Aloe Vera Oil Market By Packaging Type (Bottles, Jars), By Application (Personal Care & Cosmetics, Medicines & Healthcare Products, Other Applications), By Distribution Channel (Online Platforms, Offline Platforms) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2023

- Report ID: 84060

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

- Aloe Vera Oil Market Overview:

- Key Takeaways:

- Driving Factors

- Restraining Factors

- By Segmental Analysis

- By Packaging Type Analysis

- By Application Analysis

- By Distribution Channel Analysis

- By End-user Analysis

- Global Aloe Vera Oil Market Segments Includes:

- Growth Opportunities

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Report Scope:

Aloe Vera Oil Market Overview:

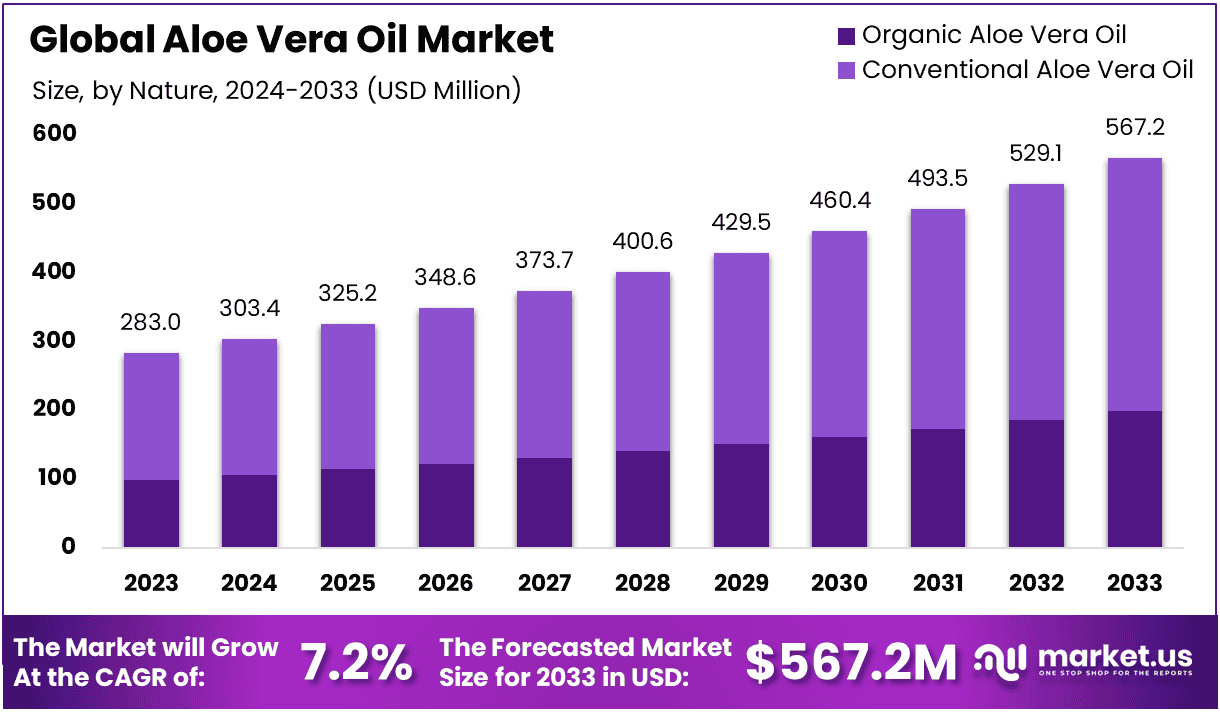

The Global Aloe Vera Oil Market size is expected to be worth around USD 567.2 Million by 2033, from USD 283 Million in 2023, growing at a CAGR of 7.20% during the forecast period from 2024 to 2033.

