Global Wine Packaging Boxes Market Market Size, Share, Growth Analysis By Type (Corrugated, Paper, Wooden, Polypropylene, Kraft Paper, Others), By Distribution Channel (Offline Retail, Online Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 152952

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

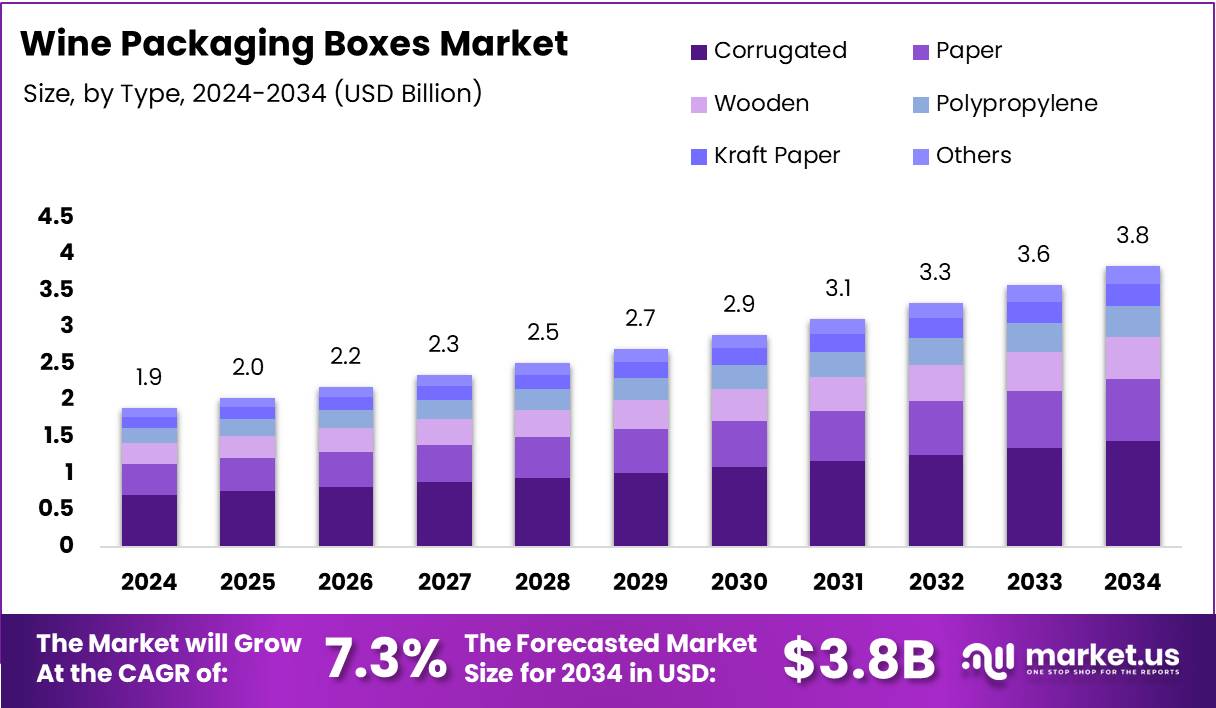

The Global Wine Packaging Boxes Market size is expected to be worth around USD 3.8 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034.

The Wine Packaging Boxes Market is gaining traction as consumer preferences shift toward sustainable and visually appealing packaging solutions. Wine packaging boxes, made of cardboard, paperboard, or corrugated materials, offer both protection and premium brand presentation. They cater to retail shelves, gifting and e-commerce, supporting the wine sector’s evolving demands.

The market is fueled by innovation in packaging design and eco-conscious materials. According to Gleepackaging, a poll conducted by Ipsos for the Paper and Packaging Board reveals that 72% of consumers believe packaging design influences their buying decisions, while 67% consider packaging material during selection. This data underscores packaging’s vital role in the wine industry.

Transitioning to consumer trends, ProWein reports that 53% of wine buyers favor the bag in box format. Available in various sizes from 2.25 to 5 liters, these options offer both convenience and flexibility. As a result, wine producers are adapting to meet this demand, driving consistent innovation in packaging formats and box designs.

Environmental impact is also shaping the market. Packaging Digest highlights that bag in box (BIB) wine packaging has an 84% smaller carbon footprint than traditional glass bottles. This sustainability advantage positions wine boxes as a favorable choice for eco-conscious brands and consumers seeking lower impact alternatives.

