Global AMHS for Semiconductor Market Size, Share, Statistics Analysis Report By Product Type (Overhead Transport (OHT) Systems, Automated Guided Vehicles (AGVs), Stockers, Conveyors, Rail Guided Vehicles (RGVs), Robots / Robotic Arms, Others (Lifters, Load Ports, etc.)), By Wafer Size (200 mm, 300 mm, 450 mm), By Automation Level (Semi-Automated AMHS, Fully Automated AMHS), By Application (Front-End (Wafer Fabrication), Back-End (Assembly & Packaging)), By End-User (Integrated Device Manufacturers (IDMs), Foundries, Outsourced Semiconductor Assembly and Test (OSAT) Providers), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147437

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analyst’s Viewpoint

- US Tariff Impact

- China Market Growth

- Product Type Analysis

- Wafer Size Analysis

- Automation Level Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities for Players

- Recent Developments

- Report Scope

Report Overview

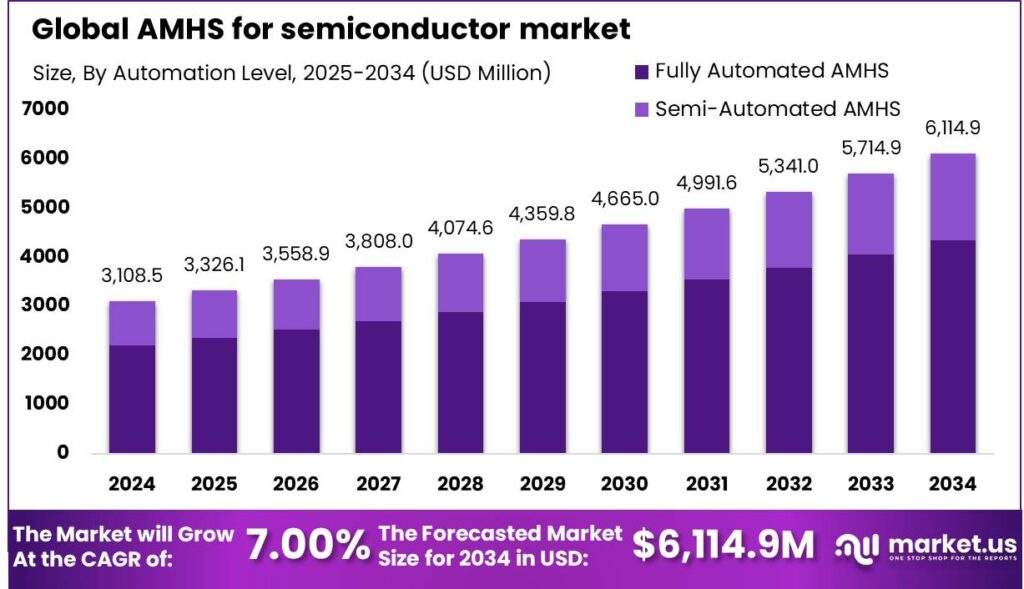

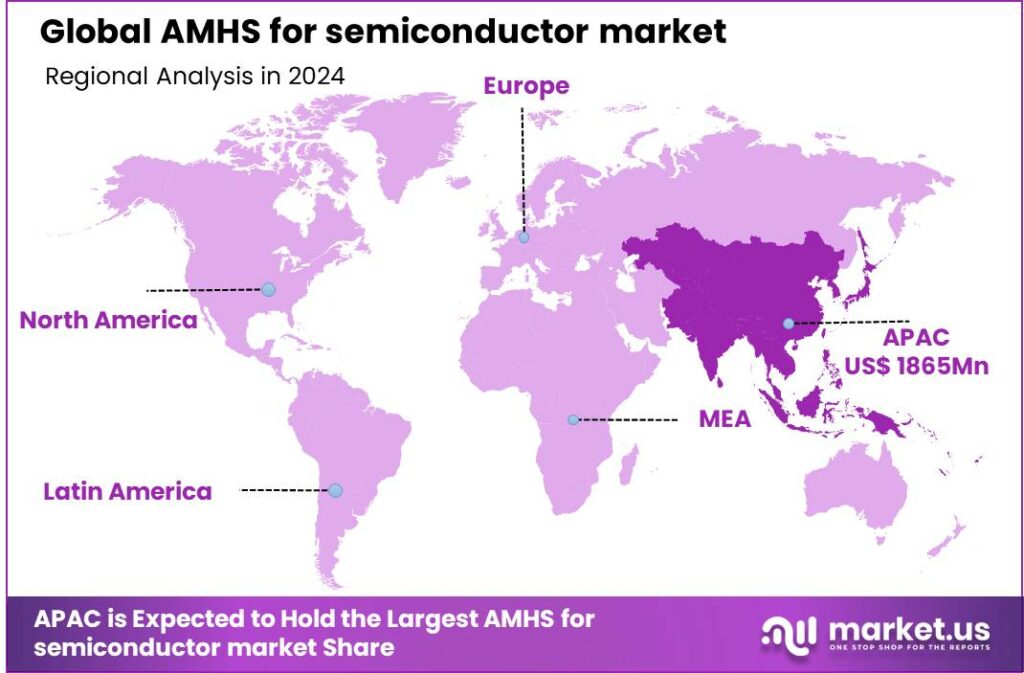

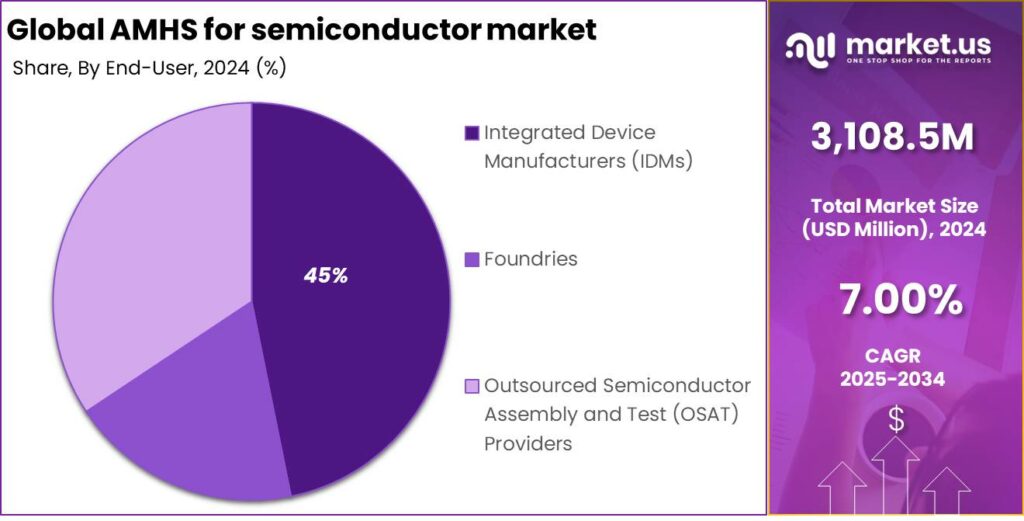

The Global AMHS for semiconductor market size is expected to be worth around USD 6,114.9 Mn By 2034, from USD 3,108.5 Mn in 2024, growing at a CAGR of 7.00% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific dominated the AMHS for semiconductors, with over 60% market share and revenue surpassing USD 1,865 mn. The China market was valued at USD 637.8 mn, driven by advanced manufacturing technologies, and is expected to grow at a 5.6% CAGR.

Automated Material Handling Systems (AMHS) in semiconductor manufacturing use advanced automation to transport materials like silicon wafers and photomasks, minimizing human intervention and contamination risks. These systems, including conveyors, AGVs, and RGVs, enhance efficiency and maintain the precision and cleanliness required in semiconductor production.

Primary growth factors driving the AMHS market in the semiconductor industry include the increasing complexity and miniaturization of semiconductor devices, which demand precise and contamination-free handling solutions. As device architectures shrink, the need for highly accurate and automated material handling becomes essential.

The growing demand for electronic devices, like smartphones and IoT products, is driving the need for higher semiconductor production, increasing the adoption of AMHS to optimize manufacturing. Technological advancements, including integration with IoT and AI, enhance efficiency and support scalable, high-quality semiconductor production.

