Company Overview

Tyson Foods Statistics: Tyson Foods, Inc. is a global food company and a recognized leader in protein production, dedicated to feeding the world like family. The company boasts a diverse portfolio of brands, including Tyson, State Fair, Ball Park, Hillshire Farm, Jimmy Dean, Wright, Aidells, and ibp. Tyson operates through 4 primary business segments: Chicken, Beef, Pork, and Prepared Foods, each contributing to its integrated global operations.

The Beef segment focuses on dealing out live-fed cattle and constructing dressed beef carcasses into primal and sub-primal cuts, including case-ready products. These products are distributed across domestic markets, serving retailers, schools, restaurant chains, foodservice distributors, healthcare facilities, hotels, and the military, as well as international export markets.

The Pork segment encompasses processes related to processing live market hogs and fabricating pork carcasses into sub-primal and primal cuts, along with case-ready offerings. These products are marketed internationally and domestically through restaurant operators, noncommercial foodservice channels, food retailers, and food processors.

The Chicken segment encompasses Tyson’s domestic operations, which involve the processing and raising of live chickens, as well as the purchase of raw materials for frozen, fresh, and value-added chicken products. The company’s value-added portfolio includes nuggets, breaded chicken strips, patties, and fully cooked products, catering to food retailers, convenience stores, restaurant operators, and institutional foodservice providers across domestic and export markets.

Moreover

The Prepared Foods segment specializes in marketing and producing frozen and refrigerated food products while managing the logistics to support global distribution. Offerings include ready-to-eat sandwiches, bacon, Philly steaks, burger patties, appetizers, breakfast sausage, hot dogs, tortillas, prepared meals, ethnic dishes, side items, and processed meats serving retail, foodservice, and institutional clients worldwide.

Tyson Foods has established a strong international footprint with 3 R&D centers, 7 processing plants, and dozens of breeding farms in China, supported by a regional headquarters in Shanghai. In Europe, it operates 2 Innovation Centers located in Ashford (United Kingdom) and Oosterwolde (Netherlands). In Malaysia, Tyson manages 3 facilities that employ over 1,500 team members, forming part of its Asia Pacific network. The company also maintains operations in Mexico and across the Middle East, with 3 facilities spread between Saudi Arabia and the United Arab Emirates. In Thailand, Tyson Poultry Thailand Ltd. serves as one of the nation’s largest integrated chicken processors.

As of September 28, 2024, Tyson Foods employed approximately 138,000 team members worldwide. Of these, around 120,000 were based in the United States, with nearly 114,000 working in non-corporate settings such as production facilities, warehouses, truck shops, hatcheries, and feed mills, underscoring Tyson’s expansive operational presence across the global food supply chain.

History of Tyson Foods, Inc.

1930s

- In 1931, John W. Tyson relocated his family to Springdale, Arkansas, during the Great Depression, in search of new business opportunities.

- He began transporting chickens to large markets across the Midwest, laying the foundation for Tyson Foods’ poultry enterprise.

1940 – 1949

- During World War II, with food rationing in effect, poultry demand surged as it was not rationed.

- Tyson expanded operations by raising chicks and producing feed for local farmers.

- On April 10, 1946, Tyson made history by delivering a load of New Hampshire Red chickens by airplane to Fayetteville.

- In 1947, the company was incorporated as Tyson Feed and Hatchery, Inc., offering chicks, feed, and transportation services for chickens.

1950 – 1959

- In 1952, Don Tyson, John’s son, joined the business as general manager at the age of 22.

- By 1958, Tyson opened its first processing plant on Randall Road at a total cost of $90,000, achieving full vertical integration.

1960 – 1969

- Tyson Foods went public in 1963 under the name Tyson’s Foods, Inc., marking the start of nationwide growth.

- Don Tyson became company president in 1966.

- In 1967, following the tragic deaths of John and Helen Tyson, Don assumed the roles of chairman and CEO.

1970 – 1979

- Tyson opened its new corporate headquarters in Springdale in 1970, which remains its base today.

- The company officially changed its name to Tyson Foods, Inc. in 1972, introducing the Tyson oval logo.

- In 1979, Don Tyson formalized the company’s commitment to community involvement, emphasizing social responsibility.

1980 – 1989

- Despite economic challenges, the early 1980s marked a period of significant growth for Tyson Foods.

- In 1983, the company acquired Mexican Original, Inc., expanding into tortilla production.

- By 1989, Tyson had doubled in size in just 5 years and became the world’s largest fully integrated poultry producer.

- The International Division was established, launching joint ventures in Mexico and Japan.

