Global Apoptosis Testing Market By Product Type (Consumables (Kits and Reagents, Microplate, and Others) and Instruments), By Technology (Flow Cytometry, Spectrophotometry, Cell Imaging & Analysis System, and Others), By Application (Cancer, Degenerative Disorders, Chronic Inflammation, Cardiovascular Diseases, and Others), By Assay Type (Caspase Assays, DNA Fragmentation Assays, Mitochondrial Assays, Cell Permeability Assays, and Annexin V), By End-user (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and Hospital & Diagnostic Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168209

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Technology Analysis

- Application Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

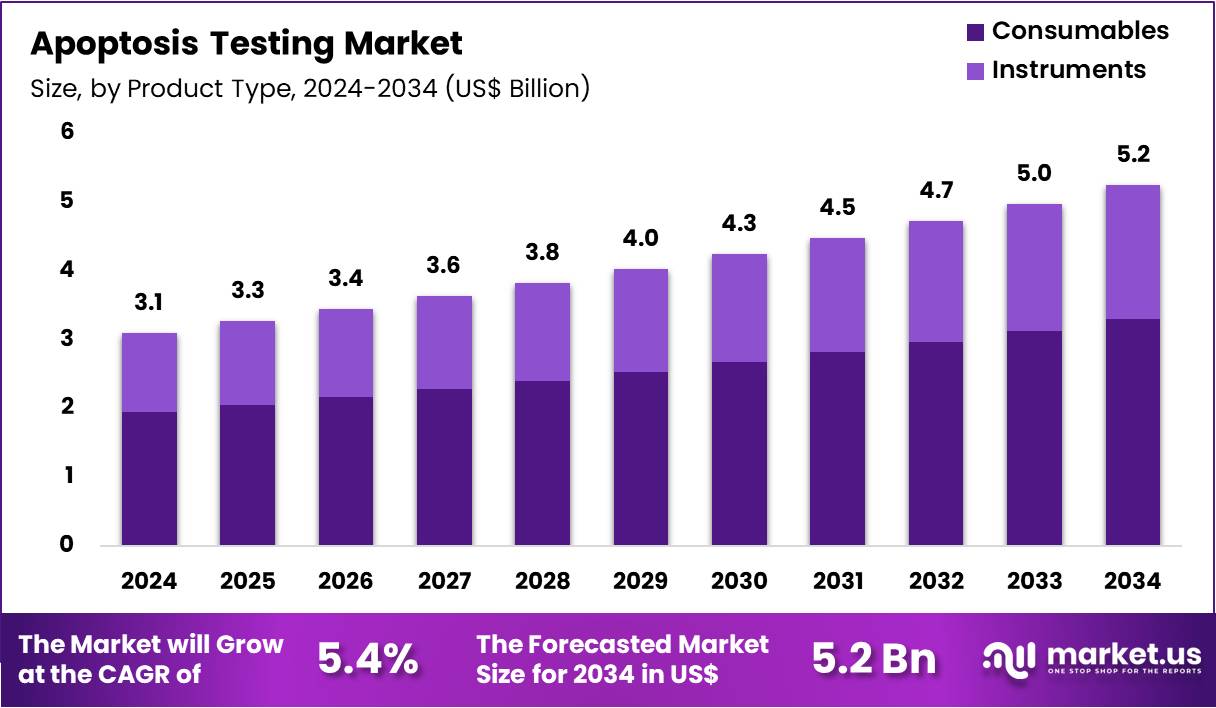

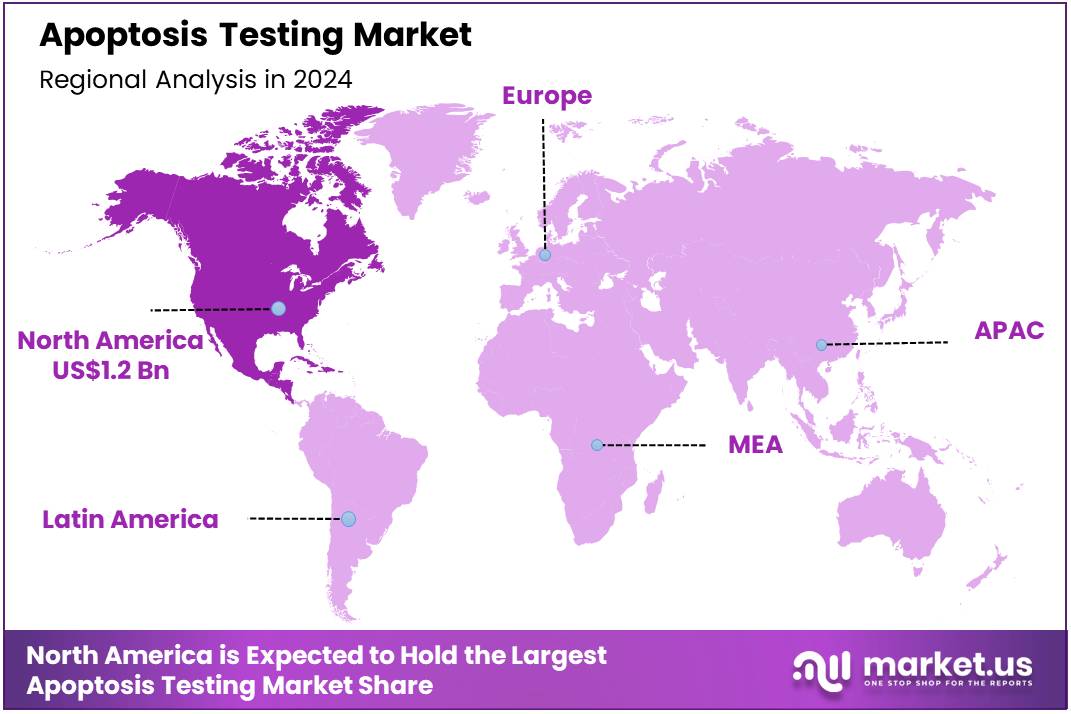

The Global Apoptosis Testing Market size is expected to be worth around US$ 5.2 Billion by 2034 from US$ 3.1 Billion in 2024, growing at a CAGR of 5.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.5% share with a revenue of US$ 1.2 Billion.

Increasing demand for precision oncology research propels the Apoptosis Testing market, as scientists seek robust assays to evaluate therapeutic-induced cell death mechanisms in drug discovery pipelines. Biotechnology firms develop high-affinity antibodies that target cleaved caspases and Bcl-2 family proteins for superior pathway discrimination. These tests enable high-throughput screening of apoptosis inducers in leukemia cell lines, efficacy assessment of TRAIL agonists in solid tumors, and resistance profiling in immunotherapy-resistant melanoma models.

