Global Aircraft After Market Size, Share, Industry Analysis Report By Components (Engines & Engine, Airframe Parts, Avionics & Electrical Systems, Interior Components), By Application (Maintenance, Repair, Overhaul), By Type (Engine Components, Airframe, Avionics, Interiors), By End-User (Commercial Aviation, Military Aviation, General Aviation), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161474

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Investment and Business Benefit

- China Market Size

- Growth Factors

- Top 5 Use Cases

- Emerging Trends

- By Components

- By Application

- By Type

- By End-User

- Key Market Segment

- Key Regions and Countries

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

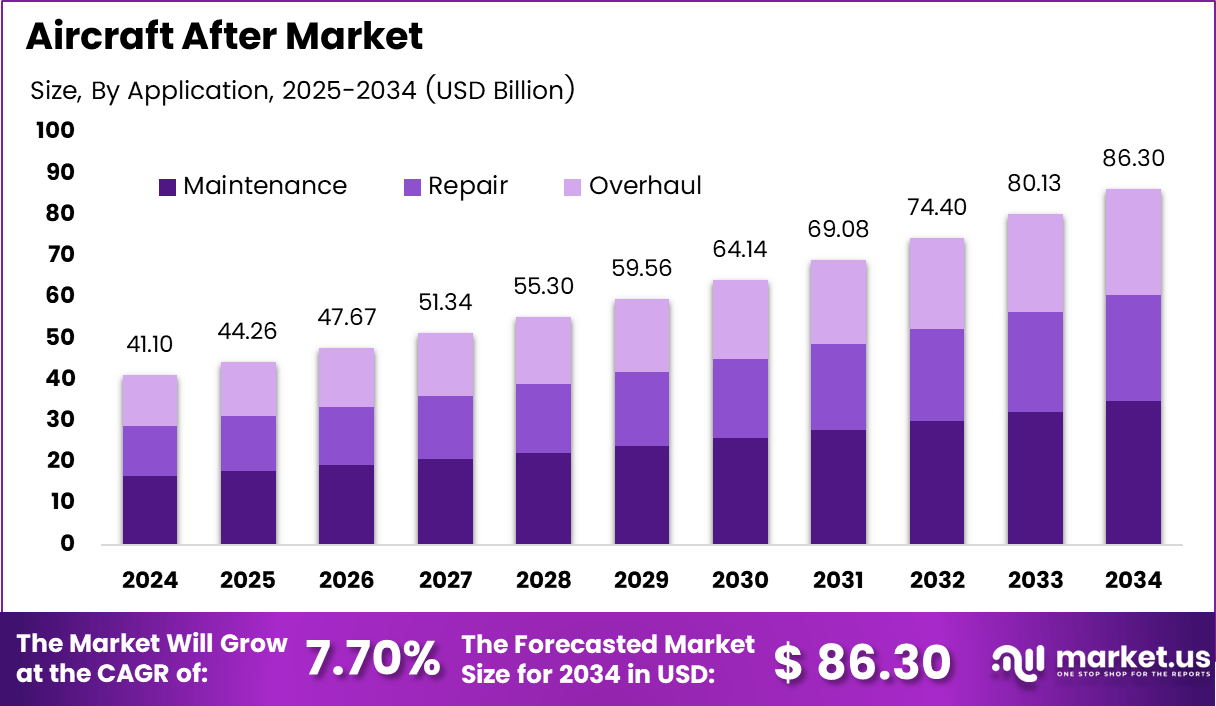

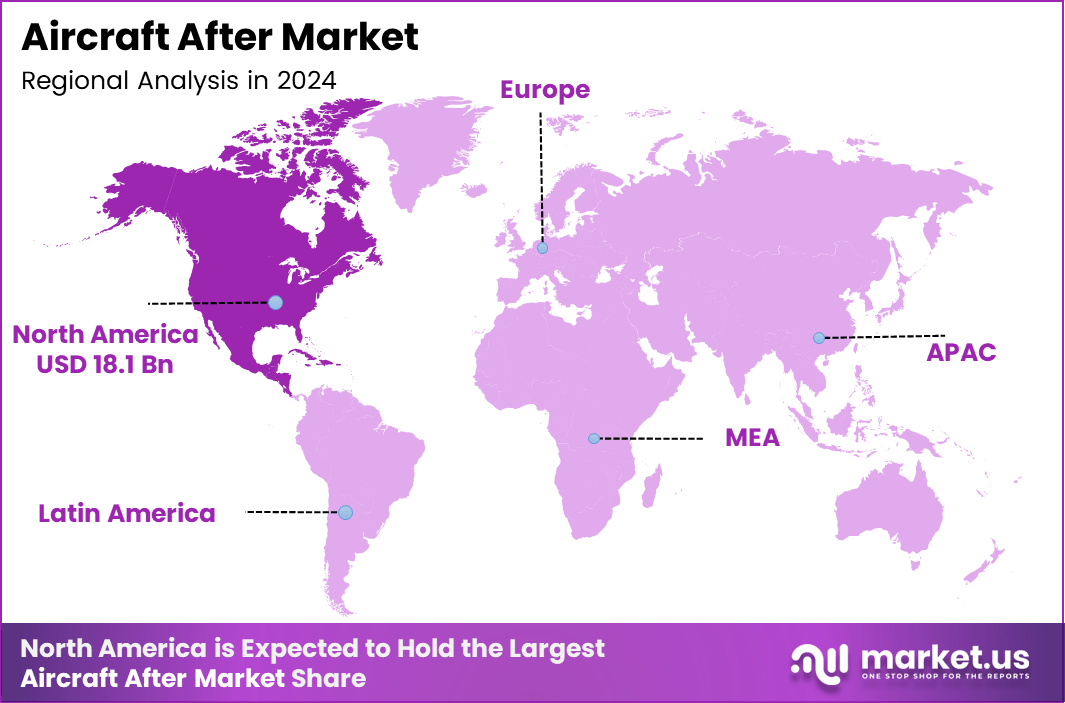

The Global Aircraft After Market was valued at USD 41.1 billion in 2024 and is projected to reach USD 86.3 billion by 2034, growing at a CAGR of 7.7% during 2025–2034. The growth is driven by rising aircraft fleet modernization, increasing passenger traffic, and expanding MRO capabilities worldwide. In 2024, North America dominates the market, contributing USD 18.1 billion in 2024, supported by a strong network of OEMs, airlines, and maintenance providers.

The aircraft aftermarket covers all products and services required to maintain, repair, overhaul, upgrade, and support aircraft after their delivery from the manufacturer. It includes maintenance, spare parts supply, engine services, cabin retrofits, landing gear support, digital diagnostics, and component replacement. Both commercial and defense fleets rely on these services to ensure safety, regulatory compliance, and operational availability.

Top driving factors behind the growth of the aircraft aftermarket include the increasing age of global aircraft fleets, which necessitates more frequent maintenance and part replacements. Another key driver is the rising volume of air travel, which boosts demand for reliable maintenance and quicker turnaround times. Airlines also focus heavily on cost optimization and extending aircraft lifecycles, fueling demand for cost-effective aftermarket solutions.

Technologies increasingly adopted in the aircraft aftermarket include Artificial Intelligence (AI), the Internet of Things (IoT), and additive manufacturing such as 3D printing. AI and data analytics enable predictive maintenance, identifying potential failures ahead of time, thereby reducing downtime. IoT sensors embedded in aircraft provide real-time health data of components, enhancing performance monitoring. Additive manufacturing lowers lead times and inventory costs by enabling on-demand production of complex parts.

