Global Agriculture Waste Management Market Size, Share Analysis Report By Waste Type (Crop Residues, Livestock Waste, Processing Waste, and Others), By Service Type (Waste Collection And Transportation, Waste Processing And Treatment, and Others), By Technology (Physical Treatment, Biological Treatment, Thermal Treatment, Recycling And Reuse, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169490

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

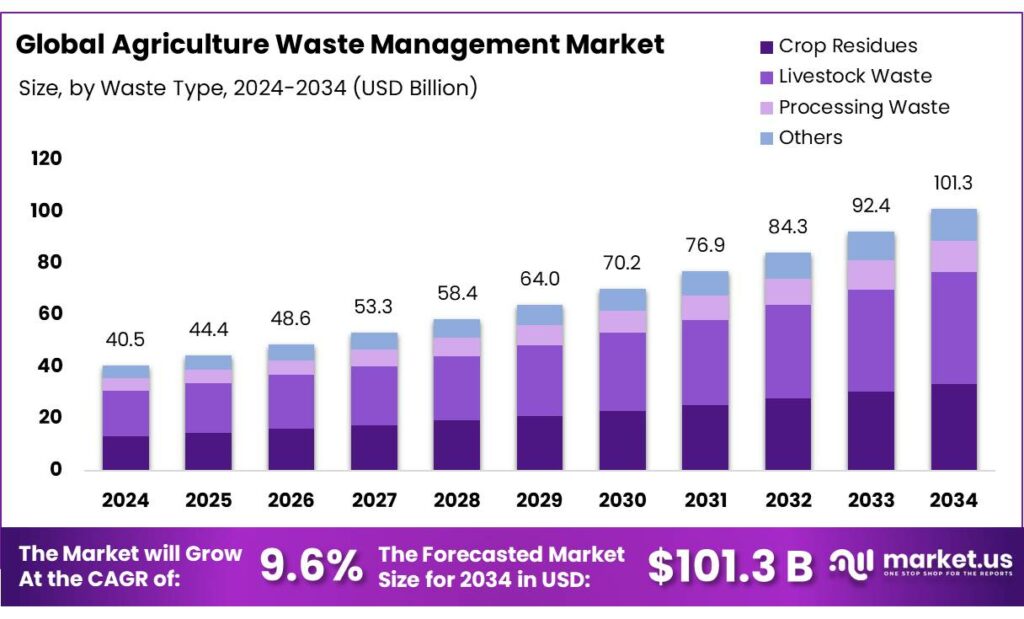

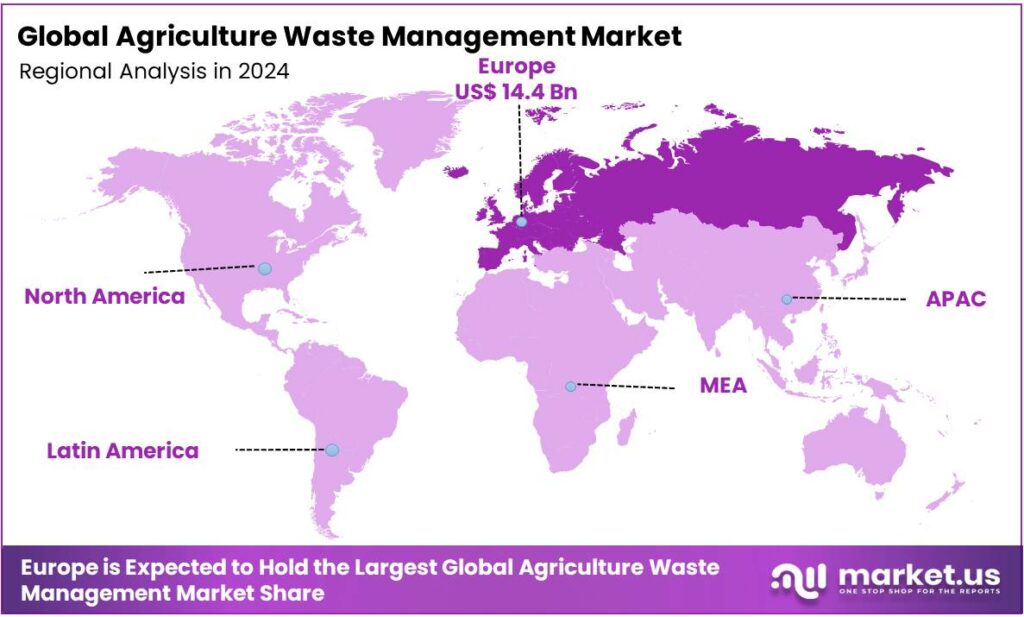

The Global Agriculture Waste Management Market size is expected to be worth around USD 101.3 Billion by 2034, from USD 40.5 Billion in 2024, growing at a CAGR of 9.6% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 35.6% share, holding USD 14.4 Billion revenue.

Agricultural waste management is the responsible handling, disposal, and reuse of byproducts from farming to reduce environmental harm and promote sustainability. The agriculture waste management market is driven by the need for sustainable solutions to address the growing volumes of agricultural waste generated globally. The market is primarily focused on biological treatment technologies, such as composting and anaerobic digestion, due to their cost-effectiveness and ability to efficiently process organic waste into valuable by-products.