1990 – 1999

- During the 1990s, Tyson entered new markets across Asia, Central and South America, the Caribbean, and the Pacific Rim.

- By 1991, sales offices were established in Japan, Hong Kong, Singapore, and Canada, followed by Moscow in 1995.

- John H. Tyson, the third generation of leadership, succeeded Don Tyson as chairman by the end of the decade.

2000 – 2009

- In 2000, John H. Tyson assumed the roles of chairman and CEO, guiding the company through major acquisitions.

- The 2001 acquisition of IBP, Inc., positioned Tyson as the world’s largest processor of Chicken, beef, and pork.

- In 2007, Tyson opened The Discovery Center in Springdale, an innovation hub for product development and research.

2010

- In 2010, Tyson celebrated 10 years with Share Our Strength, donating over 76 million pounds of food to hunger relief and disaster relief efforts.

- By 2014, the company marked a decade of sustainability progress, centered on animal welfare, community well-being, environmental care, food quality, and workplace health.

- In August 2014, Tyson acquired Hillshire Brands Company, creating a $ 40 billion enterprise with brands such as Jimmy Dean, Ball Park, Hillshire Farm, and others.

- In April 2017, the acquisition of AdvancePierre Foods expanded Tyson’s prepared food offerings.

- In November 2018, Tyson completed the acquisition of Keystone Foods, strengthening its position in the global foodservice supply chain.

- In February 2019, the company acquired BRF S.A.’s Thai and European operations, adding plants in Thailand, the Netherlands, and the United Kingdom, enhancing its international protein production network.

(Source: Company Website)

Employee Analysis

- As of September 28, 2024, Tyson Foods employed approximately 138,000 team members globally, reflecting a steady and balanced workforce distribution.

- Approximately 120,000 employees were based in the United States, with nearly 114,000 working at non-corporate locations, including production facilities, warehouses, hatcheries, feed mills, and truck shops.

- Approximately 18,000 team members were employed in international operations, primarily in Thailand and China, supporting Tyson’s integrated production network.

- The company’s domestic workforce retention rate in fiscal 2024 remained consistent with fiscal 2023, indicating stable employment conditions.

- Within the U.S., about 30,000 employees were covered under collective bargaining agreements with various labor unions.

- Roughly 20% of these unionized employees were either in active contract renewal discussions or under agreements set to expire in fiscal 2025.

- The remaining agreements are expected to continue over the next several years, maintaining operational continuity.

- Across international markets, nearly 6,000 employees were also represented under collective bargaining agreements.

(Source: Tyson Annual Report)