Enhanced reagent sensitivity creates opportunities for multiplexed Western blotting and immunoprecipitation studies in early-phase trials. Cell Signaling Technology strengthened this capability in October 2025 by launching a specialized range of apoptosis-related antibodies with elevated sensitivity and specificity, empowering clearer pathway elucidation in cancer biology and immunology. This innovation elevates assay reliability and accelerates adoption in academic and industrial laboratories.

Growing emphasis on multiparametric flow cytometry accelerates the Apoptosis Testing market, as researchers integrate viability markers with surface phosphatidylserine exposure for nuanced cell population analysis. Diagnostic developers engineer brighter fluorophores that minimize spectral overlap in complex panels.

Applications encompass early apoptosis detection in T-cell activation assays, quantification of drug-induced phosphatidylserine flipping in lymphoma cultures, and co-staining with viability dyes for necroptosis differentiation in ischemia models. Advanced conjugates open avenues for full-spectrum cytometry in heterogeneous tissue digests.

Bio-Rad Laboratories advanced this precision in August 2024 with the release of its Annexin V StarBright conjugates, delivering sharper resolution and superior brightness for accurate apoptotic cell enumeration. Such enhancements expand workflow flexibility and heighten demand for fluorescent-based apoptosis quantification.

Rising investment in research infrastructure invigorates the Apoptosis Testing market, as collaborative hubs equip emerging teams with cutting-edge platforms for routine assay integration. Industry partnerships provide hands-on training and access to validated kits that streamline experimental design. These facilities support caspase activity profiling in neurodegeneration studies, TUNEL-based DNA fragmentation analysis in developmental biology, and live-cell imaging of mitochondrial outer membrane permeabilization in metabolic disorders.