According to Market.us, The Global Aircraft Market is projected to reach approximately USD 596.5 billion by 2033, increasing from USD 414.8 billion in 2023, reflecting a steady CAGR of 3.7% between 2024 and 2033. The market’s growth can be attributed to expanding commercial aviation fleets, rising passenger traffic, and increased investments in next-generation aircraft for improved fuel efficiency and sustainability.

Low-cost carriers and commercial airlines operating large fleets contribute heavily to this demand through increased flight frequency and aircraft hours. The aftermarket demand is particularly strong in engine parts, which represent about 45% of the market share owing to their complex maintenance needs, as well as avionics upgrades fueled by evolving technology requirements. Airlines place high importance on reducing aircraft downtime to meet strict schedules, pressing for faster part deliveries and proactive maintenance.

Key Takeaways

- The global aircraft aftermarket is projected to reach USD 86.3 billion by 2034, expanding at a CAGR of 7.7% from 2025 to 2034.

- North America is predicted to account for over 38% of the total market value by 2034, supported by robust MRO infrastructure and OEM presence.

- By Components: Airframe Parts dominate with 51.0% share, driven by continuous structural upgrades and lightweight material integration.

- By Application: Maintenance leads the segment with 40.3%, reflecting high demand for routine checks and predictive maintenance programs.

- By Type: Engine Components account for 36.2%, supported by propulsion modernization and performance monitoring technologies.

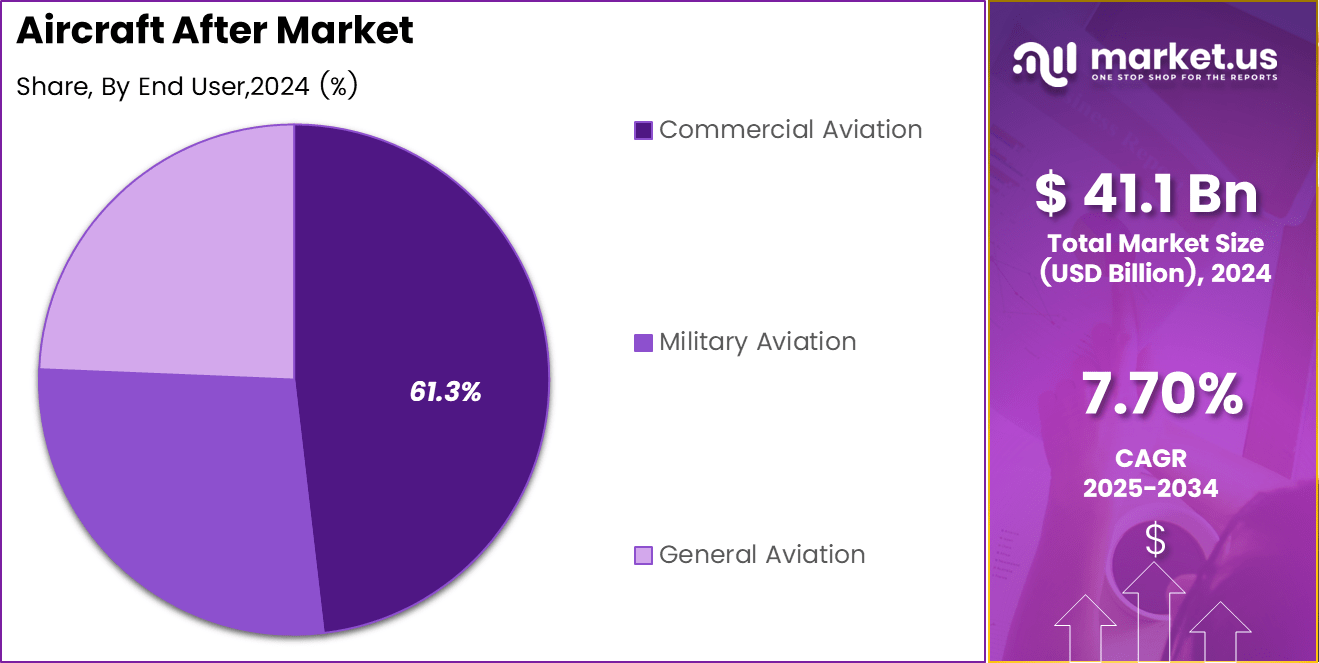

- By End-User: Commercial Aviation remains the largest segment at 61.3%, driven by rising air passenger traffic and fleet expansion.

