Introduction

Consumer Goods Industry Statistics: The consumer goods sector is a vast and evolving industry that includes products used daily, typically classified as either fast-moving consumer goods (FMCG) or durable goods. Data indicates its considerable economic influence, with the global market value for categories such as furniture reaching several USD 100 billion, and India’s FMCG sector alone valued at more than $110 billion, projected to double by 2025.

Notable trends encompass a transition towards organized retail, the increasing impact of online platforms, a rising consumer appetite for personalized and technology-enhanced products, and a heightened focus on sustainability and health.

The worldwide consumer goods market is anticipated to exceed $16 trillion in value by 2025, with manufacturing representing a substantial share. Significant industry metrics include an expected global compound annual growth rate (CAGR) of 4.9% and a projected revenue of $97.4 billion for the US footwear market in 2024.

Emerging trends highlight the growing significance of online retail and direct-to-consumer sales, an expanding rural market, and a shift towards premium products fueled by increased disposable incomes and changing consumer preferences for convenience, sustainability, and digital integration.

Editor’s Choice

- The global market for consumer packaged goods was valued at approximately USD 5,467.5 billion in 2024.

- Globally, the largest FMCG Company, Nestlé’s extensive portfolio spans food, beverage, nutrition, and health products, and has a net sale of $102 billion.

