Global Application Security Market Size, Share Analysis Report By Type (Web Application Security, Mobile Application Security), By Component (Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, SMEs), By Industry Vertical (BFSI, Government & Public Sector, Healthcare, IT & Telecommunication, Retail & E-commerce, Education, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150695

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

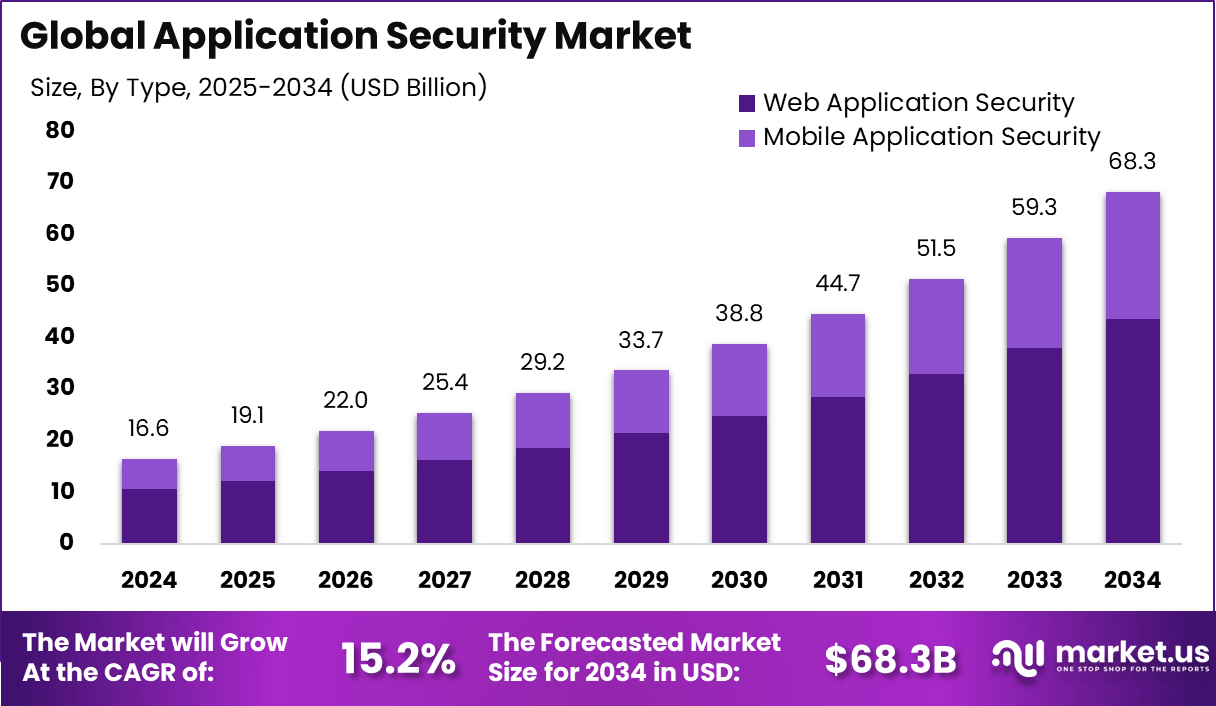

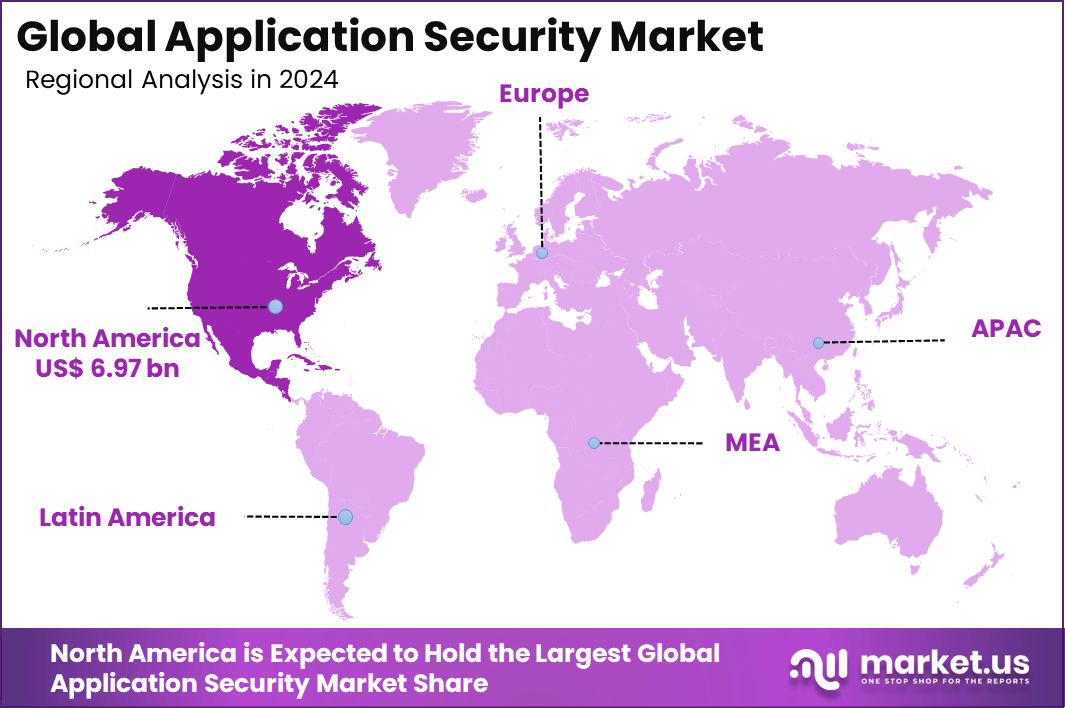

The Global Application Security Market size is expected to be worth around USD 68.3 billion by 2034, from USD 16.6 billion in 2024, growing at a CAGR of 15.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42% share, holding USD 6.97 billion in revenue.

The Application Security Market is undergoing transformative expansion as the surge in digital adoption, cloud migration, and sophisticated cyber threats intensifies the need for proactive defenses. Applications are now recognised as primary attack vectors, reshaping the security perimeter and prompting organisations to embed security throughout development lifecycles.

One Top Driving Factor behind market acceleration is the escalating frequency and ingenuity of attacks targeting applications. Web and mobile applications now account for a majority of data breaches and ransomware incidents, provoking regulatory scrutiny and financial repercussions. Compliance demands from frameworks such as GDPR, PCI DSS, and emerging privacy laws further oblige organisations to formalise security into their development pipelines.

