Global Semiconductor OHT (Overhead Hoist Transport) Market Size, Share, Statistics Analysis Report By Carrier Types (12 Inches FOUP, 6/8 Inches SMIF Pod, Others), By Trasnport Type (Inter-bay Transport, Intra-bay Transport), By Application (200mm Wafer FAB, 300mm Wafer FAB, 450mm Wafer FAB), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141589

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- China Market Size

- Analysts’ Viewpoint

- Carrier Types Analysis

- Transport Type Analysis

- Application Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

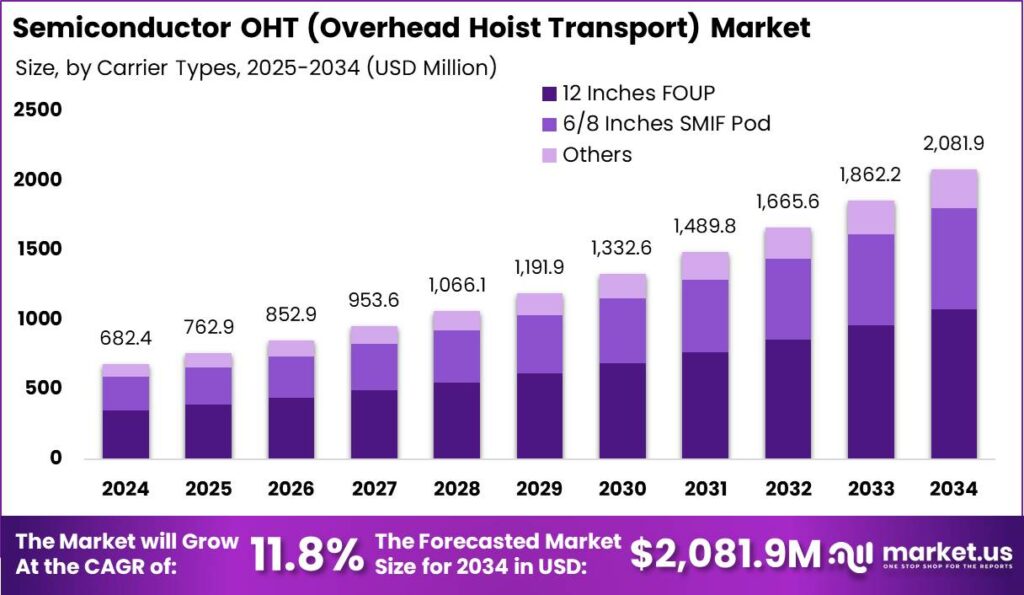

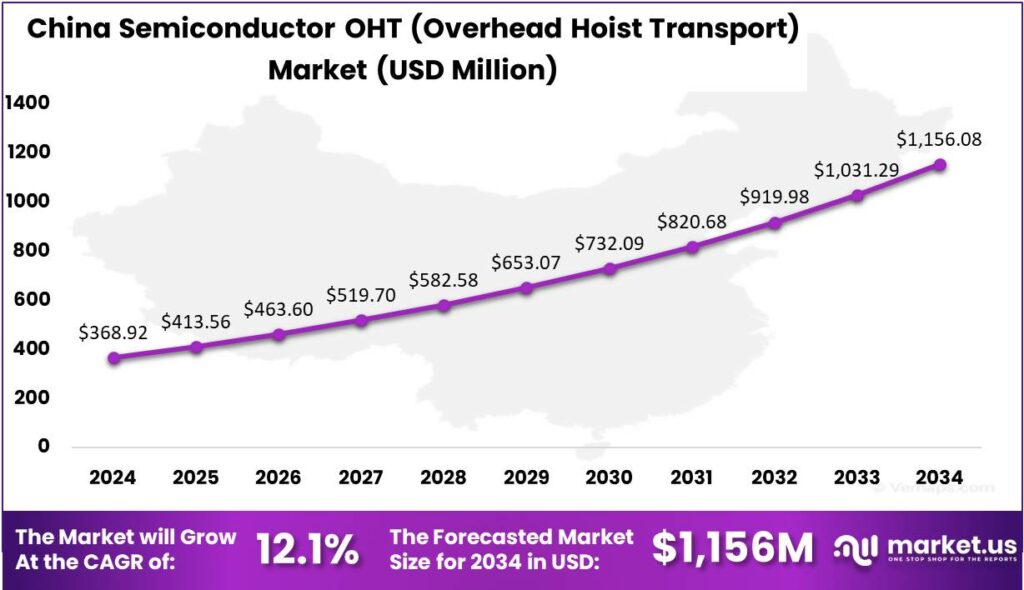

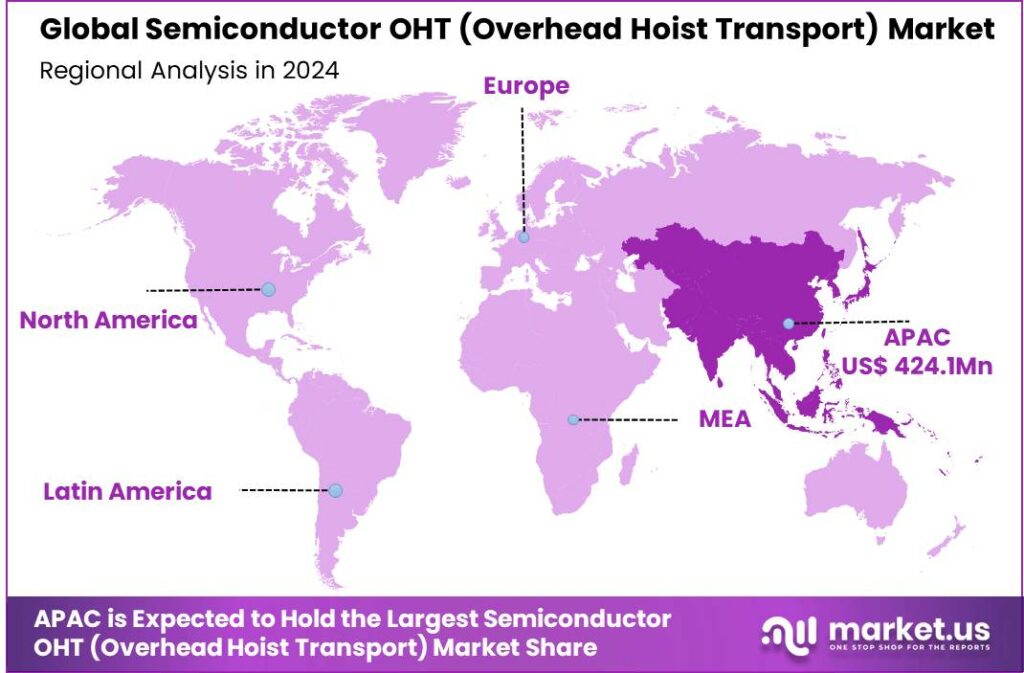

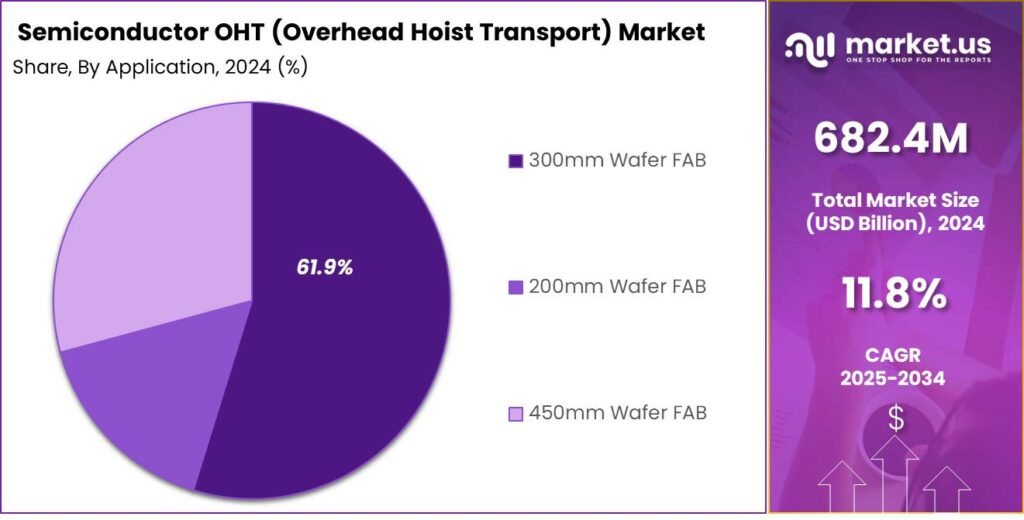

The Semiconductor OHT (Overhead Hoist Transport) Market size is expected to be worth around USD 2,081.9 Mn By 2034, from USD 682.4 Mn in 2024, growing at a CAGR of 11.8% during the forecast period. In 2024, Asia-Pacific led the Semiconductor OHT market with 62.15% market share and USD 424.1 Mn in revenues. The OHT market in China was valued at USD 368.92 Mn, CAGR of 12.1%.