The Aloe Vera Oil Market refers to the global industry involved in the extraction, processing, and distribution of oil derived from the Aloe Vera plant, a succulent known for its therapeutic properties. This market caters to a diverse range of sectors including cosmetics, pharmaceuticals, and alternative medicine, driven by consumer demand for natural and organic health and wellness products. It encompasses various stages of the value chain, from the cultivation and harvesting of Aloe Vera to the innovative extraction methods that preserve the plant’s beneficial compounds. Aloe vera oil is extracted from the aloe vera plant through maceration using a transporter oil.

From an analyst’s perspective, the Aloe Vera Oil Market is positioned for robust growth, driven by an increasing consumer preference for natural and organic personal care products. The market’s expansion is underpinned by the Aloe Vera plant’s rich composition, which includes at least 160 essential ingredients, with some experts suggesting the presence of 300 to 400 vital components. This rich biochemical composition includes vitamins A, C, E, and B—potent antioxidants that play a crucial role in combating oxidative stress by neutralizing free radicals. Since aloe vera is plentiful in nutrients and minerals, its oil is used to restore skin and hair cells. This oil contains growth-invigorating mixtures such as glucomannans.

Moreover, the presence of powerful antioxidants known as polyphenols, along with several other compounds in Aloe Vera, significantly contributes to the oil’s antimicrobial properties. These substances have been proven to inhibit the growth of certain bacteria that can cause infections in humans, adding a layer of value to Aloe Vera oil in the health and wellness sector. Aloe vera oil is an excellent tonic for hair and skin and treats chronic skin diseases, wounds, bruises, burns, and even constipation. Aloe vera hair oil is made by mixing aloe gel with carrier oil. Their yellow sap and green outer skin contain anthraquinones, glycosides, sugars, and protein.

As health and wellness trends continue to influence consumer behavior, the demand for Aloe Vera oil is expected to surge. Market players are likely to invest in research and development to further explore the potential applications of Aloe Vera oil, ensuring its integration into a wider array of products. This oil has potent anti-inflammatory, wound-healing, and antimicrobial properties. This, in turn, suggests a promising outlook for the Aloe Vera Oil Market, as it becomes increasingly integral to the natural and organic product landscape.

Key Takeaways:

- Market Growth: The Aloe Vera Oil Market has shown significant growth, with the market value increasing from USD 283.0 million in 2023 to USD 567.2 million in 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.20%.

