Company Overview

Pernod Ricard Statistics: Pernod Ricard SA is a globally integrated yet locally autonomous group, comprising a central flagship operation in France, supported by brand companies, independent affiliates, and market firms worldwide. The company is a leading distributor, manufacturer, and marketer of premium and prestige wines and spirits, serving retail markets and hospitality worldwide.

The companies’ extensive product portfolio includes brandy, vodka, cognac, tequila, champagne, spirits, gin, aperitifs, rum, whiskey, bitters, mezcal, and various wines. Among its renowned brands are Havana Club International, Regal, Perrier-Jouët, The Glenlivet, Chivas Mumm, Jameson, Absolut, and Martell, each representing excellence in its respective category.

Pernod Ricard maintains a truly global presence with in-house sales teams operating in 60 countries and brand distribution spanning over 160 countries. The company’s operations are organized across three major regions: Europe, the Middle East & Africa, Asia & Pacific, and the Americas. Its key markets include the United States, India, China, France, Brazil, Japan, Türkiye, and Africa, along with a robust presence in Global Travel Retail, collectively reflecting its unparalleled international footprint.

History of Pernod Ricard S.A.

1900’s

- 1975: Pernod and Ricard merged to form a unified spirits company centered on anise-based beverages, marking the official establishment of the Pernod Ricard Group.

- 1988: The group diversified into Irish whiskey by acquiring Irish Distillers, the maker of Jameson, significantly expanding its premium spirits portfolio.

- 1989: With the acquisition of Orlando Wyndham, producer of Jacob’s Creek, Pernod Ricard entered the international wine market and reinforced its global reach.

- 1993: A strategic joint venture with Cuba Ron introduced the Havana Club rum brand to the company’s portfolio, strengthening its foothold in the premium rum segment.

2000’s

- 2001: The acquisition of Seagram’s spirits and wine business added renowned brands like Chivas Regal, The Glenlivet, and Martell, elevating Pernod Ricard’s status in the luxury spirits category.

- 2005: The purchase of Allied Domecq transformed Pernod Ricard into the world’s second-largest wine and spirits company, adding celebrated labels such as Ballantine’s, Mumm, Perrier-Jouët, and Beefeater.

- 2008: The acquisition of Vin & Sprit brought Absolut Vodka into the group’s brand family, cementing its leadership in the global vodka market.

- 2011: Pernod Ricard launched “Responsib’All Day,” a global employee volunteering initiative promoting responsible business practices and community engagement.

- 2016: The company marked the 50th anniversary of the Paul Ricard Oceanographic Institute and strengthened its premium gin portfolio with the acquisition of Monkey 47.

- 2017: Pernod Ricard expanded in the U.S. craft spirits sector by acquiring stakes in Smooth Ambler bourbon and Del Maguey mezcal, reinforcing its high-end positioning.

- 2018: The group deepened its sustainability agenda by joining the Ellen MacArthur Foundation’s New Plastics Economy initiative and becoming a UN Global Compact LEAD member.

- 2019: The launch of the “Good Times from a Good Place” roadmap set clear 2030 sustainability goals, accompanied by new acquisitions including Malfy gin and Rabbit Hole whiskey.

- 2020: Pernod Ricard strengthened its premium portfolio through strategic investments in Ki No Bi Japanese gin and Italicus aperitivo, reinforcing its presence in the fast-growing luxury craft spirits segment.

Latest

- 2021: The company introduced a universal “no-minors” symbol across all bottles, underscoring its long-term commitment to responsible consumption and consumer awareness.

- 2022: Pernod Ricard acquired a majority stake in Château Sainte Marguerite, a prestigious Côtes de Provence cru classé winery, expanding its footprint in high-end rosé wines. In the same year, it launched digital product labels, providing consumers with transparent information on ingredients, nutrition, and sustainability.

- 2023: The group advanced its premiumization strategy by acquiring majority stakes in Código 1530 prestige tequila, Skrewball super-premium flavored whiskey, and Ace Beverage, a leading Canadian ready-to-drink beverage company. It also partnered with Casa Lumbre and Lenny Kravitz to develop Nocheluna Sotol, a spirit rooted in the heritage of Northern Mexico. It launched The Chuan, the first prestige malt whisky crafted in China by an international group.

