Global Automotive Clutch Market By transmission type (Manual, Automatic, Automated manual transmission, Other transmission), By vehicle type (Passenger vehicles, Commercial vehicles), By Clutch Type (Friction Clutch, Hydraulic Clutch, Dog Clutch, Others), By Clutch Disk and Plate Size (Below 9 Inches, 9 Inches to 10 Inches, 10 Inches to 11 Inches, 11 Inches and Above), By Distribution Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132429

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

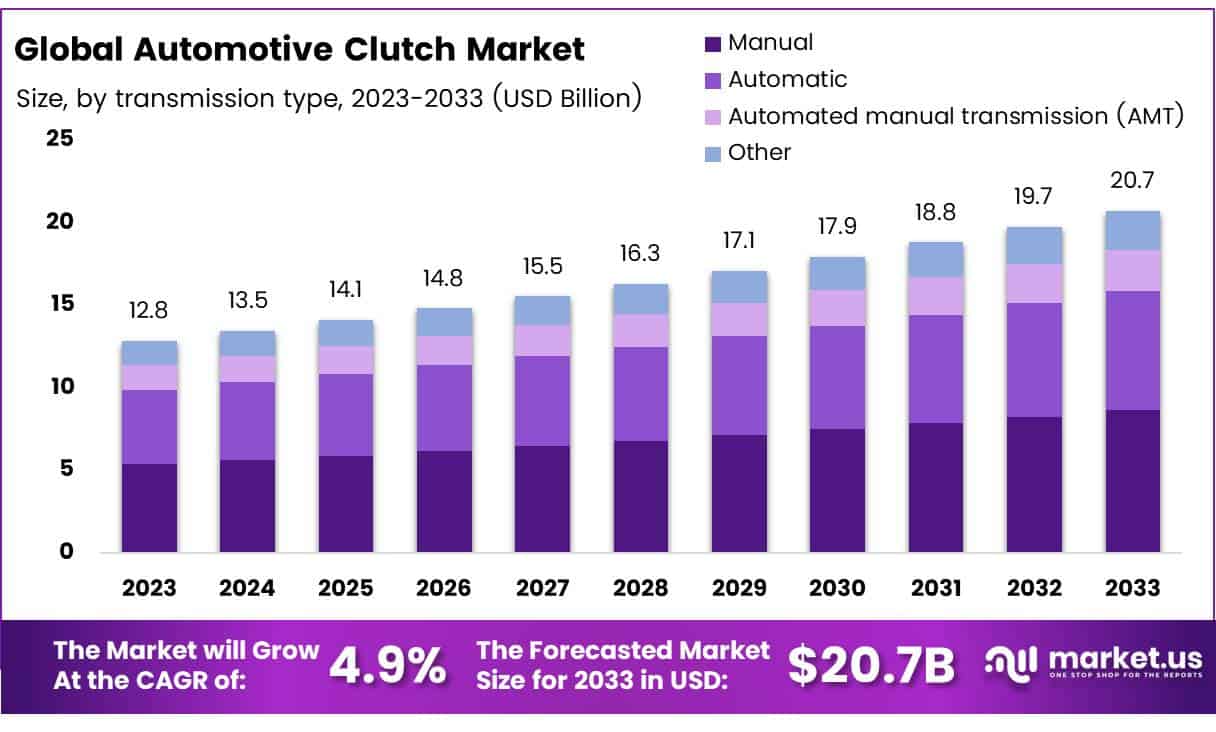

The Global Automotive Clutch Market size is expected to be worth around USD 20.7 Billion by 2033, from USD 12.8 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2024 to 2033.

An automotive clutch is a mechanical device in motor vehicles that manages the connection between the engine and the transmission. It allows drivers to switch gears or stop without shutting off the engine by temporarily disconnecting the engine from the transmission system.

The automotive clutch market includes the production, distribution, and sale of clutches and related components within the global automotive industry. This market is part of the larger automotive parts industry and is shaped by automobile manufacturing trends, consumer demand, and technological advancements.

The market is expected to grow due to increasing vehicle production and a demand for fuel-efficient vehicles. Technological improvements, such as electronics integrated into clutch systems, are enhancing performance and reliability, offering significant opportunities for growth.

Furthermore, the move towards hybrid and electric vehicles is driving innovation in clutch designs that accommodate higher torque and smoother transmission operations.

