Global Zero Trust Security Market Report By Component (Solution [Network Security, Cloud Security, Endpoint Security, Data Security, Others], Services), By Authentication Type (Single-Factor Authentication, Multi-Factor Authentication), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Healthcare, Retail and E-Commerce, Government and Defense, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sept. 2024

- Report ID: 127962

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Analysis

- Authentication Type Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

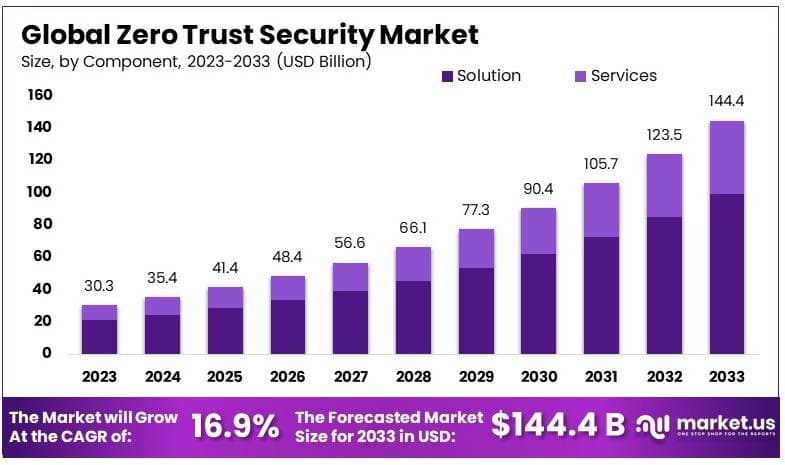

The Global Zero Trust Security Market size is expected to be worth around USD 144.4 Billion by 2033, from USD 30.3 Billion in 2023, growing at a CAGR of 16.9% during the forecast period from 2024 to 2033.

Zero Trust Security is a strategic approach to cybersecurity that eliminates implicit trust in any entity, regardless of whether it is inside or outside the network perimeter. This model operates on the principle of “never trust, always verify,” requiring all users, whether in or outside of the network, to be authenticated, authorized, and continuously validated for security configuration and posture before being granted access to data and applications.

The Zero Trust Security Market is experiencing significant growth driven by the increasing number of cyberattacks and the rising need for compliance with regulatory frameworks. As organizations recognize the insufficiencies of traditional security models in the face of sophisticated cyber threats, the adoption of Zero Trust principles is gaining momentum.

The market’s expansion is further propelled by the widespread adoption of cloud-based services, remote working trends, and digital transformation initiatives. This has created a surge in demand for advanced security solutions that can provide robust protection across diverse environments and complex infrastructures.

The demand for Zero Trust Security solutions is bolstered by the continuous evolution of cyber threats, which compels businesses to enhance their security frameworks. Key growth factors for the Zero Trust Security Market include the rising prevalence of data breaches and cybersecurity incidents, which drive organizations to adopt more effective security measures.

Additionally, stringent compliance requirements across various industries necessitate robust security solutions, thereby fostering the growth of the Zero Trust market. Opportunities within this market are vast, especially as emerging technologies such as the Internet of Things (IoT) and artificial intelligence (AI) integrate with Zero Trust frameworks, offering enhanced security capabilities and new market prospects. This scenario presents lucrative possibilities for market players to innovate and expand their offerings to meet the evolving security needs of modern enterprises.

As a result, Zero Trust Security is gaining traction, with 96% of security decision-makers prioritizing it, and 76% actively implementing it within their organizations. However, the transition to Zero Trust is not without challenges, especially for organizations with hybrid IT architectures. Despite these challenges, the potential benefits, such as a 34% reduction in data breaches and a 32% decrease in cyber incidents, make it an essential investment for forward-thinking companies.

For instance, the average cost of a data breach increased to $4.35 million in 2022, highlighting the financial risks associated with inadequate security measures. As organizations face an average of over 1,000 cyberattacks per week, the demand for comprehensive Zero Trust solutions is set to rise sharply.

Several factors are driving the adoption of Zero Trust Security. The increasing complexity of IT environments, the shift to hybrid work models, and the growing threat landscape are significant contributors. ESG research shows that implementing Zero Trust can lead to a $675k reduction in average security costs.

