Global Agentic AI in Cybersecurity Market Size, Share, Statistics Analysis Report By Component (Solutions, Services), By Deployment Mode (Cloud-Based, On-Premises), By Application (Threat Detection and Response, Vulnerability Management, Others), By Industry Vertical (BFSI, IT & Telecom, Government, Healthcare, Retail, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139949

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Scope

- Key Takeaways

- Analyst View

- Key Statistics

- Regional Analysis

- By Component

- By Deployment Mode

- By Application

- By Industry Vertical

- Key Market Segments

- Driving Factor

- Restraining Factor

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Scope

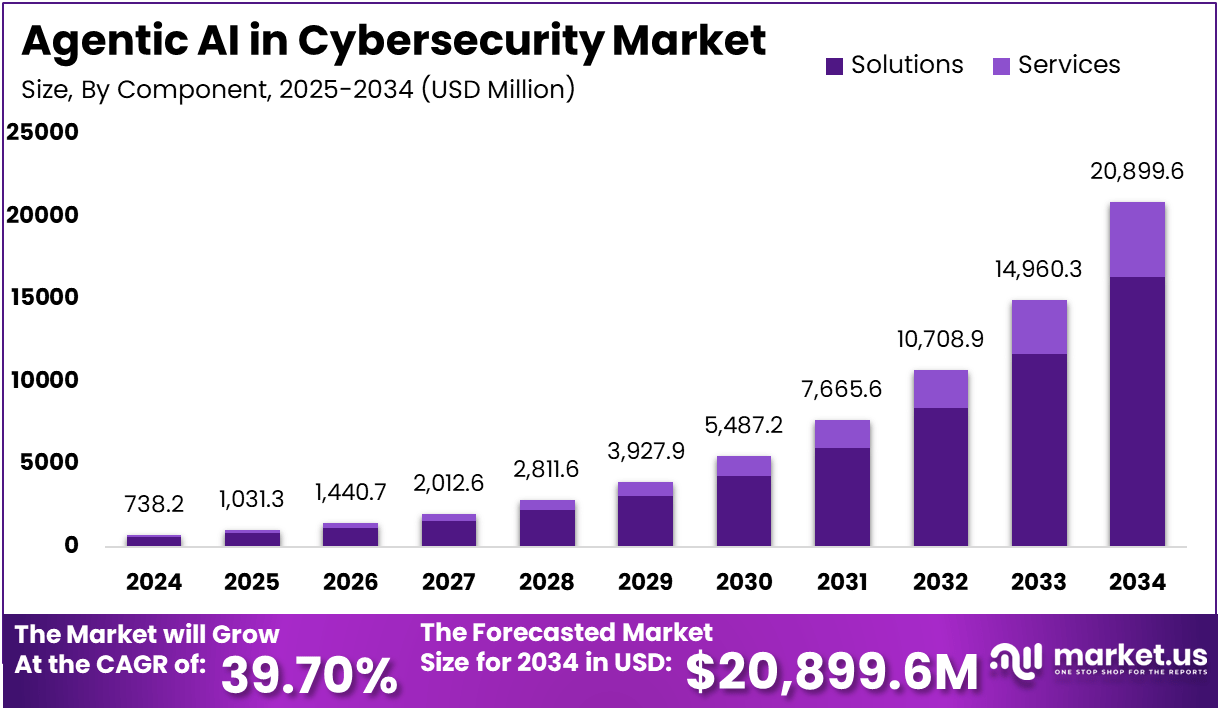

The Global Agentic AI in Cybersecurity Market is expected to be worth around USD 173.47 Million By 2034, up from USD 738.2 Million in 2024. It is expected to grow at a CAGR of 39.70% from 2025 to 2034.

