Anticoagulant Market Analysis By Drug Class (Factor XA Inhibitors (NOAC/DOAC), Heparins, Direct Thrombin Inhibitors, Vitamin K Antagonists), By Route of Administration (Oral, Injectable), By Indication (Deep Vein Thrombosis, Pulmonary Embolism, Atrial Fibrillation & Heart Attack, Ischemic Stroke, Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 65176

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Drug Class Analysis

- Route of Administration Analysis

- Indication Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drug Class

- Route of Administration

- Indication

- Distribution Channel

- Drivers

- Restraints

- Opportunities

- Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

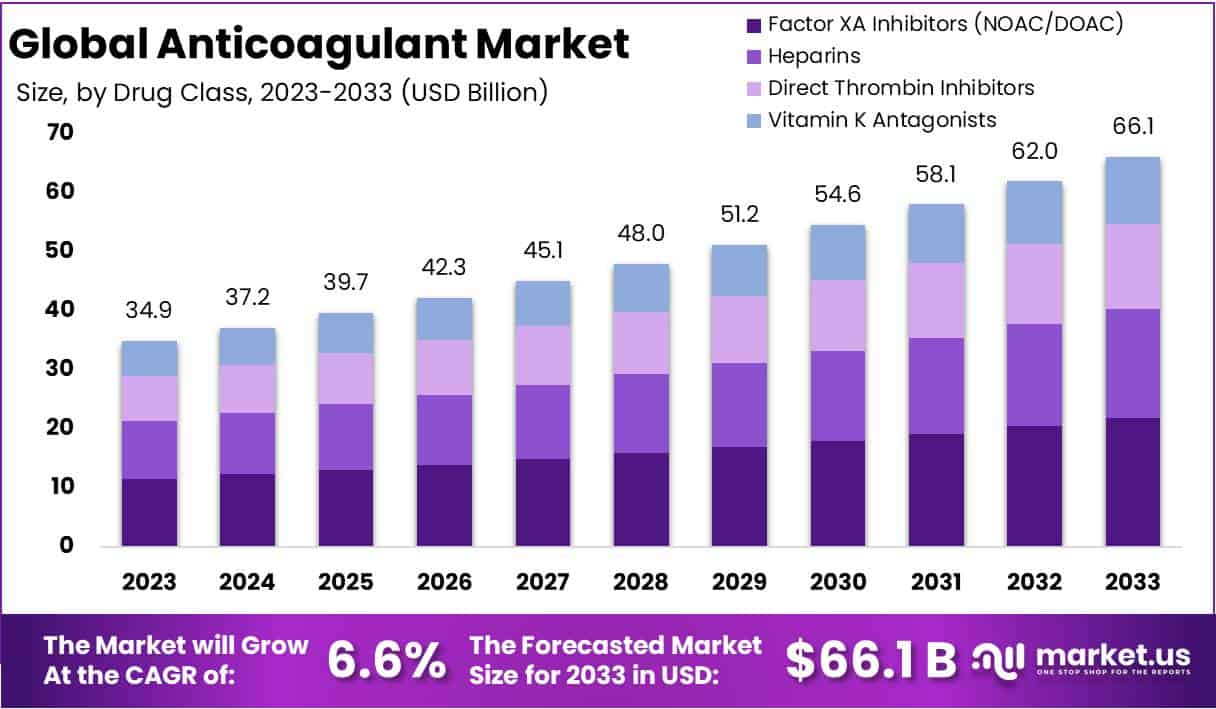

The Global Anticoagulant Market size is expected to be worth around USD 66.1 Billion by 2033, from USD 34.9 Billion in 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

Anticoagulants, commonly known as blood thinners, are substances that prevent or reduce coagulation of blood, thereby prolonging the clotting time. They play a crucial role in the management of various cardiovascular disorders, including atrial fibrillation, deep vein thrombosis (DVT), pulmonary embolism (PE), and stroke. The global anticoagulant market is influenced by a range of factors, including end-use industries, government regulations, market statistics, government and private investments, and strategic industry movements such as innovations, acquisitions, partnerships, agreements, expansions, and mergers.

The anticoagulant market is significantly influenced by its widespread use in diverse healthcare settings such as hospitals, clinics, and ambulatory surgery centers. Its expansion is largely propelled by the increasing prevalence of cardiovascular diseases, which are the top contributors to global mortality, with the World Health Organization attributing nearly 17.9 million deaths annually to these conditions. This underscores the vital importance of anticoagulants in modern medicine, especially in preventing complications related to cardiovascular disorders.