Skill-building initiatives create opportunities for standardized protocols in biopharma R&D acceleration. Thermo Fisher Scientific, through its partnership with C-CAMP, established a Centre of Excellence in January 2024 featuring advanced flow cytometry and molecular tools, significantly boosting researcher proficiency and assay incorporation across diverse pipelines. This development fosters broader technological adoption and innovation in apoptosis evaluation.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.1 Billion, with a CAGR of 5.4%, and is expected to reach US$ 5.2 Billion by the year 2034.

- The product type segment is divided into consumables and instruments, with consumables taking the lead in 2024 with a market share of 62.8%.

- Considering technology, the market is divided into flow cytometry, spectrophotometry, cell imaging & analysis system, and others. Among these, flow cytometry held a significant share of 41.6%.

- Furthermore, concerning the application segment, the market is segregated into cancer, degenerative disorders, chronic inflammation, cardiovascular diseases, and others. The cancer sector stands out as the dominant player, holding the largest revenue share of 46.2% in the market.

- The assay type segment is segregated into caspase assays, DNA fragmentation assays, mitochondrial assays, cell permeability assays, and annexin V, with the caspase assays segment leading the market, holding a revenue share of 39.3%.

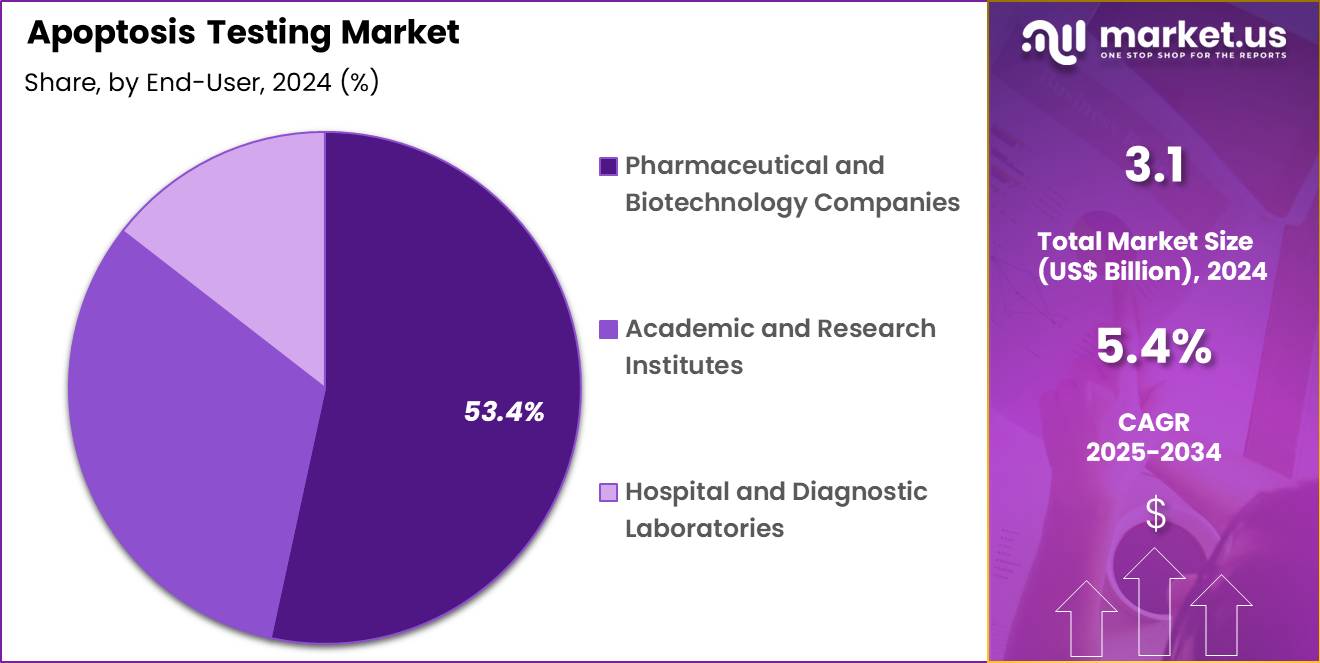

- Considering end-user, the market is divided into pharmaceutical & biotechnology companies, academic & research institutes, and hospital & diagnostic laboratories. Among these, pharmaceutical & biotechnology companies held a significant share of 53.4%.