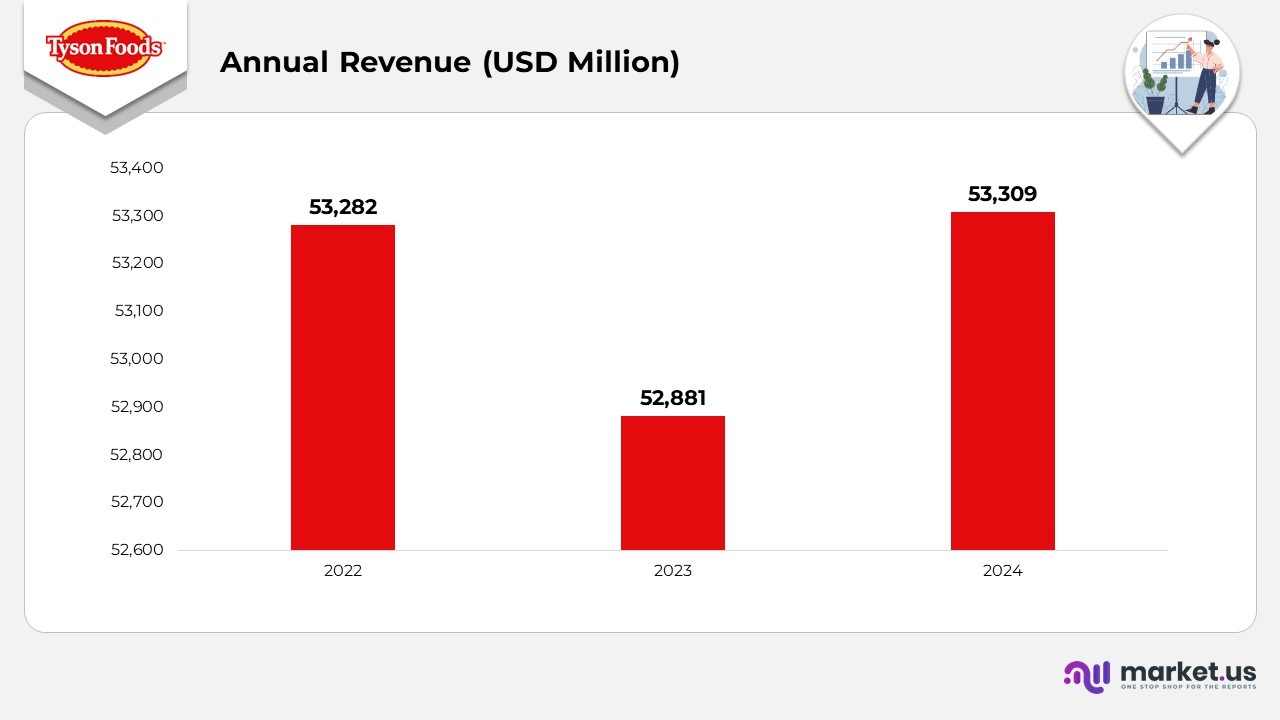

Financial Analysis

- In 2022, Tyson Foods generated annual revenue of $ 53.28 billion, reflecting strong performance across all major protein divisions, supported by stable consumer demand and operational consistency.

- In 2023, revenue slightly declined to $52,881 million, marking a 0.75% year-over-year decrease. The decline was primarily linked to lower average selling prices in the Pork and Chicken segments, partially offset by stronger pricing in Beef and Prepared Foods.

- Despite lower pricing, sales volume in 2023 increased, resulting in $507 million in additional revenue, primarily from the Chicken segment. However, this gain was offset by a $752 million impact from reduced price realizations.

- In 2024, Tyson Foods reported a recovery in total revenue, reaching $53,309 million, a 0.8% increase compared to 2023. The rebound was supported by improved average selling prices, adding $298 million, largely driven by the Beef division.

- Sales volumes in 2024 remained nearly stable, adding $19 million in incremental revenue, as increased volumes in Beef, Pork, and Prepared Foods offset lower production in Chicken.

- Legal contingency accruals impacted sales by $45 million in 2024 and $156 million in 2023, marginally reducing reported totals for both years.

- Overall, between 2022 and 2024, Tyson Foods maintained a stable revenue band of $52.9–$53.3 billion, highlighting resilient operations despite price volatility and shifts in protein market dynamics.

