Global Automatic Identification System Market By Class (Class A, Class B, and AIS Base Stations), By Platform (Vessel Based and On-Shore), By Application (Fleet Management, Vessels Tracking, Maritime Security, Other Applications), By Region and Companies – Industry Segment Outlook, Mark Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 48428

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

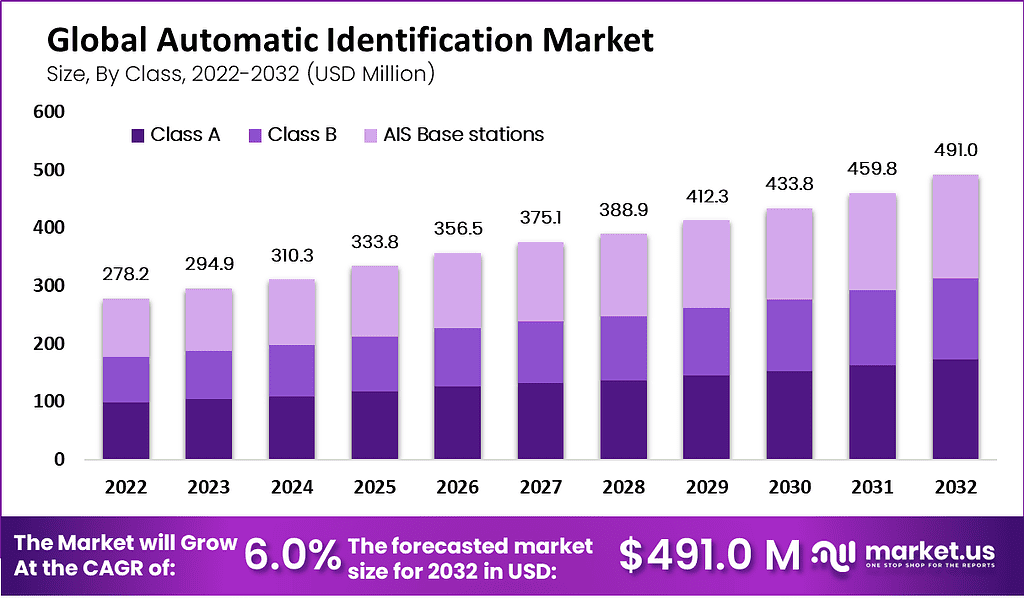

The Global Automation Identification System Market size is expected to be worth around USD 491.0 Million by 2032 from USD 278.2 Million in 2023, growing at a CAGR of 6.0% during the forecast period 2023 to 2032.

An Automation Identification System is a technological framework designed to identify and track objects or individuals automatically through various technologies such as RFID, barcodes, biometrics, and optical character recognition (OCR). This system plays a crucial role in enhancing operational efficiency, reducing human error, and improving data accuracy across diverse sectors including logistics, healthcare, retail, and manufacturing.

The Automation Identification System market is poised for significant growth, driven by the increasing demand for automation across various industries such as manufacturing, logistics, and retail. Key growth factors include the need for enhanced operational efficiency, improved data accuracy, and the reduction of manual errors. These systems, incorporating technologies like RFID, barcodes, and biometrics, are crucial for inventory management, security, and compliance with regulatory standards.

The opportunities in the Automation Identification System market are vast. With the increasing adoption of Internet of Things (IoT) devices and the integration of artificial intelligence (AI) technologies, there is immense potential for growth and innovation in this sector. Companies that can navigate these challenges and capitalize on these opportunities stand to benefit greatly in the evolving landscape of automation identification systems.

However, challenges such as high initial investment costs and concerns regarding data privacy and security pose obstacles to market expansion. Moreover, the complexity of integrating AIS with existing systems can deter adoption among smaller enterprises. Despite these challenges, opportunities abound in the development of more cost-effective and user-friendly AIS solutions that can cater to a broader market.

Additionally, the growing e-commerce sector and advancements in technologies like the Internet of Things (IoT) present new avenues for the application of AIS, further enhancing its market potential. This landscape suggests a robust future for the Automation Identification System market as it continues to evolve with technological progress.

According to marineinsight, a position report from one AIS station is allocated to one of the 2,250 time slots established every 60 seconds. AIS signals are received through a network of receivers deployed across over 140 countries, enabling approximately 40 million users to track vessels annually. The system can handle well over 4,500 reports per minute and updates as frequently as every two seconds.