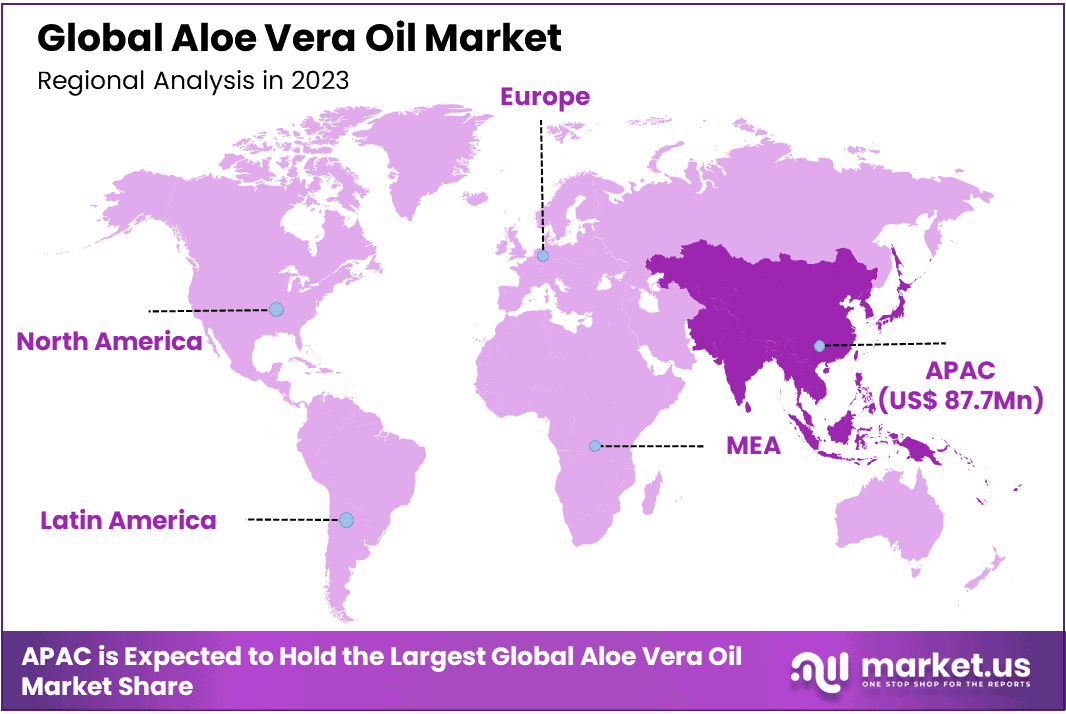

- Regional Dominance: The Asia-Pacific region stands out as the dominant market for Aloe Vera Oil, capturing 31% of the market share. This signifies a strong presence and demand in this geographical area.

- Segmentation Insights:

- Nature: Conventional Aloe Vera Oil holds the majority share at 65%, indicating a preference for traditional or standard products.

- Packaging Type: Bottles account for 27% of the market, suggesting a popular choice for packaging among consumers.

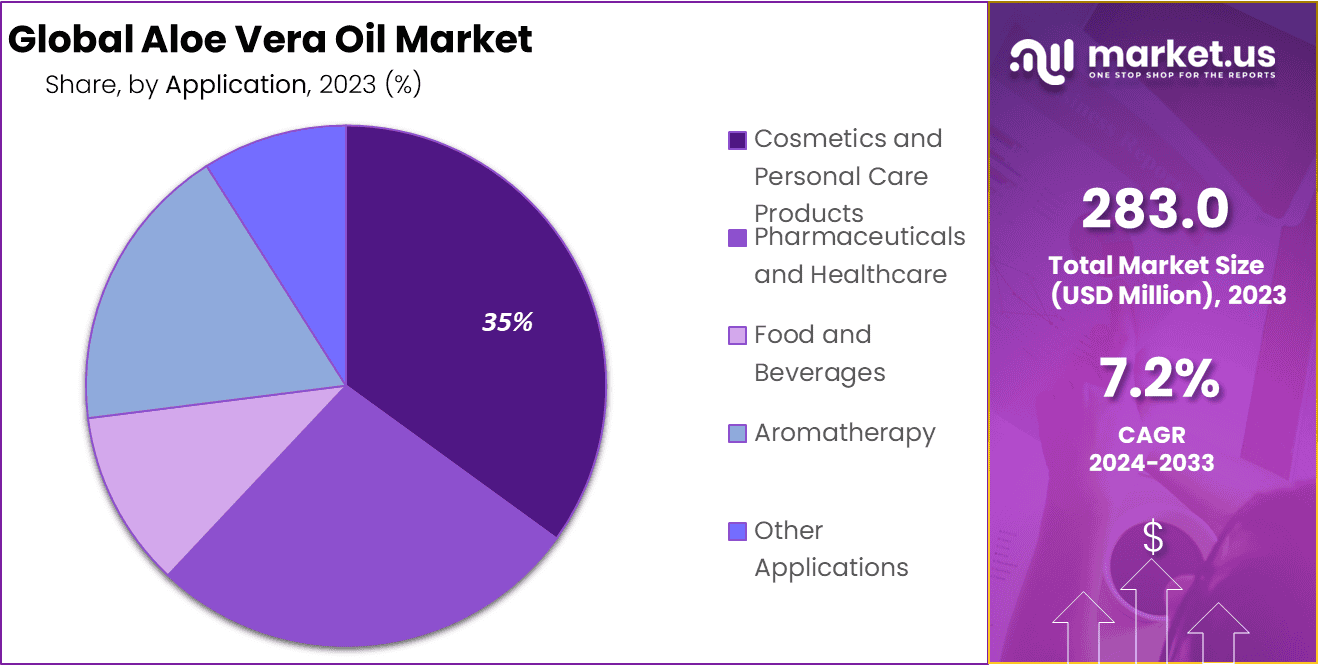

- Application: A significant portion (35%) of the market demand is driven by the use of Aloe Vera Oil in cosmetics and personal care products, indicating its widespread use in this industry.