The Increasing Adoption of Technologies is largely attributed to the convergence of DevSecOps practices, cloud-native architectures, AI-driven analytics, and API-focused security. Security testing is now automated across CI/CD pipelines, enabling continuous code validation. Meanwhile, APIs – vital for digital services – are being safeguarded through dedicated API security solutions, reflecting a broader market evolution toward integrated, intelligent protection frameworks.

According to AIMultiple, application breaches make up 25% of all security incidents, mainly due to stolen credentials and vulnerabilities. Over 75% of applications have at least one flaw, and 83% reveal security issues during initial assessments. In total, 26,447 vulnerabilities were disclosed, exceeding the previous year by over 1,500 CVEs, highlighting the urgent need for stronger application security.

For instance, in January 2025, NVIDIA announced new tools for AI-powered application security, aimed at enhancing the protection of applications through advanced machine learning techniques. These tools are designed to help organizations identify vulnerabilities, predict potential security threats, and automate responses, significantly improving the efficiency and effectiveness of security measures.

Key Takeaway

- Web Application Security led the market by type, accounting for a dominant 64% share, driven by the growing volume of cyberattacks targeting public-facing applications and APIs.

- The Solutions segment held a key position, capturing 30% of the overall market, as organizations continue to invest in advanced application scanning, firewalls, and code analysis tools.

- Cloud-based deployment emerged as the preferred model with 71% market share, reflecting increased adoption of cloud-native applications and need for scalable, real-time protection.

- Large Enterprises dominated the user base, holding 68% of the market share, supported by their capacity for comprehensive security integration across multiple application layers.