Key Takeaways

- The Global Automation Identification System Market is projected to expand significantly, reaching an estimated value of USD 491.0 Million by 2032, up from USD 278.2 Million in 2023. This growth represents a steady compound annual growth rate (CAGR) of 6.0% from 2023 to 2032.

- In 2022, the Class A segment of the Automatic Identification System market maintained a commanding lead, capturing a substantial portion of the market share. This dominance is attributed to its critical role in large commercial maritime operations, which are heavily regulated and require robust communication and tracking systems.

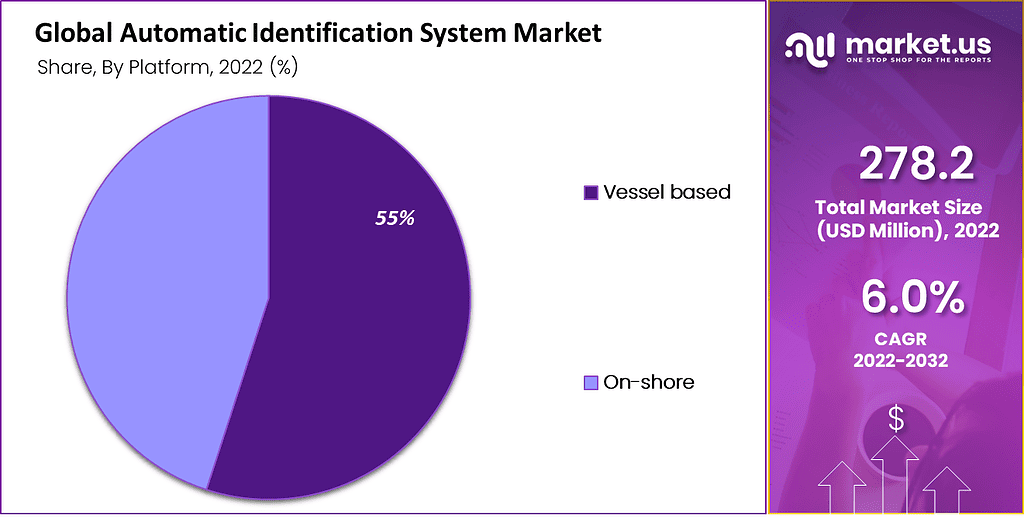

- Similarly, the Vessel Based segment held a predominant market position within the AIS market, securing about 55% of the total market. This segment’s leadership is driven by the increasing necessity for advanced navigational aids aboard vessels to ensure safe and efficient maritime traffic management.

- The Vessels Tracking segment also demonstrated significant market leadership in 2022, underscoring its importance in global maritime operations. The segment’s capacity to provide essential real-time data for maritime navigation and safety has made it indispensable in the AIS market.