Government regulations and environmental policies are encouraging eco-friendly packaging development. Many countries now incentivize recyclable packaging and penalize non compliant materials. This shift supports investment in sustainable wine packaging solutions and accelerates the transition toward greener alternatives, benefiting manufacturers of paper based and biodegradable wine boxes.

Additionally, there is rising government investment in circular economy initiatives. These policies promote biodegradable materials and recycling infrastructure, boosting the demand for recyclable wine packaging boxes. Companies that align with these regulations are well positioned for long term market gain.

Digital printing and customized branding are driving further growth. With shorter production runs and high quality visuals, manufacturers can create limited edition wine packaging boxes that appeal to niche audiences. These innovations enhance shelf visibility and reinforce brand identity.

e-commerce expansion has created fresh opportunities. Wine brands now rely on durable, well designed packaging boxes that ensure product safety during transit while delivering an unboxing experience. As online wine sales rise, packaging plays a crucial role in customer satisfaction and brand loyalty.

Key Takeaways

- The Global Wine Packaging Boxes Market is projected to reach USD 3.8 Billion by 2034, growing at a CAGR of 7.3% from 2025 to 2034.

- In 2024, Corrugated packaging dominated the By Type segment with a 37.5% share, favored for its strength and cost effectiveness.

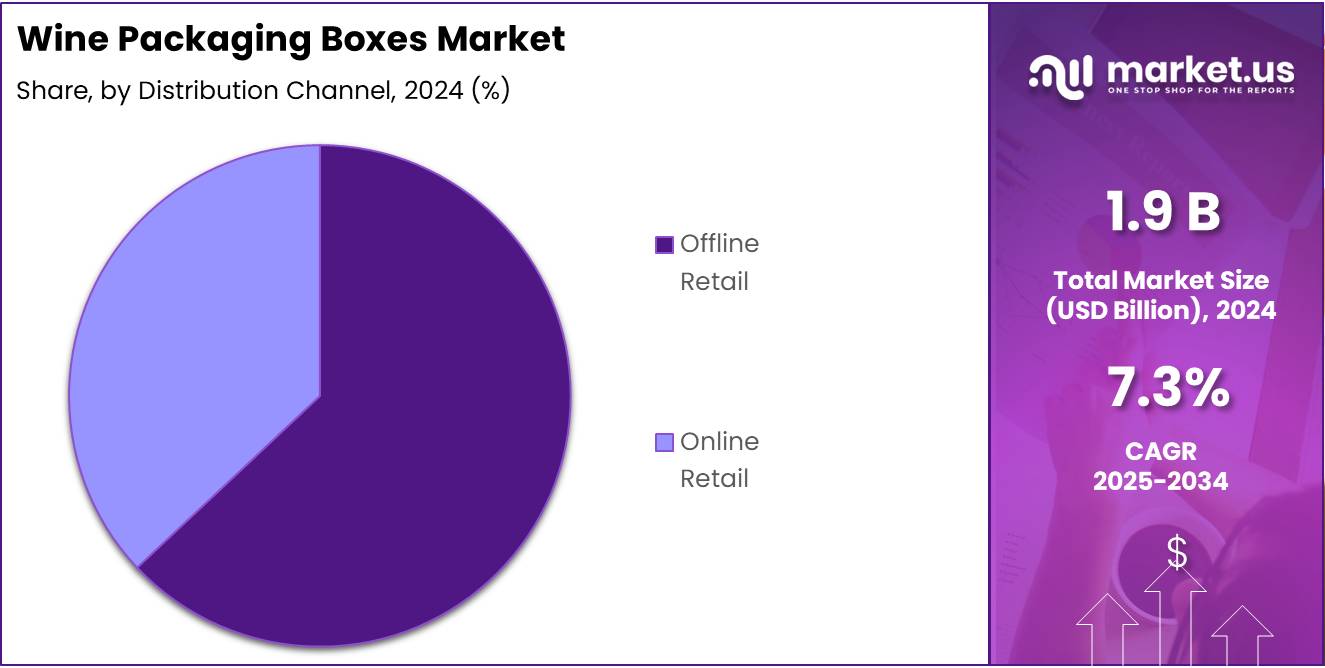

- Offline Retail led the Distribution Channel segment in 2024, reflecting consumer preference for inspecting packaging firsthand.