- 2024: Pernod Ricard unveiled new innovation-driven products, including the Absolut Vodka & Sprite ready-to-drink cocktail created in collaboration with The Coca-Cola Company, and Beefeater 0.0%, an alcohol-free version of the iconic London Dry Gin, marking a major step toward inclusivity in modern beverage consumption.

(Source: Company Website)

Employee Analysis

- Pernod Ricard employs 18,224 people worldwide, forming a diverse and globally integrated workforce.

- The company’s success is built on the talent, passion, and commitment of its teams, united by shared values and a strong brand heritage.

- Employees play a central role in preserving the company’s excellence and savoir-faire across its premium portfolio.

- In FY25, more than 416,600 training hours were completed, emphasizing Pernod Ricard’s dedication to continuous learning and professional development.

(Source: Pernod Ricard Company Website)

Financial Analysis

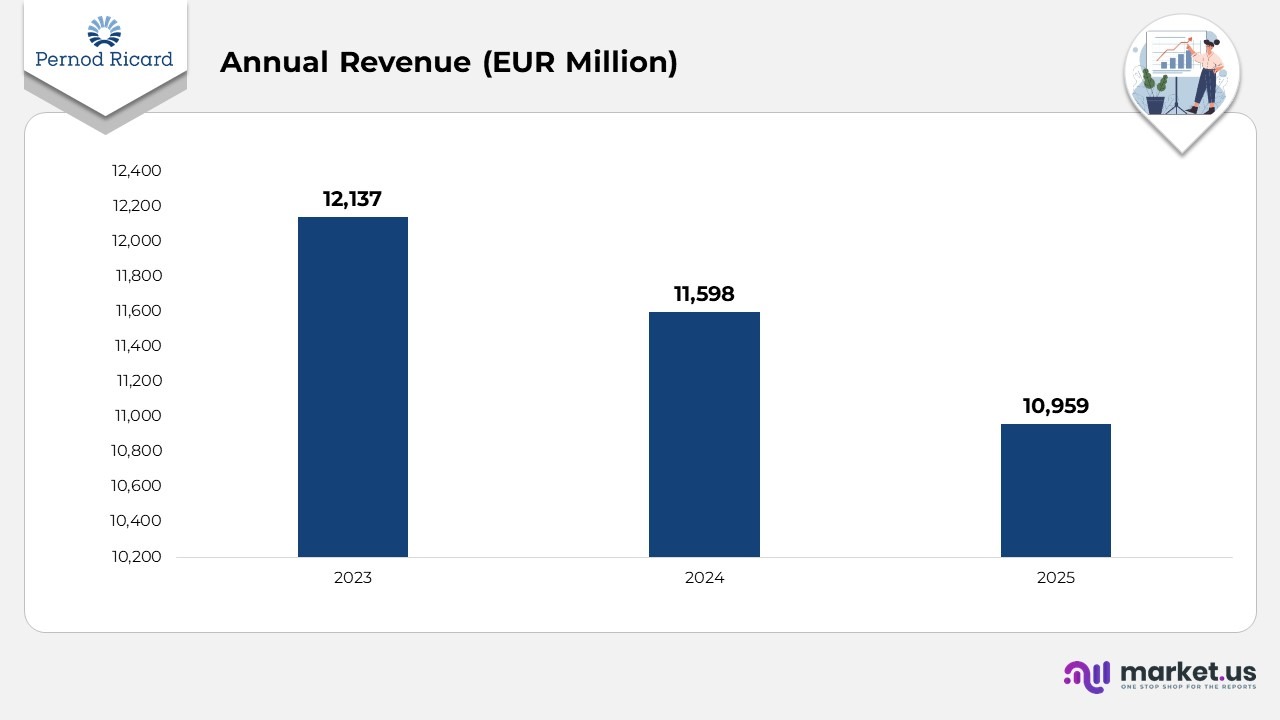

- In 2023, Pernod Ricard achieved revenue of EUR 12,137 million, driven by solid demand across major international markets and continued brand strength in premium segments.

- Revenue moderated to EUR 11,598 million in 2024, showing a 4% year-on-year decline, mainly attributed to currency fluctuations, a slowdown in discretionary spending, and uneven regional recovery trends.

- By 2025, revenue further decreased to EUR 10,959 million, a 5% decline from 2024, as global economic pressures and inventory rationalization impacted short-term sales momentum despite ongoing portfolio resilience.

