Global Anemia Drugs Market By Drug Type (Supplements (Iron Supplements and Vitamin Supplements) and Drugs (Erythropoiesis-Stimulating Agents (ESAs), Hypoxia-Inducible Factor Prolyl Hydroxylase Inhibitors (HIF-PHIs), Iron Chelators and Others)), By Indication (Iron Deficiency, Chronic Kidney Disease, Vitamin B12/Folic Acid Deficiency, Sickle Cell Anemia, Aplastic Anemia, Thalassemia and Others), By Route of Administration (Oral and Injectable), By End-User (Hospitals and Infusion Centers, Specialty Clinics and Nephrology Centers, Homecare Settings and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172589

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

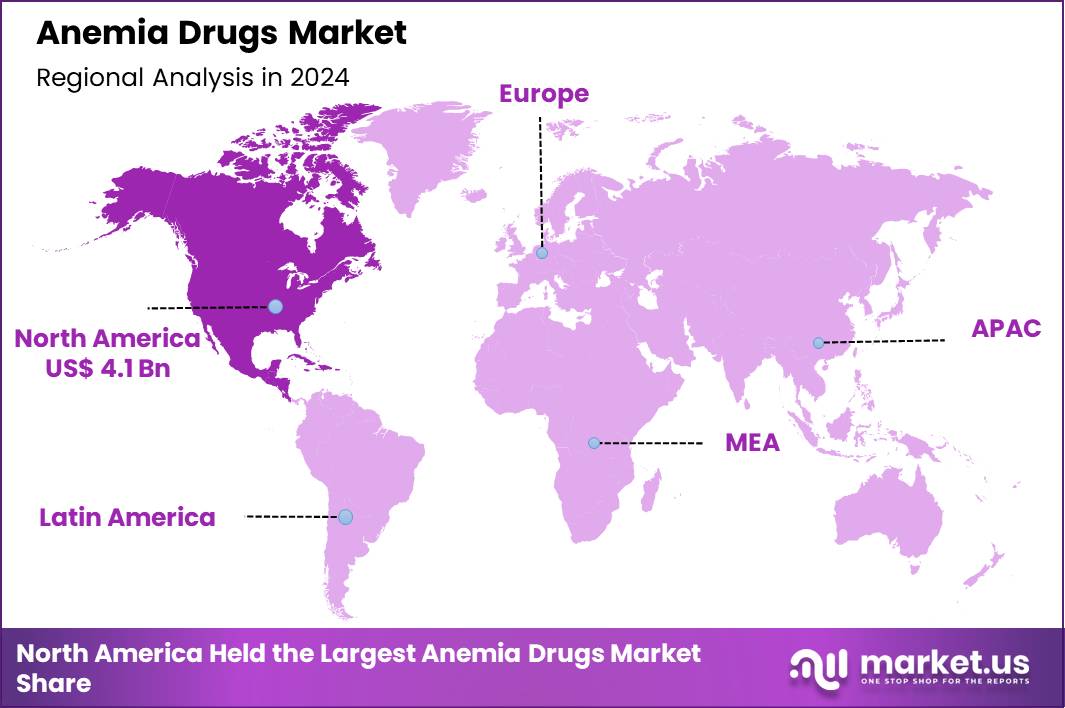

The Global Anemia Drugs Market size is expected to be worth around US$ 25.3 Billion by 2034 from US$ 11.2 Billion in 2024, growing at a CAGR of 8.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.6% share with a revenue of US$ 4.1 Billion.

Growing prevalence of chronic kidney disease accelerates demand for anemia drugs that effectively stimulate erythropoiesis and improve hemoglobin levels in affected patients. Nephrologists increasingly prescribe erythropoiesis-stimulating agents to manage renal anemia, correcting deficiencies arising from impaired endogenous erythropoietin production in dialysis and non-dialysis stages. These medications support oncology patients by countering chemotherapy-induced anemia, sustaining energy levels and reducing transfusion dependency during cancer treatments.

Clinicians administer intravenous iron supplements alongside these agents to optimize response in inflammation-associated anemia, enhancing iron availability for red blood cell synthesis. These therapies address anemia in chronic heart failure, alleviating symptoms and improving exercise capacity through better oxygen delivery.