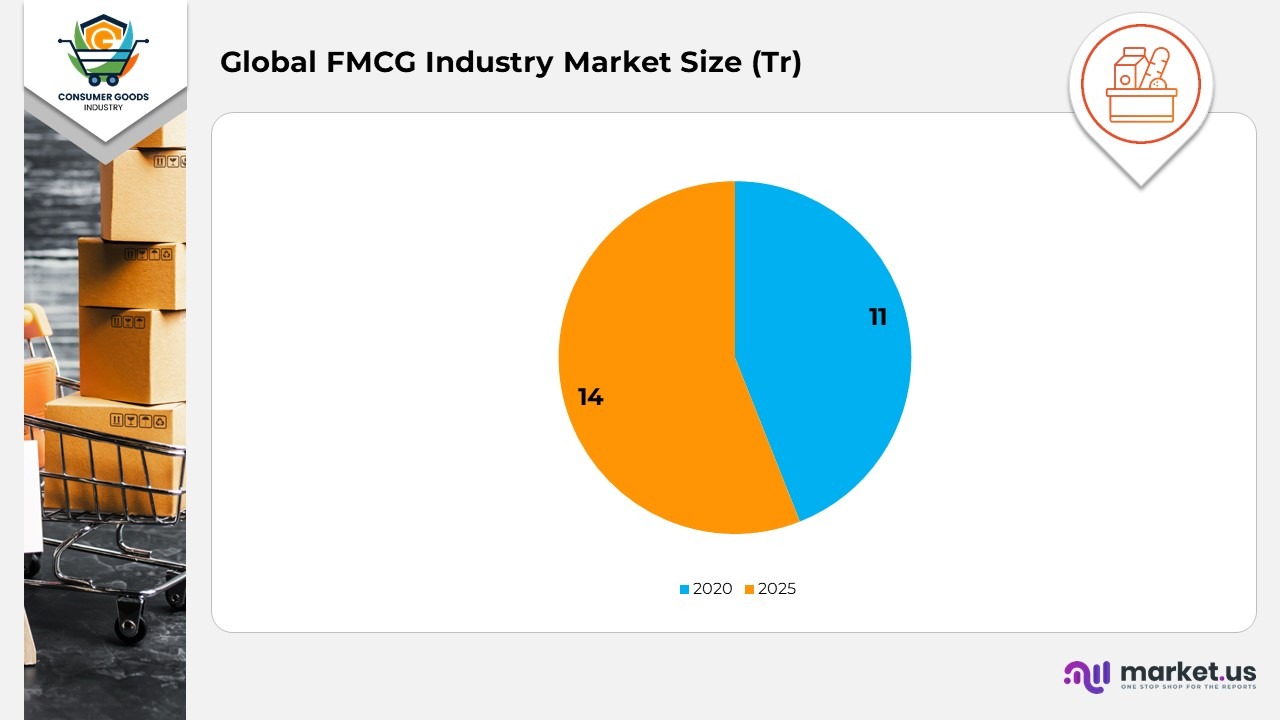

- The global FMCG market was valued at about $11 trillion in 2020 and is expected to reach $14 trillion by the end of 2025, with a CAGR of 4-6%.

- The largest FMCG sector, valued at around $7 trillion globally, is driven by demand for convenience, health foods, and premium organic products.

- In 2024, it was recorded that impulse buying dropped to 18%, while 57% of consumers research products before buying, favouring curated and personalised selection.

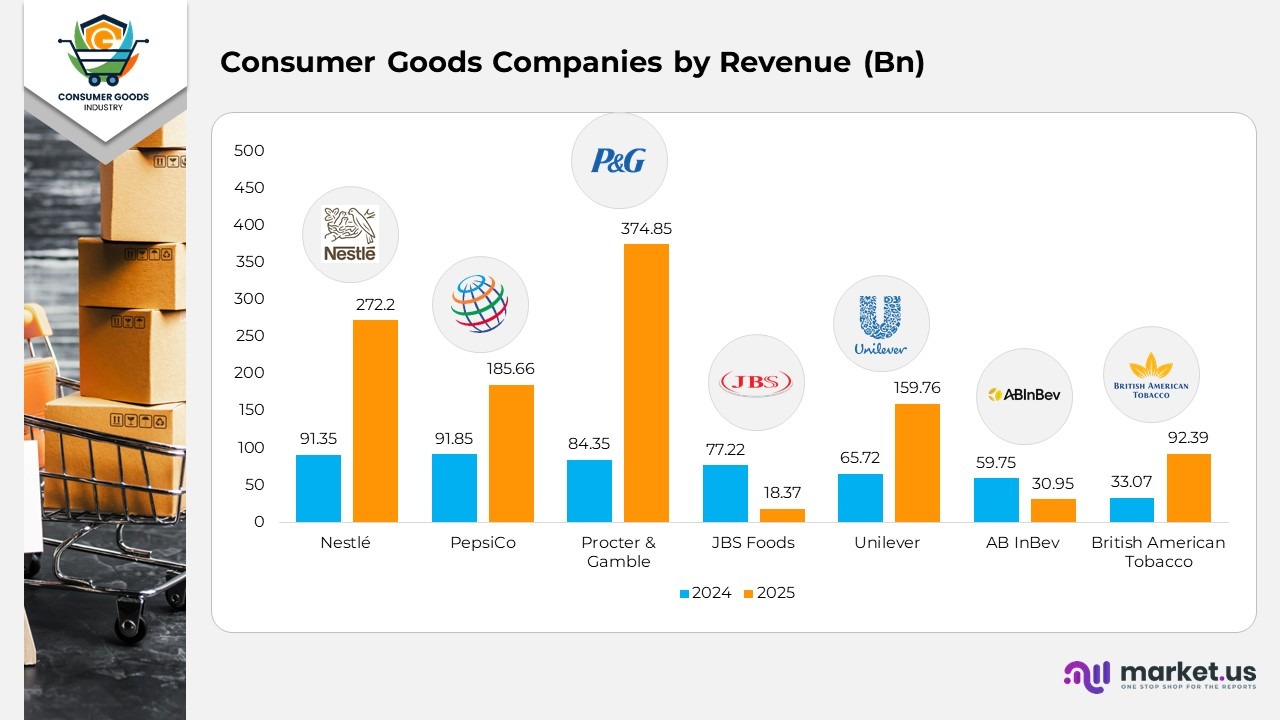

Consumer Goods Companies by Revenue

- Nestlé is a Swiss multinational corporation specializing in the processing of food and beverages. The company offers a diverse range of products, including confectionery, infant formula, bottled water, dairy items, and cereals. As of mid-2025, its market capitalization stood at $272.2 billion, with a reported revenue of $91.35 billion for the year 2024.