Technological advancements, including robotics, AI-driven automation, and advanced sensing technologies, are transforming the AMHS landscape. These innovations improve precision and efficiency, while the adoption of Industry 4.0 practices further drives digitalization in semiconductor manufacturing. Together, these technologies enhance handling accuracy and reduce the risk of contamination and damage to semiconductor wafers.

Deploying AMHS in semiconductor manufacturing provides several business benefits. It reduces operational costs by minimizing manual labor and material wastage. AMHS also boosts production efficiency and throughput by ensuring timely and accurate material delivery. This level of automation enhances product consistency and quality, ultimately increasing customer satisfaction.

The AMHS market in the semiconductor industry is poised for further growth as manufacturers invest in smart factory solutions. This expansion extends beyond high-volume hubs to smaller facilities seeking a competitive edge through automation. As the industry shifts towards more complex and miniaturized products, the precision of AMHS becomes crucial, driving ongoing growth and innovation.

Key Takeaways

- The Global AMHS for semiconductor market size is expected to be worth around USD 6,114.9 Million by 2034, up from USD 3,108.5 Million in 2024, growing at a CAGR of 7.00% during the forecast period from 2025 to 2034.

- In 2024, the Overhead Transport (OHT) Systems segment held a dominant market position within the automated material handling systems for the semiconductor industry, capturing more than a 28% share.

- In 2024, the 300 mm segment held a dominant market position in the Automated Material Handling Systems (AMHS) market for semiconductors, capturing more than a 74% share.

- In 2024, the Fully Automated AMHS (Automated Material Handling System) segment held a dominant market position, capturing more than 71% of the global share in the semiconductor sector.

- In 2024, the Front-End (Wafer Fabrication) segment held a dominant market position, capturing more than a 63% share in the AMHS for semiconductor market.

- In 2024, the Integrated Device Manufacturers (IDMs) segment held a dominant market position, capturing more than a 45% share in the AMHS for semiconductor market.

- In 2024, Asia-Pacific held a dominant position in the global AMHS for semiconductor market, capturing over 60% market share, with revenue exceeding USD 1,865 million.

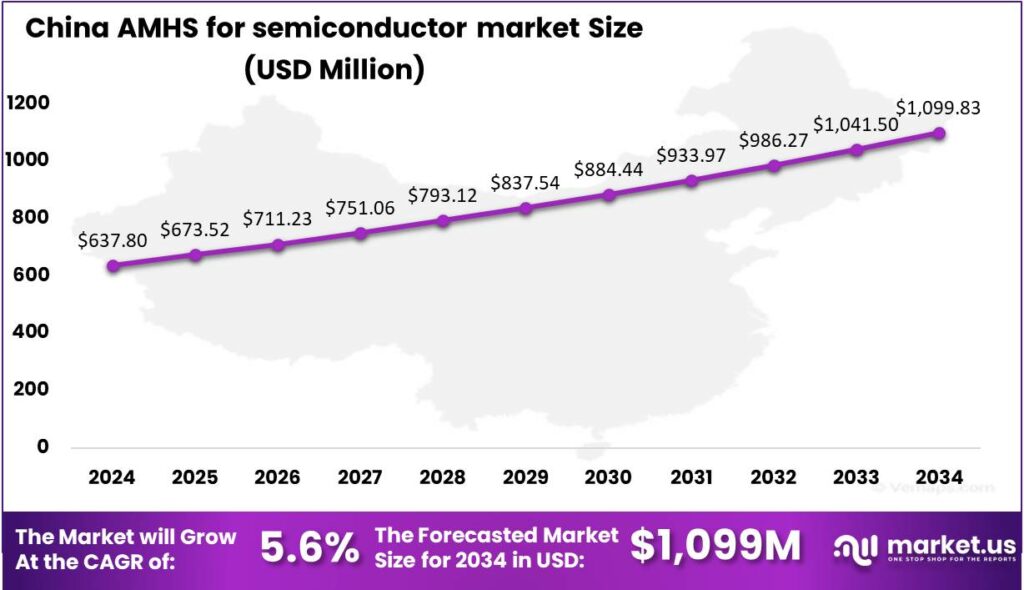

- In 2024, the China Automated Material Handling System (AMHS) market for semiconductors was valued at USD 637.8 million, driven by the country’s push for advanced manufacturing technologies. The market is projected to grow at a CAGR of 5.6% during the forecast period.

