Global 3D Printed Surgical Models Market By Material (Plastic, Metal, Polymer and Others), By Technology (Fused Deposition Modeling (FDM), Stereolithography (SLA), MultiJet/PolyJet Printing, ColorJet Printing (CJP) and Others), By Speciality (Orthopedic Surgery, Transplant Surgery, Surgical Oncology, Reconstructive Surgery, Neurosurgery, Gastroenterology Endoscopy of Esophagus and Cardiac Surgery), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177847

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

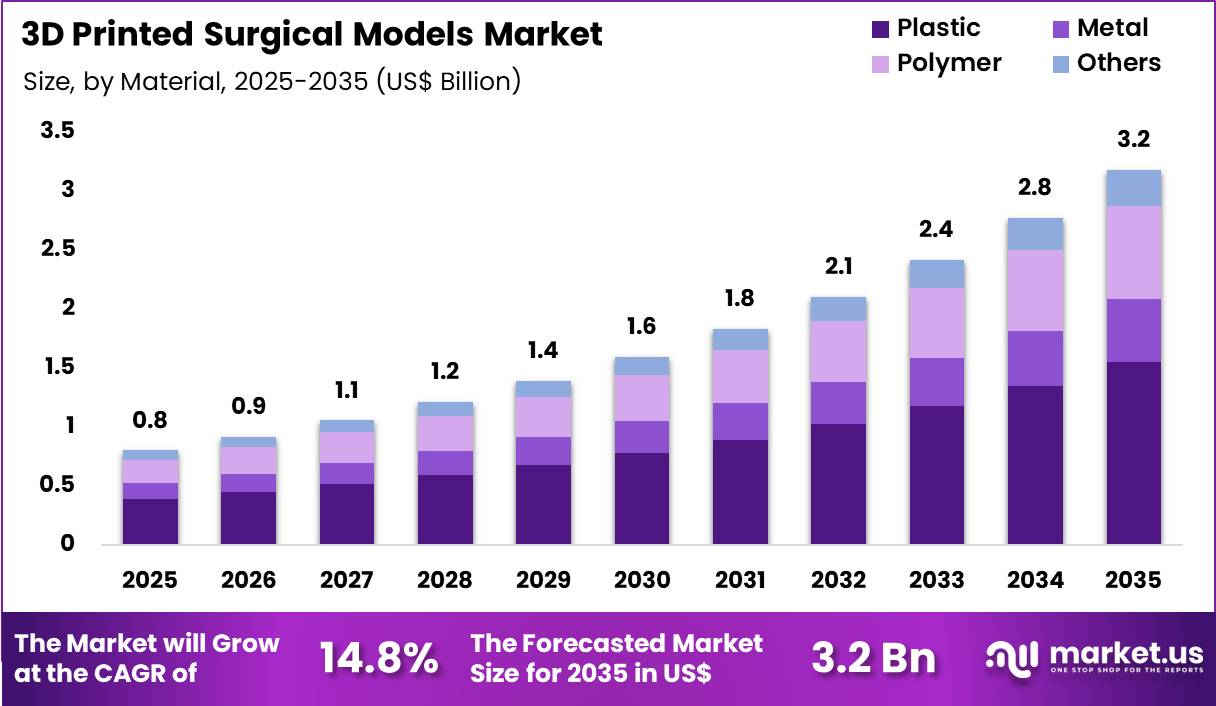

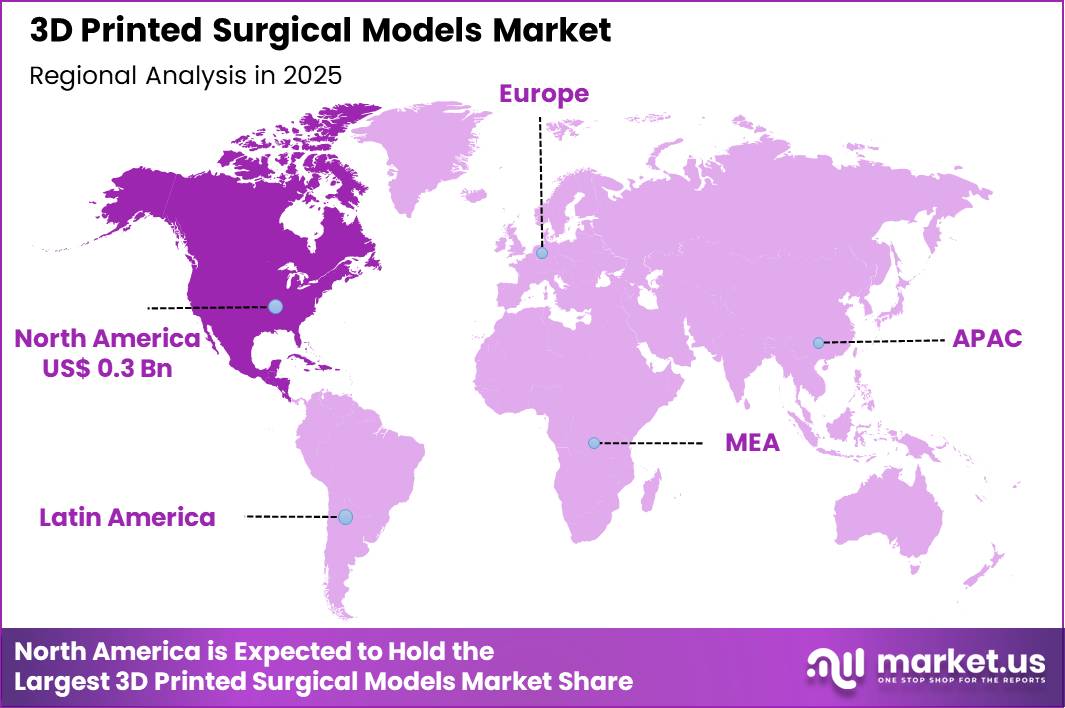

The Global 3D Printed Surgical Models Market size is expected to be worth around US$ 3.2 Billion by 2035 from US$ 0.8 Billion in 2025, growing at a CAGR of 14.8% during the forecast period 2026-2035. In 2025, North America led the market, achieving over 42.8% share with a revenue of US$ 0.3 Billion.

Increasing adoption of personalized surgical planning accelerates the 3D printed surgical models market as healthcare professionals demand accurate, patient-specific replicas that enhance procedural precision and reduce operative risks.

Surgeons increasingly utilize these models for preoperative simulation in complex orthopedic reconstructions, where detailed bone structures guide implant placement and fracture alignment in joint replacements and trauma repairs. These replicas support cardiovascular applications by replicating vessel anatomies for aneurysm coiling or valve repair rehearsals, allowing teams to anticipate challenges and optimize stent deployment.

Neurosurgeons apply 3D models to map intricate brain tumors and vascular malformations, facilitating safe resection paths that preserve critical neural functions during craniotomies. Plastic and reconstructive specialists employ them for craniofacial defect corrections, customizing grafts and flaps based on exact replicas of patient anatomy.

Medical educators integrate these models into training programs, enabling residents to practice intricate procedures like spinal fusions or organ transplants on tangible simulations that mimic real tissue textures.

Manufacturers pursue opportunities to integrate augmented reality overlays with 3D printed models, expanding applications in intraoperative guidance where virtual projections align with physical replicas for enhanced accuracy. Developers advance bioprinted hybrid models that incorporate soft tissue simulants, broadening utility in minimally invasive simulations for endoscopic and robotic surgeries.

These innovations facilitate patient education tools that visualize procedural steps, improving informed consent in elective operations like hernia repairs. Opportunities emerge in scalable, cost-effective printing materials that support high-volume production for hospital networks.

Companies invest in AI-driven design software that automates model generation from imaging data, streamlining workflows across specialties. Recent trends emphasize sustainable, recyclable polymers and multi-material printing, positioning the market for growth in eco-conscious healthcare environments focused on innovation and efficiency.