- PepsiCo (PEP) is an American food enterprise known for its production of soft drinks and snack foods. In mid-2025, its market capitalization was recorded at $185.66 billion, and it achieved a revenue of $91.85 billion in 2024.

- Procter & Gamble is an American consumer goods corporation that manufactures a wide array of health, personal care, and hygiene products, including soaps, fabrics, and beauty items. The company had a market capitalization of $374.85 billion in mid-2025, with a revenue of $84.35 billion for the year 2024.

- JBS Foods is a Brazilian meat handling company that markets beef, salmon, chicken, pork, and various meat byproducts. As of mid-2025, it had a market capitalization of $18.37 billion and reported a revenue of $77.22 billion for 2024.

- Unilever is a British fast-moving consumer goods company that produces beauty products, cereals, energy drinks, healthcare items, and other daily-use products. Its market capitalization was $159.76 billion in mid-2025, with a revenue of $65.72 billion for the year 2024.

- AB InBev is a Belgian brewing company recognized as the largest beer producer globally, including brands like Budweiser. In mid-2025, it had a market capitalization of $30.95 billion and reported revenues of $59.75 billion for 2024.

- British American Tobacco is a British firm that concentrates on the production of cigarettes and other nicotine-related products. Its market capitalization was $92.39 billion in mid-2025, with revenues amounting to $33.07 billion in 2024.

