Global Maternity Wear Market Size, Share, Growth Analysis By Product (Outerwear, Innerwear, Nightwear), By Material Type (Cotton, Rayon, Spandex & Lycra, Silk & Satin, Others), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 17151

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

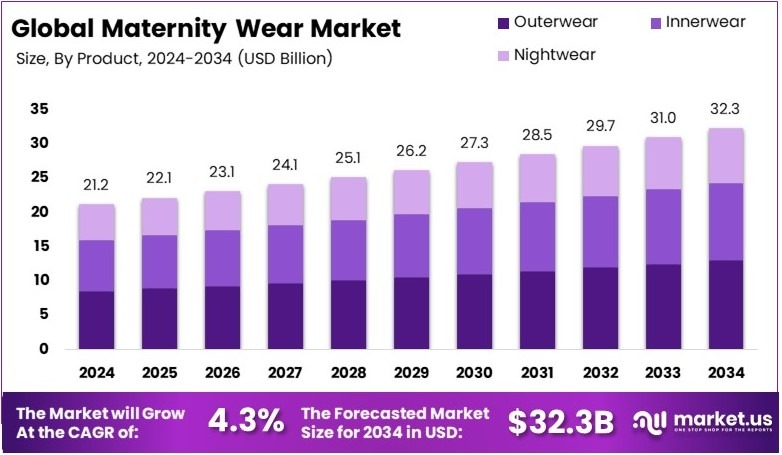

The Global Maternity Wear Market size is expected to be worth around USD 32.3 Billion by 2034, from USD 21.2 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

Maternity wear refers to clothing designed specifically for pregnant women. These clothes provide comfort and style, accommodating the changes in the body during pregnancy. They are designed to support the growing belly, offering flexibility and comfort while maintaining a fashionable appearance.

The maternity wear market is the sector that focuses on the production and sale of clothing for pregnant women. It includes a wide range of garments, such as dresses, tops, pants, and underwear. The market has seen growth due to rising awareness of maternity fashion and changing lifestyle preferences.

The maternity wear market is witnessing steady growth, largely driven by the increasing demand for comfortable and functional clothing for expectant mothers. According to Our World in Data, approximately 134 million babies were born globally in 2023, which highlights the growing number of pregnant women and, consequently, the rise in demand for maternity wear.

Comfort is a key consideration for these women, as 96.3% of women, according to a survey by Mylo, prioritize fabric quality when selecting maternity wear. In fact, 48.3% of respondents rated fabric quality as a perfect 10 in importance. This trend emphasizes the need for brands to focus on comfort alongside style.

Furthermore, thermal comfort during pregnancy is gaining attention. A study conducted with 1,055 pregnant women in Xi’an, China, explored how proper clothing insulation helps maintain comfort during different trimesters, especially in hospital settings.

This growing awareness of the importance of thermal comfort offers brands an opportunity to innovate and offer clothing that addresses this specific need. As a result, maternity wear manufacturers may focus on functional fabrics that provide both comfort and temperature regulation.

The competitive landscape of the maternity wear market continues to evolve. While there is room for new entrants, the market is becoming saturated with a variety of brands offering maternity clothing. For example, the popularity of maternity fashion on social media platforms such as Instagram reflects a rising interest, with the #maternity hashtag accumulating over 7 million posts.

This highlights the growing global attention towards maternity wear, increasing market visibility and competition. Companies must differentiate themselves with unique designs, innovative materials, and exceptional comfort.

Key Takeaways

- The Maternity Wear Market was valued at USD 21.2 Billion in 2024, and is expected to reach USD 32.3 Billion by 2034, with a CAGR of 4.3%.

- In 2024, Outerwear dominates the product segment with 40.2%, driven by increased daily wear demand during pregnancy.

- In 2024, Cotton leads the material type segment with 41.0%, due to its breathability and comfort for expecting mothers.

