Global Insulating Gloves Market Size, Share, Growth Analysis By Type (Low Voltage, Medium Voltage, High Voltage), By Size (Small, Medium, Large, Extra Large), By Product Type (Leather Gloves, Aluminized Gloves, Aramid Gloves, Disposable Gloves, Synthetic Gloves, Metal Mesh Gloves, Fabric Gloves, Coated Fabric Gloves, Chemical Protective Gloves, Rubber-Insulating Gloves, Others), By Application (Electrical and Electronics, Automotive Industry, Public Utilities, Communication Industry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 19955

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

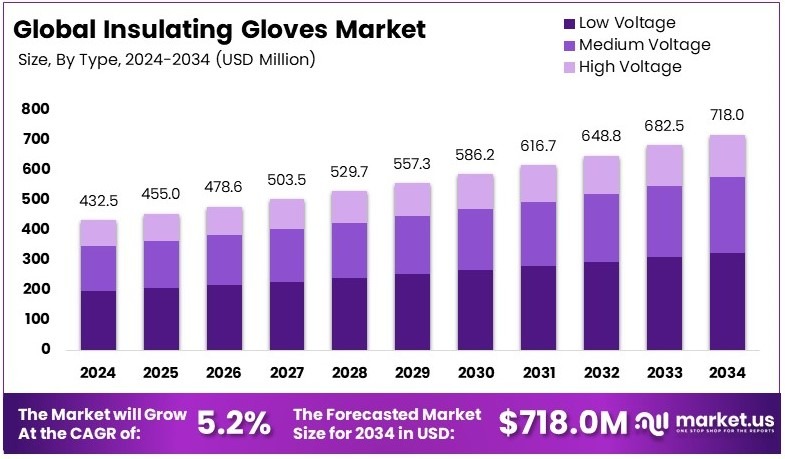

The Global Insulating Gloves Market size is expected to be worth around USD 718.0 Million by 2034, from USD 432.5 Million in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Insulating gloves are personal protective equipment designed to protect workers from electrical hazards. These gloves are made from insulating materials, often rubber, to prevent electrical shock. They are essential in industries like electrical maintenance, construction, and utilities, where workers may be exposed to high voltage sources.

The insulating gloves market involves the design, production, and sale of gloves that protect workers from electrical hazards. This market serves industries like electrical utilities, construction, and manufacturing. As safety regulations become stricter and the need for worker protection rises, the demand for insulating gloves continues to increase.

The insulating gloves market is growing as workplace safety becomes a higher priority. According to the Bureau of Labor Statistics, 5,486 fatal work injuries were recorded in 2022, highlighting the importance of protective equipment. As industries like construction and electrical maintenance expand, the need for reliable insulating gloves increases to prevent work-related injuries.

With rising concerns over workplace safety, the demand for insulating gloves is increasing. Companies are focusing on improving glove durability and protection. In addition, regulatory standards, such as those from OSHA, are pushing companies to adopt better safety measures. This creates significant opportunities for the insulating gloves market to grow.

The market for insulating gloves remains competitive, with several key players offering different types of gloves. Many companies are focusing on innovation, such as creating industrial safety gloves with enhanced protection and comfort. As the market grows, new entrants also emerge, adding to the competitive landscape. This creates both challenges and opportunities for businesses.

Insulating gloves improve worker safety across various industries, particularly in high-risk sectors like construction and electrical utilities. These gloves help reduce the risk of injury, enhancing productivity and reducing workplace accidents. Locally, they protect workers and reduce the likelihood of costly injury claims, benefiting businesses.

Key Takeaways

- The Insulating Gloves Market was valued at USD 432.5 million in 2024 and is expected to reach USD 718.0 million by 2034, with a CAGR of 5.2%.

- In 2024, Low Voltage gloves dominated the type segment with 45.3%, attributed to their extensive use in electrical maintenance.

- In 2024, Large size gloves led with 38.2%, preferred for industrial safety applications.

- In 2024, Rubber-Insulating Gloves accounted for 26.5% due to their superior protection against electrical hazards.

