Global Antihistamines Market Analysis By Product Type (H-1 Blockers, H-2 Blockers), By Type (Prescription-based, Over-the-counter), By Dosage Forms (Tablets, Capsules, Liquids, Other Dosage Forms), By Route of Administration (Oral, Parenteral, Topical), By Indication (Allergies, Urticaria, Dermatitis, Other Indications), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136254

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Industrial Advantages

- Key Takeaways

- Product Type Analysis

- Type Analysis

- Dosage Forms Analysis

- Route of Administration Analysis

- Indication Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

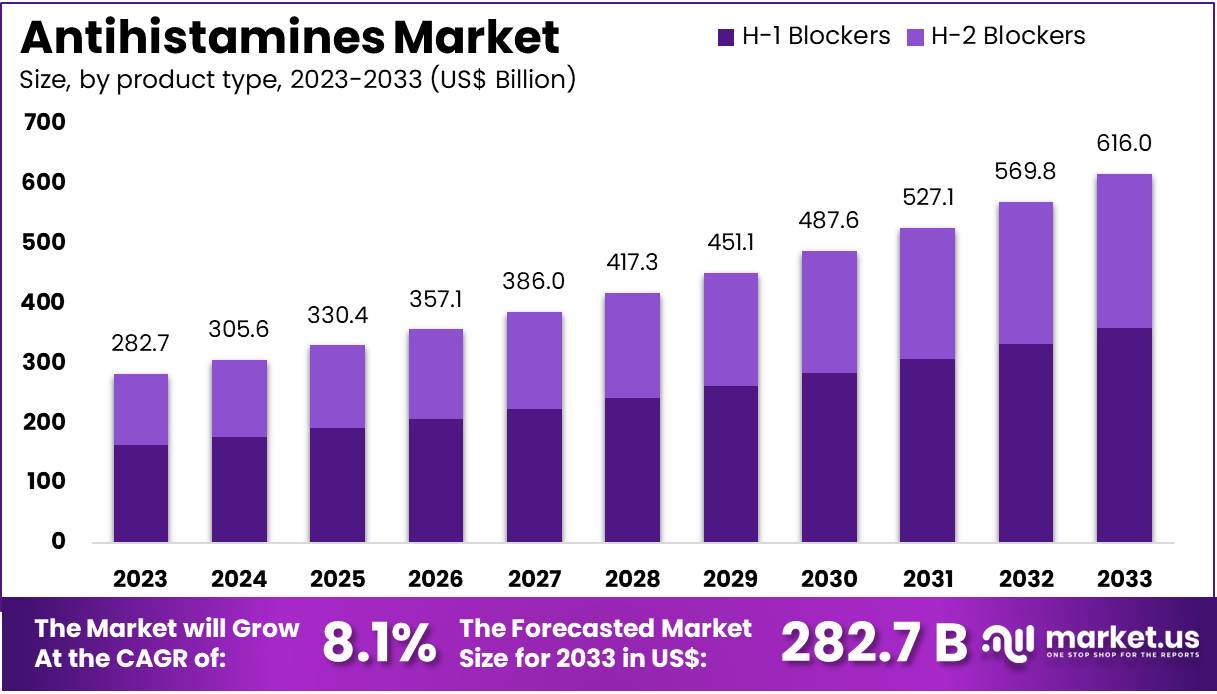

The Global Antihistamines Market Size is expected to be worth around US$ 616 Billion by 2033, from US$ 282.7 Billion in 2023, growing at a CAGR of 8.1% during the forecast period from 2024 to 2033. North America maintained a leading position in the Antihistamines Market, accounting for over 35.82% of the market share, with a valuation of US$ 105.4 billion.

Antihistamines are widely used to manage allergy symptoms, such as sneezing, itching, and swelling, by blocking histamine-a chemical released during allergic reactions. According to studies, these medications are essential for treating conditions like hay fever, hives, and certain cold symptoms. They are categorized into H1 antihistamines, which address respiratory and skin-related allergies, and H2 antihistamines, which reduce stomach acid and treat issues like acid reflux or ulcers.

The antihistamines market has seen significant growth due to the increasing prevalence of allergies and advancements in drug formulations. Rising awareness about effective allergy management has also driven demand. For example, the market includes products for seasonal allergies, insect bites, and chronic conditions, reflecting a diverse range of applications. The development of user-friendly formulations, such as non-drowsy options, has further boosted the market’s expansion.