- Distribution Channel: Online retail holds a substantial share (40%) as the preferred channel for purchasing Aloe Vera Oil, indicating a shift towards digital platforms for product access.

- End-user: Individual consumers represent 26% of the market, highlighting a considerable portion of direct users among the customer base.

- Market Dynamics: Similar to the Aloe Vera Oil market, consumer preferences significantly influence the Aloe Vera Oil market, reflecting the importance of aligning products with evolving trends and demands.

- Industry Players: Major players in the Aloe Vera Oil Market represent the core contributors driving market growth and innovation in this sector.

Driving Factors

Rising Demand for Aloe Vera Oil in the Pharmaceutical Industry

Aloe Vera Oil’s integration into the pharmaceutical sector significantly propels the market’s growth. Its rich biochemical profile, containing essential vitamins and antioxidants, positions Aloe Vera Oil as a potent ingredient in formulations designed to improve skin health, wound healing, and even in treatments for certain conditions. This demand is further buoyed by the oil’s anti-inflammatory and antimicrobial properties, making it a sought-after component in topical ointments, creams, and health supplements. aloe vera is perceived to be healthier than its processed or chemically treated alternatives. This factor, along with aloe vera’s numerous health benefits, is expected to influence its global demand positively.

Growing Awareness about the Health Benefits of Aloe Vera Oil

The market is witnessing a surge in consumer interest in natural and organic products, fueled by a growing awareness of the health benefits associated with Aloe Vera Oil. This awareness is not just anecdotal; it is supported by a body of research highlighting the oil’s antioxidant and antimicrobial properties, which play a crucial role in preventing oxidative stress and bacterial infections. As consumers become more informed about the ingredients in their health and wellness products, the preference for Aloe Vera Oil-enhanced products is on the rise, contributing significantly to market growth.

Growing Popularity of Aloe Vera Oil in Aromatherapy:

The wellness industry’s burgeoning interest in aromatherapy as a method to promote relaxation, reduce stress, and enhance psychological well-being has spotlighted Aloe Vera Oil. Its calming scent and therapeutic properties make it a favorite among aromatherapy practitioners and enthusiasts. This trend is not isolated; it coincides with a broader shift towards natural wellness practices, where Aloe Vera Oil’s benefits are leveraged to create a holistic sense of well-being. This growing popularity not only opens new avenues for market expansion but also aligns with the increasing consumer inclination towards natural and holistic health solutions.

Restraining Factors

Health and Safety Concerns Limiting Adoption

The presence of hydroxy anthracene derivatives in Aloe Vera has raised safety concerns, particularly regarding their potential laxative effects and links to carcinogenicity when ingested. These concerns can significantly impact consumer confidence and, consequently, the demand for Aloe Vera Oil products, especially in applications intended for internal use. Regulatory scrutiny and the need for clear labeling and safety guidelines have become more pronounced, placing additional pressure on manufacturers to ensure product safety and compliance, potentially restraining market growth.

Chemical Additives Affecting Consumer Perception

The trend towards natural and organic products is juxtaposed against the industry practice of adding chemicals to enhance the shelf life of Aloe Vera Oil products. This practice can deter the increasingly health-conscious consumer base, wary of synthetic additives and their potential health impacts. The reliance on preservatives and other chemicals to extend product longevity can undermine the natural appeal of Aloe Vera Oil, posing a restraint to market growth. Consumers are seeking purity and authenticity in natural products, and any deviation from these expectations can lead to decreased demand.

By Segmental Analysis

Conventional Aloe Vera Oil held a dominant market position, capturing more than a 65% share.