- North America led the market by securing a market share of 39.5% in 2024.

Product Type Analysis

Consumables, holding 62.8%, are expected to grow strongly due to rising demand for reagents, kits, probes, dyes, and buffers used in repetitive apoptosis testing workflows. Research laboratories increase their consumption as cancer biology, immunology, and neurodegeneration projects expand globally. Pharmaceutical companies intensify their screening pipelines for apoptosis-related targets, and this trend drives recurring consumable requirements.

Diagnostic labs investigate apoptosis pathways in disease progression studies, and frequent testing raises kit utilization. High-throughput screening platforms generate continuous need for assay-ready reagents, and this need strengthens consumables revenue. Emerging markets increase laboratory capacity, and this expansion drives higher procurement of ready-to-use kits. Academic institutes perform mechanistic studies on targeted therapies, and their regular testing boosts consumable turnover.

Vendors design simplified, one-step assay kits, and this convenience accelerates adoption across small and mid-sized labs. Multiplex consumables gain traction as researchers integrate multiple apoptotic markers into a single experiment. Startup biotech firms rely heavily on consumables for proof-of-concept studies. Quality-sensitive experiments require validated reagents, and researchers choose premium kits to ensure accuracy.

Increasing focus on pathway-targeted drug discovery intensifies consumable usage across screening stages. Single-cell research influences higher adoption of sensitive dyes and fluorometric reagents. Accelerating oncology research pipelines continue to generate high-volume consumable demand.

Rising collaborations between labs and manufacturers improve access to advanced assay kits. Expanding global investments in disease modeling support consistent growth. Consumables therefore remain anticipated to dominate the product type category due to their recurring, essential role in apoptosis testing workflows.

Technology Analysis

Flow cytometry, holding 41.6%, is anticipated to remain the most widely used technology due to its precision in quantifying apoptotic cell populations. Researchers depend on its ability to detect early and late apoptosis markers through multicolor analysis. Pharmaceutical companies integrate flow cytometry into screening workflows to evaluate drug-induced apoptosis responses. Oncology studies require high-resolution cell-death profiling, and this requirement pushes consistent adoption.

Academic institutes conduct mechanistic pathway research using flow-based analysis, supporting steady usage. Technological upgrades introduce faster acquisition speeds and improved detectors, attracting laboratories with high-throughput needs. Multiparametric capabilities allow simultaneous measurement of caspases, mitochondrial potential, and membrane changes.

Flow cytometry platforms integrate automation, reducing manual workloads and improving reproducibility. Biotech startups build early drug-efficacy datasets using flow-based apoptosis quantification. Contract research organizations adopt flow cytometry to support large trial portfolios. Sensitive fluorescent probes optimized for flow systems enhance accuracy, encouraging wider usage.

Advancements in spectral flow cytometry increase data depth and strengthen adoption across immunology and cancer research. Hospitals with advanced diagnostic capabilities use flow cytometry to study cell-death patterns in hematological disorders. As personalized medicine grows, flow cytometry provides detailed apoptotic signatures that support treatment decisions.

Continuous improvements in software analytics simplify interpretation, encouraging broader use among non-specialists. Its strong analytical power, adaptability, and high sensitivity keep flow cytometry projected to remain the dominant technology in the apoptosis testing market.

Application Analysis

Cancer, holding 46.2%, is expected to dominate the application segment because researchers prioritize apoptosis pathways in oncology drug development. Therapeutic strategies increasingly target mechanisms such as caspase activation, mitochondrial dysfunction, and DNA damage, and these mechanisms demand high-frequency apoptosis testing.

Pharmaceutical companies intensify oncology pipelines across immuno-oncology, targeted therapies, and combination regimens, and this intensifies testing requirements. Laboratories analyze tumor-cell response to chemotherapeutics and small-molecule inhibitors, driving extensive apoptosis assays. Real-time cell-death profiling supports dose optimization and strengthens therapy selection.