Analyst’s Viewpoint

Automated Material Handling Systems (AMHS) play a crucial role in the semiconductor industry, driven by complex chip designs and the need for efficiency. Investment opportunities are robust, particularly in Asia-Pacific, home to major semiconductor hubs.

Rising demand across sectors like electronics, automotive, and healthcare fuels growth, while the integration of AI and machine learning into AMHS presents opportunities to enhance efficiency and reduce maintenance costs.

Technological advancements are driving the evolution of Automated Material Handling Systems (AMHS). The integration of AI enables predictive analytics, allowing systems to anticipate potential issues and optimize material handling processes. Robotics improves precision in wafer handling, minimizing the risk of contamination and damage. These innovations enhance efficiency while delivering substantial cost savings.

The regulatory environment is crucial in shaping the AMHS landscape. Compliance with regulations like the EU’s REACH and the US TSCA is essential, requiring strict control over chemical usage and waste management. These regulations impact the design and operation of AMHS to ensure safety and environmental standards are met.

US Tariff Impact

The imposition of U.S. tariffs in 2025 has introduced significant challenges for the Automated Material Handling Systems (AMHS) market within the semiconductor industry. These tariffs have led to increased costs, supply chain disruptions, and strategic shifts in manufacturing and sourcing practices.

- Rising Costs and Supply Chain Disruptions – The U.S. government’s decision to double tariffs on Chinese semiconductor imports – from 25% to 50% – has directly impacted the cost structure of AMHS components, many of which are sourced from China. This escalation has led to increased production costs for semiconductor track systems, particularly for memory chips and fully automatic systems, resulting in higher prices for U.S. consumers and manufacturers.

- Reshoring and Diversification – In response to the tariffs, many companies in the industrial control and factory automation sectors have begun reshoring (bringing production back to the U.S.) or nearshoring (shifting production to nearby countries, such as Mexico or Canada). This move is driven by the desire to reduce tariff-related costs and enhance supply chain resilience.

- Opportunities Amid Challenges – Despite the immediate challenges posed by the tariffs, the long-term outlook for the AMHS market in the semiconductor industry remains cautiously optimistic. The ongoing demand for advanced memory chips and automation in semiconductor fabrication plants is expected to continue fueling the market’s expansion, especially in North America and the Asia-Pacific regions.

China Market Growth

In 2024, the China Automated Material Handling System (AMHS) market for semiconductors was valued at approximately USD 637.8 million, reflecting the nation’s accelerated push toward advanced manufacturing technologies in semiconductor fabrication.

The rising need for automation in wafer fabrication, packaging, and testing is driving AMHS adoption in Chinese semiconductor foundries. To handle higher volumes and enhance cleanroom efficiency, manufacturers are turning to AMHS to optimize material flow, cut human error, and maintain ultra-clean conditions.

The market is expected to grow at a compound annual growth rate (CAGR) of 5.6% during the forecast period, supported by a combination of domestic policy incentives, increasing chip design startups, and rising investments in front-end and back-end fabs. Growth is further driven by China’s push for semiconductor self-reliance amid global supply chain uncertainties.

China’s demand for AMHS is driven by its semiconductor expansion plans and local subsidies. Leading firms are partnering with global automation experts to adopt advanced, modular AMHS technologies. As China moves to more advanced process nodes, AMHS will be crucial for productivity, consistency, and contamination control, making them key to the country’s semiconductor competitiveness.

In 2024, Asia-Pacific held a dominant position in the global AMHS (Automated Material Handling Systems) for semiconductor market, capturing over 60% market share, with revenue exceeding USD 1,865 million. This regional dominance is primarily driven by the concentration of major semiconductor fabrication hubs in countries like China, Taiwan, South Korea, and Japan.

Countries with major foundries like TSMC, Samsung, and SMIC are heavily investing in next-gen automation to increase wafer throughput, reduce cycle time, and improve yield. The surge in local semiconductor demand, alongside government-backed investments in fab capacity, has led to widespread adoption of AMHS solutions in both new and existing fabs.

South Korea and Taiwan lead in advanced node manufacturing (below 7nm), where precise material handling is crucial for high yield rates. Growth in backend packaging and testing is further driving AMHS demand. Meanwhile, North America, supported by Intel, GlobalFoundries, and the CHIPS Act, ranks second in market share.