Government regulations aimed at promoting fuel efficiency and reducing emissions are boosting the adoption of advanced clutch systems. These include the use of start-stop systems that need durable clutches capable of frequent operation. Additionally, government incentives for clean vehicle technologies and investments in automotive infrastructure are supporting market expansion.

Stricter emission standards are pushing manufacturers to develop advanced clutches that improve fuel economy and reduce wear. Innovations such as dual-clutch technology combine the efficiency of manual transmissions with the ease of automatic systems.

The lifespan and maintenance costs associated with automotive clutches are critical factors in the market dynamics. According to U-Pull It, clutches typically last between 60,000 to 80,000 miles (approximately 96,000 to 128,000 kilometers), but this can vary significantly based on driving habits, vehicle type, and maintenance practices.

In terms of repair and replacement costs, data from Toyota of Downtown LA indicates that transmission repair costs range from $300 to $1,400.

JD Power further elaborates on the cost implications, stating that the replacement cost for a mainstream car with an automatic transmission can range from $2,500 to $5,000, including parts and labor. Manual transmission replacements are slightly less costly, ranging from $1,500 to $3,000.

For luxury or high-performance vehicles, the costs can exceed $6,000 due to specialized transmissions and higher labor rates. These financial considerations are pivotal in shaping consumer preferences and influencing market trends, as they highlight the need for advanced clutch systems that can reduce the overall ownership costs through enhanced reliability and decreased need for frequent repairs.

Key Takeaways

- The global automotive clutch market is projected to remain stable at USD 20.7 billion through 2033, growing at a CAGR of 4.9% from 2024 to 2033.

- Manual transmissions led the market in 2023, favored for providing direct control and engagement while driving.

- Passenger vehicles dominated the 2023 market due to increasing personal vehicle ownership, boosted by higher disposable incomes and greater need for private transport in suburban areas.

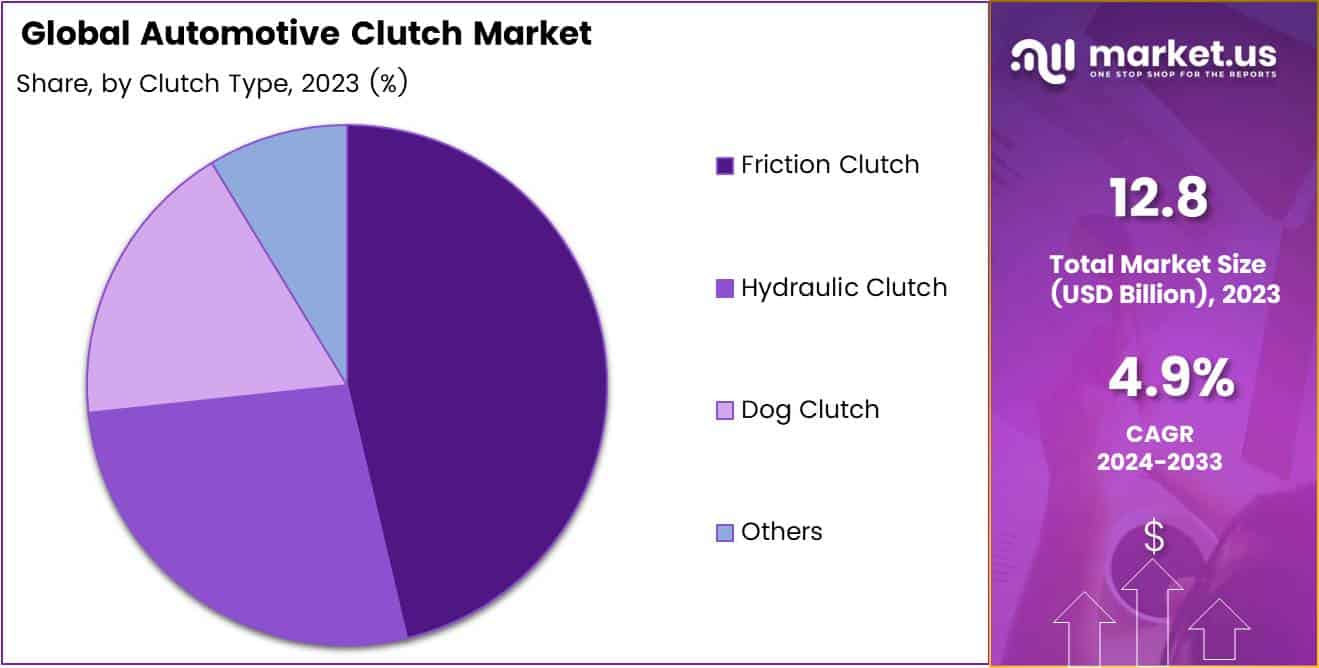

- In 2023, friction clutches, accounting for largest market share, were preferred for their cost-effectiveness and reliability in torque transfer.