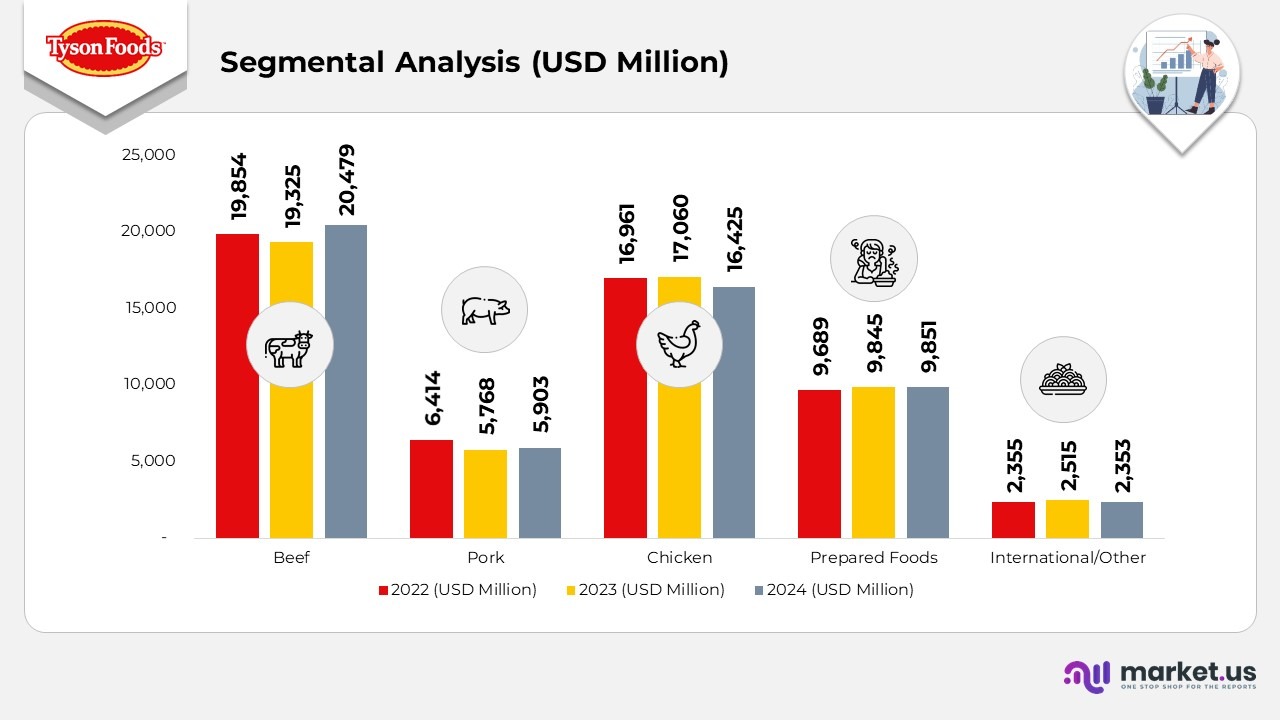

Segmental Revenue

- In 2024, Tyson Foods generated 20,479 million in sales from its Beef segment, showing an increase of 0% over 2023 sales of 19,325 million, reflecting higher average selling prices and stronger domestic demand.

- The Pork segment reached 5,903 million in 2024, up 3% from 5,768 million in 2023, supported by improved sales volumes and balanced supply management despite moderate pricing pressures.

- The Chicken segment recorded $16,425 million in 2024, a decline of 3.7% compared to $17,060 million in 2023, mainly due to softer pricing and lower volumes, although partially cushioned by stable demand for value-added products.

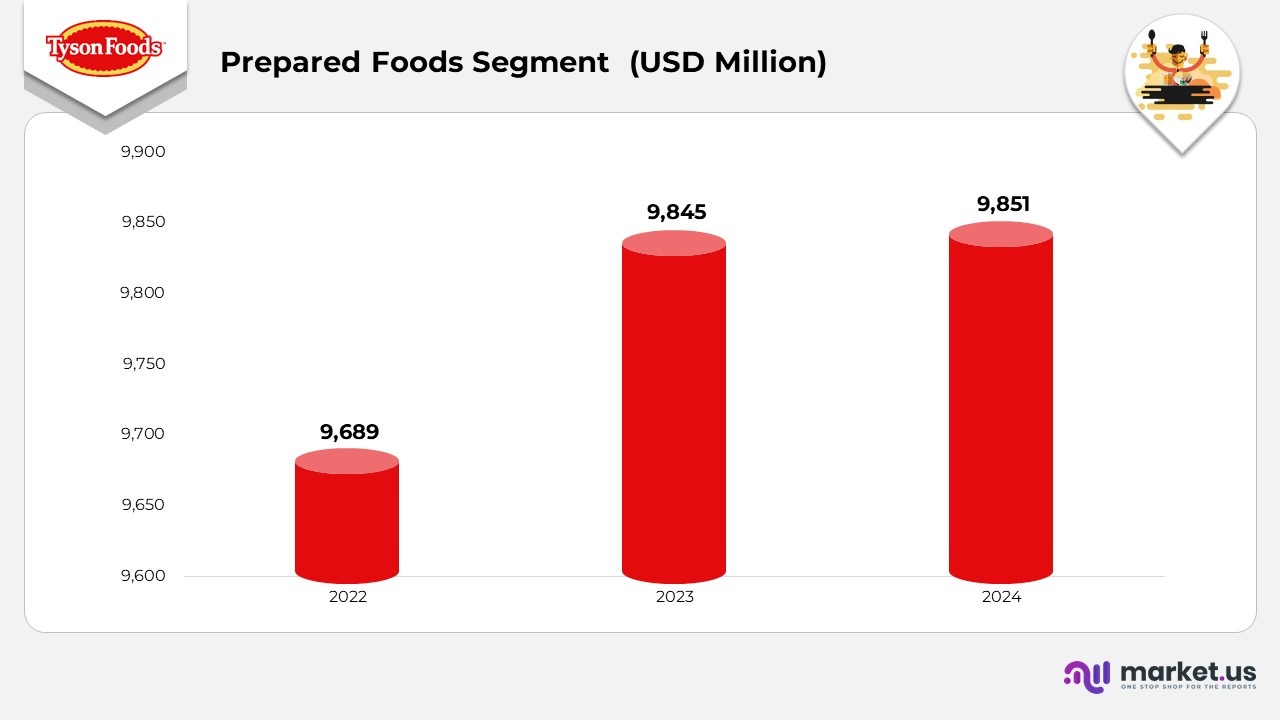

- Prepared Foods reported steady performance, with $9,851 million in 2024, compared to $9,845 million in 2023, maintaining consistent growth in the ready-to-eat and convenience food categories.

- The International/Other category recorded 2,353 million in 2024, down 4% from 2,515 million in 2023, reflecting reduced export volumes and market fluctuations in Asia and Europe.

