Global Anti-Money Laundering Market By Component (Software, Services), By Product Type (Compliance Management, Currency Transaction Reporting, Customer Identity Management, and Transaction Monitoring), By Deployment (Cloud and On-premise), By End-Use (BFSI, Government, Healthcare, IT & Telecom, and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 22939

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

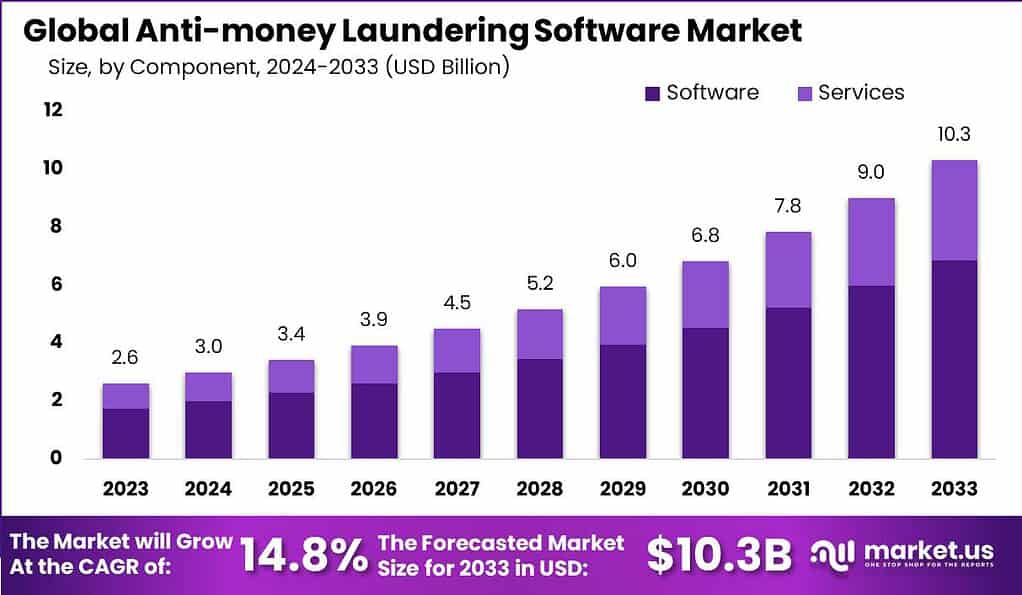

The global Anti-money Laundering Software Market has achieved substantial growth, reaching a size of USD 2.6 Billion in 2023. Looking ahead, industry experts anticipate even greater expansion, with the market projected to reach USD 10.3 Billion by 2033. This impressive growth trajectory reflects a Compound Annual Growth Rate (CAGR) of 14.8% during the period from 2024 to 2033.

Anti-money laundering (AML) software refers to specialized technology solutions designed to help financial institutions and other regulated entities detect and prevent money laundering activities. Money laundering involves the process of making illicitly obtained funds appear legitimate by disguising their true origins. It is a significant concern for governments, financial institutions, and law enforcement agencies worldwide, as it facilitates criminal activities, including drug trafficking, corruption, and terrorism financing.

The AML software market has witnessed substantial growth in recent years due to the increasing complexity of financial crimes, rising regulatory scrutiny, and the need for enhanced risk management in the financial sector. The market encompasses a wide range of software solutions, including transaction monitoring systems, customer due diligence (CDD) tools, watchlist screening applications, and regulatory reporting platforms.

Key factors driving the growth of the AML software market include the global expansion of financial services, the proliferation of digital transactions, and the growing sophistication of money laundering techniques. Additionally, the increasing adoption of technology and automation in the financial industry has led to a greater demand for advanced AML solutions to mitigate risks effectively.

The landscape of Anti-Money Laundering (AML) efforts in 2022 presents a complex and challenging environment for financial institutions and regulatory bodies globally. An estimated $800 billion, nearly 5% of the global GDP, is laundered annually, underscoring the magnitude of the issue at hand. The United Nations reports that a staggering 90% of global money laundering activities remain undetected each year, highlighting significant gaps in current detection and enforcement mechanisms.