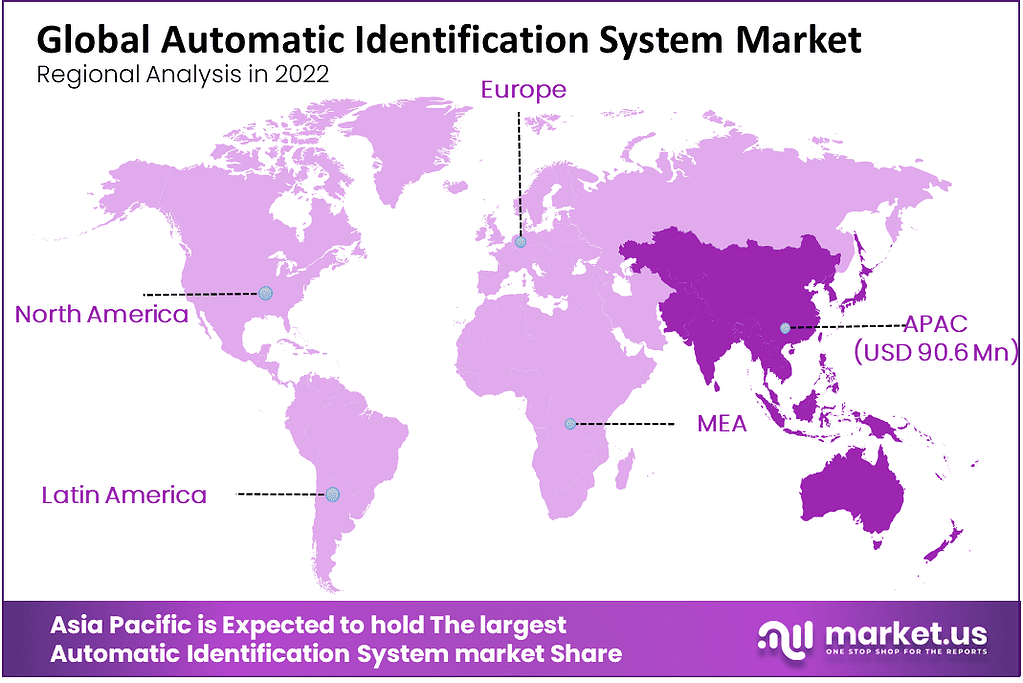

- In the regional analysis, the Asia-Pacific (APAC) region was the frontrunner in the AIS market in 2022, claiming over 32.6% of the market share with revenues reaching USD 90.6 billion. APAC’s dominance is supported by its extensive maritime routes, strategic investments in maritime infrastructure, and stringent regulatory mandates, positioning it as a crucial area for AIS deployment

Class Analysis

In 2022, the Class A segment of the Automatic Identification System market held a dominant position, capturing a significant market share. This segment primarily caters to large commercial vessels, which are required by international maritime laws to be equipped with Class A AIS devices. These systems are essential for enhancing navigational safety by providing real-time location and vessel information to ship operators and maritime authorities.

The leadership of the Class A segment can be attributed to several key factors. First, the stringent regulatory requirements for vessels engaged in international voyages mandate the use of Class A AIS. This regulation ensures that all movements are monitored for safety and efficient maritime traffic management, which drives the adoption of Class A systems.

Moreover, Class A devices offer a higher transmission power and a more frequent reporting rate than Class B devices, making them more reliable for tracking in congested sea routes and poor weather conditions. Furthermore, the growing focus on maritime safety and the expansion of shipping routes has led to increased investments in maritime infrastructure and technology, which benefits the Class A segment.

These systems are integrated with advanced features such as dynamic data transmission and detailed navigational status, which are critical for large vessels operating in high-traffic areas. As the maritime industry continues to evolve with technological advancements, the importance of robust and reliable communication systems like Class A AIS will likely increase, sustaining its leading position in the market.

Platform Analysis

In 2022, the Vessel Based segment of the Automatic Identification System (AIS) market held a dominant market position, capturing a significant share (55%) of the market. This segment encompasses systems installed on ships and vessels, which are crucial for real-time tracking and maritime traffic management. The prevalence of Vessel Based AIS systems stems from their pivotal role in enhancing navigational safety and operational efficiency on the open seas.

The leadership of the Vessel Based segment can primarily be attributed to the international regulations mandating the use of AIS systems on most commercial vessels. These regulations are enforced by maritime authorities worldwide to ensure safety and to prevent collisions.

Additionally, the increasing volume of global sea trade necessitates robust tracking and monitoring systems to manage the ever-growing traffic in major shipping lanes, further bolstering the demand for Vessel Based AIS systems. Moreover, the technological advancements in Vessel Based AIS devices have significantly improved their functionality.

These systems now offer features such as real-time position updates, detailed navigational statistics, and other critical maritime data, which are essential for vessel operators to navigate safely and efficiently. The integration of AIS with other onboard navigation and communication systems has also enhanced the value of Vessel Based AIS, making it indispensable for modern maritime operations.

Application Analysis

In 2022, the Vessels Tracking segment of the Automatic Identification System (AIS) market held a dominant market position, capturing a significant share. This segment is pivotal in the global maritime industry, primarily due to its essential role in ensuring the safety and operational efficiency of maritime navigation. Vessels Tracking enables real-time monitoring of ship locations, which is crucial for managing the complex and busy sea routes worldwide.

The prominence of the Vessels Tracking segment is driven by its fundamental role in collision avoidance and route planning. With the increasing volume of maritime traffic, the risk of maritime accidents has risen. AIS systems provide critical data that help vessel operators to make informed decisions about navigation and routing, significantly reducing the likelihood of collisions. This capability is particularly vital in narrow and congested waterways, where precise tracking and timely communication are essential for safe passage.

Furthermore, regulatory compliance plays a significant role in bolstering the Vessels Tracking segment. International maritime organizations mandate the use of AIS for vessels of certain sizes and types, making it a standard component of maritime operations. This regulatory environment ensures continuous demand for AIS systems, as ship operators worldwide must comply with these safety standards.