While livestock waste constitutes the largest portion of agricultural waste, crop residues and food processing waste are given significant attention. Key opportunities lie in the rising demand for value-added products such as organic fertilizers, biogas, and bioplastics. However, challenges remain in the form of high initial costs, limited infrastructure, and a niche market for recycled agricultural products. The market plays a crucial role in enhancing agricultural sustainability and reducing environmental impact through effective waste management practices.

- According to the Food and Agriculture Organization (FAO), the agricultural sector generates over 998 million tons of waste annually. If not properly handled, these waste materials contribute to soil degradation, water pollution, and greenhouse gas emissions. Food waste is responsible for 6% of global greenhouse gas emissions every year.

Key Takeaways

- The global agriculture waste management market was valued at USD 40.5 billion in 2024.

- The global agriculture waste management market is projected to grow at a CAGR of 9.6% and is estimated to reach USD 101.3 billion by 2034.

- Based on the type of waste, livestock waste dominated the agriculture waste management market, with a substantial market share of around 42.8%.

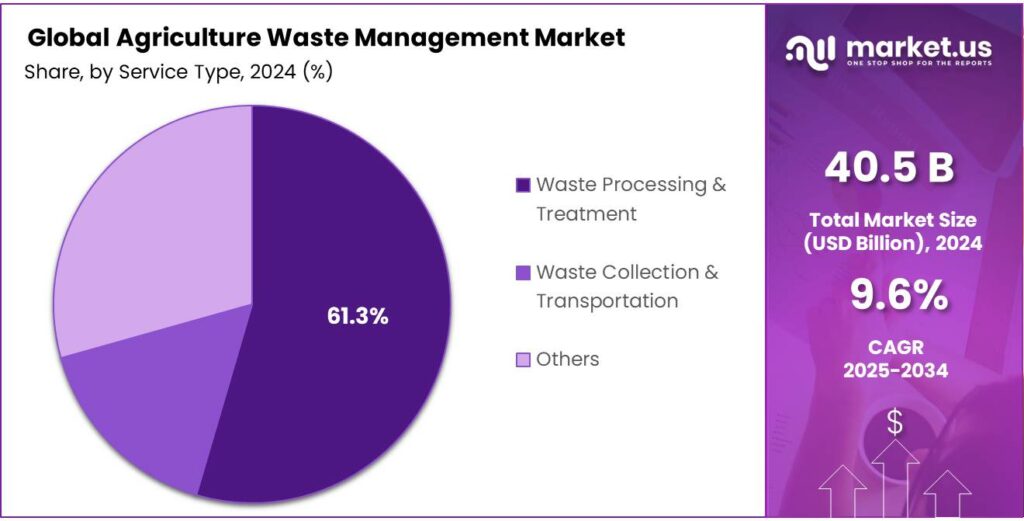

- On the basis of service type, the agriculture waste management market is dominated by waste processing & treatment, comprising 61.3% share of the total market.

- Among the technologies used for agricultural waste management, biological treatments held a major share in the market, 38.9% of the market share.

- In 2024, Europe was the most dominant region in the agriculture waste management market, accounting for around 35.6% of the total global consumption.