Semiconductor Overhead Hoist Transport (OHT) systems are crucial in the automated movement of wafers within semiconductor manufacturing facilities. These systems operate on aerial tracks, automating the transport of Front Opening Unified Pods (FOUPs) which contain semiconductor wafers. This automation is essential for maintaining the delicate handling required in wafer processing, minimizing human error, and increasing manufacturing efficiency.

The global market for Semiconductor OHT systems is experiencing robust growth, driven by the expanding semiconductor industry. As the demand for electronic devices surges, semiconductor manufacturers are investing in advanced automation technologies to increase production capacity and improve operational efficiencies. The market’s expansion can be attributed to the increasing complexity of semiconductor device fabrication, which necessitates highly sophisticated and reliable material handling solutions.

Several key factors are propelling the growth of the Semiconductor OHT market. First, the ongoing miniaturization of electronic devices demands more precise and efficient handling systems to manage smaller and more delicate wafers. Additionally, the global increase in semiconductor production capacities, especially in regions like Asia Pacific and North America, boosts the demand for advanced OHT systems.

The demand for Semiconductor OHT systems is particularly strong in markets with high technological advancement and substantial semiconductor production. Countries such as South Korea, Taiwan, and the United States are leading consumers of OHT systems, driven by their substantial investments in semiconductor manufacturing capacities.

Key Takeaways

- The Global Semiconductor OHT (Overhead Hoist Transport) Market size is expected to reach USD 2,081.9 Million by 2034, up from USD 682.4 Million in 2024, with a CAGR of 11.80% during the forecast period from 2025 to 2034.

- In 2024, the 12 Inches FOUP (Front Opening Unified Pod) segment held a dominant market position within the Semiconductor OHT market, capturing more than a 51.7% share.

- The Inter-bay Transport segment also held a dominant position in the Semiconductor OHT market in 2024, with a share exceeding 68.5%.

- In 2024, the 300mm Wafer FAB segment was the leader in the Semiconductor OHT market, accounting for over 61.9% of the total market share.

- The Overhead Hoist Transport (OHT) market in China was estimated to be valued at USD 368.92 million in 2024, and it is projected to grow at a CAGR of 12.1%.

- Asia-Pacific dominated the Semiconductor Overhead Hoist Transport (OHT) market in 2024, holding over 62.15% of the market share, with revenues totaling USD 424.1 million.

- The OHT market in China was valued at USD 368.92 million in 2024, and it is expected to grow at a CAGR of 12.1%.

China Market Size

The Overhead Hoist Transport (OHT) market in China was estimated to be valued at USD 368.92 million in the year 2024. It is projected to grow at a compound annual growth rate (CAGR) of 12.1%.

This significant growth is driven by factors such as China’s booming semiconductor industry, increased investments in manufacturing facilities, and supportive government policies. OHT systems are essential for efficiently transporting semiconductor wafers through clean rooms during fabrication, ensuring precision and reliability.

Additionally, the rising demand for electronic devices and the integration of advanced technologies like IoT and AI across various sectors are set to drive the need for more sophisticated semiconductor components. This will likely increase the demand for faster and more efficient OHT systems, supporting continued market growth in the near future.

In 2024, Asia-Pacific held a dominant market position in the semiconductor Overhead Hoist Transport (OHT) market, capturing more than a 62.15% share with revenues amounting to USD 424.1 million. This leading position is due to the region’s strong semiconductor manufacturing capabilities, with China, South Korea, and Taiwan leading production.

The significant growth of the Asia-Pacific region is closely tied to strategic government initiatives to strengthen the semiconductor industry. China’s Made in China 2025 plan and South Korea’s investments aim to decrease reliance on foreign technology and promote local innovation and production.

Furthermore, the rising demand for consumer electronics, particularly smartphones, tablets, and other smart devices in the Asia-Pacific region, has propelled the semiconductor industry’s growth. As devices become more technologically advanced, the complexity of semiconductor chips increases, necessitating the use of sophisticated OHT systems in their production.