This segment’s strong presence is primarily attributed to the established supply chains, production efficiencies, and the relatively lower price points of conventional products compared to their organic counterparts. Conventional Aloe Vera Oil benefits from its wide availability and extensive application in various industries, including pharmaceuticals, cosmetics, and food and beverages. Despite growing consumer awareness and preference for organic products, the scale of conventional Aloe Vera Oil production and its cost-effectiveness continue to drive its substantial market share.

On the other hand, the Organic Aloe Vera Oil segment has been witnessing a steady increase in demand, underpinned by the rising consumer inclination towards natural and organic products. This shift is largely motivated by concerns over health, safety, and environmental sustainability. Although organic Aloe Vera Oil constituted a smaller portion of the market in 2023, its growth trajectory is promising, propelled by heightened consumer awareness and willingness to pay a premium for products perceived as safer and more environmentally friendly.

The organic segment’s growth is also supported by stringent regulatory standards for organic certification, which ensure product purity and sustainable farming practices. As consumers continue to prioritize health and environmental impact in their purchasing decisions, the organic segment is expected to gain market share, reflecting a broader trend towards natural and organic products across industries.

By Packaging Type Analysis

Bottles held a dominant market position in the packaging segment of the Aloe Vera Oil market, capturing more than a 27% share.

This leading position can be attributed to the convenience, durability, and versatility that bottles offer for liquid products like Aloe Vera Oil. They are preferred for their ease of use, ability to preserve product integrity, and suitability for various sizes, making them a popular choice across both retail and industrial markets. Bottles, being recyclable and often made from materials like glass and PET, align with the growing consumer demand for sustainable packaging solutions.

Jars followed closely, appreciated for their reusability and aesthetic appeal, particularly in the premium product segment. They are favored for creams and gels, offering a substantial market share due to their appeal in the cosmetics and skincare industries, where presentation and product preservation are key.

Tubes emerged as a convenient option for targeted applications, such as in the pharmaceutical and cosmetic sectors, where precision and hygiene are paramount. Their ease of use, portability, and controlled dispensing mechanism cater to consumer preferences for travel-friendly and user-friendly packaging.

Sachets marked their presence by offering single-use convenience, affordability, and reduced packaging waste, appealing to price-sensitive markets and sample product distributions. Their growth is driven by the increasing demand for travel-size products and the convenience of trial portions.

By Application Analysis

Cosmetics and Personal Care Products held a dominant market position within the Aloe Vera Oil market, capturing more than a 35% share.

This prominence is largely due to the widespread acknowledgment of Aloe Vera Oil’s hydrating, anti-inflammatory, and healing properties, which make it an invaluable ingredient in skincare, haircare, and other personal care formulations. The demand in this segment is driven by the growing consumer preference for natural and organic ingredients in beauty and personal care products, alongside increasing awareness about the benefits of Aloe Vera Oil in enhancing skin and hair health.

Pharmaceuticals and Healthcare emerged as another significant segment, utilizing Aloe Vera Oil for its therapeutic properties, including wound healing and anti-inflammatory actions. This segment leverages the oil in formulations designed to treat various skin conditions, burn relief, and as a component in health supplements, reflecting its vital role in natural and holistic healthcare solutions.

The Food and Beverages sector also capitalized on the health benefits of Aloe Vera Oil, incorporating it into health drinks, dietary supplements, and functional foods. This segment benefits from the growing consumer trend towards health and wellness products, with Aloe Vera Oil being prized for its antioxidant and digestive health benefits.

By Distribution Channel Analysis

Online Retail held a dominant market position in the distribution channels of the Aloe Vera Oil market, capturing more than a 40% share.

This dominance can be attributed to online platforms’ convenience, wide selection, and competitive pricing. The growth of e-commerce has significantly transformed consumer purchasing behaviors, with more individuals preferring to shop from the comfort of their homes. Online retail platforms have capitalized on this trend by providing detailed product information, customer reviews, and easy comparison shopping, which are particularly appealing for buyers looking for Aloe Vera Oil products. The ability to reach a global audience has also allowed online retailers to scale rapidly, catering to the growing demand for natural and organic products.