- The “Below 9 Inches” clutch disk/plate size segment led in 2023, driven by demand for lightweight, fuel-efficient vehicles in cost-sensitive emerging markets.

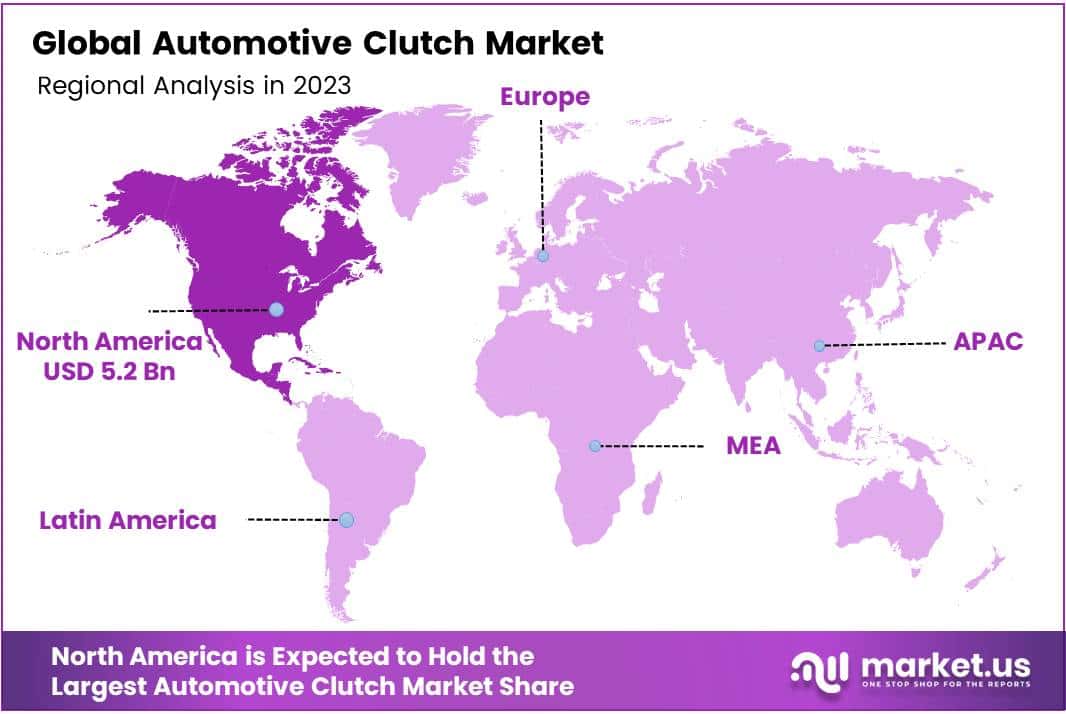

- North America claimed a 41% market share in 2023, valued at USD 5.2 billion, supported by advanced automotive manufacturing and technology adoption in hybrid and electric vehicles.

Transmission Type Analysis

Manual Transmission Leads Clutch Market with Robust Control

In 2023, Manual transmission held a dominant market position in the By Transmission Type Analysis segment of the Automotive Clutch Market. This traditional system continues to be preferred by drivers seeking direct engagement and control over their vehicles.

Manual clutches are celebrated for their durability, cost-effectiveness, and lower maintenance needs compared to more technologically advanced systems. They offer a significant advantage in terms of fuel efficiency and driving performance, particularly valued in markets with a high prevalence of manual driving skills.

Conversely, the Automatic transmission segment is catching up, appealing to consumers through convenience and ease of use, especially in urban settings with frequent stop-and-go traffic.

Automated Manual Transmission (AMT) represents a blend of manual and automatic benefits, providing efficiency and simpler operation, which has led to increased adoption in commercial vehicles as well as passenger cars.