Further complicating the AML landscape is the high rate of false-positive screening results reported by 41% of organizations, according to Deloitte. This not only impedes efficient operations but also diverts resources away from investigating genuine threats. Additionally, Deloitte’s findings that 48% of banks are equipped with outdated technology to meet AML compliance requirements effectively signal a pressing need for technological advancement and modernization within the sector.

Despite these challenges, efforts to combat money laundering yield some measure of success. The National Crime Agency indicates that 31% of the illicit flow of funds is intercepted annually through Suspicious Activity Reports (SARs). However, the effectiveness of these interventions is put into perspective by the University of Melbourne’s finding that only 0.1% of laundered funds are recovered after an AML investigation, pointing to the difficulties in tracing and reclaiming illicit assets.

The role of cryptocurrencies in money laundering is often highlighted, yet Forbes notes that fiat currency is utilized 400 times more for money laundering activities than cryptocurrencies. This emphasizes the need for regulatory frameworks to evolve in line with changing financial practices and technologies.

The financial penalties imposed for AML violations also reflect the seriousness with which regulatory bodies view compliance breaches. The Financial Conduct Authority (FCA)’s imposition of a £37.8 million fine on Commerzbank in 2020 stands as a testament to this, alongside a $126 million fine on Goldman Sachs Bank for ineffective risk management.

The submission of around 500,000 suspicious activity reports to the Financial Intelligence Unit every year, as reported by the UKFIU, alongside the National Crime Agency’s report of over 200,000 money laundering cases reported to UK authorities annually, underscores the scale of the challenge faced by financial institutions and regulatory bodies.

Key Takeaways

- The Anti-money Laundering Software Market is estimated to reach USD 10.3 billion by 2033, with a projected Compound Annual Growth Rate (CAGR) of 14.8% from 2024 to 2033.

- An estimated $800 billion, nearly 5% of the global GDP, is laundered annually, posing significant challenges for governments, financial institutions, and law enforcement agencies worldwide.

- Despite AML efforts, 90% of global money laundering activities remain undetected annually, highlighting significant gaps in detection and enforcement mechanisms.

- In 2023, the Software segment held a dominant market position in the Anti-money laundering (AML) software market, capturing more than a 66.5% share.

- In 2023, the Transaction Monitoring segment held a dominant market position in the Anti-money laundering (AML) software market, capturing more than a 42.9% share.

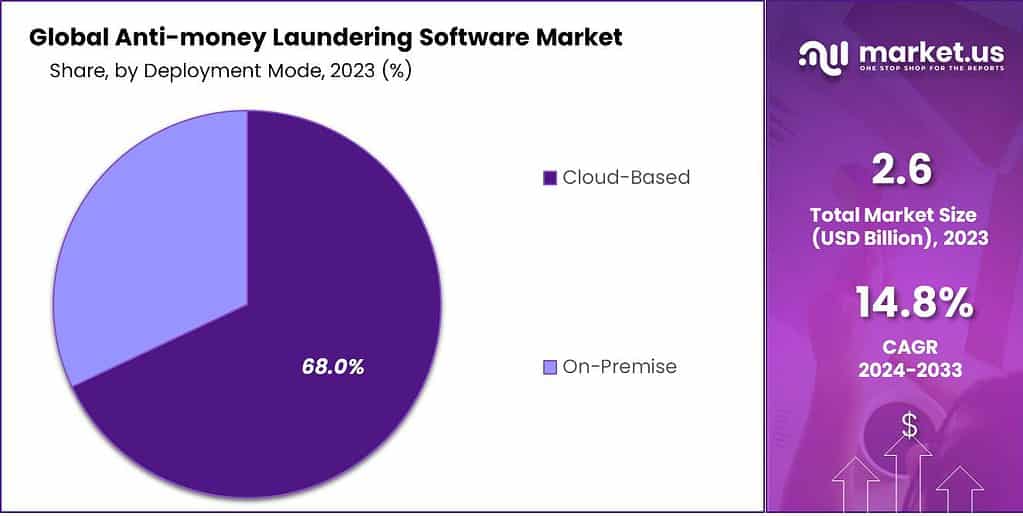

- In 2023, the On-premise segment held a dominant market position in the Anti-money laundering (AML) software market, capturing more than a 68.0% share.