Strategic International Brands Performance

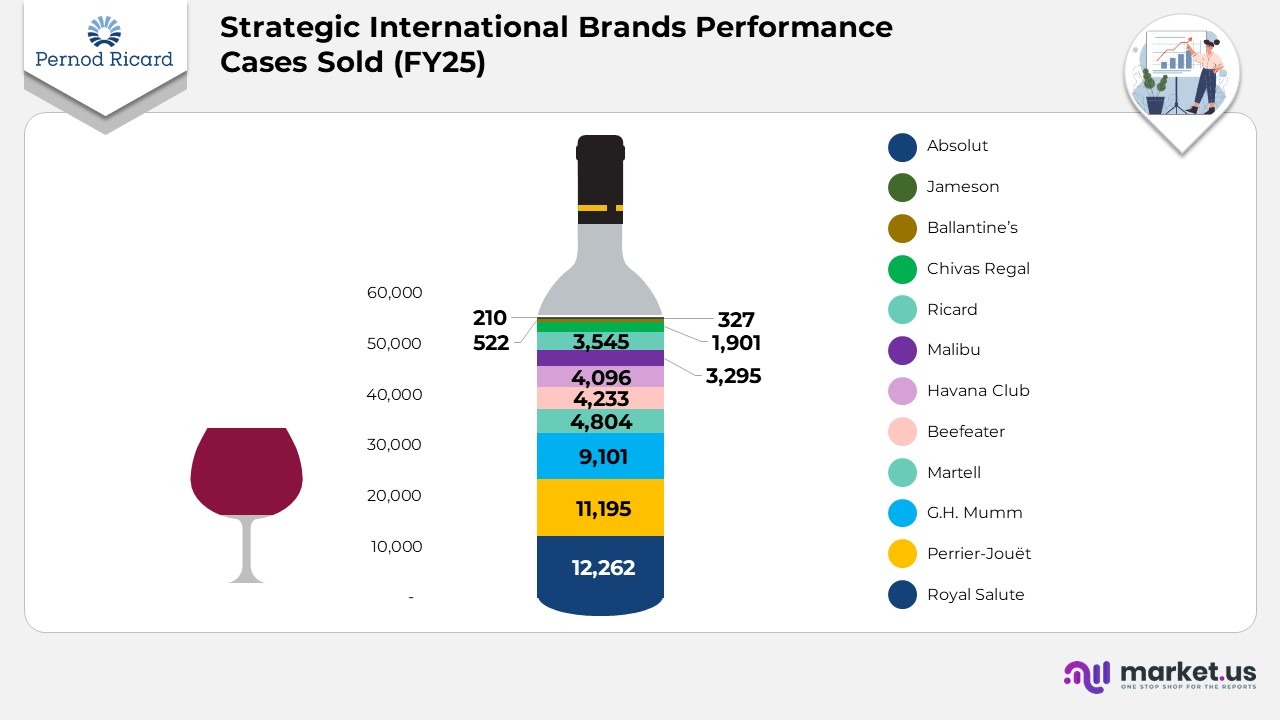

- Pernod Ricard’s strategic international portfolio achieved 56.7 million 9-liter cases sold globally in 2025, reflecting strong brand equity and market reach.

- Absolut led the lineup with 12,262 cases, maintaining dominance in the premium vodka category.

- Jameson followed with 11,195 cases, sustaining strong global demand for Irish whiskey.

- Ballantine’s recorded 9,101 cases, solidifying its position in Scotch whisky markets across Europe and Asia.

- Chivas Regal achieved 4,804 cases, backed by consistent performance in the luxury whisky segments.

- Ricard accounted for 4,233 cases, continuing its heritage strength in anise-based spirits.

- Malibu sold 4,096 cases, driven by the growing appeal of flavoured liqueurs and cocktails.

- Havana Club registered 3,295 cases, benefiting from increased premium rum consumption.

- Beefeater recorded 3,545 cases, reinforcing its global standing in the gin category.

- Martell delivered 1,901 cases, supported by steady cognac sales, particularly in Asian markets.

- Champagne labels G.H. Mumm and Perrier-Jouët sold 522 and 327 cases, respectively, fueled by premium hospitality recovery.

- Royal Salute contributed 210 cases, reinforcing the group’s commitment to high-end luxury offerings.