Motion sickness, also known as kinetosis, affects up to 90% of individuals at some point in their lives, according to the Pharmaceutical Journal. This condition arises from sensory conflicts in the vestibular, visual, and proprioceptive systems, leading to symptoms like dizziness, nausea, and vomiting. Factors such as age, gender, and mode of transport influence susceptibility. Studies highlight the importance of antihistamines in alleviating these symptoms, making them a key product in the travel and healthcare sectors.

Sleep aids are another critical segment of the pharmaceutical market, addressing disorders like insomnia and sleep apnea. According to CFAH, 50 to 70 million Americans experience sleep disorders, with 30% to 40% reporting insomnia symptoms and 10% facing chronic insomnia. In 2022, approximately 8% of U.S. adults used prescription sleep aids, while 11% opted for non-medicinal solutions like herbal teas and melatonin. Gender differences are notable, with 10.2% of women and 6.6% of men using sleep medications, as reported by the CDC.

In Canada, the prevalence of anxiolytic and hypnotic usage rose from 14.8% to 16.6% between 2019 and 2021, stabilizing in 2022 as reported by the IQVIA. Experts attribute the initial rise to pandemic-related stress, followed by a return to normalcy. This trend underscores the importance of both pharmacological and non-pharmacological approaches to anxiety management, reflecting changing consumer preferences.

The sleep aid market also highlights generational and lifestyle differences. For example, older adults are more likely to use prescription medications, while younger individuals prefer natural remedies. The increasing availability of over-the-counter options and public awareness campaigns have contributed to market growth. Additionally, technological innovations, such as sleep tracking devices, complement traditional aids and offer holistic solutions for sleep health.

Overall, the pharmaceutical markets for antihistamines, sleep aids, and anxiolytics demonstrate dynamic growth driven by evolving consumer needs and scientific advancements. These trends emphasize the importance of targeted marketing strategies and continued research to address diverse health challenges effectively.

Industrial Advantages

Antihistamines, widely used for treating allergies, significantly boost pharmaceutical revenue due to the growing global incidence of allergic reactions. The demand creates substantial market expansion opportunities, particularly in emerging regions where awareness and accessibility are increasing. Companies can capitalize on this by innovating products like non-sedative or faster-acting formulations, which attract a broader customer base and offer a competitive edge.

The sector benefits from ongoing research and development, leading to improved antihistamine formulations with reduced side effects and enhanced effectiveness. This continuous innovation bolsters brand reputation and builds consumer trust. Additionally, the ease of market access for over-the-counter antihistamines provides a regulatory advantage, fostering quicker consumer adoption compared to prescription medications.

Strategic alliances between pharmaceutical companies and research institutions are pivotal. These partnerships can expedite drug development and regulatory approval processes, effectively reducing the time-to-market. Moreover, they help distribute the financial burden of research and development, making innovative drug formulations more economically feasible.

There are promising opportunities for antihistamines in extended therapeutic applications, such as anti-inflammatory properties and potential uses in skincare. Embracing digital marketing strategies can also heighten consumer awareness, particularly among younger, tech-savvy demographics. Furthermore, participating in global health initiatives to increase drug accessibility in underserved areas not only expands market presence but also enhances corporate social responsibility.

Key Takeaways

- The Antihistamines Market is projected to reach US$ 616 billion by 2033, growing from US$ 282.7 billion in 2023, at a CAGR of 8.1%.

- In 2023, the H-1 Blockers segment dominated the product type segment, holding a 58.3% market share, reflecting its widespread usage and demand.