- In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Anti-money laundering (AML) software market, capturing more than a 54.5% share.

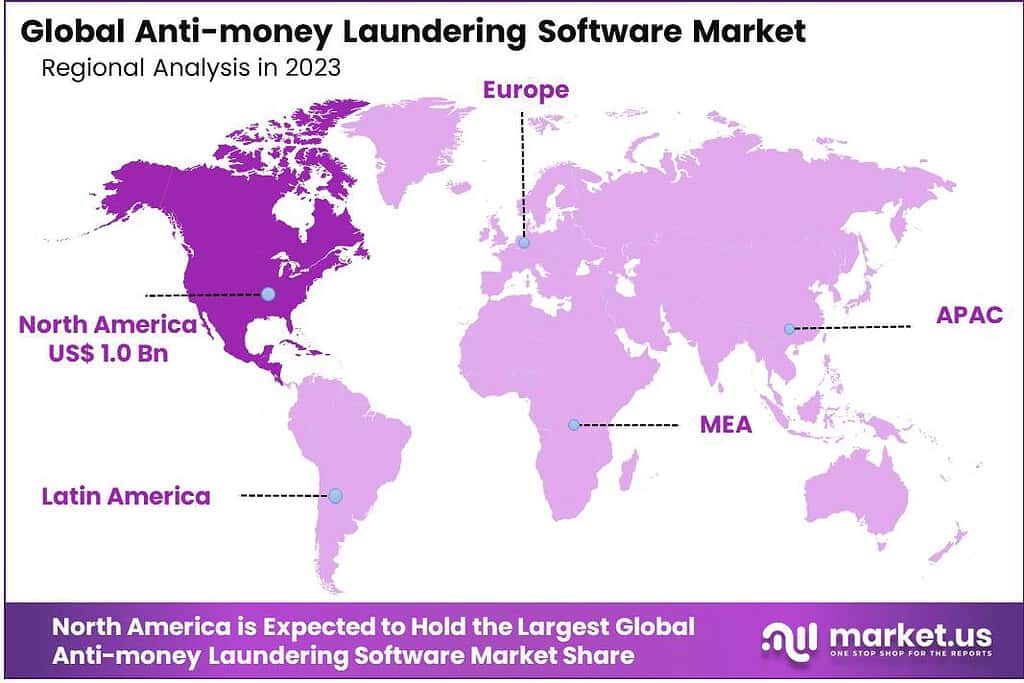

- In 2023, North America held a dominant market position in the Anti-money laundering (AML) software market, capturing more than a 38.4% share.

Component Analysis

In 2023, the Software segment held a dominant market position in the Anti-money laundering (AML) software market, capturing more than a 66.5% share. This significant lead can be attributed to the escalating demand for advanced AML solutions across financial institutions, driven by the need to comply with increasingly stringent regulatory standards and combat sophisticated money laundering schemes.

The software segment’s dominance is further reinforced by the rapid integration of artificial intelligence (AI), machine learning (ML), and blockchain technologies, which significantly enhance the efficiency and effectiveness of AML processes. The surge in software adoption stems from its pivotal role in identifying, tracking, and reporting suspicious activities.

AML software solutions offer comprehensive capabilities ranging from transaction monitoring to customer due diligence and sanctions screening, enabling institutions to automate and streamline their compliance processes. This not only reduces the operational burden on these institutions but also increases the accuracy and speed of detection, crucial in the fast-paced financial sector.

Moreover, the continuous evolution of financial crimes necessitates adaptive and robust AML solutions. The software segment’s growth is fueled by the ongoing development of innovative features, such as predictive analytics and advanced data analysis techniques, which provide deeper insights into transaction patterns and potential risks.

This innovation, coupled with the increasing investment in cybersecurity measures to protect sensitive financial data, underscores the software segment’s critical role in the broader AML market landscape. The integration of these advanced technologies into AML software not only empowers financial institutions to stay ahead of money launderers but also significantly contributes to the integrity and stability of the global financial system.

