Global Adiponectin Testing Market By Product Type (Assay Kits, and Reagents & Consumables), By Species Type (Human, Rat, Mouse, and Others), By End-user (Research & Academic Institutes, Diagnostic Labs, and Hospitals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163238

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

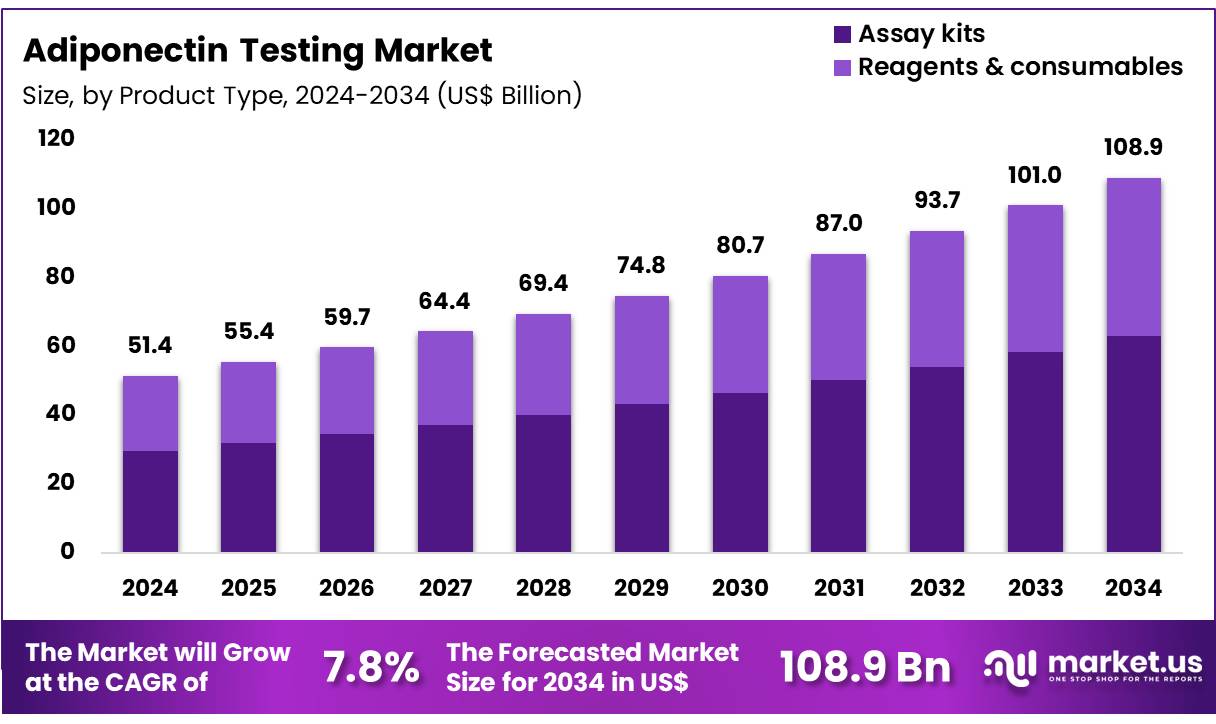

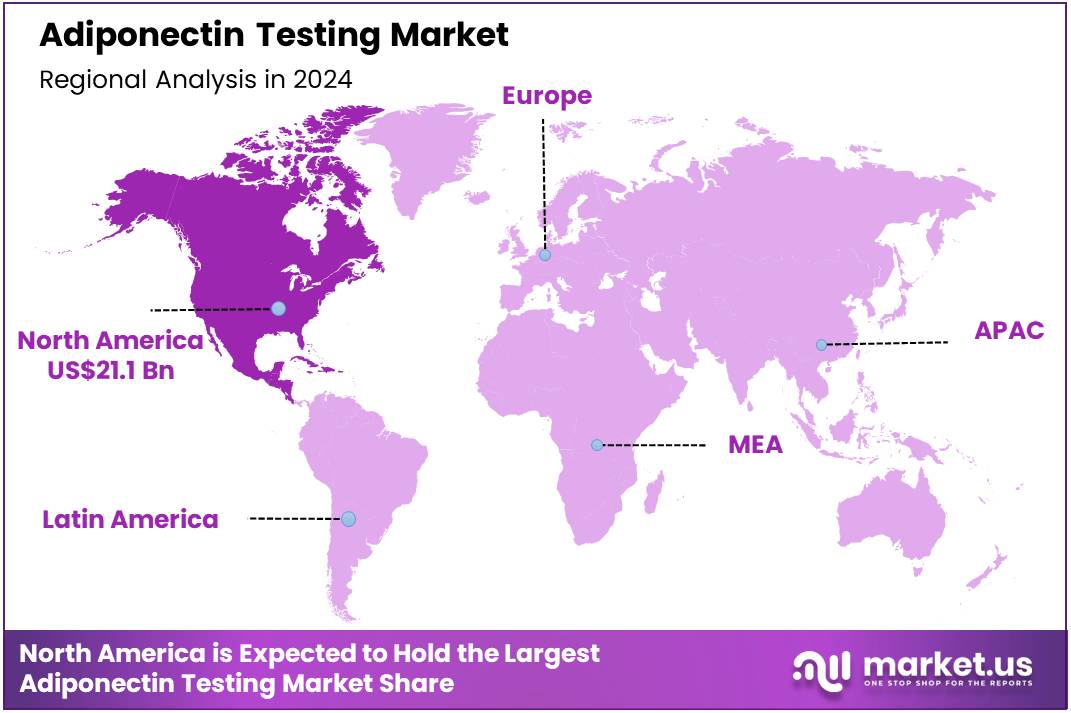

Global Adiponectin Testing Market size is expected to be worth around US$ 108.9 Billion by 2034 from US$ 51.4 Billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.1% share with a revenue of US$ 21.1 Billion.

Increasing awareness of metabolic disorders drives the Adiponectin Testing Market, as healthcare providers recognize the biomarker’s role in assessing insulin resistance and cardiovascular risk. Clinicians employ adiponectin assays in diabetes management to evaluate insulin sensitivity, guiding personalized treatment plans for type 2 diabetes patients.

These tests support cardiovascular risk stratification by measuring circulating adiponectin levels, identifying patients at risk for atherosclerosis. Research institutions utilize high-sensitivity ELISA kits to study adiponectin’s role in obesity-related complications, advancing therapeutic development.

In March 2024, a study using National Health and Nutrition Examination Survey (NHANES) data highlighted the high prevalence of cerumen impaction, indirectly emphasizing the need for accessible health assessments, including metabolic biomarkers like adiponectin. This focus on comprehensive diagnostics fosters market growth by integrating adiponectin testing into routine health screenings.

Growing emphasis on preventive healthcare fuels the Adiponectin Testing Market, with adiponectin levels serving as a key indicator in wellness programs. Primary care facilities apply these tests to screen for metabolic syndrome in asymptomatic individuals, enabling early lifestyle interventions.

