Global Adaptive Cruise Control System Market Size, Share, Growth Analysis By Component Type (LiDAR, RADAR, Image Sensor, Ultrasonic, Infrared Sensor, Other Types), By Vehicle Type (Passenger Cars, Commercial Vehicles), By End-Use (OEMs, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 99410

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

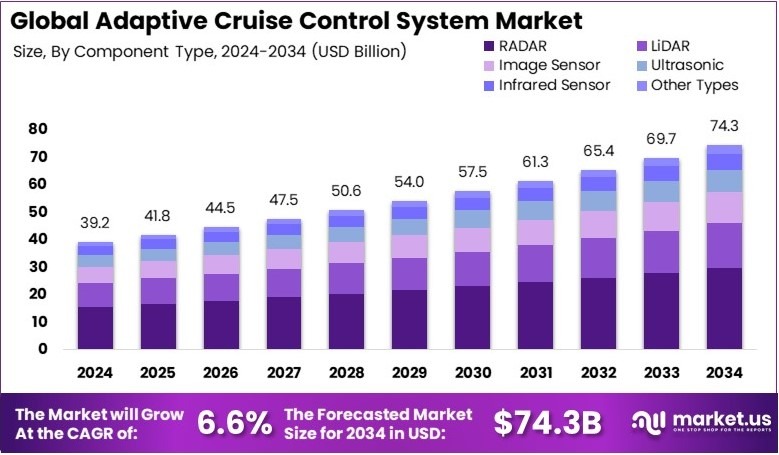

The Global Adaptive Cruise Control System Market size is expected to be worth around USD 74.3 Billion by 2034, from USD 39.2 Billion in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034.

An Adaptive Cruise Control System is an advanced driver assistance feature in vehicles. It automatically adjusts the vehicle’s speed to maintain a safe distance from the car ahead. The system uses sensors and radar to monitor traffic conditions. It helps reduce driver fatigue and supports safer highway driving.

The Adaptive Cruise Control System Market includes all products, technologies, and services related to adaptive cruise systems in vehicles. It involves manufacturers, tech companies, and suppliers. The market is driven by rising demand for vehicle safety, comfort, and smart driving technologies across passenger and commercial vehicles.

Adaptive Cruise Control (ACC) systems are becoming a popular safety feature in modern vehicles. These systems help maintain a safe distance from the vehicle ahead by adjusting speed automatically, reducing the need for frequent braking or acceleration.

As drivers seek greater comfort and safety, demand for ACC systems is rising. Moreover, increased traffic congestion in urban areas has made these systems more useful for reducing fatigue during long drives. As car buyers become more familiar with driver assistance technologies, ACC is quickly moving from a luxury feature to a standard offering in many new vehicles.

According to the National Highway Traffic Safety Administration (NHTSA), a new rule finalized in April 2024 requires nearly all new vehicles sold in the United States to have automatic emergency braking (AEB) systems by 2029. These systems must function effectively at speeds up to 62 miles per hour.

NHTSA projects that this regulation will save at least 360 lives and prevent over 24,000 injuries each year. Similarly, in the European Union, emergency braking systems became mandatory for new vehicle models in May 2022, with full compliance for all new vehicles by May 2024. This demonstrates how strong regulatory backing is shaping the future of vehicle safety systems.

Consequently, the global Adaptive Cruise Control System market is growing at a steady pace. As more countries introduce road safety regulations, automakers are under pressure to include these systems in both high-end and mid-range vehicles.

In particular, Asia-Pacific and Latin America are emerging as promising markets, due to rising car sales and urbanization. Meanwhile, developed regions like North America and Europe are already experiencing higher adoption rates, driven by policy support and growing consumer awareness.

In terms of market competition, the landscape remains moderately competitive. Leading players are focusing on developing radar, LiDAR, and sensor fusion technologies to improve system performance under different driving conditions. For instance, some systems now combine camera and radar inputs for better lane tracking and object detection.

Furthermore, strategic partnerships between automotive and tech companies are helping accelerate innovation. This includes the use of AI to support more predictive responses, enhancing the system’s ability to manage complex driving scenarios.

Key Takeaways

- The Adaptive Cruise Control System Market was valued at USD 39.2 billion in 2024 and is expected to reach USD 74.3 billion by 2034, with a CAGR of 6.6%.

- In 2024, RADAR dominated the component type segment with 39.5%,due to its high accuracy in object detection.

- In 2024, Passenger Cars led the vehicle type segment with 58.3%, driven by increasing adoption in modern vehicles.

