Asia Pacific Automotive Suspension Systems Market Size, Share, Growth Analysis By Vehicle (Passenger Vehicles, Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)), By System (Independent Suspension, Dependent (Rigid) Suspension), By Damping (Hydraulic Damping, Air Suspension, Electromagnetic Damping, Others), By Component (Springs, Control Arms, Shock Absorber/Dampener, Ball Joints, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143057

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

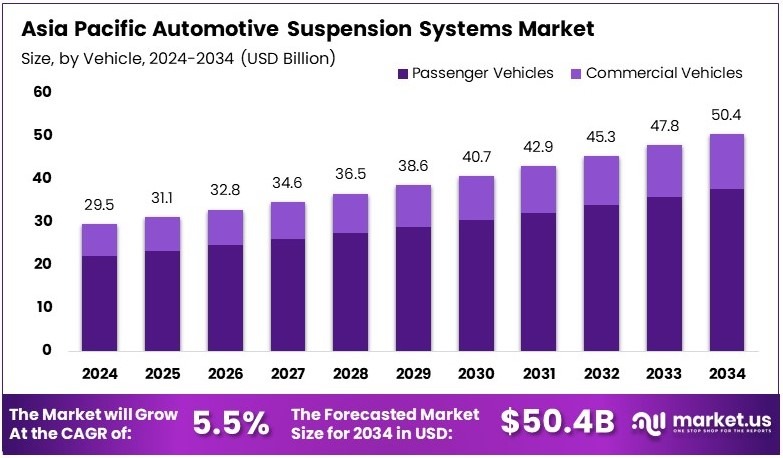

The Asia Pacific Automotive Suspension Systems Market size is expected to be worth around USD 50.4 Billion by 2034, from USD 29.5 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Automotive suspension systems in Asia Pacific include components like shock absorbers, springs, and struts that improve vehicle stability and comfort. These systems help vehicles handle road conditions, reduce vibrations, and enhance safety. Automakers focus on developing lightweight and durable suspension systems to improve fuel efficiency.

The Asia Pacific automotive suspension systems market includes companies producing and supplying suspension components. Market growth is driven by increasing vehicle production, rising demand for comfort, and advancements in suspension technology. Manufacturers focus on developing smart and adaptive suspension systems to enhance vehicle performance and ride quality.

Asia Pacific automotive suspension systems are experiencing strong growth. In 2024, suspension parts imported from China reached $3.87 billion, up 28.5% from $3 billion in 2023. Consequently, businesses in this sector benefit from increased demand driven by rising vehicle sales, especially electric models.

Additionally, the Asia Pacific automotive suspension systems market is highly competitive. For instance, Italy’s Brembo acquired Sweden’s Öhlins Racing for $405 million in October 2024, strengthening its position through advanced technology. Similarly, partnerships, such as REE Automotive with India’s Motherson Group, illustrate growing cooperation to improve supply chains and efficiency.

In this context, market opportunities remain strong, particularly for innovative suspension technologies suited to electric vehicles. As an example, REE Automotive’s partnership secured over $45 million in funding in September 2024, boosting production capabilities. Therefore, companies investing in efficient technologies have clear pathways for expansion and higher profitability.

However, despite rapid growth, the market has moderate saturation, with room for new players specializing in unique technologies. Specifically, firms offering advanced solutions like lightweight suspension systems can succeed against established competitors. Thus, focusing on technological advancements or unique products allows businesses to stand out clearly.

Key Takeaways

- The Asia Pacific Automotive Suspension Systems Market was valued at USD 29.5 billion in 2024 and is expected to reach USD 50.4 billion by 2034, with a CAGR of 5.5%.

- In 2024, Passenger Vehicles dominated the vehicle segment with 74.8%, driven by high production and increasing consumer demand.