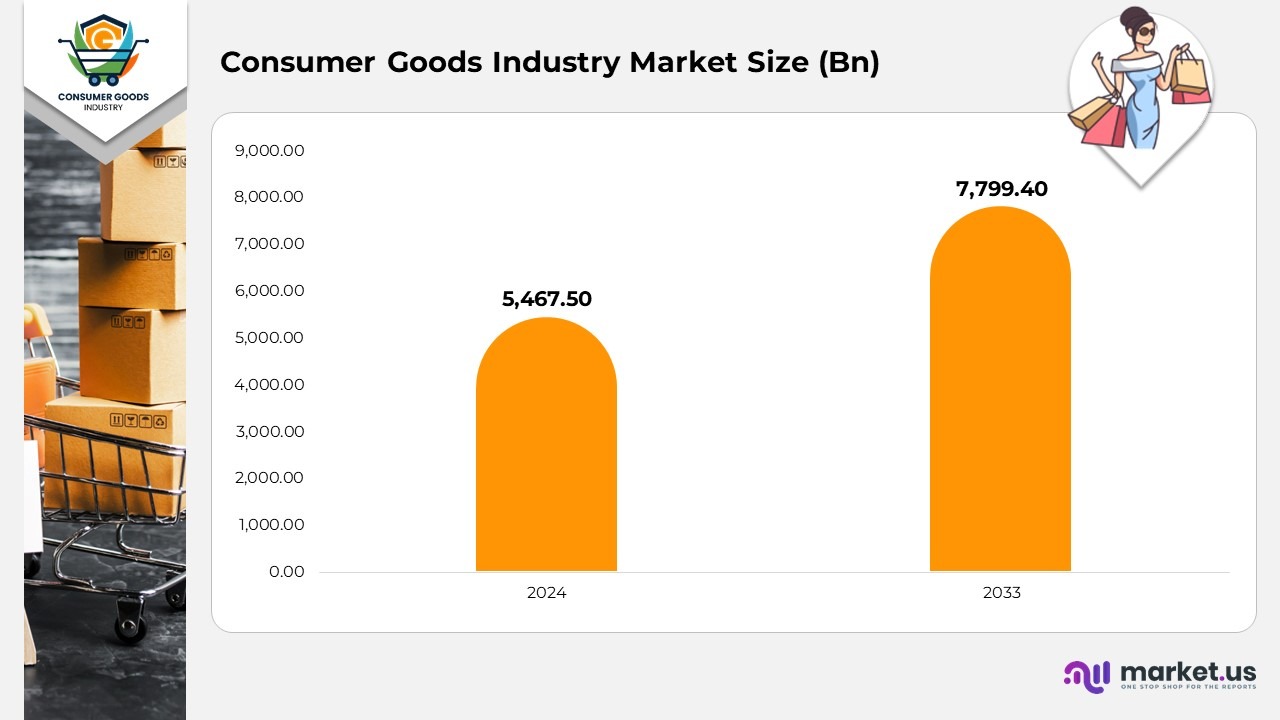

Consumer Goods Industry Market Size

- The global market for consumer packaged goods was valued at approximately USD 5,467.5 billion in 2024.

- It is anticipated to grow to around USD 7,799.4 billion by 2033, reflecting a compound annual growth rate (CAGR) of approximately 4.1% from 2025 to 2033.

- Furthermore, the overall “consumer goods” market is projected to be valued at USD 12.5 trillion in 2024, with expectations to expand to USD 18.5 trillion by 2031, achieving a CAGR of 4.8%.

- In the realm of fast-moving consumer goods, the market is estimated at USD 13,500.75 billion in 2024, with projections indicating it will reach USD 21,045.34 billion by 2032, corresponding to a CAGR of 5.8%.

- Key growth drivers include the penetration of e-commerce, increasing disposable incomes in emerging markets, urbanization, and a rising demand for sustainability.

- Examining the product segments within CPG, the ‘food’ category is expected to account for 43% of revenue in 2024.

Global FMCG Industry Market Size

- The global FMCG market was valued at about $11 trillion in 2020 and is expected to reach $14 trillion by the end of 2025, with a CAGR of 4-6%.

- E-commerce sales in FMCG are rising rapidly, expected to reach $2.4 trillion in 2025, where Asia-Pacific is driving 45% of this growth, and e-commerce will account for over 20% of the FMCG market.

- The health food market is expected to reach $1.5 trillion in 2025, and health-focused products are expected to capture 25% of the FMCG market.

- Around 73% of consumers globally are willing to pay more for eco-friendly brands, with higher willingness among young consumers aged 18-34.

- Asia-Pacific dominates FMCG market growth, with China alone representing 30% of the market.