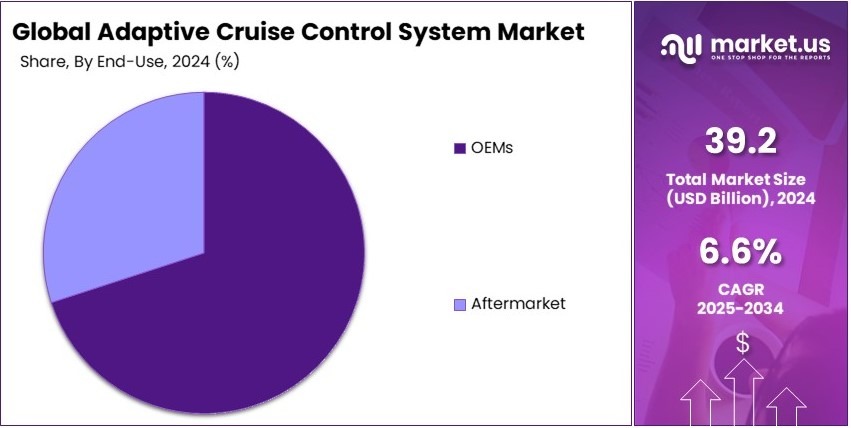

- In 2024, OEMs dominated with 75.4% of the end-use segment due to strong partnerships with automotive manufacturers.

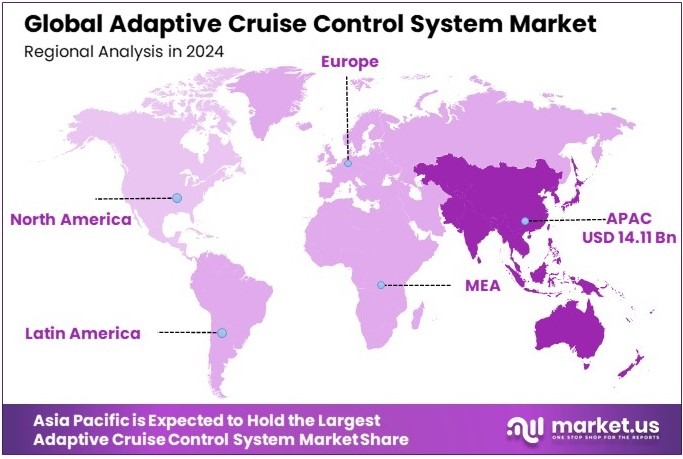

- In 2024, Asia Pacific held 36% market share, valued at USD 14.11 billion, driven by rapid automotive advancements.

Type Analysis

RADAR dominates with 39.5% due to its critical role in enabling precise distance measurement and velocity detection.

The RADAR component in the Adaptive Cruise Control System market is a major driver of technological advancement. This sub-segment has shown remarkable growth, mainly due to its efficacy in maintaining safe driving distances and accurately detecting the speed of vehicles ahead.

RADAR systems are preferred for their reliability in various weather conditions and their ability to function effectively at higher speeds, making them indispensable in modern automotive safety technologies. Their precision and speed in processing data make them superior for dynamic and complex driving environments, where quick response times are essential.

Other Types in the component segment include LiDAR, Image Sensor, Ultrasonic, and Infrared Sensor. Each plays a vital role; for instance, LiDAR contributes to detailed environment mapping, which is crucial for autonomous driving technologies.

Image Sensors are crucial for object detection and classification, providing visual data necessary for interpreting road signs and lane markings. Ultrasonic sensors are predominantly used for close-range detection and parking assist systems, essential in urban environments. Infrared Sensors are beneficial for night vision capabilities, enhancing vehicle usability during nighttime or in poor visibility conditions.

Vehicle Type Analysis

Passenger Cars lead with 58.3% owing to increased consumer demand for safety features and comfort.

Passenger cars have become the predominant sector within the Adaptive Cruise Control System market. The surge in consumer demand for advanced safety features, coupled with a growing emphasis on comfort and convenience, has driven the adoption of these systems.

Manufacturers are increasingly integrating adaptive cruise control in passenger vehicles to enhance market competitiveness and meet regulatory safety standards. The integration not only elevates the driving experience but also significantly improves road safety, contributing to lower accident rates and enhanced traffic management.

The Commercial Vehicles sub-segment also plays a significant role, particularly in enhancing fleet safety and reducing driver fatigue, which are crucial in commercial operations. Despite its smaller market share, this segment is expected to grow as logistics and transportation companies continue to invest in safety technologies. These systems help in maintaining consistent flow and speed, which are critical in commercial transport, leading to more efficient logistics operations and reduced operational costs.

End-Use Analysis

OEMs command the market with 75.4% due to robust integration during vehicle assembly.

OEMs (Original Equipment Manufacturers) are the most influential players in the Adaptive Cruise Control System market, primarily because these systems are often integrated during the initial manufacturing phase.

This integration ensures that adaptive cruise control systems are optimally configured with the vehicle’s other systems, resulting in more efficient and reliable performance. The early adoption during the manufacturing process also helps in standardizing safety features across various models, which enhances brand reputation and consumer trust.

