Global Aerospace MRO Market Size, Share, Industry Analysis Report By Service (Engine Overhaul, Airframe Maintenance, Line Maintenance, Modification, Components), By Organization Type (Airline/Operator MRO, Independent MRO, OEM MRO), By Aircraft Type (Narrow-Body, Wide-Body, Regional Jet, Others), By Aircraft Generation (Old Generation, Mid Generation, New Generation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158004

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

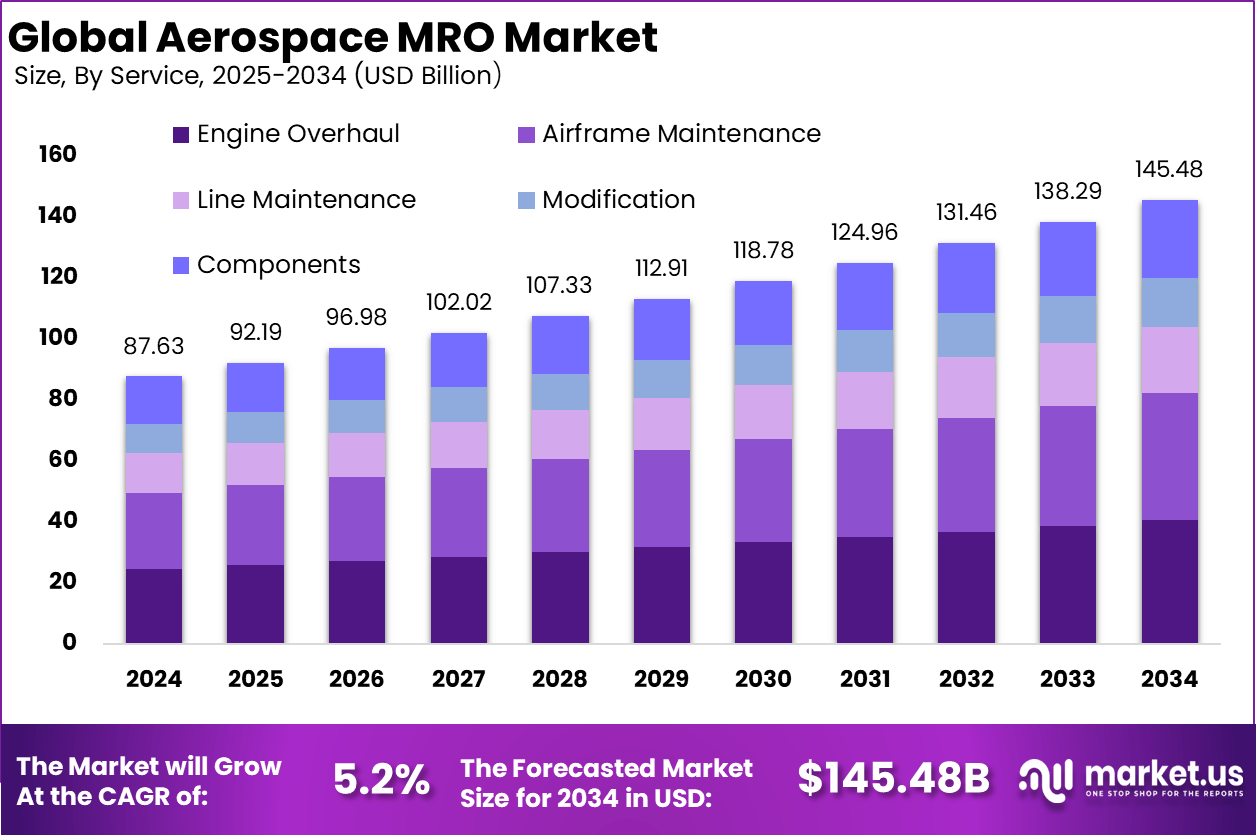

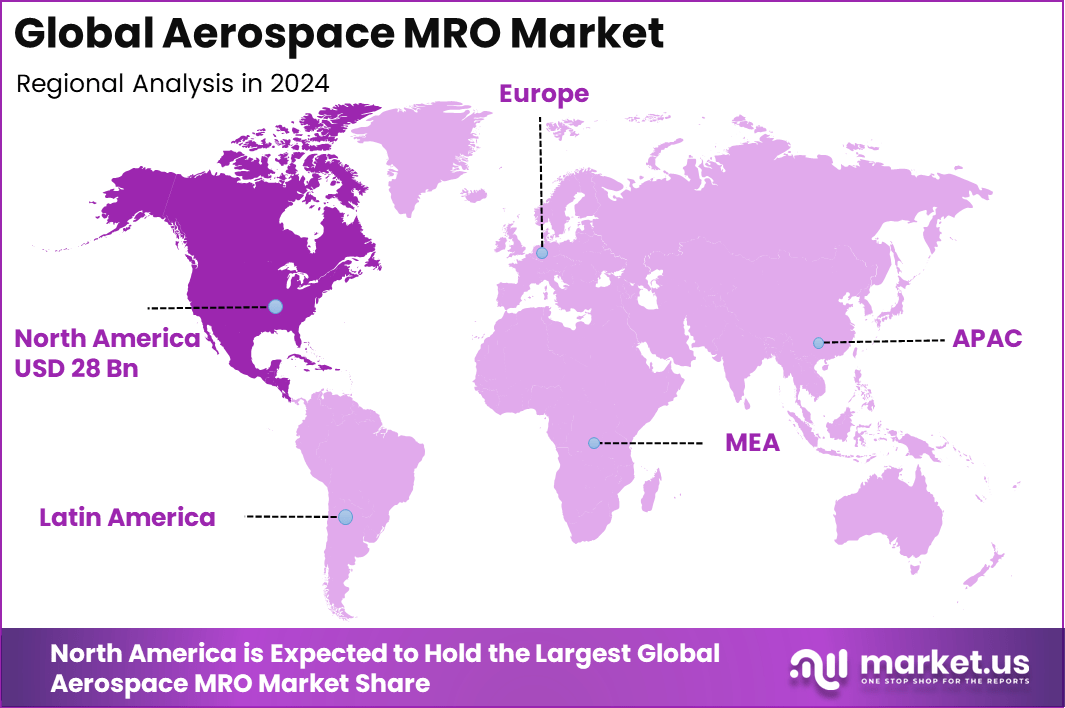

The Global Aerospace MRO Market size is expected to be worth around USD 145.48 billion by 2034, from USD 87.63 billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32% share, holding USD 28.04 billion in revenue.

The Aerospace MRO Market refers to the industry that provides maintenance, repair, and overhaul services for aircraft, engines, components, and systems. MRO activities are essential to ensure the safety, reliability, and regulatory compliance of aircraft throughout their service life.

The market includes line maintenance, base maintenance, engine overhaul, component repair, and modifications. Service providers include independent MRO companies, original equipment manufacturers (OEMs), and airline-affiliated maintenance divisions. This market serves both commercial and military aviation, covering passenger aircraft, cargo fleets, and defense aircraft.

The growth of the aerospace MRO market is driven by the expanding global aircraft fleet, rising air passenger traffic, and increasing demand for cargo transport. Airlines are extending the operational life of older aircraft, which requires consistent maintenance and upgrades. Regulatory requirements for airworthiness and safety standards further fuel the demand for MRO services.

Additionally, outsourcing by airlines to specialized MRO providers is becoming more common, as it helps reduce operational costs and focus on core flight operations. Growth in low-cost carriers and expansion into emerging markets are also important drivers.

According to uja.in, only 15-20% of MRO services are carried out locally, while 80-85% are outsourced to international providers. Engine MRO, which makes up nearly 50% of the total market, is almost entirely managed overseas. Furthermore, India’s Defence MRO market is projected to reach INR 260 billion by 2031 to support a fleet of more than 2,000 aircraft.