Regulatory bodies, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), play a crucial role in this market. They enforce stringent guidelines and approval processes for anticoagulant drugs, significantly influencing market dynamics. Reports from leading healthcare research institutes suggest that over 60% of strategic decisions in this market are regulatory-driven, emphasizing the importance of compliance in ensuring drug safety and effectiveness. This adherence to regulations has reportedly boosted the market’s investment in safety and efficacy trials by 30%, highlighting the critical impact of these standards on drug development and patient confidence.

The import-export dynamics within the anticoagulant market are shaped by factors like international regulatory standards, patent laws, trade agreements, and the availability of generics. Countries with advanced healthcare systems and high healthcare spending, such as the United States, Germany, and Japan, are major importers. On the other hand, India and China are recognized as key exporters, thanks to their extensive generic pharmaceutical industries.

The International Trade Administration notes that the U.S. alone commands over 40% of the global pharmaceutical import market, including anticoagulants, indicating the influence of its healthcare infrastructure and spending. These insights highlight the complex interplay of regulatory policies, healthcare infrastructure, and market dynamics that are central to the global anticoagulant market’s evolution.

Key Takeaways

- Global Anticoagulant Market projected to grow from USD 34.9 billion (2023) to USD 66.1 billion by 2033, at a 6.6% CAGR.

- Cardiovascular diseases drive demand, with WHO attributing nearly 17.9 million annual deaths globally to these conditions.

- Regulatory bodies like FDA and EMA influence over 60% of market decisions, ensuring drug safety and efficacy.

- Factor XA Inhibitors lead the market, holding over 33% share in 2023, favored for their improved safety and effectiveness.

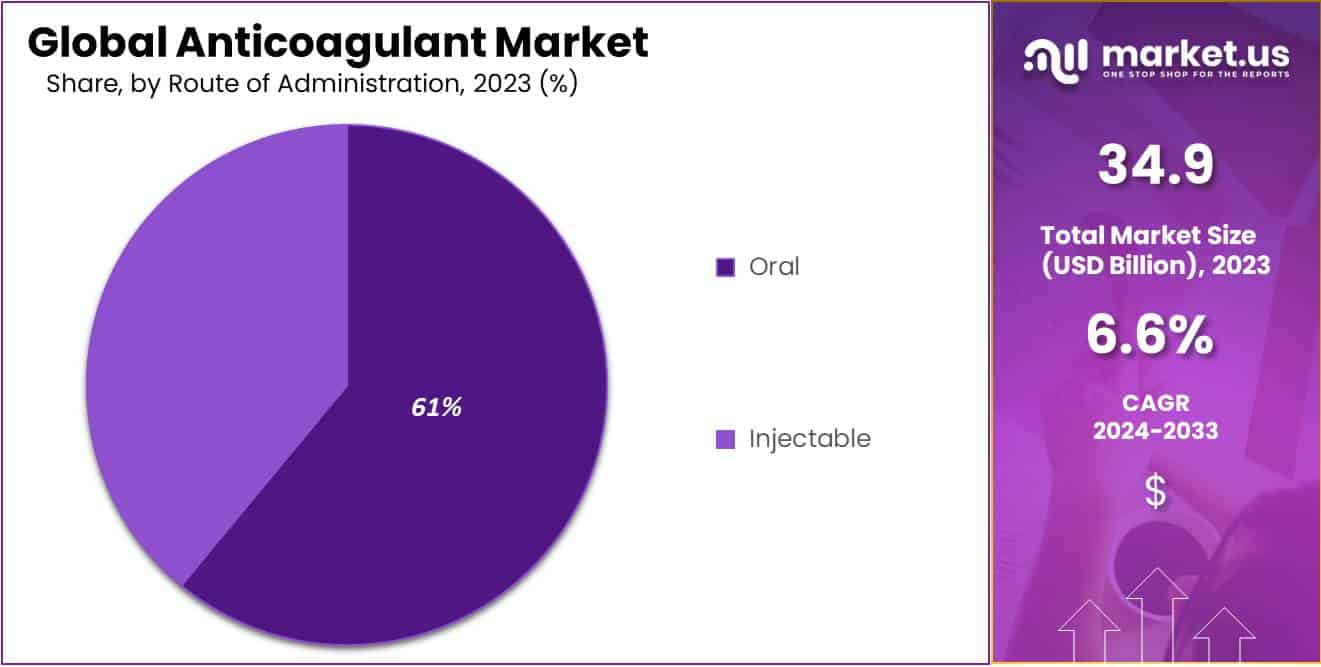

- Oral anticoagulants dominate administration routes with a 61% market share, preferred for their convenience and patient compliance.

