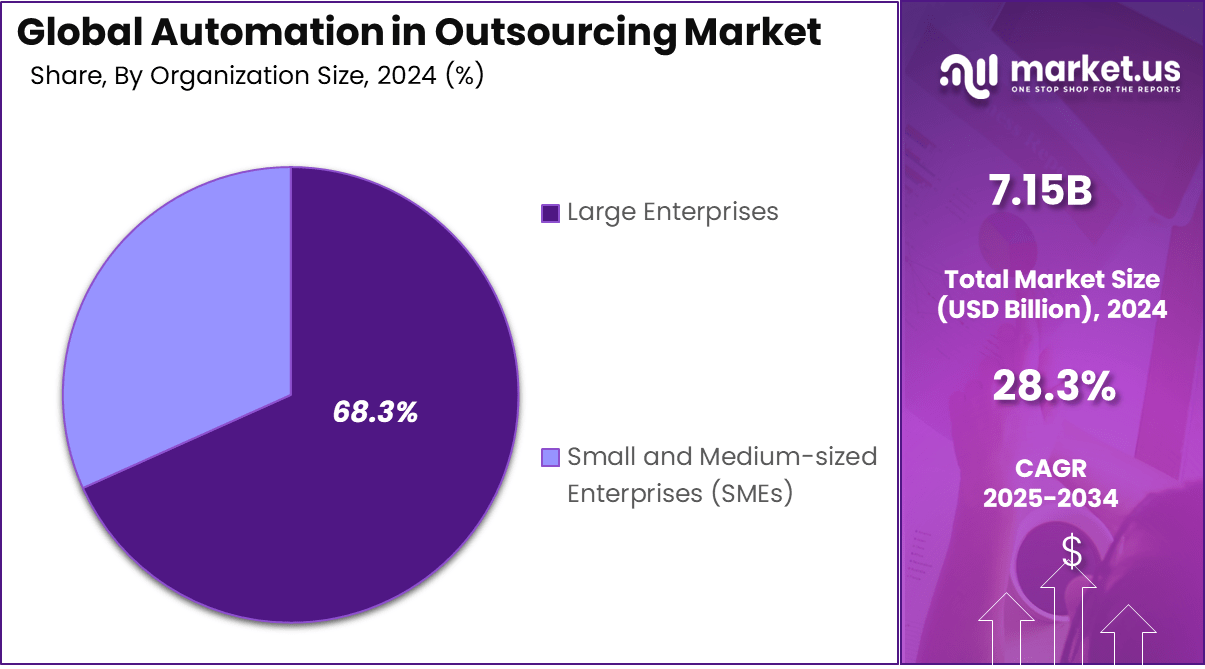

- In terms of organization size, Large Enterprises led with 68.3% share, given their greater resources and strategic need for scalable automation solutions.

- Among industries, Banking, Financial Services, and Insurance (BFSI) was the largest adopter, holding 24.9% share, driven by the sector’s focus on compliance, transaction speed, and operational efficiency.

U.S. Market Size

The market for Automation in Outsourcing within the U.S. is growing tremendously and is currently valued at USD 2.47 billion, the market has a projected CAGR of 26.7%. In the U.S., companies are actively seeking cost-cutting measures to increase efficiency and productivity, which is driving the adoption of automation tools like RPA and AI.

The U.S. organization possesses a robust technological infrastructure and skilled staff that can execute these advanced solutions. The demand for faster, more accurate services, combined with the pressure to remain competitive in a rapidly changing global market, is driving this growth.

For instance, in June 2025, Just Energy partnered with HCL Technologies for an AI-led business transformation aimed at enhancing operations through automation. This collaboration focuses on integrating AI-driven solutions to streamline processes, improve customer experiences, and drive cost efficiencies. This move underscores the growing role of AI in reshaping outsourcing strategies in the U.S. and across industries.

In 2024, North America held a dominant market position in the Global Automation in Outsourcing Market, capturing more than a 38.4% share, holding USD 2.74 billion in revenue. The North American region’s technological base and early adoption of automation innovations like RPA and AI helped it maintain a dominant position in the global outsourcing market for automation.

This makes the region’s leadership strong, with large companies seeking to increase operational efficiency and cut costs. In addition, significant investments in cloud computing and digital transformation, along with a skilled workforce, make it easy to incorporate sophisticated automation systems smoothly. Outsourced automation services are in constant demand due to their focus on scalability, innovation, and quality.

For instance, in June 2025, IBEX was recognized as a Leader in Frost & Sullivan’s Radar for Customer Experience Management Outsourcing. The company’s success is driven by its use of AI-driven automation solutions, optimizing customer service operations. IBEX’s integration of RPA and AI technologies has fueled its growth and leadership in North America, enhancing service quality and customer satisfaction.

Component Analysis

In 2024, Solution segment held a dominant market position, capturing a 66.1% share of the Global Automation in Outsourcing Market. This dominance is due to the growing demand for comprehensive, end-to-end automation solutions that cater to a wide range of business needs, from process automation to data analysis.

