Global Amla Oil Market Size, Share, Growth Analysis By Product Type (Pure Amla Oil, Mixed or Blended Amla Oil, Organic Amla Oil, Conventional Amla Oil), By Application (Hair Care, Skin Care, Pharmaceutical or Medicinal Use, Aromatherapy and Wellness), By Distribution Channel (Online Retail, Offline Retail, Specialty Stores, Pharmacies and Drugstores), By End-User (Individual or Personal Use, Commercial or Professional Use, Cosmetic and Skincare Manufacturers, Pharmaceutical and Healthcare Providers), By Packaging (Bottles, Tubes, Jars, Pouches or Sachets), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 84100

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

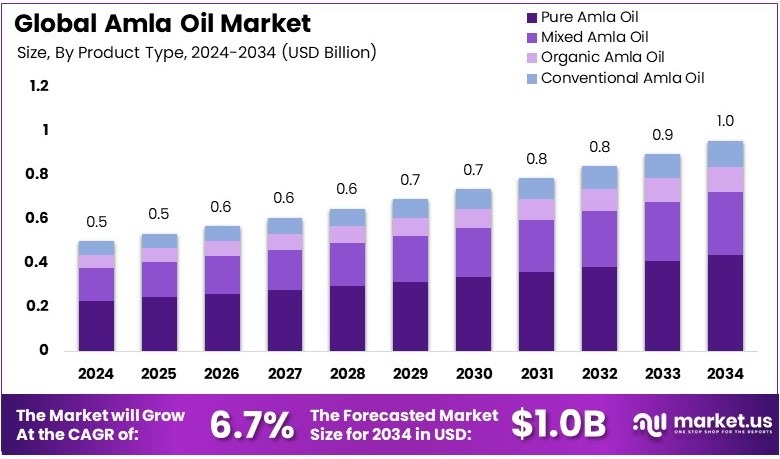

The Global Amla Oil Market size is expected to be worth around USD 1.0 Billion by 2034, from USD 0.5 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034.

Amla oil is derived from the Indian gooseberry fruit and is highly valued for its benefits in enhancing hair growth and improving scalp health. It is a key component in traditional Indian health practices and is increasingly popular in global markets for its natural remedial qualities. The Amla Oil Market includes the production, distribution, and sale of this oil, appealing to a growing consumer base that prioritizes organic and natural personal care products.

According to the Agricultural and Processed Food Products Export Development Authority (APEDA), India exported approximately 5,300 metric tons of amla products during the fiscal year 2022-2023. This significant export volume underscores India’s pivotal role in the global amla oil market and reflects the substantial demand for amla oil worldwide.

Furthermore, the market dynamics of amla oil are shaped by consumer preferences shifting towards more natural and herbal products. This trend supports a sustained interest in amla oil, enhancing its market presence and consumer base.

However, the market faces challenges such as competitiveness and saturation in some regions. Nevertheless, strategic government investments and regulatory support have facilitated stable growth and market expansion, demonstrating a promising outlook for the future of the amla oil market.

Key Takeaways

- The Amla Oil Market was valued at USD 0.5 Billion in 2024 and is expected to reach USD 1.0 Billion by 2034, with a CAGR of 6.7%.

- In 2024, Pure Amla Oil led the product type segment with 45.7%, attributed to its perceived purity and effectiveness.

- In 2024, Hair Care dominated the application segment with 60.3%, driven by its benefits for scalp health and hair growth.

- In 2024, Online Retail accounted for 50.8% of the distribution channel, reflecting increasing e-commerce adoption.

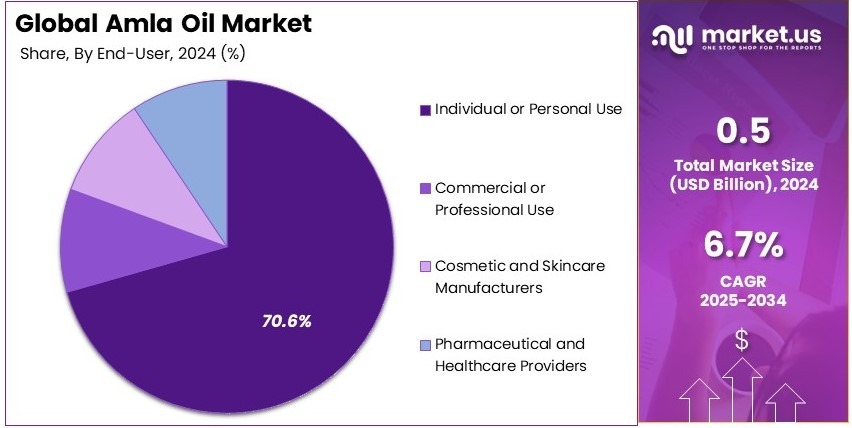

- In 2024, Individual/Personal Use dominated the end-user segment with 70.6%, due to its widespread use in home care.