Key Takeaways

- In 2025, the market generated a revenue of US$ 0.8 Billion, with a CAGR of 14.8%, and is expected to reach US$ 3.2 Billion by the year 2035.

- The material segment is divided into plastic, metal, polymer and others, with plastic taking the lead with a market share of 48.7%.

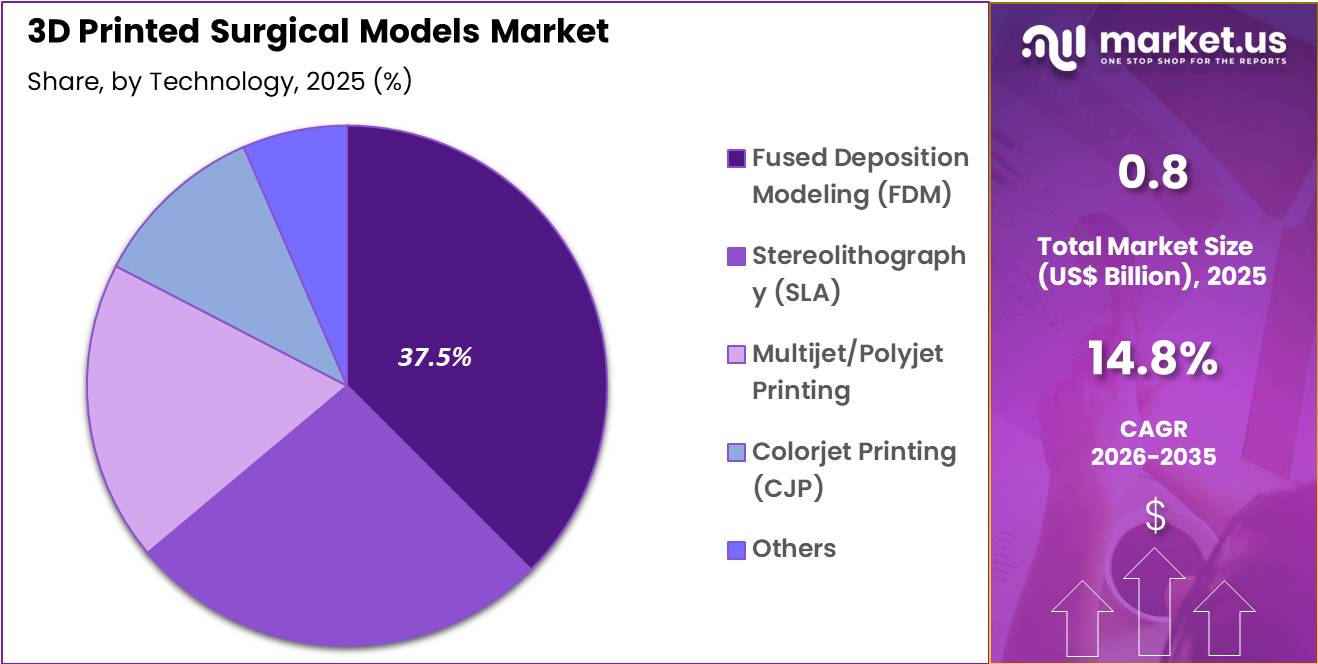

- Considering technology, the market is divided into fused deposition modeling (FDM), stereolithography (SLA), multijet/polyjet printing, colorjet printing (CJP) and others. Among these, fused deposition modeling (FDM)held a significant share of 37.5%.

- Furthermore, concerning the speciality segment, the market is segregated into orthopedic surgery, transplant surgery, surgical oncology, reconstructive surgery, neurosurgery, gastroenterology endoscopy of esophagus and cardiac surgery. The orthopedic surgery sector stands out as the dominant player, holding the largest revenue share of 33.8% in the market.

- North America led the market by securing a market share of 42.8%.

