Company Overview

JBS SA Statistics: JBS S.A. is a global food processing leader specializing in poultry, beef, pork, chicken, lamb, and other convenience food products. In addition to its core protein business, the company also produces and sells leather, collagen, biodiesel, metal packaging, hygiene, and cleaning products, and offers solid waste management and transportation solutions. The company operates in 7 business units, namely JBS Australia, JBS Brazil, JBS USA, Pilgrim’s Mexico, Pilgrim’s Europe, Pilgrim’s U.S., and Rigamonti.

The company markets its products under a wide portfolio of well-known brands, including Pilgrim’s, Co Trade, Renova, Do Chef, Primor, Reserva Friboi, Casings, Friboi Novapron+, Seara da Granja, H&B, Incrível Seara Nature, ORYGINAVivera, Delicia, Biopower, Seara Turma da Mônica, Seara Gourmet, Hans, Great Southern, TRS, Zempack, Gold’n Plump, Seara, Primo, Bordon, Genu-in, Moy Park, O’Kane, Swift, Maturatta, Swift Black, and Ambiental. JBS operates production facilities and commercial offices across the Americas, Africa, the Middle East, Europe, Asia, and Oceania, with its headquarters located in Amstelveen, the Netherlands.

The company manages more than 70 brands, reaching customers in 190 countries with trusted, high-quality, and responsibly produced food products. JBS serves over 300,000 customers worldwide and maintains operations in more than 25 countries across five continents, with over 600 facilities located in Argentina, the United States, Canada, Mexico, Australia, Brazil, Europe, New Zealand, the United Kingdom, Uruguay, and Vietnam.

With a workforce of over 270,000 global team members and more than 150 globally recognized brands, JBS continues to drive innovation, sustainability, and excellence in the global food industry.

JBA SA History

- In 1953, JBS S.A. was founded by rancher José Batista Sobrinho in Anápolis, Brazil, as a small slaughtering operation that marked the company’s entry into the meat industry.

- In 1953, the company expanded its footprint with the acquisition of a meatpacking plant in Planaltina, thereby enhancing its production capacity and regional distribution capabilities.

- In 1970, JBS strengthened its domestic operations by acquiring its second beef processing plant, marking the beginning of a large-scale expansion phase.

- Between 1970 and 2001, JBS expanded its dominance in the Brazilian beef sector, increasing processing capacity and establishing itself as a national industry leader.

- 2001–2006 The company began its international expansion, entering Argentina’s meat market and marking its first move beyond Brazilian borders.

- In 2007, JBS became a global force in the animal protein industry by acquiring Swift & Company, one of the largest meat processors in North America, in the United States.

- In 2008, the company continued its global growth by purchasing Tasman Group in Australia, Smithfield Beef Company in the U.S., and Five Rivers Cattle Feeding, one of the world’s largest cattle feeding operations.

- In 2009, JBS entered the U.S. poultry market through the acquisition of a controlling stake in Pilgrim’s Pride Corporation (PPC), the country’s second-largest poultry company at the time.

Moreover

- In 2010, the company further expanded its global operations with the acquisition of Tatiara Meats in Australia and McElhaney Feedyard in Arizona, U.S., thereby boosting its beef and feedlot capacities.

- In 2013, JBS acquired XL Foods in Canada, Zenda in Brazil, and Seara Alimentos, a major Brazilian food producer, thereby diversifying its product portfolio and expanding its international reach.

- In 2014, JBS was recognized by Bloomberg as the second-largest packaged food company globally, and it further expanded by acquiring Tyson do Brasil, strengthening its processed foods division.

- In 2015, JBS USA and JBS Australia expanded their operations by acquiring Primo Smallgoods Group, Tyson de México, Moy Park in the UK, and Cargill’s Pork Division in the U.S., thereby solidifying their position in global meat production.

- In 2016, the company acquired a 50.1% controlling stake in Scott Technology Ltd., a New Zealand-based robotics and automation firm, signaling its entry into advanced processing technologies.

- In 2017, Pilgrim’s Pride, a JBS subsidiary, expanded further with the acquisitions of GNP Company in the U.S. Midwest and Moy Park in the UK and Europe, thereby reinforcing its international poultry operations.

- In 2018, JBS USA divested its Five Rivers Cattle Feeding business, streamlining operations to focus on core meat processing and protein production capabilities.

Employee Analysis

- JBS reported a total global headcount of 278,833 employees in 2023, showing steady growth from 256,482 in 2022 and 247,745 in 2021.

- The company’s global workforce distribution by region included major contributions from the United States (152,502), Brazil (71,490), Europe (32,230), Australia (13,554), Canada (13,554), and Mexico (3,637), with other international operations employing smaller teams.

