Global Autoimmune Disease Diagnostics Market By Product Type (Consumables & Assays and Instruments), By Test Type (Antinuclear Antibody Tests, Autoantibody Tests, C-Reactive Protein (CRP), Complete Blood Count (CBC), Urinalysis, and Others), By Application (Localized Autoimmune Disease Diagnostics (Type 1 Diabetes, Multiple Sclerosis, Idiopathic Thrombocytopenic Purpura, Hashimoto’s Thyroiditis, and Others), and Systemic Autoimmune Disease Diagnostics (Systemic Lupus Erythematosus (SLE), Rheumatoid Arthritis, Ankylosing Spondylitis, and Others)), By End-user (Hospitals, Diagnostic Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 65481

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

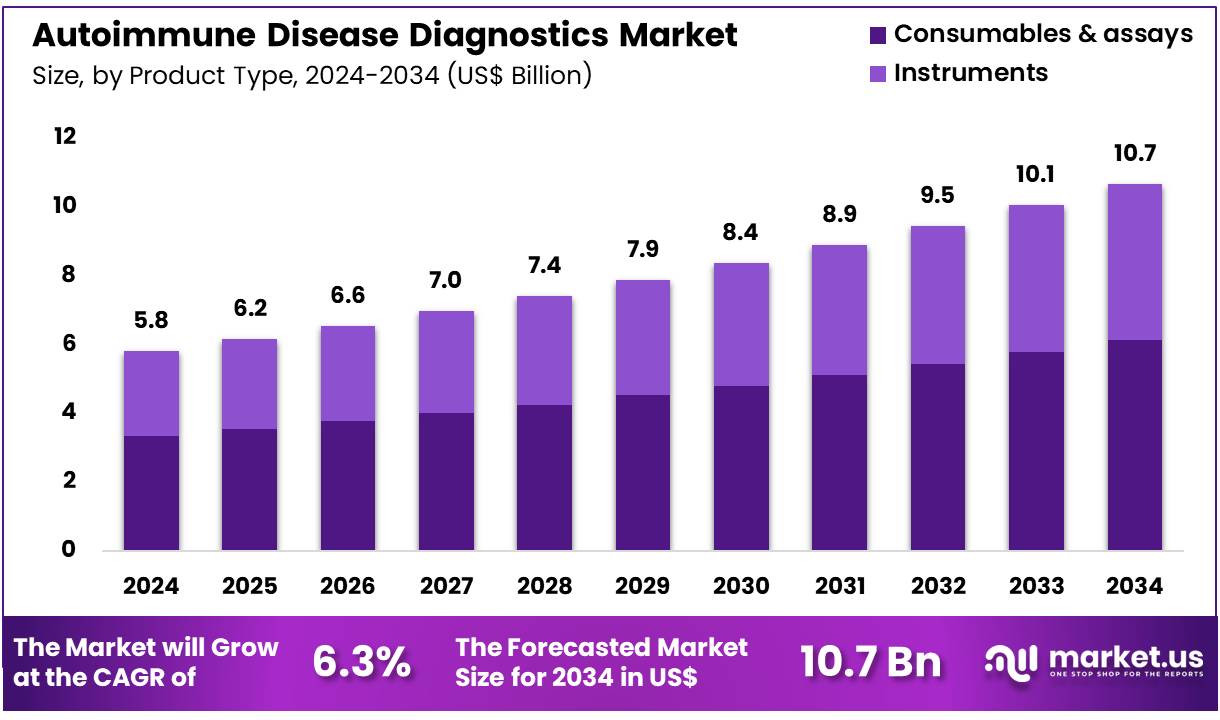

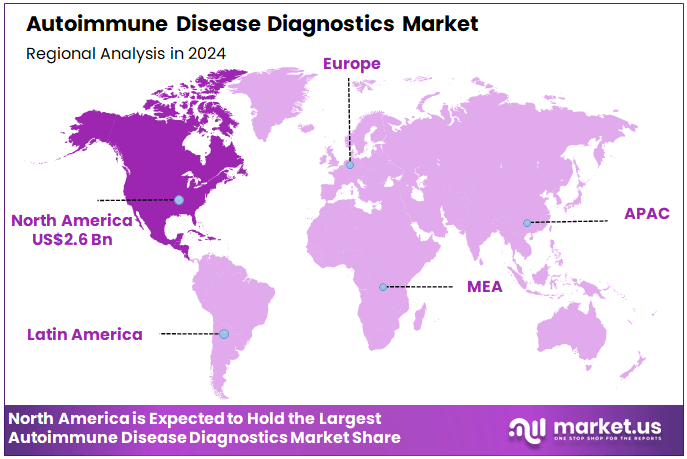

The Global Autoimmune Disease Diagnostics Market size is expected to be worth around US$ 10.7 Billion by 2034 from US$ 5.8 Billion in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 45.4% share with a revenue of US$ 2.6 Billion.

Increasing prevalence of complex autoimmune disorders drives the Autoimmune Disease Diagnostics Market, as clinicians demand accurate tools for early intervention. Rheumatologists utilize antinuclear antibody assays to screen for systemic lupus erythematosus, enabling timely immunosuppressive therapy initiation. These diagnostics support gastroenterology by detecting anti-tissue transglutaminase antibodies in celiac disease, guiding gluten-free diet adherence.

Research laboratories apply multiplex panels to profile cytokine levels in rheumatoid arthritis, identifying inflammatory pathways for targeted biologics. In January 2025, RheumaGen secured $15 million in Series A funding to advance gene-editing therapies for rheumatoid arthritis, spurring development of precise HLA gene profiling assays. This investment accelerates market growth by aligning diagnostics with emerging genetic therapies.