Market Key Segments

By Class

- Class A

- Class B

- AIS Base stations

By Platform

- Vessel based

- On-shore

By Application

- Fleet Management

- Vessels Tracking

- Maritime Security

- Other Applications

Driver

Increased Demand for Efficiency and Automation

The Automation Identification System (AIS) market is primarily driven by the increasing need for efficiency and automation in various sectors such as logistics, manufacturing, and retail. The integration of AIS with technologies like RFID, barcode systems, and biometrics enhances operational efficiencies, reduces errors, and streamlines workflows, making it invaluable in handling large volumes of transactions and tracking myriad items efficiently.

As businesses globally push for digitization and smarter operational frameworks, the demand for AIS systems is expected to surge, supported by advancements in related technologies such as the Internet of Things (IoT) and big data analytics.

Restraint

High Implementation Costs

One of the primary restraints in the AIS market is the high cost associated with implementing these systems. The initial setup, integration with existing systems, and ongoing maintenance can be substantial, often acting as a barrier for small and medium enterprises (SMEs).

This financial burden can deter businesses from adopting advanced AIS technologies despite the operational benefits they offer. Additionally, the customization required to fit specific business needs further escalates the expenses, making it challenging for smaller players to justify the investment.

Opportunity

Expansion into Emerging Markets

Emerging markets present a significant opportunity for the expansion of the AIS market. Regions such as Asia-Pacific are experiencing rapid industrial growth, increased urbanization, and a surge in retail and manufacturing sectors, which in turn drives the demand for advanced AIS solutions.

The growing middle class in these regions, coupled with increasing investments in technology infrastructure, provides a fertile ground for the adoption of AIS technologies. Companies are looking to tap into these new markets to leverage the burgeoning demand for automation and data-driven management solutions.

Challenge

Data Security and Privacy Concerns

With the increasing integration of AIS technologies, concerns regarding data security and privacy have become more pronounced. The use of systems like biometrics and RFID involves handling and storing sensitive information, which poses significant risks if not managed properly.

Ensuring the security of this data against breaches and unauthorized access is a major challenge for AIS providers. Moreover, the regulatory landscape around data privacy is becoming stricter globally, requiring companies to invest heavily in securing their systems and complying with data protection laws, which adds to the operational complexity and cost.

Growth Factors

The Automation Identification System (AIS) market is propelled by several significant growth factors. Firstly, the increasing demand for operational efficiency and enhanced security measures across various sectors like manufacturing, retail, and logistics supports the widespread adoption of AIS technologies. These systems streamline processes and reduce errors by automating identification tasks using technologies like RFID, barcoding, and biometric systems.

Secondly, advancements in related technologies such as the Internet of Things (IoT) and big data analytics further drive the growth of the AIS market. These technologies enhance the capabilities of AIS systems, allowing for more effective integration and data management, which is crucial for sectors requiring high-volume tracking and management, such as logistics and e-commerce.

Moreover, the global push towards digital transformation in industries and the integration of AIS with cloud computing platforms are expanding the market. These integrations offer scalable solutions that improve data accessibility and decision-making processes across organizations.

Emerging Trends

Several emerging trends are shaping the future of the AIS market. The growing adoption of cloud-based systems is notable, as these systems offer more flexibility and scalability than traditional on-premise solutions. This shift is particularly beneficial for organizations looking to enhance their operational agility and data accessibility in real-time.

Another significant trend is the increasing use of AI and machine learning in AIS systems. These technologies are being integrated to improve the accuracy and efficiency of automatic identification processes. For instance, AI can optimize inventory tracking and management, significantly reducing errors and increasing productivity in retail and warehouse settings.

Additionally, the expansion of AIS applications in the healthcare sector, where they are used for patient tracking, medication management, and ensuring compliance with health regulations, underscores the versatile applications of these technologies across different industries.

Regional Analysis

In 2022, the Asia-Pacific (APAC) region held a dominant market position in the Automatic Identification System (AIS) market, capturing more than a 32.6% share with revenues amounting to USD 90.6 billion. This leading stance is primarily driven by the extensive and busy maritime routes that facilitate a large volume of global sea trade passing through this region.

Major shipping lanes like the Straits of Malacca, South China Sea, and the Indian Ocean are critical to global supply chains, necessitating robust maritime management solutions like AIS. The dominance of APAC in the AIS market can also be attributed to the rapid industrialization and expansion of maritime activities in countries such as China, India, Japan, and South Korea.

These nations have heavily invested in maritime infrastructure, including ports and shipping facilities, which boosts the adoption of advanced technologies like AIS for vessel tracking and safety. Furthermore, the region’s focus on enhancing maritime security and environmental protection has led to stringent regulations that mandate the use of AIS in vessels, thereby propelling market growth.

