Global Antioxidants Reagent Market By Product Type (Antioxidant Enzyme Activity Assay Kits, Glutathione Assay Kits, Antioxidant Capacity Assay Kits, and Ascorbic Acid Assay (FRASC) Kits), By Sample (Blood Plasma, Serum, Urine, and Tissue Extracts), By End User (Hospitals, Diagnostic Laboratories, and Ambulatory Surgical Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169727

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

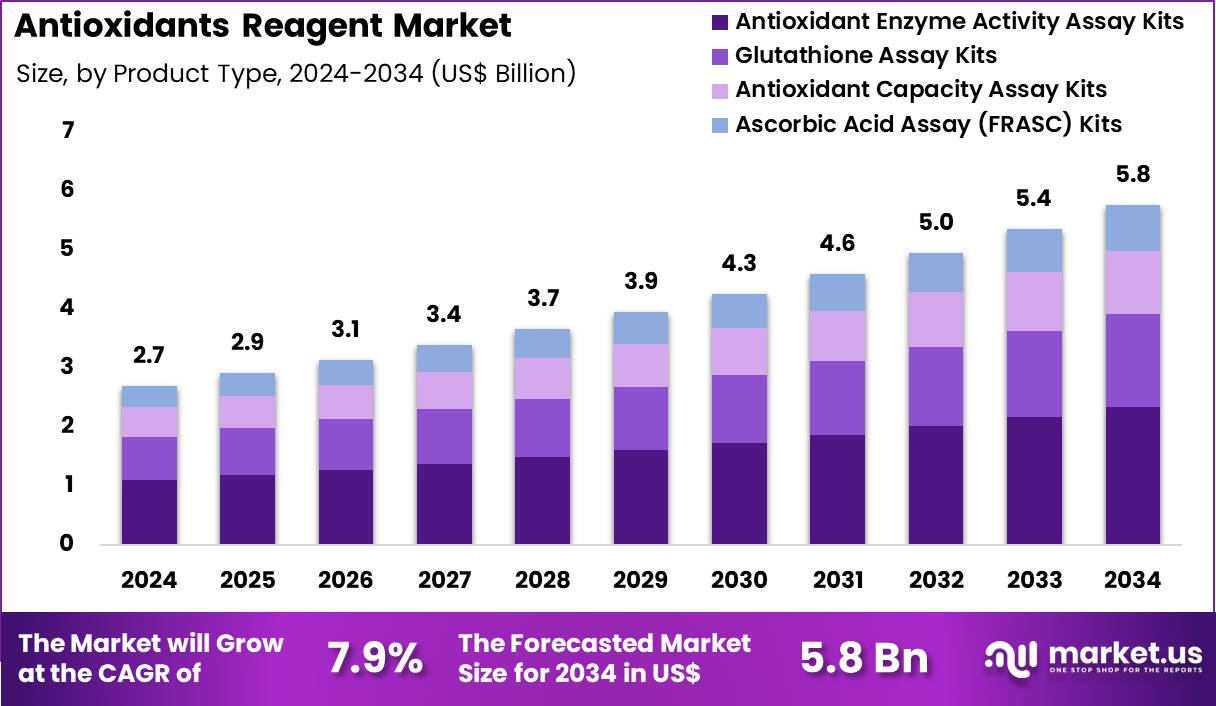

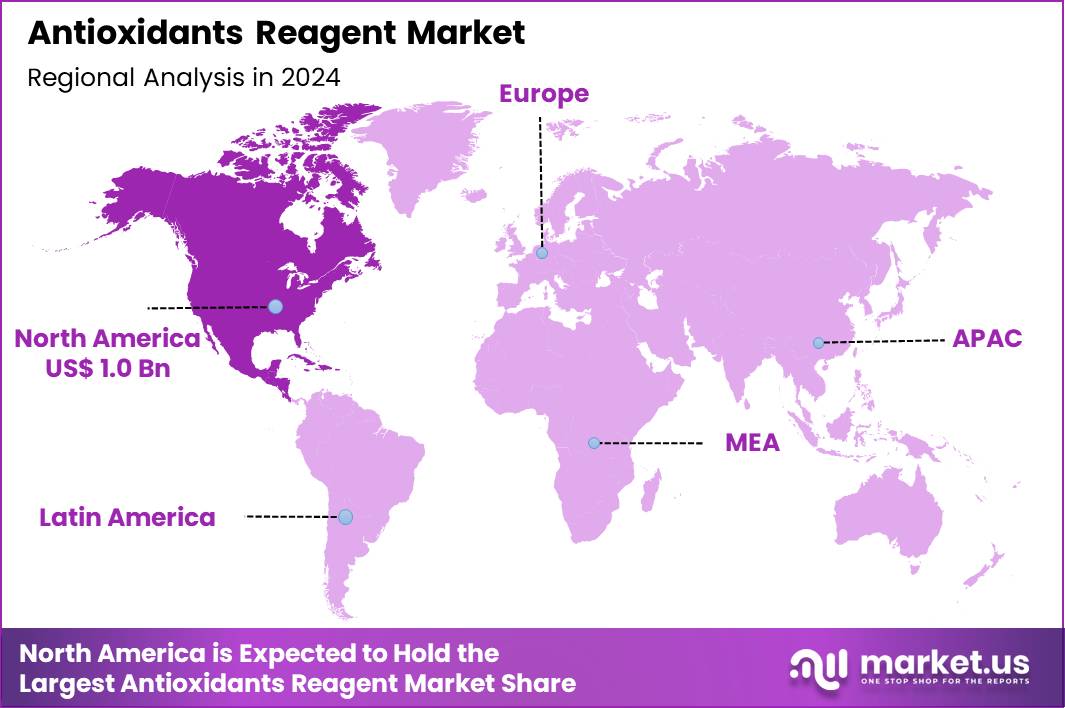

Global Antioxidants Reagent Market size is expected to be worth around US$ 5.8 Billion by 2034 from US$ 2.7 Billion in 2024, growing at a CAGR of 7.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.3% share with a revenue of US$ 1.0 Billion.

Increasing consumer awareness of oxidative stress-related health risks propels the Antioxidants Reagent market, as laboratories and manufacturers prioritize assays that accurately measure total antioxidant capacity in biological and food samples. Diagnostic firms develop colorimetric and fluorometric kits that quantify superoxide dismutase activity, glutathione peroxidase levels, and lipid peroxidation markers with high reproducibility.

These reagents enable clinical assessment of cardiovascular disease risk through plasma antioxidant profiling, neurological disorder evaluation via cerebrospinal fluid oxidative burden, diabetes management by monitoring glycation end-products, and athletic performance optimization through muscle tissue redox status. Bio-based innovations create opportunities for sustainable reagent formulations that align with clean-label trends.

In early 2025, Louis Dreyfus Company introduced plant-derived Vitamin E variants including mixed tocopherols, acetate, and succinate expanding bio-based antioxidant availability for food preservation and pharmaceutical stabilization. This launch directly enhances reagent compatibility with natural antioxidants and supports broader applications in health-focused product development.