The region’s overall share remains smaller than Asia-Pacific’s due to fewer operational fabs. Europe is seeing moderate growth, mainly in specialized areas like automotive semiconductors. Latin America, the Middle East, and Africa are emerging markets with limited semiconductor infrastructure, where AMHS adoption is still in early stages, often limited to pilot projects or small upgrades.

Product Type Analysis

In 2024, the Overhead Transport (OHT) Systems segment held a dominant market position within the automated material handling systems for the semiconductor industry, capturing more than a 28% share. This segment leads due to the system’s efficiency in managing high wafer traffic while preserving a clean environment essential for semiconductor manufacturing. OHT systems are preferred for their compact footprint, which is crucial for space optimization in cleanroom facilities.

OHT systems are essential in semiconductor fabrication plants due to their ability to minimize human intervention. By transporting delicate materials above the production area, they significantly reduce the risk of contamination, which is common with ground-level transport methods, ensuring a more efficient and precise manufacturing process.

OHT systems are highly preferred by semiconductor manufacturers due to their adaptability to existing systems and scalability for future growth. As semiconductor processes evolve with smaller chips and more complex circuits, their flexibility to meet changing operational needs solidifies their market leadership.

Ongoing innovations in OHT technology, such as advancements in speed, precision, and automation, reinforce their market leadership. Manufacturers are increasingly investing in OHT systems to capitalize on these improvements, boosting throughput, reducing wafer handling times, and driving greater production efficiencies in semiconductor manufacturing.

Wafer Size Analysis

In 2024, the 300 mm segment held a dominant market position in the Automated Material Handling Systems (AMHS) market for semiconductors, capturing more than a 74% share. This dominance is attributed to several key factors that underscore the segment’s central role in modern semiconductor manufacturing.

The 300 mm wafer size has become the standard in semiconductor production, offering cost-effectiveness and higher yield per wafer. This size enables manufacturers to produce more chips, a key factor in high-volume production. Consequently, demand for AMHS capable of handling 300 mm wafers efficiently has risen, driving the segment’s expanding market share.

The infrastructure for 300 mm wafer production is well-established, with many semiconductor fabs optimized for 300 mm processing and equipped with compatible equipment. This widespread adoption has increased demand for AMHS solutions that integrate seamlessly with existing production lines, reinforcing the dominance of this segment.

Advancements in technology for 300 mm wafer handling have driven the development of more sophisticated AMHS solutions. Innovations in robotics and precision engineering have improved the speed and accuracy of wafer handling, ensuring the integrity and quality of the wafers throughout the production process.

Automation Level Analysis

In 2024, the Fully Automated AMHS (Automated Material Handling System) segment held a dominant market position, capturing more than 71% of the global share in the semiconductor sector. This dominance is driven by the growing demand for high precision, speed, and contamination-free environments in semiconductor fabrication.

The rise of fully automated AMHS is fueled by the shift to smart factories, offering real-time data integration and process visibility. These systems handle thousands of wafer cassettes daily, boosting productivity with shorter cycle times. Fabs in Asia-Pacific and North America are adopting these systems to meet rising demand for advanced chips in electronics, automotive, and 5G.

The Semi-Automated AMHS segment caters to fabs with limited budgets or older infrastructure, typically in small-scale or legacy facilities. These systems offer a mix of automation and manual handling but lack the scalability and speed needed for next-gen wafer production. As chipmakers modernize, the segment’s market share is gradually declining.

The preference for fully automated AMHS is driven by the need for cleanroom contamination control, workforce safety, and 24/7 operations. As fabs move towards lights-out manufacturing, demand for intelligent, self-operating systems grows. With innovations in sensors, AI-driven logistics, and modular designs, the fully automated AMHS segment is set to remain a key player in the industry’s future automation strategies.

Application Analysis

In 2024, the Front-End (Wafer Fabrication) segment held a dominant market position, capturing more than a 63% share in the AMHS for semiconductor market. This dominance is driven by the growing complexity and miniaturization of integrated circuits, which require ultra-clean environments and precise material handling to avoid yield losses.

