Global Animal Sedatives Market By Drug Type (Phenothiazines, Butyrophenones, Benzodiazepines, Alpha-2 Adrenergic Receptor Agonists, and Others), By Route of Administration (Parenteral and Oral), By Application (Surgical, Diagnostic, and Others), By Animal Type (Dogs, Horses, Cats, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146598

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

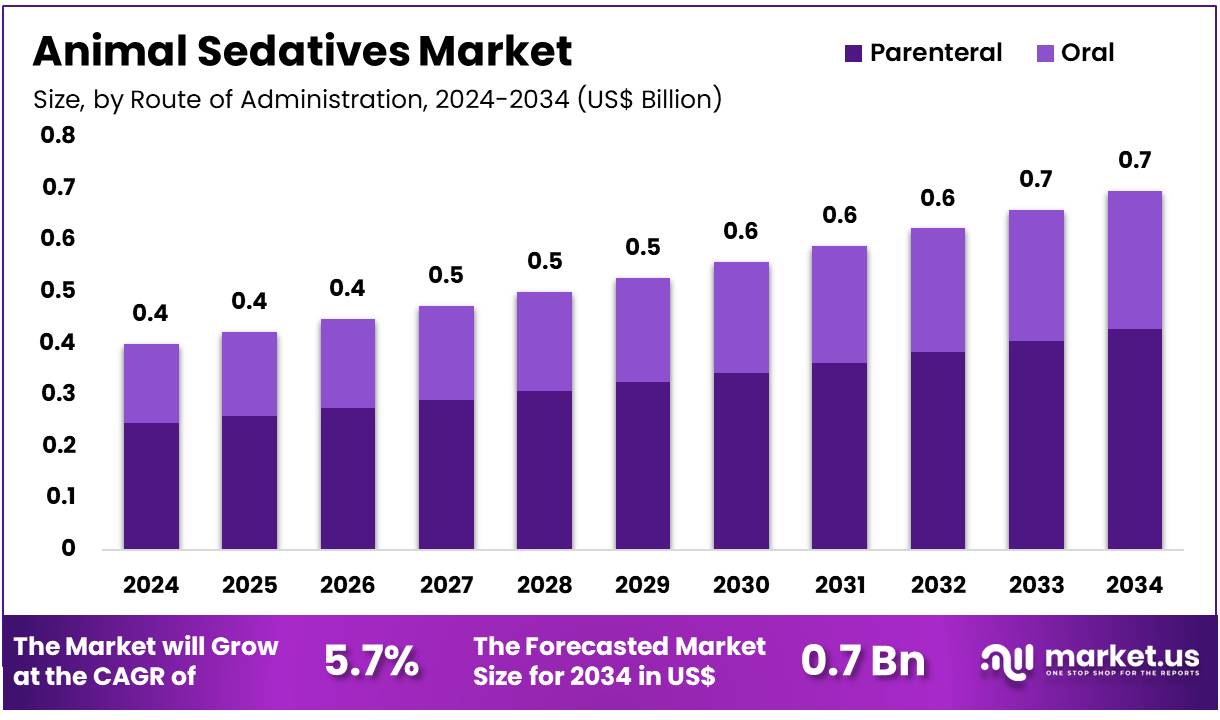

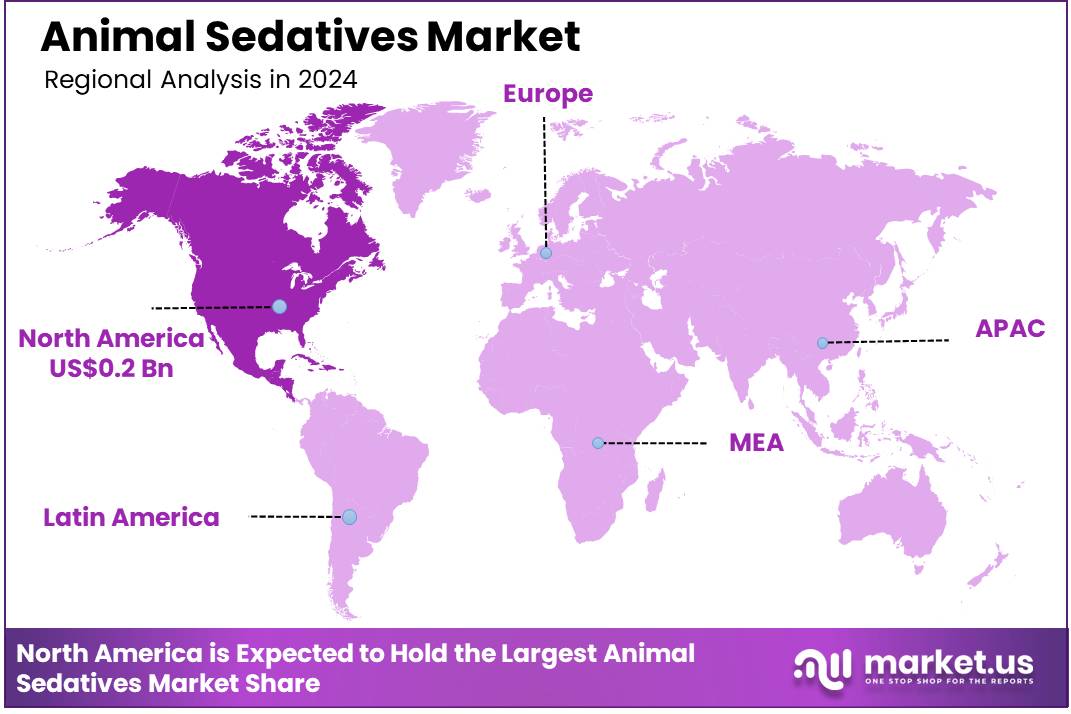

Global Animal Sedatives Market size is expected to be worth around US$ 0.7 Billion by 2034 from US$ 0.4 Billion in 2024, growing at a CAGR of 5.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.2% share with a revenue of US$ 0.2 Billion.

Increasing demand for veterinary care and a growing emphasis on animal welfare have significantly driven the expansion of the animal sedatives market. These medications are widely used in veterinary practices for managing stress, anxiety, and aggressive behavior in animals during procedures such as surgeries, diagnostic tests, and transport. As pet ownership rises globally, the need for effective and safe sedatives in small animal care continues to grow, creating substantial opportunities for manufacturers.

Additionally, sedatives are becoming crucial in livestock management, where their use facilitates easier handling during medical treatments and transportation, reducing stress in animals and improving overall welfare. Recent trends indicate a rise in the development of sedatives with fewer side effects and more targeted action, ensuring animal safety while optimizing the efficacy of treatments.

In May 2023, Virbac expanded its operations in Central Europe through the acquisition of GS Partners, a distributor based in the Czech Republic and Slovakia. This move strengthens Virbac’s local presence, helping the company to better serve the growing demand for animal health solutions in the pet and ruminant sectors. This strategic move highlights the increasing need for animal sedatives and the expanding market opportunities across various sectors in veterinary care.

Key Takeaways

- In 2024, the market for Animal Sedatives generated a revenue of US$ 0.4 billion, with a CAGR of 5.7%, and is expected to reach US$ 0.7 billion by the year 2033.

- The drug type segment is divided into phenothiazines, butyrophenones, benzodiazepines, alpha-2 adrenergic receptor agonists, and others, with alpha-2 adrenergic receptor agonists taking the lead in 2024 with a market share of 56.2%.

- Considering route of administration, the market is divided into parenteral and oral. Among these, parenteral held a significant share of 61.5%.