In September 2025, Novartis finalized the acquisition of a specialized biotechnology company with a focus on anemia-focused drug development. The transaction strengthens Novartis’s capabilities in targeted anemia therapies and underscores a wider industry trend in which large pharmaceutical companies use strategic acquisitions to rapidly enhance their therapeutic portfolios and speed up innovation cycles.

Pharmaceutical developers pursue opportunities to formulate hypoxia-inducible factor prolyl hydroxylase inhibitors that offer oral administration convenience, expanding treatment options for chronic kidney disease-related anemia in outpatient settings. Companies engineer next-generation erythropoiesis-stimulating agents with prolonged half-lives, reducing dosing frequency in myelodysplastic syndrome management and enhancing patient adherence. These innovations broaden applications in preoperative anemia correction, optimizing hemoglobin prior to elective surgeries to minimize perioperative transfusion risks.

Opportunities emerge in biosimilar erythropoietins that provide cost-effective alternatives for inflammation-driven anemia in rheumatoid arthritis patients. Firms explore combination regimens integrating iron chelators with stimulators, addressing complex anemias in thalassemia and sickle cell disease for improved hematological outcomes. Enterprises invest in patient-specific dosing guided by biomarkers, tailoring therapies for anemia in inflammatory bowel disease with variable iron absorption profiles.

Industry specialists advance small-molecule activators of erythropoietin gene expression, delivering erythropoietin-independent pathways for anemia treatment in oncology supportive care. Developers refine Fc-fusion protein technologies to extend circulation time, supporting less frequent administration in chronic disease-associated anemia. Market participants launch subcutaneous biosimilars that maintain efficacy while improving injection site tolerability in long-term renal anemia protocols.

Innovators incorporate anti-hepcidin antibodies to mobilize stored iron, augmenting responses in cancer-related anemia refractory to standard iron supplementation. Companies prioritize oral iron formulations with enhanced bioavailability, complementing stimulators in heart failure anemia management. Ongoing research emphasizes gene therapy approaches targeting erythropoietin production, promising durable corrections in hereditary anemias with single interventions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 11.2 Billion, with a CAGR of 8.5%, and is expected to reach US$ 25.3 Billion by the year 2034.

- The drug type segment is divided into supplements and drugs, with supplements taking the lead in 2024 with a market share of 62.1%.

- Considering indication, the market is divided into iron deficiency, chronic kidney disease, vitamin B12/folic acid deficiency, sickle cell anemia, aplastic anemia, thalassemia and others. Among these, iron deficiency held a significant share of 30.7%.