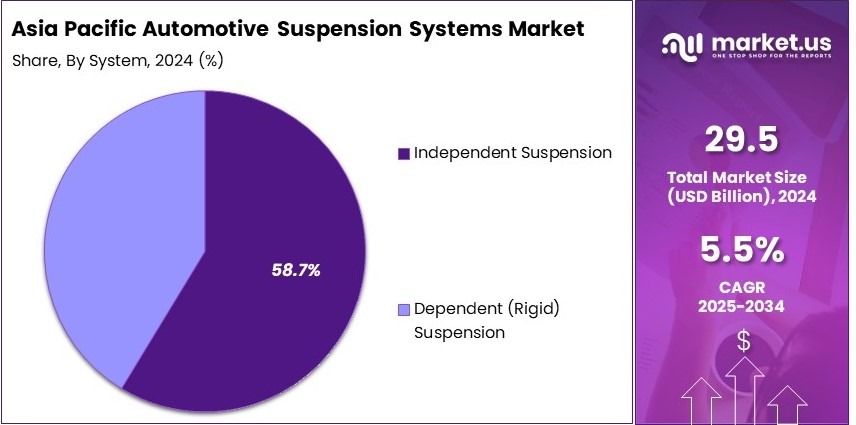

- In 2024, Independent Suspension accounted for 58.7%, due to its advantages in ride comfort and handling performance.

- In 2024, Hydraulic Damping led the damping segment with 46.5%, owing to its widespread use in traditional and modern suspension systems.

- In 2024, Shock Absorber/Dampener dominated the component segment with 38.4%, driven by rising demand for better ride control and durability.

- In 2024, China held the largest market share at 37.4%, contributing USD 11.03 billion, supported by extensive automotive production and infrastructure growth.

Vehicle Analysis

Passenger Vehicles dominate with 74.8% due to high consumer demand and extensive model variety.

In the Asia Pacific Automotive Suspension Systems Market, Passenger Vehicles hold a commanding 74.8% market share, underscoring their dominance. This is largely due to the increasing consumer demand for personal vehicles, which offer comfort and convenience, coupled with a broad variety of models ranging from economy to luxury, catering to a wide demographic.

Commercial Vehicles also play a crucial role in the market, segmented into Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs). LCVs are essential for transportation and delivery services within urban and suburban areas, while HCVs are vital for long-haul transport and industrial applications, each contributing to the growth and diversification of the market.

System Analysis

Independent Suspension leads with 58.7% due to its superior ride quality and handling.

The System segment of the market is predominantly led by Independent Suspension, which accounts for 58.7% of the market. Its popularity stems from its ability to provide superior ride quality and handling compared to Dependent (Rigid) Suspension systems, as it allows each wheel to move independently, improving comfort and vehicle control.

Dependent Suspension, while less prevalent, remains important in heavy-duty applications where vehicle durability and the ability to carry heavy loads are prioritized, making it indispensable in larger commercial vehicles.

Damping Analysis

Hydraulic Damping dominates with 46.5% due to its reliability and performance.

Damping technology within the market is primarily dominated by Hydraulic Damping, holding a 46.5% share. This technology is favored for its proven reliability and performance, offering a balance of cost-effectiveness and functionality, suitable for a wide range of vehicle types.

Air Suspension and Electromagnetic Damping are emerging as significant sub-segments, offering advanced control and adjustable rigidity for enhanced ride quality, particularly in luxury vehicles and performance-oriented models. Other damping technologies continue to develop, focusing on improving driver comfort and vehicle dynamics.

Component Analysis

Shock Absorbers/Dampeners lead with 38.4% due to their critical role in vehicle stability and comfort.

In the Component segment, Shock Absorbers/Dampeners take the lead with a 38.4% market share. Their primary role is to absorb and dampen shock impulses, which is essential for maintaining vehicle stability and passenger comfort, making them a key component in suspension systems.

Springs and Control Arms are integral to the suspension assembly, providing the necessary support and flexibility for vehicle movement. Ball Joints play a crucial role in steering and wheel alignment, contributing to safer driving conditions. The ‘Others’ category includes various additional components that support the overall functionality and efficiency of the suspension system.

Key Market Segments

By Vehicle

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By System

- Independent Suspension

- Dependent (Rigid) Suspension

By Damping

- Hydraulic Damping

- Air Suspension

- Electromagnetic Damping

- Others

By Component

- Springs

- Control Arms

- Shock Absorber/Dampener

- Ball Joints

- Others

Driving Factors

Growing Vehicle Production and Demand for Comfort Drive Market Growth

The Asia Pacific automotive suspension systems market is expanding due to increasing vehicle production in emerging economies such as India and China. These countries are witnessing a surge in automobile sales, driven by rising disposable income and urbanization. As a result, the demand for advanced suspension systems is growing to enhance driving experience and road safety.

