Global Yeast Infection Diagnostics Market By Instrument Type (Real-time qPCR systems, Point-of-care, Digital PCR (dPCR) systems, High-throughput qPCR platforms, Multiplex/microfluidic qPCR systems), By Application (Infectious disease diagnostics, Oncology & cancer biomarker testing, Genetic/ genomic research and gene expression profiling, Agricultural / animal health testing, Other applications), By End-User (Diagnostic laboratories, Hospitals & clinics, Pharma & biotech companies, and Other end-users), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167436

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

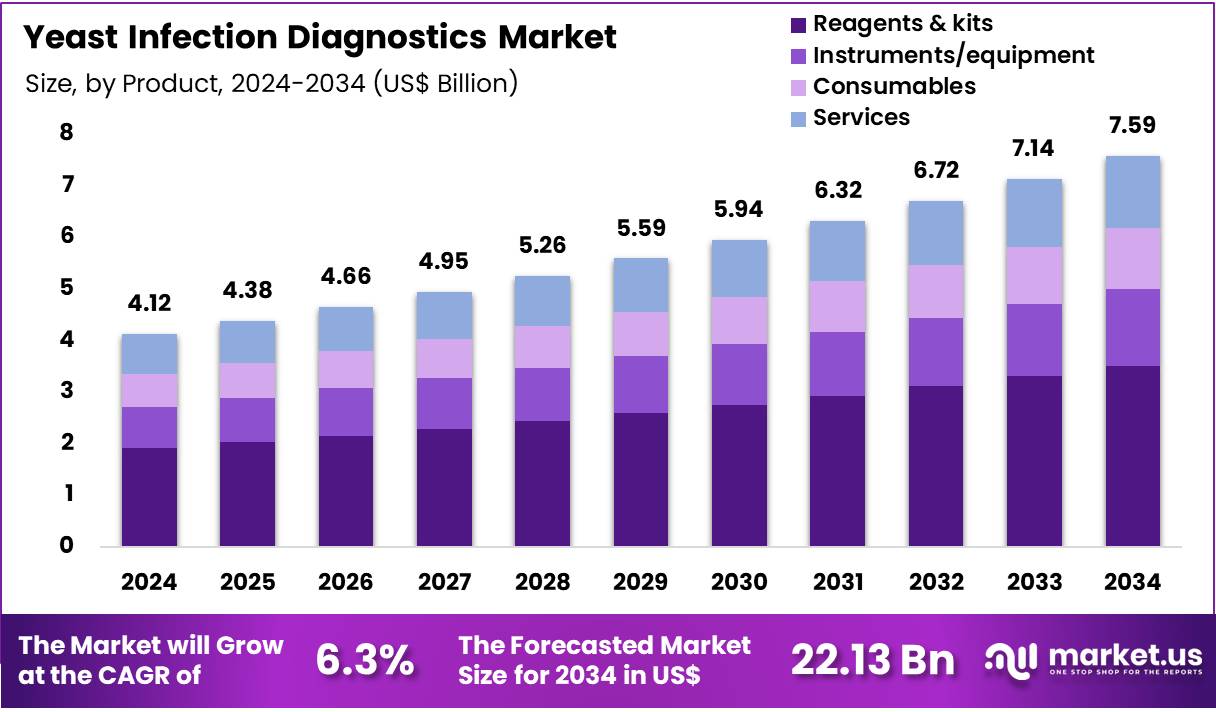

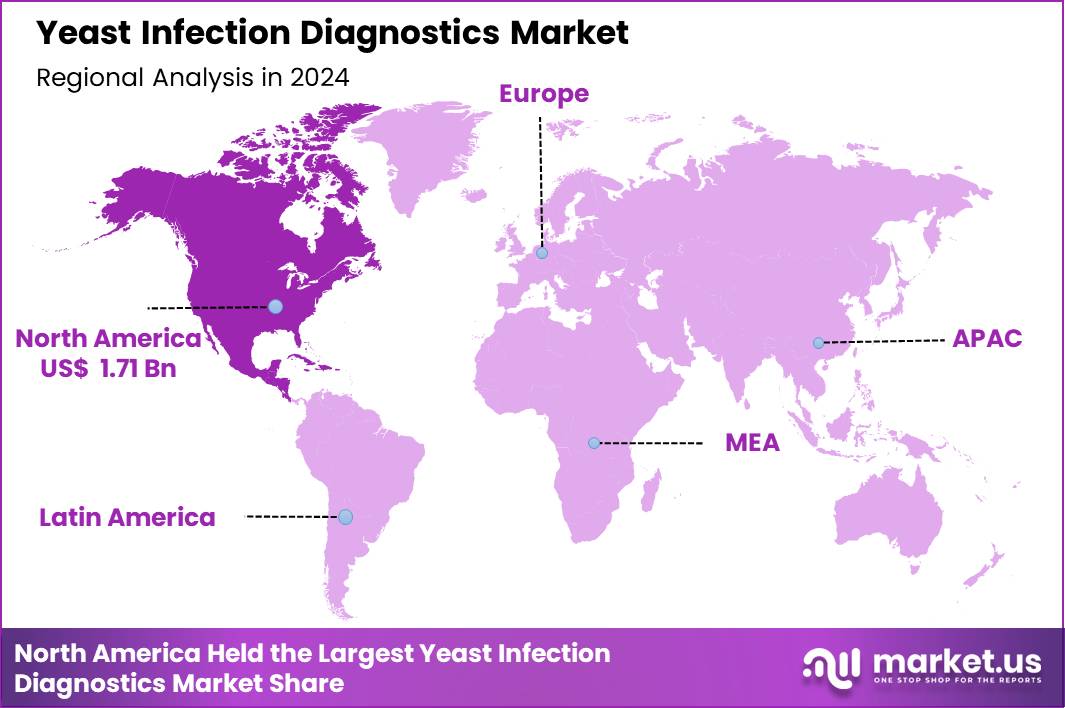

Global Yeast Infection Diagnostics Market size is expected to be worth around US$ 7.59 Billion by 2034 from US$ 4.12 Billion in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.5% share with a revenue of US$ 1.71 Billion.

Candidiasis, commonly referred to as a yeast infection, is a fungal infection primarily caused by Candida species. These yeasts are typically found in the human body as part of the natural microbiome, or in the surrounding environment, without causing harm.

However, when conditions arise that disrupt the body’s balance, such as a weakened immune system or changes in the body’s environment (e.g., hormonal fluctuations, antibiotic use, or other factors), Candida can proliferate and lead to infection. Candidiasis can affect different parts of the body, presenting with a variety of symptoms.