- Intersegment Sales adjustments amounted to 1,702 million in 2024, slightly higher than 1,632 million in 2023, representing internal sales eliminations within Tyson’s integrated operations.

- Overall, the Beef and Pork segments were the main growth drivers in 2024, while Chicken and International operations faced mild declines, resulting in stable consolidated performance across Tyson’s diversified protein portfolio.

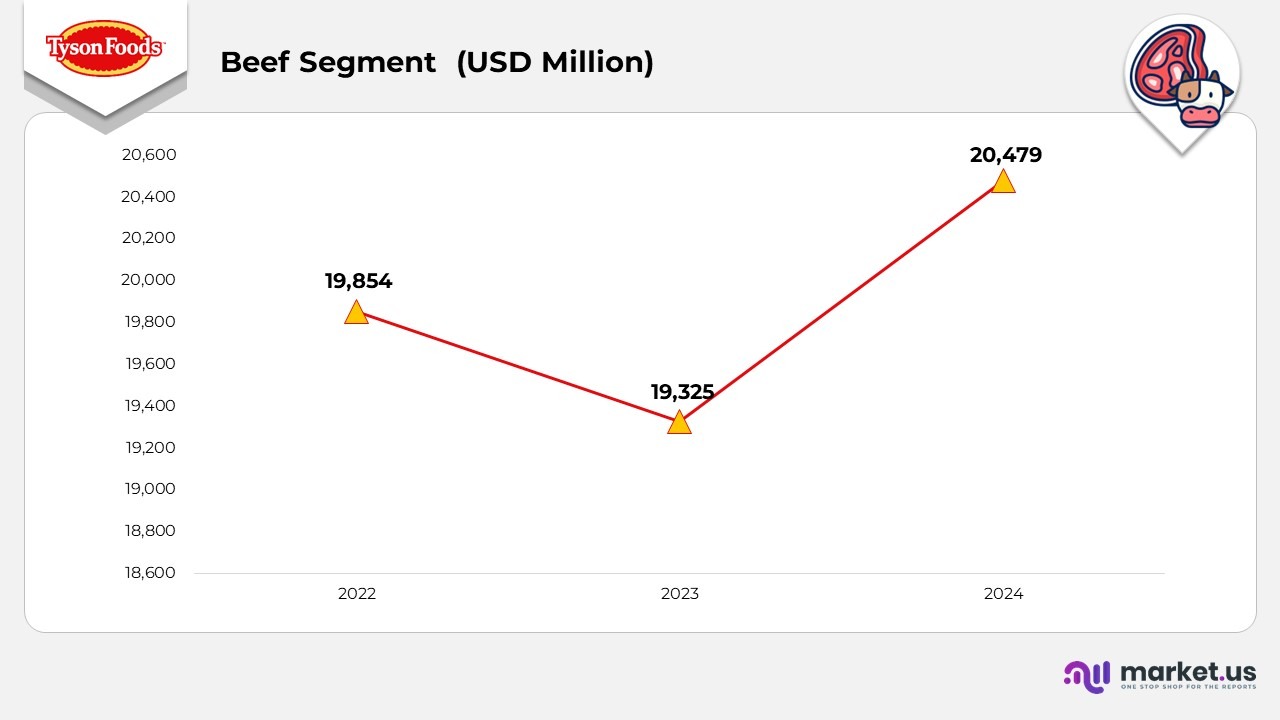

Tyson Foods Beef Statistics

- In 2024, Tyson Foods’ Beef segment generated $20,479 million in sales, marking an increase of $1,154 million from 2023, primarily driven by higher average carcass weights and improved market demand.

- Sales volume increased due to higher production efficiency and a stronger supply of fed cattle, while average sales prices rose 4%, reflecting elevated input costs and robust consumer demand.

- Operating income recorded a loss of 381 million, compared with a loss of 91 million in 2023, mainly due to compressed beef margins and legal contingency accruals. Insurance proceeds from a prior fire incident in 2019 partially offset the losses.

- The operating margin stood at 9% (loss) in 2024, compared to 0.5% (loss) in 2023, reflecting margin pressure from cost inflation and market challenges.

- Comparing 2023 to 2022, sales declined to $19,325 million, a reduction of $529million, as beef volume decreased due to limited live cattle availability.

- Average sales prices experienced a modest increase due to a reduced cattle supply and higher input costs, although this was tempered by weaker export demand.

- Operating income fell to a loss of $91 million from a profit of $2,502 million in 2022, influenced by unfavourable cattle market conditions, higher feed costs, and reduced export activity.