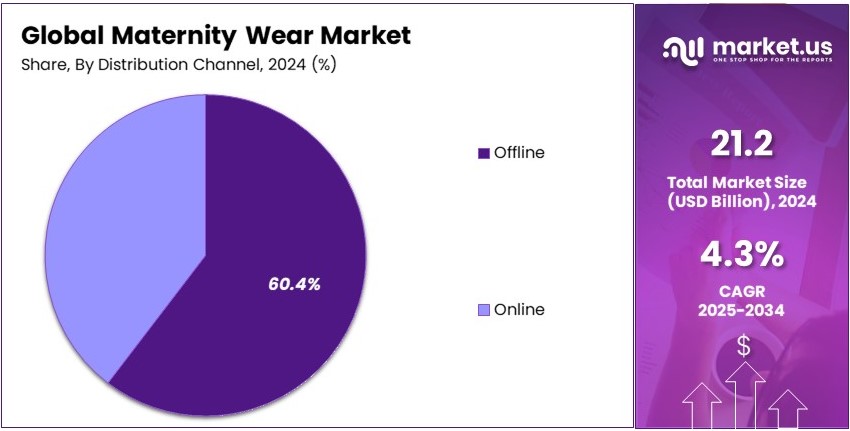

- In 2024, Offline channels hold the highest share of 60.4%, owing to better product trials and brand preferences.

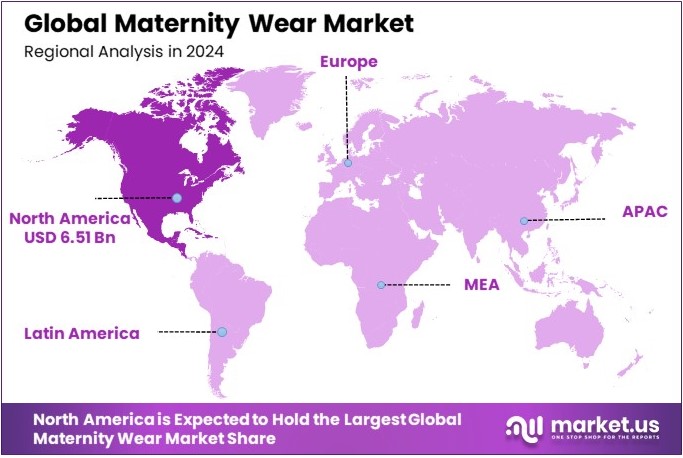

- In 2024, North America leads the regional market with 30.7% and a value of USD 6.51 Billion, supported by high spending capacity.

Type Analysis

Outerwear sub-segment dominates with 40.2% due to its versatility and comfort.

The Maternity Wear Market is significantly driven by the Type segment, particularly through its Outerwear sub-segment. Outerwear for pregnant women, encompassing items such as maternity jeans, leggings, and tunics, has become a staple due to its adaptability and comfort, which are essential throughout the pregnancy. These garments are designed to accommodate changes in body size while providing support and style, contributing to their 40.2% market dominance.

Maternity Innerwear and Nightwear are also critical but with a lesser impact. Innerwear, which includes maternity bras and underwear, is valued for its functionality and specialized support features, while Nightwear offers comfort during sleep, crucial during pregnancy. These sub-segments, though smaller, play a pivotal role in the comprehensive growth of the maternity wear market by addressing specific needs at different pregnancy stages.

Material Type Analysis

Cotton sub-segment dominates with 41.0% due to its breathability and softness.

In the Material Type segment, Cotton leads with a 41.0% share, favored in maternity wear for its breathability and softness, which are paramount to ensuring comfort for expectant mothers. This natural fiber’s hypoallergenic properties make it ideal for maternity apparel, reducing skin irritation and accommodating body temperature fluctuations.

Other materials like Rayon, Spandex & Lycra, and Silk & Satin also contribute to the market. Rayon is appreciated for its silk-like feel and affordability, whereas Spandex & Lycra offer essential elasticity, beneficial for growing bellies.

Silk & Satin provide a luxurious feel but are less common due to higher costs and maintenance requirements. Each material supports the market by catering to diverse consumer preferences and needs.

Distribution Channel Analysis

Offline sub-segment dominates with 60.4% due to personalized shopping experiences.

The Distribution Channel segment is largely dominated by Offline channels, accounting for 60.4% of the market. This dominance is attributed to the personalized shopping experiences they offer, such as fitting advice and the ability to try before buying, which are highly valued in maternity wear. Physical stores also provide instant gratification and the avoidance of return hassles, which appeal to the immediate needs of expectant mothers.

Conversely, Online channels are growing rapidly, driven by the convenience of home shopping and often wider selections. Despite the lower market share, online platforms are becoming increasingly popular due to their convenience, competitive pricing, and the increasing trust in online retail among consumers. These channels are crucial for market expansion, offering opportunities for reaching a broader audience.