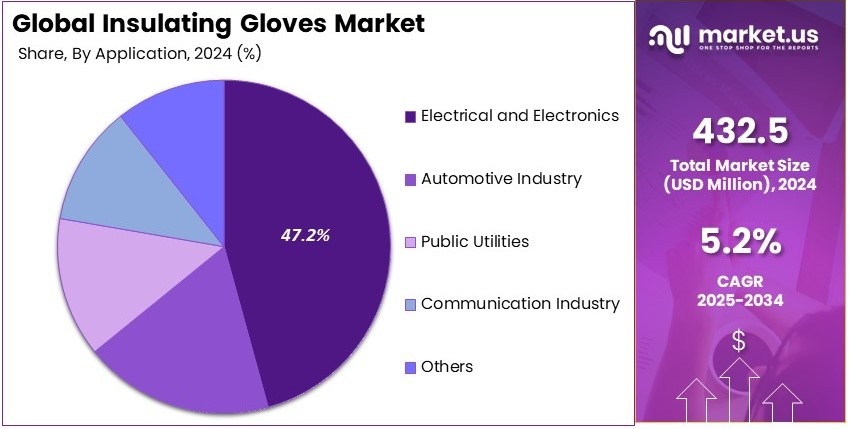

- In 2024, Electrical and Electronics held 47.2%, driven by strict safety regulations in the sector.

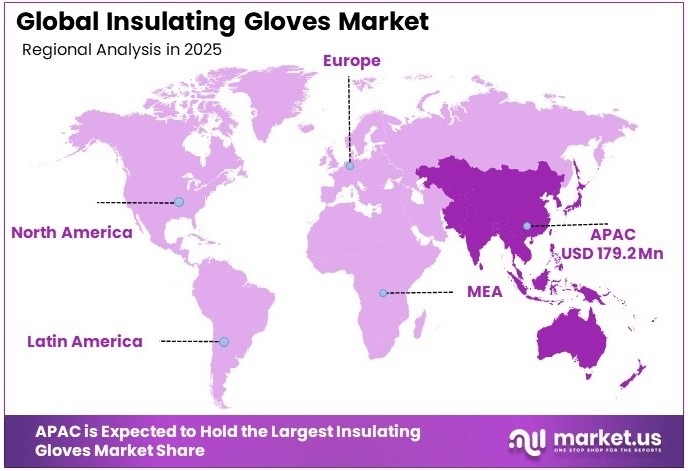

- In 2024, APAC dominated with 41.5% and valued at USD 179.2 million, fueled by increasing industrialization and workplace safety regulations.

Type Analysis

Low Voltage dominates with 45.3% due to the high demand for protective gloves in everyday electrical work.

In the Insulating Gloves Market, the Low Voltage sub-segment holds the largest market share, accounting for 45.3%. These gloves are widely used by workers in environments where they handle electrical equipment that operates under lower voltages, such as household appliances or small electrical systems.

The demand for low voltage insulating gloves is particularly high due to their application in various industries, including electrical maintenance, automotive collision repair, and construction, where the risk of electric shock is prevalent. The ease of use, comfort, and cost-effectiveness of these gloves have further cemented their position as the dominant type in the market.

Medium and High Voltage gloves, while also essential for worker safety, hold smaller shares. Medium voltage gloves are designed for use in environments with slightly higher electrical risks, such as industrial machinery or utility work.

High voltage gloves, on the other hand, are specialized for tasks that involve even higher electrical risks and are mostly used in the energy sector. While these gloves are critical for certain high-risk applications, the widespread need for low voltage protection across various sectors drives the dominance of this sub-segment.

Size Analysis

Large gloves dominate with 38.2% due to their suitability for a wide range of industrial applications.

The Large size sub-segment holds the highest share in the Insulating Gloves Market, capturing 38.2% of the market. This is because large-sized gloves are versatile and can accommodate a wide variety of users. In industries such as electrical work, automotive repair, and manufacturing, large-sized gloves provide the right balance of protection and comfort for most workers.

The demand for large gloves is further driven by the fact that they fit the average hand size of most adults, making them the go-to choice in most industrial settings. Large gloves also tend to offer better flexibility and dexterity, which is crucial for workers who need to handle tools or operate machinery while ensuring their safety from electrical hazards.