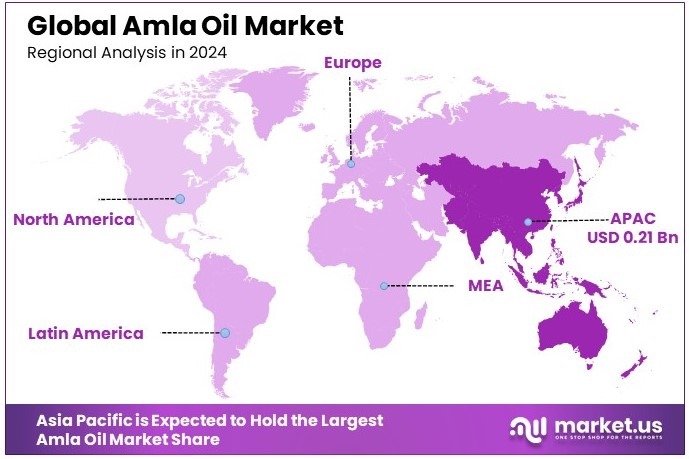

- In 2024, APAC held a 42.5% market share, valued at USD 0.21 Billion, driven by traditional use and strong consumer demand.

Product Type Analysis

Pure Amla Oil dominates with 45.7% due to its high demand in both personal and commercial uses.

In the Amla Oil market, Pure Amla Oil holds the largest market share at 45.7%. This sub-segment’s dominance is driven by the increasing awareness of the numerous health and cosmetic benefits associated with pure Amla oil. It is widely used for its high vitamin C content, which supports hair growth, improves scalp health, and enhances overall skin texture.

Pure Amla oil is considered the most natural and potent form, making it highly popular among consumers who prefer organic and chemical-free products. The growing trend toward natural and plant-based ingredients in skincare and haircare further strengthens the market position of pure Amla oil.

The other product types, such as mixed/blended Amla oil, organic Amla oil, and conventional Amla oil, also contribute to the market, but to a lesser extent. Mixed/blended Amla oil is often formulated with other oils to offer specific benefits, such as moisturizing or soothing properties.

Organic Amla oil is gaining popularity due to its environmental and health benefits, although it remains a niche segment compared to pure Amla oil. Conventional Amla oil, on the other hand, is commonly used but is perceived as less premium than pure or organic variants. Despite this, these products still contribute to the market by catering to price-sensitive consumers or those seeking particular blends.

Application Analysis

Hair Care dominates with 60.3% due to increasing demand for hair growth and scalp health products.

The hair care application leads the Amla Oil market with 60.3% of the market share. This is because Amla oil is widely recognized for its benefits in promoting hair growth, preventing hair loss, and improving overall scalp health. It is commonly used in shampoos, conditioners, and hair oils that focus on strengthening hair follicles and restoring shine and thickness.

With the increasing consumer preference for natural and chemical-free hair care products, Amla oil has become a go-to ingredient for those seeking sustainable and effective solutions. This shift toward natural products in personal care is a major factor driving the growth of the hair care segment.

Other applications, such as skincare, pharmaceutical use, and wellness, have a smaller market share but contribute to the overall growth of Amla oil. Skincare products that contain Amla oil are popular for their anti-aging and moisturizing properties, although they are not as dominant as hair care products.

Pharmaceutical and medicinal uses are relatively niche but are growing due to Amla oil’s antioxidant and anti-inflammatory properties. Aromatherapy and wellness applications also represent a growing trend, as Amla oil is increasingly used in massages and relaxation treatments for its therapeutic properties. These sub-segments complement the dominant hair care segment but remain smaller in comparison.

Distribution Channel Analysis

Online Retail dominates with 50.8% due to the convenience and global reach of e-commerce.

The online retail channel is the leading distribution method for Amla oil, accounting for 50.8% of the market share. This dominance is largely driven by the convenience that e-commerce platforms offer consumers. Online retail allows buyers to easily compare prices, read reviews, and purchase products from global brands without leaving their homes.