Biomarker-driven research in breast, lung, colorectal, and hematologic cancers expands demand for apoptosis measurement tools. Hospitals study patient-derived tumor cells to evaluate treatment sensitivity, increasing application volume. Clinical trial programs use apoptosis data to support efficacy endpoints. Immunotherapy research depends on understanding T-cell-mediated apoptosis, boosting usage.

Academic institutions explore genetic mutations that alter apoptotic pathways, adding steady demand. Personalized treatment models encourage apoptosis-focused diagnostics. Investments in cancer research across the US, Europe, and Asia significantly raise assay consumption. Tumor microenvironment studies rely on apoptosis markers to assess treatment impact. High need for early drug-response insights further fuels testing requirements. Cross-disciplinary oncology research keeps cancer anticipated to remain the dominant application.

Application Analysis

Caspase assays, holding 39.3%, are projected to stay dominant as researchers intensify focus on caspase-mediated pathways in apoptosis regulation. Drug-discovery teams use caspase activity measurements to identify promising compounds during early screening. Laboratories rely on caspase assays to quantify intrinsic and extrinsic apoptotic responses with high specificity. Oncology studies analyze caspase activation to evaluate drug potency and mechanism of action.

Pharmaceutical companies incorporate caspase assays into high-throughput workflows, increasing reagent consumption. Academic institutes explore caspase dynamics in neurodegeneration, autoimmune diseases, and inflammation, pushing steady adoption. Diagnostic researchers investigate caspase-related biomarkers in disease severity studies. Ready-to-use caspase kits simplify workflows and support rapid data generation.

Fluorometric and luminescent caspase assays gain traction due to high sensitivity. Biotech startups depend on caspase data to support preclinical validation. Contract research organizations integrate caspase assays into multiparametric panels. Advances in multiplex caspase profiling help researchers study pathway interactions.

More research centers incorporate caspase imaging technologies, fueling associated assay usage. As interest in targeted apoptosis modulation grows, caspase assays remain central to mechanistic understanding. Rising investments in therapeutic development and disease-model studies keep caspase assays anticipated to dominate the assay type category.

End-User Analysis

Pharmaceutical and biotechnology companies, holding 53.4%, are anticipated to dominate the end-user segment as they drive the majority of apoptosis-focused research and development. Drug-discovery teams evaluate apoptosis modulation across various therapeutic areas, generating high assay usage. Companies screen compounds extensively to study toxicity, mechanism of action, and cell-death kinetics. Preclinical studies require continuous apoptosis testing to validate drug candidates.

Biologics, gene therapies, and targeted small molecules rely on apoptosis data during optimization. Oncology pipelines expand globally, and apoptosis insights strengthen efficacy evaluation. Firms integrate advanced technologies such as flow cytometry, high-content imaging, and multiplex assays into research workflows, raising demand for reagents and instruments.

Collaborations with CROs increase volumes of apoptosis-related projects. Biopharma companies invest in personalized medicine, and this investment increases the need for apoptosis biomarkers. Research on immune-cell therapies requires detailed apoptosis profiling. Large companies expand global R&D centers, increasing assay consumption. Early toxicity testing depends heavily on apoptosis detection.

Continuous innovation in cell-based assays attracts biopharma interest. Strong focus on mechanistic clarity and therapeutic validation keeps pharmaceutical and biotechnology companies projected to remain the dominant end-user segment in the apoptosis testing market.

Key Market Segments

By Product Type

- Consumables

- Kits and reagents

- Microplate

- Others

- Instruments

By Technology

- Flow cytometry

- Spectrophotometry

- Cell imaging & analysis system

- Others

By Application

- Cancer

- Degenerative Disorders

- Chronic Inflammation

- Cardiovascular diseases

- Others

By Assay Type

- Caspase assays

- DNA fragmentation assays

- Mitochondrial assays

- Cell permeability assays

- Annexin V

By End-user

- Pharmaceutical & biotechnology companies

- Academic & research institutes

- Hospital & diagnostic laboratories

Drivers

Increasing Global Cancer Incidence is Driving the Market

The steady rise in global cancer incidence has established a robust driver for the apoptosis testing market, as these tests are essential for evaluating programmed cell death mechanisms in tumor biology and therapeutic responses. Oncologists and researchers increasingly rely on apoptosis assays to assess drug efficacy in preclinical models, where induction of cell death serves as a key endpoint for candidate selection. This demand is amplified by the need to differentiate between apoptotic and necrotic pathways, guiding the development of targeted anticancer agents.