Common forms of candidiasis include vulvovaginal candidiasis (vaginal yeast infection), which impacts the vagina; oral candidiasis (thrush), which affects the mouth and throat; and invasive candidiasis, a serious systemic infection that can involve any organ in the body. Invasive candidiasis is particularly concerning in critically ill and immunocompromised individuals.

Growth is being driven by the increasing prevalence of yeast infections (especially those caused by Candida albicans and other non‑albicans species), rising rates of immunocompromised populations (including HIV/AIDS, cancer and transplant patients), and the need for rapid, accurate diagnostics. The advent of molecular techniques (e.g., nucleic acid amplification testing) and the push toward decentralised or point‑of‑care diagnostics are further enabling market expansion.

A challenge for the market is the reliance on traditional culture‑based diagnostics in many regions, which may delay diagnosis and reduce uptake of advanced diagnostics in low‑ and middle‑income countries. Technological innovation and improved lab infrastructure are creating opportunities, particularly in emerging economies, where awareness of women’s health and preventive diagnostics is growing.

Regionally, North America is expected to hold a significant share, owing to strong healthcare infrastructure and higher adoption of advanced diagnostics. As the diagnostic landscape evolves, providers that offer rapid, sensitive and cost‑effective testing solutions are well‑positioned.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.12 Billion, with a CAGR of 6.3%, and is expected to reach US$ 7.59 Billion by the year 2034.

- The Product segment is divided into Reagents & kits, Instruments/equipment, Consumables, and Services, with Reagents & kits taking the lead in 2024 with a market share of 46.3%.