Growing adoption of cell-based therapies creates opportunities in the Autoimmune Disease Diagnostics Market, as biomarkers guide patient stratification and efficacy monitoring. Endocrinologists employ islet autoantibody tests to predict type 1 diabetes progression, facilitating enrollment in preventive trials. These assays aid neurology by measuring aquaporin-4 antibodies in neuromyelitis optica, differentiating from multiple sclerosis.

Automated platforms enhance throughput for companion diagnostics in inflammatory bowel disease management. In June 2023, AstraZeneca partnered with Quell Therapeutics to develop T-regulatory cell therapies for type 1 diabetes and inflammatory bowel disease, emphasizing immune biomarker testing for therapy selection. This collaboration drives market expansion by integrating diagnostics into advanced treatment protocols.

Rising integration of microarray technologies propels the Autoimmune Disease Diagnostics Market, as high-density platforms improve specificity in connective tissue disease detection. Dermatologists leverage extractable nuclear antigen panels to confirm Sjögren’s syndrome, optimizing sicca symptom management. These tools support pulmonology by identifying anti-synthetase antibodies in interstitial lung disease, informing prognostic assessments.

Trends toward point-of-care autoantibody testing enable rapid results in outpatient settings. In June 2022, Quotient Limited partnered with Theradiag to enhance MosaiQ platform diagnostics for connective tissue diseases using precise reagents and microarrays. This partnership positions the market for sustained growth through efficient, accurate autoimmune profiling solutions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.8 Billion, with a CAGR of 6.3%, and is expected to reach US$ 10.7 Billion by the year 2034.

- The product type segment is divided into consumables & assays and instruments, with consumables & assays taking the lead in 2023 with a market share of 57.4%.

- Considering test type, the market is divided into antinuclear antibody tests, autoantibody tests, C-reactive protein (CRP), complete blood count (CBC), urinalysis, and others. Among these, antinuclear antibody tests held a significant share of 34.8%.

