Global Action Camera Market Report By Resolution (Standard Resolution, HD, Full HD, Ultra HD), By Distribution Channel (Retail, Online), By Application (Recreational Activities, Sports, Emergency Services, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 21547

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

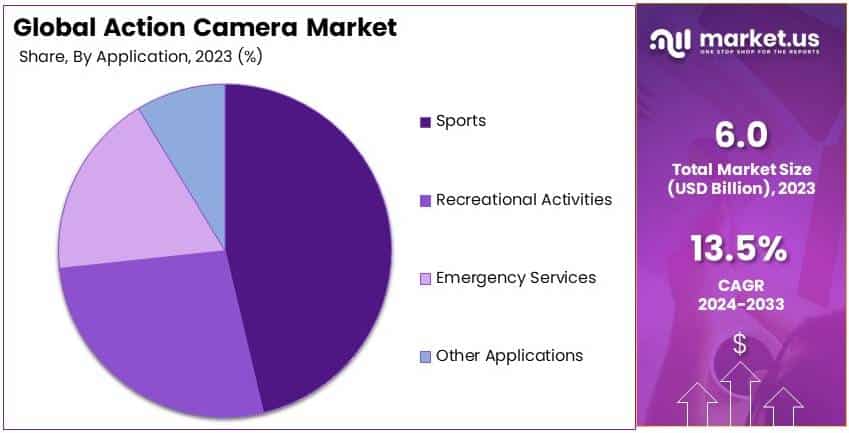

The Global Action Camera Market size is expected to be worth around USD 21.3 Billion by 2033, from USD 6.0 Billion in 2023, growing at a CAGR of 13.5% during the forecast period from 2024 to 2033.

An action camera is a compact, lightweight device designed to capture high-quality video and images during extreme activities. It is often used in sports, adventure travel, and other high-motion environments due to its durable, waterproof, and mountable design.

The action camera market refers to the industry that includes the production, sales, and distribution of these cameras. The market is growing due to increased interest in adventure sports, travel vlogging, and social media content creation. Consumer demand for high-definition video quality, ease of use, and portability drives innovation in this space.

The action camera market is expanding due to the growing demand for outdoor and adventure activities. These cameras are built for rugged conditions and provide high-quality footage, making them popular among sports enthusiasts, travelers, and content creators.

According to the Outdoor Industry Association (OIA), outdoor recreation participation grew by 2.3% in 2022, with 168.1 million Americans engaging in such activities. This growing trend has created a substantial market for action cameras, as these devices allow users to capture and share their experiences on social media and other platforms.

Furthermore, the market is benefiting from the increased adoption of ultra-high-definition (UHD) technology, especially in 360-degree cameras. UHD models provide enhanced image clarity and immersive experiences, appealing to professional vloggers and digital creators.

Leading brands such as GoPro are capitalizing on this trend by launching advanced models like the Hero 12 Black, which features HDR support and vertical video capabilities, aimed at optimizing digital content creation for social media platforms. These innovations are critical as content creators prioritize high-quality visual experiences to engage their audiences effectively.

The action camera market’s growth is driven by several factors, including the rise in adventure and sports tourism and the increasing use of digital platforms. In 2023, Strava data indicated a 55% increase in gravel riding activities, demonstrating the shift towards off-road and adventure cycling.

According to the Adventure Travel Trade Association, 34% of global adventure tourist clientele is based in the U.S., while Europe accounts for 40% of the industry’s revenue. This global surge in adventure tourism directly contributes to the rising demand for action cameras, as travelers seek to document their experiences.

Additionally, there is a strong push for high-quality content, with vloggers and influencers driving demand for advanced features like UHD and 360-degree capabilities. The market has also seen growth opportunities through integration with social media platforms, as users seek to share professional-grade visual content seamlessly.

While demand remains high, the market is increasingly competitive. Major players such as GoPro, DJI, and Sony dominate, but emerging brands are introducing lower-cost alternatives, intensifying competition. Market saturation is visible in regions like North America and Europe, where many consumers already own action cameras.

However, opportunities exist in Asia-Pacific and Latin America, where rising incomes and growing outdoor activity participation present new growth avenues. Companies are investing heavily in these regions to capture untapped potential.

Key Takeaways

- The Action Camera Market was valued at USD 6.0 billion in 2023, expected to reach USD 21.3 billion by 2033, with a CAGR of 13.5%.