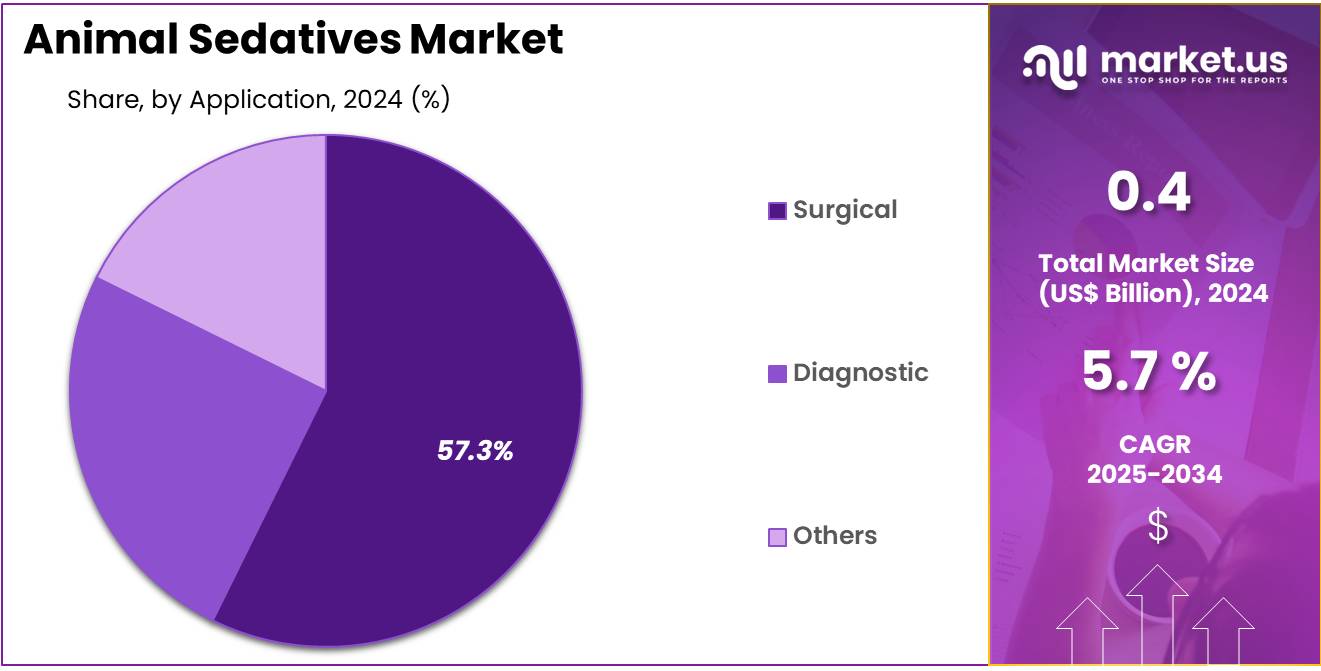

- Furthermore, concerning the application segment, the market is segregated into surgical, diagnostic, and others. The surgical sector stands out as the dominant player, holding the largest revenue share of 57.3% in the Animal Sedatives market.

- The animal type segment is segregated into dogs, horses, cats, and others, with the dogs segment leading the market, holding a revenue share of 63.8%.

- North America led the market by securing a market share of 39.2% in 2024.

Drug Type Analysis

The alpha-2 adrenergic receptor agonists segment led in 2024, claiming a market share of 56.2% owing to the increasing demand for effective and safe sedatives in veterinary practices. Alpha-2 adrenergic receptor agonists, such as medetomidine and dexmedetomidine, offer controlled sedation with minimal side effects, which makes them increasingly popular for various animal procedures.

The growth of this segment is anticipated to be driven by the need for safer anesthetic and sedative options for both routine and complex veterinary procedures. Additionally, the growing awareness among veterinarians regarding the efficacy and safety of these drugs is likely to contribute to the continued growth of the alpha-2 adrenergic receptor agonists segment in the animal sedatives market.

Route of Administration Analysis

The parenteral held a significant share of 61.5% due to its effectiveness in delivering quick and controlled sedation. Parenteral administration, including intravenous and intramuscular routes, ensures that sedatives are quickly absorbed and exert their effects rapidly, which is especially important during emergency veterinary procedures.