- Adoption of predictive maintenance is expected to enhance operational efficiency by around 22% in the next decade.

- Sustainable repair and recycling practices are anticipated to reduce carbon emissions by nearly 18%, reinforcing long-term growth momentum.

Investment and Business Benefit

The aircraft after market is projected to attract over USD 25 billion in new investments by 2034, primarily in MRO infrastructure, predictive analytics platforms, and sustainable component refurbishment. Investors are focusing on AI-enabled predictive maintenance solutions, expected to deliver a 28% return on efficiency gains by reducing downtime and operational costs.

Strategic investments in 3D printing facilities and digital twin systems are forecasted to increase part production efficiency by 35%. Additionally, the rise in hybrid and electric aircraft maintenance services is anticipated to open new high-growth investment pockets worth USD 6.2 billion globally by 2033.

Businesses operating in the aircraft after market are expected to achieve 20–25% higher profitability margins by adopting digital MRO systems and cloud-based fleet management tools. Predictive maintenance and AI-driven supply chain optimization can reduce operational costs by up to 22%, enhancing aircraft uptime and service reliability.

Companies integrating sustainable practices, such as circular maintenance and recyclable materials, could improve brand valuation by 15–18% and strengthen regulatory compliance. The growing collaboration between OEMs and independent service providers is also predicted to expand global service reach by 30%, creating a competitive advantage in long-term contracts and recurring revenue streams.