The category labeled as Other Transmission Types includes dual-clutch and continuously variable transmissions (CVTs), which are gaining traction due to their ability to optimize shifting patterns and improve overall vehicle efficiency. Each transmission type caters to specific consumer preferences and vehicle requirements, shaping the competitive landscape of the Automotive Clutch Market.

Vehicle Type Analysis

Passenger Vehicles Lead Automotive Clutch Market in 2023

In 2023, passenger vehicles held a dominant market position in the By Vehicle Type Analysis segment of the Automotive Clutch Market. This dominance is attributed to the substantial increase in personal vehicle ownership driven by rising disposable incomes and the expanding suburban sprawl that demands private transportation solutions.

As a cornerstone of the automotive transmission system, clutches in passenger vehicles have undergone significant innovation to accommodate the shift towards automation and comfort in driving experiences.

The commercial vehicles segment also showed notable growth, fueled by the surge in e-commerce and the consequent need for efficient logistics and freight transport. Advances in clutch technology, such as the integration of hydraulics and pneumatics for heavier load management, have enhanced the durability and efficiency of clutches in this segment, catering to the rigorous demands of commercial use.

Both segments are poised for further expansion as emerging markets continue to invest in automotive infrastructure and as manufacturers focus on developing more robust and energy-efficient clutch systems. This evolution reflects the industry’s adaptive strategies to meet the dynamic consumer and business needs in the global automotive clutch market.

Clutch Type Analysis

Friction Clutch Leads in Automotive Clutch Market

In 2023, Friction Clutch held a dominant market position in the By Clutch Type Analysis segment of the Automotive Clutch Market, reflecting its pivotal role in the industry’s operational dynamics.

Friction clutches are preferred due to their straightforward design and proven efficiency in seamlessly transferring torque from the engine to the drivetrain.

Following the Friction Clutch, the Hydraulic Clutch segment emerged as the second most prevalent type. This variant, known for its smoother operation and reduced pedal effort, leverages fluid dynamics to facilitate power transmission, addressing the growing consumer demand for comfortable and low-maintenance vehicles.

The Dog Clutch, although less common, was noted for its application in environments requiring precise engagement, such as racing and high-performance vehicles. This type is distinguished by its lack of slippage and direct engagement, offering robustness in specific automotive scenarios.

Other types of clutches, including electromagnetic and pneumatic clutches, collectively accounted for a smaller portion of the market. These are generally tailored for specialized applications that require unique operational characteristics not fully addressed by more conventional clutch systems.

Clutch Disk/Plate Size Analysis

Below 9 Inches Dominates the Automotive Clutch Market

In 2023, the Below 9 Inches category maintained a leading position in the By Clutch Disk/Plate Size Analysis segment of the Automotive Clutch Market. This segment outperformed others due to the increasing demand for compact and economical vehicles, especially in emerging markets where cost-effectiveness and fuel efficiency are pivotal.

Vehicles equipped with smaller clutch disks are typically lighter and offer better fuel economy, which aligns with global trends towards sustainability and reduced emissions.

The 9 Inches to 10 Inches size segment followed, benefiting from its widespread use in mid-sized cars, which balance performance and practicality. The 10 Inches to 11 Inches segment caters primarily to larger vehicles that require more robust transmission systems, thus showing a steady but more niche growth.

Meanwhile, the 11 Inches and Above segment, although the smallest, is critical for high-performance and commercial vehicles that demand superior torque and power handling capabilities.

As automotive manufacturers continue to innovate and respond to consumer preferences for efficient and performance-oriented vehicles, the dynamics within the clutch disk/plate size segments are expected to evolve, potentially reshaping market standings in upcoming years.

Key Market Segments

By transmission type

- Manual

- Automatic

- Automated manual transmission

- Other transmission types

By vehicle type

- Passenger vehicles

- Commercial vehicles

By Clutch Type

- Friction Clutch

- Hydraulic Clutch

- Dog Clutch

- Others

By Clutch Disk/Plate Size

- Below 9 Inches

- 9 Inches to 10 Inches

- 10 Inches to 11 Inches

- 11 Inches and Above

By Distribution Channel

- OEM

- Aftermarket

Drivers

Surge in Vehicle Manufacturing Boosts Clutch Market

The automotive clutch market is witnessing substantial growth, primarily driven by the global increase in vehicle production and sales. As manufacturers continue to ramp up their output to meet rising consumer demand, the need for automotive clutches is surging concurrently.