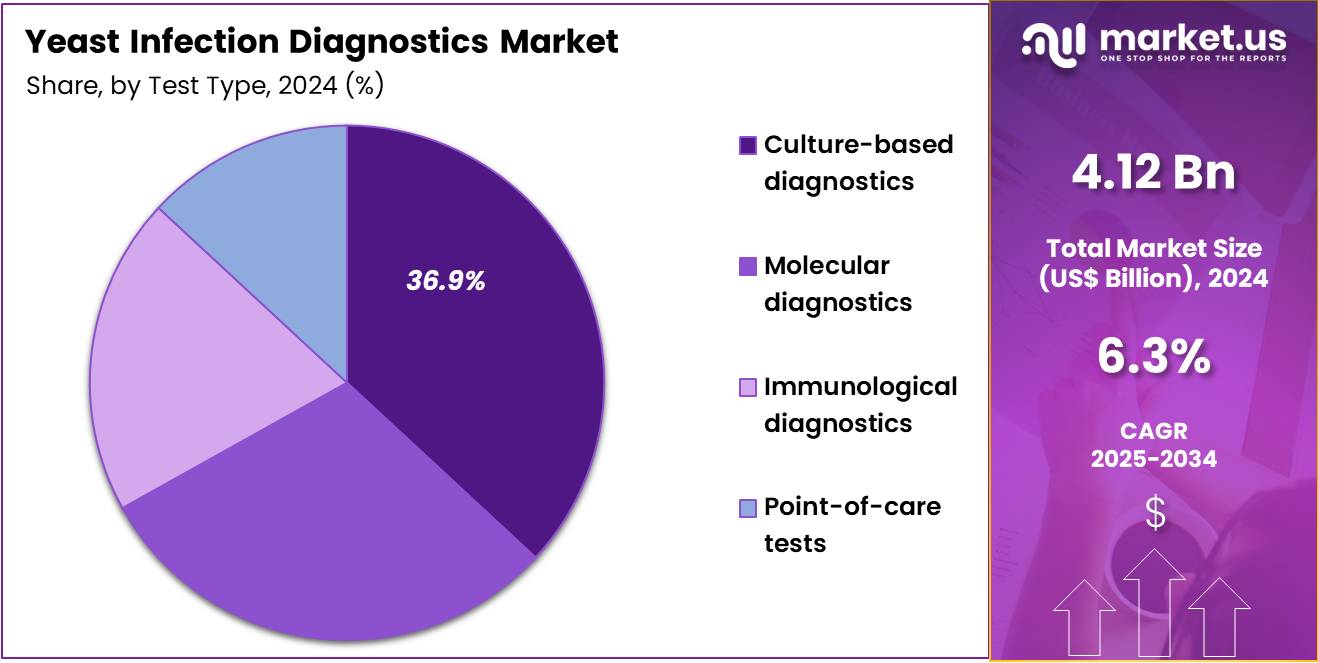

- The Test Type segment is divided into Culture‑based diagnostics, Molecular diagnostics, Immunological diagnostics, and Point‑of‑care tests, with Culture‑based diagnostics taking the lead in 2024 with a market share of 36.9%

- The Indication segment is divided into Vulvovaginal Candidiasis, Trichomoniasis, Chlamydia, Gonorrhea, and Bacterial Vaginosis, with Vulvovaginal Candidiasis taking the lead in 2024 with a market share of 55.2%.

- Considering Pathogen, the market is fragmented into Candida albicans, Candida glabrata, Candida rugosa, and Others, with Candida albicans dominating the market with 71.4% market share in 2024.

- By End‑User, the market is classified into Hospitals, Diagnostic laboratories, Clinics and ambulatory care centers, and Point‑of‑care settings, with Hospitals taking the lead in 2024 with 43.7% market share.

- North America led the market by securing a market share of 41.5% in 2024.

Product Analysis

Reagents & kits dominated the product segment in the Yeast Infection Diagnostics Market with 46.3% market share. This segment is expected to account for the largest share because most diagnostic workflows for yeast infections rely on ready-to-use reagent kits for culture, molecular, and immunological assays.