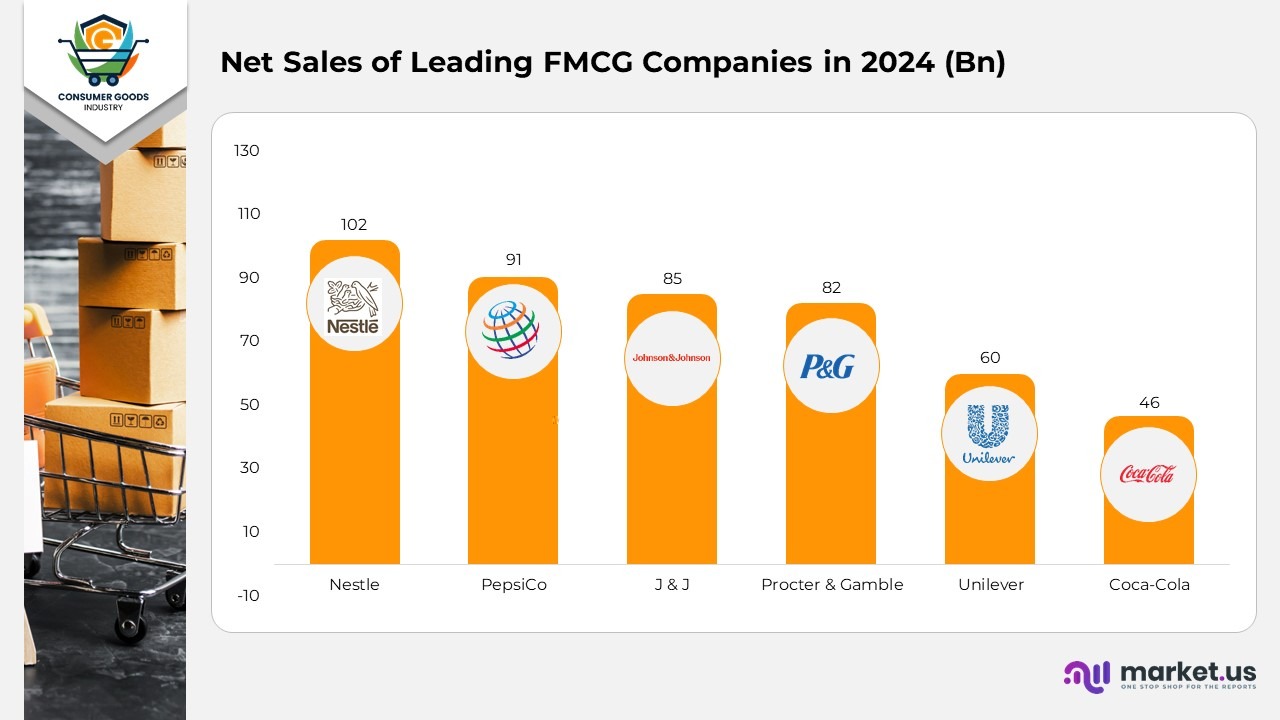

Net Sales of Leading FMCG Companies in 2024

Globally, the largest FMCG Company, Nestlé’s extensive portfolio spans food, beverage, nutrition, and health products, and has a net sale of $102 billion.

The company is known for its beverages, snacks, and packaged foods. PepsiCo’s annual net sales in 2024 were $91 billion.

-

J & J

Johnson & Johnson’s consumer segment included personal care and wellness products, which contributed significantly to its FMCG’s net sales, which was accounted for $85 billion in 2024.

-

Procter & Gamble

P&G dominates in personal care, hygiene, and household products with iconic brands, strong marketing, and innovation in consumer needs, which accounts for up to its annual net sales worth of $82 billion in 2024.

-

Unilever

With a diverse portfolio including food, beverages, home care, and personal care, Unilever marked $60 billion in net sales in 2024.

Coca-Cola drives FMCG sales through global reach, product innovation, and marketing, and its net sales in 2024 were $46 billion.