Adiponectin assays aid in monitoring treatment efficacy in patients with dyslipidemia, supporting tailored lipid-lowering therapies. Emerging point-of-care technologies streamline testing in outpatient settings, enhancing accessibility for chronic disease management.

In February 2024, the United Nations reported a significant population increase in the Asia Pacific, coupled with WHO’s projection of rising hearing loss cases, underscoring the need for scalable diagnostic solutions, including metabolic testing. This trend creates opportunities for adiponectin testing to address co-morbid metabolic conditions in aging populations.

Rising adoption of precision medicine propels the Adiponectin Testing Market, as advanced diagnostics align with individualized treatment strategies. Pharmaceutical companies leverage adiponectin testing in clinical trials to evaluate anti-diabetic drug efficacy, correlating biomarker levels with therapeutic outcomes.

These tests find applications in bariatric surgery follow-ups, assessing metabolic improvements post-intervention. Trends toward automated platforms enhance throughput in clinical labs, supporting large-scale epidemiological studies.

In March 2024, the NHANES study’s findings on cerumen impaction prevalence, particularly in older adults, highlighted the importance of integrated health assessments, indirectly boosting demand for biomarkers like adiponectin. Such developments drive market expansion by embedding adiponectin testing in multidisciplinary diagnostic frameworks.

Key Takeaways

- In 2024, the market generated a revenue of US$ 51.4 Billion, with a CAGR of 7.8%, and is expected to reach US$ 108.9 Billion by the year 2034.

- The product type segment is divided into assay kits and reagents & consumables, with assay kits taking the lead in 2023 with a market share of 57.8%.

- Considering species type, the market is divided into human, rat, mouse, and others. Among these, human held a significant share of 63.5%.