- By employee type, 268,752 were permanent, 748 were temporary, and 1,346 worked under non-guaranteed hour contracts.

- In terms of age demographics, the 2023 workforce comprised 0% of employees under 30 years old, 48.0% between 30 and 50 years old, and 19.0% over 50 years old, indicating a balanced mix of experienced and younger employees.

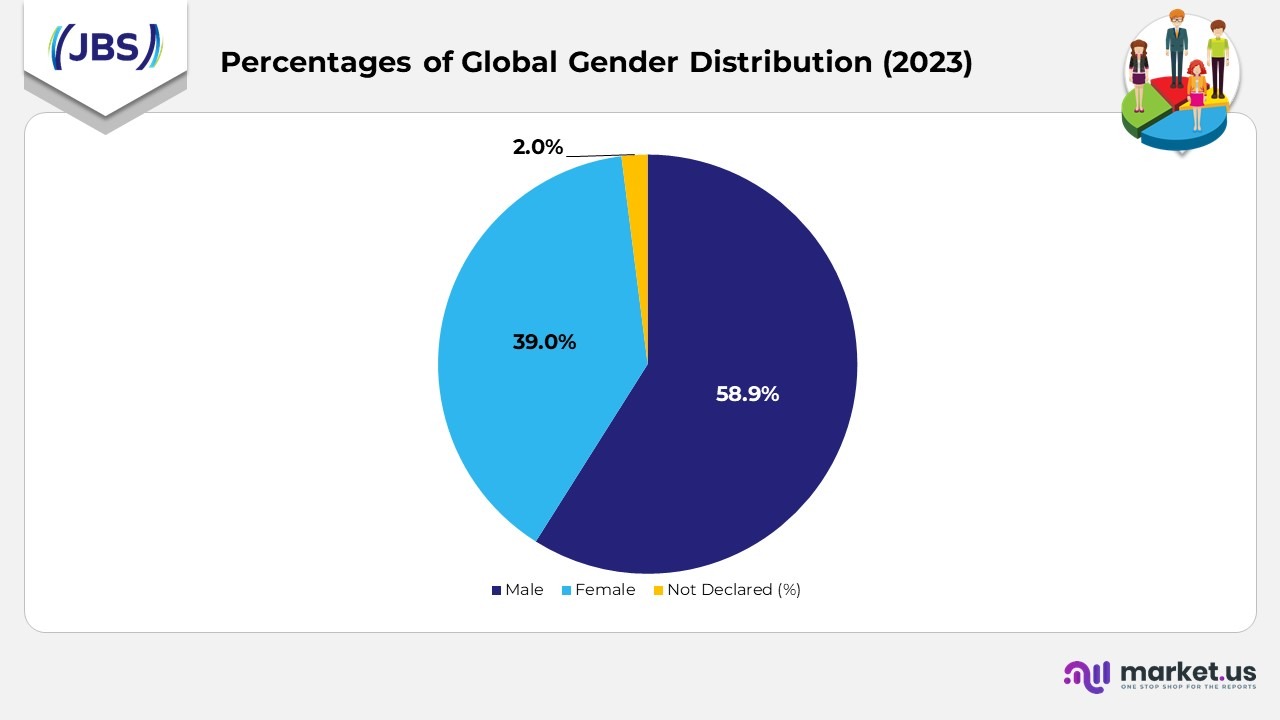

- Regarding gender diversity, the breakdown was 59.8% male, 40.1% female, and 0.2% not disclosed, reflecting a consistent representation compared to earlier years.

- Across business units, permanent employment levels remained high, reaching nearly 100% in JBS Brazil, JBS Canada, and JBS USA. Meanwhile, Pilgrim’s Mexico and Pilgrim’s Europe maintained a workforce composition of over 96% permanent employees.

- The global workforce at JBS in 2023 consisted of 9% males, 39.0% females, and 2.0% not declared, maintaining a consistent gender distribution compared to previous years.

- Within the Board of Directors, female representation was 6%, while males accounted for 71.4%, reflecting ongoing efforts toward gender balance at leadership levels.

- Among leaders, females represented 3%, while males made up 80.7%, showing a modest increase in female leadership participation compared to prior years.

- The administrative category reported 9% male and 49.6% female, showing near gender parity within this segment.

Moreover

- In operations, males represented 4% of the workforce, and females 40.5%, highlighting the continued predominance of men in production roles.

- Apprentices, interns, and trainees comprised 57.0% males, 43.0% females, and 0.0% with no data under ‘not declared’, indicating a healthy gender balance in entry-level programs.