This cost efficiency, coupled with the reduction in data breaches and cyber incidents, presents a compelling case for adoption. Additionally, the rise in ransomware attacks—up by 33% in 2023—further underscores the need for robust security frameworks. As organizations continue to digitize their operations, the demand for Zero Trust Security solutions is expected to grow, creating significant market opportunities.

Government initiatives and regulations are also playing a critical role in the adoption of Zero Trust Security. Agencies like CISA are actively promoting cybersecurity best practices across critical infrastructure sectors. For example, in 2023, CISA’s “Pre-Ransomware Notification Initiative” provided over 1,000 early warnings, helping organizations preemptively counter ransomware threats.

Additionally, as governments increasingly focus on securing digital infrastructure, investments in Zero Trust solutions are likely to rise. These regulatory and governmental actions are expected to further drive market growth, making Zero Trust Security a central element in national and corporate cybersecurity strategies.

Key Takeaways

- Zero Trust Security Market was valued at USD 30.3 Billion in 2023, and is expected to reach USD 144.4 Billion by 2033, with a CAGR of 16.9%.

- In 2023, Solution dominated the component segment with 68.8% due to the need for comprehensive security measures.

- In 2023, Multi-Factor Authentication led the authentication type segment with 70.6%, driven by increasing security concerns.

- In 2023, On-Premise deployment dominated with 69.5%, preferred for its control over sensitive data.

- In 2023, Large Enterprises led the organization size segment with 68.0%, reflecting their demand for robust security solutions.

- In 2023, IT and Telecommunications dominated the industry vertical segment with 24.9%, driven by the need to secure vast data networks.

- In 2023, North America led the market with 37.1%, driven by high cyber threat levels.

Component Analysis

Solution sub-segment dominates with 68.8% due to its comprehensive offerings in securing various aspects of enterprise IT environments.

In the Zero Trust Security market, the Component segment is divided into solutions and services, with solutions holding the majority share at 68.8%. This dominance is primarily due to the crucial role that solutions play in the architecture of zero trust frameworks, encompassing network security, cloud security, endpoint security, and data security, among others.

These solutions are integral to enforcing the principle that organizations should not automatically trust anything inside or outside its perimeters and instead must verify anything and everything trying to connect to its systems before granting access.

While network security focuses on securing the connections between devices and network resources, cloud security is essential for protecting data stored online from theft, leakage, or deletion. Endpoint security secures end-user devices like computers and smartphones, and data security focuses on protecting data integrity and privacy.

Services, though smaller in market share, are pivotal for the implementation, maintenance, and updating of zero trust security frameworks. They include professional and managed services that help organizations adopt new technologies and ensure their security measures are up-to-date.

The growth of the solutions segment is driven by the increasing complexity of cyber threats and the expansion of enterprise environments to include cloud-based resources and mobile workforces. As businesses continue to evolve digitally, the demand for robust zero trust solutions that can protect diverse and dynamic environments is expected to rise, further strengthening the market dominance of this segment.

Authentication Type Analysis

Multi-Factor Authentication dominates with 70.6% due to its effectiveness in providing robust security checks across multiple layers.

In the Authentication Type segment of the Zero Trust Security market, multi-factor authentication (MFA) takes the lead with a 70.6% share. This prevalence is attributed to MFA’s capability to provide enhanced security by requiring two or more verification factors, which significantly reduces the likelihood of unauthorized access.

Single-factor authentication, although simpler, offers less security as it relies on one method of user verification, which can be easily compromised. MFA enhances security by combining two or more independent credentials: what the user knows (password), what the user has (security token), and what the user is (biometric technology verification).

The adoption of MFA is particularly driven by its ability to thwart common security threats like phishing attacks, credential exploitation, and other forms of cyber attacks that exploit weaker authentication methods. As cyber threats grow more sophisticated, the implementation of MFA is becoming a critical component of zero trust strategies aimed at safeguarding sensitive data and systems.

Deployment Mode Analysis

On-Premise deployment dominates with 69.5% due to its control and security features, which are critical for sensitive.