The front-end process involves critical steps like photolithography, etching, and deposition, requiring precise timing and coordination. AMHS ensures wafers are safely and quickly transferred between tools, maintaining cleanroom integrity. Robotic arms, OHT systems, and automated storage units are increasingly used in front-end fabs to improve uptime and reduce human intervention.

The rapid capacity expansion of leading foundries like TSMC, Samsung, and Intel has driven increased demand for front-end AMHS. As companies invest in upgrading automation for advanced nodes like 5nm and 3nm, the shift to EUV lithography demands highly synchronized, contamination-free material handling, further enhancing the segment’s importance.

The Back-End (Assembly & Packaging) segment, while important, has less stringent requirements and still relies on manual and semi-automated solutions, slowing high-end AMHS adoption. In contrast, the front-end segment sees stronger growth due to technological advances, more wafer starts, and the critical role of AMHS in reducing cycle times and boosting productivity.

End-User Analysis

In 2024, the Integrated Device Manufacturers (IDMs) segment held a dominant market position, capturing more than a 45% share in the AMHS for semiconductor market. This leadership can be attributed to the vertically integrated nature of IDMs, where both front-end wafer fabrication and back-end assembly processes are managed under one roof.

IDMs, with higher capital investments and control over the semiconductor value chain, can implement advanced automation like OHT, AGVs, and smart stockers. Given their high-volume manufacturing models, delays or errors in wafer transfer can lead to significant losses, driving stronger demand for fully automated AMHS in this segment.

The growing demand for advanced logic chips and memory, driven by AI, automotive, and data center applications, is pushing IDMs to expand fab capacities and improve throughput. Companies like Intel, Micron, and Texas Instruments are investing heavily in new and upgraded fabs, many incorporating next-generation AMHS technologies, further driving AMHS deployment in IDM environments.

Foundries implement AMHS in phases based on client projects, while OSAT providers prioritize cost-efficiency over full automation. As a result, the IDM segment remains the largest contributor to AMHS demand, driven by comprehensive production control, high-volume output, and a strong need for integrated cleanroom automation.

Key Market Segments

By Product Type

- Overhead Transport (OHT) Systems

- Automated Guided Vehicles (AGVs)

- Stockers

- Conveyors

- Rail Guided Vehicles (RGVs)

- Robots / Robotic Arms

- Others (Lifters, Load Ports, etc.)

By Wafer Size

- 200 mm

- 300 mm

- 450 mm

By Automation Level

- Semi-Automated AMHS

- Fully Automated AMHS

By Application

- Front-End (Wafer Fabrication)

- Back-End (Assembly & Packaging)

By End-User

- Integrated Device Manufacturers (IDMs)

- Foundries

- Outsourced Semiconductor Assembly and Test (OSAT) Providers

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Operational Efficiency and Cost Reduction

The semiconductor industry requires precision, cleanliness, and efficiency, which Automated Material Handling Systems (AMHS) help achieve. By automating wafer and material transport within fabrication facilities, AMHS reduce human intervention, minimizing contamination and errors. A key advantage is improved operational efficiency, as automated systems run continuously without fatigue, increasing throughput and maintaining consistent production rates.

AMHS improve space utilization in cleanrooms by using overhead transport and vertical storage, allowing for more equipment and processes in the same area. This is essential as the industry transitions to larger wafer sizes, like 300mm and beyond, which require more space. Additionally, AMHS offer real-time tracking and monitoring, improving inventory management, traceability, and ensuring compliance with quality control and industry standards.

Restraint

High Initial Capital Investment

The high initial capital investment for implementing AMHS presents a significant barrier for SMEs, with costs for purchasing, installing, and integrating automated systems being prohibitive. Additionally, retrofitting legacy equipment in semiconductor plants for automation requires extensive modifications, resulting in substantial costs and production downtime.

The complexity of AMHS requires specialized maintenance and technical support, driving up operational costs. Finding skilled personnel to manage these systems can be difficult, especially in areas with limited expertise. Moreover, the fast pace of technological advancements in the semiconductor industry heightens concerns about investing in systems that could quickly become obsolete, raising doubts about the return on investment.