Product Type Analysis

In 2023, the Transaction Monitoring segment held a dominant market position in the Anti-money laundering (AML) software market, capturing more than a 42.9% share. This prominence is largely due to its crucial role in enabling financial institutions to continuously oversee customer transactions in real-time or on a near-real-time basis for suspicious activities.

Such capabilities are essential for meeting regulatory compliance requirements and for preventing money laundering activities. The demand for transaction monitoring solutions has surged as these systems can efficiently identify anomalies in transaction patterns, which could indicate potential money laundering or fraudulent activities.

Transaction monitoring systems utilize advanced algorithms and analytical techniques to sift through vast volumes of data, flagging transactions that deviate from established norms or patterns indicative of illicit activity. This allows financial institutions to act swiftly in investigating and reporting these activities to the relevant authorities, thereby mitigating risks and potential legal consequences.

The increasing sophistication of financial crimes, coupled with the rising volume of digital transactions, has made transaction monitoring systems indispensable to modern AML strategies. Moreover, as regulatory environments around the world tighten, the need for comprehensive transaction monitoring solutions that can adapt to new rules and regulations has become more pronounced.

Financial institutions are investing heavily in upgrading their transaction monitoring capabilities to include features like machine learning and behavioral analytics, which enhance the accuracy and efficiency of detection mechanisms. This technological advancement, combined with the critical need for compliance and security, cements the Transaction Monitoring segment’s leading position in the AML market.

Deployment Mode Analysis

In 2023, the On-premise segment held a dominant market position in the Anti-money laundering (AML) software market, capturing more than a 68.0% share. This leading position can be attributed to several key factors, including the high level of control and security that on-premise solutions offer to financial institutions.

Organizations, particularly those in the banking, financial services, and insurance (BFSI) sector, often deal with highly sensitive customer information and require robust security measures to protect against data breaches and cyber threats. On-premise deployment allows these institutions to maintain complete control over their AML systems and data, ensuring compliance with stringent regulatory requirements regarding data sovereignty and privacy.

Moreover, the preference for on-premise solutions is reinforced by their ability to be customized to fit the specific needs of an organization. Unlike cloud-based solutions, on-premise systems can be tailored to the unique operational and compliance requirements of each financial institution, providing a level of flexibility and integration with existing legacy systems that is crucial for complex regulatory landscapes.

This customization capability, combined with the direct control over system updates and maintenance, ensures that on-premise solutions remain a preferred choice for many large and medium-sized organizations that prioritize security and compliance.

Furthermore, despite the growing adoption of cloud technologies, the on-premise segment continues to thrive due to the perceived reliability and performance stability it offers, especially for organizations operating in regions with strict data localization laws or those with concerns over internet connectivity and cloud service downtimes.

The investment in on-premise AML solutions reflects an organization’s commitment to maintaining the highest standards of data security and operational integrity, making it a critical component of comprehensive risk management and regulatory compliance strategies in the financial sector.

End-Use Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Anti-money laundering (AML) software market, capturing more than a 54.5% share. This significant market share is primarily due to the direct impact of financial crimes on this sector and the stringent regulatory requirements imposed on it to combat money laundering and terrorist financing.

Financial institutions are at the forefront of efforts to detect, prevent, and report money laundering activities, necessitating robust AML solutions that can efficiently manage the vast volumes of transactions they process daily. The predominance of the BFSI segment in the AML market is further bolstered by the sector’s need to uphold its reputation and ensure customer trust.

Money laundering not only poses a legal risk but also damages the credibility and stability of financial institutions, leading to potential loss of business and stringent penalties from regulators. As a result, banks, insurance companies, and other financial services providers invest heavily in advanced AML systems capable of performing diligent customer due diligence, ongoing transaction monitoring, and compliance reporting. These systems are crucial for identifying suspicious activities and ensuring compliance with evolving global and local AML regulations.

Moreover, the digital transformation of the financial sector, characterized by the rise of online banking, digital payments, and fintech innovations, has increased the sector’s vulnerability to sophisticated money laundering schemes. This digital shift necessitates that BFSI entities adopt state-of-the-art AML solutions equipped with artificial intelligence, machine learning, and data analytics capabilities to effectively monitor and analyze transactional data for potential illicit activities.