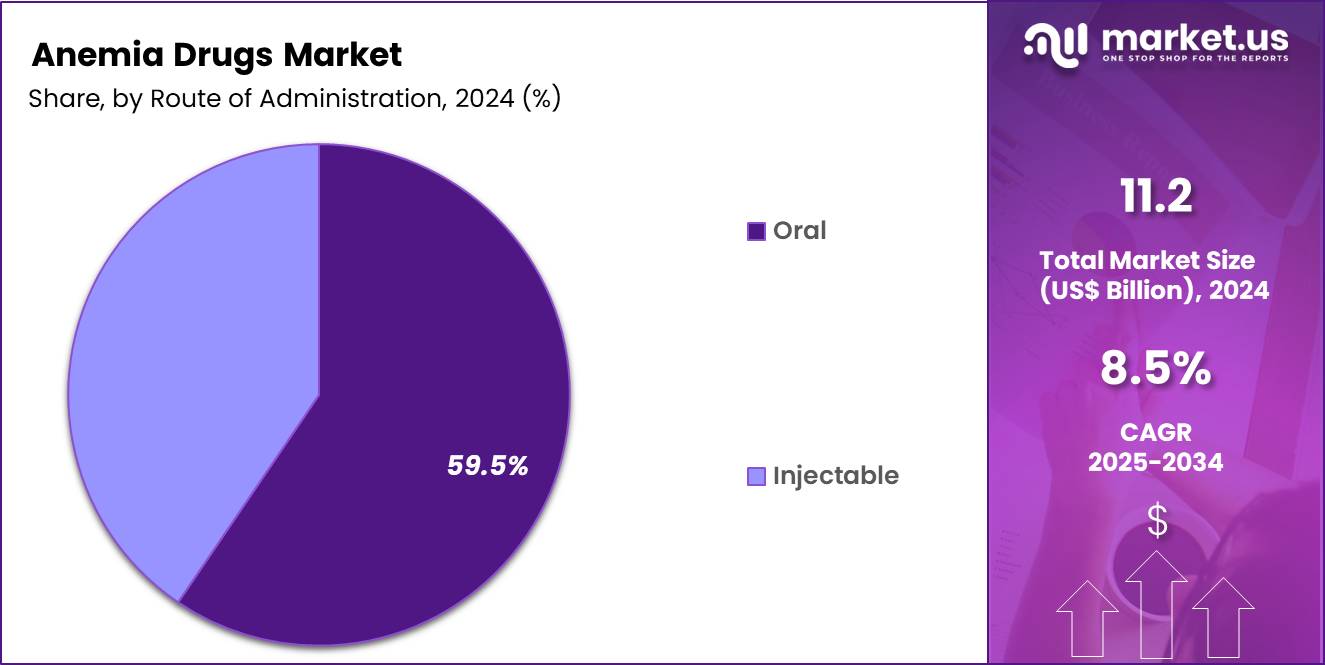

- Furthermore, concerning the route of administration segment, the market is segregated into oral and injectable. The oral sector stands out as the dominant player, holding the largest revenue share of 59.5% in the market.

- The end-user segment is segregated into hospitals and infusion centers, specialty clinics and nephrology centers, homecare settings and others, with the hospitals and infusion centers segment leading the market, holding a revenue share of 48.9%.

- North America led the market by securing a market share of 36.6% in 2024.

Drug Type Analysis

Supplements accounted for 62.1% of the anemia drugs market, reflecting their broad use across preventive and therapeutic care. Clinicians frequently recommend iron, vitamin B12, and folic acid supplements as first line interventions due to established efficacy and safety. High prevalence of nutritional deficiencies across both developed and emerging regions expands routine supplementation demand.

Easy availability and lower treatment complexity encourage early initiation in primary care settings. Public health programs increasingly promote supplementation to address population level anemia burden. Strong physician familiarity supports consistent prescribing across age groups. Manufacturers focus on improved formulations to enhance absorption and gastrointestinal tolerability.

Long term use suitability strengthens adherence among chronic anemia patients. Cost effectiveness compared to injectable therapies improves accessibility. This segment is projected to sustain dominance due to preventive focus and wide clinical acceptance.

Indication Analysis

Iron deficiency represented 30.7% of the anemia drugs market, driven by its status as the most common anemia type globally. Dietary insufficiencies, blood loss, and increased nutritional needs in women and children expand the affected population. Routine screening programs improve early diagnosis rates in primary and maternal care.

Physicians prioritize iron replacement due to its direct correction of the underlying deficiency. Rising awareness of anemia related fatigue and productivity loss encourages treatment uptake. Chronic conditions and gastrointestinal disorders further increase iron deficiency incidence. Oral iron therapies align well with long term management strategies. Public health guidelines emphasize iron repletion as a core intervention.

Consistent clinical outcomes reinforce prescribing confidence. As a result, iron deficiency is anticipated to remain the leading indication due to high prevalence and clear treatment pathways.

Route of Administration Analysis

Oral administration accounted for 59.5% of the anemia drugs market, supported by convenience and patient adherence advantages. Oral formulations integrate easily into outpatient and home based care models. Physicians prefer oral routes for mild to moderate anemia management due to simplified dosing. Lower administration costs compared to injectables improve affordability. Patients demonstrate higher compliance with noninvasive therapies during long term treatment.

Advances in formulation technology improve bioavailability and tolerability. Retail availability supports uninterrupted therapy continuation. Oral drugs align with preventive and maintenance treatment approaches. Reduced need for clinical supervision accelerates uptake. Consequently, oral administration is likely to maintain leadership due to accessibility and ease of use.

End-User Analysis

Hospitals and infusion centers held a 48.9% share of the anemia drugs market, reflecting their role in managing complex and severe cases. These settings treat patients requiring rapid correction of anemia or intravenous supplementation. Availability of diagnostic infrastructure supports accurate anemia classification and treatment selection. Hospitals manage anemia associated with surgery, oncology, and chronic kidney disease.

Infusion centers provide controlled environments for high dose or injectable therapies. Specialist oversight improves treatment safety and outcomes. High patient inflow sustains consistent drug utilization volumes. Integration with multidisciplinary care pathways strengthens demand. Reimbursement structures often favor hospital based administration. Therefore, hospitals and infusion centers are projected to remain dominant due to clinical complexity management and centralized care delivery.