Key Market Segments

By Product

- Outerwear

- Innerwear

- Nightwear

By Material Type

- Cotton

- Rayon

- Spandex & Lycra

- Silk & Satin

- Others

By Distribution Channel

- Online

- Offline

Driving Factors

Growing Awareness of Maternity Wellness Drives Market Growth

The increasing awareness of maternity wellness and prenatal care has been a key driver in the growth of the Maternity Wear Market. Urban women are now more focused on health during pregnancy, which includes wearing comfortable and supportive clothing.

As women become more educated about the benefits of maternity-specific apparel, there is a growing demand for stylish yet functional maternity wear. This has led to the rise of brands that offer both fashion and comfort. As urban women prioritize well-being during pregnancy, the need for appropriate clothing has become more prominent, boosting the market.

In addition, the growing awareness surrounding prenatal care encourages expectant mothers to invest in clothing that promotes physical health. As a result, the maternity wear industry has shifted to focus on not only aesthetic appeal but also comfort and support.

These trends are reflected in the increased demand for maternity wear, which supports women throughout their pregnancies and during their postpartum period. Furthermore, this awareness creates a growing market for products that are designed with health and comfort in mind, further contributing to the market’s growth.

Restraining Factors

Limited Product Cycle and Regional Availability Restrain Market Growth

One of the key factors restraining the growth of the Maternity Wear Market is the limited product usage cycle, which reduces the frequency of repeat purchases. Maternity wear is only needed during pregnancy, limiting the time frame for consumers to purchase new items. This short cycle means that once women have completed their pregnancy, they do not require new clothing.

Additionally, limited availability of size-inclusive and region-specific styles further restricts the market’s reach. Some women may have difficulty finding suitable maternity wear in their size or style, especially in smaller or rural markets.

Another factor is the perception of maternity wear as a non-essential expense in low-income groups. Many families do not prioritize maternity wear, viewing it as an optional purchase rather than a necessity. Additionally, slow product refresh cycles in offline retail channels also contribute to this issue.

With fewer new collections being introduced in physical stores, customers may feel that the market lacks excitement and innovation, leading to a slower pace of growth. As these factors limit the volume of sales and hinder product availability, they create barriers for the market’s full expansion.

Growth Opportunities

Product Innovation and Collaborations Provide Growth Opportunities

Opportunities for growth in the Maternity Wear Market lie in the integration of adaptive clothing technologies for postpartum use. These innovations cater to the needs of new mothers who require functional clothing during the recovery period.

Adaptive clothing technology offers features like easy access for breastfeeding and supports post-pregnancy body changes, which have gained popularity in recent years. Additionally, there is significant potential for the development of office-appropriate maternity wear, which is especially in demand as more women continue to work throughout their pregnancy.

Collaborations between maternity wear brands and healthcare providers present another growth opportunity. These partnerships can help raise awareness about the importance of maternity wear in supporting maternal health, leading to increased adoption.

Furthermore, the growth of subscription-based maternity fashion rental services presents a unique opportunity for both consumers and businesses. Renting maternity wear allows women to access high-quality clothing without committing to purchases they will only use for a short period, appealing to the cost-conscious consumer.

Emerging Trends

Athleisure and Sustainability Are Latest Trending Factors

The rise of athleisure-inspired maternity collections is one of the latest trends driving the Maternity Wear Market. Expecting mothers now prefer comfortable, flexible, and stylish clothing that fits into their active lifestyles, which has led to the integration of athleisure designs into maternity wear. These items allow women to maintain an active routine while still looking fashionable.

Moreover, there is an increasing preference for organic and breathable fabrics in maternity garments. Eco-conscious consumers are now more likely to choose maternity wear made from natural, sustainable materials, aligning with the broader movement toward sustainability in the fashion industry.

Additionally, the demand for transitional wear that supports breastfeeding has also risen. These garments cater to new mothers who need versatile clothing that works both during pregnancy and after childbirth. Maternity fashion bloggers and influencers continue to shape consumer choices, spreading awareness of these trends and further influencing market demand. As these trends gain traction, they help drive the growth of the maternity wear market.