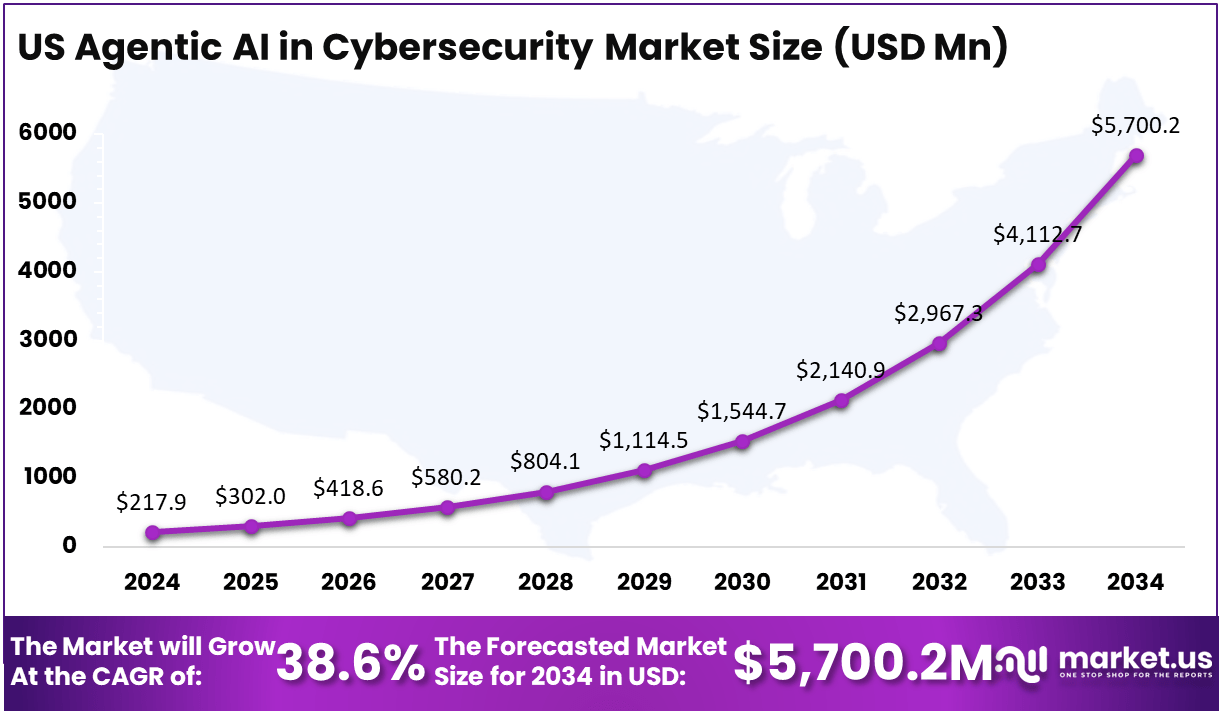

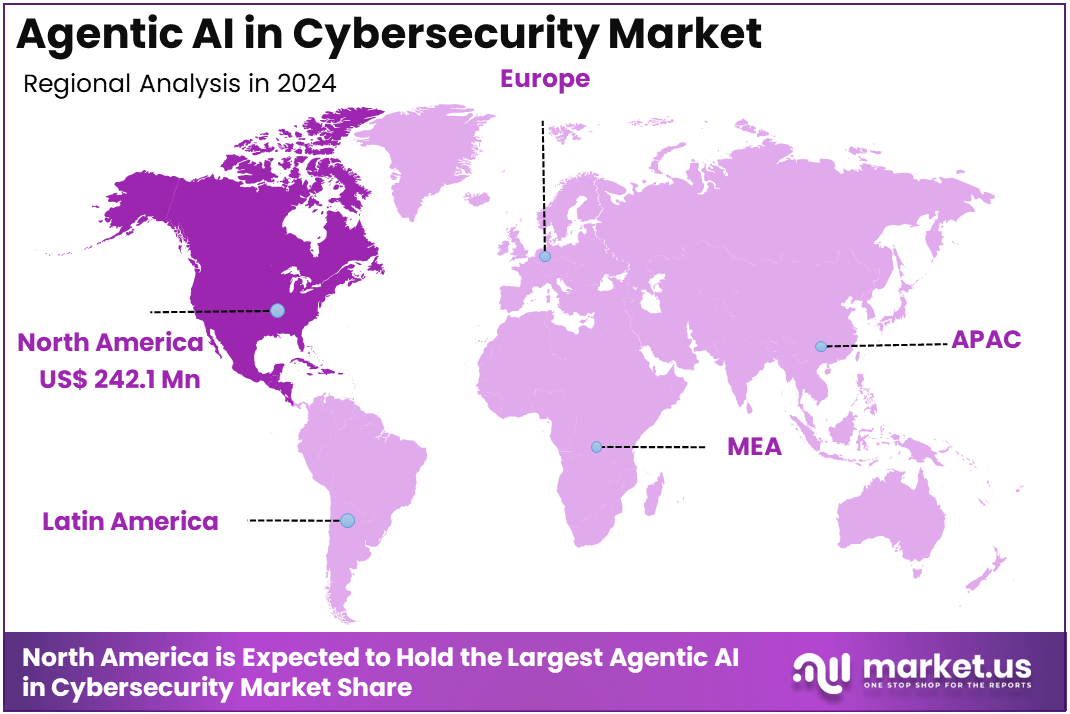

In 2024, North America held a dominant market position, capturing over a 32.8% share and earning USD 242.1 Million in revenue. Further, the United States dominates the market by USD 217.9 Million, steadily holding a strong position with a CAGR of 38.6%.

Agentic Artificial Intelligence (AI) refers to autonomous systems capable of making decisions and executing tasks without human intervention. In cybersecurity, agentic AI functions as an independent sentinel, continuously monitoring networks, analyzing data, and proactively safeguarding systems.

Unlike traditional security measures that rely on predefined rules and manual oversight, agentic AI adapts to emerging threats in real time, learning from its environment to enhance its defensive strategies. This dynamic approach enables organizations to counter sophisticated cyberattacks more effectively, as the AI anticipates and mitigates risks before they escalate.

Integrating agentic AI into cybersecurity has catalyzed a burgeoning market, with organizations worldwide investing in advanced AI-driven security solutions. This market encompasses a range of products and services designed to autonomously detect and respond to cyber threats, thereby reducing reliance on human intervention.

Companies like Palo Alto Networks have reported significant revenue growth attributed to the adoption of AI-powered cybersecurity tools, indicating robust market demand. The market is characterized by continuous innovation, with firms developing sophisticated AI agents capable of handling complex security tasks, from threat detection to automated incident response.

Key Takeaways

- Market Growth: The Agentic AI in Cybersecurity Market is projected to grow from USD 738.2 million in 2024 to USD 173.47 million in 2034, reflecting a CAGR of 39.70%.

- Dominant Component: Solutions account for the largest share, comprising 78.3% of the market.