This uptick is further supported by significant advancements in transmission technologies, including the development of dual-clutch and automated manual transmissions.

These innovations not only enhance driving efficiency but also elevate overall vehicle performance, making sophisticated clutch systems increasingly indispensable.

Additionally, the growing consumer demand for fuel-efficient vehicles compels automakers to integrate advanced clutch systems that optimize power transmission and improve fuel economy.

These factors collectively foster a robust environment for the expansion of the automotive clutch market, as manufacturers and consumers alike seek performance and efficiency.

Restraints

Shift Towards Electric Vehicles Challenges Clutch Market

The automotive clutch market is facing significant constraints, notably from the increasing shift towards electric vehicles (EVs). EVs, which generally lack the traditional clutch systems found in internal combustion engine vehicles, are gaining popularity due to their environmental benefits and technological advancements.

Additionally, the high costs associated with advanced clutch systems present another barrier. These sophisticated clutches, designed to enhance performance and efficiency in conventional vehicles, come at a premium. This makes them less appealing to price-sensitive consumers, potentially restricting market expansion.

As an analyst observing these trends, it is evident that these factors collectively contribute to a restrained growth outlook for the automotive clutch market, as manufacturers and suppliers may need to pivot or innovate to maintain relevance in a rapidly evolving automotive landscape.

Growth Factors

Hybrid Vehicle System Designs

Automotive clutch market is poised for notable growth, primarily propelled by the advancement in hybrid vehicle clutch systems. Designing clutches that are compatible with hybrid powertrains represents a significant opportunity for innovation and market expansion.

Moreover, the integration of lightweight materials like carbon composites in clutch manufacturing not only enhances the efficiency of these systems but also contributes to the overall reduction in vehicle weight, thus improving fuel economy.

Additionally, expanding into emerging markets such as India and China, where automotive production and adoption are rapidly increasing, could further bolster market growth. These regions offer a burgeoning customer base that is increasingly receptive to advanced automotive technologies, including hybrid systems, providing a fertile ground for the adoption of innovative clutch designs.

Emerging Trends

Adoption of Dual-Clutch Transmission (DCT)

The automotive clutch market is significantly influenced by the growing popularity of Dual-Clutch Transmission (DCT) systems in modern vehicles. This technology is known for delivering superior performance and enhanced fuel efficiency.

As consumers increasingly favor SUVs and crossovers, there is a parallel demand for heavy-duty clutch systems capable of handling greater torque, which is driving innovations in this segment.

Additionally, the integration of automation and robotics in clutch manufacturing processes is revolutionizing production lines. These technological advancements ensure high precision and efficiency, facilitating the production of more reliable and durable clutch systems.

Collectively, these factors are reshaping the dynamics of the automotive clutch market, making it a key area for strategic investments and development.

Regional Analysis

North America Leads with 41% market share

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each exhibiting distinct market dynamics and growth potentials.

North America emerges as the dominant region in the automotive clutch market, commanding a 41% market share with a valuation of USD 5.2 billion. This region’s prominence can be attributed to robust automotive manufacturing capabilities and high adoption rates of advanced automotive technologies, including hybrid and electric vehicles that utilize sophisticated clutch systems.

Regional Mentions:

Europe follows, characterized by a mature automotive industry and stringent environmental regulations driving the adoption of fuel-efficient vehicles. The region’s market is bolstered by the presence of leading automotive manufacturers and suppliers investing heavily in R&D to innovate clutch technologies that accommodate shifting consumer preferences and regulatory demands.

The Asia Pacific region is identified as a rapidly growing segment in the automotive clutch market. This growth is driven by increasing vehicle production in countries such as China, India, and Japan. The region benefits from lower manufacturing costs, rising automotive exports, and growing domestic demand for passenger vehicles, which collectively propel the demand for automotive clutches.

In the Middle East & Africa, the market experiences moderate growth, influenced by expanding automotive sales in Gulf Cooperation Council (GCC) countries and an increasing preference for personal transportation. Although the automotive industry is less mature compared to other regions, significant investments in automotive parts distribution channels are anticipated to boost the automotive clutch market.