The Medium and Small sizes contribute to the market, but they have smaller shares. Medium-sized gloves are used by workers with smaller hand sizes, while Small gloves cater to those with even more compact hands. These sub-segments serve specific needs, but due to the broad applicability of large gloves, they do not capture as much of the market share.

Product Type Analysis

Rubber-Insulating Gloves dominate with 26.5% due to their widespread use in electrical safety applications.

Rubber-insulating gloves hold the dominant share in the Insulating Gloves Market, accounting for 26.5%. These gloves are widely used in electrical work, providing essential protection against electrical shocks and ensuring worker safety when handling live wires or electrical components.

The rubber material offers excellent insulating properties, which are crucial when working with high-voltage systems. Rubber gloves are durable, flexible, and provide a high level of protection, making them the preferred choice for workers in electrical maintenance, utility services, and other high-risk industries.

Other product types, such as Leather Gloves, Aluminized Gloves, and Aramid Gloves, serve specialized needs. Leather gloves offer durability and are often used in construction or heavy-duty applications, while aluminized gloves provide thermal protection for workers dealing with high temperatures.

Aramid gloves, made from materials like Kevlar, offer cut resistance and are used in industries where sharp objects are a risk. Despite these alternatives, rubber-insulating gloves remain the dominant product type due to their unmatched ability to protect against electrical hazards.

Application Analysis

Electrical and Electronics dominate with 47.2% due to the high demand for safety in electrical work environments.

The Electrical and Electronics sub-segment leads the Insulating Gloves Market with a significant share of 47.2%. This is primarily driven by the constant need for safety in environments where workers handle electrical systems, machinery, and devices. Electrical engineers, technicians, and maintenance workers rely heavily on insulating gloves to prevent electric shocks and injuries.

As industries continue to evolve and the use of electrical equipment becomes more widespread, the demand for insulating gloves in this sector is expected to grow. Furthermore, advancements in electrical systems and increased focus on workplace safety standards contribute to the growing market for these protective gloves.

The Automotive, Public Utilities, and Communication Industry applications also contribute to the market but to a lesser extent. In the automotive sector, gloves are essential for technicians working with electrical components in vehicles.

Public utilities rely on insulating gloves for workers maintaining electrical grids and infrastructure. The communication industry, while less dependent on insulating gloves, still requires them for workers dealing with communication towers and electrical equipment. Despite these applications, the electrical and electronics sector remains the dominant driver of the insulating gloves market.

Key Market Segments

By Type

- Low Voltage

- Medium Voltage

- High Voltage

By Size

- Small

- Medium

- Large

- Extra Large

By Product Type

- Leather Gloves

- Aluminized Gloves

- Aramid Gloves

- Disposable Gloves

- Synthetic Gloves

- Metal Mesh Gloves

- Fabric Gloves

- Coated Fabric Gloves

- Chemical Protective Gloves

- Rubber-Insulating Gloves

- Others

By Application

- Electrical and Electronics

- Automotive Industry

- Public Utilities

- Communication Industry

- Others

Driving Factors

Stringent Safety Regulations Drive Market Growth

As regulations for workplace safety become more stringent, industries are required to adhere to higher safety standards, especially for workers dealing with electrical hazards. Insulating gloves are essential in protecting workers from electrical shock, and as compliance becomes more critical, the demand for certified, high-quality gloves rises.

Growing awareness about occupational hazards in electrical work also contributes to market growth. Electrical workers are becoming more aware of the risks they face, such as exposure to electrical shocks, burns, and fatalities. As a result, industries are placing greater emphasis on providing proper personal protective equipment (PPE), including insulating gloves, to ensure worker safety.

The rising demand for insulating gloves in the energy and utilities sector further boosts the market. As the energy sector expands, particularly with the rise of renewable energy projects, there is an increasing need for protective equipment for workers who handle high-voltage materials. Technological innovations in glove materials are also enhancing the protection level of insulating gloves, making them more reliable and comfortable for long-term use.

Restraining Factors

High Costs and Regional Variability Restrain Market Growth

Despite the growth in demand, several factors restrain the Insulating Gloves market. One significant challenge is the high cost of high-performance insulating gloves. Advanced materials used in manufacturing these gloves often increase their price, making it difficult for smaller businesses or workers in low-income regions to afford them.