Opportunity

Integration of AI and IoT for Smart Manufacturing

The integration of AI and IoT enhances AMHS in semiconductor manufacturing by enabling real-time decision-making, predictive maintenance, and adaptive optimization. AI algorithms analyze data from IoT sensors to predict equipment failures and optimize material routing and scheduling, reducing downtime and improving system efficiency.

IoT-enabled AMHS provide real-time visibility into material movement, enhancing responsiveness and flexibility in manufacturing, crucial for just-in-time production and meeting semiconductor customization demands. The integration of AI and IoT ensures seamless communication across systems, promoting interoperability, adaptive operations, and improved resource management and product quality.

Challenge

Adapting the workforce and integrating with legacy systems

A major challenge in implementing AMHS in semiconductor manufacturing is integrating advanced systems with existing legacy equipment. Many facilities use machinery and infrastructure not designed for automation, making the integration process both complex and expensive.

Legacy systems often lack compatibility with modern AMHS, requiring costly modifications or replacements, which can disrupt production and demand extensive testing for reliability. The transition to automation also requires employees to acquire new skills to operate, monitor, and maintain advanced systems. In regions with limited training access, this can be a significant challenge.

Emerging Trends

The semiconductor sector is undergoing a major transformation in material handling, with AMHS leading the way. A key trend is the integration of AI and IoT into AMHS, which enhances real-time decision-making and predictive maintenance. This integration improves operational responsiveness and efficiency, allowing systems to adapt quickly to the evolving demands of semiconductor fabrication.

Modular system designs are gaining traction, offering scalability and flexibility to accommodate varying production volumes and facility layouts. These designs enable manufacturers to customize their AMHS configurations, aligning with specific operational requirements and facilitating easier upgrades or expansions.

The adoption of Overhead Hoist Transport (OHT) systems is growing, particularly in facilities handling 300mm wafers. OHT systems optimize cleanroom space and reduce contamination risks by transporting materials above the production floor. This approach improves operational efficiency while maintaining the strict cleanliness standards essential in semiconductor fabrication.

Business Benefits

Key business benefits of implementing AMHS include reduced human intervention, which lowers the risk of contamination and defects a critical factor in semiconductor manufacturing where even small impurities can affect product quality. AMHS ensure clean and precise handling, leading to higher yield rates, improved product performance, and ultimately, greater operational efficiency.

Implementing AMHS reduces the need for manual labor in material transport and handling tasks. This not only lowers labor costs but also reallocates human resources to more value-added activities. The automation of routine tasks enhances workforce productivity and allows for better utilization of skilled labor.

AMHS reduce workplace injuries by automating material handling, minimizing manual lifting and transport. This contributes to a safer working environment and helps companies comply with occupational health and safety regulations. The reduction in manual handling also decreases the likelihood of accidents and associated costs.

Key Player Analysis

Daifuku Co., Ltd. is widely recognized as the global leader in the AMHS market. Daifuku specializes in highly automated, integrated systems for major semiconductor manufacturers. Their reliable, scalable, and precise cleanroom AMHS solutions are tailored for fabs and support future wafer size expansion. Ongoing R&D in AI and digital twins boosts predictive maintenance and system efficiency, giving them a competitive advantage.

Murata Machinery, Ltd., often called “Muratec,” is another major player with strong capabilities in both intra-bay and inter-bay AMHS solutions. Muratec’s systems, known for their compact and energy-efficient designs, are widely used in advanced fabs that demand high throughput and minimal downtime. Their focus on sustainable and smart manufacturing solutions ensures they remain relevant in the rapidly evolving chipmaking industry.

SFA Engineering Corp. has emerged as a rising star in the AMHS market, particularly in Asia. They specialize in full automation of semiconductor processes, including robotic handling and conveyor systems tailored for next-gen fabs. SFA’s uniqueness lies in their deep customization and cost-competitive offerings, which appeal to both large and mid-sized semiconductor companies.

Top Key Players in the Market

- Daifuku Co., Ltd.

- Murata Machinery, Ltd.

- SFA Engineering Corp.

- Shin Material Handling Co., Ltd.

- Mitsubishi Electric Corporation

- Kardex Group

- System Logistics S.p.A.

- Beumer Group GmbH & Co. KG

- SSI Schaefer AG

- Dematic GmbH & Co. KG

- Swisslog Holding AG

- Vanderlande Industries B.V.