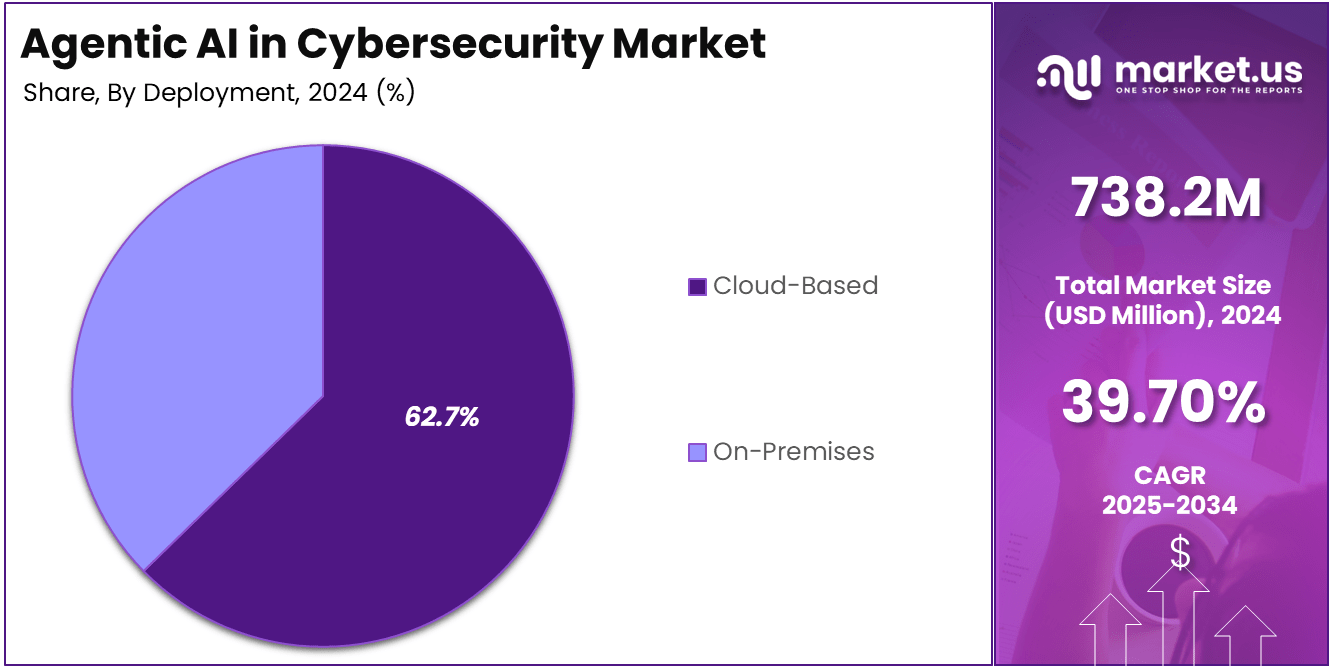

- Deployment Mode: Cloud-based solutions dominate the deployment segment, holding 62.7% of the market share.

- Primary Application: Threat Detection and Response is the leading application, making up 47.23% of the market.

- Leading Industry Vertical: The IT & Telecom sector is the largest end-user, contributing 21.74% of the market.

- Regional Leadership: North America holds the largest market share, accounting for 32.8% of the total market.

- U.S. Market: The United States is the leading country, with a market valuation of USD 217.9 million in 2024 and a CAGR of 38.6%.

Analyst View

The demand for agentic AI in cybersecurity is on an upward trajectory. Organizations are increasingly seeking solutions that offer proactive defense capabilities to stay ahead of potential threats. This demand is reflected in the financial performance of companies specializing in AI-driven security solutions.

For instance, Palo Alto Networks raised its annual revenue forecast, citing steady demand for its AI-powered cybersecurity products. Similarly, SentinelOne reported a 33% increase in quarterly revenue, attributing this growth to heightened interest in AI-enhanced security measures.

Market Opportunities

The evolving cybersecurity landscape presents several opportunities for agentic AI:

- Integration with Existing Systems: Developing AI agents that seamlessly integrate with current security infrastructures can enhance overall defense mechanisms without requiring complete system overhauls.

- SME Adoption: Small and medium-sized enterprises, often lacking extensive security budgets, represent a significant market segment. Offering scalable and cost-effective agentic AI solutions can help these organizations bolster their cybersecurity posture.

- Regulatory Compliance: As data protection regulations become more stringent, agentic AI can assist organizations in maintaining compliance by continuously monitoring and securing sensitive information.

Technological Advancements

Recent technological developments have significantly bolstered the effectiveness of agentic AI in cybersecurity:

- Enhanced Machine Learning Algorithms: Improved algorithms enable AI agents to analyze complex datasets more efficiently, leading to faster and more accurate threat detection.

- Behavioral Analytics: By assessing user behavior patterns, agentic AI can identify anomalies indicative of potential security breaches, allowing for preemptive action.

- Integration of Generative AI: Combining agentic AI with generative models allows for the creation of dynamic defense strategies, enabling systems to anticipate and counteract novel attack vectors.

Key Statistics

- Phishing Attacks: McKinsey reports a surge of 1,265% in phishing attacks since 2022, which is enhanced by AI-driven social engineering.

- Accuracy: KPMG’s generative AI tool achieved 98% accuracy in interpreting financial statements.

- Cost Reduction: Agentic AI security reduces cybersecurity incidents from disconnected applications, which can save organizations millions annually.

- Incident Response: Agentic AI can filter and resolve a large number of alerts automatically. For example, one implementation saw 74,826 out of 75,000 alerts resolved automatically, with only 174 requiring manual review. Of those escalated alerts, 38 were true positives.