Material Analysis

Plastic contributed 48.7% of growth within material and led the 3D printed surgical models market due to its cost efficiency, versatility, and ease of fabrication. Hospitals and academic centers prefer plastic materials because they allow rapid prototyping of anatomical structures at lower expense compared to metal alternatives.

Surgeons use plastic models for preoperative planning to visualize fractures, deformities, and tumor boundaries. Lightweight properties and color adaptability improve anatomical clarity and surgical rehearsal outcomes.

Growth strengthens as material science advances enhance durability and surface detail without significantly increasing cost. Plastic supports high-resolution printing suitable for educational and simulation purposes. Widespread availability of compatible printers further accelerates adoption.

Training institutions increasingly integrate plastic models into curricula for hands-on surgical preparation. The segment is expected to remain dominant as affordability and adaptability continue to drive broad clinical and educational use.

Technology Analysis

Fused deposition modeling accounted for 37.5% of growth within technology and dominated the 3D printed surgical models market due to its accessibility and operational simplicity. Healthcare facilities adopt FDM systems because they offer reliable printing at manageable capital investment levels.

The technology supports rapid turnaround, which enables surgeons to prepare patient-specific models within tight procedural timelines. Compatibility with widely available thermoplastics enhances cost control and workflow efficiency.

Growth accelerates as printer reliability improves and layer resolution advances enhance anatomical accuracy. FDM supports decentralized production within hospital innovation labs. Maintenance requirements remain relatively straightforward, which strengthens adoption in resource-limited settings. Integration with imaging software improves model precision. The segment is anticipated to maintain leadership as hospitals prioritize scalable and cost-effective in-house 3D printing capabilities.

Speciality Analysis

Orthopedic surgery generated 33.8% of growth within speciality and emerged as the leading segment due to the high volume of fracture, joint, and deformity correction procedures. Surgeons rely on 3D printed models to understand complex bone anatomy and plan implant placement.

Preoperative visualization improves alignment accuracy and reduces intraoperative uncertainty. Increasing prevalence of trauma and degenerative joint conditions raises demand for precise surgical preparation tools.

Growth strengthens as minimally invasive and patient-specific orthopedic interventions expand. Customized surgical guides and rehearsal models enhance procedural efficiency. Teaching hospitals integrate orthopedic models into resident training programs.

Advanced imaging integration further improves model fidelity. The segment is projected to remain dominant as orthopedic procedures continue to benefit from detailed anatomical replication and preoperative simulation.

Key Market Segments

By Material

- Plastic

- Metal

- Polymer

- Others

By Technology

- Fused Deposition Modeling (FDM)

- Stereolithography (SLA)

- MultiJet/PolyJet Printing

- ColorJet Printing (CJP)

- Others

By Speciality

- Orthopedic Surgery

- Transplant Surgery

- Surgical Oncology

- Reconstructive Surgery

- Neurosurgery

- Gastroenterology Endoscopy of Esophagus

- Cardiac Surgery

Drivers

Increasing prevalence of musculoskeletal conditions is driving the market.

The global rise in musculoskeletal conditions has notably increased the demand for 3D printed surgical models, as these tools aid in preoperative planning for orthopedic surgeries to address bone and joint disorders. Enhanced diagnostic capabilities and aging populations have contributed to higher case numbers, necessitating accurate models for surgical rehearsal and implant customization.

Healthcare institutions are increasingly adopting 3D models to improve procedural outcomes in patients with conditions like osteoarthritis and fractures. The correlation between musculoskeletal impairments and disability underscores the need for personalized surgical aids derived from patient imaging.

Government health entities report substantial impacts on quality of life, prompting investments in advanced planning technologies. The association between low back pain and work limitations further amplifies the role of 3D models in reducing operative risks. National health strategies emphasize rehabilitation, supporting the integration of 3D printing in orthopedic care.

Key developers are refining model accuracy to meet this escalating clinical requirement. According to the World Health Organization, approximately 1.71 billion people have musculoskeletal conditions worldwide. This driver sustains market momentum by aligning with efforts to mitigate the socioeconomic burden of these disorders through innovative surgical preparation.