For instance, in April 2025, GE Aerospace and CFM International announced plans to continue expanding their MRO capacity to meet the increasing demand for aircraft maintenance services. The collaboration aims to enhance the overhaul capacity for CFM56 and LEAP engines, reinforcing their position in the global aerospace MRO market.

Key Takeaway

- In 2024, the Engine Overhaul segment led with a 28% share of the market.

- The Independent MRO segment dominated by provider type, capturing 40% share.

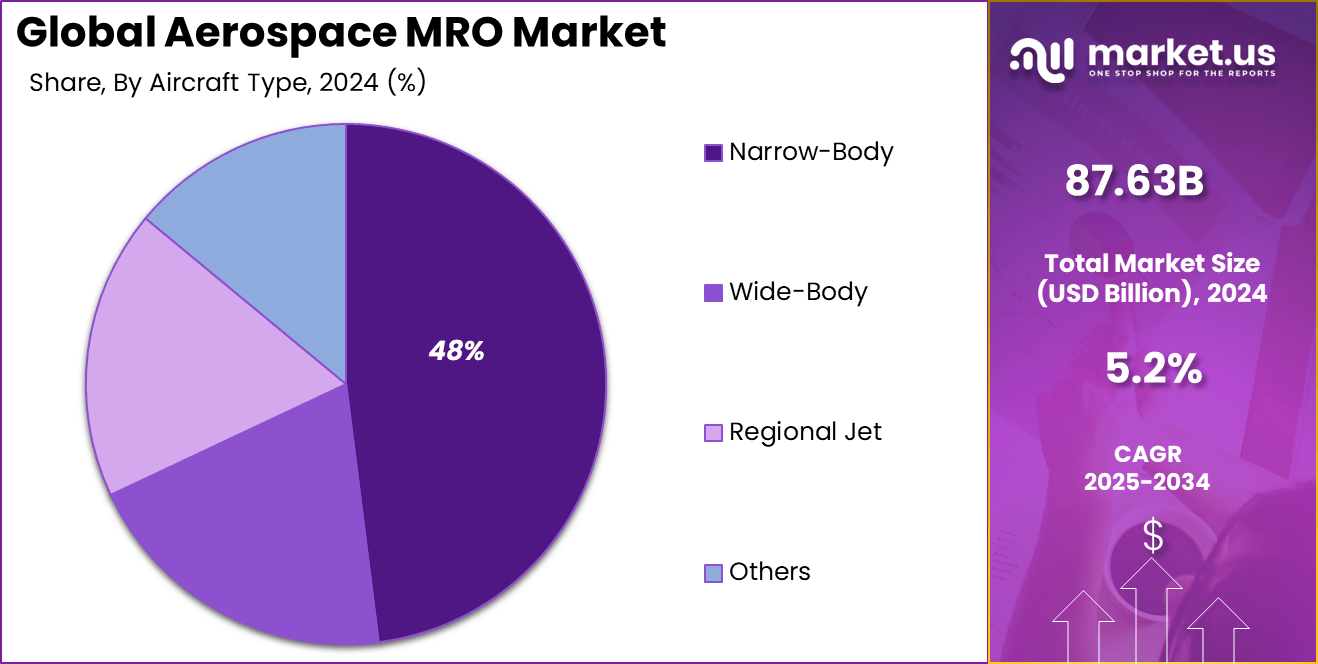

- By aircraft type, the Narrow-Body segment held the top position with 48% share.

- By generation, the Mid Generation segment accounted for 43% share.