- Visibility and Detection: Agentic AI can improve visibility across systems by over 98% and improve detection coverage by 110% within six months.

- Productivity and Efficiency: Agentic AI improves analyst morale and retention by performing routine triage and investigation work, allowing analysts to focus on more complicated security initiatives and strategic work.

Regional Analysis

Why is North America Leading?

North America’s dominance in the Agentic AI Cybersecurity Market is driven by a strong technological ecosystem, early adoption of AI security solutions, and regulatory frameworks that prioritize cybersecurity. The region has a well-developed cybersecurity infrastructure, with leading tech firms continuously innovating to stay ahead of cyber threats.

Additionally, the presence of major enterprises investing heavily in AI-powered threat detection and automation ensures steady market growth. With the US contributing over USD 217.9 million, North America remains the most advanced region in adopting agentic AI for cybersecurity, setting the benchmark for global market trends.

US Region Market Size

The United States dominates, with a market size of USD 217.9 million, maintaining its leadership with a strong CAGR of 38.6%. This indicates a steady demand for AI-driven cybersecurity solutions in the region.

Among market components, solutions hold the dominant share at 78.3%, reflecting strong investment in AI-powered cybersecurity platforms. Cloud-based deployment leads the market with 62.7%, driven by enterprises shifting to cloud environments. Threat Detection and Response remains the most sought-after application, contributing 47.23%. The IT & Telecom sector is the largest end-user, accounting for 21.74% of the market.

This rapid expansion is fueled by rising cyber threats, increasing adoption of AI-driven security solutions, and the growing need for real-time threat detection and response. Organizations across industries are integrating agentic AI to enhance security automation and minimize human intervention in cybersecurity operations. The market is driven by the increasing sophistication of cyber threats, growing reliance on cloud-based security solutions, and the need for automated threat detection.

North America Market Size

In 2024, North America held a dominant market position, capturing more than a 32.8% share, with USD 242.1 million in revenue. The region’s leadership in the Agentic AI Cybersecurity Market is attributed to the rapid adoption of AI-driven security solutions, increasing cyber threats, and strong government regulations on data protection.

The United States, with a market size of USD 217.9 million, remains the largest contributor, exhibiting a CAGR of 38.6%. The high concentration of leading cybersecurity firms, such as CrowdStrike, Palo Alto Networks, and Microsoft, further strengthens North America’s position. Enterprises across industries, especially IT, BFSI, and government sectors, are heavily investing in AI-powered cybersecurity to counter sophisticated cyberattacks.

Europe

Europe follows closely behind, with significant investments in cybersecurity technologies driven by stringent GDPR and increased cybercrime activities. Countries like Germany, the UK, and France are at the forefront, deploying AI-based threat detection and response systems. The European cybersecurity market is witnessing robust growth, as organizations prioritize compliance, data privacy, and risk mitigation strategies. The CAGR in Europe is projected at around 35%, with substantial investments in cloud-based AI security solutions.

Asia-Pacific (APAC)

The APAC region is emerging as one of the fastest-growing markets for agentic AI in cybersecurity, fueled by digital transformation, rising cyberattacks, and government-led cybersecurity initiatives. Countries like China, India, Japan, and South Korea are experiencing an increased demand for cloud-based AI security solutions, with a growing adoption in the banking, telecom, and e-commerce sectors. The region’s CAGR is expected to exceed 40%, making it a key growth hub. The Chinese market alone is investing heavily in AI-driven cybersecurity, with major tech firms enhancing their security frameworks.

Latin America

Latin America’s cybersecurity market is growing steadily, with Brazil, Mexico, and Argentina leading adoption. The rising digital economy and increasing cybercrime have pushed governments and enterprises to strengthen their cybersecurity infrastructure. However, budget constraints and a lack of skilled AI professionals remain challenges. Despite this, the region is expected to witness a CAGR of around 30%, with AI-driven security solutions gaining traction among financial and government institutions.

Middle East & Africa (MEA)

The Middle East & Africa market is still in its early stages, but growing cyber threats, digital banking expansion, and cloud adoption are driving demand. Countries like the UAE, Saudi Arabia, and South Africa are making significant investments in AI-based cybersecurity, particularly in the financial, oil & gas, and government sectors. The MEA cybersecurity market is projected to grow at a CAGR of approximately 32%, with an increasing focus on national cybersecurity strategies and AI-driven threat detection.

