Global API-based Payroll Tech Market Size, Share, Industry Analysis Report By Service Offering (Payroll Management, Tax Compliance & Filing, Benefits Administration, Time & Attendance Integration, Employee Self-Service Portals, Others), By Integration Capabilities (Integration with HR Management Systems (HRMS), Integration with Accounting & Finance Systems, Integration with Time & Attendance Systems), By End-User Type (Small and Medium Enterprises (SMEs), Large Enterprises, Payroll Service Providers), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166076

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Business Adoption and Impact

- Key Technology Trends

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Service Offering Analysis

- Integration Capabilities Analysis

- End-User Type Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

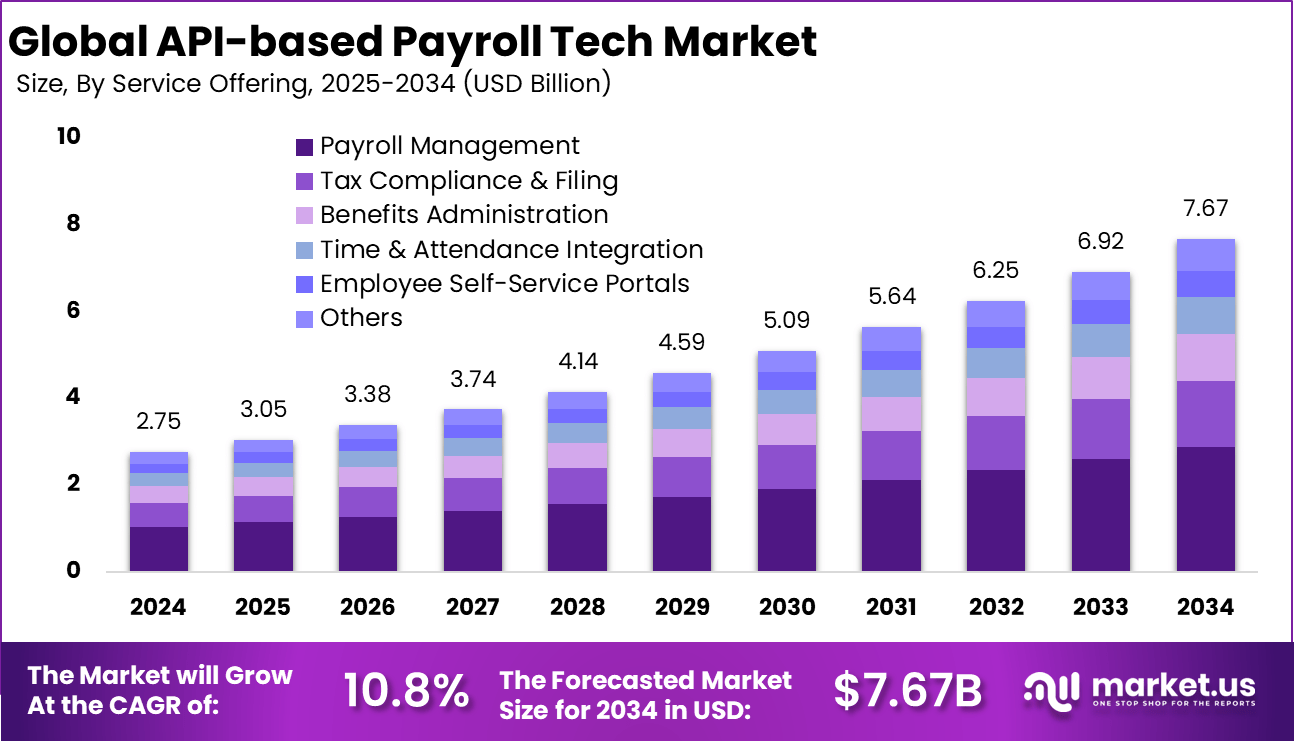

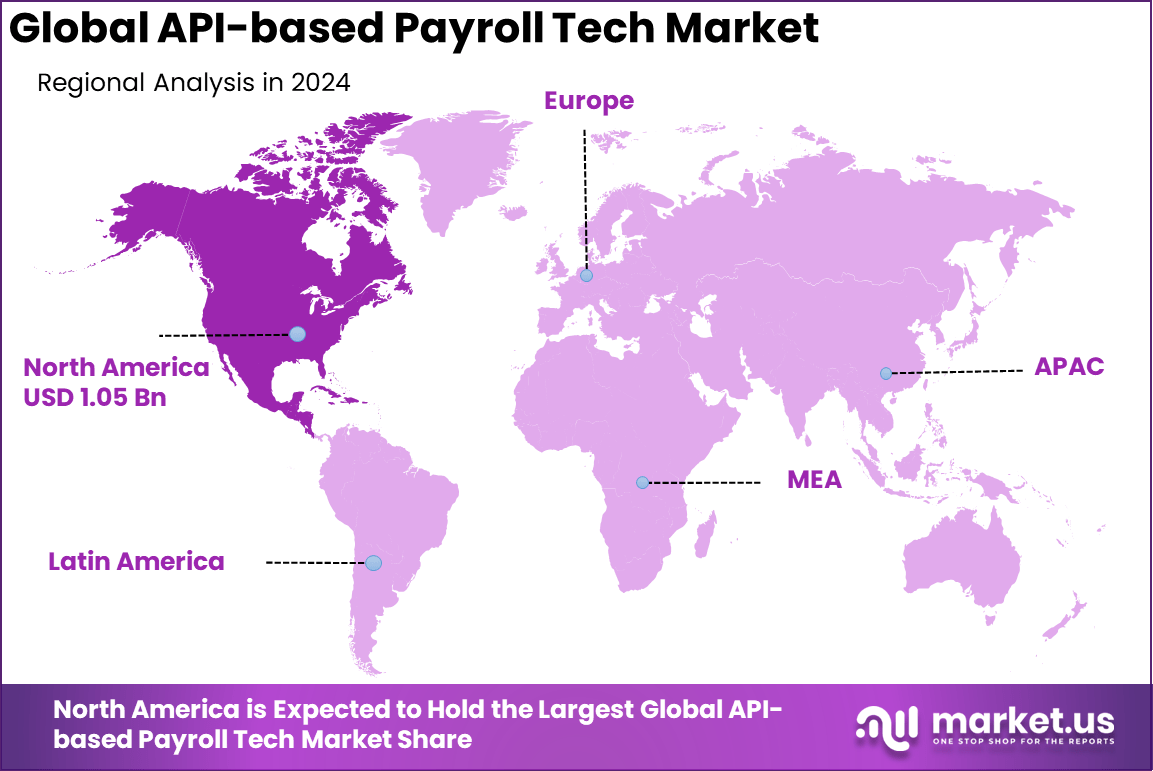

The Global API-based Payroll Tech Market size is expected to be worth around USD 7.67 billion by 2034, from USD 2.75 billion in 2024, growing at a CAGR of 10.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.4% share, holding USD 1.05 billion in revenue.

The API based payroll tech market has grown steadily as organisations transition from traditional payroll systems to more flexible, cloud connected architectures. This market has become a central part of modern workforce management because APIs enable direct, real time communication between payroll engines, HR platforms, banking systems and compliance tools. Growth reflects the wider adoption of digital payroll processes and the need for unified data flows across multiple workforce applications.

The growth of this market can be attributed to increasing demand for automation, improved accuracy and faster payroll processing. Organisations are shifting to API driven systems to eliminate manual data entry, reduce errors and integrate payroll with time tracking, scheduling and benefits platforms. Regulatory requirements for accurate reporting and timely wage payments also strengthen the need for more connected payroll infrastructures.

Top driving factors for API based payroll technology include the growing need for automation, rising regulatory complexity, and expanding global workforces. Real time cloud based payroll systems support remote and hybrid work models, increasing adoption. More than 70% of payroll processing now uses cloud or API enabled tools as firms work to cut manual errors and improve efficiency.