Growing emphasis on food quality control accelerates the Antioxidants Reagent market, as producers implement rigorous testing to verify shelf-life extension and nutritional claims for fortified products. Biotechnology companies refine enzymatic assays that measure polyphenol content and radical scavenging capacity in beverages, oils, and supplements.

Applications encompass beverage oxidation stability testing for vitamin C retention, edible oil rancidity prevention through tocopherol quantification, infant formula protection against lipid peroxidation, and functional food validation of anthocyanin antioxidant potency. High-throughput formats open avenues for in-line process monitoring and regulatory compliance documentation. Food safety authorities increasingly mandate antioxidant efficacy data to support health claims on packaging. This quality-driven demand fuels sustained investment in sensitive, rapid-testing reagents.

Rising integration of antioxidants in cosmetic formulations invigorates the Antioxidants Reagent market, as formulators require precise assays to substantiate anti-aging and photoprotective claims in skincare products. Manufacturers launch specialized kits that evaluate ascorbyl glucoside stability, resveratrol radical quenching, and coenzyme Q10 mitochondrial protection in topical emulsions. These tools support sunscreen efficacy testing against UV-induced reactive oxygen species, anti-pollution cream validation through urban dust challenge models, hair care antioxidant incorporation for color retention, and lip product rancidity prevention via carotenoid measurement.

Stability-testing reagents create opportunities for accelerated shelf-life studies and patent-protected ingredient blends. Cosmetic regulatory bodies actively scrutinize antioxidant performance data for claim substantiation. This beauty-science convergence positions advanced reagents as essential for innovative, evidence-based product development.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.7 Billion, with a CAGR of 7.9%, and is expected to reach US$ 5.8 Billion by the year 2034.