Waste Type Analysis

Livestock Waste is a Prominent Segment in the Agriculture Waste Management Market.

The agriculture waste management market is segmented based on waste type as crop residues, livestock waste, processing waste, and others. The livestock waste dominated the market, comprising around 42.8% of the market share, due to the large-scale production of livestock worldwide. Livestock accounts for a significant portion, specifically 59%, of the world’s mammal biomass.

- According to the US Department of Agriculture, the global total livestock population for 2018 was over 35 billion animals, including nearly 29 billion chickens and over 1.5 billion cattle. Livestock farming involves substantial quantities of manure, which is often produced in high concentrations in confined spaces such as feedlots and dairy farms.

For instance, a single cow can produce around 40-50 kg of manure per day, contributing to millions of tons of waste annually across the globe. Additionally, livestock waste contains high levels of organic material, making it more prominent in terms of volume and environmental impact.

Service Type Analysis

Waste Processing & Treatment Service Dominated the Agriculture Waste Management Market.

On the basis of service type, the agriculture waste management market is segmented into waste collection & transportation, waste processing & treatment, and others. The waste processing & treatment dominated the market, comprising around 61.3% of the market share, due to the increasing need to convert agricultural residues into valuable by-products, such as biogas, compost, and organic fertilizers.

As agriculture continues to grow globally, waste processing technologies such as anaerobic digestion, composting, and pyrolysis play a critical role in reducing environmental impact and turning waste into renewable resources. While waste collection and transportation are important, they are often considered preliminary steps that lead to the more value-driven processes of treatment and recycling.

Technology Analysis

Biological Treatment was the Most Used Technology for Agriculture Waste Management.

Based on the technologies used for agricultural waste management, the market is divided into physical treatment, biological treatment, thermal treatment, recycling & reuse, and others. The biological treatment dominated the market, with a market share of 38.9%, as it is cost-effective, environmentally friendly, and well-suited to the organic nature of agricultural waste. Processes such as composting and anaerobic digestion are particularly effective at breaking down organic materials such as crop residues, manure, and food waste into valuable by-products such as compost, biogas, or organic fertilizers.

For instance, anaerobic digestion can convert livestock manure into biogas, providing renewable energy while reducing greenhouse gas emissions. Additionally, biological treatments are less energy-intensive compared to thermal treatments, which require higher temperatures and significant fuel consumption, and they produce fewer pollutants. The combination of cost-effectiveness, efficiency, and sustainability drives the preference for biological treatment over other methods in agricultural waste management.

Key Market Segments

By Waste Type

- Crop Residues

- Livestock Waste

- Processing Waste

- Others

By Service Type

- Waste Collection & Transportation

- Waste Processing & Treatment

- Others

By Technology

- Physical Treatment

- Composting

- Mulching

- Others

- Biological Treatment

- Anaerobic Digestion

- Vermicomposting

- Fermentation

- Others

- Thermal Treatment

- Incineration

- Pyrolysis

- Gasification

- Recycling & Reuse

- Others

Drivers

The Need for Environmental Protection Drives the Agriculture Waste Management Market.

The increasing emphasis on environmental protection through regulations and public awareness has significantly shaped the agricultural waste management market. Agriculture is a major contributor to global waste, resulting in substantial environmental impact. Globally, about one-third of food produced, 1.3 billion tons annually, is lost or wasted, with a significant portion coming from on-farm crop waste. This waste accounts for 40% of all food produced and is a major contributor to climate change, generating around 2.2 gigatons of CO2eq emissions annually.

- The management of agricultural waste is crucial, as it wastes about 1.4 billion hectares of agricultural land, 24% of all water used for agriculture, and contributes to food insecurity.

Governments worldwide have introduced stricter regulations to mitigate this issue, such as waste reduction mandates and sustainability goals. For instance, in the United States, the Resource Conservation and Recovery Act (RCRA) governs the disposal of hazardous agricultural waste, and Clean Water Act (CWA) regulates runoff from farms to prevent water pollution from pesticides, manure, and fertilizers.