- Ultra HD resolution dominated in 2023, showing high growth due to demand for high-quality and immersive recording experiences.

- Retail was the largest distribution channel in 2023, reflecting consumer preference for hands-on product testing before purchasing.

- The Online channel is rapidly growing, driven by e-commerce expansion and increased digital sales efforts.

- Sports applications led with the largest market share in 2023, highlighting the demand for durable and high-performance recording equipment.

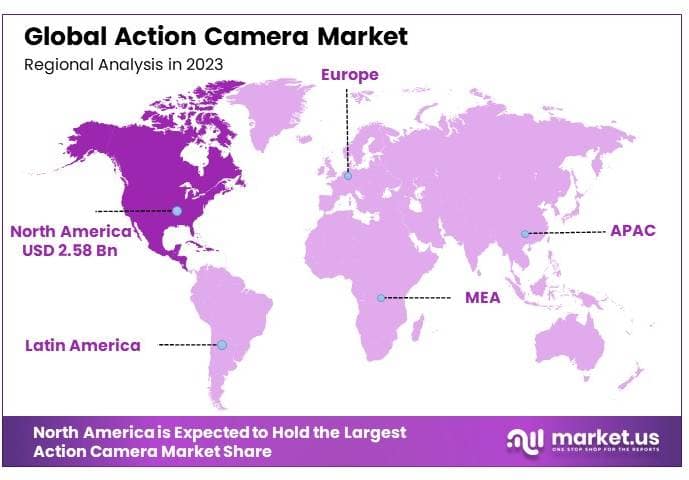

- North America held 43% market share, generating USD 2.58 billion, supported by advanced technology adoption and outdoor activity trends.

Type Analysis

Ultra HD dominates with a high percentage due to its superior video quality and consumer preference for high-resolution imaging.

The action camera market has seen significant growth, primarily driven by advancements in camera technology and the rising popularity of outdoor and adventure sports. The Type segment, particularly concerning resolution, serves as a crucial area of analysis.

Standard resolution action cameras, often characterized by resolutions less than 720p, continue to occupy a niche market segment. These digital cameras appeal to budget-conscious consumers and are used predominantly in less demanding recording situations. Their contribution to the market’s growth is limited due to the growing consumer preference for higher resolutions.

HD action cameras, which record in 720p, have traditionally been popular for everyday use due to their balance between cost and quality. However, their market share is diminishing as consumers increasingly opt for higher resolution cameras that offer better image quality and more features.

Full HD action cameras, which record in 1080p, are a standard choice for amateurs and professional vloggers alike. These cameras provide high-quality video at a reasonable price point, making them suitable for a variety of recording scenarios from family gatherings to semi-professional sports filming.

Ultra HD, or 4K resolution cameras, currently dominate the action camera market segment. These cameras offer superior video quality with four times the resolution of Full HD models. The remarkable clarity and detail captured in 4K video make these cameras highly sought after by professional videographers and technology enthusiasts.

The dominance of Ultra HD cameras is attributed to consumer demands for high-quality video and the trend towards the production of more engaging and immersive content. The segment’s growth is bolstered by continuous innovations in sensor technology and image stabilization, making these cameras ideal for capturing fast-paced actions and dynamic environments.

Distribution Channel Analysis

Retail dominates with the largest market share due to strong consumer trust and the ability to experience products firsthand.

Retail outlets remain the dominant distribution channel for action cameras, accounting for the largest share of the market. This segment benefits from the direct customer engagement that physical stores offer, allowing consumers to experience the look and feel of different cameras before making a purchase decision.

Retailers have adapted to the competitive market by providing in-store demonstrations and knowledgeable staff to assist customers, which has helped maintain their relevance in the digital age.

The online distribution channel is experiencing rapid growth, driven by the broader trend of e-commerce expansion. This channel offers consumers the convenience of easy comparison shopping and often more competitive pricing.

The growth of online sales is further supported by the increasing trust and reliability of online retail platforms, enhanced logistics, and the widespread adoption of consumer-friendly return policies. Online channels are expected to continue their growth trajectory as digital platforms become more integrated with everyday consumer shopping habits.

Application Analysis

Sports dominate with the largest market share due to widespread use in professional and amateur sports filming.