Public health institutions prioritize funding for diagnostic tools that facilitate early-stage biomarker identification, aligning with national cancer control plans. Manufacturers are compelled to develop high-throughput platforms compatible with flow cytometry and fluorescence microscopy, supporting large-scale screening initiatives. The integration of apoptosis testing into pharmacodynamic studies enhances translational research, bridging laboratory findings to clinical trials.

Regulatory agencies emphasize standardized protocols for these assays, ensuring reproducibility in multi-center studies. Collaborative consortia facilitate data sharing, accelerating the validation of novel apoptosis markers for prognostic applications. This driver not only sustains equipment sales but also boosts consumable revenues from kits and reagents.

Educational programs for laboratory personnel underscore the assays’ role in precision oncology, promoting widespread adoption. The World Health Organization’s GLOBOCAN 2022 estimates indicate approximately 20 million new cancer cases worldwide. These epidemiological data highlight the pressing requirement for advanced testing infrastructures.

Restraints

Complexity in Assay Standardization is Restraining the Market

The inherent complexity of standardizing apoptosis assays across diverse methodologies continues to act as a notable restraint on the market, complicating comparative analyses and hindering regulatory acceptance. Variations in detection techniques, from Annexin V staining to caspase activity measurements, lead to inconsistent results influenced by sample preparation and timing. This lack of uniformity discourages adoption in routine clinical settings, where reproducibility is paramount for diagnostic reliability.

Developers face prolonged validation periods to harmonize protocols, diverting resources from innovation to compliance efforts. Inter-laboratory discrepancies further erode confidence, prompting reliance on established but less sensitive methods. The restraint is particularly acute in academic environments, where budget constraints limit access to certified reference materials.

International guidelines strive to address these issues through consensus documents, yet enforcement remains fragmented. Manufacturers must invest in cross-platform compatibility, increasing development costs without guaranteed market share gains. These challenges collectively slow the transition to automated systems, perpetuating manual workflows.

Health authorities advocate for collaborative benchmarks, but progress is gradual amid evolving biomarker landscapes. The Organisation for Economic Co-operation & Development categorizes cell viability assessment methods, including apoptosis assays, into four groups: non-invasive cell structure damage, cell growth, invasive cell structure damage, and cellular metabolism. Such categorization underscores the multifaceted obstacles to seamless integration.

Opportunities

Advancements in Targeted Anticancer Therapies are Creating Growth Opportunities

The progression of targeted therapies modulating apoptotic pathways is generating significant growth opportunities for the apoptosis testing market, as these treatments demand precise assays to monitor pathway activation. Inhibitors of anti-apoptotic proteins, such as BCL-2 family members, require companion diagnostics to stratify responders, expanding the assay portfolio beyond research applications. This evolution opens avenues for multiplex kits that simultaneously evaluate multiple death signals, appealing to pharmaceutical pipelines.

Regulatory incentives for breakthrough designations expedite assay co-development, fostering partnerships between biotech firms and diagnostic providers. Opportunities extend to point-of-care formats, enabling real-time assessment in oncology clinics for adaptive dosing. Global clinical trial networks prioritize apoptosis endpoints, driving demand for scalable, validated platforms.

Economic analyses project cost savings from reduced trial failures through early efficacy signals, justifying investments in assay refinements. The focus on combination regimens further amplifies utility, as tests discern synergistic effects on cell death induction. Emerging markets benefit from technology transfers, tailoring assays to local epidemiological profiles. These dynamics position the market for diversified revenue, encompassing software for data interpretation.

The US Food and Drug Administration approved 50 novel drugs in 2024, many of which involve mechanisms related to apoptosis modulation in oncology. This approval volume signals expansive potential for integrated diagnostic solutions.