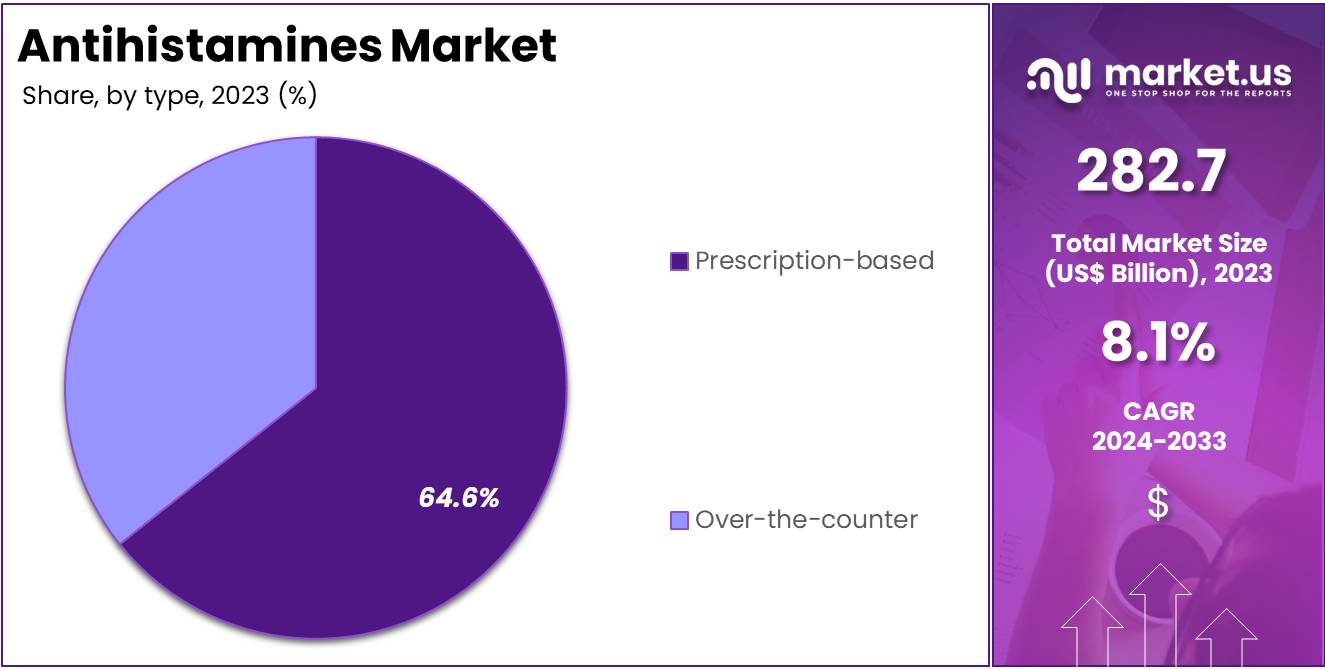

- The Prescription-based segment led the type analysis category in 2023, accounting for more than 64.6% of the market share, indicating strong reliance on prescribed medications.

- The oral route of administration was the preferred choice in 2023, capturing over 73.2% of the market, highlighting its convenience and effectiveness.

- Allergies emerged as the leading indication segment in 2023, representing 42.3% of the market share, driven by increasing allergy-related cases globally.

- In 2023, retail pharmacies were the dominant distribution channel, securing a 41.7% market share, emphasizing their accessibility and consumer preference.

- North America held the largest regional share of the market in 2023 at 35.82%, with a valuation of US$ 105.4 billion, underscoring its market strength.

Product Type Analysis

In 2023, the H-1 Blockers segment held a dominant position in the Product Type Analysis Segment of the Antihistamines Market, capturing more than a 58.3% share. This dominance can be attributed to their widespread use in treating allergies such as hay fever, hives, and other allergic conditions. H-1 Blockers, including well-known drugs like cetirizine, loratadine, and fexofenadine, are preferred for their efficacy in alleviating allergy symptoms by blocking the action of histamine at the H1 receptor sites. This reduces typical symptoms like sneezing, itching, and watery eyes.

The market’s preference for H-1 Blockers is also bolstered by their minimal sedative effects compared to first-generation antihistamines. This makes them suitable for daily use by individuals needing continuous symptom management without significant drowsiness. Moreover, the availability of these drugs in various forms, including tablets, liquids, and nasal sprays, enhances their accessibility and convenience, further supporting their strong market share.

On the other hand, H-2 Blockers, which are primarily used to reduce stomach acid production and treat conditions like peptic ulcers and gastroesophageal reflux disease (GERD), accounted for a smaller portion of the antihistamines market. Their specific targeting of the H-2 receptors in the stomach lining differentiates them from H-1 Blockers but limits their use in broader allergy treatments. As a result, their market share remains significantly lower in the antihistamines segment.