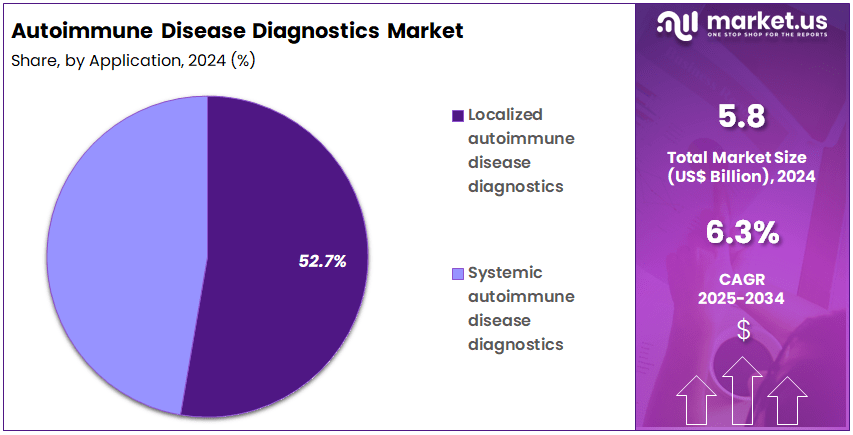

- Furthermore, concerning the application segment, the market is segregated into localized autoimmune disease diagnostics and systemic autoimmune disease diagnostics. The localized autoimmune disease diagnostics sector stands out as the dominant player, holding the largest revenue share of 52.7% in the market.

- The end-user segment is segregated into hospitals, diagnostic centers, and others, with the hospitals segment leading the market, holding a revenue share of 49.6%.

- North America led the market by securing a market share of 45.4% in 2023.

Product Type Analysis

Consumables & assays account for 57.4% of the Autoimmune Disease Diagnostics market and are projected to dominate due to their high utilization rate in routine testing and clinical validation processes. The increasing global prevalence of autoimmune disorders, such as rheumatoid arthritis, lupus, and multiple sclerosis, drives continuous demand for reliable assay-based diagnostics.

Laboratories and hospitals increasingly rely on enzyme-linked immunosorbent assays (ELISA), immunofluorescence assays (IFA), and chemiluminescence immunoassays (CLIA) for precise antibody detection. The expansion of test menus and automation in immunodiagnostic platforms accelerates assay throughput and consistency. Manufacturers are focusing on producing cost-effective, ready-to-use kits compatible with multiple analyzers, ensuring flexibility and efficiency in clinical workflows.

Continuous R&D in biomarker discovery has introduced novel antigen-specific assays that enhance diagnostic accuracy and early disease detection. Increasing awareness among clinicians about early intervention for autoimmune conditions promotes frequent testing. The widespread availability of high-sensitivity consumables supports their use in monitoring disease progression and treatment efficacy. As personalized medicine and laboratory automation advance, consumables & assays are expected to remain the backbone of autoimmune diagnostics globally.

Test Type Analysis

Antinuclear antibody (ANA) tests account for 34.8% of the test type segment and are expected to dominate due to their clinical relevance in detecting systemic and localized autoimmune diseases. ANA testing serves as a first-line diagnostic tool for conditions such as systemic lupus erythematosus (SLE), scleroderma, and Sjögren’s syndrome. The growing adoption of automated ANA analyzers and multiplex immunoassay technologies enhances test accuracy and throughput.

Rising incidence of autoimmune diseases globally, particularly among women, amplifies test demand. Laboratories prefer ANA tests for their high sensitivity and ability to screen for a wide range of autoantibodies. Continuous improvements in fluorescence pattern interpretation through AI-based imaging systems are improving diagnostic reliability. Regulatory approvals for automated indirect immunofluorescence (IIF) systems expand market accessibility.

Increasing inclusion of ANA testing in rheumatology diagnostic protocols strengthens its clinical adoption. The introduction of integrated platforms combining ANA with specific autoantibody profiling further supports comprehensive disease evaluation. As awareness and screening initiatives expand in emerging markets, ANA tests are projected to remain the cornerstone of autoimmune disease diagnostics.

Application Analysis

Localized autoimmune disease diagnostics hold 52.7% of the application segment and are anticipated to maintain dominance due to the growing incidence of organ-specific autoimmune disorders such as Type 1 diabetes, Hashimoto’s thyroiditis, and celiac disease. Increasing emphasis on early detection of tissue-specific antibodies drives diagnostic development. Laboratories and hospitals increasingly utilize advanced immunoassays and molecular platforms for accurate localization of autoimmune activity.