- The product type segment is divided into antioxidant enzyme activity assay kits, glutathione assay kits, antioxidant capacity assay kits, and ascorbic acid assay (FRASC) kits, with antioxidant enzyme activity assay kits taking the lead in 2024 with a market share of 40.5%.

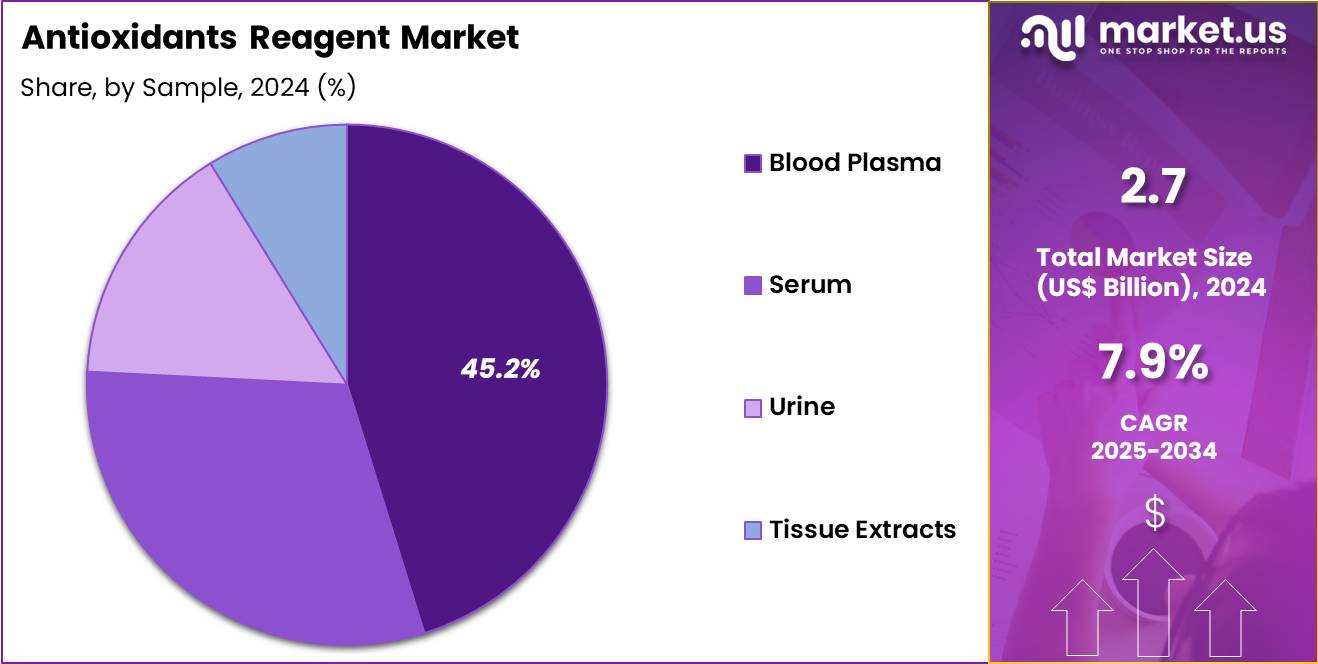

- Considering sample, the market is divided into blood plasma, serum, urine, and tissue extracts. Among these, blood plasma held a significant share of 45.2%.

- Furthermore, concerning the end user segment, the market is segregated into hospitals, diagnostic laboratories, and ambulatory surgical centers. The hospitals sector stands out as the dominant player, holding the largest revenue share of 47.8% in the market.

- North America led the market by securing a market share of 38.3% in 2024.

Product Type Analysis

Antioxidant enzyme activity assay kits, holding 40.5%, are expected to dominate due to their ability to measure the activity of various antioxidant enzymes such as superoxide dismutase (SOD), catalase, and glutathione peroxidase, which are crucial for assessing oxidative stress in biological samples. As the understanding of oxidative stress and its role in chronic diseases grows, the demand for these assays is expected to rise.

Healthcare providers and researchers rely on antioxidant enzyme activity assays to investigate the mechanisms of diseases such as cancer, cardiovascular disorders, and neurodegenerative diseases. The growth of preventive healthcare and personalized medicine, which focuses on monitoring oxidative damage, further strengthens the demand for these kits. Continuous advancements in assay technology, improving sensitivity and throughput, will drive the segment’s growth. These factors keep antioxidant enzyme activity assay kits anticipated to remain the leading product type in the market.