In the Deployment Mode segment, on-premise solutions lead the market with 69.5%. This dominance is largely due to the high level of control and security offered by on-premise infrastructures, which is particularly important in industries and organizations handling sensitive data, requiring compliance with strict data protection regulations.

Cloud-based solutions are growing in popularity due to their scalability and cost-effectiveness; however, certain organizations prefer on-premise deployments to maintain direct control over their security environments and avoid the vulnerabilities associated with cloud platforms.

The preference for on-premise deployment is especially pronounced in sectors with stringent regulatory requirements, such as government, healthcare, and finance. These sectors often require immediate, on-site access to security systems to manage and respond to threats quickly, which is more feasible with on-premise solutions.

Organization Size Analysis

Large Enterprises dominate with 68.0% due to their capacity to implement comprehensive zero trust security strategies.

In the Organization Size segment, large enterprises hold the majority with 68.0%. Large organizations are typically equipped with the resources necessary to implement comprehensive zero trust security strategies across their extensive and often global operations. These enterprises face significant security challenges due to their size, diversity of operations, and the value of their data, making them prime targets for cyber attacks.

Small and medium-sized enterprises (SMEs), while increasingly adopting zero trust principles, often face constraints in terms of resources and expertise, which can limit their ability to deploy extensive zero trust architectures.

The dominance of large enterprises in this market segment is reinforced by their need to protect vast amounts of sensitive data across multiple locations and platforms, driving the adoption of zero trust models that can provide robust and flexible security solutions.

Industry Vertical Analysis

IT and Telecommunications dominate with 24.9% due to the critical need for robust security measures to protect sensitive data.

In the Industry Vertical segment, IT and telecommunications lead with a 24.9% share. This industry’s dominance in the zero trust security market is driven by the critical need to protect sensitive data and maintain service integrity in an environment characterized by rapid technological advancements and frequent cyber threats.

Other significant industry verticals include BFSI, healthcare, retail and e-commerce, government and defense, each with specific security needs that zero trust security solutions can address. The IT and telecommunications sector, in particular, requires robust security measures to manage and protect the vast amounts of data it handles, making it particularly susceptible to cyber threats and breaches.

As digital transformation continues to be a priority for all sectors, the importance of implementing zero trust security strategies is becoming more widely recognized, driving further adoption across all industry verticals. The ongoing evolution of cyber threats and the increasing reliance on digital platforms are expected to push more industries towards zero trust security solutions to safeguard their critical assets and ensure business continuity.

Key Market Segments

By Component

- Solution

- Network Security

- Cloud Security

- Endpoint Security

- Data Security

- Others

- Services

By Authentication Type

- Single-Factor Authentication

- Multi-Factor Authentication

By Deployment Mode

- Cloud-Based

- On-Premise

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Industry Vertical

- IT and Telecommunications

- BFSI

- Healthcare

- Retail and E-Commerce

- Government and Defense

- Other Industry Verticals

Driver

Rising Cyber Threats and Regulatory Demands Drive Market Growth

The Zero Trust Security market is experiencing robust growth, driven by several key factors. The increasing frequency and sophistication of cyber threats is a primary driver, pushing organizations to adopt more stringent security measures. As traditional perimeter-based security models become inadequate, Zero Trust approaches, which assume that threats could be inside or outside the network, are gaining traction.

Regulatory demands are another significant factor. Governments and regulatory bodies worldwide are introducing stricter data protection laws and compliance requirements. These regulations compel organizations to enhance their security frameworks, leading to greater adoption of Zero Trust models that ensure continuous verification of users and devices.

The shift towards remote work, accelerated by the COVID-19 pandemic, is also contributing to market growth. As employees access corporate resources from various locations and devices, the need for robust, identity-based security systems has become critical. Zero Trust Security provides a framework that secures these diverse environments without compromising user experience.

Additionally, the growing adoption of cloud services is driving demand for Zero Trust solutions. As organizations migrate more of their operations to the cloud, they need security models that protect data and applications in a distributed, multi-cloud environment. Zero Trust Security fits this need by securing all access points, regardless of where they are located.