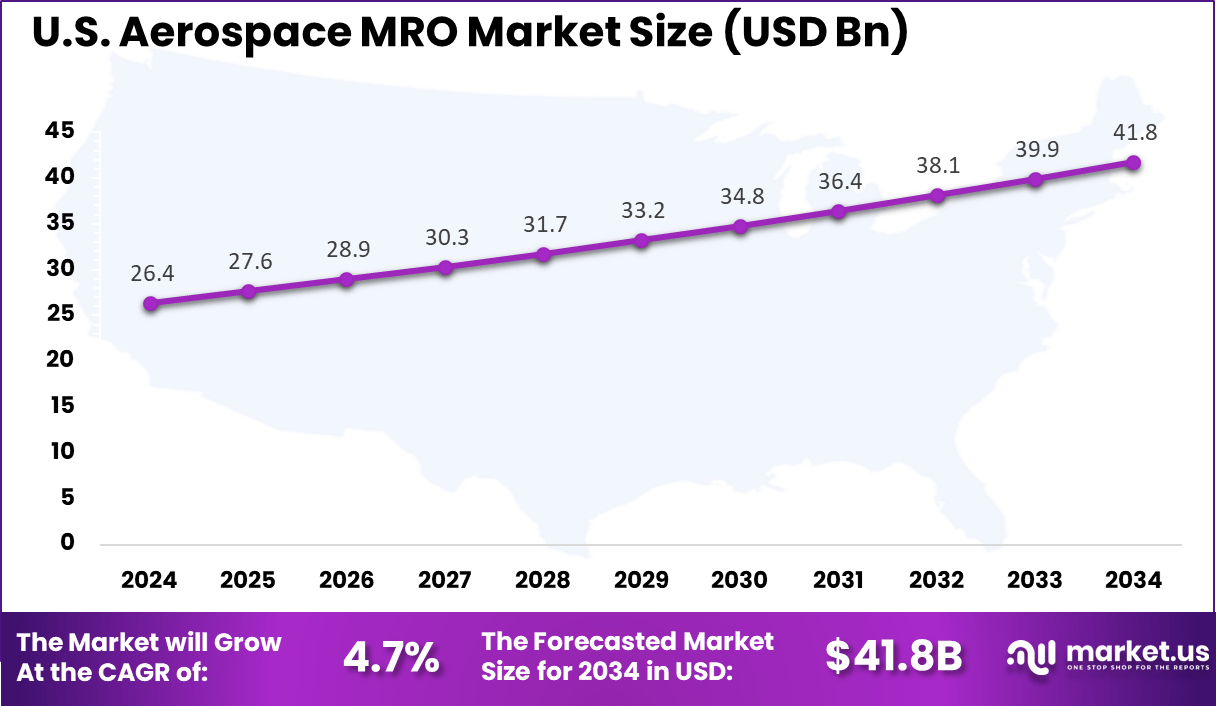

- The U.S. Aerospace MRO market was valued at USD 26.4 Billion in 2024, growing at a steady 4.7% CAGR.

- Regionally, North America led the global market with over 32% share in 2024.

U.S. Market Size

The market for Aerospace MRO within the U.S. is growing tremendously and is currently valued at USD 26.4 billion, the market has a projected CAGR of 4.7%. The market is growing tremendously due to the expansion of both commercial and military air fleets, leading to increased demand for maintenance and repair services.

The U.S. remains a global aviation hub, with a significant number of aging aircraft requiring more frequent servicing. Technological advancements in digital tools, predictive maintenance, and automation are also driving growth. Additionally, the U.S. government’s defense spending and regulatory requirements ensure continued investment in aerospace MRO services, further fueling the market’s growth.

For instance, in June 2025, a landmark Indo-U.S. collaboration was announced between RSR Aviation and Alpha Aircraft Systems, forming a joint venture focused on aerospace MRO services. This strategic partnership highlights the growing dominance of the U.S. in the global aerospace MRO market.

In 2024, North America held a dominant market position in the Global Aerospace MRO Market, capturing more than a 32% share, holding USD 28 billion in revenue. This dominance is due to its well-established aerospace industry and large fleet of commercial and military aircraft.