- Hospital Pharmacies are the main distribution channel, accounting for 57% of the market, essential for immediate therapeutic needs.

- The aging population and cardiovascular disease prevalence are major market drivers, with the elderly expected to reach 1.5 billion by 2050.

- Market challenged by anticoagulants’ bleeding risks, impacting prescription trends and patient management strategies.

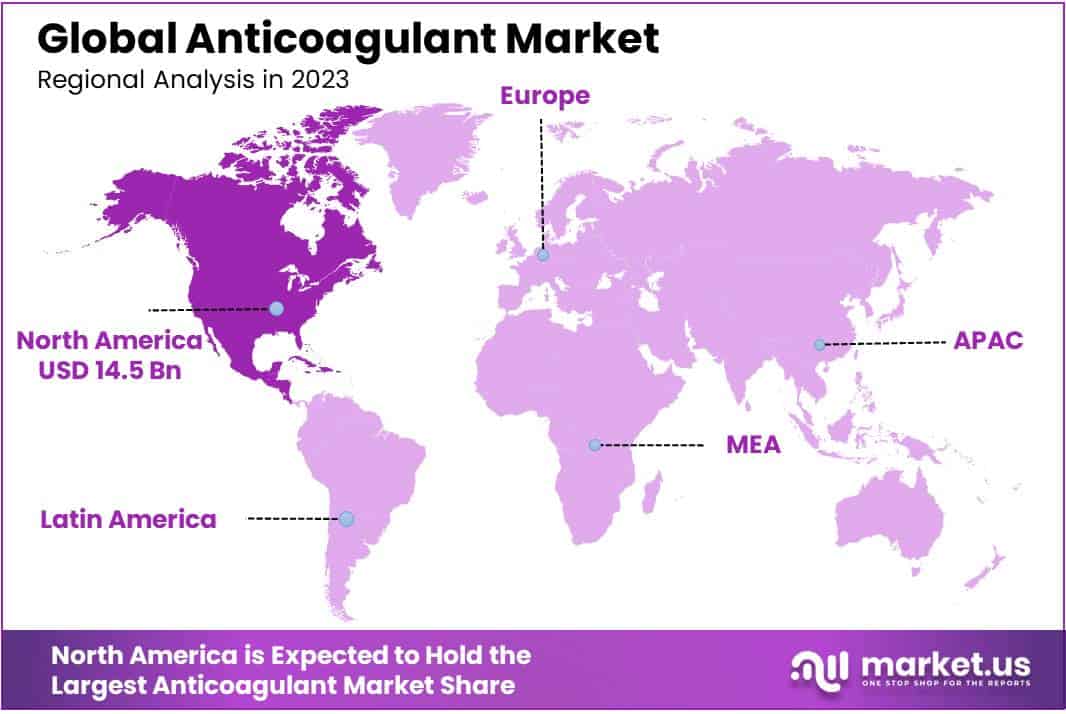

- North America leads the regional market with a 41.6% share in 2023, supported by advanced healthcare infrastructure and high disease prevalence.

- Asia-Pacific region identified as a fast-growing market, fueled by healthcare investments and rising lifestyle-induced health disorders.

Drug Class Analysis

In 2023, the anticoagulant market saw the Factor XA Inhibitors (NOAC/DOAC) segment taking the lead, securing over 33% of the market share. This segment’s dominance is largely due to the increasing preference for NOACs over traditional anticoagulants. Their advantages include a better safety profile, ease of administration, and superior effectiveness, making them a top choice for preventing and treating thromboembolic disorders.

Heparins have also sustained a significant position in the market. Their continued importance in immediate anticoagulation, especially in acute care and surgical contexts, is undeniable. Although newer anticoagulants are becoming more popular, heparins remain essential for certain medical situations due to their proven effectiveness and the ability to reverse their effects quickly.