The growing preference for parenteral sedatives over oral formulations is anticipated to be driven by their faster onset of action and more precise control over dosage. As the need for efficient sedation in surgical and diagnostic procedures rises, the parenteral segment is expected to continue its growth within the market.

Application Analysis

The surgical segment had a tremendous growth rate, with a revenue share of 57.3% owing to the increasing number of surgical procedures performed on animals. Sedatives are a critical part of ensuring that animals remain calm and stable during surgeries, and the demand for high-quality sedatives tailored for surgical use is rising.

Veterinary practices are increasingly adopting advanced sedative agents that provide the right balance of sedation, analgesia, and muscle relaxation. As the number of routine and specialized surgeries grows, including orthopedic and soft tissue surgeries, the demand for effective animal sedatives in surgical applications is expected to expand significantly.

Animal Type Analysis

The dogs segment grew at a substantial rate, generating a revenue portion of 63.8% due to the increasing number of dog surgeries, diagnostic procedures, and veterinary visits. Dogs are the most common pets and frequently require sedation for procedures such as spaying, neutering, dental work, and routine checkups.

The rising awareness about animal welfare, including minimizing stress during veterinary treatments, is expected to drive demand for sedatives tailored for dogs. As pet ownership continues to rise and veterinary care becomes more specialized, the growth of the dogs segment in the animal sedatives market is likely to continue, as more sedative options are developed for canine-specific needs.

Key Market Segments

Drug Type

- Phenothiazines

- Butyrophenones

- Benzodiazepines

- Alpha-2 Adrenergic Receptor Agonists

- Others

Route of Administration

- Parenteral

- Oral

Application

- Surgical

- Diagnostic

- Others

Animal Type

- Dogs

- Horses

- Cats

- Others

Drivers

Rising Livestock Population is Driving the Market

The increasing global livestock population is significantly driving the demand for animal sedatives. As of 2023, the USDA reported that the US cattle inventory stood at 89.3 million head, a modest decline from 91.9 million in 2022, yet still reflective of substantial livestock maintenance needs. The FAO has consistently emphasized that global meat consumption will continue rising through 2030, with a projected increase of 14% from 2020 levels.

This growth necessitates routine procedures like surgeries, transportation, and vaccination, all of which require sedation to minimize animal stress and injury. Moreover, the expansion of veterinary healthcare infrastructure, especially in developing nations, further amplifies sedative use.

According to Zoetis’ 2023 financial report, their livestock product sales grew by 5% year-over-year, a portion of which was attributed to animal health management tools, including sedatives. Increased awareness around animal welfare standards is also compelling farms to opt for humane handling, boosting adoption. As such, the livestock sector’s consistent growth is a foundational driver of the animal sedatives market.

Restraints

Stringent Regulatory Policies are Restraining the Market

Tightened global regulations on drug residues in food-producing animals are increasingly restraining market growth. In 2023, the European Medicines Agency (EMA) introduced updated withdrawal period guidelines for sedatives used in food animals, affecting how and when these drugs can be administered. The US FDA’s Center for Veterinary Medicine also issued a revision to its Animal Drug User Fee Act performance goals, emphasizing post-market safety and compliance.

These regulatory changes often increase the burden on manufacturers and limit rapid deployment of new sedative formulations. For instance, Elanco Animal Health reported in its 2023 investor briefings that regulatory compliance costs increased by 8% over the previous year due to more rigorous testing and documentation requirements.

Furthermore, global harmonization efforts like Codex Alimentarius have introduced stricter Maximum Residue Limits (MRLs), reducing off-label usage. This environment creates uncertainty and slows down product innovation pipelines. While such regulation aims to ensure food safety and animal welfare, it does pose short-term challenges to manufacturers and distributors alike.

Opportunities

Plant-Based Alternatives are Creating Growth Opportunities

The emergence of plant-based sedatives and herbal formulations is creating lucrative growth opportunities in the animal sedation market. Rising demand for organic and residue-free animal products is driving innovation in this space. In 2023, the National Institutes of Health (NIH) documented an increase in research funding for natural sedative alternatives for veterinary applications, with funding reaching US$2.8 million, up from US$2.1 million in 2022.