The Aftermarket segment, though smaller, is crucial for upgrading older vehicles that did not originally include these advanced systems. This segment allows existing vehicle owners to benefit from new technologies, enhancing safety and vehicle functionality without the need for purchasing new models. It provides a cost-effective solution for consumers seeking to enhance their vehicle’s capabilities, thereby fostering a culture of safety and modernization in older vehicle fleets.

Key Market Segments

By Component Type

- LiDAR

- RADAR

- Image Sensor

- Ultrasonic

- Infrared Sensor

- Other Types

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By End-Use

- OEMs

- Aftermarket

Driving Factors

Growing Demand for Smart Vehicles Drives Market Growth

The Adaptive Cruise Control (ACC) System market is seeing strong growth due to rising global sales of premium vehicles. Many luxury cars now include advanced safety systems like ACC as standard. This trend reflects consumer demand for comfort and convenience on the road. In addition, governments around the world are enforcing stricter road safety laws. These regulations encourage automakers to install collision avoidance systems, including ACC, to reduce accidents.

Another key driver is the growing interest in autonomous and semi-autonomous vehicles. Buyers are increasingly looking for smart features that offer hands-free driving experiences. ACC plays a crucial role in enabling these functions.

On top of that, technology has improved rapidly. Modern radar and sensor systems are more accurate and reliable than before. These upgrades make ACC systems safer and more efficient, even in tough driving conditions.

For instance, brands like Tesla, BMW, and Mercedes-Benz are already using advanced ACC features that adjust speed and maintain safe distances on highways. These innovations show how ACC is becoming essential in the shift towards smarter mobility. Together, rising consumer demand, strict safety norms, and tech advancements are fueling growth in this market segment.

Restraining Factors

High Costs and Infrastructure Gaps Restraint Market Growth

Despite strong interest, the ACC system market faces several challenges. One major issue is the high cost of installation and upkeep. Many advanced cruise control systems require premium components, which raises the final price of vehicles. This makes them less attractive to budget-conscious buyers, especially in developing regions.

In addition, there is still limited trust in fully automated driving features. Some drivers are hesitant to rely on systems they do not fully understand. This slows down adoption, particularly among older or less tech-savvy users. Another roadblock is technical difficulty. ACC systems must work in all weather conditions, but snow, rain, or fog can affect sensor accuracy. Developing reliable solutions for such environments remains a challenge.

Moreover, many existing roads lack the infrastructure needed for ACC to function smoothly. In areas with poor lane markings or outdated traffic signals, these systems may fail or behave unpredictably. For example, rural or underdeveloped regions often lack proper road networks. This limits where ACC systems can be safely used. Together, these factors create obstacles that slow down broader market expansion, especially outside high-income markets.

Growth Opportunities

Tech Integration and Market Expansion Provide Opportunities

The market for adaptive cruise control systems is expected to benefit from several new opportunities. A key growth area is the integration of ACC with connected vehicle technologies. These features allow vehicles to communicate with each other and road infrastructure, improving traffic flow and safety. As a result, manufacturers are working to combine ACC with vehicle-to-everything (V2X) platforms.

Another promising opportunity lies in expanding to emerging markets. Countries like India, Brazil, and Indonesia are witnessing strong growth in car sales. With rising income levels and urbanization, there is a greater demand for vehicles with safety and comfort features. Automakers are likely to introduce ACC in mid-range models to tap this growing audience.

In addition, collaborations between auto firms and tech companies are becoming more common. These partnerships aim to boost AI capabilities in ACC systems. This includes better decision-making and more accurate distance management. Furthermore, aftermarket solutions for older vehicles present a niche but growing segment. Retrofitting cars with basic ACC features can bring these systems to more users.

Emerging Trends

Sensor Fusion and Smart Analytics Are Latest Trending Factor

New technologies are shaping the future of adaptive cruise control systems. One major trend is the use of multi-sensor fusion. This approach combines input from cameras, radar, and LiDAR for better accuracy. As a result, vehicles can detect and respond to their surroundings more effectively, even in complex traffic conditions.

Another rising trend is the use of predictive analytics. By studying driving behavior, the system can anticipate actions and make smoother adjustments. For instance, if a driver often slows down near certain intersections, the ACC can learn and react accordingly. This not only improves safety but also enhances the overall driving experience.

There is also growing cooperation between automakers and tech companies. These partnerships are driving the development of smart mobility solutions, where ACC systems are part of a larger ecosystem that includes navigation, traffic updates, and real-time communication. This is already seen in collaborations between companies like Google and major car brands.

Lastly, governments in developing countries are pushing for better safety standards. This is encouraging more automakers to adopt ACC, even in entry-level models. These trends are setting the stage for the ACC system to become a core part of next-generation vehicles across global markets.