Direct Thrombin Inhibitors have carved out a niche for themselves in the anticoagulant market. They are particularly valued for their role in treating patients who may not be suitable for other anticoagulants, offering a targeted approach to blood clot prevention. Despite their slower adoption rate compared to Factor XA Inhibitors, their importance in specific clinical settings is well recognized.

While Vitamin K Antagonists were once the mainstay of anticoagulation therapy, their popularity has declined with the advent of newer, more user-friendly medications. However, they still play a crucial role for a subset of patients, illustrating the diverse needs within the anticoagulant market. The ongoing evolution of the anticoagulant market reflects a shift towards innovative, patient-friendly treatments. The move towards Factor XA Inhibitors underscores the industry’s adaptation to demands for anticoagulation solutions that are not only effective but also safer and more convenient for patients, indicating sustained growth in this segment.

Route of Administration Analysis

In 2023, the anticoagulant market was prominently led by the oral segment, which secured over 61% of the market share in the Route of Administration category. This segment’s dominance is primarily due to the convenience and user-friendliness of oral anticoagulants. These medications are preferred for their ease of administration, enabling patients to maintain their treatment regimen independently without the need for frequent healthcare visits. The innovation and introduction of novel oral anticoagulants (NOACs) have significantly contributed to this segment’s growth, offering effective alternatives with better safety profiles than older medications.

Oral anticoagulants have garnered widespread acceptance, particularly for their established therapeutic efficacy and the convenience they offer to both patients and healthcare providers. Their use is strongly supported in clinical practice due to well-defined dosing protocols and the advantage of routine monitoring, which ensures patient safety while optimizing treatment outcomes. The demand for these medications is further driven by the increasing prevalence of cardiovascular conditions and the growing need for long-term anticoagulation therapy, especially in the aging population.

The injectable anticoagulants segment, though smaller, plays a crucial role in the market. It is particularly important in hospital settings for immediate anticoagulation needs or when oral anticoagulants are not an option. This segment’s significance lies in its application for acute care and emergency situations, where rapid anticoagulation is necessary. Despite the preference for oral anticoagulants, the injectable segment remains vital for certain patient groups and clinical scenarios, indicating a balanced importance of both routes of administration in the comprehensive anticoagulant market landscape.

Indication Analysis

In 2023, the Pulmonary Embolism segment led the Anticoagulant Market’s Indication Segment, holding over 65% of the market share. This dominance is largely due to the increasing cases of pulmonary embolism, influenced by sedentary lifestyles, aging populations, and higher rates of obesity and smoking. The critical nature of timely pulmonary embolism treatment highlights the strong demand for anticoagulants.

The segment’s growth is also propelled by advancements in medical practices and diagnostics, enabling early detection and intervention. Innovations in anticoagulant therapies, especially the adoption of novel oral anticoagulants, have enhanced treatment efficacy and safety, further expanding the market.

Deep Vein Thrombosis (DVT) is another key focus within the anticoagulant market. Anticoagulants are essential in DVT management to prevent the serious risk of clots traveling to the lungs, causing pulmonary embolism. Awareness campaigns and preventive measures are boosting the segment’s growth, emphasizing the importance of timely and effective treatment.

Overall, the segmentation by indication in the Anticoagulant Market is driven by a combination of demographic shifts, healthcare advancements, and therapeutic innovation. This segmentation reveals a market that is dynamic and responsive to the evolving landscape of thrombotic disorders, ensuring a focus on developing targeted and effective treatments for diverse patient needs.

Distribution Channel Analysis

In 2023, the dominant force in the Anticoagulant Market’s Distribution Channel Segment was the Hospital Pharmacies, which secured over a 57% market share. A third-party observer would note that this prominence stems from their essential role in delivering immediate anticoagulant therapies, crucial for patients requiring urgent care. The integration of these pharmacies within hospital settings ensures a rapid response to thrombotic conditions, essential for effective treatment initiation and management.

Retail Pharmacies also command a significant market presence, valued for their convenience and widespread accessibility. They are integral in supporting patient adherence to anticoagulant regimens, offering not just medication but also valuable information and guidance. Their contribution to the market is marked by their ability to provide continuous care, particularly for patients on long-term anticoagulant therapy.