Additionally, insulating gloves have a limited product lifespan, and regular replacement is necessary to ensure their protective capabilities. Over time, the materials degrade, reducing their effectiveness and requiring frequent replacements, which adds to the overall cost.

Another issue is the variability in standards and regulations across different regions. Some countries have stringent safety regulations, while others have less rigorous standards, making it difficult for manufacturers to standardize their products globally. This discrepancy creates challenges in ensuring consistent safety levels across various markets.

Furthermore, there is a lack of awareness and adoption of insulating gloves in emerging markets. Workers in these regions may not be fully informed about the importance of using proper protective gear, leading to slower market penetration in developing areas.

Growth Opportunities

Opportunities in Emerging Markets and Sustainability

There are several growth opportunities in the Insulating Gloves market. The growing adoption in emerging markets due to industrial growth is one of the primary drivers. As industries such as construction, energy, and manufacturing expand in developing countries, the demand for personal protective equipment, including insulating gloves, is expected to rise.

Innovations in eco-friendly and sustainable glove materials also present new opportunities. As businesses and consumers become more environmentally conscious, the demand for sustainable products is increasing. Manufacturers are focusing on creating gloves from recycled or biodegradable materials, making them more appealing to eco-conscious industries.

The rise in demand from renewable energy installations, such as solar and wind, also provides growth potential. As the renewable energy sector expands, workers in this field require proper protection, further driving the demand for insulating gloves. Additionally, the expansion of distribution channels for workplace safety products will make insulating gloves more accessible in remote and underserved regions.

Emerging Trends

Smart Technologies and Online Sales Lead Market Trends

Several trending factors are shaping the Insulating Gloves market. The increasing use of smart wearables in electrical safety gear is one of the most notable trends. Smart insulating gloves equipped with sensors can monitor a worker’s exposure to electrical hazards, providing real-time data and improving safety in high-risk environments.

Developments in multi-layered gloves for enhanced durability are another trend. Multi-layer gloves offer better protection against electrical hazards while providing increased comfort and flexibility. These innovations make the gloves more reliable and longer-lasting, which is crucial for workers who are exposed to electrical risks on a regular basis.

The surge in online sales and e-commerce platforms for personal safety gear is also changing the landscape. Workers can now easily access a wide range of insulating gloves and other PPE products through online channels, making it easier to purchase high-quality safety gear.

Finally, the integration of enhanced grip technology into insulating gloves is gaining popularity. This feature improves worker efficiency and safety by providing a better grip, reducing the risk of accidents while handling equipment or materials in hazardous environments. These trends highlight the ongoing innovation in the insulating gloves market, enhancing both the functionality and safety of these essential products.

Regional Analysis

Asia Pacific Dominates with 41.5% Market Share

Asia Pacific holds a dominant share of 41.5% in the Insulating Gloves Market, valued at USD 179.2 million. This leadership can be attributed to the region’s rapid industrialization, especially in countries like China and India, where there is significant growth in manufacturing, construction, and electrical industries. The increasing adoption of safety regulations and awareness about worker protection has also fueled demand for insulating gloves.

The region benefits from the presence of major manufacturing hubs, which require reliable protective equipment for workers in high-risk industries such as electrical, oil and gas, and construction. Furthermore, the growing number of workers in these sectors, combined with an increase in safety-consciousness, has further boosted market growth. Additionally, government policies promoting workplace safety are contributing to the demand for insulating gloves in APAC.

Looking ahead, APAC’s market share is expected to continue its upward trajectory, supported by continued industrial expansion and stricter safety regulations. As more industries in the region grow and modernize, the need for protective gear like insulating gloves will remain high, ensuring the region maintains its strong market position.

Regional Mentions:

- North America: North America holds a significant position in the Insulating Gloves Market, driven by well-established industries like construction and electrical. Stricter workplace safety standards and advanced manufacturing technologies further fuel demand for high-quality insulating gloves.