Companies like Vetoquinol and Ayurvet have expanded their portfolios to include herbal sedation products targeting companion animals and livestock alike. These products are being marketed for use in non-critical procedures or in organic-certified animal farming.

Additionally, consumer preference for sustainable and chemical-free livestock management practices aligns with these offerings. Market trials indicate that formulations using valerian root, chamomile, and ashwagandha have shown efficacy comparable to synthetic agents in mild sedation scenarios. The regulatory environment is also more favorable for herbal products, given fewer side effect concerns and lenient MRLs. This segment is expected to see sustained growth as awareness spreads and regulatory approvals broaden.

Impact of Macroeconomic / Geopolitical Factors

The animal sedatives sector in 2025 is navigating a complex macroeconomic and geopolitical landscape. Ongoing geopolitical tensions, particularly in Eastern Europe and the Middle East, continue to disrupt global trade routes and logistics networks, affecting the availability and distribution of essential veterinary pharmaceuticals. Commodity price volatility, especially for key ingredients like alpha-2 adrenergic receptor agonists (e.g., xylazine, detomidine), remains high due to supply chain disruptions and export restrictions from major producers. These challenges are prompting strategic reassessments across the industry.

Governments and private entities are increasingly investing in localized and alternative pharmaceutical solutions, including compounded formulations and domestically sourced active pharmaceutical ingredients. Stricter international standards on veterinary drug safety and environmental impact are driving innovation in formulation and sourcing practices.

The adoption of advanced veterinary technologies, including precision medicine approaches, is also on the rise, helping practitioners manage risk and improve treatment outcomes. Despite the uncertainty, the sector is demonstrating operational adaptability through diversification, enhanced traceability, and local capacity building.

The recent US tariff actions implemented in April 2025 have significantly impacted the animal sedatives industry, particularly concerning raw material costs and supply chain continuity. Many pharmaceuticals, medical supplies, and active pharmaceutical ingredients used in veterinary medicine are sourced internationally, with key suppliers including China, Mexico, and Canada.

According to the Georgia Veterinary Medical Association, approximately 17% of US active pharmaceutical ingredient imports originate from China . These tariffs—additional taxes on foreign products—aim to protect US industries but may inadvertently affect animal healthcare. Veterinary clinics rely on a steady supply of medications and equipment; any trade disruption could lead to higher costs, potential shortages, and operational delays.

In response, veterinary practices are exploring alternative sourcing strategies, such as diversifying suppliers or increasing domestic procurement, and advocating for policy adjustments to mitigate the adverse effects of these tariffs. While challenges persist, these developments are prompting the industry to build a more resilient and self-reliant supply chain.

Latest Trends

Smart Monitoring and AI Integration is a Recent Trend in the Market

One of the most significant recent trends in the animal healthcare sector, including sedation, is the integration of AI and smart monitoring. These technologies allow real-time assessment of animal stress levels, enabling more precise and targeted sedative administration. Companies like Merck Animal Health have invested in wearable tech for livestock that monitor heart rate, body temperature, and movement. According to their 2023 annual report, the use of smart monitoring tools improved medication accuracy and reduced overuse by 12%.

This not only enhances animal welfare but also minimizes drug wastage and reduces the risk of tolerance. AI-driven diagnostic tools are being tested for use in pre-procedure screening, ensuring sedatives are only used when absolutely necessary. A study published by the Journal of Veterinary Pharmacology in 2023 noted a 15% increase in operational efficiency when smart monitoring preceded sedative administration. Such tech-driven precision supports regulatory compliance while also appealing to cost-conscious livestock managers. This trend is set to redefine how sedatives are managed in modern animal care settings.