The rise in autoimmune thyroid and gastrointestinal conditions promotes test adoption across primary and secondary care settings. Continuous biomarker discovery for localized immune dysregulation enhances precision in identifying affected organs. The growing integration of multiplex panels allows simultaneous testing for multiple localized disorders, improving diagnostic efficiency.

Government-backed healthcare initiatives for early screening of autoimmune diseases in high-risk populations expand test uptake. Pharmaceutical research on organ-targeted immunotherapies further drives demand for diagnostic validation. As patients seek timely and accurate diagnoses for localized conditions, this segment is projected to grow steadily, supported by advancements in clinical immunology and personalized diagnostic approaches.

End-User Analysis

Hospitals account for 49.6% of the end-user segment and are expected to dominate due to their central role in patient diagnosis, disease monitoring, and treatment planning for autoimmune disorders. Hospitals integrate comprehensive testing infrastructure that supports both serological and molecular diagnostics under a single clinical network. Increasing hospitalization rates for autoimmune flare-ups and chronic management drive test utilization.

Hospitals offer multidisciplinary diagnostic services combining rheumatology, immunology, and pathology expertise, enabling accurate disease classification. The rising adoption of high-throughput automated analyzers enhances testing speed and reliability in hospital laboratories. Collaborations with diagnostic manufacturers ensure access to the latest FDA- and CE-approved assay kits. Hospital-based biobanks and clinical studies contribute to continuous improvement in diagnostic standards.

The inclusion of autoimmune screening in routine health check-ups broadens accessibility. Growing healthcare investments, particularly in emerging economies, are expanding hospital laboratory capacity for advanced immunoassay testing. As personalized treatment protocols depend heavily on diagnostic precision, hospitals are anticipated to remain the leading end-users in the autoimmune disease diagnostics landscape.

Key Market Segments

By Product Type

- Consumables & Assays

- Instruments

By Test Type

- Antinuclear antibody tests

- Autoantibody tests

- C-reactive Protein (CRP)

- Complete blood count (CBC)

- Urinalysis

- Others

By Application

- Localized autoimmune disease diagnostics

- Type 1 diabetes

- Multiple sclerosis

- Idiopathic thrombocytopenic purpura

- Hashimoto’s Thyroiditis

- Others

- Systemic autoimmune disease diagnostics

- Systemic lupus erythematosus (SLE)

- Rheumatoid arthritis

- Ankylosing spondylitis

- Others

By End-user

- Hospitals

- Diagnostic centers

- Others

Drivers

Increasing Prevalence of Autoimmune Diseases is Driving the Market

The steady rise in autoimmune disease cases worldwide has substantially accelerated the autoimmune disease diagnostics market, as accurate testing is vital for confirming diagnoses and initiating timely management strategies. Autoimmune conditions, involving erroneous immune attacks on healthy tissues, require serological assays like antinuclear antibody tests to detect autoantibodies and guide immunosuppressive therapies. This driver is especially prominent among women, who comprise the majority of patients, prompting expanded screening in primary care to address symptoms like joint pain and fatigue.

Medical facilities are enhancing laboratory capabilities to handle growing test volumes, integrating multiplex panels for comprehensive profiling. The condition’s chronicity demands ongoing monitoring, further embedding diagnostics in long-term care plans. Health authorities promote early detection to mitigate organ damage, fueling investments in point-of-care solutions.

The National Institutes of Health estimates that approximately 8% of the U.S. population lives with an autoimmune disease, with nearly 80% being women, based on data through 2024. This demographic highlights the testing imperative, as diagnostics prevent complications through proactive interventions.

Progress in enzyme-linked immunosorbent assays refines sensitivity, managing diverse autoantibody spectra. Cost-wise, their use optimizes resource distribution, preventing escalation to specialized consultations. Transnational efforts unify diagnostic criteria, aiding deployment in varied economies. This prevalence growth not only boosts assay demands but also cements diagnostics’ role in immune health oversight. Ultimately, it inspires enhancements in automated workflows, coordinating tests with treatment protocols.

