Global Wine Logistics Market Size, Share, Growth Analysis By Service Type (Transportation, Warehousing and Storage, Inventory Management, Freight Forwarding, Customs Clearance, Value-Added Services), By Mode of Transportation (Roadways, Railways, Airways, Seaways), By End User (Wineries, Distributors, Retailers, E-commerce Platforms, HoReCa), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145498

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

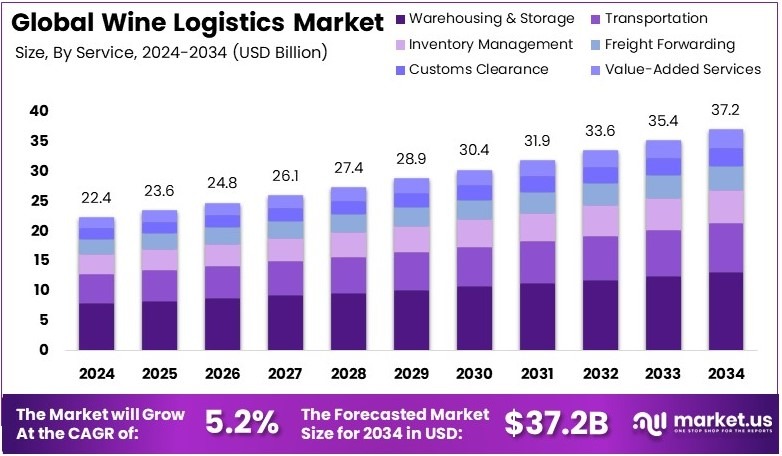

The Global Wine Logistics Market size is expected to be worth around USD 37.2 Billion by 2034, from USD 22.4 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Wine logistics refers to the process of transporting, storing, and managing the supply chain of wine from producers to consumers. It involves careful handling of wine to preserve its quality and ensure timely delivery. Wine logistics includes storage, packaging, and delivery solutions that cater to the specific needs of wine distribution.

The wine logistics market involves the companies and services that manage the transportation, storage, and distribution of wine. This market focuses on ensuring wines are stored and delivered under optimal conditions. As wine production and consumption grow globally, the wine logistics market plays a crucial role in the industry’s supply chain. Wine logistics involves a complex, efficient operation to move wine from vineyards to global markets.

According to World Bank, in 2023, global imports of champagne and sparkling wine reached $3.28 billion, with key importers being the United States, United Kingdom, Japan, Germany, and Singapore. This highlights the increasing demand for wine worldwide, particularly in markets like Asia. For instance, Beaujolais Nouveau is delivered to over 110 countries within just 60 days of harvest, emphasizing the need for well-coordinated logistics, especially in regions with growing wine consumption.

The wine logistics market is expanding as global demand for wine rises, driven by preferences for premium wines. Mediterranean vineyards, which account for 53% of global production, continue to be central to the market. Furthermore, increasing interest from countries like the United States and Asia creates substantial opportunities for wine distributors.

Despite the rapid growth, the wine logistics market is nearing saturation, particularly in mature markets like the United States and Europe. Large logistics companies dominate the space, and competition is high.

However, emerging markets still offer opportunities for companies that can innovate and offer solutions tailored to regional needs. In contrast to these established regions, markets in Asia and South America remain underdeveloped, providing potential for growth. The competition is expected to intensify, and companies will need to invest in technology and streamlined processes to maintain a competitive edge.

Key Takeaways

- The Wine Logistics Market was valued at USD 22.4 Billion in 2024, and is expected to reach USD 37.2 Billion by 2034, with a CAGR of 5.2%.

- In 2024, Warehousing and Storage dominates the service type segment with 35.4%, driven by the need for optimal storage of temperature-sensitive products.