The ongoing developments in antihistamine formulations and the introduction of faster-acting, longer-lasting options are expected to influence future market dynamics significantly. These innovations aim to enhance patient compliance and symptom control, which could lead to shifts in market share between the H-1 and H-2 Blocker segments.

Type Analysis

In 2023, the Prescription-based segment held a dominant position in the Type Analysis segment of the Antihistamines Market, capturing more than a 64.6% share. This segment includes antihistamines that require a doctor’s approval before purchase. The high percentage indicates strong reliance on professional healthcare advice for managing allergies.

Over-the-counter (OTC) antihistamines make up the remainder of the market. These are accessible without a prescription, offering convenience for minor allergy symptoms. The availability of OTC options reflects a growing consumer preference for self-medication and ease of access.

The distinction between prescription-based and OTC antihistamines plays a crucial role in consumer choices. Prescription medications often target more severe or specific allergy conditions, which justifies their larger market share. Meanwhile, the ease of obtaining OTC drugs supports their steady demand in the market.

Dosage Forms Analysis

In 2023, Tablets held a dominant market position in the Dosage Forms Segment of the Antihistamines Market, capturing more than a 48.9% share. This segment’s leadership stems from the user-friendly nature of tablets. They offer exact dosing which is essential for managing allergy symptoms effectively. Their portability and ease of use make them a top choice for consumers needing reliable allergy relief.

Capsules form another vital segment, appreciated for their ability to release medicine gradually. This quality is crucial for patients who require consistent symptom management throughout the day. Capsules help maintain stable medication levels, providing extended relief from allergies, which is especially beneficial for long-term treatment plans.

Liquid antihistamines are preferred for their fast action and ease of ingestion, making them suitable for both young children and elderly adults. They are particularly effective for quick relief from sudden allergic reactions. Their format allows for faster absorption, which can be critical in managing severe symptoms promptly.

Other innovative dosage forms like gels and dissolvable strips are emerging in the market. These alternatives offer unique benefits such as rapid absorption and ease of use, providing immediate relief. Their innovative application methods cater to specific preferences, adding diversity to the antihistamines market and enhancing consumer choices.

Route of Administration Analysis

In 2023, the oral route held a dominant position in the Antihistamines Market’s Route of Administration segment, capturing more than a 73.2% share. This high percentage reflects the widespread preference for oral antihistamines. Users favor these for their convenience and rapid response to allergic symptoms.

Oral antihistamines are popular due to their ease of administration. People often choose them to quickly alleviate allergy symptoms. This method provides efficient relief from common allergic reactions, making it a preferred choice for many.

The parenteral route is also crucial, especially in severe cases. It involves antihistamines administered through injections. This method is essential for immediate intervention during acute allergic reactions. It is particularly useful when oral medication is not feasible.

Topical antihistamines cater to localized allergic responses. These are applied directly to the skin to soothe irritations like rashes and itching. Though not as widely used as oral antihistamines, topical treatments are indispensable for addressing specific, surface-level allergic symptoms.

Indication Analysis

In 2023, Allergies held a dominant market position in the Indication Segment of the Antihistamines Market, capturing more than a 42.3% share. This significant portion is largely due to the high occurrence of allergic reactions globally. Symptoms like sneezing, itching, and hives prompt the widespread use of antihistamines. These medications effectively block the release of histamines, providing relief to millions.

The Urticaria segment, known for causing itchy welts, also commands a notable market share. Antihistamines are essential for managing these symptoms, which can severely affect daily life. For patients with chronic urticaria, daily usage of these medications is often necessary. This continuous demand underscores the segment’s robust presence in the market.

Dermatitis, including eczema and contact dermatitis, is another significant driver in the antihistamine market. These conditions cause severe itching, and antihistamines play a crucial role in managing this symptom. By reducing itching, these drugs help minimize scratching and potential secondary infections. This therapeutic benefit maintains steady demand within this market segment.

The ‘Other Indications’ segment covers the use of antihistamines for conditions such as insomnia and motion sickness. Although it holds a smaller share compared to allergies and dermatitis, it addresses specific therapeutic needs. This segment explores niche applications of antihistamines, expanding beyond traditional allergy treatment and contributing to the overall market diversity.