Regional Analysis

North America Dominates with 30.7% Market Share

North America leads the Maternity Wear Market with a 30.7% share, valued at USD 6.51 billion. This dominance is fueled by a combination of consumer demand for stylish, functional maternity wear, high disposable income, and the presence of key brands catering to this market segment. The region’s established retail infrastructure also boosts its market leadership.

Key factors include the growing focus on convenience and comfort in maternity apparel, as well as the adoption of sustainable and organic fabric choices. North America also benefits from advanced e-commerce platforms and strong marketing strategies, making it easier for consumers to access a wide range of maternity wear options.

Market dynamics show that consumer preferences for fashionable and versatile maternity clothing are influencing product offerings. North America’s demand for maternity wear is expected to continue its upward trend as more women enter the workforce and seek products that combine style with functionality.

Regional Mentions:

- Europe holds a significant share of the market with its focus on eco-conscious products and fashion-forward maternity wear. The growing trend for ethically made clothing and government support for women’s rights boosts the market.

- Asia Pacific’s maternity wear market is expanding rapidly, particularly in countries like China and India, due to increasing awareness and changing social norms around maternity fashion. Growing disposable incomes contribute to market growth.

- Middle East & Africa is seeing rising demand for maternity wear, driven by evolving social attitudes and a growing number of women entering the workforce. Fashion trends in this region influence maternity apparel.

- Latin America maternity wear market is growing as urbanization and shifting cultural trends create a demand for both affordable and stylish clothing. Brazil and Mexico are key contributors to the market’s expansion.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Maternity Wear Market, several key players have established themselves as leaders, offering a wide range of products that cater to the needs of expectant mothers. Seraphine is known for its luxury maternity wear, offering stylish and comfortable clothing that appeals to fashion-conscious women. Its products are widely popular in Europe and North America, making it one of the top brands in the market.

FirstCry is a leading online retailer that provides a vast selection of maternity wear, baby products, and accessories. As one of India’s largest e-commerce platforms for maternity and baby care, FirstCry has a significant market share in Asia, capitalizing on the growing middle class and demand for convenient shopping experiences.

H&M Group offers maternity clothing through its H&M brand, combining affordability with stylish designs. Its wide global presence, paired with a focus on sustainability, appeals to price-sensitive customers who also care about the environment. H&M’s extensive network and focus on affordable fashion make it a strong player in the market.

ASOS, a UK-based fashion retailer, has a significant presence in the maternity wear market. It offers a variety of maternity clothing in line with current fashion trends. ASOS targets young, fashion-forward mothers with its modern designs and has expanded its reach through its strong online platform, especially popular in North America and Europe.

These companies have leveraged their brand recognition, strong retail infrastructure, and online platforms to meet the growing demand for stylish, comfortable, and affordable maternity wear. With an increasing focus on eco-friendly options, comfort, and inclusive sizing, these brands are poised to maintain their dominance in the global maternity wear market.

Major Companies in the Market

- Seraphine

- FirstCry

- H&M Group

- ASOS

- Mamacouture

- House of Napius

- The Gap, Inc.

- Hotmilk Lingerie

- Pinkblush Maternity

- JoJo Maman Bébé

Recent Developments

- Hooters: On February 2025, Hooters introduced a new maternity uniform, a black, full-length T-shirt designed for expectant mothers. The uniform was showcased by waitress Gabrielle Harlan through TikTok videos, which received millions of views. The move underscores Hooters’ commitment to accommodating pregnant employees.

- Beyond Nine: On November 2024, maternity clothing brand Beyond Nine reported significant growth with a turnover of £4.2 million in 2023. The company has expanded its product offerings, now targeting a broader audience, including menopausal women.

Report Scope

Report Features Description Market Value (2024) USD 21.2 Billion Forecast Revenue (2034) USD 32.3 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Outerwear, Innerwear, Nightwear), By Material Type (Cotton, Rayon, Spandex & Lycra, Silk & Satin, Others), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Seraphine, FirstCry, H&M Group, ASOS, Mamacouture, House of Napius, The Gap, Inc., Hotmilk Lingerie, Pinkblush Maternity, Belabumbum, JoJo Maman Bébé, Cake Maternity, Mina Roe, Beyond Nine, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Seraphine

- FirstCry

- H&M Group

- ASOS

- Mamacouture

- House of Napius

- The Gap, Inc.

- Hotmilk Lingerie

- Pinkblush Maternity

- JoJo Maman Bébé