Quick Navigation

Overview

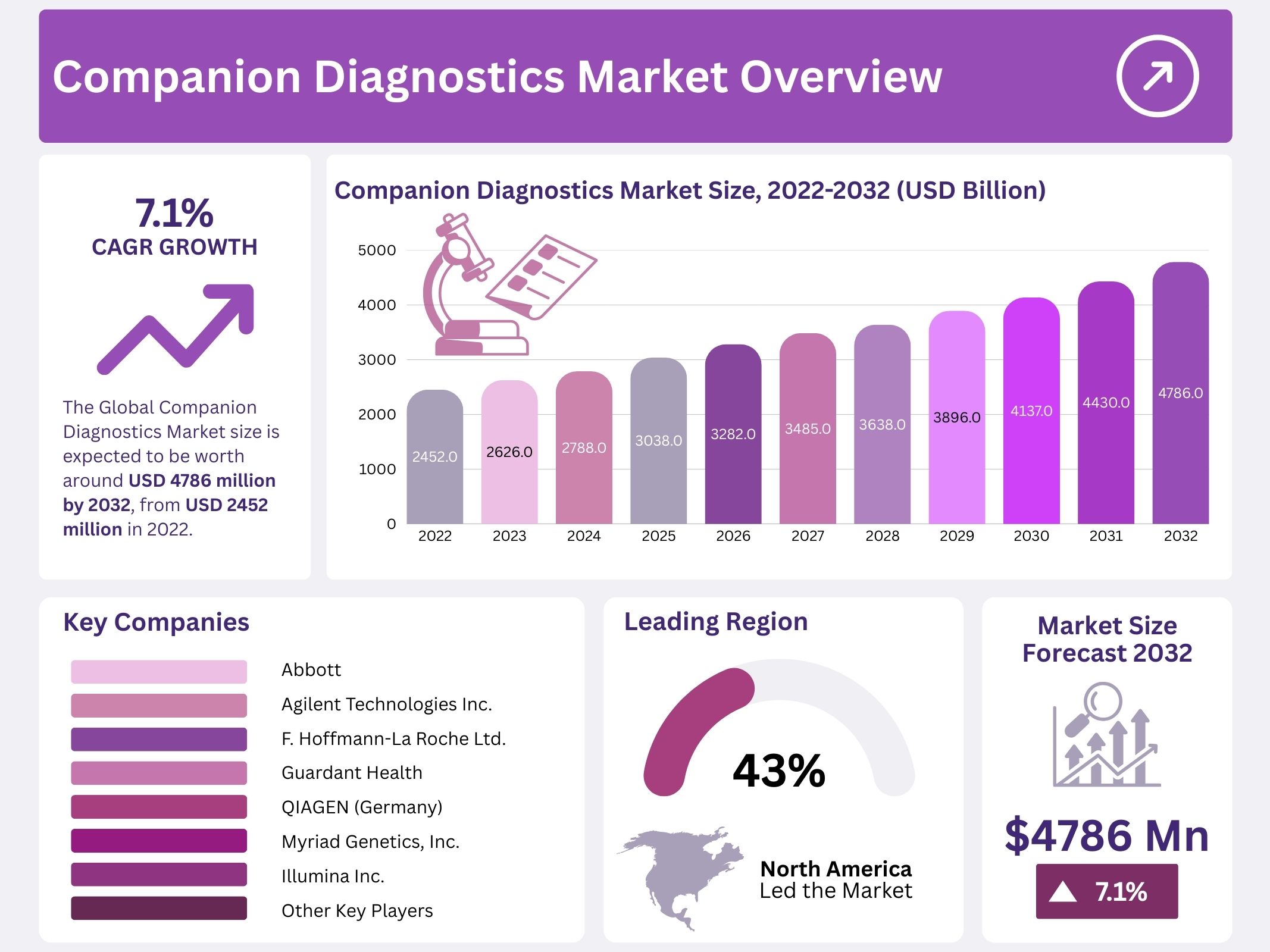

The Global Companion Diagnostics Market is projected to reach USD 4,786 million by 2032, growing from USD 2,452 million in 2022 at a CAGR of 7.1%. This growth reflects the increasing demand for precision-based medical solutions. Advances in genomics and sequencing technologies have improved the ability to identify patient-specific drug responses. As a result, pharmaceutical companies are integrating diagnostic tools early in the drug development process to ensure better alignment of therapies with genetic profiles, thereby improving safety and efficacy.

The rising adoption of precision medicine is a major market driver. Healthcare systems are steadily moving away from generalized treatments toward personalized care models. Companion diagnostics enable physicians to select the most effective therapy tailored to a patient’s molecular or genetic signature. This reduces trial-and-error treatments and enhances therapeutic outcomes. The transition from a “one-size-fits-all” approach to targeted treatment strategies is fueling consistent growth in the demand for CDx across global healthcare markets.