Sample Analysis

Blood plasma, holding 45.2%, is expected to remain the dominant sample type due to its widespread use in clinical and research settings for biomarker analysis. Blood plasma is an ideal sample for measuring oxidative stress markers and antioxidants because it provides a broad representation of the systemic oxidative state. It is commonly used in hospitals and diagnostic laboratories to assess antioxidant levels, as well as in research to study the pathophysiology of diseases linked to oxidative stress.

The ease of collection and the non-invasive nature of blood plasma sampling increase its popularity. Moreover, blood plasma is frequently utilized in clinical trials and pharmaceutical studies, further driving its demand in the antioxidants reagent market. These factors keep blood plasma projected to remain the dominant sample type in antioxidant testing.

End-User Analysis

Hospitals, holding 47.8%, are expected to dominate the end-user segment due to their critical role in patient diagnosis, treatment, and monitoring, especially in chronic conditions related to oxidative stress. Hospitals use antioxidant reagent kits to assess oxidative damage in patients with cancer, cardiovascular diseases, diabetes, and neurodegenerative disorders.

With the growing prevalence of these diseases, hospitals are increasingly adopting antioxidant assays to monitor patients’ health and response to treatment. The need for accurate, rapid diagnostic tests in hospitals to assess biomarkers for oxidative stress will continue to drive demand. As hospitals focus on integrating more advanced diagnostic technologies into patient care, the use of antioxidant reagent kits in clinical settings is projected to grow. These drivers ensure that hospitals remain the leading end-user segment in the antioxidant reagent market.

Key Market Segments

By Product Type

- Antioxidant Enzyme Activity Assay Kits

- Glutathione Assay Kits

- Antioxidant Capacity Assay Kits

- Ascorbic Acid Assay (FRASC) Kits

By Sample

- Blood Plasma

- Serum

- Urine

- Tissue Extracts

By End User

- Hospitals

- Diagnostic Laboratories

- Ambulatory Surgical Centers

Drivers

The Escalating Global Burden of Oxidative Stress-Related Chronic Diseases Is Driving the Market

The escalating global burden of oxidative stress-related chronic diseases has emerged as a principal driver for the antioxidants reagent market, as it intensifies the demand for reliable tools to quantify antioxidant capacities in research and clinical settings. Oxidative stress, characterized by an imbalance favoring reactive oxygen species over antioxidants, underpins pathologies such as cardiovascular diseases, diabetes, and neurodegeneration, necessitating precise assays for biomarker evaluation. Reagents like Trolox equivalents in total antioxidant capacity kits enable standardized measurements of scavenging potential, supporting investigations into therapeutic interventions.

This surge correlates with demographic shifts, including population aging and urbanization, which amplify exposure to environmental pro-oxidants. According to the National Institutes of Health, reactive oxygen species contribute to chronic conditions affecting over 60% of adults in developed nations, with projections indicating a 25% increase in diabetes prevalence by 2045 due to oxidative mechanisms. Such epidemiological data compel academic and pharmaceutical laboratories to procure advanced reagents for high-throughput screening of novel compounds.

Manufacturers respond by refining assay sensitivities, ensuring compatibility with diverse matrices like serum and tissue extracts. Public funding for oxidative stress research further bolsters reagent utilization, as grants prioritize mechanistic studies linking antioxidants to disease mitigation. Economically, the reagents’ role in accelerating drug discovery pipelines justifies sustained investments amid rising healthcare expenditures. This driver ultimately anchors the market’s expansion by aligning diagnostic innovation with preventive health imperatives.

Restraints

Methodological Limitations in Antioxidant Capacity Assays Are Restraining the Market

Methodological limitations in antioxidant capacity assays continue to restrain the antioxidants reagent market by fostering skepticism regarding reproducibility and comparability across studies. Common assays, such as DPPH and FRAP, exhibit variability due to differences in reaction kinetics, solvent effects, and non-specific interferences from sample matrices. This inconsistency hampers standardization, as evidenced by divergent results in evaluating natural extracts where up to 30% variance occurs between laboratories employing identical reagents.

Regulatory bodies emphasize the need for validated protocols, yet the absence of universal benchmarks delays reagent adoption in quality-controlled environments. The National Institutes of Health notes that such discrepancies contribute to inconclusive clinical translations, with over 40% of antioxidant trials failing due to assay unreliability in the 2020-2023 period. Resource-intensive validations divert budgets from routine procurement, particularly in underfunded academic settings.