Key Market Segments

By Drug Type

- Supplements

- Iron Supplements

- Vitamin Supplements

- Drugs

- Erythropoiesis-Stimulating Agents (ESAs)

- Hypoxia-Inducible Factor Prolyl Hydroxylase Inhibitors (HIF-PHIs)

- Iron Chelators

- Others

By Indication

- Iron Deficiency

- Chronic Kidney Disease

- Vitamin B12/Folic Acid Deficiency

- Sickle Cell Anemia

- Aplastic Anemia

- Thalassemia

- Others

By Route of Administration

- Oral

- Injectable

By End-User

- Hospitals and Infusion Centers

- Specialty Clinics and Nephrology Centers

- Homecare Settings

- Others

Drivers

Rising prevalence of anemia in women is driving the market

The anemia drugs market is substantially driven by the rising prevalence of anemia in women, particularly those of reproductive age, which necessitates increased utilization of iron supplements, erythropoiesis-stimulating agents, and other therapeutic interventions. This condition often stems from nutritional deficiencies, heavy menstrual bleeding, and pregnancy-related demands, prompting healthcare providers to prescribe targeted drugs for correction.

Global health organizations highlight the need for effective treatments to mitigate associated morbidity, such as fatigue and reduced productivity. Pharmaceutical companies develop formulations tailored to women, including oral iron preparations and injectable agents for severe cases. Regulatory bodies support initiatives to address anemia through drug accessibility programs in high-burden regions.

Clinical guidelines recommend routine screening and early intervention with anemia drugs to prevent complications like maternal mortality. Public health campaigns educate on dietary improvements alongside pharmacological support. Research focuses on innovative delivery systems to enhance absorption and compliance among affected women.

According to the World Health Organization’s 2025 estimates, the global prevalence of anemia in women aged 15–49 years stood at 30.7% in 2023. This figure underscores the persistent public health challenge that sustains demand for anemia management pharmaceuticals.

Restraints

Biosimilar competition is restraining the market

The anemia drugs market encounters notable restraints from intensifying biosimilar competition, which erodes market share for branded products through lower pricing and increased substitution. Biosimilars replicate erythropoiesis-stimulating agents like epoetin alfa, leading to reduced revenues for originators as payers favor cost-effective alternatives.

Manufacturers of branded drugs invest in litigation and differentiation strategies to protect intellectual property, yet face ongoing market erosion. Healthcare systems adopt biosimilars to control expenditures, limiting growth for established therapies. Regulatory approvals for biosimilars accelerate entry, intensifying pressure on pricing models. Clinical equivalence demonstrations enable seamless switching, further constraining branded sales volumes. Supply agreements with biosimilar providers disrupt traditional distribution channels.

Economic evaluations by governments emphasize savings from biosimilars in chronic disease management. Amgen reported Epogen revenues of $506 million in 2022, declining to $226 million in 2023 and $125 million in 2024 due to lower unit demand and biosimilar impacts. These declines illustrate the competitive dynamics that hinder profitability and innovation in the sector.

Opportunities

Increasing FDA approvals for novel anemia treatments is creating growth opportunities

The anemia drugs market presents significant growth opportunities through the increasing number of FDA approvals for novel treatments, expanding therapeutic options for conditions like chronic kidney disease-associated anemia. These approvals validate innovative mechanisms, such as hypoxia-inducible factor prolyl hydroxylase inhibitors, for patients on dialysis. Developers capitalize on breakthrough designations to expedite market entry and address unmet needs in refractory cases.

Clinicians gain access to oral alternatives that improve patient convenience over injectable standards. Partnerships between pharmaceutical firms and research entities facilitate post-approval studies for label expansions. Global harmonization of approval processes supports international commercialization efforts. Healthcare providers integrate new drugs into protocols for enhanced efficacy and safety profiles.

Patient outcomes improve with reduced transfusion dependencies, fostering broader adoption. The U.S. Food and Drug Administration approved Jesduvroq (daprodustat) in 2023 and Vafseo (vadadustat) in 2024 for anemia in chronic kidney disease. These milestones enable diversification and strengthen the pipeline for anemia management.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic forces bolster the anemia drugs market as surging healthcare budgets and escalating chronic kidney disease rates worldwide drive pharmaceutical firms to ramp up erythropoietin and iron supplement production for broader patient access. Leading companies strategically enhance formulations with biosimilars and extended-release options, capitalizing on aging demographics to fuel steady demand in emerging economies.