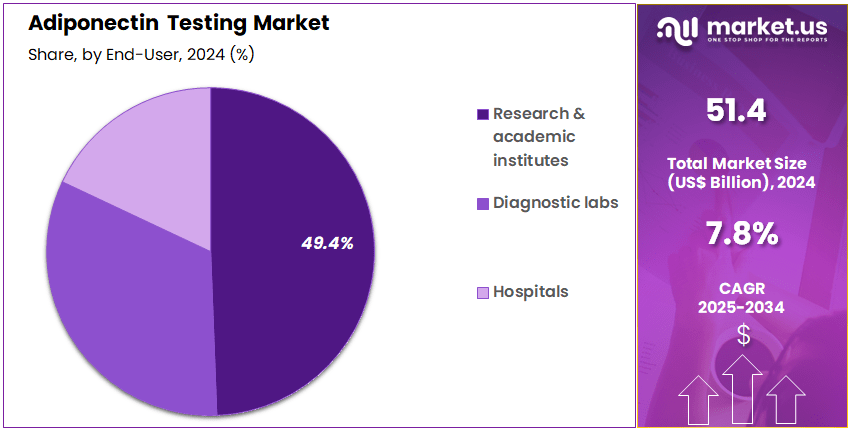

- Furthermore, concerning the end-user segment, the market is segregated into research & academic institutes, diagnostic labs, and hospitals. The research & academic institutes sector stands out as the dominant player, holding the largest revenue share of 49.4% in the market.

- North America led the market by securing a market share of 41.1% in 2023.

Product Type Analysis

Assay kits account for 57.8% of the Adiponectin Testing market and are expected to maintain strong growth due to their convenience, accuracy, and suitability for large-scale testing. These kits are essential tools in both research and clinical diagnostics for quantifying adiponectin levels, a key biomarker for metabolic disorders, obesity, and cardiovascular diseases.

The increasing prevalence of lifestyle-related diseases is projected to drive the adoption of adiponectin assay kits for early detection and biomarker validation. Advancements in ELISA, fluorescence-based, and multiplex assay technologies have improved assay precision and throughput. Laboratories prefer assay kits for their ready-to-use format, which reduces preparation time and enhances reproducibility.

The growing emphasis on metabolic and endocrinological research globally is likely to further boost demand. Manufacturers continue to innovate by introducing high-sensitivity and species-specific assay kits to support translational studies. The compatibility of these kits with automated platforms enhances workflow efficiency in both clinical and research settings.

The affordability, scalability, and accuracy of assay kits ensure their continued dominance in the adiponectin testing market. Increasing collaborations between academia and industry for biomarker research further reinforce market growth in this segment.

Species Type Analysis

The human species type holds 63.5% of the market share and is expected to remain dominant due to the growing clinical and research focus on human metabolic and cardiovascular diseases. Adiponectin testing in human samples provides critical insights into conditions such as type 2 diabetes, obesity, hypertension, and coronary artery disease. The rising incidence of these disorders is anticipated to drive demand for human-specific testing solutions.

Diagnostic laboratories and research institutions increasingly use human assay kits to measure serum and plasma adiponectin concentrations for both population studies and individualized disease management. Technological advancements in immunoassay platforms and high-sensitivity ELISA kits enhance test accuracy and reproducibility. The emphasis on personalized medicine and early biomarker-based diagnostics further promotes human-specific testing.

Additionally, clinical trials and pharmaceutical research rely heavily on human adiponectin testing to evaluate drug efficacy and safety in metabolic studies. The expansion of obesity-related research programs and government-funded initiatives targeting non-communicable diseases are projected to reinforce this segment’s growth. As clinical applications expand beyond diabetes into broader cardiometabolic syndromes, human-based adiponectin testing is likely to remain the cornerstone of both clinical and academic investigations.

End-User Analysis

Research & Academic Institutes (49.4% share)

Research and academic institutes represent 49.4% of the end-user segment and are projected to lead the market due to their extensive role in studying adiponectin’s physiological and pathological functions. Universities, research centers, and biotechnology institutes utilize adiponectin assays to explore its role in energy metabolism, inflammation, and insulin sensitivity.The increasing funding for metabolic disease research and the expansion of translational medicine programs are expected to drive growth in this segment. Academic institutions prefer high-precision assays and reagents for developing novel therapeutic strategies and validating biomarkers. Collaborations between research organizations and pharmaceutical companies further enhance test adoption for drug discovery and preclinical studies.

The growing number of obesity and diabetes-related studies globally fuels the demand for adiponectin testing kits in research environments. The shift toward multidisciplinary research integrating genomics, proteomics, and metabolomics strengthens the use of adiponectin assays in experimental design. Additionally, government grants promoting biomarker discovery and metabolic profiling initiatives contribute to growth.