High test repetition in hospitals and diagnostic laboratories, rising adoption of standardized commercial panels for Candida species identification, and continuous launches of more sensitive and rapid kits are projected to drive its dominance. The recurring nature of reagent consumption compared with one-time instrument purchases further strengthens the revenue contribution of this segment across both developed and emerging markets.

For instance, in March 2023, ELITechGroup MDx LLC (now part of Bruker Corporation) announced availability of their “Candida auris family of reagents” including reagents for C. auris detection, a multiplex of Candida species, and C. auris with fluconazole‑resistance.

Test Type Analysis

Culture-based diagnostics dominated the test type segment in the Yeast Infection Diagnostics Market with accountancy of 36.9% market share. This segment is expected to lead due to its long-established use as the gold standard for identifying Candida species, its cost-effectiveness, and its universal availability across hospitals, public health labs, and private diagnostic centers.

Culture remains essential for species-level identification and antifungal susceptibility testing, which molecular and immunological methods cannot always replace. Examples include Sabouraud dextrose agar for primary isolation, CHROMagar Candida for differentiating C. albicans, C. glabrata, and C. tropicalis, and germ-tube tests for confirming C. albicans.

Culture-based methods also play a critical role in diagnosing recurrent vulvovaginal candidiasis, bloodstream infections, and mixed-pathogen cases where microscopy and rapid tests may miss slow-growing or atypical strains. The reliance on culture in treatment-resistant infections, hospital stewardship programs, and global guidelines further consolidates culture-based diagnostics as the dominant segment.

In July 2024, Hardy Diagnostics announced the release of a new Auris Enrichment Broth for detection of Candida auris from skin and environmental samples. The broth is based on the Centers for Disease Control and Prevention (CDC) Sabouraud Salt Dulcitol (SSD) medium with chloramphenicol and gentamicin to suppress bacterial growth.

Indication Analysis

Vulvovaginal candidiasis covered the largest share in the indication segment in the Yeast Infection Diagnostics Market with 55.2% market share. This indication accounts for the highest diagnostic volume because vulvovaginal yeast infections are extremely common among women of reproductive age, with millions of symptomatic cases reported annually. Recurrent vulvovaginal candidiasis, affecting a significant share of women experiencing four or more infections per year, further drives frequent testing.

According to the CDC, an estimated 75% of women experience at least one episode of vulvovaginal candidiasis (VVC) during their lifetime, and around 40%–45% face two or more episodes. Based on clinical symptoms, microbiological findings, host-related factors, and treatment response, VVC is categorized as either uncomplicated or complicated. Approximately 10%–20% of women develop complicated VVC, which requires more detailed diagnostic evaluation and specialized treatment approaches.

Gynecology clinics, primary care centers, sexual health clinics, and even point-of-care settings rely on culture and microscopy to confirm Candida overgrowth in women presenting with itching, discharge, and pain. Diagnostic demand is strengthened by increasing awareness, high self-referral rates, and the availability of multi-pathogen vaginitis testing panels that simultaneously check for Candida species, bacterial vaginosis, and Trichomonas. The integration of Candida detection into routine reproductive health screenings reinforces the dominance of this indication.

Pathogen Analysis

Candida albicans dominated the pathogen segment in the Yeast Infection Diagnostics Market with largest share of the market in 2024 with 71.4%. This species remains the primary target in clinical testing because it accounts for the majority of mucosal yeast infections such as vulvovaginal candidiasis, oral thrush, diaper rash, and cutaneous candidiasis.

Diagnostic platforms from culture media to biochemical identification tests are optimized to detect C. albicans rapidly, often using tools such as germ-tube assays, CHROMagar plates, and enzyme-based identification systems. Although non-albicans Candida species like C. glabrata, C. parapsilosis, and C. krusei have become more prevalent in complicated cases, C. albicans still represents the dominant pathogen due to its widespread occurrence, predictable treatment response, and strong historical clinical focus.

Its high pathogenicity in both community-acquired and hospital-associated infections ensures its continued dominance in diagnostic testing algorithms.