The expansion of 5G technology and its integration into sectors like automotive and industrial applications in Asia-Pacific is expected to further drive the semiconductor OHT market. The demand for high-speed data processing and connectivity in these applications requires advanced semiconductor chips, boosting the growth of the OHT market in the region.

Analysts’ Viewpoint

The Semiconductor OHT market presents substantial investment opportunities, especially in the development and implementation of more intelligent and adaptable systems. Investors and companies can look towards sectors that are integrating Internet of Things (IoT) capabilities and artificial intelligence (AI) to enhance the functionality and efficiency of OHT systems.

The OHT market is experiencing rapid technological evolution, with newer models incorporating AI to predict maintenance needs and IoT for better integration with other factory systems. These advancements are aimed at reducing downtime and increasing throughput, crucial for the cost-intensive operations of semiconductor manufacturing.

The regulatory environment for Semiconductor OHT systems is primarily focused on safety and efficiency. Regulations often dictate the design and operation standards to ensure that these systems do not compromise the cleanroom environment’s integrity. Compliance with international safety standards such as ISO and SEMI is crucial for manufacturers to gain acceptance in global markets.

Carrier Types Analysis

In 2024, the 12 Inches FOUP (Front Opening Unified Pod) segment held a dominant market position within the Semiconductor OHT (Overhead Hoist Transport) market, capturing more than a 51.7% share. This leading position is due to key factors that underscore the segment’s vital role in the semiconductor manufacturing process.

The dominance of the 12-inch FOUP segment is due to its widespread use in advanced semiconductor fabs handling 300 mm wafers. These FOUPs protect wafers from contamination and damage while enabling efficient transport and storage in cleanrooms. Their ability to handle multiple wafers boosts throughput and efficiency in high-volume manufacturing.

Additionally, the push towards higher density chips and more complex circuit designs has necessitated the use of larger wafers, thereby increasing the reliance on 12-inch FOUPs. These carriers are perfectly suited to meet the demands of next-generation semiconductor devices, which require precise and contamination-free handling to maintain yield rates.

Technological advancements in semiconductor manufacturing, such as EUV lithography, have further increased the need for robust and reliable wafer transport systems like 12-inch FOUPs. As these technologies become more widespread, the value of using 12-inch FOUPs grows, solidifying their dominant market position.

Transport Type Analysis

In 2024, the Inter-bay Transport segment held a dominant position in the semiconductor overhead hoist transport (OHT) market, capturing more than 68.5% of the market share. This segment primarily benefits from the extensive need to connect various buildings or facilities within the same semiconductor manufacturing campus.

One of the key factors driving the dominance of the Inter-bay Transport segment is its critical role in optimizing the logistics and flow of semiconductor manufacturing. These systems are designed to handle long-distance transport of materials, crucial for maintaining a smooth and uninterrupted production line across multiple buildings.

The Inter-bay Transport segment leads due to the integration of advanced technologies like automation and real-time tracking systems. These innovations improve efficiency and reliability, minimizing delays and errors in material transport. Integration with manufacturing execution systems (MES) further enhances scheduling and reduces wafer travel time, boosting overall productivity.

The growth and dominance of the Inter-bay Transport segment is driven by the expanding scale and geographic spread of semiconductor fabs. As manufacturers aim to optimize production and cut costs, the need for inter-bay transport systems becomes crucial, linking different parts of large manufacturing sites.

Application Analysis

In 2024, the 300mm Wafer FAB segment held a dominant market position within the semiconductor Overhead Hoist Transport (OHT) market, capturing more than a 61.9% share.This segment’s leadership stems from the widespread adoption of 300mm wafers in semiconductor manufacturing, offering greater cost-effectiveness and higher capacity than 200mm wafers.

The shift from 200mm to 300mm wafers, supported by technological advancements and investments in fabrication facilities, is driven by the demand for more powerful, energy-efficient chips. As the industry evolves, the strong demand for 300mm wafer fabrication will continue to reinforce the segment’s leading position in the OHT market.

The 300mm Wafer FAB segment benefits from a mature supply chain and infrastructure, with many leading semiconductor producers standardizing on 300mm technology. This has created a stable ecosystem of equipment suppliers, including OHT systems, supporting continued investments and upgrades in the segment.

The growing use of semiconductors in emerging technologies like AI, IoT, and autonomous vehicles will drive further growth in the 300mm Wafer FAB segment. These applications require high-performance chips, which are most efficiently produced on 300mm wafers, ensuring the segment’s continued market dominance.