Restraints

High Costs of Advanced Diagnostic Tests is Restraining the Market

The elevated expenses of sophisticated autoimmune disease diagnostics, coupled with inconsistent coverage, persistently obstruct market accessibility, especially in underserved communities reliant on affordable options. Biomarker panels and genetic sequencing, while precise, surpass financial thresholds for routine application, burdening patients and providers alike. This limitation fosters delayed confirmations, as economic barriers prioritize symptomatic relief over confirmatory assays.

Regional disparities in insurer policies amplify inequities, with some requiring extensive justification for reimbursement. Producers confront substantial R&D outlays, restricting portfolio growth to subsidized niches. The ensuing underemployment heightens unmanaged case loads, taxing healthcare systems.

Biomarker-based tests and multiplex assays are 25-30% more expensive than traditional methods, restricting access in low-income areas where 40% of patients encounter affordability issues, per analyses from 2022-2024. These premiums mirror structural pressures, as cost controls hinder widespread innovation.

Practitioner wariness from fiscal uncertainties favors conventional serology over cutting-edge panels. Campaigns for tiered pricing proceed deliberately, limited by value proof shortages. These financial hurdles not only dampen expansion but also sustain gaps in diagnostic equity. Hence, they demand collaborative models to align affordability with precision goals.

Opportunities

Technological Advancements in Molecular Diagnostics is Creating Growth Opportunities

Breakthroughs in molecular techniques have opened extensive avenues for the autoimmune disease diagnostics market, delivering high-fidelity assays for early autoantibody detection in at-risk populations. Next-generation sequencing and proteomics uncover subtle immune dysregulation patterns, surpassing legacy immunoassays in specificity for conditions like lupus. Prospects flourish in companion test developments, where molecular markers predict therapy responses to biologics.

Biotech collaborations fund validations for portable sequencers, filling voids in ambulatory diagnostics. This molecular focus counters diagnostic ambiguities, framing tests as enablers of personalized immunosuppression. Budgets for tech upgrades spur acquisitions, branching into integrated omics suites. The National Institutes of Health reported 24 million Americans affected by autoimmune diseases in 2022, up from 22 million in 2021, driving demand for advanced molecular tools.

This upswing validates extensible frameworks, with pilots anticipating heightened kit requisitions. Innovations in CRISPR-based probes boost resolution, alleviating sample constraints in sparse settings. As analytics platforms develop, molecular outputs generate predictive income. These tech evolutions not only widen application scopes but also merge the market into tailored immune strategies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic challenges, including high interest rates and lingering inflation in 2025, force diagnostic companies to cut spending on new autoimmune testing tools and slow down facility upgrades. Geopolitical issues, such as U.S.-China trade disputes and European counter-measures, disrupt supplies of key reagents, extend delivery times, and raise costs for labs across the United States.

Current U.S. tariffs add a universal import fee and higher duties on medical devices from Canada and Mexico, pushing up prices for test kits and consumables while squeezing profit margins for clinics and insurers. These tariffs also spark retaliation from trading partners, limiting export sales for American diagnostic firms and weakening their position in global markets.

Yet, these pressures encourage companies to build local manufacturing and strengthen domestic supply chains. They also drive closer partnerships with government agencies that speed up approvals for reliable, home-grown solutions. In the end, forward-looking leaders turn obstacles into advantages, delivering faster, more secure autoimmune diagnostics and capturing long-term growth.

Latest Trends

Introduction of AI-Integrated Autoantibody Profiling is a Recent Trend

The fusion of artificial intelligence with serological platforms has indicated a notable shift in autoimmune disease diagnostics during 2024, focusing on pattern recognition to refine autoantibody interpretation amid overlapping profiles. AI-driven systems, analyzing immunofluorescence images, classify antinuclear patterns with 95% accuracy, aiding differentiation of scleroderma from Sjögren’s syndrome. This integration marks a refinement toward interpretive aids, facilitating simultaneous evaluation of multiple autoantibodies to hasten rheumatology referrals.