Recreational activities represent the fastest-growing sub-segment within the application category. Action cameras are increasingly used by casual users and adventure enthusiasts to capture personal experiences and outdoor activities. This segment’s growth is driven by the user-friendly design of cameras, improving battery life, and the integration of features such as waterproofing and shock resistance.

The sports sub-segment holds the largest market share in the application category of action cameras. These cameras are extensively used to capture high-motion activities such as surfing, skiing, and mountain biking. The robust build, advanced features like motion sensors, and high frame rates suitable for capturing fast actions contribute significantly to their adoption in professional sports filming and training analyses.

Action cameras are also utilized within emergency services for training and real-time documentation purposes. The use in this sector is driven by the need for durable, reliable, and high-quality video recording equipment that can operate in a range of environmental conditions and critical situations.

Other applications of action cameras include uses in filmmaking, military exercises, and public safety operations. While these segments are smaller compared to sports and recreational activities, they provide important growth avenues as new applications for action camera technology are developed and adopted.

Key Market Segments

By Resolution

- Standard Resolution

- HD

- Full HD

- Ultra HD

By Distribution Channel

- Retail

- Online

By Application

- Recreational Activities

- Sports

- Emergency Services

- Other Applications

Drivers

Increasing Popularity of Adventure Sports Drives Market Growth

The popularity of adventure sports and outdoor activities, such as skiing, surfing, and mountain biking, is a primary driver. These activities require durable and portable cameras to capture immersive footage, leading to higher demand for action cameras. As more people engage in these activities, the market continues to expand.

The growth in the vlogging and content creation industry is another significant factor. Influencers and content creators are increasingly using action cameras for their versatility and high-quality video output. This demand from professionals and hobbyists alike boosts the sales of action cameras, as they become essential tools for creating engaging content.

The rising demand for high-resolution and 360-degree cameras supports market growth. Consumers seek devices that offer enhanced picture quality and immersive viewing experiences. Companies respond by developing advanced models that cater to these preferences, ensuring continued market expansion as technology evolves.

The expansion of social media platforms and live streaming further drives demand. Action cameras are widely used for broadcasting live adventures and activities, providing viewers with first-person perspectives. As social media trends grow, the need for action cameras that support live streaming and high-quality content increases, fueling the market’s growth.

Restraints

High Cost of Advanced Action Cameras Restraints Market Growth

The high cost of advanced action cameras is a significant barrier. These devices often include cutting-edge features like 4K video recording, image stabilization, and waterproof capabilities, which make them expensive. This pricing can deter potential buyers, particularly casual users or those on a budget, limiting the market’s reach.

Smartphones with advanced camera features present another challenge. Modern smartphones come equipped with high-resolution cameras and advanced functionalities that rival those of action cameras. This competition reduces the need for a separate action camera, as many users prefer the convenience of using a single device for both communication and capturing content.

Limited battery life is also a constraint for action cameras. Many users engage in prolonged activities like hiking or biking, requiring extended usage. However, action cameras often have short battery life, which may not be sufficient for long sessions. This limitation affects user satisfaction and discourages potential buyers.

Additionally, the performance of action cameras is highly dependent on weather and environmental conditions. Extreme temperatures, rain, or dust can affect their operation, making them less reliable in diverse outdoor settings. This dependency limits usage and adoption in varying climates, restraining the market’s growth.

Opportunity

Development of Rugged Models Provides Opportunities

Developing rugged and waterproof models is a major opportunity for the market. Consumers, particularly those engaged in extreme sports and outdoor activities, seek durable cameras that can withstand harsh conditions. Companies that focus on these features attract a loyal customer base, differentiating their products from other camera options and driving market growth.

Integration of artificial intelligence (AI) and advanced editing features also creates opportunities. AI can enhance user experience by automating video stabilization, facial recognition, and other smart functionalities, making the editing process easier and more efficient. Brands that invest in AI-powered action cameras appeal to tech-savvy consumers and professional content creators, expanding their market share.

Penetration into emerging markets presents significant potential. As adventure tourism and outdoor activities gain popularity in regions like Asia-Pacific and Latin America, there is increasing demand for affordable and high-quality action cameras. Companies that target these regions early can establish brand presence and capitalize on growing consumer interest.

Partnerships with sports and travel companies also provide opportunities for growth. Collaborating with adventure sports brands or travel agencies allows companies to promote their cameras as essential gear for travelers and athletes. These partnerships enhance brand visibility and credibility, driving product adoption among new consumer segments.