End‑User Analysis

Hospitals handle a wide spectrum of cases ranging from simple vulvovaginal infections to life-threatening bloodstream infections, making them the largest users of yeast infection diagnostic tests and thus accounting for majority market share of 43.7%. Intensive care units, neonatal wards, oncology departments, and transplant units depend heavily on culture-based diagnostics and antifungal susceptibility tests to manage high-risk patients.

Hospital laboratories typically host advanced identification systems, automated culture platforms, and large-volume incubation facilities that support rapid and accurate testing. For example, blood culture systems in hospitals are critical for diagnosing invasive candidiasis, while gynecology departments generate high testing volumes for vulvovaginal infections.

Although independent diagnostic labs and point-of-care settings are expanding, hospitals continue to dominate due to higher test complexity, larger patient loads, and greater integration with antimicrobial stewardship programs.

Key Market Segments

By Product

- Reagents & kits

- Instruments/equipment

- Consumables

- Services

By Test Type

- Culture‑based diagnostics

- Molecular diagnostics

- Immunological diagnostics

- Point‑of‑care tests

By Indication

- Vulvovaginal Candidiasis

- Trichomoniasis

- Chlamydia

- Gonorrhea

- Bacterial Vaginosis

By Pathogen

- Candida albicans

- Candida glabrata

- Candida rugosa

- Others

By End‑User

- Hospitals

- Diagnostic laboratories

- Clinics and ambulatory care centres

- Point‑of‑care settings

Drivers

Growing prevalence of yeast infections and drug‑resistant strains

The driver is the increasing incidence of yeast (Candida) infections coupled with a rise in antifungal resistance. Case in point: according to a study, the mortality of invasive candidiasis may increase by 20 % for every 12‑hour delay in diagnosis.

Another report notes that non‑albicans species (e.g., Candida auris) are emerging and pose additional diagnostic challenges because many tests and conventional culture methods may mis‑identify them.

The heightened infection rate especially in immunocompromised populations (such as cancer‑treatment, transplant, HIV/AIDS patients) directly pushes diagnostic demand. For example, one review estimated more than 1.5 million deaths annually worldwide from fungal infections, signalling large unmet need.

In this context diagnostics firms see increasing volumes of tests, demand for earlier detection, species‑level identification and resistance profiling, all of which drive the diagnostics market. Additionally, reports for the yeast infection diagnostics market estimate the market size at ~US$470.5 million in 2025 and projected to reach ~US$805.2 million by 2035 (CAGR ~6 %) which reflects the underlying growth potential.

The growing prevalence and complexity of yeast infections thus serve as a fundamental driver for the diagnostics segment.

Restraints

Diagnostic complexity and limited sensitivity of current tests

The restraint arises from the fact that fungal diagnostics (including for yeast) still face significant issues in terms of speed, sensitivity, specificity and infrastructure requirements. One review highlights that many existing tests “work only for a limited range of fungi, are insufficiently accurate and take a long time to obtain results”.

For example, molecular diagnostics in medical mycology face challenges unique to fungi: sample preparation is harder compared to bacteria/viruses, reference sequences are sparse, and turnaround times remain too long in many clinical settings.

For the yeast infection diagnostics market, while growth projections exist, legacy culture‑based diagnostics still dominate in many geographies, creating a barrier to adoption of advanced molecular or point‑of‑care tests. Moreover, in low‑ and middle‑income countries (LMICs) diagnostic infrastructure is weak and laboratory staffing is limited, reducing test uptake and potential volumes. Such limitations slow the pace of market expansion and raise cost‑per‑test constraints. The restraint posed by diagnostic complexity and poor access in many settings thus tempers the market growth.

Opportunities

Expansion in emerging markets and decentralised testing

An important opportunity lies in emerging markets (Asia‑Pacific, Latin America, MEA) and the shift to decentralised testing models (e.g., clinics, point‑of‑care). These markets benefit from rising urbanisation, increased healthcare infrastructure investment, growing awareness of women’s health (where vulvovaginal candidiasis is common) and government initiatives promoting diagnostics access.