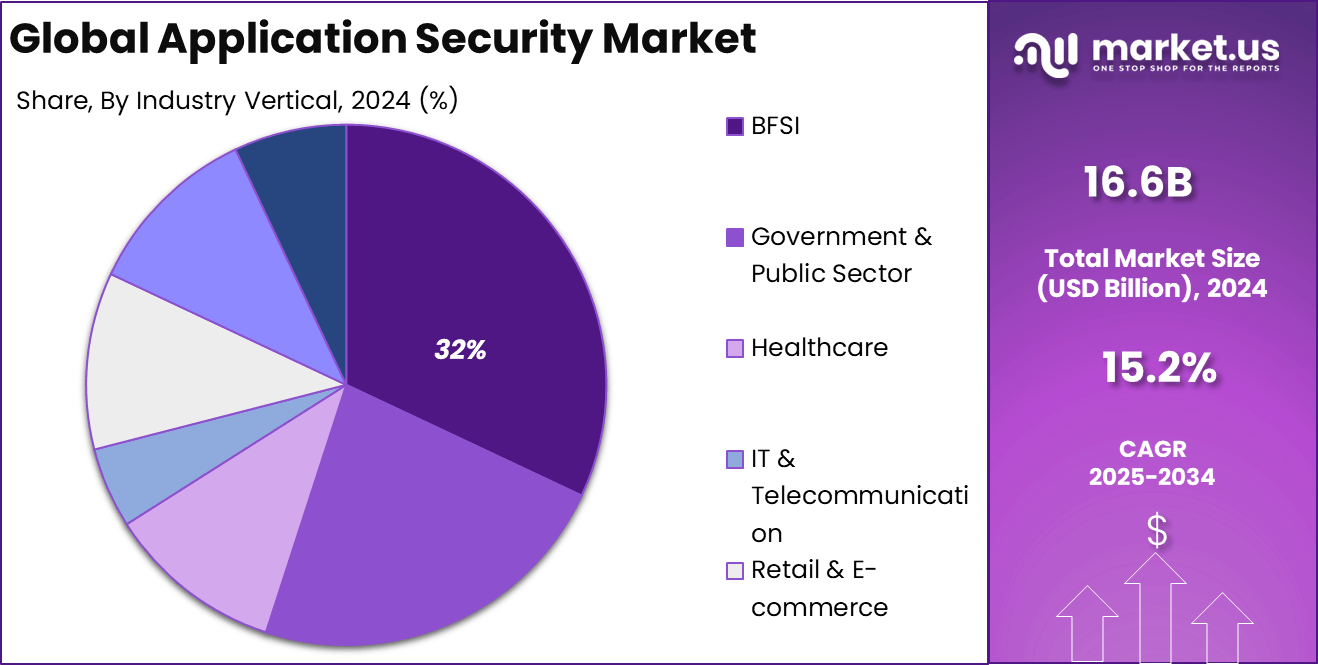

- The BFSI sector maintained its lead among verticals with a 32% share, as financial institutions prioritize secure digital infrastructure to protect customer data and ensure regulatory compliance.