Graphical Analysis

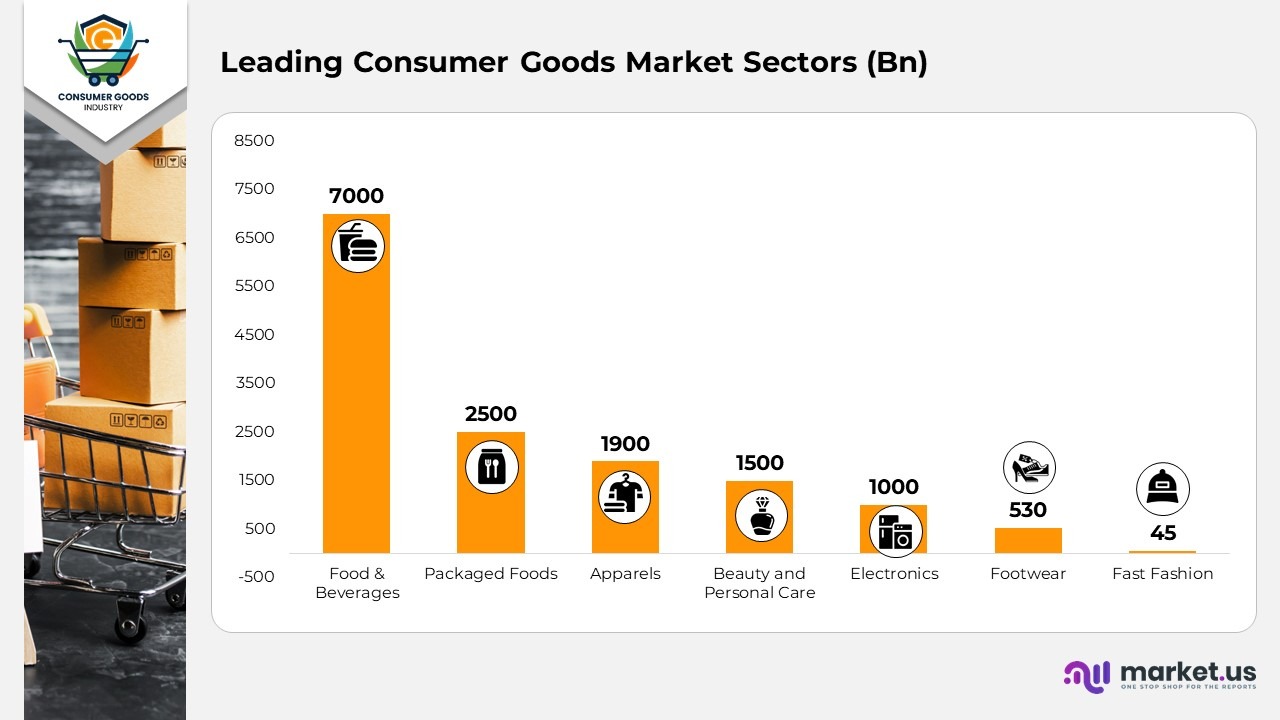

Leading Consumer Goods Market Sectors

-

Food & Beverages

The largest FMCG sector, valued at around $7 trillion globally, is driven by demand for convenience, health foods, and premium organic products.

-

Packaged Foods

A $2.5 trillion industry, boosted by innovation in craft beers, low-alcohol drinks, and health-conscious options.

-

Apparels

The apparel market is expected to to $1.9 trillion in 2025, influenced by rising middle-class incomes, fast fashion, and digital retail channels, especially in emerging markets.

-

Beauty and Personal Care

The beauty and personal care industry includes skincare, cosmetics, and hygiene products, projected to reach $1.5 trillion by 2025, with growth fuelled by rising beauty awareness.

-

Electronics

The consumer electronics market, worth more than $1 trillion, is expanding with rising demand for smart devices, wearables, and home automation, fueled by technological advancements and connectivity.

-

Footwear

The global footwear market is projected to reach $530 billion by 2025, driven by demand for sports and casual shoes among increasing health awareness and fashion trends.

This sector, valued at approximately $45 billion, thrives on rapid production and turnover, appealing to young consumers with affordable, trendy clothes and driving e-commerce sales.

Consumer Goods Industry Fun Facts

- Coca-Cola’s formula included trace amounts of cocaine when it was first introduced in 1886.

- Nike’s first shoes were made in a waffle iron; the co-founder used his wife’s waffle maker to create the prototype sole design.

- KitKat wrappers were originally made of aluminium foil; they switched to plastic in the 1990s and now use paper wrappers in many countries for sustainability.

- Oreo is the world’s best-selling cookie; it’s sold in over 100 countries, with over 40 billion Oreos produced each year.

- Around 70% of consumers say product packaging influences their buying choices more than ads do.

- L’Oreal owns 35+ beauty brands, including Maybelline, NYX, and Garnier, dominating nearly every segment of cosmetics.