Research institutions value assay kits for their reproducibility, flexibility, and cross-species compatibility. The growing academic interest in adiponectin as a predictive marker for multiple chronic conditions ensures that research and academic institutes remain a dominant end-user in this market.

Key Market Segments

By Product Type

- Assay Kits

- Reagents & Consumables

By Species Type

- Human

- Rat

- Mouse

- Others

By End-user

- Research & Academic Institutes

- Diagnostic Labs

- Hospitals

Drivers

Rising Prevalence of Obesity and Metabolic Disorders is Driving the Market

The surge in obesity and associated metabolic disorders has profoundly influenced the adiponectin testing market, as low adiponectin levels serve as an early indicator of insulin resistance and cardiovascular vulnerabilities. Adiponectin, an adipokine with anti-inflammatory and insulin-sensitizing properties, exhibits inverse correlations with body mass index, rendering its measurement essential for risk stratification in at-risk populations.

This driver is particularly salient amid lifestyle-induced epidemics, where routine screening via enzyme-linked immunosorbent assays aids in preempting type 2 diabetes progression. Healthcare guidelines increasingly incorporate adiponectin profiling into metabolic panels, enhancing predictive accuracy beyond traditional glucose metrics.

The demand escalates in primary care and endocrinology practices, where elevated testing volumes support personalized interventions like lifestyle modifications. Public health campaigns underscore adiponectin’s prognostic value, prompting laboratory expansions for high-throughput capabilities.

The Centers for Disease Control and Prevention indicated that the age-adjusted prevalence of severe obesity among U.S. adults aged 20 and older rose from 7.7% in 2013–2014 to 9.7% in August 2021–August 2023, amplifying the clinical rationale for biomarker-driven diagnostics. This escalation correlates with heightened assay procurements, as facilities integrate adiponectin evaluations to mitigate comorbidity cascades.

Technological refinements in multiplex kits further streamline workflows, accommodating burgeoning caseloads. Economically, proactive utilization averts hospitalization burdens, justifying investments in accessible platforms. Global collaborations disseminate validated protocols, bridging disparities in diagnostic equity. This metabolic tide not only sustains procedural momentum but also orients the market toward integrative health paradigms.

Restraints

High Costs of Testing and Limited Reimbursement is Restraining the Market

Elevated expenses associated with adiponectin assays and inconsistent reimbursement frameworks continue to constrain the market’s accessibility, particularly in resource-limited settings. These immunoassays demand specialized reagents and automated analyzers, often exceeding budgetary thresholds for ambulatory clinics and public facilities. This restraint perpetuates reliance on confirmatory rather than routine applications, curtailing widespread adoption amid fiscal scrutiny.

Variability in payer policies across jurisdictions exacerbates inequities, with some mandating prior authorizations that delay implementations. Developers incur substantial validation outlays, deferring innovations to high-margin segments while sidelining cost-optimized variants. The resultant underutilization inflates indirect expenditures through unmanaged metabolic escalations.

The Centers for Medicare & Medicaid Services documented U.S. healthcare expenditures totaling $4.5 trillion in 2022, yet diagnostic reimbursements for emerging biomarkers like adiponectin frequently encountered restrictive coding and coverage limitations. Such allocations reflect systemic biases favoring established metrics, marginalizing novel assays.

Provider reluctance arises from revenue models prioritizing volume over precision, fragmenting market cohesion. Advocacy for bundled reimbursements progresses slowly, hampered by evidentiary gaps in longitudinal outcomes. These fiscal impediments not only stifle scalability but also compromise the market’s alignment with preventive imperatives.

Opportunities

Advancements in Point-of-Care Adiponectin Assays is Creating Growth Opportunities

The evolution of portable adiponectin testing platforms has engendered substantial prospects, facilitating decentralized evaluations that expedite metabolic risk assessments in diverse venues. These cartridge-based systems, compatible with fingerstick samples, obviate laboratory dependencies, aligning with ambulatory expansions in chronic disease management.

Opportunities abound in partnerships with wellness networks, subsidizing validations for community deployments amid rising endocrine burdens. This portability addresses surveillance voids in transitional demographics, optimizing therapeutic escalations. Value propositions, including reduced turnaround and error minimization, underpin fiscal incentives for insurer incorporations.