Supermarkets/Hypermarkets followed as another key distribution channel, offering consumers the advantage of physical product inspection and immediate purchase. This channel benefits from high foot traffic and the convenience of one-stop shopping for a variety of goods, including Aloe Vera Oil products. Their extensive network and strategic location make them a vital component in the product distribution ecosystem.

Specialty Stores have carved out a significant niche, particularly for customers seeking expert advice and a curated range of natural and organic products. These stores often focus on health and wellness products, including Aloe Vera Oil, and cater to a more health-conscious consumer base looking for specialized items.

Drugstores/Pharmacies represent an important distribution channel for Aloe Vera Oil, especially for products positioned in the health and pharmaceutical sectors. They are trusted sources for consumers seeking health-related products, with Aloe Vera Oil being sought after for its therapeutic properties.

By End-user Analysis

Individuals held a dominant market position in the consumer segments of the Aloe Vera Oil market, capturing more than a 26% share.

This segment’s prominence is reflective of the growing trend toward personal health and wellness, with consumers increasingly incorporating natural and organic products into their daily routines. The direct purchase of Aloe Vera Oil by individuals underscores the widespread recognition of its health and beauty benefits, ranging from skin and hair care to its use in homemade remedies and personal care formulations. The ease of access through various distribution channels, particularly online retail, has significantly contributed to the ease with which individuals can obtain Aloe Vera Oil, further bolstering its market share.

Beauty Salons and Spas followed closely, utilizing Aloe Vera Oil for its therapeutic properties in professional treatments and therapies. This segment leverages the oil’s hydrating, soothing, and anti-inflammatory benefits, making it a staple in services aimed at enhancing skin and hair health. The demand within beauty salons and spas highlights the growing professional endorsement of Aloe Vera Oil’s efficacy in beauty and wellness applications.

Pharmaceutical Companies constitute another key segment, incorporating Aloe Vera Oil into a range of health and wellness products. Its application in the pharmaceutical sector is driven by its medicinal properties, including wound healing and anti-inflammatory effects, underscoring the oil’s versatility and its role in developing natural therapeutic solutions.

Food and Beverage Manufacturers are capitalizing on the health-conscious consumer trend by incorporating Aloe Vera Oil into functional foods, beverages, and supplements. This segment’s interest in Aloe Vera Oil is motivated by its nutritional benefits and the growing demand for health-enhancing consumable ingredients.

Aromatherapy Centers represent a niche but significant segment, using Aloe Vera Oil for its soothing aroma and therapeutic effects in aromatherapy practices. The oil’s popularity in aromatherapy centers highlights its role in promoting mental and physical wellness through natural means.

Global Aloe Vera Oil Market Segments Includes:

By Nature

- Organic Aloe Vera Oil

- Conventional Aloe Vera Oil

By Packaging Type

- Bottles

- Jars

- Tubes

- Sachets

- Others

By Application

- Cosmetics and Personal Care Products

- Pharmaceuticals and Healthcare

- Food and Beverages

- Aromatherapy

- Other Applications

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Drugstores/Pharmacies

- Other Distribution Channel

By End-user

- Individuals

- Beauty Salons and Spas

- Pharmaceutical Companies

- Food and Beverage Manufacturers

- Aromatherapy Centers

Growth Opportunities

Rising Demand in the Food and Beverage Industry

Aloe Vera Oil is gaining traction in the Food and Beverage sector due to its health-enhancing properties, including digestion aid and nutritional benefits. As consumers increasingly seek natural and functional ingredients in their diets, the demand for Aloe Vera Oil in this industry is expected to see a notable uptick. It is utilized in functional foods especially for the preparation of health drinks with no laxative effects, showcasing its versatility beyond traditional applications. Furthermore, Aloe Vera Oil is also used in other food products including milk, ice cream, confectionery, etc., demonstrating its broad applicability.