Impact of Macroeconomic / Geopolitical Factors

Persistent inflationary pressures and constrained research grants challenge biotech firms to deprioritize apoptosis testing kit developments, slowing innovation in academic settings. Expanding oncology pipelines and venture capital surges, however, empower developers to refine high-sensitivity assays, targeting aggressive tumor profiling needs.

Heightened geopolitical tensions in semiconductor corridors like the Taiwan Strait impede chip-based flow cytometer deliveries, extending validation timelines and swelling expenses for diagnostic labs. These same conflicts inspire diversified vendor ecosystems and fortified intellectual property frameworks that accelerate assay customization.

US Section 301 tariffs at 25% on imported analytical instruments from Asian suppliers, in effect since early 2025, escalate setup costs for American researchers and hinder grant-funded projects. Companies counter this by scaling US-based assembly lines and pursuing exemption filings that restore cost competitiveness. At its heart, these influences demand proactive risk hedging and cross-functional agility.

Latest Trends

Focus on BCL-2 Family Inhibitors is a Recent Trend

The heightened emphasis on BCL-2 family inhibitors as apoptosis inducers has emerged as a defining trend in the apoptosis testing market during 2024, reflecting their integration into frontline cancer regimens. These small-molecule agents selectively restore apoptotic balance in malignancies with dysregulated survival signals, necessitating specialized assays for pharmacodynamic evaluation.

Clinical protocols now incorporate flow-based detection of mitochondrial outer membrane permeabilization, aligning tests with inhibitor mechanisms. This trend promotes the development of quantitative PCR kits for BCL-2 expression profiling, enhancing predictive biomarker panels. Pharmaceutical collaborations accelerate assay optimizations for liquid biopsies, facilitating non-invasive monitoring.

The approach intersects with immunotherapy combinations, where apoptosis assays elucidate synergistic cell death pathways. Regulatory updates endorse these tools in accelerated approval pathways, streamlining evidence generation. Competitive advancements include high-sensitivity ELISA formats for low-abundance pro-apoptotic proteins.

Patient stratification benefits from trend-driven innovations, improving outcomes in hematologic cancers. Broader implications encompass neurodegenerative applications, adapting assays for neuroprotective contexts. Recent developments in apoptosis-targeted drugs have focused on the intrinsic pathway, including BCL-2, MCL-1, and IAP inhibitors. This concentration exemplifies the trend’s influence on therapeutic landscapes.

Regional Analysis

North America is leading the Apoptosis Testing Market

The percentage share of North America in the Apoptosis Testing market stands at 39.5%, reflecting its dominant position driven by robust investments in biomedical research and pharmaceutical development throughout 2024. This growth stems from heightened demand for advanced diagnostic tools in oncology, where precise detection of programmed cell death pathways accelerates drug discovery and personalized medicine initiatives.

Leading academic institutions and biotech firms expanded their pipelines, incorporating flow cytometry-based assays and high-throughput screening methods to evaluate therapeutic efficacy against cancer cells. Regulatory advancements by the Food and Drug Administration expedited approvals for novel apoptosis modulators, fostering innovation in clinical trials across the United States and Canada.

Collaborative efforts between universities and industry players enhanced accessibility to cutting-edge kits, reducing turnaround times for researchers studying neurodegenerative diseases. The surge in venture capital directed toward life sciences further propelled market expansion, enabling startups to commercialize fluorescence-activated cell sorting technologies tailored for apoptosis analysis.

Environmental factors, including rising incidences of chronic diseases, prompted healthcare providers to integrate these tests into routine protocols for early intervention. Supply chain optimizations post-pandemic ensured steady availability of reagents and instruments, mitigating disruptions and supporting consistent market penetration.

Educational programs in major hubs like Boston and San Francisco trained a new cadre of specialists, amplifying adoption in basic and translational research. In support of this trajectory, the National Cancer Institute received a US$120 million funding increase in fiscal year 2024, bolstering related research efforts.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Pharmaceutical giants anticipate substantial expansion in the apoptosis detection sector across Asia Pacific over the forecast period, fueled by rapid industrialization of healthcare infrastructure and burgeoning clinical research hubs in countries like China and India. Governments actively prioritize biotechnology advancements, channeling resources into facilities that employ annexin V staining and caspase activity assays for drug validation.