(Source: Pernod Ricard Annual Report)

Geographical Analysis

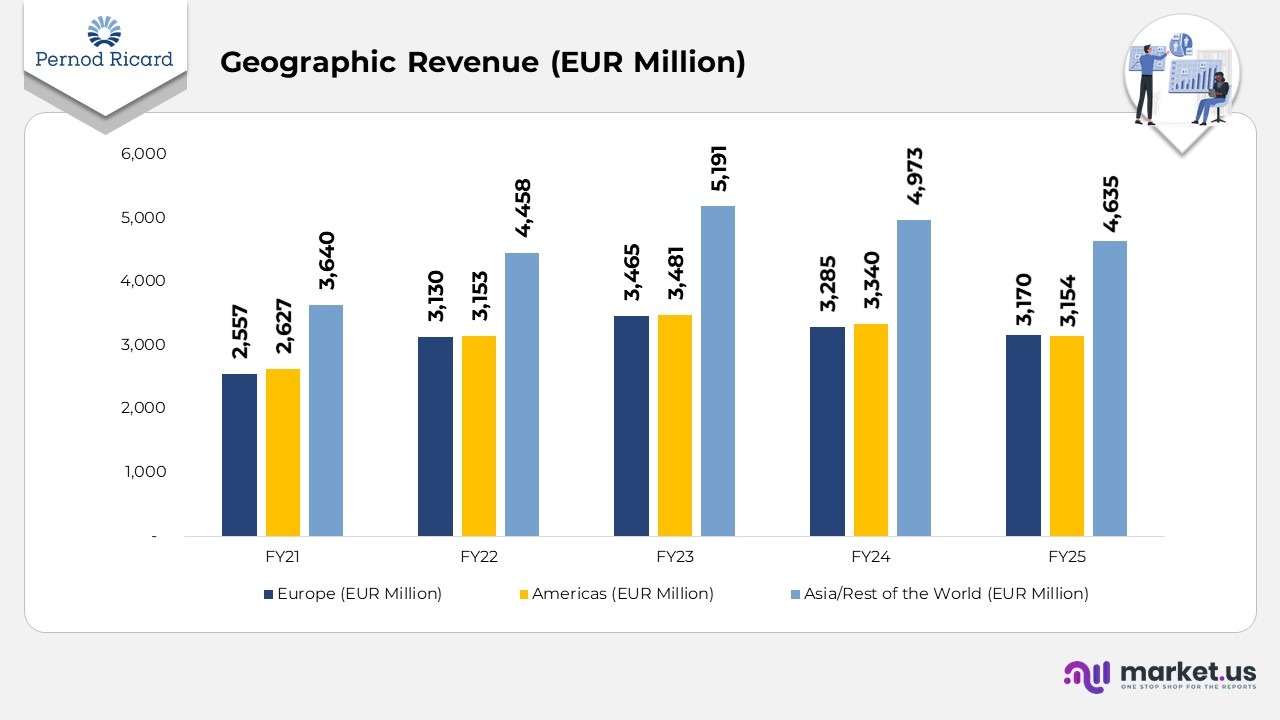

- In FY21, Europe recorded € 2,557 million, the Americas € 2,627 million, and Asia/Rest of the World € 3,640 million, reflecting balanced global market coverage.

- In FY22, Europe’s revenue rose to € 3,130 million, while the Americas contributed € 3,153 million and Asia/Rest of the World contributed € 4,458 million, showcasing a steady post-pandemic recovery.

- In FY23, Europe achieved 3,465 million euros, the Americas 3,481 million euros, and Asia/Rest of the World 5,191 million euros, driven by robust consumption in key Asian markets.

- In FY24, Europe generated 3,285 million euros, the Americas generated 3,340 million euros, and Asia/Rest of the World generated 4,973 million euros, indicating moderate stabilisation across developed economies.

- In FY25, Europe reached 3,170 million euros, the Americas 3,154 million euros, and Asia/Rest of the World 4,635 million euros, reflecting a slight softening in demand amid global economic adjustments.