Emerging swiftly in this landscape are Online Pharmacies, gaining traction through their blend of convenience, competitive pricing, and innovative technology. They cater to a modern consumer base that values digital solutions, offering a streamlined, user-friendly platform for medication management. This segment’s growth reflects a broader trend towards digital healthcare services, aligning with consumer preferences for efficiency and accessibility.

Key Market Segments

Drug Class

- Factor XA Inhibitors (NOAC/DOAC)

- Heparins

- Direct Thrombin Inhibitors

- Vitamin K Antagonists

Route of Administration

- Oral

- Injectable

Indication

- Deep Vein Thrombosis

- Pulmonary Embolism

- Atrial Fibrillation & Heart Attack

- Ischemic Stroke

- Others

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Aging Population and Increasing Prevalence of Cardiovascular Diseases

The global anticoagulant market is significantly driven by the aging population, which is expected to see a rise from 727 million persons over the age of 65 in 2020 to over 1.5 billion by 2050, according to the United Nations. Concurrently, the World Health Organization (WHO) reports that cardiovascular diseases (CVDs) are the leading cause of death globally, with an estimated 17.9 million deaths annually, representing 32% of all global deaths. Of these, approximately 85% are due to heart attacks and strokes, conditions often necessitating anticoagulation therapy.

Restraints

High Risk of Bleeding Complications

Despite their efficacy, anticoagulants are linked to a significant risk of bleeding. The incidence of major bleeding events associated with anticoagulant therapies is estimated at 2-3% annually. However, this can vary based on the patient population and specific anticoagulant used. The risk-benefit ratio of these medications is a critical consideration, particularly in individuals with a heightened risk of bleeding, which can influence the prescription trends and market dynamics.

Opportunities

Advancements in Drug Development and Personalized Medicine

Innovations in the anticoagulant market, especially the development of direct oral anticoagulants (DOACs), have been pivotal. DOACs now represent a significant share of the market, with sales surpassing $25 billion in recent years. The advent of personalized medicine, particularly pharmacogenomics, promises to optimize anticoagulant dosing, potentially reducing the annual healthcare costs related to stroke prevention in atrial fibrillation patients, which currently exceed $8 billion in the U.S. alone.

Trends

Shift Towards Outpatient Care and Self-Monitoring

The trend toward outpatient care and self-monitoring in anticoagulation therapy is underscored by the increasing market penetration of DOACs, which are estimated to account for over 60% of the market share by volume. The adoption of telehealth and home monitoring devices is anticipated to grow by 30% annually, enhancing patient convenience and potentially reducing the overall healthcare expenditure associated with inpatient anticoagulation management.

Regional Analysis

In 2023, North America held a dominant market position in the anticoagulant market, capturing more than a 41.6% share, with a market value of USD 14.5 billion for the year. This substantial market share can be attributed to several key factors, including a high prevalence of cardiovascular diseases, a well-established healthcare infrastructure, and the presence of key market players in the region. Additionally, the increasing awareness regarding the availability of advanced treatment options and the growing aging population, which is more prone to venous thromboembolism, have significantly contributed to the market’s growth.

Europe followed North America closely, influenced by its robust healthcare systems, high healthcare expenditure, and strong focus on research and development activities. The region’s market expansion is bolstered by the increasing incidence of obesity and sedentary lifestyles, leading to a higher prevalence of conditions requiring anticoagulation therapy.

The Asia-Pacific region is identified as an emerging market with a fast-growing CAGR, driven by rising healthcare awareness, improving healthcare infrastructure, and increasing investment in the healthcare sector, particularly in countries like China and India. The growing population, coupled with a surge in the prevalence of lifestyle-induced disorders, is expected to fuel the demand for anticoagulant therapies in this region.

Latin America, though with a smaller market share, is experiencing growth due to the gradual improvement in healthcare facilities, increased governmental focus on healthcare, and rising awareness about blood disorders. Meanwhile, the Middle East and Africa are expected to witness moderate growth, constrained by limited healthcare infrastructure and access to healthcare services.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Anticoagulant Market, several key players stand out for their significant contributions to driving growth and innovation. One such player is Pfizer Inc., a leading pharmaceutical company known for its diverse range of products and extensive research and development efforts. Alongside Pfizer, Sanofi SA also plays a crucial role in the market, leveraging its pharmaceutical expertise to develop and distribute anticoagulant medications globally.

