Global Zirconium Metal Market Size, Share, And Industry Analysis Report By Type (Nuclear Grade, Industrial Grade), By Application (Nuclear Reactor, Chemical Processing, Military Industry, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173099

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

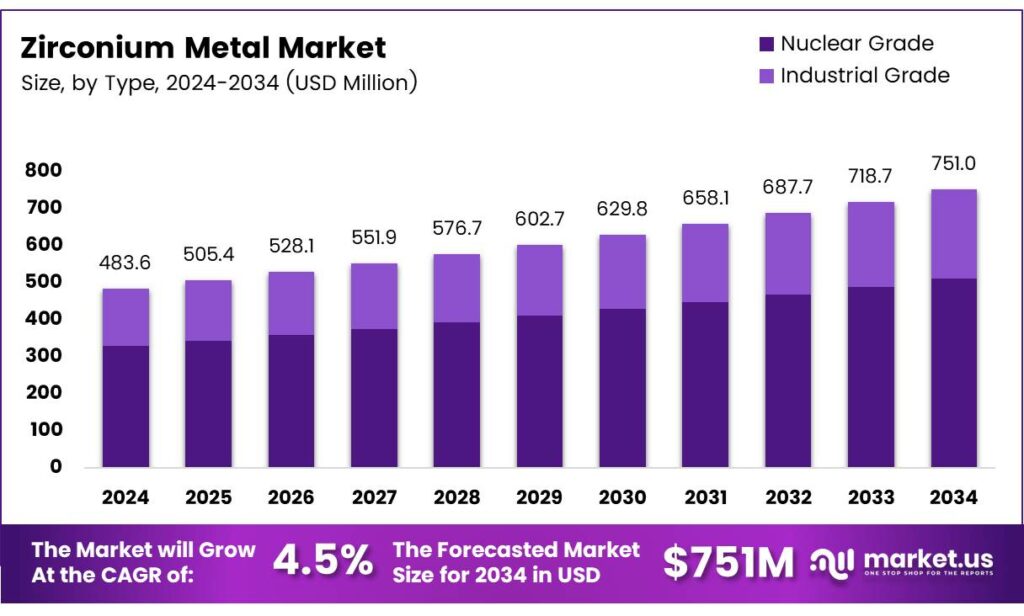

The Global Zirconium Metal Market size is expected to be worth around USD 751.0 million by 2034, from USD 483.6 million in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The Zirconium Metal Market represents the industrial ecosystem producing refined zirconium metal and alloys for nuclear, ceramics, chemicals, and high-temperature applications. Fundamentally, it links mineral extraction, chemical processing, alloy fabrication, and regulated end-use industries. It balances strategic material security with performance-driven demand from safety-critical applications worldwide.

Zirconium metal demand grows steadily because the material offers corrosion resistance, low neutron absorption, and long service life. Consequently, nuclear energy programs, advanced ceramics, and specialty chemical equipment increasingly specify zirconium-based materials. Moreover, supply chains emphasize purity control and traceability, reinforcing long-term contractual procurement models.

- Technologically, zirconia chemistry underpins zirconium metal value creation across industries. Zirconia exists in cubic, tetragonal, and monoclinic phases, influencing mechanical performance. Naturally occurring baddeleyite remains monoclinic, while cubic stability requires additives. Therefore, market-grade cubic zirconia typically contains 87.5% zirconia and 12.5% yttrium oxide, improving thermal shock resistance and toughness, according to materials science literature.

Zirconium metal production remains capital-intensive and tightly regulated. Industrial zirconium alloys originate from zircon through carbo-chlorination at nearly 2000°C, followed by hafnium removal and magnesium reduction. According to the World Nuclear Association, hafnium separation is critical for nuclear compliance, shaping cost structures and entry barriers.

Market opportunities increasingly emerge from downstream application diversification. Zircon and its derivatives serve ceramics, foundries, refractories, and chemicals. According to the U.S. Geological Survey, around 54% of global zircon output is consumed by ceramics, while 14% supports foundry applications and 11–14% feeds refractory uses. These segments ensure demand stability beyond nuclear cycles.

Key Takeaways

- The Global Zirconium Metal Market is projected to grow from USD 483.6 million in 2024 to USD 751.0 million by 2034, registering a 4.5% CAGR during 2025–2034.

- Nuclear-grade zirconium leads the market by type, accounting for a dominant share of 59.3% in 2024 due to strict nuclear safety and purity requirements.