China Market Size

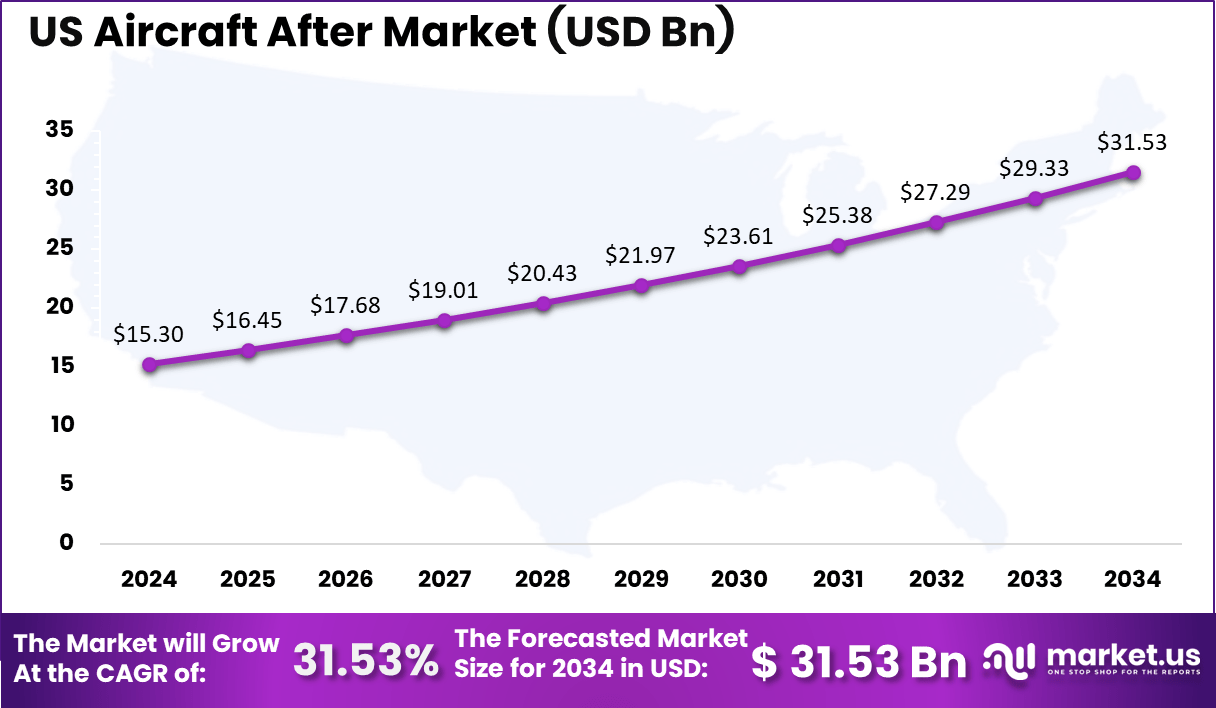

The US aircraft after market was valued at USD 15.3 billion in 2024 and is projected to reach USD 31.53 billion by 2034, expanding at a strong CAGR of 31.5%. This growth is attributed to increasing air traffic, fleet modernization, and the expansion of maintenance, repair, and overhaul (MRO) facilities across the country.

The demand for predictive maintenance and digital repair technologies is expected to rise by nearly 28% over the next decade. Furthermore, sustainability initiatives and next-generation aircraft models are likely to drive long-term investments in aftermarket innovation and lifecycle optimization across the US aviation ecosystem.

North America dominates the global aircraft after market, valued at USD 18.1 billion in 2024, supported by the presence of major OEMs, strong airline networks, and advanced MRO capabilities. The region is expected to maintain its leadership through increased investments in digital maintenance technologies, sustainability-driven operations, and the expansion of predictive maintenance solutions.

Europe follows as a key market due to the modernization of commercial fleets and regulatory emphasis on safety compliance. The Asia-Pacific region is projected to witness over 8% CAGR, fueled by growing passenger traffic and emerging MRO hubs in India and Southeast Asia. Latin America and the Middle East & Africa are gradually expanding due to the introduction of low-cost carriers and rising aircraft utilization rates.

Growth Factors

- Increasing air passenger volume, projected to grow 4.3% annually by 2034, is intensifying demand for fleet maintenance.

- Expansion of predictive analytics and IoT systems in aircraft is anticipated to grow 2.5× by 2030.

- Government incentives for local MRO capabilities are expected to lift regional service output by around 35%.

- Electrification and hybrid propulsion trends will expand component replacement opportunities by over 40%.

- Rising sustainability targets are likely to push eco-friendly maintenance adoption beyond 50% of total operations by 2034.

Top 5 Use Cases

- Predictive maintenance integrating AI and IoT – projected 25% reduction in maintenance costs by 2030.

- Digital twin applications enable real-time system optimization, improving aircraft uptime by 18%.

- 3D-printed spare parts are expected to account for 10-12% of total aftermarket components by 2034.

- Blockchain tracking systems are anticipated to improve parts traceability by up to 40%.

- Drone-based inspection and repair are expected to shorten maintenance turnaround by 15-18 hours per aircraft.

Emerging Trends

- AI-integrated MRO ecosystems are expected to achieve 35% faster repair cycles by 2032.

- Shift toward sustainable aviation materials forecasted to grow at a 9.5% CAGR through 2034.

- Hybrid-electric and hydrogen aircraft servicing is projected to create USD 8.5 billion in new aftermarket opportunities.

- Strategic partnerships between OEMs and MROs are likely to rise by 27% within the forecast period.

- Cloud-based data management in aftermarket services is expected to enhance operational transparency by over 30%.

By Components

In 2024, Airframe parts hold the largest share of the aircraft aftermarket at 51.0%, driven by continuous demand for structural replacements and upgrades. Operators are focusing on enhancing flight safety, durability, and performance through regular inspection and refurbishment of fuselage, wings, and landing gear components. The aging aircraft fleet in both commercial and regional sectors is a major factor increasing replacement activity.