Key Market Segments

By Carrier Types

- 12 Inches FOUP

- 6/8 Inches SMIF Pod

- Others

By Transport Type

- Inter-bay Transport

- Intra-bay Transport

By Application

- 200mm Wafer FAB

- 300mm Wafer FAB

- 450mm Wafer FAB

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Demand for Advanced Semiconductor Devices

The relentless pursuit of miniaturization and enhanced performance in electronic devices has led to a surge in demand for advanced semiconductor components. This trend is largely driven by the proliferation of technologies such as artificial intelligence, 5G communications, and the Internet of Things (IoT), all of which require sophisticated semiconductor solutions.

To meet these demands, semiconductor manufacturers are compelled to adopt highly automated and efficient production processes. OHT systems, designed for precise and safe material handling, become indispensable in this context.

They enable smooth wafer transport in fabrication facilities, reducing human intervention and minimizing the risk of contamination or damage. This automation boosts production efficiency while ensuring the high-quality standards needed for advanced semiconductor devices.

Restraint

High Initial Implementation Costs

The adoption of OHT systems is often hindered by substantial initial investment requirements. The costs associated with purchasing, installing, and integrating these systems into existing manufacturing infrastructures can be prohibitive, especially for small to medium-sized enterprises. Additionally, the need for specialized infrastructure to support OHT operations further escalates the financial burden.

This high capital expenditure can deter companies from implementing OHT solutions, particularly when immediate returns on investment are not evident. Moreover, the complexity of these systems necessitates skilled personnel for operation and maintenance, adding to the overall operational costs. While large corporations may absorb these expenses, smaller players might find it challenging to justify such investments, potentially slowing the widespread adoption of OHT technology.

Opportunity

Integration with Industry 4.0 Technologies

The advent of Industry 4.0, characterized by the integration of cyber-physical systems, IoT, and cloud computing in manufacturing, presents a significant opportunity for the semiconductor OHT market. By incorporating advanced sensors and connectivity features, OHT systems can evolve into intelligent transport solutions capable of real-time data collection and analysis.

Furthermore, data-driven optimization of material flow can enhance overall production efficiency. For instance, integrating artificial intelligence algorithms allows OHT systems to adapt to dynamic production schedules, ensuring timely delivery of materials to various processing stations.

Embracing these technological advancements not only improves the functionality of OHT systems but also aligns semiconductor manufacturing processes with the broader trend toward smart factories, offering a competitive edge to adopters.

Challenge

Ensuring System Reliability and Minimizing Downtime

In the fast-paced environment of semiconductor manufacturing, any disruption can lead to significant financial losses and production delays. OHT systems, while enhancing automation, introduce potential points of failure that can impact the entire production line. Ensuring system reliability is crucial, as issues like wear, software glitches, or connectivity problems can cause unexpected downtimes.

Addressing these challenges requires robust system design, regular maintenance schedules, and the implementation of redundancy measures to mitigate risks. Additionally, training personnel to respond swiftly to system anomalies is crucial in minimizing the impact of any disruptions. Manufacturers must balance the benefits of automation with the imperative of maintaining continuous, fault-free operations to fully capitalize on the advantages offered by OHT systems.

Emerging Trends

One notable trend is the adoption of Artificial Intelligence (AI) and the Internet of Things (IoT) in OHT systems. By incorporating AI algorithms and IoT sensors, these systems can monitor operations in real-time, predict maintenance needs, and optimize routes for material handling. This integration leads to reduced downtime and increased productivity.

Another emerging development is the creation of ultra-high-speed OHT systems. As semiconductor manufacturing demands faster throughput, these high-speed transports enable quicker movement of materials between processing stations, thereby enhancing overall production efficiency.

Moreover, the integration of OHT systems with other factory automation solutions is gaining traction. This holistic approach ensures seamless communication between various automated systems, resulting in synchronized operations and improved manufacturing workflows.

Collaborative robots, or cobots, are also being incorporated into material handling tasks alongside OHT systems. These robots work in tandem with human operators, enhancing flexibility and safety in the manufacturing environment.

Business Benefits

OHT systems optimize space utilization within fabrication facilities. By transporting materials overhead, they free up valuable floor space, allowing for better organization and the accommodation of additional equipment or production lines.

These systems improve safety and ergonomics for workers. By automating the movement of heavy or hazardous materials, OHT systems reduce the risk of workplace injuries associated with manual handling, leading to a safer working environment.