- Honeywell Intelligrated

- Bastian Solutions, Inc.

- Egemin Automation Inc.

- Fives Group

- TGW Logistics Group GmbH

- Knapp AG

- Mecalux, S.A.

- Interroll Holding AG

- Othes

Top Opportunities for Players

- Integration with Industry 4.0: As semiconductor manufacturing plants increasingly adopt Industry 4.0 technologies, there is a significant opportunity for AMHS providers to integrate with smart factory setups. This includes leveraging IoT, AI, and machine learning to enhance the efficiency and automation levels of material handling systems.

- Advanced Wafer Handling Solutions: With the transition to smaller node sizes in semiconductor manufacturing, such as 7nm and 5nm technologies, the need for more precise and contamination-free wafer handling solutions grows. AMHS manufacturers can capitalize on developing systems that offer greater precision and reduce the risk of wafer damage.

- Expansion into Emerging Markets: Semiconductor manufacturing is expanding in regions like Southeast Asia and India, driven by local government initiatives and growing local demand. AMHS providers have the opportunity to establish a strong presence in these emerging markets, adapting their solutions to local needs and regulations.

- Customization and Flexibility: There is a growing demand for flexible and modular AMHS solutions that can easily adapt to different production environments and scales. Opportunities exist for systems that offer scalability and customization, allowing semiconductor manufacturers to adjust swiftly to changes in production volume or processes.

- Sustainability and Energy Efficiency: As sustainability becomes a more pressing concern, semiconductor manufacturers are looking for ways to reduce their environmental impact. AMHS that minimize energy consumption and optimize logistics and material flow to reduce waste offer significant market opportunities.

Recent Developments

- In November 2024, Swisslog entered a partnership with a major chipmaker to implement AI-driven AMHS for smart fab operations. The system optimizes wafer movement and reduces downtime using machine learning.

- In June 2024, Daifuku launched an upgraded AMHS for 300mm wafer fabs, featuring faster transport speeds and AI-driven predictive maintenance. This system aims to improve efficiency in semiconductor manufacturing plants.

Report Scope

Report Features Description Market Value (2024) USD 3,108.5 Mn Forecast Revenue (2034) USD 6,114.9 Mn CAGR (2025-2034) 7.00% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Overhead Transport (OHT) Systems, Automated Guided Vehicles (AGVs), Stockers, Conveyors, Rail Guided Vehicles (RGVs), Robots / Robotic Arms, Others (Lifters, Load Ports, etc.)), By Wafer Size (200 mm, 300 mm, 450 mm), By Automation Level (Semi-Automated AMHS, Fully Automated AMHS), By Application (Front-End (Wafer Fabrication), Back-End (Assembly & Packaging)), By End-User (Integrated Device Manufacturers (IDMs), Foundries, Outsourced Semiconductor Assembly and Test (OSAT) Providers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Daifuku Co., Ltd., Murata Machinery, Ltd., SFA Engineering Corp., Shin Material Handling Co., Ltd., Mitsubishi Electric Corporation, Kardex Group, System Logistics S.p.A., Beumer Group GmbH & Co. KG, SSI Schaefer AG, Dematic GmbH & Co. KG, Swisslog Holding AG, Vanderlande Industries B.V., Honeywell Intelligrated, Bastian Solutions, Inc., Egemin Automation Inc., Fives Group, TGW Logistics Group GmbH, Knapp AG, Mecalux, S.A., Interroll Holding AG, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AMHS for Semiconductor MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

AMHS for Semiconductor MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Daifuku Co., Ltd.

- Murata Machinery, Ltd.

- SFA Engineering Corp.

- Shin Material Handling Co., Ltd.

- Mitsubishi Electric Corporation

- Kardex Group

- System Logistics S.p.A.

- Beumer Group GmbH & Co. KG

- SSI Schaefer AG

- Dematic GmbH & Co. KG

- Swisslog Holding AG

- Vanderlande Industries B.V.

- Honeywell Intelligrated

- Bastian Solutions, Inc.

- Egemin Automation Inc.

- Fives Group

- TGW Logistics Group GmbH

- Knapp AG

- Mecalux, S.A.

- Interroll Holding AG

- Othes