Restraints

High cost of 3D printing technology is restraining the market.

The substantial expense associated with 3D printing equipment and materials for surgical models limits adoption in facilities with restricted budgets. Manufacturing complexities involving high-resolution printers and biocompatible resins elevate overall production costs for these specialized tools.

Smaller hospitals often postpone implementations, preferring conventional planning methods due to financial constraints. Regulatory requirements for model validation add to the economic burden on providers. In public health systems, allocations prioritize essential services over advanced printing technologies.

Providers must balance clinical advantages against fiscal viability when selecting 3D modeling solutions for preoperative use. This restraint curtails expansion in developing regions with sparse healthcare funding. Collaborative financing models aim to ease these pressures incrementally.

Despite procedural benefits, economic factors hinder equitable access across diverse institutions. Resolving affordability through policy interventions remains critical for countering this market challenge.

Opportunities

Growth in medical segment revenues is creating growth opportunities.

The positive performance in medical 3D printing revenues among leading manufacturers indicates potential for expanded utilization of surgical models in personalized healthcare. Increased investments in additive manufacturing support the deployment of models for complex case planning in hospitals. Strategic alliances with medical device firms facilitate tailored solutions for surgical rehearsal applications.

The substantial revenue base in developed economies amplifies prospects for technology refinements in model fabrication. Reforms in healthcare reimbursement strengthen infrastructure for 3D printing adoption. Primary corporations are pursuing regional expansions to capitalize on economic upturns in biopharma. This opportunity corresponds with initiatives to elevate standards in preoperative visualization.

Focused developments can generate notable advancements in specialized surgical planning segments. Materialise reported medical segment revenue of 101,376 thousand euros in 2023, increasing to 116,358 thousand euros in 2024, reflecting a 14.8% growth. Stratasys reported total revenue of 627.6 million dollars in 2023, decreasing to 572.5 million dollars in 2024.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the 3D printed surgical models market through hospital capital allocation, surgical planning budgets, and reimbursement clarity. Inflation and higher interest rates increase equipment financing costs, which slows investment in advanced printers, software, and specialized materials.

Geopolitical tensions disrupt supplies of resins, polymers, and precision printing components, creating cost volatility and longer procurement timelines. Current US tariffs on imported printers, hardware parts, and raw materials raise production expenses for service providers and hospitals, which tightens margins and limits pricing flexibility.

These pressures challenge smaller innovation labs and delay expansion in cost sensitive health systems. On the positive side, trade exposure encourages domestic production of printing materials and localized manufacturing hubs.

Growing emphasis on personalized surgery and pre operative planning sustains demand for accurate anatomical models. With disciplined cost control, workflow integration, and clinical validation, the market continues to advance with steady confidence.

Latest Trends

Launch of advanced 3D printers for medical modeling is a recent trend in the market.

In 2024, the introduction of high-speed 3D printers has improved the production of surgical models by enabling rapid fabrication of detailed anatomical replicas. These printers feature enhanced resolution engines to support complex geometries required for preoperative planning. Manufacturers have prioritized biocompatibility in materials to ensure safety for clinical use.

Clinical applications extend to orthopedics and neurosurgery, addressing diverse modeling needs. Formlabs launched the Form 4 in April 2024, capable of printing detailed surgical models in under two hours. This development facilitates point-of-care manufacturing in hospital settings.

The trend emphasizes sustainability through efficient resin usage in model creation. Regulatory clearances in 2024 for these models have accelerated their commercialization. Industry partnerships optimize features for real-time imaging integration. These innovations aim to streamline workflows in high-acuity surgical environments.

Regional Analysis

North America is leading the 3D Printed Surgical Models Market

North America captured a 42.8% share of the 3D Printed Surgical Models market in 2024, driven by strong integration of additive manufacturing into preoperative planning and medical education. Leading hospitals expanded point of care printing labs to create patient specific anatomical replicas that improve surgical precision in complex cardiac, orthopedic, and neurosurgical cases.