The market is strengthening as companies rely on API driven integration to streamline payroll, HR, and finance operations. Flexible systems that manage multi currency and multi jurisdictional payrolls are in high demand, helping organizations accelerate payroll cycles and maintain strong compliance across global teams.

For instance, in July 2025, Knit’s cloud-based payroll platform continues to automate payroll and HR workflows for small to medium businesses, including employee self-onboarding, direct deposit, tax compliance, and time tracking. Knit aims to enhance payroll accuracy and reduce manual processes by integrating scalable and user-friendly payroll solutions.

Key Takeaway

- The Payroll Management segment led the global landscape with a 37.5% share, reflecting strong demand for automated, real-time payroll processing through API connectivity.

- Integration with HR Management Systems (HRMS) dominated with a 56.6% share, driven by enterprises prioritizing unified workforce data, seamless onboarding, and end-to-end HR automation.

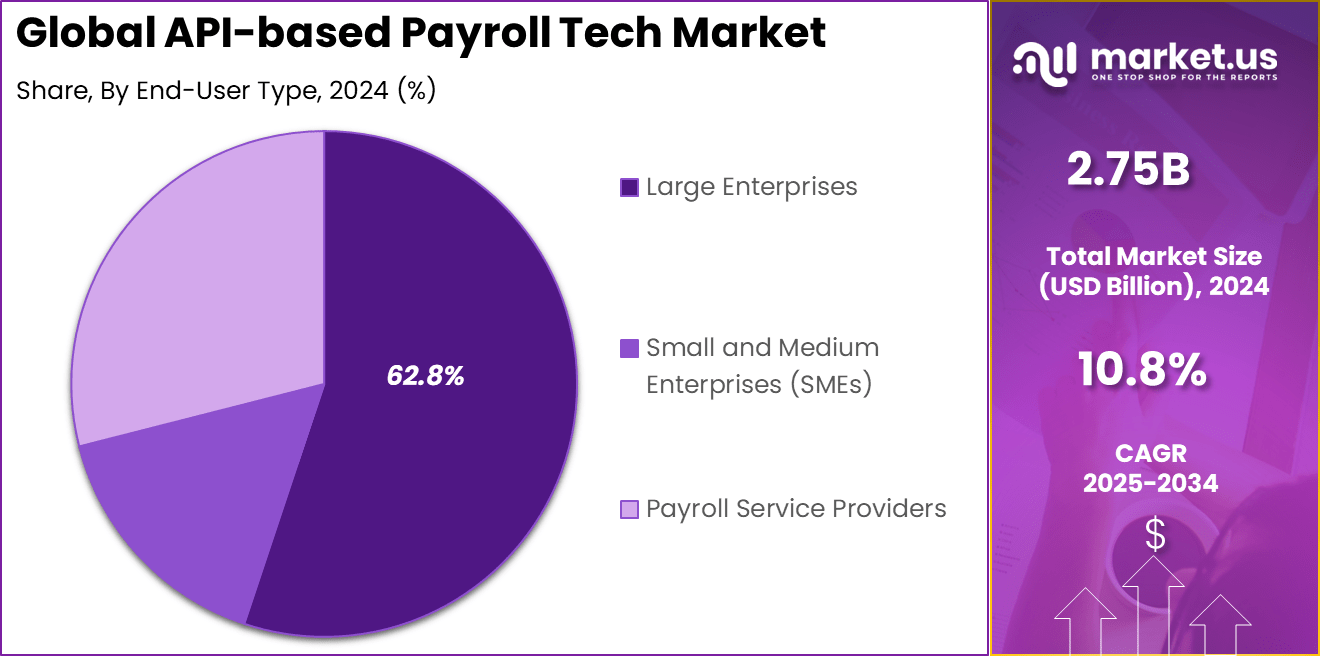

- Large Enterprises accounted for 62.8%, supported by complex payroll structures and the need for scalable, compliant API-driven systems.