Integrated solutions that leverage Robotic Process Automation (RPA), Artificial Intelligence (AI), and cloud technologies enable organizations to streamline operations and increase efficiency while reducing costs. For Instance, in January 2025, the DDC Group announced a strategic partnership with EvoluteIQ, an expert in intelligent business automation.

This collaboration aims to enhance outsourcing solutions by integrating AI-driven automation technologies into business processes. The partnership focuses on automating critical functions such as customer service, data processing, and workflow management, allowing businesses to achieve greater efficiency, accuracy, and scalability.

Business Function Analysis

In 2024, the Information Technology (IT) segment held a dominant market position, capturing a 32.5% share of the Global Automation in Outsourcing Market. The demand in this sector has been driven mainly by the increasing need for IT companies to streamline operations, enhance service delivery, and reduce costs.

The widespread use of automation tools like RPA and AI in areas such as software creation, testing, and system management has enabled IT outsourcing firms to improve efficiency, flexibility, creativity, and innovation while also meeting the growing demand for faster and more reliable services. For instance, in June 2025, Sonata Software secured a multi-million-dollar IT outsourcing deal with a leading U.S. healthcare provider.

The deal is expected to leverage advanced automation technologies to streamline the healthcare provider’s operations, enhance efficiency, and reduce costs. By integrating Robotic Process Automation (RPA) and AI-driven solutions, Sonata Software aims to automate key processes, including data management, patient records, and billing systems.

Type Segment Analysis

In 2024, Rule-based Automation segment held a dominant market position, capturing a 78.1% share of the Global Automation in Outsourcing Market. This dominance is due to the widespread applicability of rule-based automation in handling repetitive, structured tasks that follow predefined processes.

Its significant use in finance, human resources, and customer support sectors is attributed to rule-based automation, which automates tasks like data entry, payroll, or compliance verification. The affordability, reliability, and ease of use associated with rule-based automation have consistently made it a preferred choice for many outsourcing firms.

For Instance, in May 2025, IBM announced a significant shift in its operations by automating its Human Resources (HR) functions using artificial intelligence (AI) and robotic process automation (RPA). The company laid off approximately 8,000 employees in HR, as their roles were replaced by AI-powered systems that streamline administrative processes such as recruitment, payroll, and employee benefits management.

Organization Size Analysis

In 2024, Large Enterprises segment held a dominant market position, capturing a 68.3% share of the Global Automation in Outsourcing Market. This dominance is due to the substantial assets of large corporations and their ability to invest in advanced automation technologies. Companies that use automation to handle complex, high-volume tasks have significant advantages, such as increased efficiency, cost savings, and scalability.

Due to their focus on digital transformation and need for a competitive edge, there is heightened demand for outsourcing automation solutions. Additionally, major corporations rely on robust, flexible platforms that seamlessly integrate with current IT frameworks, further cementing their position as leaders in this domain.

For Instance, in May 2025, Microsoft showcased significant advancements in automation and AI at its Build 2025 conference. The company introduced updates to its Copilot Studio, expanding the use of AI agents across platforms such as Windows, GitHub, Azure, and Microsoft 365. These enhancements aim to create a more autonomous ecosystem where AI agents can function independently, helping businesses automate tasks more efficiently.

Industry Segment Analysis

In 2024, Banking, Financial Services, and Insurance (BFSI) segment held a dominant market position, capturing a 24.9% share of the Global Automation in Outsourcing Market. This dominance is due to the sector’s high demand for automation to streamline operations, enhance compliance, and reduce operational risks.

BFSI institutions rely heavily on automation tools like RPA and AI to manage various functions, including data processing, fraud detection, and customer service, which enhances efficiency while maintaining compliance with regulations. The industry’s requirement for fast, precise, and secure transaction processing drives the increasing adoption of automation solutions.

For Instance, in April 2025, HCL Technologies was recognized for its significant contributions to the BFSI (Banking, Financial Services, and Insurance) sector by leveraging AI and automation to transform outsourcing operations. The company has been at the forefront of embedding AI-driven solutions across various BFSI functions, including fraud detection, risk management, and customer service.

Key Market Segments

By Component

- Solution

- Services

- Managed Services

- Professional Services

By Business Function

- Information Technology (IT)

- Sales and Marketing

- Operations

- Finance

- Human Resources (HR)

By Type

- Rule-based Automation

- Knowledge-based Automation

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Industry

- Banking, Financial Services, and Insurance (BFSI)

- Telecom and IT

- Retail and Consumer Goods

- Healthcare and Life Sciences

- Manufacturing

- Government and Defense

- Energy and Utilities

- Media and Entertainment

- Transportation and Logistics

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Managed and Intelligent Automation Services

A prominent emerging trend in the automation outsourcing market is the growing demand for managed end‑to‑end automation services. Organizations are increasingly engaging outsourcing partners to not only implement automation technologies but also to manage, monitor, and continuously improve these systems.