Additionally, Dr. Reddy’s Laboratories, a prominent player in generic pharmaceuticals, contributes significantly to the market by providing affordable and high-quality anticoagulant treatments. Aspen Holdings, with its diverse portfolio of anticoagulant products, fosters innovation and strategic partnerships to cater to evolving patient needs. These key players, along with others in the industry, collectively drive the growth and development of the anticoagulant market through their innovative products, research initiatives, and commitment to improving patient outcomes, thus contributing to advancements in healthcare worldwide.

Market Key Players

- Pfizer Inc.

- Sanofi SA

- Dr. Reddy’s Laboratories

- Aspen Holdings

- Abbott Laboratories

- Leo Pharma AS

- Alexion Pharmaceuticals Inc.

- Bayer AG

- Johnson & Johnson

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company

- Boehringer Ingelheim Pharmaceuticals Inc.

Recent Developments

- In February 2024, Dr. Reddy’s Laboratories introduced a biosimilar of Apixaban (Eliquis) to the Indian market, aiming to provide a more affordable alternative for a wider range of patients. This move aligns with their strategic objective to expand market reach and accessibility, as highlighted in their press release.

- In October 2023, Johnson & Johnson disclosed a partnership with Alliance Pharmaceuticals, focusing on the development and commercialization of next-generation oral anticoagulants. The collaboration aims to enhance drug efficacy while minimizing bleeding risks, as stated in Johnson & Johnson’s official announcement.

- In December 2023, Boehringer Ingelheim received approval from the FDA for Pradaxa (dabigatran) to treat acute Deep Vein Thrombosis (DVT) and Pulmonary Embolism (PE). This regulatory milestone signifies an expansion of the drug’s therapeutic application, as detailed in Boehringer Ingelheim’s press release.

Report Scope

Report Features Description Market Value (2023) USD 34.9 Bn Forecast Revenue (2033) USD 66.1 Bn CAGR (2024-2033) 6.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Factor XA Inhibitors (NOAC/DOAC), Heparins, Direct Thrombin Inhibitors, Vitamin K Antagonists), By Route of Administration (Oral, Injectable), By Indication (Deep Vein Thrombosis, Pulmonary Embolism, Atrial Fibrillation & Heart Attack, Ischemic Stroke, Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pfizer Inc., Sanofi SA, Dr. Reddy’s Laboratories, Aspen Holdings, Abbott Laboratories, Leo Pharma AS, Alexion Pharmaceuticals Inc., Bayer AG, Johnson & Johnson, Bristol-Myers Squibb Company, Daiichi Sankyo Company, Boehringer Ingelheim Pharmaceuticals Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Anticoagulant market in 2023?The Anticoagulant market size is USD 34.9 billion in 2023.

What is the projected CAGR at which the Anticoagulant market is expected to grow at?The Anticoagulant market is expected to grow at a CAGR of 6.6% (2024-2033).

List the segments encompassed in this report on the Anticoagulant market?Market.US has segmented the Anticoagulant market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Drug Class the market has been segmented into Factor XA Inhibitors (NOAC/DOAC), Heparins, Direct Thrombin Inhibitors, Vitamin K Antagonists. By Route of Administration the market has been segmented into Oral, Injectable. By Indication the market has been segmented into Deep Vein Thrombosis, Pulmonary Embolism, Atrial Fibrillation & Heart Attack, Ischemic Stroke, Others. By Distribution Channel the market has been segmented into Hospital Pharmacies, Retail Pharmacies, Online Pharmacies.

List the key industry players of the Anticoagulant market?Pfizer Inc., Sanofi SA, Dr. Reddy’s Laboratories, Aspen Holdings, Abbott Laboratories, Leo Pharma AS, Alexion Pharmaceuticals Inc., Bayer AG, Johnson & Johnson, Bristol-Myers Squibb Company, Daiichi Sankyo Company, Boehringer Ingelheim Pharmaceuticals Inc.

Which region is more appealing for vendors employed in the Anticoagulant market?North America is expected to account for the highest revenue share of 41.6% and boasting an impressive market value of USD 14.5 billion. Therefore, the Anticoagulant industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Anticoagulant?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Anticoagulant Market.

-

-

- Bayer

- Boehringer Ingelheim

- Bristol-Myers Squibb

- Daiichi Sankyo

- Pfizer

- Johnson & Johnson

- Sanofi

- AstraZeneca

- Eli Lilly

- Keryx Biopharmaceuticals