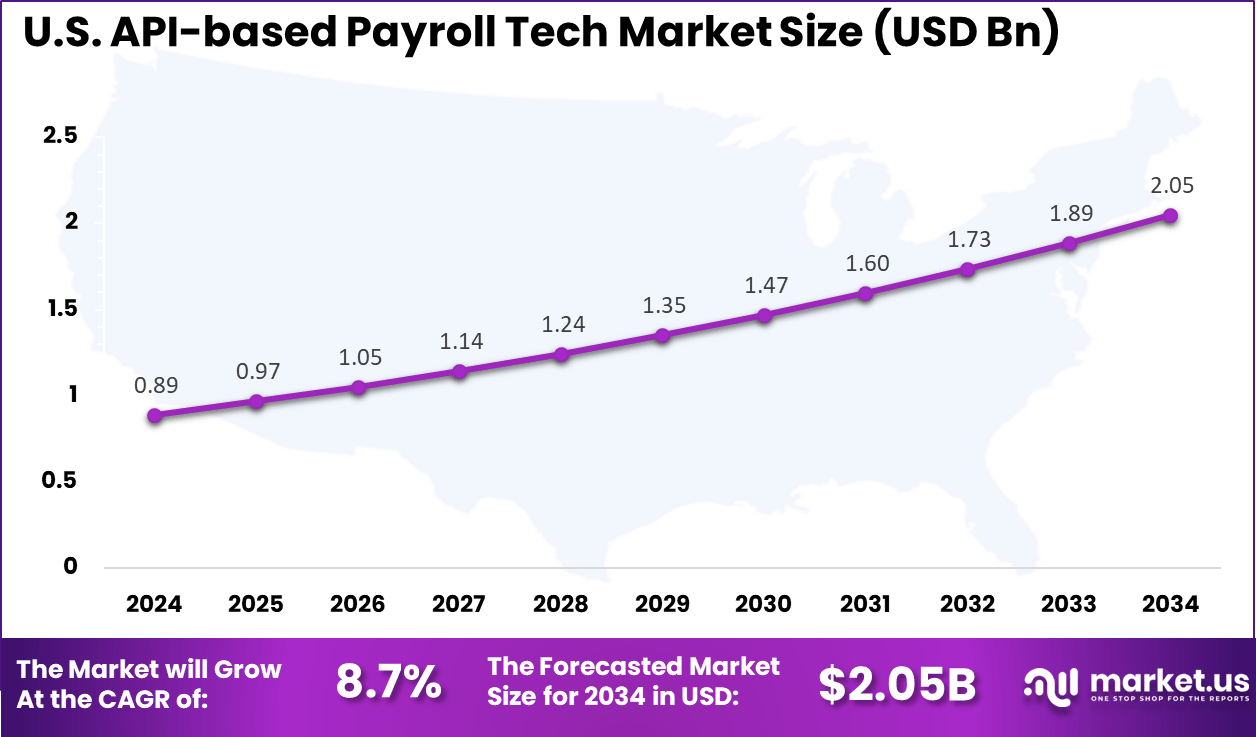

- The U.S. market reached USD 0.89 billion in 2024, expanding steadily at an 8.7% CAGR, fueled by modernization of HR infrastructure and rapid adoption of embedded payroll platforms.

- North America maintained a leading 38.4% share, reflecting advanced digital adoption, strong API ecosystems, and regulatory pressures that encourage accurate payroll processing.

Business Adoption and Impact

- API usage: About 88% of large global enterprises use APIs, and 40% rely on them for data and system integration. More than 90% of developers use APIs in their workflow.

- SaaS integration: When SaaS applications offer embedded payroll through APIs, an average of 71% of customers adopt the in-app payroll feature.

- Revenue impact: SaaS providers with embedded payroll report an average 41% increase in Annual Contract Value. Companies such as Heard recorded a 25% boost in revenue after embedding financial management capabilities.

- Efficiency: Organizations shifting to automated payroll systems report 30% fewer payroll errors and 25% higher operational efficiency.

- Market trend: Growing demand for all-in-one solutions is a major driver. About 70% of SMBs say they would switch to payroll software that offers a full vertical SaaS experience.