(Source: Pernod Ricard Annual Report)

Pernod Ricard Recurring Profit and Operating Margin Analysis

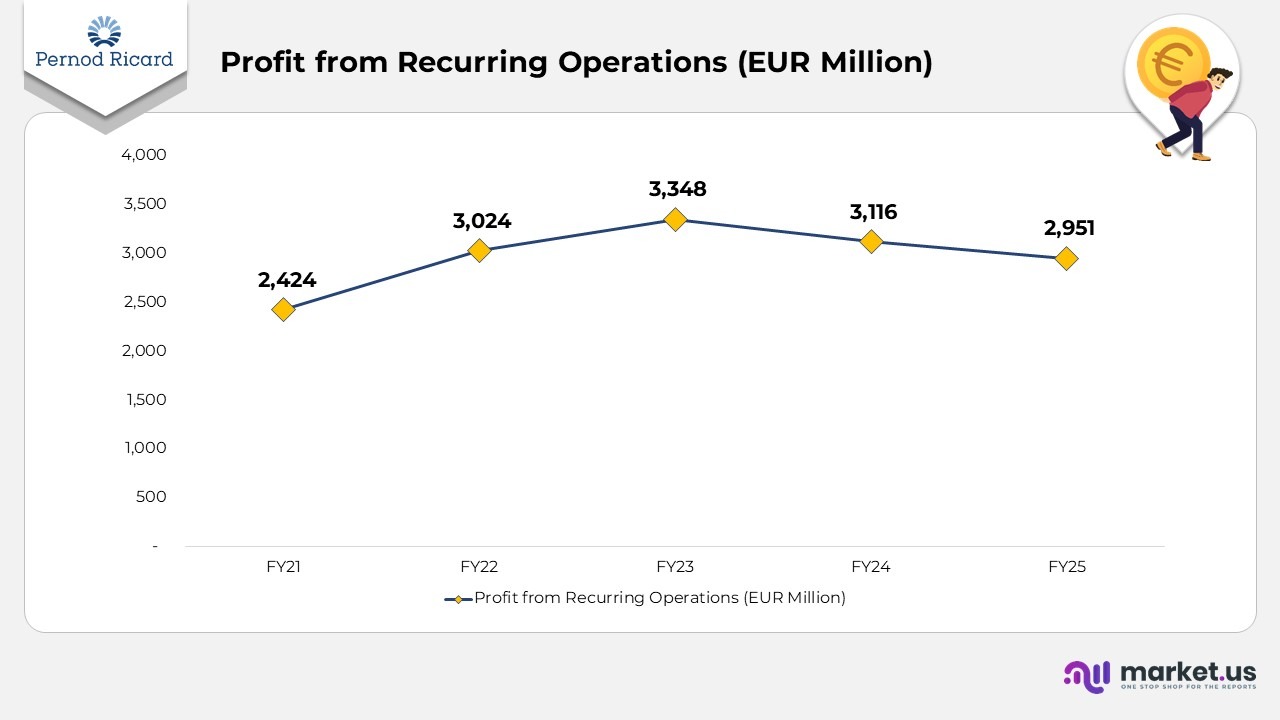

- In FY21, Pernod Ricard achieved a recurring profit of EUR 2,424 million, maintaining an operating margin of 5%, supported by a steady rebound in global consumption.

- In FY22, recurring profit increased to EUR 3,024 million, with an improved margin of 28.3%, reflecting strong premiumization and momentum from the post-pandemic recovery.

- In FY23, profit climbed to EUR 3,348 million, with a margin of 6%, indicating sustained growth in high-value spirits and brand-driven demand.

- In FY24, recurring profit slightly declined to EUR 3,116 million, while the margin moderated to 9%, impacted by inflationary pressures and uneven regional performance.

- In FY25, the company reported a recurring profit of EUR 2,951 million, maintaining a stable margin of 9%, which highlights its operational resilience amid challenging global economic conditions.

(Source: Pernod Ricard Annual Report)