- The 2023 performance also reflected a goodwill impairment charge, partially balanced by insurance recoveries and restructuring-related benefits from earlier facility incidents.

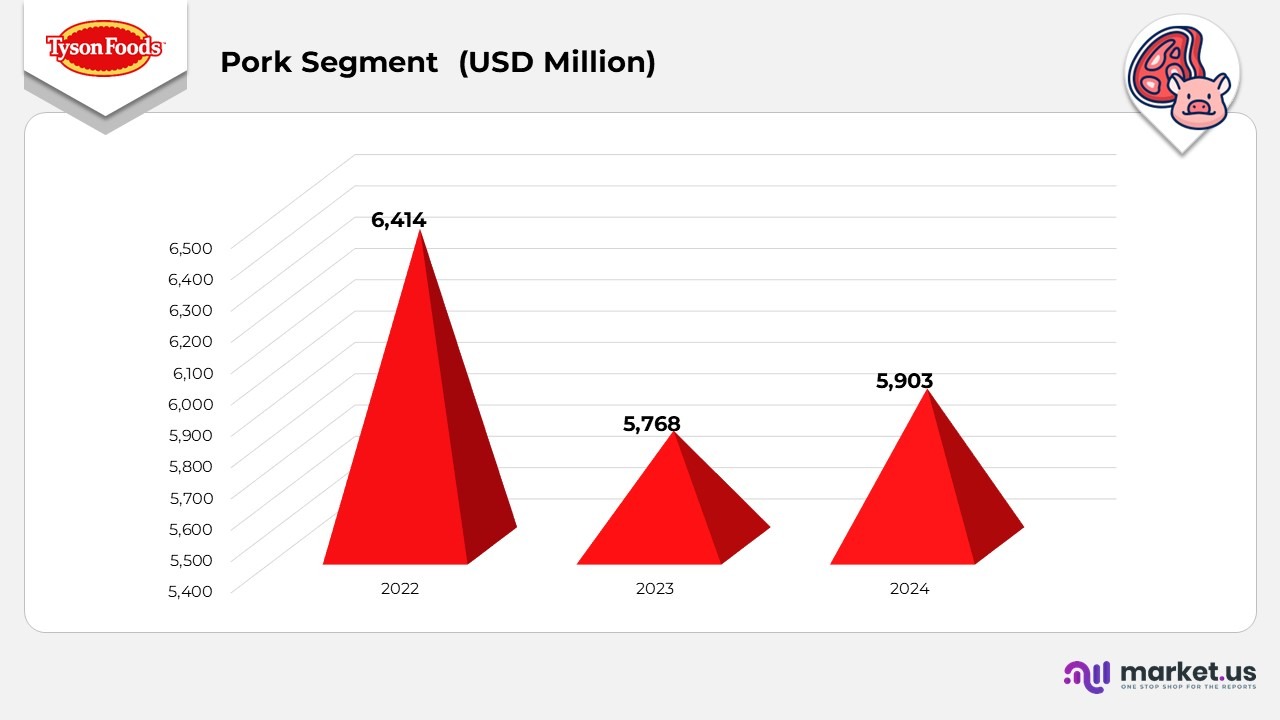

Statistics of Pork By Tyson Foods

- In 2024, the Pork segment of Tyson Foods reported $5,903 million in sales, an increase of $135 million from 2023, driven by favourable market conditions and higher domestic availability of market-ready hogs.

- Sales volume increased by 8%, reflecting improved demand and efficient production planning that enabled the meeting of domestic consumption needs.

- The average sales price decreased by 7%, primarily due to lower pricing on drop credit items; however, this figure excludes a $45 million sales reduction resulting from a legal contingency accrual in 2024.

- Operating income improved significantly, reducing losses to 40 million in 2024 compared with a loss of 139 million in 2023, aided by stronger pork margins and improved live hog operations.

- The operating margin narrowed to 7% (loss) in 2024, compared to 2.4% (loss) in 2023, showing recovery despite ongoing cost challenges and legal accrual impacts.

- Comparing 2023 to 2022, sales declined to 5,768 million from 6,414 million, representing a decrease of 646 million, or 0%, due to reduced global demand and controlled supply adjustments.

- The average sales price also decreased 9%, influenced by global market softness and lower export performance.

- Operating income declined from a profit of $193 million in 2022 to a loss of $139 million in 2023, reflecting weaker pricing and higher production expenses.