The region benefits from a strong presence of major MRO providers, advanced technological capabilities, and significant investment in research and development. Additionally, strict safety regulations and a high demand for efficient maintenance services in both the civilian and defense sectors further contribute to North America’s leading position in the global MRO market.

For instance, in July 2025, Delta TechOps approached $1 billion in revenue, driven by the surge in MRO demand. This growth highlights North America’s continued dominance in the aerospace MRO sector. As one of the largest providers of MRO services globally, Delta TechOps is capitalizing on the increasing need for aircraft maintenance, driven by a growing fleet and higher air traffic.

Service Analysis

In 2024, The Engine Overhaul segment held a dominant market position, capturing a 28% share of the Global Aerospace MRO Market. This dominance is due to the critical importance of engine maintenance in ensuring aircraft safety, performance, and efficiency.

As engines are complex, high-value components that require regular inspection, repair, and overhaul, airlines and operators prioritize them to minimize downtime and avoid costly failures. Additionally, advancements in engine technology and the growing fleet of older aircraft contribute to the sustained demand for engine overhaul services.

For Instance, in April 2025, Pratt & Whitney and Delta TechOps announced an agreement to expand GTF engine overhaul capacity at Delta TechOps’ Atlanta facility by more than 30%, increasing the facility’s annual capacity to overhaul up to 450 engines.

Organization Type Analysis

In 2024, the Independent MRO segment held a dominant market position, capturing a 40% share of the Global Aerospace MRO Market. This dominance is due to the flexibility and cost advantages independent MRO providers offer compared to OEMs.

Independent MROs can service a wide range of aircraft types, often at lower costs and with quicker turnaround times. Their ability to offer customized, competitive solutions and the increasing trend of airlines outsourcing MRO services have contributed to their strong position in the market.

For instance, in August 2024, Dassault announced plans to establish an independent MRO facility for its Rafale and Mirage aircraft, without partnering with Reliance Defence. This move highlights Dassault’s strategy to strengthen its own maintenance, repair, and overhaul capabilities for its fleet in India.

Aircraft Type Analysis

In 2024, The Narrow-Body segment held a dominant market position, capturing a 48% share of the Global Aerospace MRO Market. This dominance is due to the widespread use of narrow-body aircraft in both regional and short-haul flights, which form the backbone of many commercial airline fleets.

With a large number of narrow-body aircraft in operation, the demand for MRO services in this segment is high. Additionally, narrow-body planes are typically more cost-effective to maintain, driving continuous demand for maintenance and repair services.

For Instance, in June 2025, DTX Group launched a new initiative to provide comprehensive “nose-to-tail” MRO services for narrow-body aircraft. This expansion is aimed at addressing the increasing demand for efficient, high-quality maintenance services for popular narrow-body aircraft models like the Airbus A320 and Boeing 737.

Aircraft Generation Analysis

In 2024, The Mid Generation segment held a dominant market position, capturing a 43% share of the Global Aerospace MRO Market. This dominance is due to the large number of mid-generation aircraft in service, which includes models that are still within their operational lifespan but require regular maintenance, repair, and upgrades.

For Instance, in February 2025, ST Engineering secured significant MRO contracts with major Middle Eastern operators, focusing on a range of aircraft, including mid-generation models. These agreements highlight the growing demand for maintenance services for mid-generation aircraft, which are still widely used in commercial fleets.

Key Market Segments

By Service

- Engine Overhaul

- Airframe Maintenance

- Line Maintenance

- Modification

- Components

By Organization Type

- Airline/Operator MRO

- Independent MRO

- OEM MRO

By Aircraft Type

- Narrow-Body

- Wide-Body

- Regional Jet

- Others

By Aircraft Generation

- Old Generation

- Mid Generation

- New Generation

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increasing Air Traffic and Fleet Growth

The growing demand for air travel, especially in emerging markets, is driving the expansion of the global fleet. As demand for air travel increases, the need for Maintenance, Repair, and Overhaul (MRO) services grows in parallel.