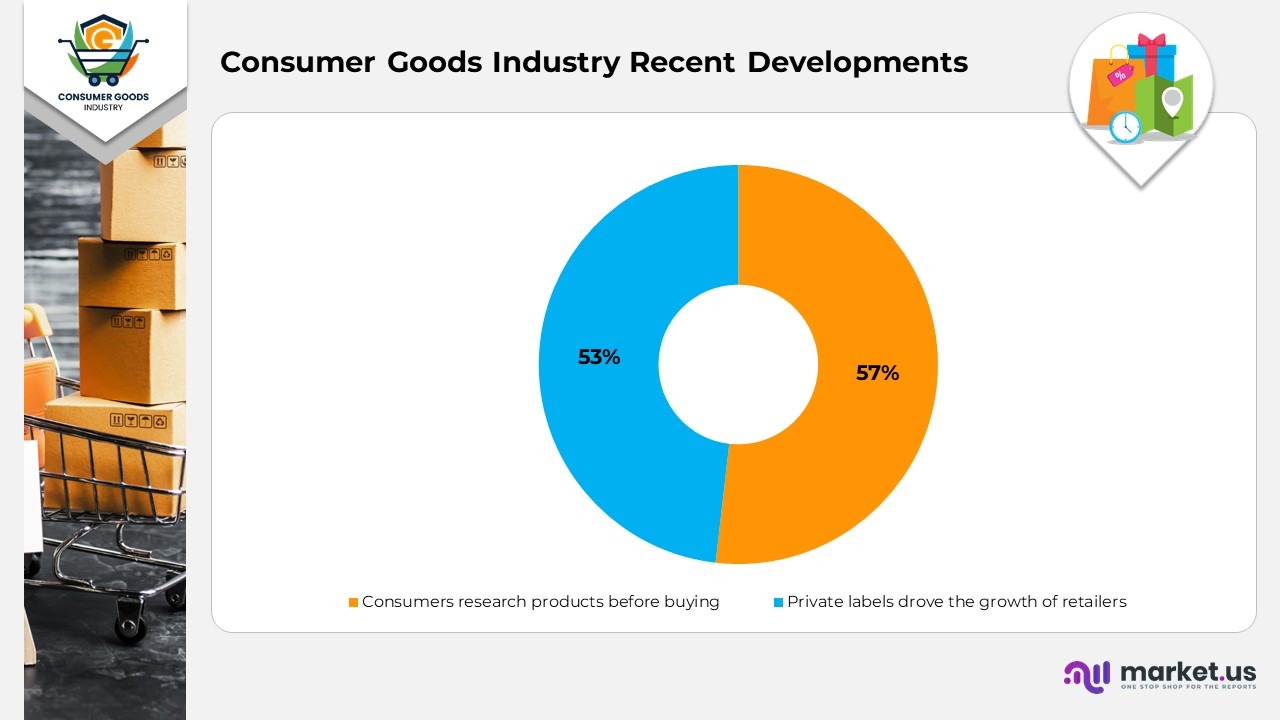

Recent Developments

- In 2024, it was recorded that impulse buying dropped to 18%, while 57% of consumers research products before buying, favouring curated and personalised selection.

- In 2024, private labels drove growth for 53% of retailers, reflecting rising consumer demand for value-driven products.

Consumer Goods Industry Future Predictions

- The sustainable packaging market was expected to expand from 427 million tonnes in 2025 to 519 million tonnes by 2030, with flexible packaging growing at a 6.35% CAGR.

- Retail consolidation in developed markets is expected to reduce major grocery retailers from 4-5 to around 3 by 2030, driven by digital retail shifts.

- Emerging markets are expected to drive 2/3 of global FMCG growth by 2030, with Asia-Pacific leading at 45.6% market share in packaging alone.

Conclusion

The consumer goods sector is a vibrant field influenced by changing consumer preferences, worldwide expansion, and technological progress. Significant trends encompass a robust emphasis on sustainability, the growing impact of digitalization and omni-channel approaches, along with ongoing difficulties posed by inflation and fluctuations in the supply chain. Anticipated growth is particularly notable in emerging markets, driven by elements such as urbanization, increasing income levels, and a youthful population.