Clinicians and researchers often revert to enzymatic methods, sidelining chemical reagents despite their accessibility. Intellectual property constraints on proprietary formulations further limit customization, exacerbating adoption barriers. These challenges perpetuate a fragmented market, where innovation lags behind evolving analytical demands. Resolving this restraint requires harmonized guidelines to enhance reagent credibility and interoperability.

Opportunities

Advancements in Kinetic-Based Antioxidant Reactivity Assays Are Creating Growth Opportunities

Advancements in kinetic-based antioxidant reactivity assays are generating substantial growth opportunities in the antioxidants reagent market by providing dynamic insights into scavenging efficiencies beyond static capacity measures. Traditional endpoint assays overlook reaction rates, but kinetic models integrated with DPPH and ORAC now quantify rate constants, enabling precise profiling of compound mechanisms. This precision supports personalized nutraceutical development, where reagents facilitate high-resolution screening of polyphenol mixtures.

Opportunities arise from collaborations between reagent suppliers and computational chemists, leveraging machine learning for predictive modeling of reactivity profiles. The National Institutes of Health highlights that these assays achieve correlation coefficients exceeding 0.95 with in vivo outcomes, validating their translational potential in 2023-2024 studies. Point-of-care adaptations extend applications to food safety labs, assessing preservative efficacy in real time.

Cost reductions through miniaturized formats attract small-scale researchers, diversifying user bases. Emerging regulations favoring kinetic data in supplement labeling spur demand for compliant reagents. International standardization efforts further amplify export potential for validated kits. These innovations collectively position the market for accelerated penetration into applied sciences.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic momentum energizes the antioxidants reagent market as expanding clinical chemistry testing, surging wellness research, and heightened focus on oxidative stress biomarkers drive laboratories and nutraceutical firms to stock larger volumes of high-purity reagents for reliable assay performance. Major suppliers rapidly broaden portfolios with advanced enzymatic and colorimetric kits, riding the wave of preventive healthcare and personalized nutrition trends that demand consistent, reproducible results.

Stubborn inflation and uneven global growth, however, raise raw material prices for vitamins, polyphenols, and synthetic standards, forcing diagnostic labs and supplement manufacturers to absorb costs or pass them on, which slows routine purchasing in price-sensitive segments. Geopolitical turbulence, especially U.S.-China trade friction and supply restrictions on specialty chemicals, repeatedly interrupts shipments of key precursors and finished reagents, triggering shortages and forcing formulators to scramble for alternative sources at premium rates.

Current U.S. tariffs sharply increase landed costs on imported antioxidant standards and bulk actives, squeezing margins for distributors and pushing some smaller labs to reduce testing frequency or switch to lower-grade alternatives. These same duties spark retaliatory actions abroad that complicate U.S. exports of finished reagent kits and disrupt long-standing technical partnerships. Nevertheless, the mounting pressure ignites fresh investment in North American synthesis plants, regional sourcing networks, and innovative domestic production methods, creating a stronger, more independent supply foundation that will deliver greater stability and accelerated growth for years ahead.

Latest Trends

The Development of Machine Learning Models for Predicting Antioxidant Activity in 2024 Is a Recent Trend

The development of machine learning models for predicting antioxidant activity in 2024 represents a transformative recent trend in the antioxidants reagent market, shifting paradigms from empirical testing to computational foresight. These models, trained on structural descriptors and assay datasets, forecast scavenging potentials with accuracies surpassing 90%, reducing reliance on physical reagents for initial screenings. This efficiency accelerates lead optimization in drug discovery, where virtual assays complement traditional kits for hybrid workflows.

Reagent suppliers are integrating predictive tools into software bundles, enhancing user analytics for experimental design. The National Institutes of Health reports that such models analyzed over 5,000 polyphenolic structures in 2024 publications, identifying novel motifs with superior reactivity. Adoption in academic consortia has surged, with collaborative platforms enabling shared datasets for model refinement. This trend mitigates assay variability by prioritizing high-confidence candidates for validation.

Early implementations demonstrate 40% reductions in reagent consumption during screening phases. As open-source algorithms proliferate, it democratizes access for global researchers. In essence, this 2024 advancement heralds a data-driven era for antioxidant evaluation.