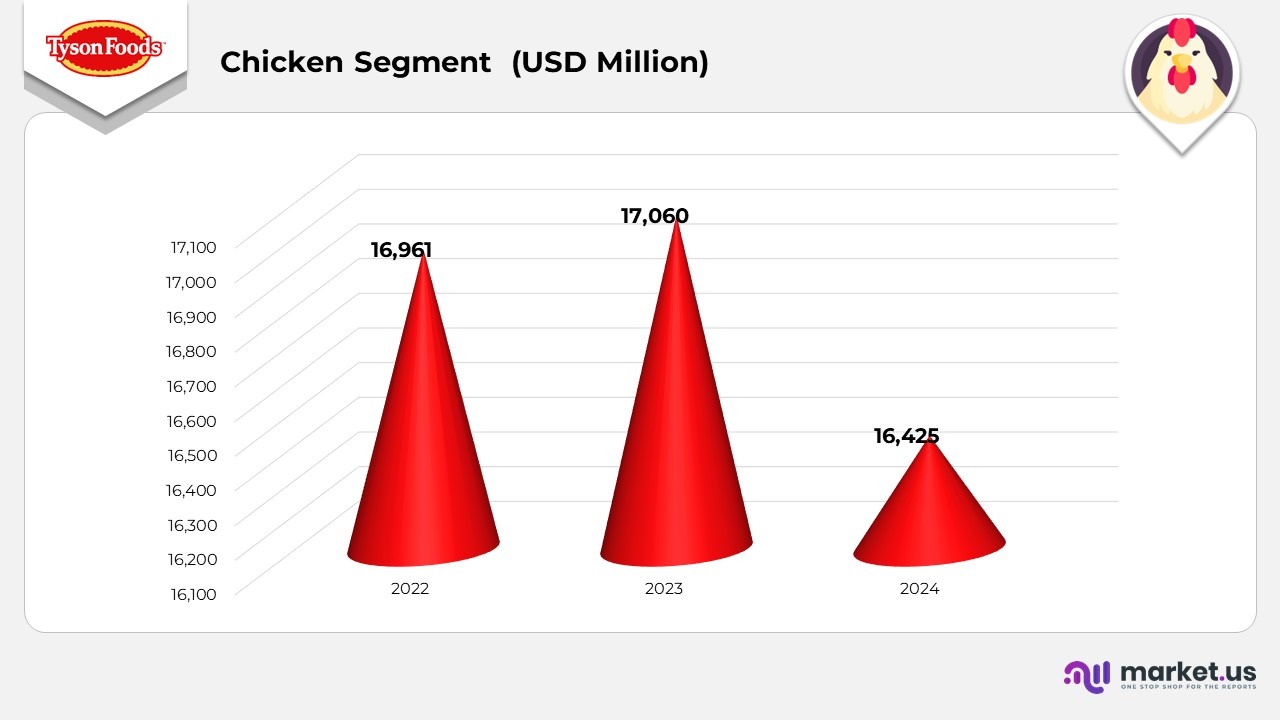

Chicken Tyson Foods Statistics

- In 2024, Tyson Foods’ Chicken segment recorded $16,425 million in sales, a decrease of $635 million from 2023, primarily caused by reduced domestic production and lower overall demand.

- Sales volume declined 2%, while the average sales price fell 2.4% due to lower input costs and competitive pricing pressures.

- Operating income rose sharply to 988 million in 2024, compared to a loss of 770 million in 2023, reflecting improved operational efficiencies, reduced freight and plant costs, and lower feed expenses of 895

- The operating margin improved to 0% in 2024, up from 4.5% (loss) in 2023, supported by better plant utilization and a favorable cost structure.

- In 2023, the Chicken segment reported sales of 17,060 million, an increase of 99 million from 2022, driven by higher domestic production and increased inventory sell-through.

- The average sales price declined due to global market softness and challenging economic conditions, though it excluded a 156 million reduction tied to legal contingency accruals.

- Operating income dropped to a loss of $ 770 million in 2023, down from a profit of $ 955 million in 2022, primarily due to inflationary pressures and elevated ingredient and feed costs totalling $300

Tyson Prepared Food Statistics

- In 2024, the Prepared Foods segment recorded 9,851 million in sales, a slight rise of 6 million compared to 2023, mainly attributed to the acquisition of Williams Sausage Company in the third quarter of 2023.

- Sales volume increased slightly due to enhanced product availability and stronger retail performance.

- The average sales price declined by 0.8%, primarily due to variations in product mix and shifts in sales composition.

- Operating income improved to 879 million in 2024, up 56 million from 823 million in 2023, driven by lower raw material and freight costs, as well as reduced marketing, advertising, and restructuring expenses.