The rise of online marketplaces like Amazon, eBay, and brand-specific websites has played a significant role in making Amla oil more accessible to a wider audience. Additionally, online platforms often offer a greater variety of Amla oil products, catering to niche preferences such as organic or premium versions.

Offline retail, specialty stores, and pharmacies also play significant roles but hold smaller shares of the market. Offline retail stores such as supermarkets and convenience stores provide easy access to Amla oil, but they often have a limited selection compared to online platforms.

Specialty stores, such as health food stores or cosmetic outlets, focus on more niche products and are popular for premium or organic Amla oil variants. Pharmacies and drugstores contribute to the distribution but remain a smaller channel, especially for medicinal or pharmaceutical-grade Amla oil, which is less common than consumer-focused personal care products.

End-User Analysis

Individual/Personal Use dominates with 70.6% due to widespread consumer interest in self-care and wellness.

Individual and personal use is the dominant end-user segment in the Amla Oil market, representing 70.6% of the market share. The increasing focus on personal health and self-care is a key driver of this trend. Consumers use Amla oil for various purposes, including hair care, skincare, and overall wellness.

The growing interest in natural beauty and personal care products has made Amla oil a popular choice for individuals seeking solutions for hair growth, skin rejuvenation, and anti-aging benefits. As individuals become more conscious about what they apply to their bodies, Amla oil’s natural and multifunctional benefits appeal to a broad consumer base.

Commercial or professional use, such as in salons or spas, also contributes to the market but represents a smaller portion. These businesses use Amla oil in treatments for clients seeking hair and skin care services. Cosmetic and skincare manufacturers are another important group, as they incorporate Amla oil into their products for its health and beauty benefits.

Pharmaceutical and healthcare providers are the smallest end-user segment, with Amla oil being used for medicinal purposes such as anti-inflammatory treatments or general wellness. However, the personal use segment overwhelmingly leads the market in terms of size and growth.

Packaging Analysis

Bottles (Plastic and Glass) dominate with 55.4% due to the convenience and affordability of bottle packaging.

In terms of packaging, bottles (both plastic and glass) dominate the Amla Oil market with a share of 55.4%. Bottle packaging is preferred because it is easy to use, store, and transport, making it convenient for both consumers and businesses.

Plastic bottles are popular due to their lightweight nature and affordability, while glass bottles are chosen for their premium appearance and eco-friendly appeal. This packaging is commonly seen in both retail and online stores, offering a balance between functionality and cost-effectiveness.

Other packaging formats, such as tubes, jars, and pouches, have smaller market shares. Tubes are often used for smaller quantities of Amla oil, primarily for skincare products, while jars are typically used for more concentrated formulations.

Pouches and sachets, while convenient for sample sizes or single-use quantities, contribute to a smaller segment of the market. Despite this, these alternative packaging options cater to specific consumer needs, such as portability or convenience for travel.

Key Market Segments

By Product Type

- Pure Amla Oil

- Mixed/Blended Amla Oil

- Organic Amla Oil

- Conventional Amla Oil

By Application

- Hair Care

- Skin Care

- Pharmaceutical/Medicinal Use

- Aromatherapy and Wellness

By Distribution Channel

- Online Retail

- Offline Retail

- Specialty Stores

- Pharmacies and Drugstores

By End-User

- Individual/Personal Use

- Commercial/Professional Use

- Cosmetic and Skincare Manufacturers

- Pharmaceutical and Healthcare Providers

By Packaging

- Bottles

- Tubes

- Jars

- Pouches/Sachets

Driving Factors

Growing Awareness of Natural Products Drives Market Growth

The Amla Oil market is experiencing significant growth due to various driving factors. One key factor is the growing consumer awareness about the benefits of natural and organic products. As consumers become more conscious of the impact of chemicals on their health, they are increasingly turning to natural alternatives like Amla Oil. This trend is particularly strong in the beauty and wellness sectors, where consumers seek products that are free from harsh chemicals.

Additionally, there is an increasing demand for hair care and skin care solutions, further boosting the demand for Amla Oil. The oil is known for its nourishing and rejuvenating properties, making it a popular choice for consumers looking to improve the health of their hair and skin. Moreover, the expanding use of Amla Oil in Ayurvedic and traditional medicine is contributing to its growing appeal. As more people embrace holistic health practices, the demand for natural oils like Amla is on the rise.