Additionally, the increase in maritime traffic has heightened concerns over maritime safety and efficiency, prompting further investments in AIS technologies. The expansion of the shipbuilding industry, particularly in South Korea and China, also plays a crucial role in this market segment’s growth by integrating AIS systems in new vessels to comply with international standards.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

In the Automatic Identification System (AIS) market, several key players are pivotal in shaping the industry’s landscape through strategic acquisitions, product innovations, and partnerships. Among them, Furuno Electric Co. Ltd., Japan Radio Co. Ltd., and Saab AB stand out due to their significant contributions and strategic movements.

Furuno Electric Co. Ltd., a leading provider of marine electronics, has consistently enhanced its AIS offerings by launching innovative products that cater to the evolving needs of maritime safety and communication. Recently, Furuno has expanded its product line with advanced AIS systems that provide superior accuracy and reliability, ensuring better vessel tracking and data exchange capabilities. The company’s commitment to integrating cutting-edge technology into its products has solidified its position in the market.

Japan Radio Co. Ltd. is another prominent player, known for its high-quality communication and navigation systems. The company has recently made headlines with its strategic acquisition of a technology firm specializing in satellite communication solutions, aiming to integrate enhanced satellite AIS tracking capabilities into its existing product portfolio. This move is expected to broaden Japan Radio’s AIS solutions, offering more comprehensive and global coverage.

Top Key Players

- Furuno Electric Co. Ltd

- Japan Radio Co. Ltd.

- Saab AB

- ExactEarth Ltd

- True Heading AB

- C.N.S. Systems AB

- ComNav Marine Ltd.

- Garmin Ltd

- Kongsberg Gruppen ASA

- L3 Technologies Inc.

- Orbcomm Inc.

- Other Key Players

Recent Developments

- February 2023: Saab AB launched their new R6 Supreme AIS transponder, which offers enhanced tracking capabilities and improved safety features for maritime navigation .

- January 2024: ExactEarth announced a strategic partnership with ORBCOMM Inc. to enhance its real-time satellite AIS data services.

- October 2023: Furuno received the Innovation Endorsement Certification from ClassNK for their Berthing Aid System. This system is designed to enhance safety and efficiency during vessel berthing operations.

Report Scope

Report Features Description Market Value (2023) USD 294.2 Mn Forecast Revenue (2032) USD 491.0 Mn CAGR (2023-2032) 6.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Class – Class A, Class B, and AIS Base Stations; By Platform – Vessel Based and On-Shore; By Application – Fleet Management, Maritime Security, Vessels Tracking, and Other Applications. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Furuno Electric Co. Ltd, Saab AB, Japan Radio Co. Ltd., ExactEarth Ltd, C.N.S. Systems AB, True Heading AB, ComNav Marine Ltd, Kongsberg Gruppen ASA, Garmin Ltd, L3 Technologies Inc., Orbcomm Inc., and other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for : Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

Frequently Asked Questions (FAQ)

What is the projected CAGR at which the Automatic Identification System Market is expected to grow at?The Automatic Identification System Market is expected to grow at a CAGR of 6.0% (2023-2032).

What is the size of the Automatic Identification System Market in 2023?The Automatic Identification System Market size is USD 278.2 Million in 2023.

Which region is more appealing for vendors employed in the Automatic Identification System Market?Asia Pacific leads the automatic identification system market by accounting for a major revenue share of 32.6%.

Name the key business areas for the Automatic Identification System Market.The US, Canada, China, India, Brazil, South Africa, etc., are leading key areas of operation for the Automatic Identification System Market.

List the segments encompassed in this report on the Automatic Identification System Market?Market.US has segmented the Automatic Identification System Market by geography (North America, Europe, APAC, South America, And Middle East and South Africa). The market has been segmented By Class Class A, Class B, and AIS Base stations. By Platform Vessel based and On-shore. By Application Fleet Management, Vessels Tracking, Vessels Tracking, Maritime Security, and Other Applications.

Automatic Identification System MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Automatic Identification System MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Furuno Electric Co. Ltd

- Japan Radio Co. Ltd.

- Saab AB

- ExactEarth Ltd

- True Heading AB

- C.N.S. Systems AB

- ComNav Marine Ltd.

- Garmin Ltd

- Kongsberg Gruppen ASA

- L3 Technologies Inc.

- Orbcomm Inc.

- Other Key Players