Aloe vera gel, extracted from the same plant, is also used as a flavoring component and preservative in some foods, enhancing both taste and shelf-life. Market analysis predicts a growth trend, with the incorporation of Aloe Vera Oil in functional beverages, health supplements, and natural food products contributing to a broader consumer base and opening new market channels. This expansion into various food and beverage categories signifies the market’s adaptability and responsiveness to consumer preferences for health-oriented and natural products.

Increasing Popularity in Pharmaceuticals:

The pharmaceutical industry’s interest in Aloe Vera Oil is on the rise, attributed to its therapeutic properties such as anti-inflammatory, antimicrobial, and healing capabilities. This trend is supported by a growing body of research advocating Aloe Vera Oil’s efficacy in treating a range of health issues, from skin conditions to digestive health. The demand for natural and plant-based remedies is fueling this segment’s growth, with projections indicating a significant increase in market share within the pharmaceutical sector.

Latest Trends

Consumer Shift to Organic Products:

There’s a pronounced move towards organic Aloe Vera Oil, propelled by growing health consciousness and environmental concerns among consumers worldwide. This shift is indicative of a broader trend where individuals are increasingly prioritizing products that are perceived as pure, safe, and environmentally friendly. Organic Aloe Vera Oil, known for its absence of synthetic pesticides and fertilizers, is becoming a preferred choice, signaling a significant market shift. This preference for organic options is fostering a more sustainable approach in production and sourcing, ultimately driving demand and premium pricing in the market.

Expansion in the Agriculture Industry:

The cultivation of Aloe Vera is expanding, thanks to its rising popularity as a versatile and beneficial ingredient. This expansion is not just in traditional growing regions but also in non-traditional areas exploring sustainable agriculture practices. The agricultural sector’s focus on enhancing Aloe Vera yield and quality through advanced farming techniques and organic cultivation methods is pivotal. This trend is facilitating a more reliable and scalable supply chain for Aloe Vera Oil production, essential for meeting the growing market demand.

The Aloe Vera Oil Market is experiencing dynamic growth, driven by a confluence of factors across the pharmaceutical, consumer health, and wellness sectors. The pharmaceutical industry’s pursuit of natural ingredients with proven therapeutic benefits has elevated the demand for Aloe Vera Oil, recognizing its potential to enhance health outcomes.

Simultaneously, heightened consumer awareness about the benefits of natural and organic products has shifted preferences towards Aloe Vera Oil-infused products. This shift is complemented by the oil’s growing role in aromatherapy, a reflection of the wider movement towards natural wellness practices. Together, these factors weave a cohesive narrative of growth, underscored by a collective move towards health-focused, natural solutions, propelling the Aloe Vera Oil Market towards broader horizons.

Regional Analysis

The Aloe Vera Oil Market exhibits with Asia-Pacific leading the charge, accounting for a commanding 31% market share.

This dominance is attributed to the region’s rich tradition of herbal medicine, coupled with substantial agricultural production capabilities. Countries like China and India are pivotal, leveraging their extensive Aloe Vera cultivation areas and advanced extraction technologies to meet both domestic and international demand. This region benefits from a well-established consumer base that is deeply aware of Aloe Vera’s health benefits, driving growth in the pharmaceutical, cosmetics, and food and beverage sectors.

North America follows suit as a significant market player, driven by a surge in consumer preference for natural and organic personal care products. The U.S. stands out for its robust health and wellness trend, which positions Aloe Vera Oil as a key ingredient in various applications, from skincare formulations to health supplements.

Europe’s market is characterized by high demand for organic and eco-friendly products, with countries like Germany, France, and the UK leading in consumer awareness and regulatory support for natural ingredients. This region’s stringent standards for product quality and sustainability further boost the demand for organic Aloe Vera Oil.

The Middle East & Africa and Latin America are emerging as potential growth areas, fueled by increasing awareness and growing investments in Aloe Vera cultivation. These regions are tapping into their agricultural strengths to carve a niche in the global Aloe Vera Oil market, focusing on both export and the burgeoning local demand.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The market for aloe vera oils is a dynamic one with numerous key players battling for dominance in the market. Based on the latest research market share is significantly divided among several important players, all of which contribute to the development of the industry. These players account for large portions of the market share, enabling the industry forward, setting standards, and influencing the market’s developments.