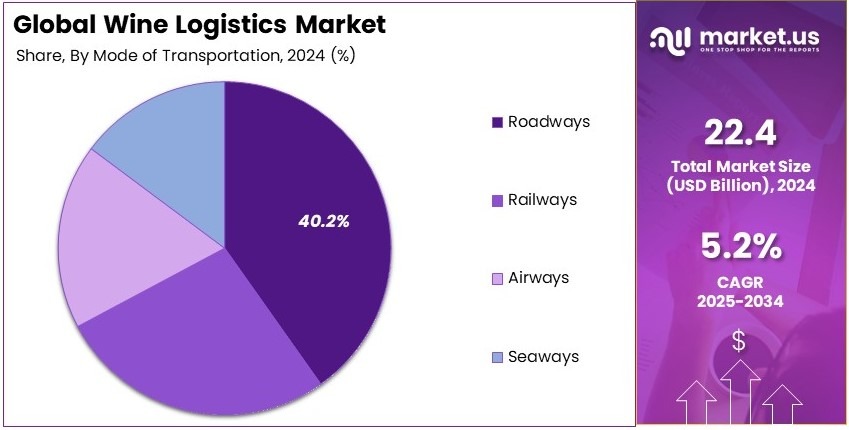

- In 2024, Roadways leads the mode of transportation segment with 40.2% due to its cost-effectiveness and regional accessibility.

- In 2024, Wineries dominate the end-user segment with 41.7%, highlighting their reliance on efficient logistics for distribution.

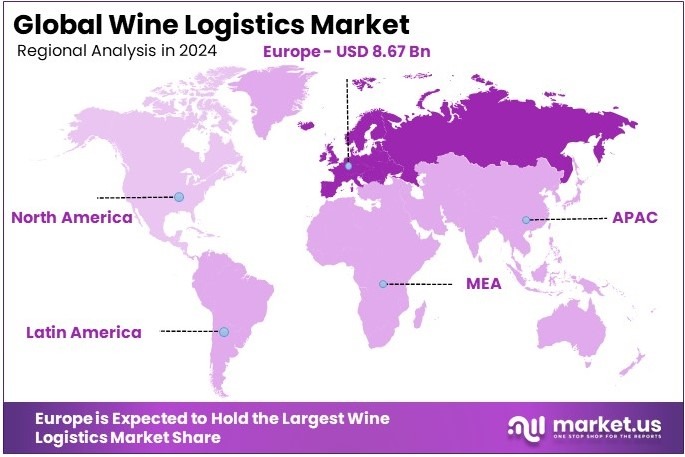

- In 2024, Europe leads with 38.7% and USD 8.67 Billion, attributed to the region’s mature wine production and consumption infrastructure.

Service Type Analysis

Warehousing and Storage sub-segment dominates with 35.4% due to its central role in inventory management and high demand.

The wine logistics market’s By Service Type segment includes key services like transportation, warehousing, inventory management, freight forwarding, customs clearance, and value-added services. Among these, the Warehousing and Storage sub-segment holds the highest share, accounting for 35.4%.

This dominance is largely due to the increased demand for secure storage, temperature control, and managing large inventories. Wineries and distributors prioritize proper storage to preserve wine quality during transportation. As more wineries expand globally, the need for reliable, efficient storage solutions has grown.

Many logistic companies are investing in climate-controlled warehouses to meet this demand. Furthermore, with the rise of e-commerce wine sales, the importance of warehousing systems that can handle fluctuations in stock levels and fast-moving inventories is greater than ever.

On the flip side, Transportation is another vital service in the wine logistics industry. While it contributes to the overall market, its share is lower compared to warehousing. Transportation is a critical part of the process, but it’s only effective when combined with proper storage and inventory systems.

Freight Forwarding and Customs Clearance have smaller market shares, mainly because they serve more specialized logistics needs. Value-Added Services, like packaging and labeling, are also important, but they are niche services with a less significant role in overall growth. Together, these sub-segments contribute to the overall wine logistics ecosystem.

Mode of Transportation Analysis

Roadways sub-segment dominates with 40.2% due to cost-effectiveness and flexibility in short-distance transportation.