Government endorsements for biomarker-driven screenings further propel procurements, diversifying applications to occupational health. Randox Laboratories introduced an analyte-specific reagent for adiponectin in January 2022, enabling automated clinical chemistry integrations that enhanced accessibility in routine workflows. This innovation exemplifies scalability, with projections indicating broadened utility in preventive paradigms.

Shelf-stable formulations mitigate logistical hurdles in austere environments, fostering inclusivity. As analytics mature, cloud-synced outputs refine population insights, unlocking performance-tied revenues. These ambulatory advancements not only augment procedural reach but also position the market as a fulcrum in holistic metabolic stewardship.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited access to capital are pressuring developers in the adiponectin testing market, leading them to delay automation upgrades for ELISA kits while prioritizing stable reagent supplies amid reduced research funding. U.S.-China export restrictions and Indian Ocean shipping disruptions are limiting imports of diagnostic antibodies from Asian suppliers, prolonging stability trials and raising certification costs for regional lab partnerships.

To tackle these barriers, some developers are partnering with Iowa-based antibody producers, adopting traceability measures that expedite FDA approvals and secure metabolic research grants. Growing obesity and diabetes prevalence is directing NIH allocations into biomarker screening tools, enhancing adoptions in endocrine clinics.

U.S. tariffs of 25% on imported pharmaceuticals and medical devices are elevating costs for Asian-sourced substrates and conjugates, compressing budgets for community diagnostics and occasionally stalling global assay validations. In response, developers are leveraging IRA innovation credits to establish Kansas synthesis facilities, advancing fluorescence-based assays and cultivating skills in enzyme conjugation.

Latest Trends

Strategic Partnership for Point-of-Care Device is a Recent Trend

The collaborative endeavors in developing a point-of-care adiponectin testing device has epitomized a transformative trajectory in 2022, prioritizing rapid bedside evaluations for metabolic profiling. This initiative deploys microfluidic cartridges to quantify adiponectin in minutes, circumventing conventional laboratory latencies. The trend signifies a maturation toward user-independent formats, accommodating non-specialists in primary and telehealth contexts.

Regulatory validations affirm analytical robustness, expediting endorsements for diverse matrices like serum and saliva. This portability resonates with precision medicine mandates, integrating outputs into digital dossiers for real-time consultations. The development underscores a pivot to resilient assays, impervious to environmental variabilities in field applications.

Merck announced this strategic partnership in 2022 to advance a point-of-care adiponectin testing device, targeting enhanced deployment in metabolic disorder screenings. Such alliances catalyze pipeline accelerations, as peers refine analogous prototypes for multiplex integrations. Observers foresee guideline assimilations, elevating its prominence in first-line protocols.

Longitudinal assessments validate discordance reductions, informing pharmacoeconomic optimizations. The horizon anticipates AI-infused calibrations, prognosticating therapeutic trajectories. This device-centric evolution not only heightens diagnostic velocity but also synchronizes with ambulatory care evolutions.

Regional Analysis

North America is leading the Adiponectin Testing Market

In 2024, North America held a 41.1% share of the global adiponectin testing market, propelled by intensified focus on adipose-derived biomarkers in endocrine clinics to evaluate hypoadiponectinemia risks for type 2 diabetes progression, amid persistent metabolic syndrome prevalence in middle-aged demographics. Endocrinologists routinely employed chemiluminescent immunoassays to measure circulating levels, providing superior prognostic insights over fasting glucose in cohorts with visceral fat accumulation, guiding metformin titrations and lifestyle prescriptions.

The National Institute of Diabetes and Digestive and Kidney Diseases’ cohort expansions facilitated serial testing in at-risk populations, correlating with enhanced predictive modeling for endothelial impairment in hypertensive patients. Demographic surges in polycystic ovary syndrome diagnoses among reproductive-age women amplified utilization, supported by grant-funded validations for fertility-linked assessments.

Innovations in multiplex bead-based assays streamlined integration with lipid panels, reducing sample volumes for pediatric evaluations of growth hormone deficiencies. These evolutions demonstrated the region’s dedication to nuanced hormonal diagnostics for preventive endocrinology. The Centers for Disease Control and Prevention reported that the age-adjusted prevalence of obesity among U.S. adults was 40.3% during August 2021–August 2023.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Regional administrators in Asia Pacific project the adiponectin testing sector to intensify during the forecast period, as public health agendas emphasize biomarker screening to stem non-communicable disease rises in transitioning economies. Officials in South Korea and India fund community assay distributions, arming urban polyclinics with ELISA modules to profile insulin resistance in high-glycemic-index diet consumers.