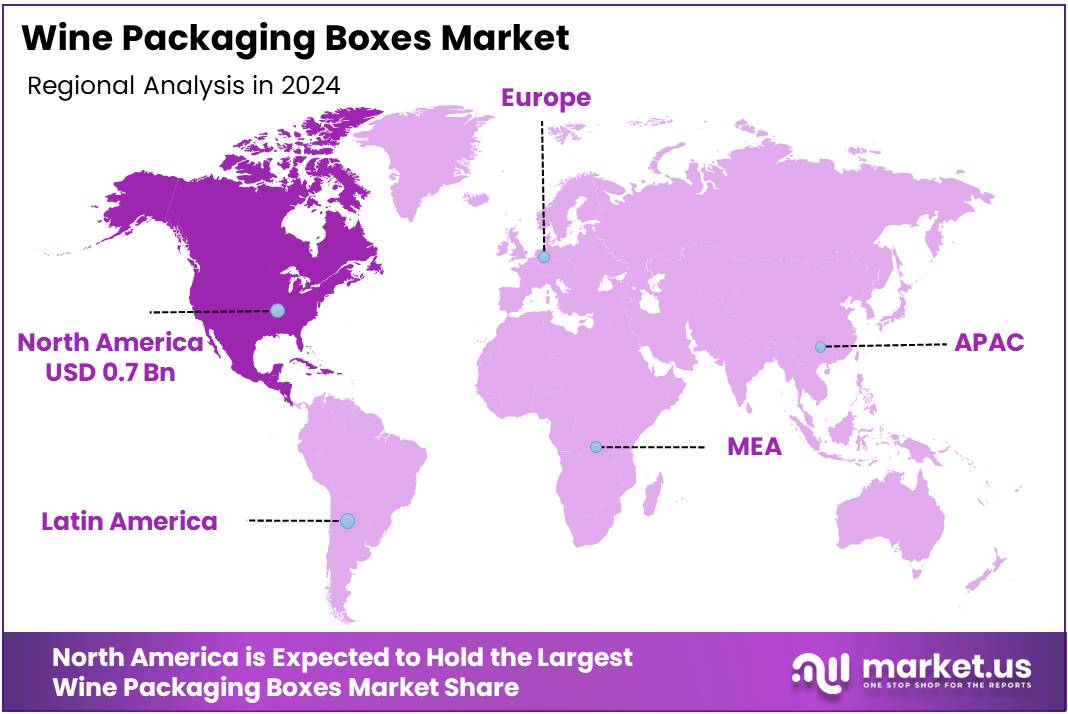

- North America accounted for the largest regional share at 39.8% in 2024, valued at USD 0.7 Billion.

Type Analysis

Corrugated leads with 37.5% due to its durability, versatility and eco-friendly profile.

In 2024, Corrugated held a dominant market position in the By Type Analysis segment of the Wine Packaging Boxes Market, with a 37.5% share. Its wide adoption stems from its excellent structural strength and cost effective nature, making it ideal for protecting wine bottles during transport and storage.

Paper based packaging continues to grow as a lightweight and recyclable option, attracting eco-conscious brands and consumers alike. It stands as a sustainable choice, though its lower strength compared to corrugated limits its use in long distance logistics.

Wooden wine packaging boxes are often used for premium offerings, lending a sense of luxury and tradition. While their market share is smaller, they remain significant in the gifting and high end retail segments.

Polypropylene offers moisture resistance and durability, positioning it as a practical option for markets focused on extended shelf life and rugged transit.

Kraft Paper appeals to the organic and rustic design trends in wine packaging. Its biodegradable qualities support sustainability efforts, though it’s typically used for lighter duty needs.

The Others category includes niche and emerging materials, often experimental or tailored to specific branding needs. While smaller in share, innovation in this segment reflects evolving consumer and environmental demands.

Distribution Channel Analysis

Offline Retail dominates due to customer trust and tactile product experience.

In 2024, Offline Retail held a dominant market position in the By Distribution Channel Analysis segment of the Wine Packaging Boxes Market. Customers continue to value the ability to inspect packaging quality in person, especially for premium or fragile items like wine.

Retailers benefit from established supplier relationships and logistical infrastructure, enabling consistent delivery and reliable quality control. Brick and mortar channels also support last minute purchases and customized packaging requests, adding to their relevance.

While Online Retail is gaining momentum due to its convenience and broader reach, it still faces challenges in conveying physical quality and ensuring safe delivery of delicate packaging materials. Nonetheless, its share is expected to grow with advancements in e-commerce logistics and digital presentation technologies.