In the By Mode of Transportation segment, Roadways leads the market with a dominant share of 40.2%. This sub-segment’s popularity is driven by its ability to provide flexible, cost-effective, and reliable transportation for short-distance wine deliveries.

Road transport can quickly reach local and regional markets, which is essential for the fast-paced wine industry where timely deliveries are a key factor in preserving product quality. It also provides significant control over delivery schedules and routes, which is crucial for ensuring that wine reaches its destination in the best possible condition.

Airways comes second, although with a smaller share. Air freight is often used for international shipments, especially for premium wines where the speed of delivery is critical. However, it comes at a higher cost, making it less favorable for regular shipments.

Seaways and Railways have smaller shares in the market. Seaways are mainly used for bulk shipping and long-distance deliveries, while railways, though reliable, are less flexible compared to roadways. Despite their lower market share, both play an essential role in the wine supply chain for large-volume shipments across long distances.

End User Analysis

Wineries sub-segment dominates with 41.7% due to increasing global wine production and demand for specialized logistics.

The By End User segment shows that Wineries hold the largest market share at 41.7%. This is primarily due to the increasing number of global wineries and their need for specialized logistics services to transport and store wine efficiently.

As the global wine industry expands, wineries face the challenge of reaching international markets and maintaining the quality of their products. Therefore, wineries rely heavily on logistics providers to ensure proper handling, storage, and timely delivery of their products. Wineries’ demand for tailored services such as temperature-controlled transport and secure storage has driven the growth of the logistics market.

Distributors play a critical role by bridging the gap between wineries and retailers. Their involvement in bulk transportation and managing shipments to various regions makes them essential to the wine logistics ecosystem. Retailers handle local deliveries but are increasingly adopting e-commerce models to reach customers directly.

E-commerce platforms have become increasingly important with the rise of online wine sales, making them an essential part of wine distribution. Lastly, HoReCa (hotels, restaurants, and cafes) plays a crucial role in the logistics of wine, especially in regions where dining out is a major part of the wine business.

Key Market Segments

By Service Type

- Transportation

- Warehousing and Storage

- Inventory Management

- Freight Forwarding

- Customs Clearance

- Value-Added Services

By Mode of Transportation

- Roadways

- Railways

- Airways

- Seaways

By End User

- Wineries

- Distributors

- Retailers

- E-commerce Platforms

- HoReCa

Driving Factors

Growth in Global Wine Exports Drives the Market

The growth in global wine exports is a major factor driving the Wine Logistics Market. As wine production increases, more wineries are expanding their reach beyond local markets. This creates a demand for efficient logistics solutions, particularly cold-chain infrastructure, to preserve wine during transportation. Wine needs to be stored and transported at specific temperatures to avoid spoilage.

Efficient logistics ensure that wine reaches international markets in top quality. The rising popularity of wine in emerging markets, coupled with robust export growth from established regions like Europe, further contributes to the increasing need for wine logistics services. With the rise in e-commerce wine deliveries, logistics providers are adapting to meet the growing demand for convenient, on-time deliveries to consumers around the world.

This demand for reliable and temperature-controlled delivery systems ensures that logistics companies continue to innovate and expand to meet the needs of global wine exports. The combination of increased wine production, international distribution networks, and consumer demand for premium wines contributes to the overall market growth.

As the wine export market continues to grow, the need for advanced and efficient logistics solutions will only increase. Logistics companies that invest in innovative technologies and streamlined processes will be well-positioned to meet the rising demands of wine producers and consumers worldwide.

Restraining Factors

Regulatory Complexities and High Costs Restrain Market Growth

Despite the growth in the Wine Logistics Market, several factors act as restraints. One major challenge is the complexity of regulatory compliance across cross-border alcohol shipments. Different countries have varying rules for the import and export of alcoholic beverages, requiring logistics companies to navigate these regulations carefully.

This can lead to delays, additional costs, and even shipment rejections. Moreover, high transportation costs are a significant barrier. Wine requires specialized handling, such as temperature-controlled containers, which can raise shipping expenses. In addition, limited infrastructure in emerging wine-producing regions makes it difficult to expand logistics networks in these areas.