Stubborn inflation and economic slowdowns, however, inflate raw material costs for active ingredients and packaging, compelling manufacturers to streamline operations and prompting hospitals to curtail bulk purchases amid tighter reimbursements. Geopolitical strains, particularly U.S.-China trade disputes and regional conflicts in API-sourcing nations like India, routinely disrupt ingredient supplies, fostering production delays and operational uncertainties for globally reliant developers.

Current U.S. tariff policies, featuring a paused 100 percent duty on branded pharmaceutical imports after October 2025 negotiations, impose price-reduction commitments on major drugmakers, squeezing profit margins while temporarily averting higher import expenses for American distributors. These measures also spark reciprocal barriers from trading partners that constrain U.S. exports of advanced anemia therapies and disrupt multinational supply alliances.

Still, the tariff pause galvanizes commitments to domestic manufacturing expansions and onshoring initiatives, forging resilient supply architectures that will accelerate technological breakthroughs and secure enduring market vitality for the long term.

Latest Trends

Advancement in hypoxia-inducible factor prolyl hydroxylase inhibitors for renal anemia is a recent trend

In 2024, the anemia drugs market has exhibited a prominent trend toward advancements in hypoxia-inducible factor prolyl hydroxylase inhibitors, focusing on their clinical translation for renal anemia management. These agents stimulate endogenous erythropoietin production, offering an oral alternative to traditional erythropoiesis-stimulating agents. Researchers prioritize safety evaluations, addressing risks like thromboembolism in phase 3 trials.

Developers integrate these inhibitors with iron therapies to optimize hemoglobin responses in dialysis patients. Regulatory agencies review real-world data to refine usage guidelines amid growing adoption. Clinical hotspots emphasize comparative efficacy against biosimilars in hyporesponsive populations. Pharmaceutical collaborations explore combination regimens with sodium-glucose cotransporter-2 inhibitors for synergistic effects.

Academic studies investigate long-term cardiovascular outcomes to support broader indications. Ethical frameworks ensure equitable access in chronic kidney disease cohorts. This trend, as analyzed in a 2025 bibliometric study, highlights potential avenues including hepcidin antagonists alongside these inhibitors.

Regional Analysis

North America is leading the Anemia Drugs Market

In 2024, North America accounted for a 36.6% share of the global anemia drugs market, supported by escalating treatment needs in oncology and nephrology alongside refined therapeutic protocols. Hematologists broaden prescriptions of erythropoiesis-stimulating agents for chemotherapy-induced anemia, optimizing hemoglobin targets to mitigate fatigue and transfusion dependencies in breast and lung cancer regimens.

Nephrologists incorporate hypoxia-inducible factor prolyl hydroxylase inhibitors into dialysis workflows, offering oral alternatives that enhance adherence for end-stage renal disease patients managing comorbid hypertension. Pharmaceutical advancements yield longer-acting darbepoetin formulations, reducing injection frequency in outpatient settings amid workforce constraints. Guideline revisions from the American Society of Hematology endorse iron supplementation synergies, addressing multifactorial etiologies in inflammatory states.

Demographic expansions in elderly cohorts amplify requirements for intravenous ferric carboxymaltose, countering absorption impairments from proton pump inhibitor polypharmacy. Reimbursement alignments under Medicare Part D facilitate biosimilar uptake, expanding access in underserved communities. These factors converge to sustain therapeutic momentum, alleviating symptomatic burdens effectively. The Centers for Disease Control and Prevention reported an overall anemia prevalence of 9.3% among individuals aged 2 years and older in the United States during August 2021–August 2023.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders project notable progression in anemia therapeutics across Asia Pacific throughout the forecast period, as nations intensify interventions against nutritional and chronic disease drivers. Hematologists deploy subcutaneous epoetin variants in expanding cancer centers, bolstering supportive care for colorectal and gastric malignancies prevalent in aging populations.

Nephrology networks procure cost-effective biosimilars, integrating them into peritoneal dialysis programs to combat renal anemia in diabetic nephropathy surges. Governments fortify fortification mandates with ferrous sulfate enrichments, targeting adolescent girls through school-based distributions in micronutrient-deficient provinces.