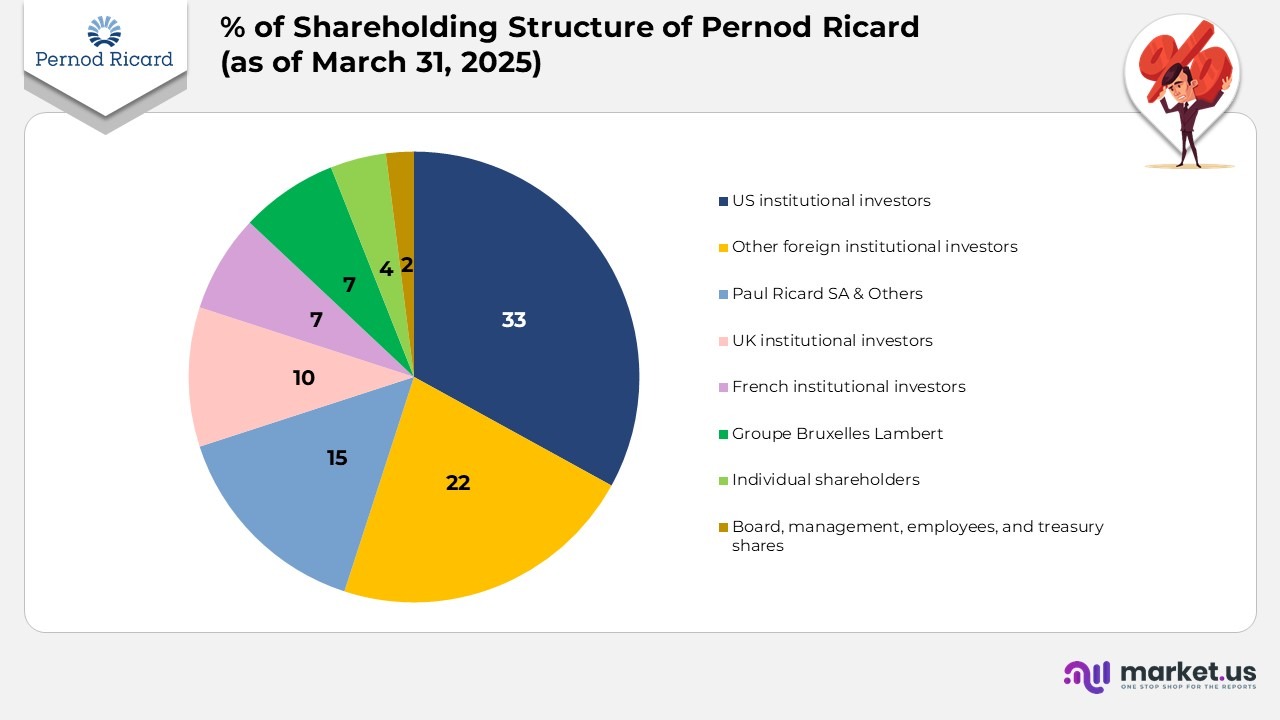

Shareholding Structure of Pernod Ricard (as of March 31, 2025)

- US institutional investors hold 33% of the company’s share capital, highlighting strong investor confidence from the United States.

- Other foreign institutional investors represent 22%, reflecting a diverse global investment base.

- Paul Ricard SA and its associated entities maintain a 15% stake, preserving the founding family’s active ownership interest.

- UK institutional investors account for 10%, signifying steady backing from the British financial sector.

- French institutional investors and Groupe Bruxelles Lambert each hold a 7% stake, reinforcing solid European investor relations.

- Individual shareholders make up 4%, demonstrating continued support from private investors.

- Board members, management, employees, and treasury shares collectively contribute 2%, underscoring internal alignment with the company’s success.

(Source: Pernod Ricard Annual Report)