Furthermore, the rising popularity of plant-based beauty and wellness products is another driving factor. Consumers are opting for plant-based solutions for their hair and skin care routines, aligning with the overall trend of clean and sustainable living.

Restraining Factors

High Costs and Limited Availability Restrain Market Growth

Despite the strong growth drivers, several factors are restraining the Amla Oil market’s potential. One major challenge is the high cost of production and sourcing raw materials. Amla fruits, known for their unique properties, are often scarce and expensive to procure, making the final product costly to produce.

Additionally, the limited availability of quality Amla Oil further exacerbates this issue. Not all Amla oil on the market meets the desired purity or potency standards, which can affect consumer trust and hinder the growth of the market.

Moreover, stringent regulations on natural product certifications can pose challenges for producers. Manufacturers must meet certain requirements to ensure the oil’s authenticity and safety, which adds complexity to production processes and increases operational costs.

Finally, competition from synthetic and chemical-based alternatives represents another barrier. Synthetic oils, although often cheaper to produce, can offer similar benefits to Amla Oil, leading some consumers to opt for these more affordable options.

Growth Opportunities

Expanding Markets and R&D Provide Growth Opportunities

The Amla Oil market also offers numerous opportunities for growth and expansion. One of the most notable opportunities is the expansion of Amla Oil in global beauty and personal care markets. As demand for natural beauty products continues to grow worldwide, Amla Oil is well-positioned to capture new market share, particularly in emerging economies.

Additionally, the introduction of Amla Oil in dietary supplements and functional foods presents a significant growth opportunity. With increasing consumer interest in health and wellness, Amla Oil’s antioxidant properties make it a valuable addition to dietary supplements that support overall well-being.

The growing trend of eco-friendly and sustainable packaging solutions also provides an opportunity for brands to differentiate themselves in the market. By adopting sustainable packaging, companies can appeal to environmentally-conscious consumers.

Finally, research and development in Amla Oil-based innovative products, such as advanced skincare formulations or new dietary supplements, can further drive market growth. As new uses for Amla Oil are discovered, more product categories may emerge, expanding the market’s potential.

Emerging Trends

DIY Beauty and Celebrity Endorsements Are Latest Trending Factors

Several trends are shaping the current landscape of the Amla Oil market. One such trend is the rising popularity of DIY beauty and hair care regimens. With more consumers seeking at-home beauty solutions, Amla Oil is being incorporated into homemade hair masks, face treatments, and other personal care routines.

Additionally, the increasing celebrity endorsement of Amla Oil-based products is helping to drive consumer interest. As influential figures in the beauty and wellness industries promote the oil’s benefits, more consumers are likely to experiment with and adopt Amla Oil in their daily routines.

Another key trend is the shift toward clean label and non-toxic beauty products. As consumers demand products free from harmful ingredients, Amla Oil fits into the clean beauty movement, positioning it as a safer and more natural alternative.

Lastly, the incorporation of Amla Oil in multinational cosmetic brands is becoming more common. As larger brands recognize the benefits of Amla Oil, it is increasingly being integrated into their product lines, making it more accessible to a wider consumer base.

Regional Analysis

Asia Pacific Dominates with 42.5% Market Share

Asia Pacific (APAC) leads the Amla Oil market with a dominant 42.5% market share, translating to USD 0.21 billion. This significant market presence is fueled by the region’s strong demand for natural and organic products, especially in countries like India, where Amla oil has long been used for its medicinal and beauty benefits. The growing interest in health and wellness has further boosted demand, especially in the personal care and pharmaceutical sectors.

Key factors driving this dominance include the traditional use of Amla oil in the region, supported by rising consumer awareness about natural skincare products. Additionally, APAC benefits from a large consumer base that increasingly favors holistic, plant-based alternatives over chemical-laden solutions.

The expanding middle class, particularly in India and China, is contributing to increased consumption of premium natural oils like Amla. Furthermore, a growing number of international brands are entering the market, providing consumers with more options and higher quality products.

Regional Mentions:

- North America: North America is steadily growing in the Amla oil market, driven by rising consumer interest in natural health products. The region’s focus on organic and herbal wellness solutions, particularly in the beauty and personal care industry, is contributing to steady market growth.

- Europe: Europe has shown growing interest in Amla oil, particularly in the organic and wellness sectors. Countries like the UK and Germany are seeing increasing demand for natural beauty products, with Amla oil being promoted for its anti-aging and nourishing properties.