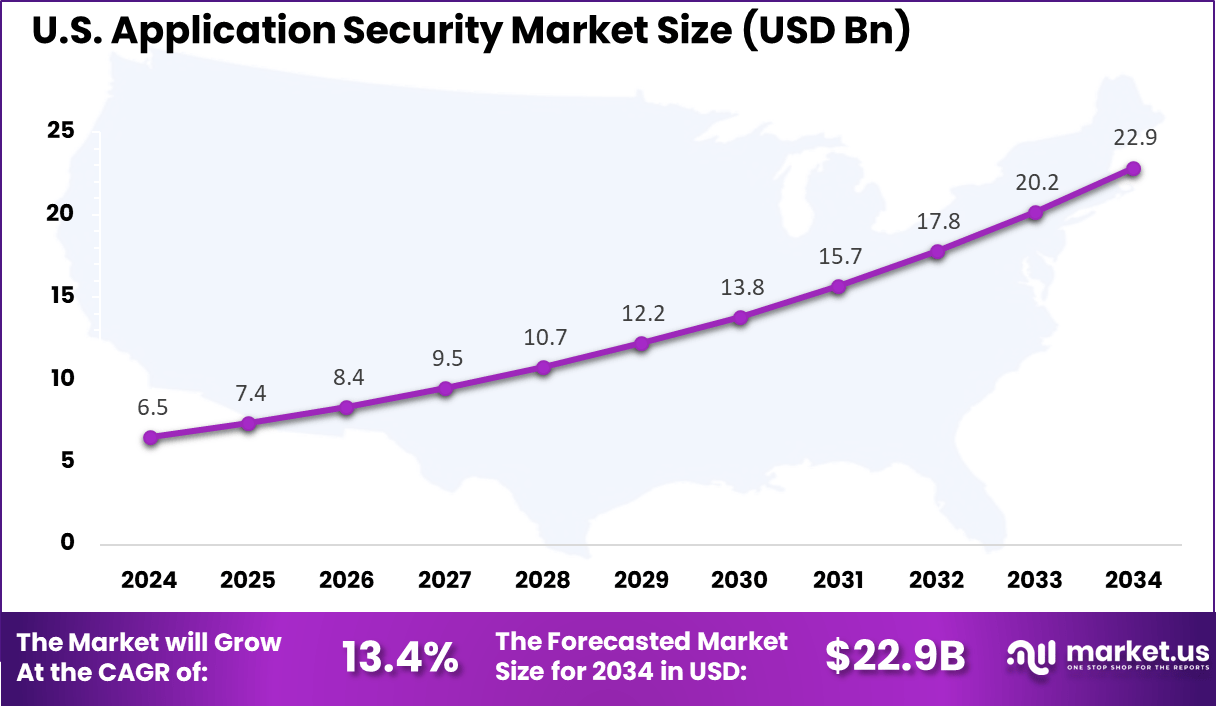

- The U.S. market reached a valuation of USD 6.5 Billion in 2024, registering a strong CAGR of 13.4%, propelled by heightened data protection regulations and digital transformation initiatives.

- North America led globally, capturing more than 42% of the total market share, backed by early adoption of security solutions and a mature cybersecurity ecosystem.

U.S. Market Size

The US Application Security Market is valued at approximately USD 6.5 Billion in 2024 and is predicted to increase from USD 12.2 Billion in 2029 to approximately USD 22.9 Billion by 2034, projected at a CAGR of 13.4% from 2025 to 2034.

The United States is leading the Application Security market due to the high concentration of digitally mature enterprises and the early adoption of advanced cybersecurity practices. U.S. organizations are under constant pressure to secure increasingly complex IT environments, driven by widespread digital transformation, hybrid work models, and cloud-native development practices.

For instance, in February 2025, U.S. based Semgrep raised $100 million to further develop its AI-powered security scanning platform. This funding round underscores the growing importance of leveraging advanced technologies like AI in application security. Semgrep’s platform focuses on enhancing code security by detecting vulnerabilities early in the development process.

In 2024, North America held a dominant market position in the Global Application Security Market, capturing more than a 42% share, holding USD 6.97 billion in revenue. The advanced technology, extensive digital transformation, and presence of leading cybersecurity companies make this market highly competitive.

A growing focus on digital transformation and government initiatives, such as the Cybersecurity Infrastructure Security Agency (CISA), has intensified calls for comprehensive security measures. Strong regulatory systems, significant R&D investments, and a proficient cybersecurity team encourage ongoing innovation and the implementation of innovative security solutions.

For instance, In October 2022, Outpost24 expanded its penetration testing services to North America to meet rising demand for advanced application security, helping organizations detect vulnerabilities and enhance cyber defenses.

Type Analysis

In 2024, the Web Application Security segment held a dominant market position, capturing more than 64% share of the overall application security market. This leadership is primarily attributed to the critical role web-based platforms play in modern digital infrastructure. As organizations increasingly migrate services and data to web environments – ranging from e-commerce portals and SaaS tools to extensive API ecosystems – the exposure to remote, high-impact cyber threats has intensified.

The universal accessibility of web applications makes them prime targets for exploitation, which has driven widespread adoption of comprehensive web security measures, such as real-time threat detection, automated vulnerability scanning, and web application firewalls. Further strengthening the segment’s position, innovation within the web application security domain continues to outpace developments in other areas.

For instance, in March 2025, Cloudflare introduced a new application security experience, aimed at enhancing the security of web applications through a more integrated and user-friendly interface. This innovation is designed to provide businesses with streamlined security management, including advanced protection against evolving threats such as DDoS attacks, data breaches, and application vulnerabilities.

Summary of Leading Segment – Web Application Security

Key Drivers Details Pervasive Web Usage Most digital services run via the web, increasing vulnerability and necessitating robust defenses High Threat Profile Web applications serve as gateways for critical data, making them primary attack targets Innovative Security Solutions AI-driven threat detection, DevSecOps integration, real-time API scanning, WAFs Regulatory & Compliance Pressure Strict standards (e.g. GDPR, PCI-DSS) require deployment of advanced web application security Component Analysis

In 2024, the Solutions segment held a dominant position in the global Application Security market, capturing more than 30% share. This leadership reflects organizations’ preference for comprehensive software tools that secure the development lifecycle.