Restraint

Complex Implementation and High Costs Restraint Market Growth

The growth of the Zero Trust Security market is restrained by several key factors, with the complexity of implementation being a major challenge. Implementing a Zero Trust framework requires a comprehensive overhaul of existing IT infrastructure, which can be a daunting and time-consuming process. This complexity can deter organizations, particularly small and medium-sized enterprises (SMEs), from adopting Zero Trust models, slowing market growth.

High implementation and operational costs are another significant restraint. Deploying a Zero Trust Security solution often involves substantial investment in technology, training, and ongoing maintenance. These costs can be prohibitive for organizations with limited budgets, restricting the market’s expansion primarily to larger enterprises that can afford these expenses.

Additionally, the lack of awareness and understanding of Zero Trust principles among decision-makers can hinder adoption. Many organizations are still unfamiliar with the concept or believe that their existing security measures are sufficient, leading to reluctance in adopting this more advanced security model.

The challenge of integrating Zero Trust Security with legacy systems further complicates its adoption. Many businesses operate on outdated infrastructure, which may not be fully compatible with modern Zero Trust solutions, leading to additional costs and technical difficulties.

Opportunity

Cloud Migration and AI Integration Provide Opportunities

The Zero Trust Security market offers significant opportunities for growth, particularly through the ongoing migration to cloud environments. As businesses increasingly move their operations and data to the cloud, there is a growing need for security solutions that can protect distributed networks. Zero Trust Security, with its focus on securing all endpoints and continuous authentication, is ideally suited to meet these demands, presenting a substantial opportunity for market players.

Another opportunity lies in the integration of artificial intelligence (AI) and machine learning (ML) into Zero Trust frameworks. AI and ML can enhance the capabilities of Zero Trust Security by automating threat detection and response, improving accuracy, and reducing the time to identify and mitigate risks. This technological advancement opens up new possibilities for innovation and differentiation in the market.

The rise of 5G networks also presents a significant opportunity. As 5G enables faster and more reliable connectivity, it also increases the potential attack surface for cyber threats. Zero Trust Security solutions that can secure these next-generation networks will be in high demand, creating opportunities for companies to expand their offerings and capture new market segments.

Challenge

Technological Integration and Skill Shortages Challenge Market Growth

The Zero Trust Security market faces several challenges that hinder its growth, with technological integration being a significant issue. Implementing Zero Trust Security requires seamless integration with existing IT infrastructure, including cloud services, on-premises systems, and various third-party applications. Achieving this level of integration can be complex and resource-intensive, often leading to delays and increased costs.

Skill shortages also present a considerable challenge to the market’s growth. As Zero Trust Security is a relatively new and advanced approach, there is a lack of professionals with the necessary expertise to design, implement, and manage these systems. This shortage can slow down the adoption of Zero Trust models, particularly in regions where cybersecurity skills are already in short supply.

Another challenge is the need for continuous monitoring and management inherent in Zero Trust frameworks. Unlike traditional security models, which rely on perimeter defenses, Zero Trust requires ongoing verification of users and devices. This continuous approach demands robust IT resources and dedicated teams, which can be challenging for organizations to maintain over time.

Finally, resistance to change within organizations can also hinder the adoption of Zero Trust Security. Many businesses are accustomed to traditional security models and may be hesitant to adopt a new, more complex approach, particularly when it involves significant changes to their existing operations.

Growth Factors

Cloud Adoption and Regulatory Compliance Are Growth Factors

The growth of the Zero Trust Security market is driven by several key factors, with cloud adoption being a significant driver. As organizations continue to migrate their operations to the cloud, the need for robust security solutions that can protect data across distributed environments becomes increasingly critical. Zero Trust Security, with its focus on securing all endpoints and continuous verification, is well-suited to meet the demands of cloud-based infrastructures.

Regulatory compliance is another critical growth factor. Governments and regulatory bodies around the world are implementing stricter data protection laws, compelling organizations to enhance their security measures. Zero Trust Security offers a framework that helps businesses meet these regulatory requirements by ensuring that all access to network resources is verified and secure.

The increasing frequency of cyber-attacks is also driving market growth. As cyber threats become more sophisticated and pervasive, organizations are seeking advanced security solutions that can provide comprehensive protection. Zero Trust Security’s approach of assuming no trust and verifying every access request helps mitigate the risks associated with these evolving threats.