- By age group, 0% of the global workforce was under 30 years, 48.9% were between 30 and 50 years, and 19.0% were above 50 years, reflecting a youthful yet experienced workforce composition.

- Across job categories, leaders and administrative staff showed a concentration in the 30–50 age range, while operations and apprenticeship programs had a higher share of employees under 30 years.

- In terms of global racial diversity, JBS reported a workforce comprising 3% Hispanic or Latino, 38.8% White, 35.0% Black, 1.8% Asian, 0.4% Native Hawaiian or Pacific Islander, 0.8% Indigenous or American Indian, 0.3% Two or more races, and 6.6% Not declared or unknown.

- The United States division showed 2% Hispanic or Latino, 26.1% White, 18.5% Black, 5.5% Asian, and smaller percentages for other racial groups, highlighting significant ethnic diversity.

- Brazil’s workforce was primarily comprised of White individuals (46.8%), Black individuals (49.0%), and Asian individuals (1.1%), indicating a well-balanced demographic distribution.

- Europe had a majority White (48.1%) workforce, followed by Asian (5.1%), while Mexico reported a 100% Hispanic or Latino workforce due to regional demographics.

- Australia and Canada had non-disclosed diversity data due to regulatory restrictions.

(Source: JBS SA Annual Report)

JBS SA Ownership Structure

- As of December 31, 2023, JBS S.A. had a total of 2,218,116,370 shares

- The company maintained a free float of 51.2%, allowing for wide market participation.

- The controlling group, comprising J&F Investimentos S.A. and JBS Participações S.A., held 48.83% of the total shares, with no shares held in treasury.

- The company’s total market capitalization stood at R$55.2 billion, with a unit share price of R$24.9.

- Among other shareholders, BNDES accounted for 81%, while other non-controlling shareholders represented 30.36% of total ownership.

(Source: JBS SA Annual Report)

Financial Analysis

- Adjusted EBITDA for 2024 totaled US$7.2 billion, representing a 108% increase compared to 2023, supported by an EBITDA margin of 9.3%, up 6 percentage points year-on-year.

- During Q4 2024, adjusted EBITDA reached US$1.8 billion, representing a 79% increase from the same period in 2023, with a 9.2% margin, an improvement of 9 points.

- Free cash flow generation extended US$2.3 billion for the year and US$906.4 million in Q4, reflecting growth of 421% and 4%, respectively, from the previous year.

- Net income for 2024 reached US$2.6 billion, while Q4 reported a profit of US$970 million.

- The company successfully reduced its net debt by US$1.7 billion, closing the year with a balance of US$13.6 billion.

- The leverage ratio improved significantly, declining from 42x in 2023 to 1.89x (net debt-to-EBITDA).

- JBS closed the year with US$5.8 billion in cash and US$3.4 billion in available revolving credit lines, ensuring a strong liquidity position.

- In 2024, JBS and its subsidiaries generated over US$641 million in Agribusiness Receivables Certificates and introduced a Commercial Paper Program with a capacity of US$1 billion to diversify their funding sources.

- The company paid US$759 million in dividends and reinstated its share buyback program in September 2024.

- Additionally, Seara’s CRA issue, with a 30-year maturity, marked the longest-term debt issuance in Brazil’s capital market history.

Segmental Analysis

Seara Segment

- Seara achieved adjusted EBITDA of 5 billion, reflecting a 322% rise over 2023, driven by efficiency gains and expanded value-added portfolios.

- The EBITDA margin stood at 5, an improvement of 13.1 percentage points, supported by higher productivity and cost control measures.

- Net revenue reached $8.8 billion, up 6% year-over-year, driven by robust demand for frozen, ready-to-eat, and premium protein products.

- In Q4 2024, adjusted EBITDA totaled 6 million, with a 19.8 margin and 2.3 billion in revenue.

- Growth was driven by export expansion, optimized logistics, and enhanced processing capabilities, especially in Europe and Asia.

Pilgrim’s Segment

- Pilgrim’s Pride posted adjusted EBITDA of 7 billion, recording a 76% increase compared to 2023, reflecting strong global poultry demand and operational optimization.

- The EBITDA margin improved to 1, up 6.3 points, supported by efficient production cycles and a shift toward higher-margin cooked products.

- Net revenue rose from $3 billion to $17.9 billion, driven by growth in retail and foodservice channels.

- In Q4 2024, adjusted EBITDA reached 1 million, with a 14.7 margin and 4.4 billion in revenue.

- The segment’s performance benefited from expansion in European markets and improved poultry processing efficiencies.

JBS SA USA Pork Statistics

- The division generated adjusted EBITDA of 1 billion, up 103% from 2023, driven by stronger export volumes and stable domestic consumption.