Consumers are prioritizing ride comfort and vehicle stability, pushing automakers to innovate suspension technologies. Smooth driving performance is now a key selling point, leading to the development of improved shock absorbers and damping systems. Companies are focusing on technologies that enhance handling and reduce vibrations, making vehicles more comfortable for passengers.

Additionally, the rise of electric and hybrid vehicles is influencing the suspension market. These vehicles require lighter and more efficient suspension systems to offset battery weight and improve overall performance. Automakers are investing in adaptive and semi-active suspension technologies to enhance efficiency and extend battery range.

Technological advancements in suspension systems are also playing a crucial role. Active and semi-active suspension technologies allow real-time adjustments, improving vehicle stability on different terrains. These innovations, along with increasing vehicle production and the shift toward EVs, are driving strong market growth in the region.

Restraining Factors

High Costs and Supply Chain Challenges Restrain Market Growth

The high cost of advanced suspension components is a significant barrier in the market. Premium systems, such as active and air suspension, are expensive to manufacture and install. This limits their adoption in budget and mid-range vehicles, slowing overall market expansion.

Another challenge is the complexity of retrofitting modern suspension systems in older vehicles. Many consumers in Asia Pacific continue to use older cars, and upgrading their suspension systems requires significant modifications. This restricts the widespread adoption of advanced technologies.

Dependence on imported raw materials also affects cost and supply chain stability. Many critical suspension components rely on materials sourced from different countries. Disruptions in global trade, fluctuating material costs, and geopolitical tensions can lead to supply shortages and increased production expenses.

Additionally, stringent emission norms are impacting traditional suspension designs. Governments are implementing stricter regulations on fuel efficiency and emissions, forcing automakers to redesign suspension systems to meet compliance requirements. These regulatory changes add complexity and cost to product development.

Growth Opportunities

Smart Suspension and Lightweight Components Provide Growth Opportunities

The expansion of smart suspension systems integrated with artificial intelligence (AI) presents a key opportunity for market growth. AI-enabled suspension systems can analyze road conditions in real time and adjust damping accordingly. This improves ride quality and safety, especially in changing driving conditions.

Lightweight suspension components are also in high demand. Automakers are increasingly using aluminum and composite materials to reduce vehicle weight and improve fuel efficiency. These materials help lower emissions while maintaining performance, making them attractive for manufacturers.

Air suspension systems are gaining popularity, particularly in luxury and commercial vehicles. These systems offer a smoother ride by adjusting air pressure in real time. As premium vehicle sales increase in Asia Pacific, the demand for air suspension is set to rise.

The growth of local manufacturing capabilities is another major opportunity. Governments and automakers are investing in domestic production to reduce reliance on imports. Expanding local manufacturing not only cuts costs but also strengthens supply chain resilience.

Emerging Trends

Adaptive and Electromagnetic Suspension Are Latest Trending Factors

Adaptive suspension systems are becoming more popular in high-performance vehicles. These systems automatically adjust suspension stiffness based on road conditions and driving style. Luxury carmakers and sports vehicle manufacturers are increasingly integrating adaptive suspension to enhance handling and comfort.

Investments in electromagnetic suspension technology are also rising. Unlike traditional systems, electromagnetic suspensions use electric motors to provide smoother and faster adjustments. This technology is gaining traction due to its ability to offer superior ride quality with minimal mechanical wear.

Integration with autonomous vehicle platforms is another emerging trend. As self-driving technology advances, suspension systems must work seamlessly with sensors and AI-driven controls. Advanced suspension technologies are being designed to improve vehicle stability, ensuring better control and passenger comfort in autonomous cars.

Additionally, 3D-printed suspension components are gaining attention. This innovation allows for lightweight, customized parts that enhance efficiency and reduce production costs. Automakers are increasingly exploring 3D printing to create optimized suspension designs for different vehicle types.

Regional Analysis

China Dominates with 37.4% Market Share

China leads the Asia Pacific Automotive Suspension Systems Market with a 37.4% share, valued at USD 11.03 billion. This dominant position is driven by China’s massive automotive industry, extensive manufacturing capabilities, and significant investments in automotive R&D.

Key factors contributing to this high market share include rapid industrialization, increasing vehicle production and sales, and a strong focus on improving vehicle quality and safety standards. The government’s push for technological advancement in the automotive sector, including new energy vehicles, further strengthens the market.