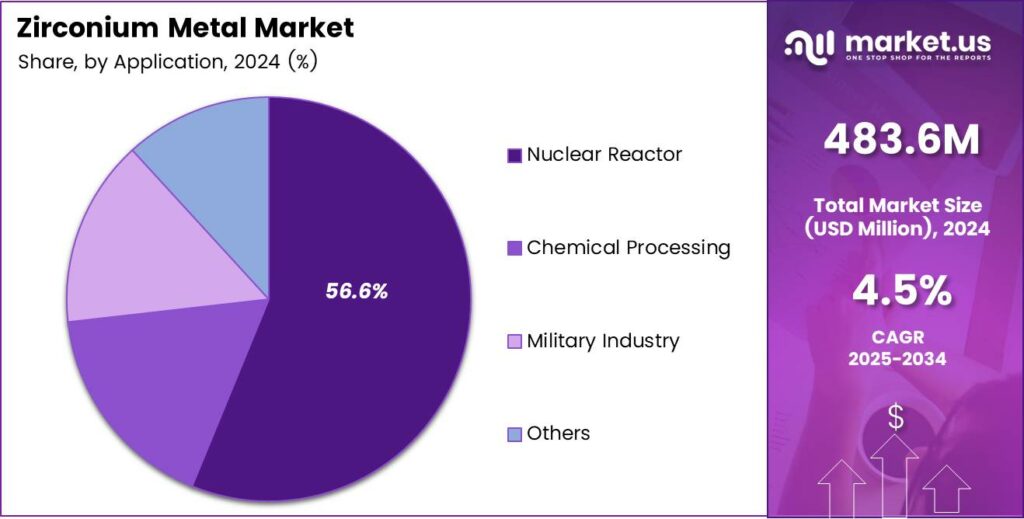

- Nuclear Reactor uses remain the largest segment, holding 56.6% of total demand in 2024, driven by fuel cladding and reactor core needs.

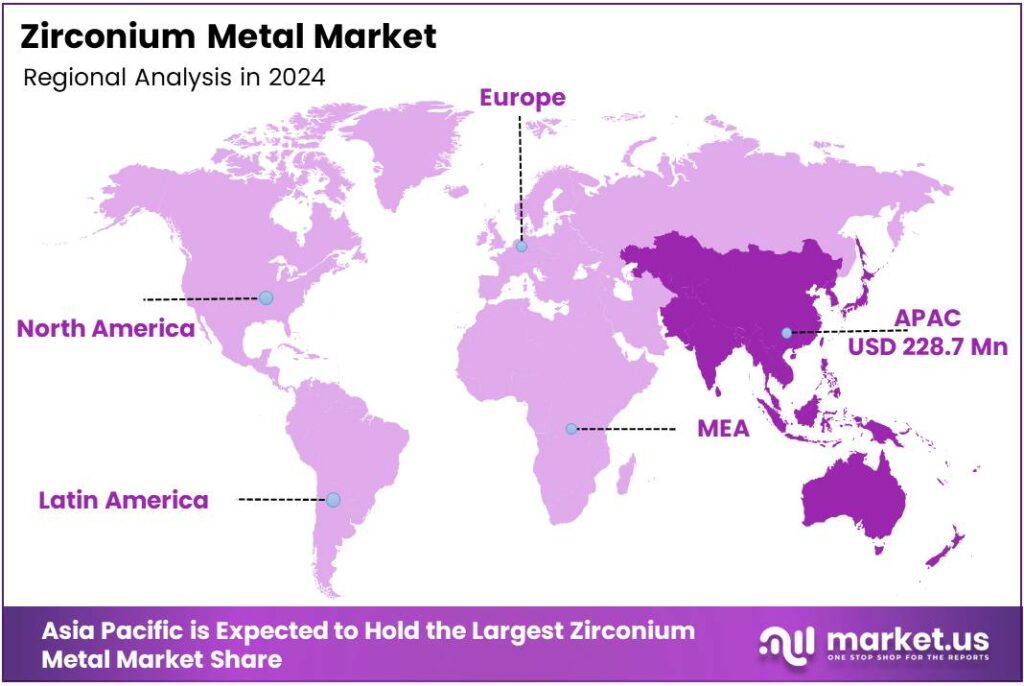

- Asia Pacific is the largest regional market, capturing 47.3% of global demand with a value of USD 228.7 million in 2024.

By Type Analysis

Nuclear Grade dominates with 59.3% due to its critical role in regulated and safety-driven nuclear applications.

In 2024, Nuclear Grade held a dominant market position in the By Type Analysis segment of the Zirconium Metal Market, with a 59.3% share. This segment benefits from rising nuclear power investments and strict material purity requirements. Moreover, its corrosion resistance and neutron transparency support steady demand growth across long-term reactor programs.

Industrial-grade zirconium serves broader manufacturing needs beyond nuclear environments. It supports chemical plants, heat exchangers, and specialized alloys. Although its share remains lower, it grows steadily as industries adopt zirconium for durability and chemical resistance. Consequently, industrial usage expands alongside infrastructure and advanced material manufacturing.