- Europe: Europe continues to have a steady presence in the market, thanks to stringent safety regulations and high industrial standards. Countries like Germany and the UK have strong demand for insulating gloves, especially in electrical and manufacturing sectors.

- Middle East & Africa: In the Middle East and Africa, the market for insulating gloves is rising due to the construction boom and increased investments in energy sectors like oil and gas. The region’s focus on industrial safety drives growth in the protective gloves market.

- Latin America: Latin America is gradually increasing its demand for insulating gloves as industries modernize and safety awareness improves. Brazil and Mexico are key markets, particularly within the electrical and manufacturing sectors, which require high-quality protective equipment.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Insulating Gloves market is shaped by several key players, including Honeywell Safety, Ansell, GB Industries, and YOTSUGI CO., LTD. These companies are recognized for their commitment to safety and innovation in the production of insulating gloves used to protect workers from electrical hazards in various industries.

Honeywell Safety is a leading player in the market, offering a wide range of high-quality insulating gloves. Known for their durability and comfort, Honeywell gloves are used across industries such as electrical, manufacturing, and utilities. The company’s strong focus on safety standards and technological advancements ensures its continued leadership.

Ansell is another prominent company known for its industrial safety products, including insulating gloves. With a reputation for producing reliable and high-performance safety gear, Ansell caters to industries like electrical, energy, and construction. The company’s insulating gloves are designed for superior protection against electrical risks while offering comfort and flexibility.

GB Industries offers a range of insulating gloves that meet the highest safety standards. Their gloves are highly regarded for their resilience and ability to withstand high-voltage applications, making them a trusted choice for electricians and power utility workers.

YOTSUGI CO., LTD. specializes in high-quality rubber gloves for electrical protection. Known for its precision manufacturing, YOTSUGI produces gloves that offer excellent insulation properties and durability. Their products are commonly used in electrical maintenance and utility services.

These companies dominate the Insulating Gloves market through their focus on providing reliable, durable, and safe products. They meet the growing demand for protective equipment across industries where electrical hazards pose significant risks, ensuring worker safety and regulatory compliance. Their continued innovations in glove technology support their strong positions in the market.

Major Companies in the Market

- Honeywell Safety

- Ansell

- GB Industries

- YOTSUGI CO., LTD.

- Regeltex

- Secura B.C.

- Boddingtons Electrical

- Hubbell Power Systems

- Biname Electroglove

- Stanco Safety Products

- Derancourt

- Protective Industrial Products (PIP)

- Dipped Products PLC (DPL)

- Cementex Products

- Magid Glove & Safety

- Saf-T-Gard

Recent Developments

Rochester Salvation Army: In October 2024, the Rochester Salvation Army organized a winter clothing drive to support individuals and families in need during the colder months. On October 14, donations of coats and heavy winter outerwear were collected at 20 First Avenue NE, Rochester.

Report Scope

Report Features Description Market Value (2024) USD 432.5 Million Forecast Revenue (2034) USD 718.0 Million CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Low Voltage, Medium Voltage, High Voltage), By Size (Small, Medium, Large, Extra Large), By Product Type (Leather Gloves, Aluminized Gloves, Aramid Gloves, Disposable Gloves, Synthetic Gloves, Metal Mesh Gloves, Fabric Gloves, Coated Fabric Gloves, Chemical Protective Gloves, Rubber-Insulating Gloves, Others), By Application (Electrical and Electronics, Automotive Industry, Public Utilities, Communication Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Honeywell Safety, Ansell, GB Industries, YOTSUGI CO., LTD., Regeltex, Secura B.C., Boddingtons Electrical, Hubbell Power Systems, Biname Electroglove, Stanco Safety Products, Derancourt, Protective Industrial Products (PIP), Dipped Products PLC (DPL), Cementex Products, Magid Glove & Safety, Saf-T-Gard Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Honeywell Safety

- Ansell

- GB Industries

- YOTSUGI CO., LTD.

- Regeltex

- Secura B.C.

- Boddingtons Electrical

- Hubbell Power Systems

- Biname Electroglove

- Stanco Safety Products

- Derancourt

- Protective Industrial Products (PIP)

- Dipped Products PLC (DPL)

- Cementex Products

- Magid Glove & Safety

- Saf-T-Gard