Similarly, the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) regulates the use and disposal of pesticides to minimize environmental contamination, and the Basel Convention regulates the transboundary movement of hazardous agricultural waste. These initiatives drive the adoption of sustainable agricultural practices and promote the development of technologies designed to transform agricultural waste into valuable resources, further enhancing environmental protection.

Restraints

High Initial Costs Might Pose a Challenge to the Agriculture Waste Management Market.

Despite the growing interest in agricultural waste management, several challenges continue to hinder its widespread adoption, particularly high initial costs, limited infrastructure, and a lack of market demand for recycled products. Establishing waste management systems, such as composting facilities, biogas plants, or recycling units, often requires significant upfront investment, which may be prohibitive for small-scale farmers or developing regions.

Additionally, the infrastructure required to efficiently collect, process, and transport agricultural waste is often underdeveloped, particularly in rural areas, making it difficult to implement effective waste management solutions. Furthermore, the market for recycled agricultural products, such as bio-based fertilizers or bioplastics, is relatively niche, with limited consumer awareness and demand. The economic viability of recycling agricultural waste can be uncertain when markets are not fully established, making it difficult for farmers to justify the investment in waste-to-value technologies.

Opportunity

Production of Value-Added Products Creates Opportunities in the Agriculture Waste Management Market.

The production of value-added products from agricultural waste presents significant opportunities in the agricultural waste management sector. By converting agricultural residues into useful by-products such as fertilizers, animal feed, bioplastics, and building materials, the industry can create sustainable solutions while reducing environmental impact. For instance, agricultural by-products such as crop residues and animal manure can be processed into organic fertilizers, promoting soil health and reducing reliance on synthetic chemicals.

Additionally, agricultural waste, such as corn stalks or rice husks, can be transformed into bioplastics, offering an eco-friendly alternative to petroleum-based plastics. Furthermore, organic waste is increasingly being used in the production of animal feed, helping to address feed shortages while minimizing food waste. Moreover, innovations in using agricultural waste for building materials, such as bio-composite bricks, are gaining traction, supporting the construction industry’s sustainability goals. These developments contribute to a circular economy and offer new avenues for waste valorization.

Trends

Emphasis on the Economic Potential of Agriculture Waste-to-Energy Technologies.

The emphasis on the economic potential of agriculture waste-to-energy technologies is becoming a prominent trend in the agriculture waste management sector. As agricultural residues such as crop stubble, food waste, and livestock manure accumulate, converting these materials into renewable energy presents both environmental and economic benefits. For instance, anaerobic digestion processes can convert organic waste into biogas, which can be used to generate electricity and heat, helping reduce reliance on fossil fuels.

- In 2024, biogas production reached 1.4 million standard cubic feet per minute (scfm), a 10% increase from 2023, in the United States alone.

In regions such as India, the adoption of biogas plants has been proven effective in both waste management and providing rural communities with energy, supporting energy independence. Similarly, agricultural biomass can be converted into biofuels, such as ethanol, contributing to cleaner energy solutions.

- According to a report by the International Energy Agency (IEA), in 2024, global biofuel production, led by the U.S. and driven by strong ethanol and biodiesel output, accounted for 20% of renewable fuel consumption.

- The IEA forecasts that global biofuel demand will reach 215 billion liters by 2030, with a focus shifting towards the aviation and maritime sectors.

By creating energy from agricultural waste, these technologies help to reduce greenhouse gas emissions and offer farmers and businesses new revenue streams, further driving sustainability and economic growth within the sector.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Agriculture Waste Management Market by Disrupting the Essential Supply Chains in the Market.

The geopolitical tensions, particularly the ongoing conflict in Ukraine and trade disruptions resulting from tensions between major global economies such as the United States, European Union, and China, have had a notable impact on the agriculture waste management market. The Russia-Ukraine conflict, with both countries being key agricultural producers and fertilizer exporters, has led to disruptions in crop production and supply chains, resulting in increased agricultural waste due to halted harvests and logistical bottlenecks. This has led to significant price spikes and volatility for key agricultural inputs, including natural gas, a major component in nitrogen fertilizers, and food commodities.

Similarly, increased shipping times and freight rates due to conflicts in the Panama and Suez canals have up surged the prices of final products of the industry. Higher production costs in core agriculture can reduce profit margins, potentially limiting immediate investment in waste management infrastructure.