By Application Analysis

Nuclear Reactor dominates with 56.6% as zirconium remains indispensable for reactor fuel assemblies.

In 2024, Nuclear Reactor held a dominant market position in the By Application Analysis segment of the Zirconium Metal Market, with a 56.6% share. This leadership is linked to zirconium’s unique ability to withstand radiation while maintaining structural integrity in reactors.

Its extensive use in fuel rods and cladding systems makes nuclear reactors the largest consumer. Additionally, ongoing reactor maintenance and life-extension projects continue to reinforce steady demand for zirconium metal in this application. The Chemical Processing segment relies on zirconium for equipment exposed to corrosive chemicals.

The Military Industry segment uses zirconium in defense alloys and specialized equipment. Meanwhile, the Others category includes medical, aerospace, and research uses, which collectively support niche demand and broaden the application base. Chemical manufacturers adopt zirconium to improve plant longevity and reduce maintenance risks.

Key Market Segments

By Type

- Nuclear Grade

- Industrial Grade

By Application

- Nuclear Reactor

- Chemical Processing

- Military Industry

- Others

Emerging Trends

Focus on Nuclear Safety and Material Innovation Shapes Market Trends

One key trend in the zirconium metal market is the strong focus on nuclear safety. Utilities and regulators are prioritizing accident-tolerant fuel designs that can perform better under extreme conditions. This is driving innovation in zirconium alloy formulations. Sustainability is also influencing the market. Producers are working to reduce energy use and waste during processing.

- The International Atomic Energy Agency, a typical 1,000 MW nuclear reactor, contains over 200 tons of zirconium-based alloys in fuel assemblies. New reactor designs now aim to extend fuel life beyond 18–24 months, which increases demand for high-purity zirconium metal.

Manufacturers are investing in research to improve oxidation resistance and mechanical strength. These improved materials help enhance reactor safety margins, making zirconium even more valuable in nuclear applications. The growing use of digital quality control in zirconium production. Advanced inspection and testing tools help ensure consistent purity and performance, which is critical for nuclear-grade materials.

Drivers

Rising Demand from Nuclear Power Generation Drives Zirconium Metal Market Growth

The zirconium metal market is strongly driven by its critical role in the nuclear power industry. Zirconium has a very low neutron absorption rate, which makes it ideal for nuclear fuel cladding. As more countries invest in clean and stable energy sources, nuclear power projects continue to expand, directly increasing zirconium demand.

- The U.S. Department of Energy is funding accident-tolerant fuel (ATF) programs that use improved zirconium alloys to withstand temperatures above 1,200 °C during emergencies. In Europe, Orano reports producing over 20,000 km of zirconium alloy fuel tubes annually, reflecting stable long-term demand.

Many governments are extending the life of existing nuclear reactors to meet energy security and carbon reduction goals. These life-extension programs require replacement and maintenance of fuel assemblies, where zirconium alloys are essential. This steady replacement cycle supports long-term market growth.

Restraints

High Production Costs and Limited Raw Material Supply Restrain Market Expansion

One major restraint in the zirconium metal market is its high production cost. The extraction and purification process is complex and energy-intensive. Separating zirconium from hafnium requires advanced technology, which increases manufacturing expenses.

- The World Nuclear Association states that over 440 reactors are currently operating worldwide, with 60+ under construction, each requiring zirconium alloys for core components. This purification can increase production costs by 30–40% compared with industrial-grade zirconium. Limited refining capacity also creates supply risks.

Raw material availability is another challenge. Zirconium is mainly sourced from zircon minerals, which are geographically concentrated. Supply disruptions caused by mining restrictions, export controls, or geopolitical issues can affect material availability and pricing. Strict regulations related to nuclear-grade zirconium further limit supplier flexibility.

Growth Factors

Expansion of Advanced Nuclear Technologies Creates New Growth Opportunities

The development of advanced nuclear technologies presents strong growth opportunities for the zirconium metal market. Small modular reactors and next-generation nuclear systems are gaining interest due to their improved safety and flexible deployment. These systems still require zirconium-based materials for fuel cladding and structural parts.

- Emerging economies are also exploring nuclear power to meet rising electricity demand. New reactor construction in these regions creates fresh demand for zirconium metal, especially for long-term fuel supply contracts. The U.S. Nuclear Regulatory Commission specifies that nuclear zirconium must contain less than 0.01% hafnium, requiring energy-intensive separation.

Beyond nuclear energy, zirconium is finding increased use in chemical processing equipment. Its resistance to acids and high temperatures makes it valuable for reactors, heat exchangers, and piping systems. Growth in specialty chemicals and advanced materials supports this demand.