By Component

In 2024, the Solutions segment held a dominant market position, capturing more than 78.3% of the market share. This strong dominance is primarily driven by the growing demand for comprehensive, automated cybersecurity solutions that provide real-time threat detection and response capabilities.

As cyber threats continue to evolve in sophistication, organizations are increasingly adopting AI-powered solutions to enhance their security posture without relying heavily on manual intervention. These solutions include advanced AI-driven threat detection systems, automated incident response tools, and behavioral analytics platforms that can identify and mitigate risks more effectively than traditional methods.

Additionally, cloud-based solutions are becoming a key preference, as they offer scalability, flexibility, and cost-efficiency. The Services segment, while also important, is growing at a slower pace because companies are opting for more self-sufficient solutions that can run autonomously with minimal external support. This trend reflects the shift towards automation and intelligence-driven security in the cybersecurity space, where organizations seek proactive rather than reactive defenses.

By Deployment Mode

In 2024, the Cloud-Based segment held a dominant market position, capturing more than 62.7% of the market share. The leading position of cloud-based solutions is largely driven by the growing adoption of cloud computing and the need for scalable, flexible security solutions.

Cloud-based deployments offer several key advantages over traditional on-premises models, such as lower upfront costs, faster implementation, and the ability to scale security resources as needed. These solutions are particularly attractive to organizations that are transitioning to the cloud or operating in hybrid environments, as they integrate seamlessly with cloud infrastructure.

Moreover, cloud-based AI solutions enable continuous updates and improvements, keeping security systems agile in the face of evolving cyber threats. On the other hand, the On-Premises segment continues to account for a smaller portion of the market due to its higher cost and maintenance requirements, along with the increasing preference for cloud-based flexibility. As a result, cloud deployment is quickly becoming the preferred choice for organizations seeking cost-effective, automated, and highly adaptive cybersecurity solutions.

By Application

In 2024, the Threat Detection and Response segment held a dominant market position, capturing more than 47.23% of the market share. This segment’s leadership can be attributed to the growing complexity and frequency of cyberattacks, which require highly advanced, real-time threat detection capabilities.

Agentic AI-driven solutions excel in identifying potential threats and responding autonomously, significantly reducing the time it takes to mitigate risks. As organizations face increasingly sophisticated cyber threats such as ransomware, phishing, and advanced persistent threats (APTs), the demand for AI-based threat detection and automated incident response systems has surged.

These solutions provide predictive analytics and can adapt to emerging threats, offering a level of agility that traditional security methods often lack. While Vulnerability Management and other applications are important, they account for a smaller market share because organizations are prioritizing solutions that can actively detect and neutralize threats in real time. This makes Threat Detection and Response the most critical application for cybersecurity strategies, driving its dominant position in the market.

By Industry Vertical

In 2024, the IT & Telecom segment held a dominant market position, capturing more than 21.74% of the market share. The leadership of this segment is driven by the increasing reliance of the IT & Telecom industry on complex digital infrastructures, which require advanced cybersecurity measures.

With the growing volume of data and the rise of digital services, this sector faces a heightened risk of cyber threats such as data breaches, DDoS attacks, and network intrusions. As a result, the demand for AI-powered cybersecurity solutions that can monitor, detect, and respond to threats in real time has skyrocketed.

Additionally, telecom providers and cloud service providers are adopting AI-driven security to protect vast, interconnected networks and support regulatory compliance. The BFSI (Banking, Financial Services, and Insurance) and Healthcare sectors also follow closely in terms of cybersecurity adoption, but the scale and complexity of threats in the IT & Telecom sector place it at the forefront of the market. The industry’s high digital transformation and extensive data flow ensure its dominant share in the market.