These services ensure the safety, performance, and regulatory compliance of aircraft, ultimately supporting airlines in maintaining fleet readiness and operational efficiency. This trend propels demand for both routine maintenance and specialized repairs across the aviation industry.

For instance, in August 2025, IndiGo Airlines announced a major growth strategy that includes the establishment of a new MRO facility in Bengaluru and plans to significantly increase its fleet ownership. With the aim of owning 30-40% of its aircraft by 2030, this expansion will drive the demand for MRO services to ensure the safety and performance of a larger fleet.

Restraint

Skilled Labor Shortage

The aerospace MRO sector faces a significant shortage of skilled labor, including engineers, technicians, and mechanics. This shortage limits the capacity of MRO providers to meet growing demands and maintain the speed and quality of service.

As the complexity of aircraft increases, the need for highly specialized skills becomes more critical, making it challenging for companies to find and retain qualified professionals. This labor gap creates operational bottlenecks, delays, and escalated costs within the industry.

For instance, in January 2024, Magnetic MRO launched a training academy aimed at addressing the growing skilled labor shortage in the aerospace MRO sector. The academy is designed to equip the next generation of engineers, technicians, and maintenance professionals with the necessary skills to meet the increasing demand for MRO services.

Opportunities

Digitalization and Automation

Digitalization and automation present significant opportunities for the aerospace MRO market. The incorporation of artificial intelligence (AI), machine learning, and robotics can streamline maintenance processes, improving efficiency and reducing operational costs.

Predictive maintenance powered by digital tools allows for proactive repairs, reducing downtime and preventing costly unscheduled maintenance. By automating routine tasks and utilizing data-driven insights, MRO providers can enhance service accuracy, minimize human error, and significantly boost overall operational performance.

For instance, in August 2025, GE Aerospace announced the increased use of automation and artificial intelligence (AI) to enhance its MRO operations. This move reflects the growing trend of digitalization in the aerospace industry, as AI and automation are being integrated to improve service efficiency and reduce turnaround times.

Challenges

Intense Competition

The aerospace MRO market is highly competitive, with a multitude of players competing for market share. Large Original Equipment Manufacturers (OEMs), independent MRO service providers, and even airlines offering in-house MRO solutions all vie for contracts.

This intense competition drives down prices, compressing margins and making it more difficult for new entrants to secure a foothold. To stay competitive, MRO providers must differentiate themselves through innovation, service quality, and customer relationships while managing costs effectively.

For instance, in August 2025, GE Aerospace announced a planned $75 million investment in its Asia-Pacific MRO operations to meet the region’s robust demand. This investment highlights the intense competition in the aerospace MRO market, as companies strive to enhance their service offerings and expand their market share.

Latest Trends

The MRO industry is placing a growing emphasis on sustainability by implementing eco-friendly practices to minimize environmental impact. This includes recycling aircraft components, reusing materials, and adopting sustainable aviation fuels (SAFs) for maintenance activities.

These initiatives help reduce carbon emissions and waste, supporting the aviation industry’s broader goal of achieving net-zero emissions. As environmental regulations tighten, sustainability has become a key priority, with MRO providers aligning their operations to meet the increasing demand for greener, more responsible aviation maintenance solutions.

For instance, in July 2025, Air France Industries KLM Engineering & Maintenance (AFI KLM E&M) took a significant step towards sustainable MRO by adopting Sustainable Aviation Fuel (SAF) for engine testing. This move marks a major milestone in the company’s commitment to reducing its environmental footprint.

Key Players Analysis

In the aerospace MRO market, Lufthansa Technik, Delta TechOps, HAECO, and KLM Engineering & Maintenance are established leaders. Their strong airline affiliations and global service networks allow them to provide comprehensive maintenance, repair, and overhaul services. These companies are trusted for their ability to manage large fleets and deliver cost-effective, reliable support across multiple aircraft types.