As businesses rapidly migrate applications to cloud and hybrid environments, demand has surged for multifaceted solutions – such as vulnerability scanners, Web Application Firewalls, container and API security – that identify and mitigate threats early.

Vendors have responded with integrated platforms that streamline risk identification across codebases, open-source dependencies, and runtime environments, offering clients both visibility and efficiency. Further contributing to the segment’s dominance, solutions benefit from continuous innovation and developer-centric integration. Many AppSec tools are now embedded directly within DevSecOps pipelines, enabling early testing, automated fixes, and real-time enforcement during application builds

For instance, in March 2025, Cloudflare was named a Leader in the WAF (Web Application Firewall) category by Forrester. This recognition highlights Cloudflare’s strength in providing advanced solutions for application security, particularly in protecting web applications from evolving threats such as DDoS attacks, SQL injections, and other vulnerabilities.

Summary of Leading Segment – Solutions

Key Drivers Details Comprehensive Toolset Includes vulnerability scanners, WAFs, container and API security tools for full lifecycle protection Cloud and DevSecOps Integration Embedded in CI/CD pipelines to enable early detection and automated security fixes Efficiency & Cost Reduction Early-stage security reduces breach costs and operational overhead High Market Share Solutions captured ~69-70% of the application security market in 2024—far surpassing services demand Deployment Mode Analysis

In 2024, the Cloud-based segment held a dominant market position in the global Application Security market, capturing more than 71% share. This leadership is anchored in the rapid adoption of cloud-native development and delivery models. As organizations increasingly shift workloads and applications to the cloud – public, private, and hybrid – security demands have gravitated toward flexible, scalable, and centrally managed solutions.

Cloud-based AppSec tools deliver real-time monitoring, automated updates, and seamless integration with DevSecOps pipelines, making them more suitable than static, on-premises alternatives to secure dynamic environments. Additionally, the rise of Security as a Service (SECaaS) models has reinforced the Cloud-based segment’s dominance.

For instance, in December 2024, Fortinet unveiled FortiAppSec Cloud, a unified cloud-based application security solution designed to provide comprehensive protection for web applications. This new platform leverages Fortinet’s advanced security technologies to offer scalable, cloud-native protection against threats such as DDoS attacks, data breaches, and other vulnerabilities.

Summary of Leading Segment – Cloud-based

Key Drivers Details Cloud-First Deployment Migrating to cloud calls for security tools that scale, update, and integrate continuously DevSecOps Integration Embedded AppSec in CI/CD pipelines ensures early detection and remediation of vulnerabilities Security as a Service (SECaaS) Outsourced, subscription-based security helps firms compensate for limited in-house capabilities Scalability & Automation Cloud-based solutions support global reach, automated patching, and seamless updates Operational Efficiency Reduces infrastructure overhead and centralizes security management across distributed environments Organization Size Analysis

In 2024, the Large Enterprises segment held a dominant market position in the global Application Security market, capturing more than 68% share. This leadership is primarily attributed to the extensive and complex application environments maintained by large organizations. Many such enterprises manage hundreds to thousands of applications – often with critical business processes and sensitive data – across cloud and on‑premises ecosystems.

Furthermore, large enterprises typically command substantial IT budgets and specialist expertise, enabling them to deploy comprehensive security tools and establish dedicated AppSec teams. According to 2024 industry data, companies with over 1,000 employees accounted for approximately 67% of total application security spending.

These organizations often integrate security practices into DevSecOps pipelines, utilize automated testing solutions, and rely on managed security services to ensure continuous protection. The combination of scale, budget, and operational maturity reinforces the Large Enterprises segment’s dominant position in the market.

For instance, in October 2024, F5 announced an enhanced AI-powered application delivery solution and security for large enterprises in collaboration with NVIDIA BlueField-3 DPUs. This innovative platform is designed to optimize and secure application delivery at scale, providing enterprise organizations with advanced security features, such as real-time threat detection and mitigation.