Key Market Segments

By Component

- Solutions

- Services

By Deployment Mode

- Cloud-Based

- On-Premises

By Application

- Threat Detection and Response

- Vulnerability Management

- Others

By Industry Vertical

- BFSI

- IT & Telecom

- Government

- Healthcare

- Retail

- Others

Driving Factor

Increasing Cyber Threats

The primary driving factor for the growth of Agentic AI in Cybersecurity is the escalating sophistication and volume of cyber threats. As organizations digitalize their operations, the attack surface for cybercriminals expands, making businesses more vulnerable to breaches. Threats such as ransomware, phishing, and advanced persistent threats (APTs) are becoming more intricate, and manual methods of detection are no longer sufficient to protect against them. This has led to a rising demand for AI-powered solutions capable of detecting anomalies and responding in real time.

Agentic AI, with its ability to learn from vast amounts of data and adapt autonomously to evolving threats, is essential in providing robust, proactive security measures. Unlike traditional security tools, AI-driven systems can analyze patterns, identify potential risks, and neutralize threats before they escalate, offering a faster, more effective response to cyberattacks.

Restraining Factor

High Initial Investment Costs

Despite the growing demand, a significant restraining factor for the widespread adoption of Agentic AI in Cybersecurity is the high initial investment cost. For many organizations, particularly small and medium-sized businesses (SMBs), the cost of implementing AI-powered cybersecurity solutions can be prohibitively expensive. The upfront costs include purchasing sophisticated AI platforms, training staff to use these systems effectively, and integrating the solutions into existing infrastructure.

Additionally, on-premises deployments often require significant investments in hardware and maintenance, further increasing the total cost of ownership. While cloud-based solutions offer more flexibility, the recurring subscription fees can still represent a major expense for some organizations. Furthermore, the need for specialized talent to configure and manage these AI systems adds another layer of financial burden.

Growth Opportunities

Expanding Adoption in Small and Medium-Sized Enterprises (SMEs)

A significant growth opportunity within the Agentic AI in Cybersecurity Market lies in expanding adoption among small and medium-sized enterprises (SMEs). While large enterprises have been at the forefront of adopting AI-driven cybersecurity solutions, SMEs are increasingly recognizing the need to strengthen their cybersecurity frameworks as they digitize operations. However, due to budget constraints, many SMEs have been slower to adopt advanced security technologies.

As cloud-based and AI-driven solutions become more affordable and accessible, SMEs now have the opportunity to leverage scalable security solutions without the hefty upfront costs associated with traditional on-premises systems. Cloud deployment, in particular, offers SMEs the flexibility to only pay for what they use, making advanced security more financially viable. Additionally, AI-powered tools can provide SMEs with enhanced threat detection and real-time responses, which were previously available only to larger enterprises with bigger budgets.

Challenging Factors

Lack of Skilled Workforce

A key challenge hindering the growth of Agentic AI in the Cybersecurity Market is the shortage of skilled professionals who can effectively implement and manage AI-driven security systems. While AI has the potential to revolutionize cybersecurity, it requires a specialized workforce with knowledge of both AI technologies and cybersecurity protocols. This skills gap is especially prevalent in regions with fewer educational and training programs focused on AI and cybersecurity.

As businesses deploy increasingly complex AI solutions, they require experts who can configure, monitor, and fine-tune these systems to respond effectively to emerging threats. The shortage of skilled talent leads to longer implementation timelines, increased training costs, and potential inefficiencies in system management. In some cases, companies may struggle to fully leverage the capabilities of AI systems due to a lack of qualified personnel, impacting the overall effectiveness of their cybersecurity infrastructure.

Growth Factors

Several factors are driving the growth of Agentic AI in the Cybersecurity market. A major contributor is the rising frequency and complexity of cyberattacks. In 2023, global ransomware damage costs were projected to exceed USD 20 billion, fueling the demand for advanced AI-driven security solutions that can detect, analyze, and mitigate such threats in real time.

The adoption of cloud services has also accelerated the need for AI cybersecurity, with cloud-based deployments expected to capture 62.7% of the market share by 2024. Additionally, the growing reliance on remote work and digital transformation across industries has made it essential for businesses to secure their networks and data from cyber threats. As a result, organizations are turning to AI solutions that provide 24/7 monitoring and autonomous threat detection to enhance their cybersecurity posture.