Regional Analysis

North America is leading the Antioxidants Reagent Market

North America accounted for 38.3% of the overall market in 2024, and the Antioxidants Reagent market experienced growth driven by the rising demand for antioxidants in industries such as food and beverages, cosmetics, and healthcare. Increased consumer awareness about the health benefits of antioxidants, particularly in preventing oxidative stress-related diseases, supported the demand for antioxidant-rich supplements and additives. Pharmaceutical and biotechnology companies expanded their use of antioxidants for drug formulation, focusing on their role in mitigating side effects from oxidative damage.

The National Institutes of Health (NIH) reported that over 90 million Americans were affected by chronic oxidative stress-related conditions, such as cardiovascular disease and neurodegenerative disorders, in 2023 (NIH – “Oxidative Stress and Human Health 2023”). Additionally, regulations supporting the inclusion of antioxidants in dietary supplements, functional foods, and skincare products further bolstered the market. These factors contributed to North America’s strong position in the antioxidants reagent market in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to see substantial growth in the Antioxidants Reagent market during the forecast period as the region’s healthcare and food industries continue to expand. Rising consumer demand for functional foods, fortified beverages, and dietary supplements, coupled with increasing health awareness, drives the market for antioxidants. The growing prevalence of lifestyle diseases, such as diabetes and heart disease, further contributes to the demand for antioxidants, known for their role in fighting oxidative stress and inflammation.

The World Health Organization (WHO) reported that over 100 million people in India were diagnosed with diabetes in 2022, fueling the need for antioxidant-based interventions (WHO – “Diabetes and Health in India 2022”). Furthermore, cosmetic industries in countries like Japan, China, and South Korea increasingly incorporate antioxidants into skincare formulations, boosting their demand. With growing investments in health and wellness, the market for antioxidants in Asia Pacific is poised for strong growth over the forecast period.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the antioxidants‑reagent segment expand their market presence by developing high‑purity assay kits and reagents that support research into oxidative stress, disease biomarkers, food preservation and nutraceutical quality this broad application base drives consistent demand across multiple industries. They strengthen global distribution networks and supply‑chain reliability to ensure that academic, industrial and clinical laboratories including those in emerging markets access reagents promptly and reliably.

They invest in improving reagent stability, sensitivity and batch‑to‑batch reproducibility, enabling labs to adopt standardized antioxidant‑capacity assays with confidence. They broaden their product portfolios by offering both natural and synthetic antioxidant reagents and by tailoring formulations to meet regulatory standards and sector‑specific requirements such as food safety or clinical diagnostics. They foster growth through collaborations with contract research organisations and regulatory bodies to validate assay protocols, publish performance data and encourage adoption in pharmaceuticals, cosmetics, food and health sectors.

One prominent company, MilliporeSigma (Sigma‑Aldrich brand under Merck KGaA), supplies a comprehensive catalog of biochemical reagents, antioxidants among them, leverages its established global logistics and quality standards to support laboratories worldwide, and uses its scale in life‑sciences chemicals and assay kits to maintain a leading position in the market.

Top Key Players

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Bio‑Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Sigma‑Aldrich (Merck group)

- PerkinElmer, Inc.

- DiaSorin S.p.A.

- BioVision Inc.

Recent Developments

- In March 2025, BASF SE announced its investment in a new manufacturing facility in Puebla, Mexico. This expansion is focused on boosting production capacity for aminic antioxidants used in lubricants, reinforcing the company’s commitment to securing a stable supply within the industrial applications market.

- On August 12, 2025, Syensqo, previously part of Solvay, launched Riza, a line of 100% plant-based antioxidants derived from rosemary. This product release reflects the growing demand for clean-label and natural ingredients, particularly in the food and personal care industries.

Report Scope

Report Features Description Market Value (2024) US$ 2.7 Billion Forecast Revenue (2034) US$ 5.8 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Antioxidant Enzyme Activity Assay Kits, Glutathione Assay Kits, Antioxidant Capacity Assay Kits, and Ascorbic Acid Assay (FRASC) Kits), By Sample (Blood Plasma, Serum, Urine, and Tissue Extracts), By End User (Hospitals, Diagnostic Laboratories, and Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., Merck KGaA, Bio‑Rad Laboratories, Inc., Agilent Technologies, Inc., Sigma‑Aldrich, PerkinElmer, Inc., DiaSorin S.p.A., BioVision Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Antioxidants Reagent MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Antioxidants Reagent MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Bio‑Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Sigma‑Aldrich (Merck group)

- PerkinElmer, Inc.

- DiaSorin S.p.A.

- BioVision Inc.