Another critical growth factor is the increasing prevalence of chronic and complex diseases. Conditions such as cancer, autoimmune disorders, and cardiovascular diseases require advanced therapies. Oncology represents the largest application segment due to the reliance on biomarker-driven drug administration. Companion diagnostics help predict treatment efficacy and minimize unnecessary drug exposure. This role in optimizing therapy is expected to sustain CDx demand, particularly as global disease incidence continues to rise.

Support from regulatory authorities further strengthens the market. Agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have promoted parallel drug–diagnostic approvals. This regulatory clarity encourages collaboration between pharmaceutical firms and diagnostic developers, ensuring faster drug–diagnostic launches. Such policies reduce commercialization timelines and increase investor confidence, creating a favorable environment for the expansion of the companion diagnostics industry over the next decade.

Technological Innovations and Emerging Opportunities

Technological advancements are reshaping the companion diagnostics landscape. Breakthroughs in next-generation sequencing (NGS), digital polymerase chain reaction (PCR), and molecular technologies now allow highly sensitive biomarker detection. These innovations expand the range of conditions addressed by CDx while reducing costs, improving accessibility, and enhancing accuracy. As testing technologies become more affordable, adoption in both developed and emerging healthcare markets is expected to accelerate significantly in the coming years.

Strategic partnerships between pharmaceutical companies and diagnostic manufacturers are another catalyst. Such collaborations ensure the co-development of drugs and diagnostics, reducing the time required for clinical validation and approval. This integrated approach aligns drug discovery with diagnostic development, strengthening the pipeline of personalized therapies. In turn, it enhances patient outcomes, accelerates access to targeted drugs, and drives greater adoption of companion diagnostics across therapeutic areas.

Cost-effectiveness is an additional driver. Healthcare systems worldwide face rising pressure to balance quality and cost. Companion diagnostics reduce unnecessary treatments, hospitalizations, and associated expenditures by ensuring accurate therapy selection. Value-based healthcare models, especially in developed regions, are supporting the adoption of CDx as a means to deliver both clinical and economic benefits. This cost advantage is expected to remain a compelling reason for broader utilization across patient populations.

Emerging markets present untapped opportunities for expansion. Investments in healthcare infrastructure, increasing clinical awareness, and rising diagnostic demand are driving adoption across Asia-Pacific and Latin America. Furthermore, the development of biologics and immunotherapies, particularly in oncology, has created new applications for CDx. These therapies often require biomarker-driven approaches, further broadening the market scope beyond traditional drugs. Together, these factors indicate strong long-term growth potential for the global companion diagnostics market.

Key Takeaways

- The global companion diagnostics market is projected to surpass USD 4,786 million by 2032, indicating a strong growth trajectory for the industry.

- In 2022, the market size was estimated at USD 2,452 million, reflecting the baseline value from which current growth trends are measured.

- The companion diagnostics sector is expanding at a compound annual growth rate (CAGR) of 7.1%, signaling consistent and sustainable market advancement.

- North America accounted for 43% of the companion diagnostics market revenue in 2022, making it the leading regional contributor to global share.

- Europe followed as the second-largest region with a 25% revenue share in 2022, highlighting its significant role in global market dynamics.

Regional Analysis

North America represents a significant share of the global companion diagnostics market. The region’s dominance is supported by the rising burden of cancer and chronic diseases. In 2020 alone, the USA reported 1,806,590 new cancer cases, highlighting the scale of demand for advanced diagnostics. Adoption of companion diagnostics (CDx) tests is high due to established healthcare infrastructure. Europe follows closely, driven by its expanding pharmaceutical industry. Collaborative initiatives, such as the December 2021 partnership between QIAGEN and Denovo Biopharma LLC, further boost market growth.

The Asia Pacific region is projected to witness the fastest market growth. Cancer incidence rates are increasing rapidly in the region, and improvements in healthcare systems are enhancing access to advanced testing. Asia Pacific accounts for half of global annual new cancer cases, making it a key growth driver. Projections indicate cancer deaths in the region may increase by 36% by 2030. These factors underline the need for advanced diagnostic solutions to manage growing healthcare challenges across major markets.

Strategic collaborations are further strengthening the Asia Pacific market. In July 2022, Geneseeq partnered with Hospital de Base in Brazil to establish a precision cancer diagnostic laboratory, showing expanding regional influence. This initiative reflects the focus on developing innovative CDx solutions tailored to local healthcare needs. In contrast, regions such as Latin America, the Middle East, and Africa are anticipated to grow at a slower pace. Limited healthcare resources and weaker diagnostic infrastructure in these regions hinder rapid adoption of companion diagnostics tests.