Distribution Channel Analysis

In 2023, Retail Pharmacies held a dominant market position in the Distribution Channel Segment of the Antihistamines Market, capturing more than a 41.7% share. This prominence can be attributed to the accessibility and convenience offered by retail pharmacies. These outlets are widely available and provide consumers with immediate access to medications without the need for a doctor’s visit. Additionally, retail pharmacies often offer competitive pricing and value-added services such as pharmacist consultations, which enhance their appeal to consumers seeking quick relief from allergic reactions.

Hospital Pharmacies also play a critical role in the distribution of antihistamines. They primarily serve inpatients and outpatients in medical facilities, ensuring that patients receive the appropriate medications as part of their treatment plans. The controlled environment of hospital pharmacies aids in the precise administration of dosages, which is crucial for patients with severe allergic reactions.

Online Pharmacies have seen significant growth, attributed to the rise in e-commerce and digital health solutions. This channel offers the convenience of home delivery, often at lower prices than traditional outlets. Online pharmacies appeal especially to a tech-savvy demographic that prefers shopping online. Moreover, the ongoing advancements in telehealth services are expected to further boost the use of online pharmacies for purchasing antihistamines. Each distribution channel has its unique strengths, catering to different consumer needs and preferences within the antihistamines market.

Key Market Segments

By Product Type

- H-1 Blockers

- H-2 Blockers

By Type

- Prescription-based

- Over-the-counter

By Dosage Forms

- Tablets

- Capsules

- Liquids

- Other Dosage Forms

By Route of Administration

- Oral

- Parenteral

- Topical

By Indication

- Allergies

- Urticaria

- Dermatitis

- Other Indications

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Rising Prevalence of Allergies and Chronic Conditions

The rising prevalence of allergies and chronic conditions is a major driver for the antihistamines market. Allergic rhinitis, asthma, and other histamine-mediated conditions are increasing globally. This trend is largely due to urbanization, changing lifestyles, and growing exposure to environmental triggers. Urban areas, with high pollution levels, contribute significantly to respiratory issues and allergies. Additionally, climate change is extending pollen seasons, intensifying allergic reactions. These factors are driving the demand for antihistamines as people seek effective solutions for managing symptoms and improving their quality of life.

Urbanization and environmental factors are key contributors to the increasing prevalence of allergies. Higher levels of air pollution in cities lead to more cases of respiratory allergies and asthma. Industrial activities and vehicle emissions release allergens and irritants, worsening symptoms. Urban residents often face prolonged exposure to pollutants, making them more susceptible to histamine-related conditions. These environmental challenges create a growing need for antihistamines to alleviate allergy symptoms. As awareness grows, the antihistamines market benefits from increased adoption across diverse demographics.

Climate change further accelerates the demand for antihistamines. Changes in weather patterns and rising temperatures extend pollen seasons and increase allergen exposure. This results in more frequent and severe allergic reactions globally. Healthcare providers and consumers are increasingly relying on antihistamines to combat these issues. Chronic conditions like asthma, which are closely linked to allergies, also fuel this demand. The growing focus on effective treatment options positions the antihistamines market for continued growth. Rising health awareness ensures sustained demand in both developed and developing regions.

Restraints

Side Effects and Safety Concerns

Side effects significantly restrain the growth of the antihistamines market. First-generation antihistamines are known for causing drowsiness, dry mouth, and dizziness. These adverse effects can disrupt daily activities and reduce patient compliance. The impact is particularly noticeable in individuals requiring long-term treatment, as these side effects may outweigh the benefits of the medication. This leads to a preference for alternative therapies with fewer side effects, limiting the adoption of antihistamines in the market. Patients and healthcare providers often seek safer and more tolerable options.

Safety concerns and regulatory scrutiny further challenge the antihistamines market. Health authorities closely monitor the safety profiles of these medications, especially for extended use or off-label applications. Strict approval processes and labeling requirements can delay market entry for new products. In severe cases, regulatory actions may restrict the use of specific antihistamines due to safety issues. These hurdles create uncertainties for manufacturers, impacting product development and market expansion. As a result, safety concerns remain a key factor restraining market growth.

Opportunities

Development of Non-Sedating and Targeted Therapies

The development of non-sedating antihistamines is a key opportunity in the antihistamines market. Traditional antihistamines often cause drowsiness, limiting their use. Non-sedating alternatives address this issue, offering allergy sufferers an effective treatment without the risk of daytime fatigue. These drugs improve patient compliance and expand the consumer base, including those who need to stay alert for work or daily activities. As a result, non-sedating antihistamines are becoming more popular, driving growth in the market as they meet the needs of a broader demographic.