Challenges

Rapid Technological Obsolescence Challenges Market Growth

Technological obsolescence is a critical challenge for the market. As technology advances rapidly, new features and models are continuously introduced, making older versions quickly outdated. This rapid pace puts pressure on manufacturers to innovate frequently, which can be resource-intensive and costly.

High competition among leading brands is another challenge. Major players in the action camera market, as well as new entrants, compete aggressively on features, pricing, and brand appeal. This competition requires companies to continuously invest in product development and marketing strategies, which can strain resources and impact profitability.

Managing product durability across diverse conditions is also challenging. Action cameras are expected to perform in extreme environments like underwater, high altitudes, and rough terrains. Ensuring consistent product quality and durability across these diverse settings demands rigorous testing and robust materials, which can increase production costs.

Regulatory compliance and certification for safety standards further complicate the market. Action cameras must adhere to safety regulations, especially when designed for extreme environments. Compliance involves certification processes that can be time-consuming and expensive, affecting the speed of product launches and market entry.

Growth Factors

Surge in Demand for Professional-Grade Action Cameras Are Growth Factors

The surge in demand for professional-grade action cameras is a key growth driver. As content creation, including professional vlogging and extreme sports documentation, continues to rise, professionals and enthusiasts seek advanced cameras that offer superior video quality, stabilization, and durability.

The increasing usage of action cameras in automotive and surveillance applications further supports market expansion. Action cameras are now utilized in vehicles for capturing driving footage and in surveillance systems for monitoring activities in extreme environments.

The expansion of accessories and mounting solutions is also contributing to market growth. Manufacturers offer a wide range of attachments, including mounts for helmets, bikes, cars, and drones, which enhance the versatility and functionality of action cameras. These accessories enable users to capture footage from various angles and environments, promoting further adoption and repeat purchases.

Lastly, there is a growing focus on enhancing user interactivity and creating immersive experiences. Brands are incorporating features such as voice control, touch screens, and connectivity with smartphones for live streaming and easy sharing.

Emerging Trends

Growth in Wearable Camera Models Is Latest Trending Factor

Wearable camera models are becoming increasingly popular as consumers seek hands-free and compact options for capturing experiences. These wearable devices are convenient for adventure sports, travel, and everyday activities, making them a trending choice for tech enthusiasts and athletes.

Wireless and hands-free operation is another growing trend. Consumers prefer action cameras that can be controlled remotely via apps or wearable devices, allowing greater freedom during activities. This trend supports the development of advanced connectivity features and enhances the user experience, further driving market demand.

The adoption of AI-powered features for enhanced user experience is also shaping the market. AI functionalities such as automatic scene detection, video editing assistance, and facial recognition are becoming standard, making action cameras more user-friendly and appealing to a broad audience, including content creators.

Sustainable and eco-friendly product development is another trend gaining traction. Brands are increasingly focusing on using recyclable materials and reducing the environmental impact of their products. This shift attracts environmentally conscious consumers and aligns with global sustainability initiatives, boosting market credibility and appeal.

Regional Analysis

North America Dominates with 43.0% Market Share

North America leads the global action camera market with a 43.0% share, valued at USD 2.58 billion. This dominance is fueled by high consumer demand for outdoor and adventure activities, coupled with a strong culture of content creation and vlogging. The presence of leading action camera brands and tech startups also drives market growth in this region.

North America benefits from advanced technological infrastructure and a well-established retail network, both online and offline. High disposable incomes enable consumers to invest in premium and feature-rich action cameras. Moreover, a thriving sports and adventure tourism sector boosts the demand for high-performance cameras, enhancing the region’s market dynamics.

North America’s influence in the action camera market is expected to remain strong as the popularity of extreme sports, outdoor activities, and digital content creation continues to rise. Further innovation in camera technology, such as AI integration and 360-degree capabilities, is likely to sustain and potentially expand the region’s market share in the coming years.

Regional Mentions:

- Europe: Europe holds a solid position in the action camera market, driven by a growing interest in travel and adventure sports. The region benefits from a tech-savvy population and high demand for quality content creation tools.

- Asia Pacific: Asia Pacific is rapidly expanding its share in the action camera market, supported by increasing urbanization and rising disposable incomes. Countries like China and Japan are leading the growth, focusing on innovative camera features.