Certification bodies endorse its dependability, quickening adoptions in overburdened clinics. This synthesis complements clinical judgment, interfacing results with decision support for nuanced diagnoses. The feature resolves ambiguity pitfalls, preferring algorithms adaptable to ethnic variabilities. The Journal of Clinical Laboratory Analysis published findings in January 2025 on AI-enhanced flow cytometry Coombs tests detecting antinuclear antibodies in autoimmune patients, advancing diagnostic precision. These discoveries emphasize expandability, as trials validate alignment with manual standards.

Forecasters predict protocol embeddings, boosting its standing in primary screenings. Progressive reviews indicate inconsistency drops, sharpening economic reviews. The future contemplates modular upgrades, envisioning multi-disease synergies. This AI-serology blend not only sharpens profiling accuracy but also aligns with interpretive health directives.

Regional Analysis

North America is leading the Autoimmune Disease Diagnostics Market

In 2024, North America commanded a 45.4% share of the global autoimmune disease diagnostics market, propelled by heightened clinical adoption of multiplex assays for early detection of antinuclear antibodies in systemic lupus erythematosus and rheumatoid arthritis, amid a documented rise in antinuclear antibody prevalence that underscores the need for sensitive immunofluorescence techniques in routine rheumatology panels.

Laboratories expanded capacity for enzyme-linked immunosorbent assays to quantify anti-cyclic citrullinated peptide antibodies, enabling precise risk stratification for joint erosions in early inflammatory arthritis, where timely biologics like JAK inhibitors avert disability progression by up to 50% in seropositive cases.

The National Institutes of Health’s strategic plan for autoimmune research, released in December 2023, facilitated grant-driven validations of next-generation sequencing for HLA typing, addressing genetic predispositions in diverse ethnic groups and correlating with federal efforts to mitigate underdiagnosis in women, who comprise 80% of affected individuals.

Regulatory advancements under the FDA’s Laboratory Developed Test oversight proposed in 2024 expedited clearances for point-of-care autoantibody panels, enhancing accessibility in primary care for Sjögren’s syndrome evaluations. Demographic trends, including a 4.5% overall prevalence extrapolated to over 15 million cases by mid-2022, intensified demand for comprehensive profiling in chronic fatigue clinics.

These catalysts affirmed the region’s preeminence in serological innovation for immune-mediated disorders. The National Institutes of Health reported antinuclear antibody prevalence at 15.9% in 2011-2012, up from 11.0% in 1988-1991, with trends indicating sustained increases through 2022.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National authorities across Asia Pacific project the autoimmune disease diagnostics sector to thrive during the forecast period, as public health agendas prioritize serological screening to stem rising rheumatoid arthritis incidences in aging urban demographics. Officials in Japan and China allocate resources to ANA immunofluorescence kits, outfitting community labs to detect lupus biomarkers in high-stress occupational cohorts.

Diagnostic firms collaborate with regional institutes to refine anti-CCP ELISA assays, anticipating improved early interventions for psoriatic arthritis in genetically susceptible populations. Oversight bodies in India and South Korea subsidize HLA genotyping platforms, positioning district facilities to assess multiple sclerosis risks without urban dependencies.

Administrative networks estimate integrating autoantibody data into digital health systems, expediting rituximab referrals for vasculitis in migrant groups. Regional rheumatologists pioneer multiplex bead arrays, coordinating with WHO hubs to profile Sjögren’s prevalence in dry-climate enclaves.

These initiatives forge a resilient framework for immune disorder profiling. The Global Burden of Disease 2019 reported age-standardized prevalence rates for rheumatoid arthritis at 224.25 per 100,000 globally in 2019, with higher rates in Asia persisting through 2022.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent enterprises in the autoimmune biomarker sector propel expansion by unveiling multiplex immunoassay panels that simultaneously detect ANA, RF, and anti-CCP markers, enabling clinicians to accelerate differential diagnoses for conditions like lupus and rheumatoid arthritis. They negotiate licensing pacts with academic researchers to incorporate next-generation sequencing for genetic predisposition profiling, shortening validation timelines and enhancing test specificity.