Key Market Segments

By Component

- Software

- Services

By Product Type

- Compliance Management

- Currency Transaction Reporting

- Customer Identity Management

- Transaction Monitoring

By Deployment

- Cloud

- On-premise

By End-Use

- BFSI

- Government

- Healthcare

- IT & Telecom

- Other End-Uses

Driver

One driver in the anti-money laundering (AML) software market is the increasing regulatory pressure on financial institutions. Governments and regulatory bodies are imposing stricter AML regulations to combat money laundering and terrorism financing effectively. Financial institutions are required to implement robust AML programs and leverage advanced technology solutions to detect and prevent illicit financial activities. This regulatory push is driving the demand for AML software as organizations seek to ensure compliance, avoid hefty fines, and protect their reputation. The need to meet regulatory requirements is a significant driver for the adoption and continuous improvement of AML software solutions.

Restraint

One restraint in the AML software market is the complexity and volume of financial data. Financial institutions generate vast amounts of transactional and customer data, making it challenging to analyze and identify suspicious activities accurately. AML software relies on sophisticated algorithms and machine learning techniques to process and analyze this data effectively.

However, the sheer volume and complexity of data can pose challenges in terms of data integration, data quality, and false positive rates. Ensuring the accuracy and reliability of AML software outputs requires ongoing data management efforts and continuous fine-tuning of algorithms. Additionally, the integration of data from disparate sources and legacy systems can be a complex and time-consuming process. These data-related challenges can impact the efficiency and effectiveness of AML software implementations.

Opportunity

One opportunity in the AML software market lies in the integration of artificial intelligence (AI) and machine learning (ML) technologies. AI and ML offer the potential to enhance the capabilities of AML software by enabling more accurate detection of suspicious activities and reducing false positives. These technologies can analyze vast amounts of data, identify patterns, and adapt to evolving money laundering techniques, making them valuable tools in combating financial crime.

By leveraging AI and ML, AML software can continuously learn from new data and improve its detection capabilities over time. Furthermore, AI-powered solutions can automate manual processes, streamline investigations, and provide real-time insights to investigators, enhancing operational efficiency and decision-making. The integration of AI and ML technologies presents an opportunity for AML software vendors to deliver more advanced and effective solutions to financial institutions, enabling them to stay ahead of emerging threats and regulatory requirements.

Challenge

One challenge in the AML software market is the cat-and-mouse game between criminals and AML systems. Money launderers constantly develop new techniques and methods to evade detection, requiring AML software to continuously evolve and adapt. Criminals may employ sophisticated measures such as structuring transactions, layering funds, or using new technologies like cryptocurrencies to obscure the origins of illicit funds.

AML software providers need to stay vigilant and proactive in identifying and addressing emerging money laundering patterns and techniques. This challenge necessitates ongoing research and development efforts to enhance the capabilities of AML software, collaborate with law enforcement agencies and industry stakeholders, and stay abreast of the latest trends in financial crime. Additionally, the dynamic nature of the AML landscape requires regular updates and enhancements to software systems to ensure they remain effective in detecting and preventing money laundering activities.

Regional Analysis

In 2023, North America held a dominant market position in the Anti-money laundering (AML) software market, capturing more than a 38.4% share. This significant market share is attributed to the stringent regulatory environment in the region, particularly in the United States and Canada, where compliance with AML regulations is heavily enforced.

Financial institutions in North America are among the most proactive in adopting advanced AML solutions to comply with laws such as the Bank Secrecy Act (BSA) and the Patriot Act, which mandate rigorous monitoring and reporting of suspicious activities. The region’s leadership in technological innovation further supports the adoption of sophisticated AML tools, incorporating artificial intelligence, machine learning, and big data analytics to enhance the efficiency and effectiveness of AML operations.

Europe follows closely, with a robust AML framework driven by directives from the European Union, aimed at preventing money laundering and terrorist financing across its member states. The region’s commitment to enhancing financial transparency and the harmonization of AML regulations across borders has spurred the adoption of advanced AML solutions. The European market is characterized by a high degree of collaboration between financial institutions and regulatory bodies, facilitating the development and implementation of comprehensive AML strategies.