Regional Analysis

Asia Pacific Dominates with 36% Market Share

Asia Pacific leads the Adaptive Cruise Control System Market with a 36% share, totaling USD 14.11 billion. This dominance is fueled by rapid vehicle production, high adoption of advanced automotive technologies, and increasing regulatory mandates for vehicle safety.

The region’s robust automotive manufacturing base, especially in countries like China, Japan, and South Korea, supports the widespread integration of these systems. Furthermore, the growing middle-class population and rising disposable incomes enable consumers to opt for vehicles equipped with advanced safety features, including adaptive cruise control.

The future looks promising for Asia Pacific in the Adaptive Cruise Control System Market. Continued economic growth and technological advancements are likely to push the demand even higher. The region’s commitment to improving road safety standards and reducing traffic accidents through technology could further solidify its leading position.

Regional Mentions:

- North America: North America maintains a significant presence in the Adaptive Cruise Control System Market due to early technology adoption and stringent safety regulations. The region’s advanced automotive sector continually integrates adaptive cruise control systems to enhance vehicle safety and driving comfort.

- Europe: Europe is a key player in the Adaptive Cruise Control System Market, supported by strong governmental regulations and the presence of major automotive manufacturers. The region focuses on innovation and safety in automotive technologies, driving the adoption of advanced systems.

- Middle East & Africa: The Middle East and Africa are gradually advancing in the Adaptive Cruise Control System Market. Investments in modern transportation infrastructure and an increasing interest in luxury and passenger vehicles equip with advanced systems are contributing to the market growth.

- Latin America: Latin America shows growth in the Adaptive Cruise Control System Market as it adopts more safety features in vehicles. Economic improvements and increasing vehicle sales in the region promote the adoption of advanced automotive technologies.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Adaptive Cruise Control System Market is shaped by strong competition and continuous innovation. The top four companies—Autoliv Inc., Continental AG, Delphi Automotive PLC, and Denso Corporation—play a major role in driving market growth and technology development.

These companies focus on developing advanced safety and driver-assistance technologies. Their strong R&D capabilities allow them to improve adaptive cruise control systems for better accuracy, comfort, and safety. For example, radar and camera-based solutions are becoming more common, and these leaders are pushing for higher integration with other autonomous driving systems.

Continental AG and Denso Corporation have strong global manufacturing and supply chains. This gives them a strategic edge in reaching both developed and emerging markets. Delphi Automotive PLC and Autoliv Inc., on the other hand, are known for their collaborative efforts with automakers, which helps in the smooth integration of adaptive cruise control in vehicles.

The top players benefit from long-standing relationships with leading car brands and original equipment manufacturers (OEMs). This ensures a steady demand for their technologies as adaptive cruise systems become standard in many vehicle models.

Overall, the market is expected to remain competitive as these key players continue investing in product upgrades, strategic partnerships, and expanding their presence in fast-growing regions like Asia Pacific and North America. Their efforts are focused on enhancing vehicle automation, improving road safety, and meeting changing customer preferences.

Major Companies in the Market

- Autoliv Inc

- Continental AG

- Delphi Automotive PLC

- Denso Corporation

- Ford Motor Company

- Hyundai Mobis

- Magna International

- Other Key Players

Recent Developments

- General Motors and Cruise: On February 2025, General Motors completed the full acquisition of its autonomous vehicle subsidiary, Cruise. This strategic move aims to integrate Cruise’s autonomous technology into GM’s Super Cruise system, enhancing hands-free driving capabilities across North America. The merger is expected to streamline operations and focus on personal autonomous vehicle development.

- Revv and AI in Auto Repair: On November 2024, Revv, a company specializing in AI-driven auto repair solutions, secured over $20 million in funding. Led by Left Lane Capital, with participation from Soma Capital, 1984, and Agalé Ventures, this investment underscores confidence in Revv’s potential to transform auto repair services, particularly in addressing the complexities of Advanced Driver Assistance Systems (ADAS).

Report Scope

Report Features Description Market Value (2024) USD 39.2 Billion Forecast Revenue (2034) USD 74.3 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component Type (LiDAR, RADAR, Image Sensor, Ultrasonic, Infrared Sensor, Other Types), By Vehicle Type (Passenger Cars, Commercial Vehicles), By End-Use (OEMs, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Autoliv Inc, Continental AG, Delphi Automotive PLC, Denso Corporation, Ford Motor Company, Hyundai Mobis, Magna International, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Adaptive Cruise Control System MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Adaptive Cruise Control System MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Autoliv Inc

- Continental Ag

- Delphi Automotive PLC

- Denso Corporation

- Ford Motor Company

- Hyundai Mobis

- Magna International

- Other Key Players