CAC stands out for its integrated supply chain and commitment to organic cultivation, positioning it as a leader in sustainable Aloe Vera Oil production. Its focus on quality and eco-friendly practices appeals to the growing market segment prioritizing environmental impact.

Marico has capitalized on its strong distribution networks, especially in emerging markets, to enhance the accessibility of Aloe Vera Oil products. Its marketing strategies and product diversification cater to a broad consumer base.

Dabur leverages its deep-rooted brand presence and expertise in natural products, introducing innovative Aloe Vera Oil formulations. Its focus on research and development supports its reputation for quality and efficacy.

Hollywood Secrets is recognized for its premium-grade Aloe Vera Oil, targeting the high-end cosmetics and personal care market. The brand’s emphasis on purity and natural ingredients resonates with the luxury consumer segment.

Market Key Players:

- CAC

- Marico

- Dabur

- Hollywood Secrets

- Green Leaf Industries

- Indus Valley

- Azores

- Nature’s Way

- Essential Depot

- Now Foods

- Mountain Rose Herbs

- Herbalife International

- Aloecorp

- Other Key Players

Recent Developments:

- In June 2023, Aloe Vera of America passed the required audits to achieve the International Organization for Standardization (ISO) water efficiency management system and energy efficiency management system certifications.

- In February 2023: The aloe vera oil market might arise between skincare or wellness brands and retailers to create specialized aloe vera oil-based products. These collaborations could focus on targeted formulations catering to specific consumer needs, such as skin care for active individuals or specialized therapeutic oils for various health applications.

- In January 2023: Aloe vera oil manufacturers might announce initiatives to adopt eco-friendly packaging, drawing inspiration from Havaianas’ introduction of made-from-recycled PET bottles. Companies could emphasize using recyclable or biodegradable materials for aloe vera oil packaging to align with sustainability goals.

Report Scope:

Report Features Description Market Value (2022) USD 283 Million Forecast Revenue (2033) USD 567.20 Million CAGR (2023-2033) 7.20% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Nature(Organic Aloe Vera Oil, Conventional Aloe Vera Oil), By Packaging Type(Bottles, Jars, Tubes, Sachets, Others), By Application(Cosmetics and Personal Care Products, Pharmaceuticals and Healthcare, Food and Beverages, Aromatherapy, Other Applications), By Distribution Channel(Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Drugstores/Pharmacies, Other Distribution Channel), By End-user(Individuals, Beauty Salons and Spas, Pharmaceutical Companies, Food and Beverage Manufacturers, Aromatherapy Centers) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa. Competitive Landscape CAC, Marico, Dabur, Hollywood Secrets, Green Leaf Industries, Indus Valley, Azores, Nature’s Way, Essential Depot, Now Foods, Mountain Rose Herbs, Herbalife International, Aloecorp, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User license (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

Frequently Asked Questions (FAQ)

What is the Aloe Vera Oil Market Size in the Year 2023?The Global Aloe Vera Oil Market size was USD 283 Million by 2023, growing at a CAGR of 7.20%.

What is the Aloe Vera Oil Market CAGR During the Forecast Period 2023-2032?The Global Aloe Vera Oil Market size is growing at a CAGR of 7.20% during the forecast period from 2023 to 2032.

What is the Estimated Aloe Vera Oil Market Size in the Year 2032?The Global Aloe Vera Oil Market size is expected to be worth around USD 567.2 Million by 2032 during the forecast period from 2023 to 2032.

-

-

- CAC

- Marico

- Dabur

- Hollywood Secrets

- Green Leaf Industries

- Indus Valley

- Azores

- Nature's Way

- Essential Depot

- Now Foods

- Mountain Rose Herbs

- Herbalife International

- Aloecorp

- Other Key Players