Key Market Segments

By Type

- Corrugated

- Paper

- Wooden

- Polypropylene

- Kraft Paper

- Others

By Distribution Channel

- Offline Retail

- Online Retail

Drivers

Rising Global Wine Tourism Boosting Demand for Attractive Packaging

The growth of global wine tourism is playing a key role in driving demand for visually appealing and sturdy wine packaging boxes. Tourists visiting vineyards and wine producing regions are often drawn to wines with premium packaging that reflect the story and quality of the product. As a result, wineries are investing in customized, travel friendly boxes that appeal to international buyers.

The rise of premium and craft wine segments is another strong driver in the packaging box market. Craft winemakers aim to differentiate their products from mass market brands and one way to do that is through tailor made packaging. These custom boxes often feature unique shapes, materials and high quality printing that showcase the exclusivity of the wine inside.

In addition, brand storytelling through packaging design has become increasingly important. Wine producers now use boxes not just to protect the bottle, but to communicate their heritage, production methods and sustainability practices. This storytelling approach builds emotional connections with consumers and strengthens brand loyalty in a competitive market.

Restraints

High Costs Associated with Sustainable and Luxury Packaging Materials

One major restraint in the wine packaging boxes market is the high cost of sustainable and luxury materials. Many eco-friendly options, such as biodegradable plastics or recycled paper, are more expensive to produce and source. These added costs often limit the ability of small and mid sized wine producers to adopt premium packaging solutions.

Another issue affecting the market is the limited shelf life of certain packaging types in varied climate conditions. Boxes made from certain biodegradable or untreated materials may degrade faster in humid or extremely dry environments. This limits their usefulness in long distance shipping or storage.

Handling and logistics challenges also present a barrier to growth. Wine bottles are fragile and require careful packaging to avoid damage. This increases complexity in transport and warehouse handling and adds to overall costs. These logistical issues make it harder for producers to maintain quality while ensuring packaging remains intact through the supply chain.

Growth Factors

Development of Smart Packaging with QR Codes and NFC Technology

The development of smart packaging technologies presents a major growth opportunity in the wine packaging boxes market. By integrating QR codes and NFC chips, brands can offer digital experiences to customers such as virtual tastings, winery tours, or authentication features. This adds value and strengthens customer engagement.

Another growth driver is the rising demand for subscription based wine delivery services. As more consumers opt for regular home delivery, wine brands are focusing on creating durable, branded packaging that enhances the unboxing experience while protecting the product. These recurring deliveries create ongoing packaging needs, expanding market opportunities.

Personalized and limited edition packaging is also gaining traction. Consumers enjoy collecting or gifting uniquely designed wine boxes that offer a sense of exclusivity. This trend is especially strong around holidays, anniversaries, or special events. Customizable designs help wineries stand out in a crowded market and increase customer retention.

Emerging Trends

Adoption of Minimalist and eco-Conscious Packaging Aesthetics

Minimalist and eco-conscious packaging designs are becoming increasingly popular in the wine packaging boxes market. Brands are moving away from bulky or flashy designs in favor of clean, sustainable aesthetics that align with environmentally responsible values. This appeals to younger consumers who prioritize sustainability.

The integration of augmented reality (AR) in packaging is another growing trend. By scanning the wine box with a smartphone, consumers can access immersive experiences such as product stories, food pairings, or behind the scenes winery videos. This not only boosts engagement but also helps educate consumers about the wine.

Finally, recyclable and compostable materials are becoming standard in wine packaging. With rising environmental awareness, both producers and buyers are shifting towards boxes made from paperboard, molded pulp, or other biodegradable materials. These sustainable alternatives are gaining market share as regulators and consumers push for greener options.

Regional Analysis

North America Dominates the Wine Packaging Boxes Market with a Market Share of 39.8%, Valued at USD 0.7 Billion

North America leads the global wine packaging boxes market, accounting for a dominant 39.8% share and reaching a value of USD 0.7 Billion. The region benefits from a well established wine industry, high consumer demand for premium packaging and a strong preference for sustainable and aesthetically appealing packaging solutions. The market is further driven by innovation in design and materials, especially among boutique wineries and premium brands.

Europe Wine Packaging Boxes Market Outlook

Europe represents a mature market for wine packaging boxes, supported by a long standing wine culture and high per capita wine consumption. Sustainability trends and premiumization are key forces shaping packaging demand in this region. Countries like France, Italy and Spain continue to influence packaging aesthetics and functionality, fueling market growth.