Additionally, the rise in remote work is contributing to the growth of the Zero Trust Security market. With employees accessing corporate resources from various locations and devices, traditional perimeter-based security models are no longer sufficient. Zero Trust Security provides a more effective solution by securing all access points, regardless of location.

Emerging Trends

AI Integration and Remote Work Are Latest Trending Factors

The Zero Trust Security market is currently influenced by several trending factors, with the integration of artificial intelligence (AI) being a key trend. AI enhances Zero Trust Security frameworks by enabling more sophisticated threat detection, real-time monitoring, and automated responses to security incidents. This trend is driving the development of more intelligent and adaptive security solutions that can better protect against evolving cyber threats.

The widespread shift to remote work, accelerated by the COVID-19 pandemic, is another significant trend shaping the market. As organizations adopt more flexible work arrangements, there is an increased need for security solutions that can protect remote access to corporate networks. Zero Trust Security, with its emphasis on securing all endpoints and verifying every access attempt, is ideally suited to meet these new demands.

The growing adoption of micro-segmentation is also trending in the market. Micro-segmentation involves dividing a network into smaller, isolated segments to limit the spread of potential breaches. This approach aligns well with Zero Trust principles, which focus on minimizing trust zones and securing each segment of the network individually.

Lastly, the trend towards zero-touch automation is gaining traction. Zero-touch automation allows security processes to be automated without the need for human intervention, reducing the potential for errors and speeding up incident response times. Integrating this trend with Zero Trust Security can lead to more efficient and effective security operations.

Regional Analysis

North America Dominates with 37.1% Market Share

North America leads the Zero Trust Security market with a 37.1% share, totaling USD 11.24 billion. This dominance is driven by heightened cybersecurity threats, robust technological infrastructure, and stringent regulatory compliance requirements.

The region’s market dynamics are shaped by a proactive approach to cybersecurity, with businesses and government entities rapidly adopting Zero Trust frameworks to prevent data breaches. The integration of advanced technologies such as AI and machine learning in cybersecurity solutions further strengthens this market.

The influence of North America in the Zero Trust Security market is expected to grow. With increasing cyber threats and the expansion of IoT and cloud services, the demand for stringent security measures is projected to rise, reinforcing North America’s leading position in the global market.

Regional Mentions:

- Europe: Europe’s Zero Trust Security market is advancing, propelled by GDPR compliance and increasing cyber threats. The region is focusing on enhancing data protection and privacy measures.

- Asia Pacific: The Asia Pacific market is witnessing significant growth in Zero Trust Security due to escalating cyber-attacks and digital transformation initiatives across businesses.

- Middle East & Africa: The Middle East and Africa are developing their Zero Trust Security frameworks, driven by growing digitalization and the need to protect critical infrastructures.

- Latin America: Latin America is gradually adopting Zero Trust Security measures, with an emphasis on protecting against escalating cyber threats and improving regional cybersecurity capabilities.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Zero Trust Security market is driven by key companies that lead the way in cybersecurity innovation and strategic implementation. The top three companies—Microsoft Corporation, Cisco Systems, Inc., and Palo Alto Networks, Inc.—are the most influential in this space.

Microsoft Corporation is a dominant player in the Zero Trust Security market, leveraging its extensive cloud and security portfolio. Microsoft’s strong market impact is due to its integration of Zero Trust principles across its products, including Azure, Office 365, and Windows. Its broad reach and continuous innovation position it as a leader in securing enterprise environments.

Cisco Systems, Inc. holds a significant position, known for its comprehensive approach to network security. Cisco’s Zero Trust solutions, integrated with its existing network infrastructure, offer robust protection across all access points. Its strategic focus on securing hybrid work environments and its vast customer base enhance its influence in the market.

Palo Alto Networks, Inc. is a key player recognized for its advanced cybersecurity solutions. Palo Alto Networks’ Zero Trust approach is embedded in its extensive product suite, offering end-to-end security for enterprises. Its emphasis on automation, AI-driven threat detection, and seamless integration with cloud platforms make it a major force in the market.

These companies lead the Zero Trust Security market with their strategic innovations, comprehensive solutions, and strong customer trust, setting the standard for cybersecurity practices across industries.