Key Regions and Countries covered іn thе rероrt:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The Anti-money laundering (AML) software market is highly competitive, with several key players contributing to the development and deployment of AML solutions worldwide. These entities play a pivotal role in shaping the dynamics of the market through innovation, strategic partnerships, and compliance with evolving regulatory standards.

Fiserv stands out as a leading provider of financial services technology solutions, including AML software. The company offers comprehensive AML systems that integrate transaction monitoring, customer identity verification, and compliance reporting. Fiserv’s solutions are designed to help financial institutions manage risks and comply with regulatory requirements efficiently.

Top Market Leaders

- SAS Institute Inc.

- Oracle Corporation

- NICE Actimize

- BAE Systems plc

- Thomson Reuters Corporation

- Tata Consultancy Services Limited

- ACI Worldwide

- Fiserv, Inc.

- FICO

- Temenos AG

- LexisNexis Risk Solutions

- Other Key Players

Recent Developments

1. Oracle Corporation:

- February 2023: Launched Oracle Financial Services Regulatory Compliance Cloud Service, including enhanced AML capabilities with AI-powered transaction monitoring and risk scoring.

- April 2023: Partnered with Thomson Reuters to integrate KYC and AML data for improved identity verification and sanctions screening.

- October 2023: Announced collaboration with World Economic Forum on a blockchain-based platform for AML information sharing and collaboration.

2. NICE Actimize:

- March 2023: Released AML Accelerator, a cloud-based solution powered by AI and machine learning for efficient transaction monitoring and alert management.

- June 2023: Acquired Verafin, a leading provider of financial crime compliance solutions, expanding its AML portfolio and global reach.

- December 2023: Partnered with Amazon Web Services (AWS) to offer its AML solutions on the AWS Marketplace, increasing accessibility for cloud-focused clients.

Report Scope

Report Features Description Market Value (2023) US$ 2.6 Bn Forecast Revenue (2033) US$ 10.3 Bn CAGR (2024-2033) 14.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Product Type (Compliance Management, Currency Transaction Reporting, Customer Identity Management, and Transaction Monitoring), By Deployment Mode (Cloud and On-premise), By End-Use (BFSI, Government, Healthcare, IT & Telecom, and Other End-Uses) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape SAS Institute Inc. , Oracle Corporation, NICE Actimize, BAE Systems plc, Thomson Reuters Corporation, Tata Consultancy Services Limited, ACI Worldwide, Fiserv Inc., FICO, Temenos AG, LexisNexis Risk Solutions, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Anti-money Laundering (AML) Software?AML software is a tool used by financial institutions and other regulated entities to detect and prevent money laundering activities. It helps in identifying suspicious transactions, monitoring customer behavior, and ensuring compliance with regulatory requirements.

How big is Anti-money Laundering Software Market?The global Anti-money Laundering Software Market has achieved substantial growth, reaching a size of USD 2.6 Billion in 2023. Looking ahead, industry experts anticipate even greater expansion, with the market projected to reach USD 10.3 Billion by 2033.

Who are the key players in Anti-money Laundering Software Market?SAS Institute Inc., Oracle Corporation, NICE Actimize, BAE Systems plc, Thomson Reuters Corporation, Tata Consultancy Services Limited, ACI Worldwide, Fiserv Inc., FICO, Temenos AG, LexisNexis Risk Solutions, Other Key Players are the top key players in Anti-money Laundering Software Market.

Which is the fastest growing region in Anti-money Laundering Software Market?In 2023, North America held a dominant market position in the Anti-money laundering (AML) software market, capturing more than a 38.4% share.

What are the challenges in implementing AML Software?Challenges in implementing AML software include the complexity of regulatory requirements, the need for continuous monitoring and updating of the software, and the cost of implementation and maintenance.

Anti-money Laundering Software MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample

Anti-money Laundering Software MarketPublished date: Feb. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- SAS Institute Inc.

- Oracle Corporation

- NICE Actimize

- BAE Systems plc

- Thomson Reuters Corporation

- Tata Consultancy Services Limited

- ACI Worldwide

- Fiserv, Inc.

- FICO

- Temenos AG

- LexisNexis Risk Solutions

- Other Key Players