- The operating margin strengthened to 9% in 2024, up from 8.4% in 2023, reflecting better cost control and improved operational efficiency.

- Comparing 2023 to 2022, total sales increased from USD 9,689 million to USD 9,845 million, a rise of USD 156 million, driven by stronger retail volumes despite lower foodservice demand.

- The average sales price increased by 0.3%, benefiting from effective pricing strategies and a favourable product mix amid inflationary conditions.

- Operating income increased from $746 million in 2022 to $823 million in 2023, demonstrating resilience through disciplined cost management and efficient revenue optimization.

(Source: Tyson Foods, Inc. SEC Filings)

Tyson Foods Patents Portfolio

| Patent / Publication Title | Patent / Publication Number | Filing Date | Date of Patent / Publication |

|---|---|---|---|

| Continuous Mini Corndog Production Process | 12245619 | May 31, 2019 | March 11, 2025 |

| Automated Deboning with Robotic Knife System | 12193450 | February 14, 2024 | January 14, 2025 |

| High-pH Treatment for Food Disinfection | 20240268420 (Application) | March 19, 2024 | August 15, 2024 |

| Induction-Heated Extrusion Horn | 12059020 | June 21, 2022 | August 13, 2024 |

| Non-Contact Temperature Measurement of Food Items | 12055445 | March 8, 2022 | August 6, 2024 |

| Ultrasonic Knife-Based Automated Deboning System | 11992931 | November 27, 2018 | May 28, 2024 |

| Automated Meat Cutting with Knife and Vision System | 11944105 | December 5, 2021 | April 2, 2024 |

| Mounting Cone and Wing Support for Automated Meat Cutting | 11606958 | December 5, 2021 | March 21, 2023 |

| Automatic Chine Saw | 11576390 | January 4, 2021 | February 14, 2023 |

| Poultry Colony Storage and Conveyance System | 11540493 | May 31, 2019 | January 3, 2023 |

| Breast Pull and Coracoid Stabilizer System | 11540525 | December 5, 2021 | January 3, 2023 |

| Volumetric Portioning of Food Products | 20210329931 (Application) | April 12, 2021 | October 28, 2021 |

| Smart Packaging Information System | 20210248657 (Application) | February 12, 2020 | August 12, 2021 |

| Packaging with Pressure-Driven Oxygen Egress | 20210145029 (Application) | January 29, 2021 | May 20, 2021 |

| Eggshell Powder Composition Manufacturing Process | 11001700 | November 16, 2012 | May 11, 2021 |

| Dry Ice-Based Food Preservation Packaging | 10925300 | October 1, 2018 | February 23, 2021 |

| Advanced Rib-Meat Product Formation Method | 10674736 | February 16, 2018 | June 9, 2020 |

| Cylindrical Rib-Meat Processing Method | 10660344 | February 16, 2018 | May 26, 2020 |

| Cooking Extrusion Horn System | 10368572 | February 12, 2016 | August 6, 2019 |

(Source: Justia Patents, Company Website)

Recent Developments

- In September 2025, Tyson Foods introduced Tyson Chicken Cups, a convenient portable meal option offering 30 grams of protein or more per serving. Designed for on-the-go consumers, these single-serve cups provide a wholesome, ready-to-eat source of protein that combines flavor with functionality for busy lifestyles.

- In June 2025, Tyson Foods unveiled a new line of individually packaged protein snacks, each portion containing 6 grams of protein. These ready-to-eat options cater to growing consumer demand for quick, high-quality snacks that deliver convenience without sacrificing taste or nutrition.

- In July 2024, Tyson Foods announced the sale of its poultry complex in Vienna, Georgia, to House of Raeford Farms. The transaction forms part of Tyson’s ongoing strategy to optimize its plant network while maintaining uninterrupted service to customers through production at other facilities.

- In June 2024, the company introduced new Honey Chicken Bites and Restaurant-Style Crispy Wings, offering consumers an enhanced flavour and convenience experience. The products reflect Tyson’s commitment to expanding its ready-to-cook and ready-to-eat portfolio with restaurant-quality innovations.

- Also in June 2024, Tyson Foods expanded its $355 million production facility in Bowling Green, Kentucky, strengthening its bacon production capacity. The expansion underscores Tyson’s category leadership and positions the company to meet rising demand in the value-added protein market.

- In November 2023, Tyson Foods expanded its $300 million fully cooked food production plant in Danville, Virginia, supporting long-term growth initiatives. The investment aligns with Tyson’s strategy to enhance efficiency, expand poultry operations, and strengthen its U.S. production infrastructure.

(Source: Tyson Foods Press Releases)