Sustainability goals are also shaping the segment, with service providers offering lightweight and recyclable materials. Airlines are adopting advanced composite repair solutions to reduce maintenance time and cost. The steady rise in passenger traffic and fleet utilization further strengthens the need for consistent airframe maintenance and retrofitting.

By Application

In 2024, Maintenance accounts for 40.3% of the aircraft aftermarket, reflecting its vital role in flight safety and regulatory compliance. Regular overhaul, inspection, and component servicing keep aircraft performance at optimal levels. The rise in flight cycles and operational intensity is creating more frequent maintenance opportunities across airframe, avionics, and engine systems.

Digital maintenance technologies are gaining attention, especially predictive analytics and IoT-based diagnostics. These tools allow operators to prevent unexpected breakdowns and extend component life. Airlines are increasingly entering long-term maintenance agreements with MRO providers to ensure efficiency and cost predictability.

By Type

In 2024, Engine components represent 36.2% of the aftermarket, mainly due to high wear-and-tear rates and critical performance requirements. Engines undergo the most intensive maintenance routines, ranging from part replacement to complete refurbishment. The need for fuel efficiency and emission control has driven interest in upgraded turbines, compressors, and combustion systems.

Manufacturers and MRO firms are collaborating to develop modular engine parts that simplify replacement and shorten turnaround times. With newer generation engines entering fleets, maintenance complexity is increasing, prompting airlines to rely more on certified aftermarket suppliers for both repair and overhaul work.

By End-User

In 2024, Commercial aviation leads the aircraft aftermarket with 61.3% share, supported by growing air passenger traffic and expanding fleet operations. The high frequency of long-haul and short-haul flights generates consistent demand for part replacement, repair, and scheduled servicing. Regional airlines are also adding to the volume by upgrading older jets to meet safety and efficiency standards.

Airlines are adopting modern maintenance strategies to reduce aircraft-on-ground time and balance cost with reliability. Expansion of low-cost carriers and rising utilization of leased aircraft ensure steady aftermarket growth, as both depend heavily on third-party MRO and spares support to maintain operational readiness.

Key Market Segment

By Components

- Engines & Engine

- Airframe Parts

- Avionics & Electrical Systems

- Interior Components

By Application

- Maintenance

- Repair

- Overhaul

By Type

- Engine Components

- Airframe

- Avionics

- Interiors

- Others

By End-User

- Commercial Aviation

- Military Aviation

- General Aviation

- Segment Share Distribution

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Fleet Utilization & Aging Aircraft

The aircraft after market is being fueled by steadily increasing global air travel, which pushes airlines to use their fleets more intensively. This accelerates wear and tear on engines, structures, avionics, and interiors, thereby increasing demand for replacement components and maintenance services. For instance, many airlines are holding older jets longer due to new aircraft delivery delays, which intensifies the aftermarket need for parts and repair services.

Because older aircraft often need more frequent overhaul and inspection, the aftermarket players that can supply parts reliably and deliver quick turnaround have a clear advantage. This trend helps sustain a robust baseline volume of business for MRO providers and parts manufacturers over the coming decade.

Restraint Analysis

Supply Chain Disruptions & Part Scarcity

A significant restraint in the aircraft after market is the challenge of supply chain instability, especially for critical components and raw materials. Delays in manufacturing, parts shortages, and logistic bottlenecks impose higher lead times and costs on operators and MROs. For instance, airlines periodically face multi-month backorders for engine spares due to component supplier constraints.

Because of these disruptions, some operators must keep older parts in stock or suffer downtime waiting for deliveries. This adds holding cost and reliability risk, which can deter smaller MROs or new entrants from scaling operations aggressively.

Opportunity Analysis

Digitalization & Predictive Maintenance Services

One key opportunity is the adoption of digital tools and predictive maintenance models, which allow earlier detection of component stress or failure before it materializes. Offering analytics-as-a-service or condition-based maintenance contracts can create new, higher-margin revenue streams. For example, an MRO provider could equip a regional airline with sensors and AI tools to forecast turbofan module replacements 3–6 months ahead, reducing unscheduled downtime.