Laboratory networks collaborate with academic consortia to standardize reference ranges, anticipating precise evaluations of adipokine imbalances in gestational diabetes screenings. Regulatory entities in China and the Philippines endorse portable immunoassay strips, enabling field-based assessments of metabolic profiles in agrarian labor forces.

National frameworks anticipate syncing test outputs with electronic registries, facilitating targeted interventions for non-alcoholic steatohepatitis in coastal populations. Regional biochemists innovate fluorescence polarization techniques, linking with epidemiological cohorts to delineate ethnic variations in hormone secretion.

These advancements yield a comprehensive platform for adipose health surveillance. The International Diabetes Federation estimated 89 million adults with diabetes in South-East Asia in 2021, escalating to 92 million by 2022, reflecting the critical demand for advanced biomarker tools.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the metabolic biomarker diagnostics arena propel advancement by unveiling ELISA kits with elevated sensitivity for low-level detection, catering to precision needs in diabetes risk assessment. They negotiate co-development pacts with biotech startups to refine immunoassay protocols, accelerating validation and integration into routine wellness panels.

Enterprises channel investments into portable analyzers for clinic-based use, minimizing lab dependencies and broadening adoption in primary care. Executives target acquisitions of niche assay providers to diversify portfolios with multiplex options for comorbid profiling.

They intensify efforts in high-obesity regions like the Middle East and Southeast Asia, customizing kits to local regulatory hurdles and public screening drives. Moreover, they implement bundled service agreements with health networks, incorporating training modules to drive uptake and secure ongoing revenue commitments.

Thermo Fisher Scientific Inc., founded in 2006 via merger and headquartered in Waltham, Massachusetts, engineers comprehensive life sciences solutions that span diagnostics, research tools, and biopharma services for global laboratories. The company equips users with Invitrogen adiponectin ELISA kits, delivering quantitative assays that support metabolic disorder investigations in clinical and exploratory settings.

Thermo Fisher allocates substantial R&D to workflow enhancements, emphasizing automation and data interoperability for efficient biomarker analysis. CEO Marc N. Casper directs a multifaceted operation across 50 countries, prioritizing sustainability in supply chains.

The firm engages with academic consortia to pioneer assay innovations, fostering breakthroughs in endocrine health. Thermo Fisher anchors its market authority by synergizing analytical depth with expansive ecosystem collaborations to elevate diagnostic precision.

Top Key Players

- Thermo Fisher Scientific Inc.

- STRATEC SE

- Randox Laboratories Ltd

- Merck KGaA

- LabCorp (Laboratory Corporation of America Holdings)

- Eagle Biosciences

- Boster Biological Technology

- Bio-Rad Laboratories, Inc.

- AssayPro LLC

- Abcam plc

Recent Developments

- In October 2025, Bio-Rad Laboratories deepened its diagnostics capabilities by extending its partnership with Gencurix to distribute Droplet Digital PCR (ddPCR) IVD Oncology Kits in Europe. While not directly tied to adiponectin testing, this collaboration reinforces Bio-Rad’s technological expertise in ultra-sensitive molecular diagnostics, a critical platform supporting biomarker testing advancements, including adiponectin assays, across clinical and research domains.

- In July 2025, Thermo Fisher Scientific advanced its leadership in precision diagnostics by launching innovative products, including the Human Adiponectin ELISA Kit (KHP0041). The assay enables accurate quantification of adiponectin levels in human samples, supporting both clinical evaluation and metabolic research. This continued focus on specialized immunoassays strengthens Thermo Fisher’s role in expanding access to reliable biomarker testing globally.

Report Scope

Report Features Description Market Value (2024) US$ 51.4 Billion Forecast Revenue (2034) US$ 108.9 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Assay Kits, and Reagents & Consumables), By Species Type (Human, Rat, Mouse, and Others), By End-user (Research & Academic Institutes, Diagnostic Labs, and Hospitals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., STRATEC SE, Randox Laboratories Ltd, Merck KGaA, LabCorp (Laboratory Corporation of America Holdings), Eagle Biosciences, Boster Biological Technology, Bio-Rad Laboratories, Inc., AssayPro LLC, Abcam plc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc.

- STRATEC SE

- Randox Laboratories Ltd

- Merck KGaA

- LabCorp (Laboratory Corporation of America Holdings)

- Eagle Biosciences

- Boster Biological Technology

- Bio-Rad Laboratories, Inc.

- AssayPro LLC

- Abcam plc