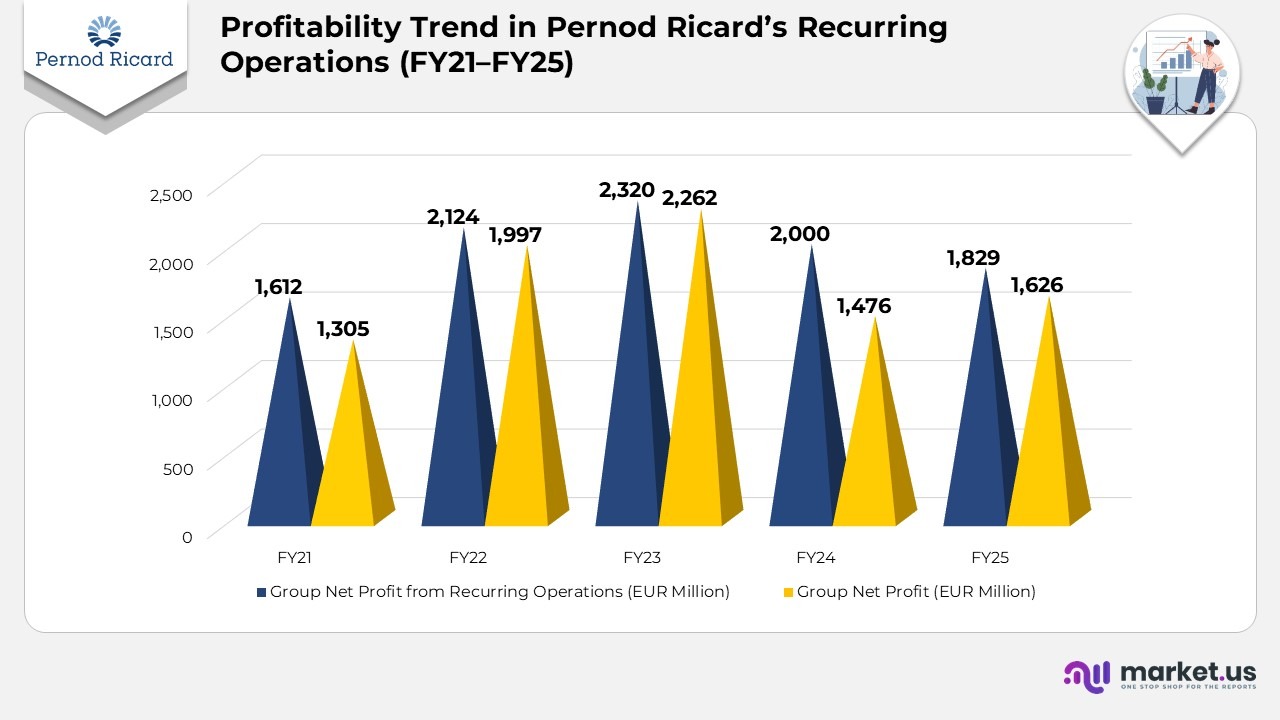

Profitability Trend in Pernod Ricard’s Recurring Operations (FY21–FY25)

- In FY21, the group recorded a profit from recurring operations of EUR 1,612 million, with a group net profit of EUR 1,305 million, supported by a gradual post-pandemic recovery.

- FY22 saw a strong rebound, as recurring profit rose to EUR 2,124 million and net profit to EUR 1,997 million, reflecting robust demand across premium categories.

- In FY23, profitability peaked with recurring operations reaching EUR 2,320 million and net profit at EUR 2,262 million, driven by solid pricing and premiumization strategies.

- FY24 marked a normalization phase, with recurring profit declining to EUR 2,000 million and net profit to EUR 1,476 million, impacted by inflationary pressures and softer consumer sentiment.

- By FY25, the group had maintained its resilience, posting recurring profits of EUR 1,829 million and a net profit of EUR 1,626 million, reflecting disciplined cost management and the strength of its brand portfolio.

(Source: Pernod Ricard Annual Report)

Pernod Ricard Stock Market Performance Statistics

- The total number of listed shares decreased from 255,631,733 in FY23 to 253,328,748 in FY24 and further to 252,269,195 in FY25, reflecting a gradual reduction due to share buybacks.

- The average number of diluted shares, excluding treasury shares, declined from 256,878,253 in FY23 to 253,188,307 in FY24 and 252,011,273 in FY25, indicating a tighter circulation of equity.

- Market capitalization fell sharply from €51,740 million in FY23 to €32,097 million in FY24 and €21,342 million in FY25, driven by weaker market valuations.

- Diluted group net profit per share dropped from €9.11 in FY23 to €7.90 in FY24 and €7.26 in FY25, reflecting moderated earnings performance.

- The dividend per share remained steady at €4.70 across FY23 to FY25, showcasing a consistent shareholder return policy.

- Trading activity exhibited steady growth, with the average monthly volume increasing from 8,535 thousand shares in FY23 to 11,940 thousand in FY25, indicating sustained investor engagement.

- The highest share price fell from €218.0 in FY23 to €141.1 in FY25, while the lowest share price dropped from €170.85 to €83.04, indicating increased market volatility.

- The average share price declined from €193.15 in FY23 to €109.3 in FY25, mirroring the broader market correction in the alcoholic beverages sector.

- The closing share price at June 30 decreased significantly from €202.40 in FY23 to €84.6 in FY25, reflecting bearish sentiment and valuation pressure.