OHT systems enhance production efficiency. They enable precise and timely delivery of materials to various processing stations, minimizing delays and ensuring a smooth production flow. This efficiency can result in higher throughput and reduced cycle times.

Furthermore, the scalability of OHT systems supports business growth. As production demands increase, these systems can be expanded or reconfigured to accommodate new requirements without significant overhauls, providing flexibility in manufacturing strategies.

Key Player Analysis

DAIFUKU is a prominent player in the semiconductor OHT market, known for its advanced automation solutions. The company specializes in material handling systems, including OHT systems, which help improve productivity in semiconductor fabrication facilities. DAIFUKU’s strength lies in its ability to integrate automation and robotics into OHT systems, making them highly efficient and reliable.

Murata Machinery is another major player that has made significant strides in the semiconductor OHT market. The company offers highly customizable OHT systems that focus on enhancing operational efficiency and reducing costs for semiconductor manufacturers. Murata Machinery’s OHT systems are known for their robustness, energy efficiency, and precision.

SMCore is an emerging leader in the semiconductor OHT market, focusing on providing intelligent and flexible transportation solutions. The company offers advanced OHT systems that can be integrated into various semiconductor production environments. SMCore’s OHT systems are designed to minimize human intervention, reduce contamination, and optimize space utilization.

Top Key Players in the Market

- DAIFUKU

- Murata Machinery

- SMCore

- SYNUS Tech

- Shinsung E&G

- Mirle Automation Inter

- SFA Engineering Corporation

- TOTA

- KENMEC MECHANICAL ENGINEERING

- Other Major Players

Top Opportunities Awaiting for Players

- Expansion in 300mm Wafer Fabrication Facilities: There is a growing trend of investing in 300mm wafer fabrication facilities, as seen with major industry players like Intel and TSMC. These expansions are crucial because they typically involve the integration of advanced OHT systems to enhance efficiency and precision in manufacturing.

- Innovations and Advancements in OHT Technologies: Companies are continually developing high-speed and energy-efficient OHT systems. Samsung’s R&D initiatives, for example, focus on creating more advanced solutions. This push towards innovation presents opportunities for OHT manufacturers to offer differentiated products and capture market share.

- Geographical Expansion: The Asia-Pacific region, particularly countries like China, Japan, and South Korea, dominates the market due to their significant semiconductor manufacturing capabilities. However, North America and Europe also present robust growth opportunities as they expand their semiconductor production capacities. Companies looking to increase their market presence would benefit from focusing on these key regions.

- Integration of AI and IoT: There is an emerging trend towards the integration of artificial intelligence (AI) and the Internet of Things (IoT) in OHT systems. These technologies enhance operational efficiencies and are becoming increasingly important in the semiconductor industry. Players that can effectively integrate these technologies into their offerings are likely to gain a competitive advantage.

- Sustainability and Energy Efficiency: As sustainability becomes a more pressing concern, there is a noticeable shift towards the adoption of energy-efficient and environmentally friendly OHT systems. This shift not only helps companies reduce operational costs but also aligns with global environmental regulations, providing a dual benefit of cost savings and regulatory compliance.

Recent Developments

- January 2025: Alpha X unveiled its advanced OHT system, integrating intelligent automation to enhance semiconductor logistics, featuring real-time adaptive rerouting and high-speed transport capabilities.

- November 2024: Agileo Automation introduced the E84 PIO Box, a handheld device designed to test semiconductor equipment software for compliance with SEMI’s E84 and GEM300 standards, enhancing automated carrier delivery in fabs.

Report Scope

Report Features Description Market Value (2024) USD 682.4 Mn

Forecast Revenue (2034) USD 2,081.9 Mn CAGR (2025-2034) 11.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Carrier Types (12 Inches FOUP, 6/8 Inches SMIF Pod, Others), By Trasnport Type (Inter-bay Transport, Intra-bay Transport), By Application (200mm Wafer FAB, 300mm Wafer FAB, 450mm Wafer FAB) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DAIFUKU, Murata Machinery, SMCore, SYNUS Tech, Shinsung E&G, Mirle Automation Inter, SFA Engineering Corporation, TOTA, KENMEC MECHANICAL ENGINEERING, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DAIFUKU

- Murata Machinery

- SMCore

- SYNUS Tech

- Shinsung E&G

- Mirle Automation Inter

- SFA Engineering Corporation

- TOTA

- KENMEC MECHANICAL ENGINEERING

- Other Major Players