- Middle East & Africa: The Middle East & Africa region shows moderate growth, with a growing focus on adventure tourism and outdoor activities. Investments in local distribution networks are improving product availability.

- Latin America: Latin America’s action camera market is developing steadily, influenced by expanding tourism and adventure sports sectors. The region’s rising middle class and improved access to digital platforms support its gradual growth.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The action camera market is led by major companies like GoPro, Sony Corporation, Nikon Corporation, and DJI Technology. These companies dominate due to strong brand identities, technological advances, and global reach.

Action cameras are widely used for capturing high-quality videos during extreme sports, travel, and outdoor adventures. Market growth is driven by rising demand for social media content and increasing interest in sports and travel activities.

Key players offer action cameras with features like 4K recording, waterproofing, image stabilization, and ultra-wide lenses. They also provide accessories such as mounts, cases, and editing software to enhance user experience and camera capabilities.

GoPro and Sony focus on premium, high-quality cameras targeting professional users and content creators. Brands like SJCAM and YI Technology offer budget-friendly options, attracting casual users and price-sensitive customers. Companies often collaborate with extreme sports events and influencers to strengthen brand visibility.

Pricing ranges from premium models with advanced features to entry-level models for casual users. High-end brands like GoPro and Sony set premium prices to highlight their quality and features, while other brands offer more affordable models to compete in the mass market.

Innovation is essential, with companies focusing on improving camera quality, durability, and user interface. Brands invest in technologies like voice control, mobile app integration, and AI-enhanced editing features to stay ahead of competition.

The competitive edge of these companies lies in their strong branding, technological expertise, and continuous innovation. By offering diverse models for different customer segments, they maintain leadership in the growing action camera market.

Top Key Players in the Market

- GoPro, Inc.

- Nikon Corporation

- Sony Corporation

- SJCAM

- Garmin Ltd.

- YI Technology

- SZ DJI Technology Co. Ltd.

- Olympus Corporation

- Panasonic Corporation

- Rollei GmbH & Co. KG

- Drift Innovation

- Toshiba Corporation

- Other Key Players

Recent Developments

- Insta360, based in Shenzhen, introduced the X3 in September 2022, a 360-degree sports camera. The X3 can capture 5.7K 360-degree films. Material can be altered later using AI technologies in Insta360, which includes intelligent reframing.

- In March 2022, Insta360 launched its multi-lens antishake sporting camera, “ONE RS.” The company claims that the gadget can be used for different shooting needs by simply swapping lenses. The company’s second flexible action cam, the ONE RS, is equipped with a new 4K wide-angle boosting lens and an upgraded processor. It also has a larger battery capacity.

- AKASO Tech LLC released the Brave 8 action camera in October 2021, the latest addition to the Brave series of action cameras. AKASO’s Brave 8 series action cameras are the first to utilize innovative technology and high performance to directly impact the high-end action camera market with DJI and GoPro offerings. Brave 8 will give consumers a hardcore brand image.

- In August 2021, FeiyuTech launched the FeiyuPocket 2S and FeiyuPocket 2S, two new portable gimbal cameras for videographers that are packed with attention-grabbing features. The FeiyuPocket2S, which features a magnetically removable head and handles that allow users to experiment with various shooting angles, is the most popular of the two.

Report Scope

Report Features Description Market Value (2023) USD 6.0 Billion Forecast Revenue (2033) USD 21.3 Billion CAGR (2024-2033) 13.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Resolution (Standard Resolution, HD, Full HD, Ultra HD), By Distribution Channel (Retail, Online), By Application (Recreational Activities, Sports, Emergency Services, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GoPro, Inc., Nikon Corporation, Sony Corporation, SJCAM, Garmin Ltd., YI Technology, SZ DJI Technology Co. Ltd., Olympus Corporation, Panasonic Corporation, Rollei GmbH & Co. KG, Drift Innovation, Toshiba Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GoPro, Inc.

- Nikon Corporation

- Sony Corporation

- SJCAM, Garmin Ltd.

- Garmin Ltd.

- YI Technology

- SZ DJI Technology Co. Ltd.

- Olympus Corporation

- Panasonic Corporation

- Rollei GmbH & Co. KG

- Drift Innovation

- Toshiba Corporation

- Other Key Players