Surgeons increasingly relied on tangible models to rehearse procedures and reduce intraoperative uncertainty. Academic medical centers incorporated printed anatomy into residency training, which strengthened routine utilization. Collaboration between device manufacturers and hospitals accelerated innovation in materials and imaging integration.

Reimbursement clarity for certain advanced planning procedures further encouraged adoption. A clear indicator of regulatory momentum comes from the US Food and Drug Administration, which stated in 2023 that it had authorized more than 100 3D printed medical devices, reflecting expanding acceptance of additive manufacturing technologies in clinical practice.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The 3D Printed Surgical Models market in Asia Pacific is expected to grow steadily during the forecast period as tertiary hospitals invest in precision surgery and digital health infrastructure. Governments encourage advanced manufacturing in healthcare to improve surgical outcomes and reduce complication rates.

Teaching hospitals integrate anatomical replicas into surgical simulation programs, which expands institutional demand. Rising volumes of complex oncological and cardiovascular procedures increase the need for customized preoperative planning tools. Local additive manufacturing companies collaborate with imaging centers to streamline model production.

Cross border partnerships transfer expertise and materials technology across the region. A verifiable signal of national support appears in 2023 data from China’s Ministry of Industry and Information Technology, which highlighted continued implementation of its additive manufacturing development plan, underscoring strong policy backing for medical 3D printing expansion across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the 3D printed surgical models market grow by enhancing anatomical accuracy, material realism, and customization capabilities that help surgeons plan complex procedures more effectively and reduce OR time. They also strengthen customer value by integrating advanced imaging data with scalable manufacturing platforms, enabling rapid turnaround and tailored solutions for neurosurgery, orthopedics, and cardiovascular cases.

Firms expand commercial reach through partnerships with leading hospitals, surgical training centers, and medical device innovators that embed these models into clinical education and preoperative workflows. Strategic investments in production automation and digital design tools help reduce costs, improve consistency, and support broader adoption across regional healthcare providers.

Materialise NV exemplifies a specialized medical technology company with deep expertise in patient-specific 3D planning and printing solutions, strong collaborations with clinical leaders, and a coordinated global distribution strategy that aligns innovation with practitioner needs.

The company reinforces its competitive edge through disciplined R&D funding, targeted ecosystem partnerships, and a customer-centric commercialization approach that translates emerging clinical requirements into scalable market solutions.

Top Key Players

- Stratasys

- 3D Systems

- Materialise

- Formlabs

- EnvisionTEC

- EOS GmbH

- Renishaw

- Axial3D

- Anatomics

- Simbionix

Recent Developments

- In April 2024, 3D Systems received US FDA clearance for what it described as the first 3D-printed PEEK cranial implant. The approval marks a milestone in patient-specific implant manufacturing, supporting customized cranial reconstruction procedures using advanced additive manufacturing technology.

- In December 2024, Axial3D announced a strategic collaboration aimed at broadening availability of patient-specific 3D anatomical models derived from MRI imaging. The initiative is designed to enhance surgical planning and improve accessibility to personalized modeling solutions.

Report Scope

Report Features Description Market Value (2025) US$ 0.8 Billion Forecast Revenue (2035) US$ 3.2 Billion CAGR (2026-2035) 14.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material (Plastic, Metal, Polymer and Others), By Technology (Fused Deposition Modeling (FDM), Stereolithography (SLA), MultiJet/PolyJet Printing, ColorJet Printing (CJP) and Others), By Speciality (Orthopedic Surgery, Transplant Surgery, Surgical Oncology, Reconstructive Surgery, Neurosurgery, Gastroenterology Endoscopy of Esophagus and Cardiac Surgery) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stratasys, 3D Systems, Materialise, Formlabs, EnvisionTEC, EOS GmbH, Renishaw, Axial3D, Anatomics, Simbionix Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  3D Printed Surgical Models MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

3D Printed Surgical Models MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-