Pharmaceutical alliances localize production of oral iron polymaltose complexes, suiting pediatric palatability needs amid stunting reduction goals. Regional oncology consortia validate roxadustat efficacy in non-dialysis cohorts, tailoring hypoxia pathway modulation to high-altitude adaptations. Public-private ventures enhance pharmacovigilance monitoring, ensuring safe scaling of combination regimens in tuberculosis co-management.

These efforts leverage epidemiological insights, fostering resilient strategies for widespread deficiency amelioration. The World Health Organization’s Global Burden of Disease Study documented chronic kidney disease as a significant contributor to anemia years lived with disability in high-income Asia Pacific in 2021.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the anemia drugs market drive growth by expanding differentiated therapy portfolios that address iron deficiency, chronic kidney disease–related anemia, and chemotherapy-induced conditions with improved efficacy and safety profiles. Companies strengthen demand through lifecycle strategies that include next-generation formulations, longer dosing intervals, and combination approaches that improve adherence and clinical outcomes.

Commercial teams focus on deep engagement with nephrology, oncology, and hematology specialists while aligning products with evolving treatment guidelines and reimbursement frameworks. Strategic investments target emerging markets where anemia prevalence remains high and access to advanced therapies continues to improve.

R&D priorities emphasize novel mechanisms of action and oral alternatives that reduce dependence on injectable treatments. Amgen exemplifies leadership through its strong anemia portfolio, global biomanufacturing scale, and long-standing expertise in erythropoiesis-focused therapies that support sustainable growth across regulated healthcare markets.

Top Key Players

- CSL Vifor

- Amgen Inc.

- Sanofi S.A.

- AbbVie Inc.

- Daiichi Sankyo Company, Ltd.

- Pharmacosmos A/S

- AMAG Pharmaceuticals, Inc.

- Akebia Therapeutics, Inc.

- Pieris Pharmaceuticals

- Pfizer Inc.

- Takeda

- Novartis

- Johnson & Johnson

- Roche

- Biocon Biologics

- Otsuka Pharma

- Hikma Pharmaceuticals PLC

- Zydus Lifesciences Limited

Recent Developments

- In November 2025, Amgen announced a development alliance with an external biotechnology partner focused on creating a next-generation erythropoiesis-stimulating therapy for anemia associated with chronic kidney disease. The collaboration expands Amgen’s research pipeline in renal care and highlights the industry’s growing reliance on partnerships to accelerate innovation in anemia management.

- In October 2025, Roche introduced a digital patient-monitoring platform tailored for individuals living with anemia. The solution supports ongoing assessment and data-driven treatment adjustments, reflecting Roche’s broader push toward digitally enabled, personalized care models that can improve adherence and long-term clinical outcomes.

Report Scope

Report Features Description Market Value (2024) US$ 11.2 Billion Forecast Revenue (2034) US$ 25.3 Billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Type (Supplements (Iron Supplements and Vitamin Supplements) and Drugs (Erythropoiesis-Stimulating Agents (ESAs), Hypoxia-Inducible Factor Prolyl Hydroxylase Inhibitors (HIF-PHIs), Iron Chelators and Others)), By Indication (Iron Deficiency, Chronic Kidney Disease, Vitamin B12/Folic Acid Deficiency, Sickle Cell Anemia, Aplastic Anemia, Thalassemia and Others), By Route of Administration (Oral and Injectable), By End-User (Hospitals and Infusion Centers, Specialty Clinics and Nephrology Centers, Homecare Settings and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CSL Vifor, Amgen Inc., Sanofi S.A., AbbVie Inc., Daiichi Sankyo Company, Ltd., Pharmacosmos A/S, AMAG Pharmaceuticals, Inc., Akebia Therapeutics, Inc., Pieris Pharmaceuticals, Pfizer Inc., Takeda, Novartis, Johnson & Johnson, Roche, Biocon Biologics, Otsuka Pharma, Hikma Pharmaceuticals PLC, Zydus Lifesciences Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CSL Vifor

- Amgen Inc.

- Sanofi S.A.

- AbbVie Inc.

- Daiichi Sankyo Company, Ltd.

- Pharmacosmos A/S

- AMAG Pharmaceuticals, Inc.

- Akebia Therapeutics, Inc.

- Pieris Pharmaceuticals

- Pfizer Inc.

- Takeda

- Novartis

- Johnson & Johnson

- Roche

- Biocon Biologics

- Otsuka Pharma

- Hikma Pharmaceuticals PLC

- Zydus Lifesciences Limited