China’s influence on the Asia Pacific Automotive Suspension Systems Market is expected to grow. With ongoing initiatives to boost the automotive sector’s efficiency and competitiveness, coupled with increasing export activities, China is likely to maintain its leadership position. The shift towards electric vehicles and the integration of advanced suspension technologies are projected to drive future market growth.

Key Regions and Countries Covered in the Report

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Competitive Landscape

The Asia Pacific Automotive Suspension Systems Market is driven by major manufacturers that supply high-performance suspension solutions for automakers. The top four companies in this sector are KYB Corporation, ZF Friedrichshafen AG, Tenneco Inc., and NHK Spring Co., Ltd. These companies lead the market due to their advanced suspension technologies, strong partnerships with car manufacturers, and focus on innovation.

KYB Corporation is a top producer of shock absorbers and suspension components. It is known for its high-quality hydraulic suspension systems used in both passenger and commercial vehicles. The company’s expertise in electronic suspension technologies makes it a key supplier for modern vehicles, including hybrid and electric models.

ZF Friedrichshafen AG specializes in high-performance suspension and chassis systems. It provides independent and adaptive suspension solutions that enhance vehicle handling and safety. The company focuses on integrating electronic controls into suspension systems, improving ride comfort and stability.

Tenneco Inc. is a leading supplier of suspension systems, including advanced dampers and strut assemblies. It offers both conventional and electronic suspension solutions to automakers. Tenneco’s investment in lightweight materials and fuel-efficient technologies helps meet the growing demand for eco-friendly vehicles.

NHK Spring Co., Ltd. is a key player in the suspension market, providing high-strength coil springs and stabilizers. It focuses on developing durable and lightweight suspension components, making vehicles more efficient while maintaining safety and performance.

These companies remain dominant by investing in research and development, expanding their production capabilities, and aligning with automakers’ needs for advanced, lightweight, and energy-efficient suspension systems. As demand for electric and autonomous vehicles rises, these key players are expected to introduce more innovative suspension technologies.

Major Companies in the Market

- ContiTech Deutschland GmbH

- KYB Corporation

- Tenneco Inc.

- HL Mando Corp.

- F-TECH INC.

- ZF Friedrichshafen AG

- Marelli Holdings Co., Ltd.

- thyssenkrupp AG

- Rassini

- Sogefi SpA

- NHK SPRING Co., Ltd.

- Multimatic Inc.

- Others

Recent Developments

- Brembo: On October 2024, Brembo, an Italian brake system manufacturer, agreed to acquire Öhlins Racing, a Swedish suspension technology company, for $405 million. This acquisition will enhance Brembo’s product portfolio by incorporating Öhlins’ advanced suspension products, including shock absorbers and steering dampers, further strengthening its position in the automotive market.

- Schaeffler AG: On December 2024, Schaeffler AG, through its subsidiary Industriewerk Schaeffler INA-Ingenieurdienst GmbH, acquired 100% of Dhruva Automation & Controls, a Pune-based provider of industrial automation and software solutions. This acquisition aims to support Schaeffler’s digitalization efforts and expand its presence in the Asia-Pacific region, integrating Dhruva’s expertise into Schaeffler’s operations.

Report Scope

Report Features Description Market Value (2024) USD 29.5 Billion Forecast Revenue (2034) USD 50.4 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle (Passenger Vehicles, Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)), By System (Independent Suspension, Dependent (Rigid) Suspension), By Damping (Hydraulic Damping, Air Suspension, Electromagnetic Damping, Others), By Component (Springs, Control Arms, Shock Absorber/Dampener, Ball Joints, Others) Regional Analysis Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC Competitive Landscape ContiTech Deutschland GmbH, KYB Corporation, Tenneco Inc., HL Mando Corp., F-TECH INC., ZF Friedrichshafen AG, Marelli Holdings Co., Ltd., thyssenkrupp AG, Rassini, Sogefi SpA, NHK SPRING Co., Ltd., Multimatic Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Asia Pacific Automotive Suspension Systems MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Asia Pacific Automotive Suspension Systems MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ContiTech Deutschland GmbH

- KYB Corporation

- Tenneco Inc.

- HL Mando Corp.

- F-TECH INC.

- ZF Friedrichshafen AG

- Marelli Holdings Co., Ltd.

- thyssenkrupp AG

- Rassini

- Sogefi SpA

- NHK SPRING Co., Ltd.

- Multimatic Inc.

- Others