Latin America shows potential for growth despite economic volatility in significant economies such as Brazil and Argentina. Factors such as increasing urbanization, improved roadway infrastructure, and a gradual recovery in the automotive sector contribute to the demand for automotive clutches.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global automotive clutch market, several key players demonstrate significant influence over industry dynamics in 2023.

Schaeffler AG, a prominent entity, capitalizes on its engineering excellence to enhance clutch reliability and efficiency, catering effectively to the increasing demand for hybrid and fully electric vehicles.

ZF Friedrichshafen AG, known for its innovative prowess, continues to advance clutch technology with systems designed to improve fuel economy and reduce emissions, aligning with global sustainability trends.

F.C.C. Co., Ltd remains a leader in the production of motorcycle clutches, expanding its portfolio to include automotive applications, thus leveraging its established manufacturing capabilities to meet diverse market needs.

BorgWarner Inc, with its comprehensive product range, focuses on delivering solutions that support the transition to electrification, emphasizing the development of e-clutch systems.

AISIN SEIKI’s strategic developments in drivetrain components underscore its commitment to technological advancement and market expansion, while Robert Bosch GmbH enhances its competitiveness through integrated mobility solutions that complement its clutch offerings. AMS Automotive stands out for its aftermarket services, providing robust supply chain management to meet escalating global demands.

EXEDY Corporation, renowned for its high-performance and racing clutches, continues to influence consumer segments seeking enhanced driving experiences.

FTE Automotive and Secto Automotive both contribute specialized solutions, the former focusing on hydraulic clutch systems, enhancing vehicle performance and comfort.

Valeo’s innovation in clutch systems, particularly in reducing pedal effort, marks its continued impact on improving user experience and vehicle efficiency.

Collectively, these companies drive the automotive clutch market toward higher efficiency, technological integration, and adaptability to shifting consumer preferences and regulatory standards.

Top Key Players in the Market

- Schaeffler AG

- ZF Friedrichshafen AG

- F.C.C. Co., Ltd

- BorgWarner Inc

- AISIN SEIKI

- Robert Bosch GmbH

- AMS Automotive

- EXEDY Corporation

- FTE Automotive

- Secto Automotive

- Valeo

Recent Developments

- In July 2024, Clutch, a leading digital auto retailer, secured a significant $10-million strategic investment from iA Financial Group. This investment will enhance Clutch’s market expansion efforts and bolster its technological capabilities in the automotive sales sector.”

- In July 2024, iA Financial Group made a separate investment, channeling $7.3 million into Clutch to further support its innovative approach to digital car sales. This funding aims to streamline the car buying experience and expand Clutch’s digital services.

- In May 2024, Japanese auto component manufacturer Exedy announced a strategic investment of USD 150 million in Omega Seiki Mobility, an Indian electric vehicle startup. This investment will support the development of new electric mobility solutions and expand Exedy’s footprint in the burgeoning EV market.

- In April 2024, Stellantis initiated production of electric dual-clutch transmissions in Italy, committing over €340 million to enhance electric vehicle production capabilities in the region. This move is part of Stellantis’s broader strategy to lead in the European electric vehicle market.

Report Scope

Report Features Description Market Value (2023) USD 12.8 Billion Forecast Revenue (2033) USD 20.7 Billion CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By transmission type (Manual, Automatic, Automated manual transmission, Other transmission), By vehicle type (Passenger vehicles, Commercial vehicles), By Clutch Type (Friction Clutch, Hydraulic Clutch, Dog Clutch, Others), By Clutch Disk/Plate Size (Below 9 Inches, 9 Inches to 10 Inches, 10 Inches to 11 Inches, 11 Inches and Above), By Distribution Channel (OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Schaeffler AG, ZF Friedrichshafen AG, F.C.C. Co., Ltd, BorgWarner Inc, AISIN SEIKI, Robert Bosch GmbH, AMS Automotive, EXEDY Corporation, FTE Automotive, Secto Automotive, Valeo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Schaeffler AG

- ZF Friedrichshafen AG

- F.C.C. Co., Ltd

- BorgWarner Inc

- AISIN SEIKI

- Robert Bosch GmbH

- AMS Automotive

- EXEDY Corporation

- FTE Automotive

- Secto Automotive

- Valeo