Top Key Players in the Market

- Microsoft Corporation

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Okta, Inc.

- Zscaler, Inc.

- CrowdStrike Holdings, Inc.

- Broadcom Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Forcepoint

- Other Key Players

Recent Developments

- SonicWall and Banyan Security: On January 3, 2024, SonicWall acquired Banyan Security to enhance its zero-trust network access (ZTNA) and security service edge (SSE) offerings. This acquisition aims to strengthen SonicWall’s position in providing cloud-based security solutions, particularly in the context of growing hybrid work environments. The integration of Banyan’s technology will support SonicWall’s efforts to replace legacy architectures with more modern, flexible security frameworks.

- NSA: In August 2024, the NSA released guidance on achieving zero-trust security maturity, outlining a structured approach for organizations to enhance their cybersecurity posture. The guidance emphasizes implementing strict access controls, continuous monitoring, and segmenting resources to mitigate threats effectively. This is part of the broader push to adopt zero-trust models across government and private sectors.

- Kyndryl and Cloudflare: On August 2024, Kyndryl and Cloudflare announced a global strategic alliance aimed at driving enterprise network transformation and multi-cloud innovation. The partnership focuses on integrating zero-trust security models into cloud environments, providing businesses with enhanced security, scalability, and resilience as they transition to cloud-based infrastructures.

- Zscaler and Airgap: In August 2024, Zscaler acquired Airgap to bolster its zero-trust security offerings. Airgap’s technology will enable Zscaler to provide more robust network segmentation and enhanced security for remote workforces. This acquisition aligns with Zscaler’s strategy to expand its zero-trust architecture, particularly in response to the increasing complexity of cyber threats.

Report Scope

Report Features Description Market Value (2023) USD 30.3 Billion Forecast Revenue (2033) USD 144.4 Billion CAGR (2024-2033) 16.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solution [Network Security, Cloud Security, Endpoint Security, Data Security, Others], Services), By Authentication Type (Single-Factor Authentication, Multi-Factor Authentication), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Healthcare, Retail and E-Commerce, Government and Defense, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Cisco Systems, Inc., Palo Alto Networks, Inc., Okta, Inc., Zscaler, Inc., CrowdStrike Holdings, Inc., Broadcom Inc., Fortinet, Inc., Check Point Software Technologies Ltd., Forcepoint, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Zero Trust Security Market?The Zero Trust Security Market refers to the market for security frameworks that operate on the principle of "never trust, always verify." This approach ensures that all users, whether inside or outside the network, are continuously authenticated, authorized, and validated before being granted access to applications and data.

How big is the Zero Trust Security Market?The Zero Trust Security Market was valued at USD 30.3 billion and is expected to reach USD 144.4 billion, growing at a CAGR of 16.9%.

What are the key factors driving the growth of the Zero Trust Security Market?Key factors include the increasing incidence of cyber threats and data breaches, the growing adoption of cloud services, and the need for robust security measures in remote work environments. The rising regulatory requirements for data protection also drive the adoption of zero trust security models.

What are the current trends and advancements in the Zero Trust Security Market?Trends include the widespread adoption of multi-factor authentication (MFA), the integration of AI for real-time threat detection and response, and the shift towards cloud-based security solutions. The demand for scalable and flexible security frameworks in hybrid work environments is also increasing.

What are the major challenges and opportunities in the Zero Trust Security Market?Challenges include the complexity of implementing zero trust frameworks and the need for continuous monitoring and management. Opportunities lie in the growing need for secure remote access solutions and the increasing adoption of zero trust models by large enterprises and government agencies.

Who are the leading players in the Zero Trust Security Market?Leading players include Microsoft Corporation, Cisco Systems, Inc., Palo Alto Networks, Inc., Okta, Inc., Zscaler, Inc., CrowdStrike Holdings, Inc., Broadcom Inc., Fortinet, Inc., Check Point Software Technologies Ltd., Forcepoint, and other key players.

Zero Trust Security MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample

Zero Trust Security MarketPublished date: Sept. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Okta, Inc.

- Zscaler, Inc.

- CrowdStrike Holdings, Inc.

- Broadcom Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Forcepoint

- Other Key Players