Key Technology Trends

- Automation and AI: By 2025, 80% of companies are expected to adopt automated payroll systems, and 70% are projected to integrate AI into payroll functions.

- Real-time capabilities: API-driven real-time compliance and instant payment methods, including UPI-based disbursements in India, are reshaping expectations and supporting stronger employee retention.

- Accuracy: Advanced APIs, such as salary slip OCR, can reach 99.4% precision for key data fields, reducing manual corrections during income verification and payroll processing.

Role of Generative AI

The role of generative AI in API-based payroll technology is becoming increasingly significant. Generative AI automates repetitive tasks like data entry and validation, reducing manual efforts and minimizing errors by up to 40%. It enhances payroll accuracy by automating validation processes and helps organizations comply with regulations more efficiently.

Additionally, generative AI supports predictive analytics, enabling companies to forecast payroll trends and budget needs more accurately, which substantially improves financial planning and decision-making. Generative AI also enhances employee experiences through chatbots and self-service portals, allowing employees and HR teams easier access to information and reducing administrative burden.

Studies show payroll processing time can be cut by 25%, while errors decrease by as much as 50% with AI-powered automation. These efficiencies empower payroll teams to focus on higher-value initiatives and improve overall operational effectiveness.

Investment and Business Benefits

Data monetization platforms are Investment opportunities that lie in developing intelligent, secure, and scalable payroll APIs that integrate with emerging HR and financial technologies. Solutions offering industry-specific modules for sectors with unique compliance demands have high potential.

AI-enabled payroll analytics and predictive insights are areas of innovation attracting investments. Vendors focusing on cloud-based API platforms capture large market shares by addressing the shift towards global and hybrid workforces. Enhancing security and regulatory features to safeguard sensitive payroll data also presents key investment appeal.

Business benefits include streamlined payroll processes that reduce errors and administrative overhead, faster payroll cycles ensuring on-time employee payment, and simplified compliance reporting with automated data synchronization. Integration across HR, accounting, and benefits systems leads to consistent, reliable data and better decision-making. Enhanced employee self-service options improve engagement and decrease HR dependency.

U.S. Market Size

The market for API-based Payroll Tech within the U.S. is growing tremendously and is currently valued at USD 0.89 billion, the market has a projected CAGR of 8.7%. The market is growing due to rising demand for automation and cloud-based payroll solutions. Businesses increasingly seek to reduce manual errors and simplify compliance with complex tax and labor regulations.

This demand is also propelled by the need to support remote and gig economy workers, which requires flexible, real-time payroll processing capabilities. Additionally, integration of payroll systems with broader HR management platforms is driving growth, enabling seamless data synchronization and operational efficiency. Advances in AI and machine learning further enhance payroll accuracy, anomaly detection, and user experience, positioning the market for sustained expansion.

For instance, in May 2025, Remote Technology, Inc. expanded its AI-driven payroll platform to support over 100 countries, consolidating payroll, HR, benefits, and compliance into a single system. Remote’s proprietary payroll engines enable instant payroll processing with high accuracy and compliance, giving businesses greater control and reliability, particularly for global and distributed teams.

In 2024, North America held a dominant market position in the Global API-based Payroll Tech Market, capturing more than a 38.4% share, holding USD 1.05 billion in revenue. This leadership is driven by the region’s advanced technological infrastructure, widespread adoption of cloud-based payroll solutions, and stringent regulatory compliance requirements. Organizations benefit from automated, scalable payroll processing systems that reduce manual errors and streamline complex tax and labor law adherence.

Additionally, the presence of a large number of small, medium, and large enterprises pushing for integration between payroll and HR management systems fuels market expansion. Ongoing digital transformation and adoption of AI-enhanced payroll tools position North America as the hub of innovation and growth in the payroll API sector.

For instance, in May 2025, Check Technologies, Inc. reported significant growth in its embedded payroll infrastructure platform, helping partners process nearly $1 billion in payroll in January alone, a threefold increase from the previous year, and expanding integrations across health benefits, retirement, insurance, and accounting sectors. Check supports full payroll and tax coverage across all 50 U.S. states, highlighting its strong presence in the North American API-based payroll market.