Major OEMs such as Airbus SE, Raytheon Technologies, Honeywell International, and MTU Aero Engines play a crucial role in shaping the market. Their expertise in engines, avionics, and advanced aircraft systems strengthens their presence in the MRO sector. By combining proprietary technologies with service capabilities, they support operators with integrated lifecycle management.

Regional and specialized firms including GMF AeroAsia, ST Aerospace, Jet Maintenance Solutions, Air Works, AAR Corp., Singapore Technologies Engineering, TAP Air Portugal, and others contribute to a diverse competitive landscape. These companies often focus on niche services, regional markets, or flexible support models.

Top Key Players in the Market

- GMF AeroAsia

- HAECO

- Delta TechOps

- Lufthansa Technik

- KLM Engineering & Maintenance

- Honeywell International

- ST Aerospace

- Jet Maintenance Solutions

- Air Works

- AAR Corp.

- Airbus SE

- Hong Kong Aircraft Engineering Company Limited

- MTU Aero Engines AG

- Raytheon Technologies Corporation

- Singapore Technologies Engineering Ltd

- TAP Air Portugal

- Other Key Players

Recent Developments

- In April 2025, Pratt & Whitney, a division of Raytheon Technologies, signed an agreement with Delta TechOps to increase its GTF engine MRO capacity. The deal will expand the engine overhaul capabilities at Delta TechOps’ Atlanta facility, allowing it to handle a greater volume of GTF engines.

- In October 2024, HAECO and a subsidiary of COMAC signed a collaborative agreement to provide MRO services for the ARJ21 and C919 aircraft. This partnership marks a significant step in enhancing the maintenance capabilities for these Chinese-made aircraft.

- In February 2024, GE Aerospace invested USD 11 million to establish a Smart Factory at its aircraft engine repair facility in Singapore, aiming to modernize engine repair and enhance workforce skills to support advanced technologies.

- In March 2024, AAR Corp. acquired Triumph Group’s Product Support Business to strengthen its ability to deliver specialized repair, maintenance, and overhaul services for critical aircraft components across both commercial and defense sectors.

- Also in March 2024, C&L Aviation Group purchased two Citation Sovereign and two Citation XLS aircraft for teardown at its Bangor MRO facility. With two projects completed and two in progress, the company seeks to address the shortage of aircraft parts by refurbishing and reselling components for maintenance and repair needs.

Report Scope

Report Features Description Market Value (2024) USD 87.63 Bn Forecast Revenue (2034) USD 145.48 Bn CAGR(2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service (Engine Overhaul, Airframe Maintenance, Line Maintenance, Modification, Components), By Organization Type (Airline/Operator MRO, Independent MRO, OEM MRO), By Aircraft Type (Narrow-Body, Wide-Body, Regional Jet, Others), By Aircraft Generation (Old Generation, Mid Generation, New Generation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GMF AeroAsia, HAECO, Delta TechOps, Lufthansa Technik, KLM Engineering & Maintenance, Honeywell International, ST Aerospace, Jet Maintenance Solutions, Air Works, AAR Corp., Airbus SE, Hong Kong, Aircraft Engineering Company Limited, MTU Aero Engines AG, Raytheon Technologies Corporation, Singapore Technologies Engineering Ltd, TAP Air Portugal, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GMF AeroAsia

- HAECO

- Delta TechOps

- Lufthansa Technik

- KLM Engineering & Maintenance

- Honeywell International

- ST Aerospace

- Jet Maintenance Solutions

- Air Works

- AAR Corp.

- Airbus SE

- Hong Kong Aircraft Engineering Company Limited

- MTU Aero Engines AG

- Raytheon Technologies Corporation

- Singapore Technologies Engineering Ltd

- TAP Air Portugal

- Other Key Players