Cost‑efficient, scalable reagent‑kit and molecular diagnostics providers have an opportunity to capture volumes. Moreover, decentralisation (moving tests from hospitals to outpatient clinics, mobile labs, even home‑sample kits) offers growth beyond traditional hospital lab settings. Therefore, firms that develop lower‑cost, rapid diagnostics tailored for emerging geographies and decentralised settings are well‑positioned to capture this growth opportunity.

Impact of Macroeconomic / Geopolitical Factors

The impact of macroeconomic and geopolitical factors on the yeast infection diagnostics market is multifaceted and significant. From a macroeconomic perspective, stronger GDP per capita growth and greater tax‑revenue mobilisation in emerging economies are linked to higher public health spending, which supports diagnostics uptake.

For example, a study across 21 emerging economies found that tax revenue and labour‑force participation positively influenced public healthcare expenditure. As such, rising incomes and stronger fiscal capacity enable governments and private payers to invest in advanced diagnostics for conditions including yeast infections, thereby supporting market growth.

Inflation and economic instability, however, can restrain the market. Inflation erodes purchasing power and increases costs of reagents, kits, instruments and consumables, making adoption of newer diagnostics more difficult, especially in low‑ and middle‑income countries. One analysis indicated that healthcare spending is negatively impacted during economic downturns and high unemployment. Thus, diagnostic firms may face pricing pressure and reduced volume growth when macro‑economic conditions deteriorate.

Geopolitical conflicts further impact disease-surveillance programs, increasing reliance on mobile and decentralized molecular testing. Regions facing humanitarian crises often experience higher outbreaks of TB, cholera, measles, and vector-borne infections, creating urgent demand for portable qPCR platforms capable of operating in field conditions.

At the same time, heightened global biosurveillance efforts sparked by emerging pathogens and antimicrobial resistance have encouraged governments to fund national molecular-diagnostics networks. Investments in genomic preparedness, including early detection of zoonotic spillovers, have strengthened qPCR adoption in strategic laboratories.

Latest Trends

Growth of molecular diagnostics and point‑of‑care (POC) testing in yeast infection diagnostics

A clear trend in the market is the migration from culture‑based methods toward molecular assays (PCR, NAAT) and the evolution of point‑of‑care (POC) diagnostics for yeast infections. In a broader fungal diagnostics review, authors noted that point‑of‑care devices and biosensor technologies are emerging frontiers in fungal diagnostics. For example, POC testing for fungal infections is being discussed as a way to enable rapid decentralised diagnosis, particularly in outpatient and low‑infrastructure settings.

Within yeast diagnostics, the growth of multiplex molecular panels (capable of detecting multiple Candida species and resistance markers) and the integration of AI/ML for rapid image‑based identification underscore this trend. As diagnostic turnaround time and species resolution improve, this trend enhances clinical utility (early targeted therapy) and creates differentiation for diagnostics firms. The rise of molecular and POC technologies is therefore a key trend shaping the yeast infection diagnostics market.

Regional Analysis

North America is leading the Yeast Infection Diagnostics Market

North America is currently the dominant region in the yeast infection diagnostics market, supported by the mature healthcare infrastructure, high awareness of fungal-infection diagnostics, and significant R&D investment. For example, a report indicates that the fungal infection diagnosis market in North America accounts for approximately 41.5% of the global market.

North America’s share stems from high adoption of advanced diagnostics (molecular tests, rapid assays), increasing incidence of recurrent infections (such as vulvovaginal candidiasis) and strong insurance/reimbursement systems. The region’s dominance is further reinforced by developed hospital-lab networks, and regulatory pathways that support novel diagnostics.

Thus for companies targeting large value opportunities and premium pricing in the near-term, North America remains the most critical region in the yeast infection diagnostics market. In April 2025, the World Health Organization (WHO) released its first-ever reports highlighting the critical shortage of medicines and diagnostic tools for invasive fungal diseases, underscoring the urgent need for innovative research and development (R&D) to address these gaps.