Segmentation Analysis

Companion diagnostics consist of assays, reagents, and software that assess the composition or quality of substances. Assays, used across research and clinical laboratories, often come with complete kits designed for specific applications. Reagents, which are essential chemicals, facilitate measurement or creation of other compounds. Advanced techniques such as next-generation sequencing, immunohistochemistry, and polymerase chain reaction are employed. These methods support cancer detection, particularly lung, breast, colorectal, and melanoma, and are widely utilized by pharmaceutical companies, biopharmaceutical firms, and reference laboratories for targeted therapeutic strategies.

Polymerase chain reaction (PCR) technology has a leading share in the market, supported by the consistent launch of innovative kits. Companies such as QIAGEN and Thermo Fisher Scientific are contributing strongly to this growth. Thermo Fisher’s QuantStudio 5 Dx Real-Time PCR System, launched in March 2021, increased diagnostic precision and efficiency. PCR technologies are instrumental in identifying patients suitable for new therapies, such as Amgen’s LUMAKRAS for Non-Small Cell Lung Cancer (NSCLC). Regulatory approvals and frequent product introductions further strengthen this segment’s dominance in companion diagnostics.

Cancer remains the most prominent application area for companion diagnostics, driven by rising global incidence rates. The World Health Organization reported nearly 400,000 cancer cases among children in 2022, while the World Cancer Research Fund noted over 18 million cases worldwide. Technological innovations such as Roche’s FDA-approved VENTANA HER2 dual ISH DNA probe cocktail assay highlight advancements. Neurology is also a growing application segment due to increasing central nervous system disorders like Parkinson’s and Schizophrenia. Tools such as Fujirebio’s Lumipulse assays are enabling accurate diagnosis through advanced chemiluminescent enzyme immunoassay methods.

Pharmaceutical and biopharmaceutical companies accounted for the largest share of end-users in 2022. Their dominance is due to collaborations with diagnostic developers for precision medicine. Burning Rock Biotech partnered with Merck KGaA in 2021 to advance liquid biopsy diagnostics, while later collaborating with IMPACT Therapeutics on synthetic lethality therapies. Illumina and Boehringer Ingelheim also partnered in 2022 to accelerate oncology diagnostics. Such alliances, combined with technological progress and product innovation, are expanding the role of companion diagnostics. The end-user segment is expected to witness steady growth during the forecast period.

Key Players Analysis

Hoffmann-La Roche Ltd., Agilent Technologies Inc., and Abbott are recognized as major players in the companion diagnostics market. Their leadership is driven by product launches and strategic acquisitions. In April 2021, Agilent Technologies Inc. acquired Resolution Bioscience Inc., a specialist in next-generation sequencing (NGS)-based oncology diagnostics. This acquisition expanded Agilent’s diagnostic expertise and reinforced its presence in personalized medicine. Such moves highlight the importance of acquisitions in strengthening capabilities, improving innovation, and securing a competitive position in the growing diagnostics sector worldwide.

Illumina Inc. has adopted partnerships as a growth strategy, demonstrating its focus on collaboration. A notable example is its alliance with Loxo Oncology to develop NGS-based companion diagnostics. This partnership reflects a strategy to align with leading biotechnology companies and drive advancements in therapeutic diagnostics. Similarly, BioMerieux has established collaborations with pharmaceutical and medical device companies to accelerate innovation. These partnerships help organizations expand their research capabilities and deliver advanced diagnostic solutions that meet the evolving needs of healthcare providers.

The companion diagnostics market remains fragmented, with global, regional, and local players contributing to competition. Many regional companies offer competitively priced products, creating challenges for established brands. To maintain leadership, major companies adopt strategies such as new product launches and global partnerships. These approaches enhance distribution networks and improve product portfolios. Competition in the market is intense, as established players defend their dominance against new entrants. Continuous innovation, strategic alliances, and strong distribution frameworks remain critical for sustaining growth and securing market share.

Market Key Players

- Abbott

- Agilent Technologies Inc.

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Guardant Health

- QIAGEN (Germany)

- Myriad Genetics, Inc.

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- BIOMERIEUX (France)

- Myriad Genetics Inc.

- Other Key Players.

Conclusion

The companion diagnostics market is set for strong growth as healthcare moves toward precision medicine. These tests are becoming essential for selecting the right therapy based on a patient’s genetic profile, improving treatment outcomes, and reducing unnecessary costs. Advances in molecular technologies and next-generation sequencing are expanding their applications, especially in cancer care. Supportive regulations, strategic partnerships, and cost-effectiveness are encouraging wider adoption across regions. While North America and Europe remain dominant, Asia-Pacific shows the fastest expansion due to rising cancer rates and improving healthcare systems. Overall, companion diagnostics are shaping the future of personalized medicine with growing global demand.

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]

View More

Precision Medicine Market || AI In Precision Medicine Market || Non Oncology Precision Medicine Market || Next Generation Sequencing Market || Next Generation Cancer Diagnostics Market || Liquid Biopsy Market || PCR Molecular Diagnostics Market || Pharmacogenomics Market