Regional Analysis

Asia Pacific Dominates the Zirconium Metal Market with a Market Share of 47.3%, Valued at USD 228.7 Million

Asia Pacific leads the zirconium metal market due to strong demand from nuclear energy, ceramics, and advanced material manufacturing industries. In this region, rapid industrialization and government-backed nuclear power expansion continue to support stable consumption. In 2024, Asia Pacific accounted for a dominant share of 47.3%, reaching a market value of USD 228.7 million, driven by long-term infrastructure and energy security investments.

North America represents a mature but strategically important market, supported by nuclear reactor maintenance, chemical processing, and aerospace applications. The region benefits from steady investments in reactor life extension programs and strict material performance standards. Demand growth remains moderate, with focus on high-purity zirconium for safety-critical applications and advanced manufacturing uses.

Europe’s zirconium metal market is shaped by regulatory emphasis on nuclear safety, clean energy transition, and advanced materials research. The region shows consistent demand from nuclear fuel assemblies and industrial alloys. While growth is controlled, long-term decarbonization goals and energy diversification strategies continue to support zirconium consumption across multiple end-use sectors.

The Middle East and Africa market is emerging, supported by gradual investments in nuclear energy programs and industrial diversification initiatives. Zirconium demand remains comparatively smaller but is increasing as countries explore alternative energy sources and high-performance materials. Infrastructure development and import-led consumption define the regional market landscape.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Framatome remains closely tied to nuclear-grade zirconium demand because its fuel-cycle and reactor-services focus keeps attention on materials that can handle long operating cycles and strict safety rules. In 2024, its outlook supports steady procurement of zirconium metal and alloys where corrosion resistance and low neutron absorption are non-negotiable. Framatome benefits when utilities extend plant lifetimes and when new-build programs move from planning into execution, as both trends stabilize long-term material requirements.

CMP JSC is viewed as a specialized supplier position that can benefit from customers seeking diversification in zirconium sourcing and intermediate products. In 2024, reliability, specification control, and delivery discipline matter as much as price, especially for nuclear-adjacent applications. Typically, watch CMP JSC for how it balances capacity utilization with quality assurance, because zirconium value is often determined by purity and consistency rather than volume alone.

ATI Metals is strategically placed where zirconium intersects with high-performance metallurgy, with capabilities that align with aerospace, defense, and energy-grade requirements. In 2024, ATI’s value proposition is strongest when buyers need tight chemistry windows and repeatable processing for demanding environments. From a market viewpoint, its scale and metallurgical know-how can help it serve premium segments, even when broader industrial demand is uneven.

Nuclear Fuel Complex sits in a position where state-linked nuclear programs and fuel supply chains influence zirconium metal usage patterns. In 2024, its role is best read through continuity of nuclear fuel production and the pace of reactor refueling schedules. Focus on how effectively it maintains compliance and throughput, because any disruption can shift zirconium purchasing cycles and ripple across downstream fabricators.

Top Key Players in the Market

- Framatome

- CMP JSC

- ATI Metals

- Nuclear Fuel Complex

- Westinghouse Electric Company

- Liaoning Huagao New Materials Co., Ltd.

- CNNC Jinghuan Zirconium Industry Co., Ltd.

- Sanxiang Advanced Materials Co., Ltd

- VDM Metals

Recent Developments

- In 2025, Framatome, a leader in nuclear-grade zirconium for fuel cladding and zirconium sponge, continues to advance zirconium-based technologies for nuclear applications. Research on fatigue testing of irradiated M5 Framatome cladding tubes was published, highlighting its role in evaluating structural integrity and safety of nuclear fuel rods.

- In 2025, CMP JSC, part of Rosatom’s TVEL Fuel Company, remains one of the top five global companies with proprietary technology for producing zirconium and its alloys, supplying zirconium rolled products to all power and transport reactors in Russia.

Report Scope

Report Features Description Market Value (2024) USD 483.6 Million Forecast Revenue (2034) USD 751.0 Million CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Nuclear Grade, Industrial Grade), By Application (Nuclear Reactor, Chemical Processing, Military Industry, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Framatome, CMP JSC, ATI Metals, Nuclear Fuel Complex, Westinghouse Electric Company, Liaoning Huagao New Materials Co., Ltd., CNNC Jinghuan Zirconium Industry Co., Ltd., Sanxiang Advanced Materials Co., Ltd, VDM Metals Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Framatome

- CMP JSC

- ATI Metals

- Nuclear Fuel Complex

- Westinghouse Electric Company

- Liaoning Huagao New Materials Co., Ltd.

- CNNC Jinghuan Zirconium Industry Co., Ltd.

- Sanxiang Advanced Materials Co., Ltd

- VDM Metals