Fungal infections, including common ones like candida, which causes oral and vaginal thrush, are becoming an increasing public health concern, with growing resistance to current treatments.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia-Pacific region is poised to be the fastest-growing market in the yeast infection diagnostics (and broader fungal diagnostics) segment. Growth is driven by expanding healthcare infrastructure in key markets such as China and India, rising awareness of fungal and yeast infections, growing immunocompromised populations (due to HIV, cancer, diabetes) and increasing access to diagnostic labs.

The region’s large base of untreated or under-diagnosed cases of yeast infections (such as vulvovaginal candidiasis) also presents sizable untapped demand. Therefore, for diagnostics firms seeking high-growth opportunities and market share gains, Asia-Pacific offers favourable dynamics in the medium-term.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Thermo Fisher Scientific Inc., Abbott Laboratories, Siemens Healthineers AG, bioMérieux SA, Bio‑Rad Laboratories Inc., Bruker Corporation, QIAGEN N.V., Cepheid, Meridian Bioscience Inc., DiaSorin S.p.A., Hologic Inc., Randox Laboratories Ltd., Sekisui Diagnostics LLC, Enzo Biochem Inc., and Other key players.

Thermo Fisher offers a broad clinical-microbiology portfolio addressing yeast diagnostics, including its Sensititre YeastOne™ system for antifungal susceptibility of Candida spp. Abbott’s diagnostics business encompasses infectious-disease assays and rapid molecular technologies. Siemens Healthineers delivers laboratory diagnostics solutions including infection-assay portfolios and women’s-health diagnostics.

Top Key Players

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Siemens Healthineers AG

- bioMérieux SA

- Bio‑Rad Laboratories Inc.

- Bruker Corporation

- QIAGEN N.V.

- Cepheid

- Meridian Bioscience Inc.

- DiaSorin S.p.A.

- Hologic Inc.

- Randox Laboratories Ltd.

- Sekisui Diagnostics LLC

- Enzo Biochem Inc.

- Other key players

Recent Developments

- In July 2024, DiaSorin announced that the Simplexa® C. auris Direct kit has received De-Novo authorisation from the Food and Drug Administration (FDA) for use on the LIAISON® MDX platform, enabling direct qualitative detection of C. auris DNA from axilla/groin swabs in patients suspected of colonisation.

- In May 2024, Bosch Healthcare Solutions announced the availability of the world’s first fully automated point-of-care PCR test for C. auris on its Vivalytic® platform. The test provides a result in under one hour, enabling screening of colonised patients and faster outbreak control compared to traditional culture methods taking one to three days.

- In March 2023, T2 Biosystems announced that it intends to expand the test menu for its FDA-cleared T2Dx® instrument by developing a diagnostic test for C. auris. The objective is to leverage rapid detection technology to assist in early identification of this dangerous fungal pathogen, supporting infection control in hospital settings.

Report Scope

Report Features Description Market Value (2024) US$ 4.12 Billion Forecast Revenue (2034) US$ 7.59 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Reagents & kits, Instruments/equipment, Consumables, Services), By Test Type (Culture‑based diagnostics, Molecular diagnostics, Immunological diagnostics, Point‑of‑care tests), By Indication (Vulvovaginal Candidiasis, Trichomoniasis, Chlamydia, Gonorrhea, Bacterial Vaginosis), By Pathogen (Candida albicans, Candida glabrata, Candida rugosa, Others), By End‑User (Hospitals, Diagnostic laboratories, Clinics and ambulatory care centres, and Point‑of‑care settings) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Abbott Laboratories, Siemens Healthineers AG, bioMérieux SA, Bio‑Rad Laboratories Inc., Bruker Corporation, QIAGEN N.V., Cepheid, Meridian Bioscience Inc., DiaSorin S.p.A., Hologic Inc., Randox Laboratories Ltd., Sekisui Diagnostics LLC, Enzo Biochem Inc., and Other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Yeast Infection Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Yeast Infection Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Siemens Healthineers AG

- bioMérieux SA

- Bio‑Rad Laboratories Inc.

- Bruker Corporation

- QIAGEN N.V.

- Cepheid

- Meridian Bioscience Inc.

- DiaSorin S.p.A.

- Hologic Inc.

- Randox Laboratories Ltd.

- Sekisui Diagnostics LLC

- Enzo Biochem Inc.

- Other key players