Furthermore, the current energy crisis, exacerbated by geopolitical uncertainties, has made the development of waste-to-energy solutions more difficult, as rising energy costs reduce the financial viability of implementing such technologies. Moreover, these tensions often shift focus away from long-term sustainability goals, slowing progress toward circular economy initiatives and waste valorization practices in agriculture.

Regional Analysis

Europe Held the Largest Share of the Global Agriculture Waste Management Market.

In 2024, Europe dominated the global agriculture waste management market, holding about 35.6% of the total global consumption, due to its strong regulatory framework, advanced technological innovations, and growing commitment to sustainability. The European Union has implemented robust environmental policies, such as the Circular Economy Action Plan and the Farm to Fork Strategy, which emphasize waste reduction, recycling, and the promotion of sustainable agricultural practices.

Additionally, the European Union’s Green Deal aims to promote sustainable waste management practices, encouraging the recycling and composting of agricultural by-products. These regulations incentivize the use of agricultural waste for energy production, composting, and the development of bio-based products.

- For instance, according to the International Energy Agency, Germany has the highest annual biogas production, around 87 TWh per year, while China produces around 81 TWh per year.

The region’s strong infrastructure for waste management, coupled with consumer demand for eco-friendly products, makes Europe a leader in advancing agricultural waste solutions.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major companies employ a variety of strategic activities to remain competitive in the agricultural waste management market. These include investing in advanced waste processing technologies, such as anaerobic digestion and composting, to enhance the efficiency and sustainability of waste conversion.

Additionally, companies focus on forming partnerships with agricultural stakeholders, such as farmers and agribusinesses, to ensure a consistent supply and streamline waste collection and treatment. Additionally, they prioritize research and development to innovate new waste-to-value solutions, such as bio-based fertilizers, bioplastics, or biofuels, which meet growing environmental demands by majorly investing in such firms.

Similarly, some companies emphasize acquisitions or partnerships with local players to tap into emerging markets and expand their geographic presence. These strategic activities enable companies to address market demand and environmental challenges.

The Major Players in The Industry

- Veolia

- SUEZ Group

- Republic Services Inc.

- Renewi plc

- Homebiogas

- Skip Shapiro Enterprises, LLC

- Paprec

- Engie SA

- EnviTec Biogas AG

- Air Liquide

- PlanET Biogas Group

- Black Earth Compost

- Atlas Organics

- AllSource Environmental

- Clean Harbors

- Other Key Players

Key Development

- In July 2025, SUEZ and Seabex, a French AgriTech start-up specializing in irrigation optimization and agricultural resource management, announced the signing of a partnership to experiment with the agronomic benefits of biochar on several farms.

- In March 2024, ENGIE New Ventures, ENGIE’s research and innovation investment fund for innovative start-ups that accelerate the energy transition, invested in WASE, a UK-based company developing technology that unlocks a 30% increase in the amount of methane generated from biomass, including from previously untreatable waste streams.

Report Scope

Report Features Description Market Value (2024) USD 40.5 Bn Forecast Revenue (2034) USD 101.3 Bn CAGR (2025-2034) 9.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Waste Type (Crop Residues, Livestock Waste, Processing Waste, and Others), By Service Type (Waste Collection & Transportation, Waste Processing & Treatment, and Others), By Technology (Physical Treatment, Biological Treatment, Thermal Treatment, Recycling & Reuse, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Veolia, SUEZ Group, Republic Services Inc., Renewi plc, Homebiogas, Skip Shapiro Enterprises, Paprec, Engie SA, EnviTec Biogas AG, Air Liquide, PlanET Biogas Group, Black Earth Compost, Atlas Organics, AllSource Environmental, Clean Harbors, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Agriculture Waste Management MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Agriculture Waste Management MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Veolia

- SUEZ Group

- Republic Services Inc.

- Renewi plc

- Homebiogas

- Skip Shapiro Enterprises, LLC

- Paprec

- Engie SA

- EnviTec Biogas AG

- Air Liquide

- PlanET Biogas Group

- Black Earth Compost

- Atlas Organics

- AllSource Environmental

- Clean Harbors

- Other Key Players