Regional Analysis

North America is leading the Animal Sedatives Market

North America dominated the market with the highest revenue share of 39.2% owing to the region’s high pet ownership rates and advanced veterinary infrastructure. As of 2024, 66% of US households, equating to approximately 86.9 million families, owned a pet, reflecting a significant demand for veterinary services. This surge in pet ownership has led to increased veterinary visits, with more procedures requiring sedation, such as surgeries and diagnostic tests.

The US market alone was valued at US$63.1 million in 2024, up from US$59.5 million in 2021, indicating a steady rise in demand. Additionally, the growing trend of pet humanization has resulted in higher spending on animal healthcare, with American pet expenditures reaching US$150.6 billion in 2024. Established players like Zoetis, Elanco, and Merck have contributed to market expansion through continuous innovation and product development. The combination of these factors underscores the robust growth trajectory of the animal sedatives market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing livestock populations and expanding veterinary services. In India, the number of veterinary hospitals and polyclinics reached 12,452 in 2022, enhancing access to animal healthcare services. This expansion is expected to lead to a higher demand for sedatives used in various procedures, including surgeries and diagnostics. China’s market is projected to dominate the region, with a market value of US$36.1 million by 2031, reflecting the country’s significant investment in animal healthcare infrastructure.

The rising awareness of animal welfare and the adoption of advanced veterinary practices are likely to further propel market growth. Moreover, the increasing prevalence of companion animals in urban areas contributes to the demand for sedatives in clinical settings. The Asia Pacific market’s growth is also supported by governmental initiatives aimed at improving animal health services. These combined factors position the region as a key contributor to the global expansion of the animal sedatives market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the animal sedatives market drive growth through technological innovation, strategic acquisitions, and expanding their global presence. They invest in developing advanced sedative formulations that enhance efficacy and safety during veterinary procedures. Collaborations with research institutions and veterinary professionals facilitate the integration of new technologies and broaden market reach. Additionally, targeting emerging markets with increasing demand for veterinary care presents significant growth opportunities.

Zoetis Inc., headquartered in Parsippany, New Jersey, is a leading animal health company specializing in the discovery, development, manufacture, and commercialization of animal health medicines and vaccines. The company offers a comprehensive portfolio of products for both livestock and companion animals, including sedatives and analgesics.

In 2024, Zoetis reported revenues of approximately US$9.3 billion, with a significant portion attributed to its companion animal segment. The company operates in over 100 countries, focusing on advancing care for animals through continuous innovation and strategic expansions.

Top Key Players

- Zoetis Inc

- Virbac

- Troy Laboratories Pty Ltd

- Ouro Fino Saude Animal Group

- Elanco

- Dechra Pharmaceuticals Plc

- Bimeda Inc.

Recent Developments

- In August 2022, Bimeda broadened its footprint across Africa with the acquisition of Afrivet, a leading animal health distributor with operations in South Africa, Zambia, and Mozambique. This acquisition gives Bimeda greater access to African markets, enabling the company to offer a wider range of animal health products and services across the continent.

- In March 2022, Elanco launched an initiative focused on improving sustainable farming in Sub-Saharan Africa. By creating solutions that support livestock-based livelihoods, Elanco’s efforts aim to enhance the productivity and welfare of communities that rely heavily on livestock for their income.

Report Scope

Report Features Description Market Value (2024) US$ 0.4 billion Forecast Revenue (2034) US$ 0.7 billion CAGR (2025-2034) 5.7 % Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Type (Phenothiazines, Butyrophenones, Benzodiazepines, Alpha-2 Adrenergic Receptor Agonists, and Others), By Route of Administration (Parenteral and Oral), By Application (Surgical, Diagnostic, and Others), By Animal Type (Dogs, Horses, Cats, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zoetis Inc, Virbac, Troy Laboratories Pty Ltd, Ouro Fino Saude Animal Group, Elanco, Dechra Pharmaceuticals Plc, Bimeda Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zoetis Inc

- Virbac

- Troy Laboratories Pty Ltd

- Ouro Fino Saude Animal Group

- Elanco

- Dechra Pharmaceuticals Plc

- Bimeda Inc.