Service Offering Analysis

In 2024, The Payroll Management segment held a dominant market position, capturing a 37.5% share of the Global API-based Payroll Tech Market. This segment focuses on automating critical payroll functions such as calculating salaries, managing deductions, and ensuring compliance with tax and labor laws. Automation through APIs helps reduce manual errors and speeds up payroll processing, which is essential for businesses to maintain operational efficiency.

Efficient payroll management also supports timely salary disbursement, enhancing employee satisfaction. Organizations favor payroll API services that provide seamless automation, allowing HR and finance teams to focus on strategic tasks instead of manual payroll administration. Overall, the demand for accurate, scalable, and compliant payroll management solutions continues to drive this segment’s growth.

For Instance, in September 2025, Gusto Inc. enhanced its payroll and HR management resources to streamline processes for businesses of all sizes, focusing on user-friendly, accurate payroll processing and compliance automation. This development helps small to medium companies automate tax calculations, benefits administration, and direct deposits, fostering operational efficiency and employee satisfaction.

Integration Capabilities Analysis

In 2024, the Integration with HR Management Systems (HRMS) segment held a dominant market position, capturing a 56.6% share of the Global API-based Payroll Tech Market. This underscores the importance of linking payroll with HR data such as employee records, attendance, and benefits. Integration through APIs ensures real-time, consistent data exchange, which reduces errors and discrepancies caused by manual data entry.

Many enterprises seek payroll APIs that can easily synchronize with their existing HRMS platforms to support automated workflows. By bridging payroll and HR systems, companies gain operational efficiency and improve compliance. This integrated approach meets modern workforce management needs across various industries.

For instance, in April 2025, Kombo highlighted its unified API designed to integrate with multiple HR, payroll, and recruiting systems via a single standardized API. This allows SaaS providers to support diverse HR tech stacks efficiently, meeting the demand for seamless HRMS-payroll integration.

End-User Type Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 62.8% share of the Global API-based Payroll Tech Market. These organizations typically operate across multiple locations and jurisdictions, managing complex compensation structures, varying labor laws, and diverse workforce categories. Payroll APIs help large enterprises scale operations, maintain accuracy, and ensure regulatory compliance efficiently.

Due to their extensive payroll processing demands, large enterprises choose API solutions that offer flexibility, robustness, and secure integration with other enterprise systems. This segment’s preference for advanced payroll APIs is propelled by ongoing digital transformation initiatives and the critical need to streamline payroll administration.

For Instance, in March 2024, Klamp emphasized scalability and flexibility in its payroll API system to support growing businesses and complex payroll needs typical of large enterprises, by enabling seamless integration with time-tracking, benefits, and finance systems.

Emerging trends

Emerging trends in API-based payroll technology include the integration of AI, cloud computing, and real-time payroll processing. AI is increasingly used to automate complex compliance tasks such as tax calculations and cross-border payroll management, reducing manual errors and ensuring adherence to changing regulations.

Real-time payroll systems enable faster salary disbursement and more agile workforce management, which suits the demands of remote and hybrid work models. Another emerging trend is the shift toward cloud-based payroll solutions that unify operations and compliance globally.

These cloud platforms offer scalability and flexibility, allowing companies to handle geographically dispersed workforces easily. The demand for seamless integration between HR, finance, and accounting systems is leading to a rise in sophisticated APIs that support end-to-end automation and data synchronization.

Growth Factors

Growth factors in API-based payroll technology include the rapid adoption of digital payroll management systems by small and medium enterprises (SMEs) and large organizations alike. The drive for operational efficiency and error reduction motivates businesses to replace manual payroll processes with automated API-based solutions.

These solutions offer enhanced accuracy, reduce compliance risk, and improve employee payroll experiences, supporting broader workforce management goals. The expansion of cloud technology and the rise of remote or hybrid workforces are also significant growth drivers.