Organizations direct capital toward automated analyzers with embedded AI for pattern recognition, optimizing lab efficiency amid surging screening volumes. Executives orchestrate acquisitions of regional assay developers to consolidate supply chains and penetrate underserved markets.

They advance into high-incidence zones across Asia-Pacific and the Middle East, customizing protocols to local epidemiological profiles and securing endorsements from health ministries. Moreover, they deploy integrated telehealth modules for remote result consultations, cultivating provider networks and anchoring subscription-based analytics for sustained profitability.

Thermo Fisher Scientific Inc., founded in 2006 through a merger and headquartered in Waltham, Massachusetts, engineers comprehensive diagnostic platforms that empower global labs with precision tools for autoimmune detection and beyond. The company deploys its Phadia 250 platform alongside EliA assays for quantitative antibody measurements, supporting accurate identification of systemic disorders in clinical environments.

Thermo Fisher allocates robust R&D to interoperability enhancements, linking assays with electronic health records for streamlined workflows. CEO Marc N. Casper oversees a diversified operation spanning 50 countries, prioritizing regulatory compliance and sustainable innovation.

The firm engages with clinical consortia to refine biomarker standards, advancing equitable access to advanced testing. Thermo Fisher bolsters its market stature by intertwining analytical sophistication with collaborative ecosystems to refine disease management strategies.

Top Key Players

- Siemens Healthcare Private Limited

- Quest Diagnostics

- Nova Diagnostics Pte Ltd.

- Hoffmann-La Roche Ltd

- Hemagen Diagnostics, Inc.

- EUROIMMUN Medizinische Labordiagnostika AG

- Danaher Corporation

- BIOMÉRIEUX

- Beckman Coulter, Inc.

- Abbott

Recent Developments

- In February 2025, the Benaroya Research Institute began pilot testing a new approach to early autoimmune disease detection by adding an autoantibody blood test to routine clinical visits. This initiative promotes early diagnosis of diseases such as type 1 diabetes and rheumatoid arthritis, fueling growth in the autoimmune disease diagnostics market through expanded screening and preventive healthcare integration.

- In December 2023, AstraZeneca’s acquisition of Gracell Biotechnologies strengthened its cell therapy pipeline for autoimmune disorders. The acquisition expands the clinical need for companion diagnostic tools that track immune modulation, encouraging innovation in diagnostic kits for autoimmune disease management.

Report Scope

Report Features Description Market Value (2024) US$ 5.8 Billion Forecast Revenue (2034) US$ 10.7 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Consumables & Assays and Instruments), By Test Type (Antinuclear Antibody Tests, Autoantibody Tests, C-Reactive Protein (CRP), Complete Blood Count (CBC), Urinalysis, and Others), By Application (Localized Autoimmune Disease Diagnostics (Type 1 Diabetes, Multiple Sclerosis, Idiopathic Thrombocytopenic Purpura, Hashimoto’s Thyroiditis, and Others), and Systemic Autoimmune Disease Diagnostics (Systemic Lupus Erythematosus (SLE), Rheumatoid Arthritis, Ankylosing Spondylitis, and Others)), By End-user (Hospitals, Diagnostic Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthcare Private Limited, Quest Diagnostics, Nova Diagnostics Pte Ltd., Hoffmann-La Roche Ltd, Hemagen Diagnostics, Inc., EUROIMMUN Medizinische Labordiagnostika AG, Danaher Corporation, BIOMÉRIEUX, Beckman Coulter, Inc., Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autoimmune Disease Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Autoimmune Disease Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthcare Private Limited

- Quest Diagnostics

- Nova Diagnostics Pte Ltd.

- Hoffmann-La Roche Ltd

- Hemagen Diagnostics, Inc.

- EUROIMMUN Medizinische Labordiagnostika AG

- Danaher Corporation

- BIOMÉRIEUX

- Beckman Coulter, Inc.

- Abbott