This shift not only boosts loyalty (since airlines prefer integrated service partners) but also improves asset utilization. Over time, market participants who embed data services around parts and repairs can differentiate beyond commodity supply and tap recurring revenue.

Challenge Analysis

Certification & Regulatory Hurdles

A core challenge is meeting the rigorous certification requirements imposed by aviation regulators for every part, repair process, and overhaul method. Each component and repair approach must conform to safety standards, which slows innovation and increases compliance costs. For instance, a novel composite repair technique or aftermarket avionics upgrade must often undergo lengthy testing and certification before operators will trust it.

These regulatory hurdles act as a barrier to entry and limit how fast new technologies or business models can scale. Companies must invest heavily in quality assurance, traceability, and documentation before winning acceptance, which can eat into margins or delay rollout.

Key Players Analysis

The global aircraft after market is moderately consolidated, with key players focusing on digital transformation, predictive maintenance, and sustainable component manufacturing. Leading companies collectively account for nearly 65% of the total market share. They are investing heavily in AI-based MRO solutions and advanced engine refurbishment technologies to enhance service efficiency by up to 25%.

Several firms are expanding regional maintenance centers across North America, Europe, and Asia-Pacific to cater to rising fleet volumes. Partnerships between OEMs and independent MRO providers are projected to rise by 30% through 2034, allowing players to strengthen their service portfolios and improve operational turnaround times globally.

Top Key Players

- Lufthansa Technik AG

- GE Aviation

- Rolls-Royce Holdings plc

- AAR Corp.

- ST Engineering

- MTU Aero Engines AG

- Bombardier Inc.

- Honeywell International Inc.

- Parker Hannifin Corporation

- StandardAero

- HAECO

- Turkish Technic

- Embraer S.A.

- Collins Aerospace (Raytheon Technologies)

- Safran Group

- General Electric Company

- Lockheed Martin Corporation

Recent Developments

- In December 2024, Honeywell and Bombardier signed a landmark collaboration to deliver the next generation of avionics, propulsion technologies, and satellite communications for Bombardier aircraft.

The deal includes after-sales and upgrade offerings valued at up to USD 17 billion over the life of the agreement. - In April 2025, Spirit AeroSystems and Airbus reached a definitive agreement for Airbus to acquire specific Spirit facilities that produce Airbus components, to be transferred in parallel with Boeing’s planned USD 4.7 billion acquisition of Spirit.

Report Scope

Report Features Description Market Value (2024) USD 41.1 Bn Forecast Revenue (2034) USD 86.3 Bn CAGR(2025-2034) 7.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Components (Engines & Engine, Airframe Parts, Avionics & Electrical Systems, Interior Components), By Application (Maintenance, Repair, Overhaul), By Type (Engine Components, Airframe, Avionics, Interiors), By End-User (Commercial Aviation, Military Aviation, General Aviation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lufthansa Technik AG, GE Aviation, Rolls-Royce Holdings plc, AAR Corp., ST Engineering, MTU Aero Engines AG, Bombardier Inc., Honeywell International Inc., Parker Hannifin Corporation, StandardAero, HAECO, Turkish Technic, Embraer S.A., Collins Aerospace (Raytheon Technologies), Safran Group, General Electric Company, Lockheed Martin Corporation, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)

-

-

- Lufthansa Technik AG

- GE Aviation

- Rolls-Royce Holdings plc

- AAR Corp.

- ST Engineering

- MTU Aero Engines AG

- Bombardier Inc.

- Honeywell International Inc.

- Parker Hannifin Corporation

- StandardAero

- HAECO

- Turkish Technic

- Embraer S.A.

- Collins Aerospace (Raytheon Technologies)

- Safran Group

- General Electric Company

- Lockheed Martin Corporation