Cloud deployment enables flexible, scalable payroll systems accessible from anywhere, supporting real-time updates and integration with various HR and financial applications. Heightened concern over data privacy and security accelerates the development of secure payroll APIs that protect sensitive employee information throughout payroll processing.

Key Market Segments

By Service Offering

- Payroll Management

- Tax Compliance & Filing

- Benefits Administration

- Time & Attendance Integration

- Employee Self-Service Portals

- Others

By Integration Capabilities

- Integration with HR Management Systems (HRMS)

- Integration with Accounting & Finance Systems

- Integration with Time & Attendance Systems

By End-User Type

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Payroll Service Providers

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Drivers

Growing Demand for Automation in Payroll Processing

The growing demand for automation in payroll processing is a key driver for API-based payroll technology adoption. Companies seek to reduce manual tasks, minimize errors, and speed up payroll cycles by integrating their HR, finance, and accounting systems through APIs. This seamless integration enables them to efficiently manage payroll complexities such as multi-jurisdictional tax calculations, employee benefits, and compliance reporting. Automation offers businesses a significant productivity boost while reducing the risk of costly payroll mistakes.

Besides efficiency, another contributing factor is the rising focus on employee experience, as quicker, accurate payroll processing improves satisfaction. This driver is particularly strong in industries with complex payroll needs, such as banking, healthcare, and telecommunications, where workforce mobility and regulatory demands necessitate scalable, automated solutions. The trend toward cloud-based payroll APIs amplifies this driver by enabling remote accessibility and real-time data updates.

For instance, in November 2025, Merge continues to lead by offering a unified API that allows companies to automate integrations with multiple HR and payroll systems, reducing manual tasks and speeding up workflows. Thousands of customers use Merge to sync payroll data continuously and automate complex integrations quickly.

Restraint

Concerns Over Data Privacy and Security

Data privacy and security concerns restrain the widespread adoption of payroll APIs. Payroll data includes sensitive personal information and compensation details, requiring robust protection to comply with regulations like GDPR and CCPA. Organizations worry about exposing this data through APIs, fearing breaches, unauthorized access, or loss of control over confidential information.

These concerns make some companies hesitant to replace traditional on-premises payroll systems with cloud-based API solutions. This restraint is accentuated by the increasing regulatory scrutiny on data handling and cross-border transfers, which complicate API compliance.

Additionally, smaller enterprises with limited IT expertise may find it challenging to evaluate the security posture of third-party payroll APIs, slowing adoption in certain segments. Overcoming these concerns requires providers to prioritize advanced encryption, secure authentication, and transparent data governance.

For instance, in August 2025, Gusto prioritizes bank-level encryption, multi-factor authentication, SOC 2 Type II certification, GDPR and CCPA compliance, and frequent security audits to address concerns about data privacy and security. The company also educates employees on security best practices to mitigate risks.

Opportunities

Expansion Among SMEs and Global Workforces

A significant opportunity exists in expanding API-based payroll solutions among small and medium-sized enterprises (SMEs) and companies managing global workforces. SMEs are increasingly adopting cloud-based payroll APIs because they offer cost-effective, scalable alternatives to manual payroll processes without heavy IT infrastructure investments.

Vendors are tailoring offerings with flexible pricing and user-friendly integrations suited for this fast-growing SME segment. Global workforce management also drives opportunity, as companies operate in multiple countries with diverse currencies and tax rules. APIs that support multi-jurisdictional compliance and automate tax filings enable businesses to handle cross-border payroll effortlessly.

This is particularly impactful in emerging markets across the Asia Pacific, where rapid digitalization and government incentives fuel demand. The ability to serve geographically dispersed clients creates growth potential for payroll API providers in international markets.

For instance, in April 2025, Kombo’s unified API is designed to help SaaS companies easily integrate hundreds of HRIS and payroll systems, which enables rapid expansion into the SME segment and supports global workforce management.

Challenges

Keeping Up With Regulatory Changes

Keeping pace with ever-evolving payroll regulations worldwide is a major challenge for API payroll technology providers. Frequent changes in tax laws, labor rules, and compliance requirements require continuous updates to API functionality.