Summary of Leading Segment – Large Enterprises

Key Drivers Details Extensive App Infrastructure Hundreds to thousands of web, mobile, and API applications require robust security posture High IT Investment 67% of global AppSec spend originates from large enterprises with >1,000 employees Integrated Security Strategy Adoption of DevSecOps, automated testing, and centralized AppSec programs across development lifecycles In-House Expertise & Tools Teams with specialized skills deploy end-to-end AppSec tools (SAST/DAST/RASP/WAF) Industry Vertical Analysis

In 2024, the BFSI (Banking, Financial Services & Insurance) segment held a dominant market position in the global Application Security market, capturing more than 32% share. This leadership is grounded in the sector’s critical need to protect highly sensitive financial and customer data.

The financial services industry is a frequent target for cybercriminals – driven by lucrative gains and regulatory scrutiny – prompting BFSI institutions to allocate substantial resources to application-level security.

The BFSI segment’s dominance is further reinforced by rigorous compliance requirements – such as PCI-DSS, GDPR, and industry-specific regulations – which mandate strong security controls throughout software development and deployment processes. This has led to widespread adoption of AppSec tools like static and dynamic testing, runtime protection, and API security across financial institutions.

Summary of Leading Segment – BFSI

Key Drivers Details High-Value Targets Financial systems contain sensitive consumer data and transactional records; attract cyber threats Regulatory Compliance Strict rules (PCI-DSS, GDPR, etc.) require robust application security measures Digital Transformation Shift to mobile, cloud, and API-driven finance increases need for AppSec investment Elevated Security Spending BFSI leads vertical share at ~24.1–32%, driven by high-budget allocation in AppSec For instance, in June 2025, Protecttai and I-Exceed joined forces to revolutionize mobile banking security. This strategic partnership aims to enhance the application security of mobile banking platforms by integrating advanced security technologies. The collaboration focuses on offering robust protection against emerging cyber threats, ensuring the security and privacy of financial transactions.

Key Market Segments

By Type

- Web Application Security

- Mobile Application Security

By Component

- Solutions

- Static Application Security Testing

- Dynamic Application Security Testing

- Interactive Application Security Testing

- Runtime Application Self-Protection

- Others

- Services

- Professional Services

- raining & Education

- Consulting Services

- Integration & Maintenance

- Managed Services

- Professional Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- SMEs

By Industry Vertical

- BFSI

- Government & Public Sector

- Healthcare

- IT & Telecommunication

- Retail & E-commerce

- Education

- Others

Drivers

Rising Cybersecurity Threats in Applications

The increasing occurrence and complexity of cyberattacks, particularly on mobile applications, have made it essential for businesses to prioritize the protection of their digital infrastructure. Companies are compelled to invest in enhanced application security strategies due to the significant risks associated with data breaches, ransomware, and vulnerabilities at the application level.

For instance, In January 2025, a major security breach involving French nuclear submarines was linked to the Strava fitness app, where personnel unintentionally shared location data, exposing sensitive military routes. This incident highlights the urgent need for strong application security in both civilian and defense sectors to prevent data leaks and protect classified information.

Restraint

High Implementation Costs

The cost of implementing comprehensive application security measures can be a significant hindrance, particularly for small enterprises and startups. A significant amount of money is required to invest in advanced security technologies, along with ongoing maintenance costs, updates, and training expenses, which can result in financial challenges.

Many organizations consider these costs to be excessive, which may result in delayed or restricted access to critical security tools, especially when the budget is tight. For instance, in September 2024, Bruce Warren, Chief Marketing Officer at Security Compass, discussed the high costs of delaying a security-by-design program.

it emphasized that postponing the integration of application security measures into the development lifecycle can lead to significant financial and reputational damage. As security vulnerabilities are discovered later in the process, the costs for remediation rise exponentially.

Opportunities

AI and Machine Learning Integration in Application Security

The integration of AI and machine learning (ML) into application security offers significant opportunities for innovation. These technologies enable businesses to detect threats in real-time, conduct predictive analytics, and analyze behavior for potential weaknesses before they are exploited. Through this, threat response can be automated, resulting in better decision-making, which can improve security operations, decrease human error, or enhance an organization’s security position against evolving cyber risks.

For instance, in June 2025, Contrast Security launched a unified platform for application security with AI-powered remediation. This innovative platform leverages artificial intelligence to automate the identification and remediation of vulnerabilities in real time, significantly improving the efficiency and accuracy of security efforts. By integrating AI, Contrast Security aims to streamline application security processes, making it easier for organizations to secure their applications.