(Source: Pernod Ricard Annual Report)

Patent Portfolio of Pernod Ricard

| Patent / Publication Title | Patent / Publication Number | Type | Filing Date | Publication / Grant Date |

|---|---|---|---|---|

| An alcoholic beverage containing particles comprising a caviar-based food | 11753611 | Grant | March 2, 2021 | September 12, 2023 |

| Portable device for controlling an alcoholic beverage through a container, a system and a method associated thereto | 11105743 | Grant | April 22, 2020 | August 31, 2021 |

| An alcoholic beverage containing particles comprising a caviar-based food | 20210179984 | Application | March 2, 2021 | June 17, 2021 |

| Portable device for controlling an alcoholic beverage through a container, a system and a method associated thereto | 20200249162 | Application | April 22, 2020 | August 6, 2020 |

| Beverage dispensing apparatus and method | 10683198 | Grant | November 2, 2015 | June 16, 2020 |

| Portable device for controlling an alcoholic beverage through a container, a system and a method associated thereto | 10670525 | Grant | January 31, 2018 | June 2, 2020 |

| Beverage dispensing module with activation system for a pressuring roller | 10604397 | Grant | April 13, 2017 | March 31, 2020 |

| Beverage dispensing container, apparatus, system and method | 10544028 | Grant | December 23, 2014 | January 28, 2020 |

| Portable device for controlling an alcoholic beverage through a container, a system and a method associated thereto | 20180149592 | Application | January 31, 2018 | May 31, 2018 |

| An alcoholic beverage containing particles comprising a caviar-based foodstuff | 20180112162 | Application | March 23, 2016 | April 26, 2018 |

| Bottle including a safety corking | 20180105335 | Application | December 18, 2017 | April 19, 2018 |

| Method of producing an alcoholic beverage having a fruity flavor | 9758752 | Grant | July 31, 2012 | September 12, 2017 |

| Method of producing an alcoholic beverage having a fruity flavor | 20140234481 | Application | July 31, 2012 | August 21, 2014 |

| Method for suspending particles in an alcoholic liquid composition and corresponding liquid composition | 20120107468 | Application | January 10, 2012 | May 3, 2012 |

| Bottle | D626419 | Grant | January 18, 2008 | November 2, 2010 |

| Bottle | D724952 | Grant | October 18, 2012 | March 24, 2015 |

| Container | D779319 | Grant | July 22, 2015 | February 21, 2017 |

| Container | D784126 | Grant | January 15, 2016 | April 18, 2017 |

| Base for container | D814295 | Grant | January 5, 2017 | April 3, 2018 |

| Base for container | D829046 | Grant | July 5, 2017 | September 25, 2018 |

(Source: Justia Patents)

Recent Developments

- In January 2025, Pernod Ricard partnered with JCDecaux to jointly enhance the company’s Data Portal, focusing on shared technological innovation, operational agility, and cost optimization across both technical and business units.

- In May 2024, the company entered a collaboration with ecoSPIRITS to introduce circular packaging systems for Pernod Ricard’s spirits brands, promoting sustainability and reducing waste across global on-trade venues.

- In September 2024, Pernod Ricard announced a partnership with Paris Saint-Germain, uniting two iconic French brands to create premium experiential campaigns that celebrate sportsmanship and French elegance worldwide.

- In January 2022, the company launched a new Beefeater flavor extension, followed by a refreshed packaging activation for Absolut Vodka in the UK market.

- In March 2022, Pernod Ricard expanded its luxury wine portfolio through the acquisition of a majority stake in Château Sainte Marguerite, a prestigious Côtes de Provence Cru Classé estate.

- In December 2022, Alexander Stein acquired a controlling interest in Société des Produits d’Armagnac, strengthening the group’s footprint in fine French spirits.

- In March 2021, Pernod Ricard acquired a majority stake in La Hechicera, a premium Colombian rum brand, reinforcing its presence in the Latin American spirits segment.

- In July 2021, Pernod Ricard India collaborated with Altizon Inc. to implement an IIoT-driven Digital Factory initiative aimed at improving efficiency and process automation.

- In June 2021, the group launched “A Perfect Blend,” a podcast that explores craftsmanship, culture, and sustainability in the spirits industry.

- In September 2021, Pernod Ricard made several strategic investments, including a minority stake in Sovereign Brands, a majority acquisition of The Whisky Exchange, and a minority stake in The Horse’s Spirit Company GmbH, diversifying its premium brand portfolio.

(Source: Pernood Ricard Press Releases)