- Middle East & Africa: The Middle East and Africa are experiencing moderate growth in Amla oil adoption, particularly in the health and wellness markets. The region’s interest in traditional, natural remedies and beauty treatments supports Amla oil’s increasing popularity.

- Latin America: Latin America is gradually embracing Amla oil, particularly in the beauty and skincare industries. As consumers seek natural and effective skincare solutions, Amla oil is becoming a key ingredient in beauty products across the region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Amla Oil market is led by key players who have made substantial contributions to the sector’s growth and development. The top four companies—Dabur India Ltd., Emami Ltd., Patanjali Ayurved Ltd., and Bajaj Consumer Care Ltd.—are at the forefront of the industry.

Dabur India Ltd. holds a significant market share due to its extensive product portfolio and strong distribution network. Dabur’s focus on natural products, such as Amla Oil, has made it a trusted name in the Indian and international markets. Their commitment to quality and innovation continues to drive market growth.

Emami Ltd. is another dominant player in the Amla Oil market. Known for its brand Navratna, Emami has a strong consumer base. The company’s focus on Ayurveda and natural ingredients, including Amla Oil, has helped it maintain a competitive edge in the market, particularly in India.

Patanjali Ayurved Ltd., founded by Baba Ramdev, has rapidly gained market share by offering affordable, herbal, and natural products. Patanjali’s Amla Oil offerings have proven to be popular among consumers looking for organic alternatives to conventional beauty products. Their aggressive marketing strategies and wide distribution channels further strengthen their position.

Bajaj Consumer Care Ltd., with its popular brand Bajaj Almond Drops, holds a strong presence in the Amla Oil market. The company’s extensive distribution across both urban and rural markets has helped it become a household name. Its focus on consumer-friendly pricing and consistent product quality ensures it remains a key player in the market.

These companies are driving the growth of the Amla Oil market through their innovative products, strong brand recognition, and strategic marketing efforts.

Major Companies in the Market

- Dabur India Ltd.

- Emami Ltd.

- Patanjali Ayurved Ltd.

- Bajaj Consumer Care Ltd.

- Bio Veda Action Research Co. (Biotique)

- Khadi Natural

- Forest Essentials

- Honasa Consumer Pvt. Ltd. (Mamaearth)

- Naturmed’s

- Ban Labs Ltd. (Nihar Naturals)

Recent Developments

- Dabur India Ltd and Sesa Care Pvt. Ltd: In October 2024, Dabur India Ltd announced its acquisition of a 51% stake in Sesa Care Pvt. Ltd, a prominent Ayurvedic hair care company, for an enterprise value between ₹315-325 crore. This strategic move aims to enhance Dabur’s presence in the ₹900 crore Ayurvedic hair oil market. The merger is expected to conclude within 15 to 18 months, pending necessary approvals.

- Dabur: In September 2023, Dabur’s CEO, Mohit Malhotra, unveiled the “Dabur 2.0” initiative, focusing on repackaging key brands like Dabur Amla hair oil and Vatika shampoo to appeal to a younger demographic. This effort includes redesigning product packaging for improved consumer usability and aims to rejuvenate the brand’s image among modern consumers.

Report Scope

Report Features Description Market Value (2024) USD 0.5 Billion Forecast Revenue (2034) USD 1.0 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pure Amla Oil, Mixed or Blended Amla Oil, Organic Amla Oil, Conventional Amla Oil), By Application (Hair Care, Skin Care, Pharmaceutical or Medicinal Use, Aromatherapy and Wellness), By Distribution Channel (Online Retail, Offline Retail, Specialty Stores, Pharmacies and Drugstores), By End-User (Individual or Personal Use, Commercial or Professional Use, Cosmetic and Skincare Manufacturers, Pharmaceutical and Healthcare Providers), By Packaging (Bottles, Tubes, Jars, Pouches or Sachets) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dabur India Ltd., Emami Ltd., Patanjali Ayurved Ltd., Bajaj Consumer Care Ltd., Bio Veda Action Research Co. (Biotique), Khadi Natural, Forest Essentials, Honasa Consumer Pvt. Ltd. (Mamaearth), Naturmed’s, Ban Labs Ltd. (Nihar Naturals) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dabur

- Marico Limited

- Bajaj Corp Ltd.

- Unilever

- Henkel AG & CO. KGaA

- Bio Veda Action Research Pvt. Ltd.

- Amway