Lastly, the global shipping industry is vulnerable to disruptions, such as port strikes or natural disasters, which can severely impact the timely delivery of wine. These factors create significant challenges that logistics companies must overcome to meet the growing demand in the market.

As a result, logistics providers must find ways to balance operational efficiency, compliance with regulations, and cost-effective transportation to stay competitive in the market. Overcoming these barriers is essential for sustaining growth in the wine logistics sector.

Growth Opportunities

Advanced Technology and Strategic Partnerships Provide Opportunities

There are many growth opportunities in the Wine Logistics Market. One key opportunity is the integration of IoT-enabled tracking systems. These technologies allow logistics providers to monitor temperature and humidity in real-time, ensuring wine remains in optimal conditions during transit.

The development of bonded wine warehouses and specialized fulfillment centers further supports this market, providing secure storage and efficient distribution for wine producers. Another growth opportunity is the use of blockchain technology to provide transparency and verify the provenance of wine, ensuring the integrity of the product from vineyard to consumer.

Strategic partnerships between vineyards and logistics technology providers will enable wineries to improve their logistics operations, reduce costs, and improve service delivery. These technological advancements and collaborations offer the potential to revolutionize the wine logistics industry.

As logistics companies embrace these innovative technologies and strategic alliances, they will be able to meet the growing demand for efficient and reliable wine transport solutions, driving market growth and increasing competitiveness within the industry.

Emerging Trends

Sustainability and Direct-to-Consumer Trends are Latest Market Drivers

Sustainability is a key factor driving the Wine Logistics Market. As consumers and businesses increasingly prioritize environmental responsibility, the demand for green logistics solutions has grown. Wineries are looking for sustainable packaging and logistics options that reduce carbon footprints.

Additionally, the rise in direct-to-consumer (DTC) distribution models allows wineries to bypass traditional retail channels, offering faster and more efficient delivery options to consumers. This trend is supported by the growing adoption of predictive analytics, which helps logistics providers optimize routes and manage inventory more effectively.

Predictive analytics enables wineries to better forecast demand, reduce waste, and improve overall supply chain management. Another trend is the growth of express delivery and last-mile logistics for premium wines. Consumers expect quicker delivery times, particularly for high-end wines, and logistics companies are responding by improving their last-mile services.

These trends are reshaping the wine logistics landscape, encouraging businesses to adopt more sustainable and efficient practices. As these trends continue to evolve, the wine logistics market will see more demand for quick, eco-friendly, and cost-effective delivery solutions for both premium and mass-market wines.

Regional Analysis

Europe Dominates with 38.7% Market Share

Europe holds a commanding 38.7% share of the global Wine Logistics Market with a valuation of USD 8.67 Billion, driven by its strong wine production industries and established global distribution networks. Countries like France, Italy, and Spain are major contributors to this dominance, where wine production and export are integral to the economy. Europe’s sophisticated transportation infrastructure and robust logistics networks play a key role in the region’s leadership.

Key factors contributing to this dominance include the high volume of wine exports from European countries and the presence of leading logistics providers specializing in temperature-controlled transport. Additionally, the European Union’s trade agreements facilitate seamless wine distribution across borders, promoting regional growth. The strong cultural affinity for wine in Europe also boosts demand for efficient wine logistics services.

Market dynamics in Europe benefit from a well-established supply chain that ensures timely and safe delivery of wine to international markets. The need for advanced storage and temperature control solutions remains crucial for maintaining wine quality. The region’s ability to cater to high-end markets with premium logistics services supports its strong position in the global wine logistics market.

Regional Mentions:

- North America: North America holds a 24.8% share of the Wine Logistics Market, driven by robust demand from the U.S. and Canada. The region benefits from high-tech logistics solutions, large-scale wine production in California, and increasing wine consumption.

- Asia Pacific: Asia Pacific captures 18.3% of the market, with countries like China and Japan showing rapid growth in wine consumption and import demand. The region is investing in modern logistics infrastructure to support expanding wine markets.