Asia Pacific Wine Packaging Boxes Market Trends

The Asia Pacific region is emerging as a fast growing market due to increasing wine consumption and expanding urban middle class populations. Markets such as China, Japan and Australia are seeing a shift in consumer preferences towards branded and attractively packaged wine products. Rising awareness of sustainable packaging is also contributing to increased demand.

Middle East and Africa Wine Packaging Boxes Market Analysis

The Middle East and Africa market is gradually expanding, driven by tourism, hotel industries and the growth of high end retail. Though wine consumption is culturally limited in some areas, demand exists in more liberal and tourist centric regions. Packaging innovation aimed at luxury and gift segments is supporting market development.

Latin America Wine Packaging Boxes Market Insights

Latin America is witnessing steady growth in the wine packaging boxes market, particularly in countries with significant wine production like Argentina and Chile. As export activities increase, there is a rising need for durable, visually appealing packaging that ensures product safety and marketability. The adoption of eco-friendly packaging solutions is also on the rise.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Wine Packaging Boxes Company Insights

In 2024, Wine Packaging Boxes Market continues to witness evolving strategies among key players, each bringing unique strengths to the industry.

Super Wood Touch has distinguished itself through premium wood based packaging that appeals to luxury wine brands. Its commitment to craftsmanship and aesthetic design supports its stronghold in high end markets.

Acorn Paper Products maintains a robust presence in eco-friendly packaging solutions. With growing sustainability trends, the company’s recyclable and biodegradable offerings are gaining popularity among environmentally conscious wine producers.

DS Smith leverages its expertise in corrugated packaging and circular design to cater to both boutique and mass market wine brands. Its focus on innovation and sustainable sourcing reinforces its competitiveness across European and North American regions.

International Paper remains a global heavyweight, using its vast production and logistics infrastructure to meet high volume demands. The company’s strategic partnerships with wineries enhance its role in the mass distribution of cost effective wine packaging.

Together, these players reflect the market’s blend of artisanal appeal and industrial scale, with sustainability and brand differentiation driving growth.

Top Key Players in the Market

- Super Wood Touch

- Acorn Paper Products

- DS Smith

- International Paper

- DIGRAF

- Smurfit Kappa

- MosPackaging

- Golden State Box Factory

- Riverside Paper Co.

- Cross Country Box Co. Inc.

- Sealed Air

- Taylor Box

- ALPPM

- Evergreen

- Spirited Shipper

Recent Developments

- In Jan 2025, Berlin Packaging, the world’s largest Hybrid Packaging Supplier, completed the acquisition of Rixius AG, a German company known for supplying industrial and commercial packaging solutions. This move strengthens Berlin Packaging’s presence in the DACH region and expands its product offering across Europe.

- In Jan 2025, Novvia Group, a global distributor of rigid packaging, entered into a definitive agreement to acquire Saxco, a top supplier of rigid packaging for the food and beverage industries. The acquisition enhances Novvia’s footprint and capabilities across North America.

- In Jan 2025, Berlin Packaging also completed the acquisitions of Sarom Packaging and Romgallia, two prominent packaging companies in Southern and Eastern Europe. These strategic acquisitions further reinforce Berlin’s growth across the European market and its commitment to local service excellence.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Billion Forecast Revenue (2034) USD 3.8 Billion CAGR (2025 2034) 7.3% Base Year for Estimation 2024 Historic Period 2020 2023 Forecast Period 2025 2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Corrugated, Paper, Wooden, Polypropylene, Kraft Paper, Others), By Distribution Channel (Offline Retail, Online Retail) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia and Rest of APAC), Latin America (Brazil, Mexico and Rest of Latin America), Middle East & Africa (GCC, South Africa and Rest of MEA) Competitive Landscape Super Wood Touch, Acorn Paper Products, DS Smith, International Paper, DIGRAF, Smurfit Kappa, MosPackaging, Golden State Box Factory, Riverside Paper Co., Cross Country Box Co. Inc., Sealed Air, Taylor Box, ALPPM, Evergreen, Spirited Shipper Customization Scope Customization for segments, region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wine Packaging Boxes MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

Wine Packaging Boxes MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Super Wood Touch

- Acorn Paper Products

- DS Smith

- International Paper

- DIGRAF

- Smurfit Kappa

- MosPackaging

- Golden State Box Factory

- Riverside Paper Co.

- Cross Country Box Co. Inc.

- Sealed Air

- Taylor Box

- ALPPM

- Evergreen

- Spirited Shipper