In addition to non-sedating options, targeted therapies are revolutionizing the antihistamines market. By focusing on specific biological pathways and receptors, targeted treatments offer more precise and effective allergy management. These therapies provide enhanced efficacy with fewer side effects, making them an attractive choice for patients. The shift towards second- and third-generation antihistamines, which are safer and more effective, further drives market growth. As these innovations continue, they are expected to expand treatment options and increase demand for advanced antihistamine solutions.

Trends

Shift Toward Over-the-Counter (OTC) Availability

The trend of shifting toward over-the-counter (OTC) availability is transforming the antihistamines market. More consumers now prefer self-medication for managing allergies, leading to higher demand for OTC antihistamines. This shift is driven by increased consumer awareness, as people are more informed about treating common conditions like allergies. OTC products offer convenience, as they can be easily purchased without a prescription. This growing preference for self-care is reshaping the market, with consumers opting for quicker, hassle-free solutions.

The rise of digital pharmacies is further boosting this trend. These platforms make it easier for consumers to access OTC antihistamines from the comfort of their homes. Online pharmacies offer fast delivery and easy product comparisons, enhancing convenience and satisfaction. Additionally, the cost-effectiveness of OTC antihistamines makes them an appealing choice. With regulatory changes in many regions, a wider range of antihistamines is now available over-the-counter, fostering increased accessibility and contributing to the market’s growth.

Regional Analysis

In 2023, North America held a dominant market position in the Antihistamines Market, capturing more than a 35.82% share with a market value of US$ 105.4 billion. This region’s supremacy is largely due to the high prevalence of allergies among its population. Various environmental allergens, driven by North America’s diverse climate, sustain a strong demand for antihistamine products throughout the year.

The region boasts an advanced healthcare infrastructure that ensures medications, including over-the-counter antihistamines, are widely available and accessible. This infrastructure supports ongoing consumer demand and contributes significantly to the market’s strength in North America.

Awareness about allergy treatments is notably high among North American consumers. Educational initiatives and healthcare providers actively promote effective allergy management strategies. These efforts include informing the public about the benefits and proper use of antihistamines, which helps maintain high usage rates across the population.

Regulatory support from bodies like the U.S. Food and Drug Administration (FDA) enhances the market’s dynamics by facilitating the quick approval and introduction of new antihistamine drugs. Furthermore, robust competition among leading pharmaceutical companies in the region stimulates innovation and development, leading to the availability of improved antihistamine formulations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The antihistamines market is highly competitive, with major players like GlaxoSmithKline PLC and Sanofi Consumer Healthcare leading the market. They command significant shares due to their strong global presence and reputable brands. Sun Pharmaceutical Industries and Bayer AG also hold notable market shares, supported by extensive product lines and distribution networks. Himalaya Wellness Company, although smaller, competes effectively by targeting niche markets with its natural-based products. These key players collectively drive market dynamics and foster innovation.

GlaxoSmithKline PLC stands out with its focus on innovative healthcare solutions, boasting a significant line of antihistamine products. The company’s financial strength enables substantial investment in research and development, leading to new and improved products. Sanofi Consumer Healthcare, a division of the global pharmaceutical giant Sanofi, maintains a strong market position with its established brands and comprehensive product offerings. Himalaya Wellness Company caters to a specific customer base with its focus on safety and natural ingredients.

Strengths across these companies include robust brand recognition and diverse product offerings. However, each company faces its own set of challenges, such as regulatory hurdles and market saturation. Opportunities are abundant, especially for expansion into emerging markets and further product line enhancements. The primary threats include intense competition and the increasing prevalence of generic drugs, which could undermine market positions.

Strategic movements are crucial for maintaining market dominance. GlaxoSmithKline PLC has been innovating within the allergy relief space, introducing products designed for various demographics. Sanofi Consumer Healthcare has enhanced its market reach through strategic acquisitions, broadening both its product range and geographic presence. Himalaya capitalizes on the trend towards organic and natural remedies, distinguishing its product offerings in the market.