Challenges

Regulatory Complexity

The regulatory landscape is becoming more complex, and companies, particularly those operating in different countries, face significant challenges. Organizations must continuously monitor and adjust to changing regulations due to the varying compliance standards on data privacy, cybersecurity, and application security.

The complexity of the situation demands substantial resources and knowledge, making it more challenging to achieve complete compliance without overwhelming the organization or escalating the risk of regulatory issues.

For instance, in January 2025, the U.S. government took action under the Protecting Americans from Foreign Adversary-Controlled Applications Act, applying it to TikTok. This decision highlights the administration’s focus on addressing national security risks posed by foreign-controlled applications, specifically in the context of data privacy and potential threats to American users.

Latest Trends

Organizations are increasingly adopting Shift Left Security by integrating security measures with DevSecOps at the beginning of the software development lifecycle (SDLC). This proactive approach permits security teams to detect and resolve issues early on, rather than after they have been deployed.

For instance, in March 2025, the integration of security measures with DevSecOps was highlighted as a key factor in enhancing application security within the development pipeline. By embedding security practices directly into the DevOps workflow, organizations can proactively identify vulnerabilities early in the development process, rather than after deployment.

Key Players Analysis

Some of the leading players in the application security market include Cisco Systems, Inc., International Business Machines Corporation, CAST Software and F5, Inc.

Cisco Systems, Inc. provides a suite of application security solutions, including Cisco Umbrella and Cisco Secure Cloud Analytics, designed to protect web applications, networks, and cloud environments. These tools support automation and orchestration across Cisco’s security portfolio and integrate effectively with third-party systems.

F5, Inc. delivers robust security platforms such as its Advanced Web Application Firewall (WAF), which shields end-user applications from common threats without requiring changes to the apps. In addition, its Advanced Firewall Manager (AFM) defends against large-scale DDoS attacks by automatically activating mitigation measures, alerting administrators, and adjusting thresholds based on evolving traffic behavior – ensuring uninterrupted access for legitimate users.

Among emerging players, CAST Software stands out with its CAST Security Dashboard. This solution enables enterprises to proactively embed security into the software development process and offers a centralized view of security across applications and business transactions. It supports teams in identifying and resolving critical software vulnerabilities early in the development lifecycle.

Top Key Players in the Market

- IBM Corporation

- HCL

- Cisco Systems Inc.

- Synopsys Inc.

- Veracode

- Capgemini SE

- Rapid7

- Onapsis

- Gitlab Inc.

- CAST

- Contrast Security

- Onespan Inc.

- Truswave Holdings Inc.

- F5 Inc.

- Others

Recent Developments

- In July 2024, IBM introduced new features to its IBM Security Verify platform, enhancing its identity and access management capabilities. These updates include expanded support for SAP Business Technology Platform applications and improved integration across hybrid environments. By strengthening identity controls and application-level security, IBM aims to help organizations safeguard their digital ecosystems more effectively, reinforcing the critical role of application security.

- In April 2024, Synopsys added an AI-powered Application Security Assistant to its Polaris Software Integrity Platform. This new feature leverages artificial intelligence to assist security teams in identifying and managing vulnerabilities more efficiently within the software development lifecycle. By automating aspects of vulnerability detection and remediation, Synopsys aims to enhance the application security process.

Report Scope

Report Features Description Market Value (2024) USD 16.6 Bn Forecast Revenue (2034) USD 68.3 Bn CAGR (2025-2034) 15.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Web Application Security, Mobile Application Security), By Component (Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, SMEs), By Industry Vertical (BFSI, Government & Public Sector, Healthcare, IT & Telecommunication, Retail & E-commerce, Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, HCL, Cisco Systems Inc., Synopsys Inc., Veracode, Capgemini SE, Rapid7, Onapsis, Gitlab Inc., CAST, Contrast Security, Onespan Inc., Truswave Holdings Inc., F5 Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Application Security MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Application Security MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- HCL

- Cisco Systems Inc.

- Synopsys Inc.

- Veracode

- Capgemini SE

- Rapid7

- Onapsis

- Gitlab Inc.

- CAST

- Contrast Security

- Onespan Inc.

- Truswave Holdings Inc.

- F5 Inc.

- Others