Emerging Trends

The Agentic AI in Cybersecurity Market is seeing several emerging trends that are reshaping the landscape. One significant trend is the increased integration of AI with machine learning (ML) and deep learning (DL) technologies, enabling even more accurate detection of complex threats. In 2024, AI solutions will increasingly adopt predictive analytics, allowing organizations to anticipate cyberattacks before they occur.

The demand for AI-powered automation is also growing, as businesses look for ways to reduce manual intervention and speed up the detection-to-response cycle. Another trend is the rise of AI-driven security for IoT (Internet of Things) devices, as these networks become prime targets for cyberattacks. IoT-based security is expected to be one of the fastest-growing segments in the cybersecurity market.

Additionally, cloud-native AI security solutions are on the rise, as businesses prefer scalable and cost-effective cloud-based deployments. By 2025, cloud-based cybersecurity solutions are projected to make up around 70% of the market share, signaling a shift toward more flexible, efficient security models.

Business Benefits

The adoption of Agentic AI in Cybersecurity brings numerous benefits to businesses. First, AI’s ability to automate threat detection and response significantly reduces the burden on security teams, allowing them to focus on more complex tasks. This leads to greater operational efficiency and reduced response times, which is critical for mitigating cyberattacks before they cause significant damage. For example, AI-powered systems can detect threats in milliseconds, much faster than traditional methods, ensuring quicker mitigation.

Additionally, AI solutions help businesses minimize human error, which is a major factor in most security breaches. As organizations struggle with a cybersecurity skills gap, AI can bridge this by providing autonomous decision-making and real-time analysis, reducing the need for a highly specialized workforce.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

SentinelOne has been a key player in the Agentic AI in Cybersecurity Market, known for its autonomous threat detection and response solutions powered by artificial intelligence. The company’s market positioning strengthened significantly after its IPO in 2021, as it gained widespread attention for its AI-powered endpoint security platform. In recent years, SentinelOne has made strategic acquisitions to enhance its product portfolio.

CrowdStrike remains a dominant player in the Agentic AI cybersecurity space, recognized for its cloud-native Falcon platform that leverages AI and machine learning to detect and respond to cyber threats. The company has been aggressive in its expansion strategies, making significant investments in research and development to stay ahead of evolving cyber threats. One notable move was CrowdStrike’s acquisition of Humio 2021, a log management and observability company.

Palo Alto Networks has solidified its leadership position in the Agentic AI in the Cybersecurity Market through both strategic acquisitions and continuous product innovation. In 2021, the company acquired CloudGenix, a leader in SD-WAN technology, strengthening its network security portfolio and expanding its AI-driven security solutions to offer more comprehensive protection for hybrid work environments.

Top Key Players in the Market

- SentinelOne, Inc.

- CrowdStrike, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Trend Micro Incorporated

- Vectra AI, Inc.

- Zscaler, Inc.

- Armis, Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Other Major Players

Recent Developments

- In 2024, SentinelOne strengthened its market position by launching an AI-powered autonomous SOC (Security Operations Center) designed to automate threat detection, investigation, and response across multi-cloud environments.

- In 2024, CrowdStrike further expanded its AI-driven cybersecurity capabilities by integrating AI-powered threat intelligence into its flagship Falcon platform.

Report Scope

Report Features Description Market Value (2024) USD 738.2 Million Forecast Revenue (2034) USD 173.47 Million CAGR (2025-2034) 39.70% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions, Services), By Deployment Mode (Cloud-Based, On-Premises), By Application (Threat Detection and Response, Vulnerability Management, Others), By Industry Vertical (BFSI, IT & Telecom, Government, Healthcare, Retail, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape SentinelOne, Inc., CrowdStrike, Inc., Palo Alto Networks, Inc., Fortinet, Inc., Trend Micro Incorporated, Vectra AI, Inc., Zscaler, Inc., Armis, Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc., Other Major Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agentic AI in Cybersecurity MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Agentic AI in Cybersecurity MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SentinelOne, Inc.

- CrowdStrike, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Trend Micro Incorporated

- Vectra AI, Inc.

- Zscaler, Inc.

- Armis, Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Other Major Players