Academic consortia project accelerated adoption of these technologies in stem cell therapy evaluations, addressing regional demands for treatments targeting metabolic disorders. Investors estimate heightened market penetration through partnerships with local manufacturers, optimizing costs for ELISA-based kits in high-volume settings. Regulatory bodies streamline certification processes for imported and domestically produced tools, encouraging seamless integration into national health strategies.

Emerging economies likely witness a boom in applications for infectious disease studies, where real-time monitoring of cell death informs vaccine development. Multinational corporations plan strategic expansions, establishing production units to meet escalating needs in precision oncology trials. Educational initiatives in Singapore and South Korea equip researchers with expertise in advanced imaging modalities, driving innovative protocol designs.

Cross-border collaborations with Western firms enhance technology transfer, elevating standards for quantitative PCR assessments of apoptotic markers. Underpinning this outlook, China’s government allocated over CNY 20 billion in public funding for biotech R&D in 2023, catalyzing sustained momentum into subsequent years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Apoptosis Testing market accelerate growth by launching multiplexed, no-wash flow cytometry kits that combine caspase, Annexin V, and mitochondrial probes in single-tube formats, locking in high-throughput screening contracts with global pharma discovery units. They acquire niche live-cell imaging reagent firms to dominate real-time kinetic studies, while embedding CRISPR-compatible readouts to capture gene-editing validation spend.

Executives expand Asian subsidiaries with localized technical support to win emerging biopharma budgets in China and Korea. Thermo Fisher Scientific Inc., the Waltham-based life sciences leader formed in 2006, dominates the Apoptosis Testing market through its Invitrogen and Applied Biosystems portfolios, delivering industry-standard TUNEL, Annexin V, and multicolor flow reagents that integrate seamlessly with its own cytometers and imaging platforms for end-to-end, gold-standard programmed cell death analysis worldwide.

Top Key Players

- Promega

- PerkinElmer

- Merck

- GeneCopoeia

- G Biosciences

- Danaher

- Biotium

- Bio-Techne

- Bio-Rad Laboratories

- Becton, Dickinson and Company

- Agilent Technologies

- Abcam

Recent Developments

- In August 2025, Merck KGaA (DE) introduced a new apoptosis detection kit aimed at improving the accuracy of cell-death measurement in research laboratories. This addition strengthens the company’s assay portfolio and encourages wider adoption of apoptosis-based evaluation in oncology, toxicology, and drug-screening studies. By supplying more precise tools, Merck directly stimulates market growth as laboratories increasingly rely on advanced detection kits to support high-quality research outcomes.

- In September 2025, Bio-Rad Laboratories (US) entered a co-development collaboration with a biotechnology partner to create next-generation apoptosis assays. This partnership accelerates assay innovation by combining complementary scientific expertise, resulting in more sophisticated and commercially competitive apoptosis platforms. As new, improved assays enter the market, research users gain broader options, increasing overall demand for apoptosis-focused testing solutions.

Report Scope

Report Features Description Market Value (2024) US$ 3.1 Billion Forecast Revenue (2034) US$ 5.2 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Consumables (Kits and Reagents, Microplate, and Others) and Instruments), By Technology (Flow Cytometry, Spectrophotometry, Cell Imaging & Analysis System, and Others), By Application (Cancer, Degenerative Disorders, Chronic Inflammation, Cardiovascular Diseases, and Others), By Assay Type (Caspase Assays, DNA Fragmentation Assays, Mitochondrial Assays, Cell Permeability Assays, and Annexin V), By End-user (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and Hospital & Diagnostic Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Promega, PerkinElmer, Merck, GeneCopoeia, G Biosciences, Danaher, Biotium, Bio-Techne, Bio-Rad Laboratories, Becton, Dickinson and Company, Agilent Technologies, Abcam. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Promega

- PerkinElmer

- Merck

- GeneCopoeia

- G Biosciences

- Danaher

- Biotium

- Bio-Techne

- Bio-Rad Laboratories

- Becton, Dickinson and Company

- Agilent Technologies

- Abcam