- Middle East & Africa: The Middle East & Africa account for 8.1% of the market, with increasing wine consumption in countries like South Africa and emerging demand in regions like the UAE. Investments in logistics are focused on handling growing imports and storage needs.

- Latin America: Latin America holds 10.1% of the market, with countries like Argentina and Chile being key wine producers. The region is seeing steady growth in wine exports and logistical improvements to support international distribution.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Wine Logistics Market is driven by several key players that provide specialized logistics solutions to ensure the safe and timely delivery of wine products across the globe. Among the top companies, JF Hillebrand, DHL Supply Chain, DB Schenker, and Kuehne + Nagel stand out due to their extensive experience in the wine logistics industry and their ability to offer a comprehensive suite of services tailored to the needs of the wine sector.

JF Hillebrand is a global leader in wine logistics, specializing in the transportation and storage of wine. The company offers temperature-controlled solutions, which are essential for maintaining the quality of wine during shipping. JF Hillebrand’s network of warehouses and distribution centers worldwide ensures a seamless supply chain for wineries and distributors.

DHL Supply Chain, a part of Deutsche Post DHL Group, leverages its extensive global logistics network to serve the wine industry. With a focus on end-to-end solutions, DHL provides services such as inventory management, warehousing, and temperature-controlled transportation. The company’s advanced technology and supply chain visibility tools allow it to meet the specific demands of the wine logistics market.

DB Schenker is another major player, offering global logistics services with a strong emphasis on sustainability and efficient transportation. DB Schenker provides integrated logistics services, including customs clearance, warehousing, and freight management, ensuring wine is delivered efficiently and in optimal condition.

Kuehne + Nagel is renowned for its comprehensive wine logistics solutions, offering services such as wine storage, handling, and distribution. With an extensive global network and expertise in temperature-sensitive logistics, Kuehne + Nagel supports the wine industry’s growing demands, particularly in emerging markets.

These companies, with their specialized services and global reach, play a crucial role in ensuring the smooth and efficient flow of wine across international markets, meeting the increasing demand for quality wine logistics solutions.

Major Companies in the Market

- JF Hillebrand

- DHL Supply Chain

- DB Schenker

- Kuehne + Nagel

- FedEx Logistics

- UPS Supply Chain Solutions

- Wine Logistics International

- Mainfreight

- Bolloré Logistics

- CMA CGM Group

Recent Developments

- Alba Wheels Up and Southfield Capital: On March 2025, Alba Wheels Up and Southfield Capital’s joint venture, Cobalt Wine Logistics, acquired North Coast Logistics Inc., enhancing its transportation capabilities in the wine and spirits logistics sector.

- Full Glass Wine Co.: On April 2024, Full Glass Wine Co. secured a $14 million Series A funding round led by Shea Ventures and acquired Bright Cellars, a subscription-based wine service. These moves position the company to exceed a revenue run rate of $100 million in 2024.

Report Scope

Report Features Description Market Value (2024) USD 22.4 Billion Forecast Revenue (2034) USD 37.2 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Transportation, Warehousing and Storage, Inventory Management, Freight Forwarding, Customs Clearance, Value-Added Services), By Mode of Transportation (Roadways, Railways, Airways, Seaways), By End User (Wineries, Distributors, Retailers, E-commerce Platforms, HoReCa) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape JF Hillebrand, DHL Supply Chain, DB Schenker, Kuehne + Nagel, FedEx Logistics, UPS Supply Chain Solutions, Wine Logistics International, Mainfreight, Bolloré Logistics, CMA CGM Group, Hellmann Worldwide Logistics, VinLog by Kuehne + Nagel, DSV Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- JF Hillebrand

- DHL Supply Chain

- DB Schenker

- Kuehne + Nagel

- FedEx Logistics

- UPS Supply Chain Solutions

- Wine Logistics International

- Mainfreight

- Bolloré Logistics

- CMA CGM Group