Sun Pharmaceutical Industries leverages cost-effective manufacturing and a vast distribution network to enhance its market presence, focusing on expansion into less developed regions. Bayer AG keeps its product line fresh with regular innovations that improve efficacy and patient compliance. As these companies continue to adapt and innovate, they ensure their market positions are secured and responsive to consumer needs, driving forward the antihistamines market with strategic developments and a focus on consumer needs.

Market Key Players

- GlaxoSmithKline PLC

- Sanofi Consumer Healthcare

- Himalaya Wellness Company

- Sun Pharmaceutical Industries Inc.

- Bayer AG

- Novartis AG

- Cadila Pharmaceuticals

- Bausch Health Companies Inc.

- Alcon Vision LLC

- Merck & Co.

- Dr. Reddy’s Laboratories Ltd.

- Viatris Inc.

- Somerset Pharma LLC

- F. Hoffmann-La Roche Ltd.

- Akorn Operating Company LLC

- Teva Pharmaceutical Industries Ltd.

- Speer Laboratories

- Glenmark Pharmaceuticals Limited

- TerSera Therapeutics LLC

- Pfizer Inc.

Recent Developments

- In October 2024: GSK confirmed their financial guidance for 2024, expecting sales growth of 7% to 9% and Core EPS growth of 10% to 12%. This projection follows a quarter in which the company delivered sales of £8.0 billion and a core operating profit increase of 5%. This financial strength is supported by their ongoing R&D efforts, which have resulted in successful drug trials and preparations for multiple major new product launches in the coming year.

- In January 2024: Acquisition of Inhibrx, Inc. Sanofi announced the acquisition of Inhibrx, Inc., a deal valued at approximately $1.7 billion. This acquisition includes INBRX-101, a promising treatment for alpha-1 antitrypsin deficiency, which is relevant due to its potential anti-inflammatory properties. The transaction also involved the creation of a new entity, New Inhibrx, which was funded with $200 million by Sanofi. This strategic acquisition aims to bolster Sanofi’s capabilities in rare disease treatment and immune-mediated respiratory conditions.

- In October 2023: Himalaya Wellness Company initiated construction of a $54.4 million herbal pharmaceutical factory at Dubai Industrial City. Financed by the Emirates Development Bank, this project marks Himalaya’s first manufacturing facility outside India. The factory, covering 225,000 sq. ft., is expected to produce 3 billion tablets, 15 million syrup bottles, and 3 million ointment units annually. This expansion aims to enhance their global manufacturing capabilities and align with UAE’s strategic industrial goals.

Report Scope

Report Features Description Market Value (2023) US$ 282.7 Billion Forecast Revenue (2033) US$ 616 Billion CAGR (2024-2033) 8.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (H-1 Blockers, H-2 Blockers), By Type (Prescription-based, Over-the-counter), By Dosage Forms (Tablets, Capsules, Liquids, Other Dosage Forms), By Route of Administration (Oral, Parenteral, Topical), By Indication (Allergies, Urticaria, Dermatitis, Other Indications), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GlaxoSmithKline PLC, Sanofi Consumer Healthcare, Himalaya Wellness Company, Sun Pharmaceutical Industries Inc., Bayer AG, Novartis AG, Cadila Pharmaceuticals, Bausch Health Companies Inc., Alcon Vision LLC, Merck & Co., Dr. Reddy’s Laboratories Ltd., Viatris Inc., Somerset Pharma LLC, F. Hoffmann-La Roche Ltd., Akorn Operating Company LLC, Teva Pharmaceutical Industries Ltd., Speer Laboratories, Glenmark Pharmaceuticals Limited, TerSera Therapeutics LLC, Pfizer Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GlaxoSmithKline PLC

- Sanofi Consumer Healthcare

- Himalaya Wellness Company

- Sun Pharmaceutical Industries Inc.

- Bayer AG

- Novartis AG

- Cadila Pharmaceuticals

- Bausch Health Companies Inc.

- Alcon Vision LLC

- Merck & Co.

- Dr. Reddy’s Laboratories Ltd.

- Viatris Inc.

- Somerset Pharma LLC

- F. Hoffmann-La Roche Ltd.

- Akorn Operating Company LLC

- Teva Pharmaceutical Industries Ltd.

- Speer Laboratories

- Glenmark Pharmaceuticals Limited

- TerSera Therapeutics LLC

- Pfizer Inc.