- The EBITDA margin increased to 13.2, up 6.4 points, reflecting lower feed costs and improved operational efficiency.

- Net revenue climbed 5 to 1 billion, supported by demand for high-quality pork cuts and convenience products.

- In Q4 2024, adjusted EBITDA was $ 271 million, with a 13.5% margin and $ 2 billion in revenue.

- The segment benefited from automation, modernization of production lines, and increased exports to Asia and Latin America.

Australia JBS SA Statistics

- JBS Australia reported adjusted EBITDA of $ 664.3 million, marking a 46% growth over 2023, supported by favourable cattle availability and strong export pricing.

- The EBITDA margin improved to 10%, a gain of 2.7 points, showcasing cost efficiencies and improved plant utilization.

- Net revenue increased from 7 to 6 billion, driven by high demand from Japan, Korea, and the Middle East.

- In Q4 2024, adjusted EBITDA reached 2 million, with a 7.9 margin and 1.8 billion in revenue.

- Continued investments in sustainability and premium beef lines strengthened profitability and long-term competitiveness.

JBS SA Brazil Statistics

- JBS Brazil posted adjusted EBITDA of $ 965 million, a robust 106% increase over 2023, reflecting favourable market conditions and improved cattle supply.

- The EBITDA margin rose to 7, up 3.5 points, driven by improved slaughter margins and cost optimization.

- Net revenue grew 13 to 6 billion, led by stronger export sales, particularly to China and the Middle East.

- In Q4 2024, adjusted EBITDA totaled 1 million, with a 6.6 margin and 3.5 billion in revenue.

- The segment gained traction through brand development, the introduction of value-added products, and geographical diversification of exports.

JBS SA Beef North America Statistics

- The North American beef segment recorded adjusted EBITDA of 3 million, up 117 year-on-year, reflecting a recovery in margins and stable cattle supply.

- The EBITDA margin improved to 1, up 5 points, as efficiency and yield optimization supported profitability.

- Net revenue increased from $4 billion to $24.3 billion, driven by strong demand in retail and foodservice.

- In Q4 2024, adjusted EBITDA reached 7 million, with a 1.7 margin and 6.4 billion in net revenue.

- The division enhanced operational performance through automation, higher carcass yield, and improved production scheduling.

(Source: JBS SA Company Website)

Orthopedic and Spinal Device Patents Patents of JBS SA

| Patent Title | Patent Number | Type | Filing Date | Date of Patent |

|---|---|---|---|---|

| Spacer implant for substituting missing vertebrae | 5723013 | Grant | February 6, 1996 | March 3, 1998 |

| Rehabitable connecting-screw device for a bone joint, intended in particular for stabilizing at least two vertebrae | 5658285 | Grant | October 27, 1995 | August 19, 1997 |

| Self-retaining means for fasteners, particularly screws | 5531554 | Grant | November 4, 1994 | July 2, 1996 |

| Spinal osteosynthesis rod with three branches | 5527315 | Grant | October 18, 1994 | June 18, 1996 |

| Finger prosthesis | 5522903 | Grant | November 10, 1994 | June 4, 1996 |

| Spinal osteosynthesis device | 5514132 | Grant | September 19, 1994 | May 7, 1996 |

(Source: Justia Patents)

Recent Developments

- In October 2025, the company expanded its sausage production facility in Perry, Iowa, investing $135 million in the project. The expansion is expected to generate around 500 direct jobs, strengthening its U.S. processed meat operations.

- In August 2025, the company reached an agreement to acquire a production facility in Ankeny, Iowa, formerly owned by Hy-Vee. The site will be developed into the company’s largest ready-to-eat bacon and sausage plant in the U.S. portfolio.

- In September 2025, the company partnered with MEQ, achieving AUS-MEAT approval for its Facility Objective Carcase Measurement (OCM) Device. This certification recognizes technological advancement in precision carcass grading.

- In July 2025, the company announced a $400 million investment to expand its operations in LaFayette, Georgia. The new multi-phase prepared foods facility is projected to support over 630 jobs at full capacity.

- In May 2025, the company unveiled plans to invest $135 million in a state-of-the-art sausage manufacturing facility in Perry, Iowa. The project will create 500 direct jobs and 250 construction jobs, with construction set to begin in late 2025 and operations scheduled to commence in late 2026.

- In February 2025, the company announced $200 million in investments for its beef processing facilities in Cactus, Texas, and Greeley, Colorado. The upgrades include a new fabrication floor, an expanded ground beef area in Cactus, and a modern distribution center in Greeley.

(Source: JBA SA Press Releases)