Another notable trend is the convergence of artificial intelligence, robotic process automation, and cloud‑native architectures within outsourced services. Providers are offering intelligent solutions that incorporate machine learning and predictive analytics to optimize performance dynamically. This integrated approach enhances scalability and resilience, aligning closely with organizational transformation objectives.

Drivers

Complexity of Enterprise Automation

The primary driver for automation outsourcing is the increasing complexity of automation ecosystems within enterprises. As businesses deploy diverse automation tools across multiple functions, maintaining seamless operation and integration becomes challenging. Outsourcing post‑deployment support to specialized providers ensures continuous performance, compliance, and effective management.

Additionally, the ongoing push for digital transformation is reinforcing demand. Many organizations lack in‑house expertise to manage advanced automation systems. By outsourcing to expert partners, they gain access to specialized knowledge in areas such as RPA and AI, enabling them to focus internal resources on core strategic priorities.

Restraint

Security and Control Concerns

One significant restraint for the market is heightened concern over data security and privacy. Entrusting sensitive business processes to third‑party providers exposes organizations to risks of unauthorized access, data breaches, and non‑compliance with regulations, especially in highly regulated industries like finance and healthcare.

Closely related is the perceived loss of operational control. Outsourcing critical automation tasks can create dependency on external vendors and introduce challenges in aligning outsourced operations with internal priorities. This perceived risk can slow the adoption of outsourced automation solutions.

Opportunities

Subscription and Hyperautomation Models

An important opportunity in the market lies in the emergence of subscription‑based and Robotics‑as‑a‑Service models. These approaches lower financial barriers by converting large capital expenditures into predictable operational costs, making automation outsourcing accessible to mid‑sized enterprises as well as large corporations.

There is also strong potential in hyperautomation services, which combine RPA, AI, analytics, and advanced orchestration. These intelligent solutions deliver higher business value by automating more complex, end‑to‑end processes. Such offerings are expected to attract organizations looking for more than basic task automation.

Challenges

Skills Gap and Legacy Infrastructure

One of the key challenges is the shortage of skilled professionals in advanced automation domains. Expertise in fields such as AI, machine learning, and intelligent orchestration is still limited, which can constrain the scalability and quality of outsourced services.

Another challenge is the complexity of integrating automation across hybrid IT infrastructures. Many enterprises operate with a mix of legacy on‑premise systems and modern cloud platforms. Ensuring seamless performance and compliance across such diverse environments adds significant complexity for outsourcing providers.

Key Players Analysis

Automation Anywhere and UiPath are prominent in the automation outsourcing market, focusing on robotic process automation and cloud-based solutions. Blue Prism strengthens its presence with scalable, AI-integrated platforms, meeting demand across sectors like BFSI and healthcare. These players drive enterprise adoption by offering cost-efficient and flexible automation strategies to improve operational performance.

IBM and Microsoft lead with advanced AI and cloud-enabled automation services. IBM combines RPA with cognitive solutions, while Microsoft integrates automation into Azure and Power Platform. HCL Technologies and HPE emphasize IT process automation within their managed services, supporting enterprises seeking digital transformation and operational agility.

NICE, Pegasystems, and Kofax bring specialized offerings to the market. NICE focuses on customer service and workforce automation, Kofax on document-driven workflows, and Pegasystems on CRM-integrated automation. Other emerging players cater to niche needs, increasing competition and fostering wider adoption of customized automation across industries.

Top Key Players in the Market

- Automation Anywhere

- Blue Prism

- IBM

- Microsoft

- Uipath

- HCL Technologies

- HPE

- Kofax

- Nice Ltd.

- Pegasystems

- Others

Recent Developments

- In June 2025, FTI Consulting highlighted the growing importance of intelligent automation for shared services outsourcing providers. According to their insights, automation is becoming a critical tool for providers to stay competitive and meet the rising demand for efficiency and cost reduction in outsourced services.

- In June 2025, Kofax continued to enhance its intelligent automation solutions for invoicing and accounts payable workflows. The company introduced updates to its platform that incorporate AI and machine learning technologies, enabling organizations to automate these processes with greater accuracy and speed.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution, Services), By Business Function (Information Technology (IT), Sales and Marketing, Operations, Finance, Human Resources (HR), By Type (Rule-based Automation, Knowledge-based Automation), By Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By Industry (Banking, Financial Services, and Insurance (BFSI), Telecom and IT, Retail and Consumer goods, Healthcare and Life Sciences, Manufacturing, Government and Defense, Energy and Utilities, Media and Entertainment, Transportation and Logistics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Automation Anywhere, Blue Prism, IBM, Microsoft, UiPath, HCL Technologies, HPE, Kofax, Nice Ltd., Pegasystems, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automation Outsourcing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Automation Outsourcing MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-