Failure to reflect current regulations accurately could expose clients to penalties or legal risks, harming the vendor’s reputation. This increases development costs and operational complexity for providers. The challenge is compounded by regional regulatory diversity, necessitating APIs that can adapt to local laws while maintaining a consistent user experience globally.

Vendors need strong legal expertise and agile update mechanisms to remain compliant and competitive. Additionally, ensuring APIs can generate audit trails and support reporting obligations adds further technical demands. Overall, regulatory complexity complicates scaling and delivering reliable payroll API solutions.

For instance, in March 2025, RazorpayX Payroll introduced automated compliance handling features covering TDS, PT, PF, ESIC, and government tax filings. This update addresses the critical challenge of keeping up with India’s complex and frequently changing regulatory environment by automating error-prone manual tasks. The integration helps businesses stay compliant effortlessly, reducing risks and administrative burdens while improving payroll accuracy and transparency.

Key Players Analysis

Merge, Gusto, and Kombo hold a strong position in the API-based payroll tech market. Their platforms focus on unified payroll integrations, automated data syncing, and simplified employer workflows. The growth of these providers is supported by rising demand for real-time payroll connectivity across HR, fintech, and workforce systems. Their emphasis on accuracy, compliance, and speed strengthens adoption.

udPay, Razorpay, Klamp, and Knit contribute to market expansion with flexible payroll infrastructure tailored for diverse business environments. Their solutions support multi-country payroll flows, automated deductions, and seamless employee records management. Strong adoption is driven by the need to eliminate fragmented systems.

Check Technologies, KeyPay, Remote Technology, and other participants enhance the competitive landscape with customizable payroll engines and advanced reporting capabilities. Their platforms support embedded payroll features for SaaS companies, staffing platforms, and global employers. Improved transparency, automated compliance checks, and efficient onboarding strengthen customer value.

Top Key Players in the Market

- Merge

- Gusto Inc.

- Kombo

- udPay Inc.

- Razorpay Software Limited

- Klamp

- Knit

- Check Technologies, Inc.

- KeyPay

- Remote Technology, Inc.

- Others

Recent Developments

- In September 2025, Gusto Inc. enhanced its payroll API offerings with Gusto Embedded, which provides comprehensive APIs for seamless payroll data integration. This enables partners like Vagaro to embed full payroll services inside their own apps, significantly reducing user time on payroll tasks and improving operational efficiency. Gusto’s platform supports automation of payroll insights, time tracking, and expense management directly within partner software.

- In June 2025, Razorpay Software Limited launched RazorpayX 3.0, an upgraded platform featuring advanced payroll automation, real-time vendor payouts, and AI-driven compliance. The company also acquired two fintech startups specializing in banking-as-a-service and credit underwriting, strengthening its payroll product ecosystem. RazorpayX Payroll now supports over 40,000 businesses and has introduced APIs enabling real-time mandate cancellations and higher success rates for recurring card payments.

Report Scope

Report Features Description Market Value (2024) USD 2.75 Bn Forecast Revenue (2034) USD 7.67 Bn CAGR (2025-2034) 10.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Offering (Payroll Management, Tax Compliance & Filing, Benefits Administration, Time & Attendance Integration, Employee Self-Service Portals, Others), By Integration Capabilities (Integration with HR Management Systems (HRMS), Integration with Accounting & Finance Systems, Integration with Time & Attendance Systems), By End-User Type (Small and Medium Enterprises (SMEs), Large Enterprises, Payroll Service Providers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Merge, Gusto Inc., Kombo, UdPay Inc., Razorpay Software Limited, Klamp, Knit, Check Technologies, Inc., KeyPay, Remote Technology, Inc., Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  API-based Payroll Tech MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

API-based Payroll Tech MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Merge

- Gusto Inc.

- Kombo

- udPay Inc.

- Razorpay Software Limited

- Klamp

- Knit

- Check Technologies, Inc.

- KeyPay

- Remote Technology, Inc.

- Others