Global Wine Cooler and Chest Freezer Market Size, Share, Growth Analysis By Product Type (Wine Coolers, Chest Freezers), By Capacity (Less than 100 Liters, 100–200 Liters, 200–300 Liters, Above 300 Liters), By Installation Type (Freestanding, Built-in or Integrated), By End User (Residential, Commercial, HoReCa), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145505

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

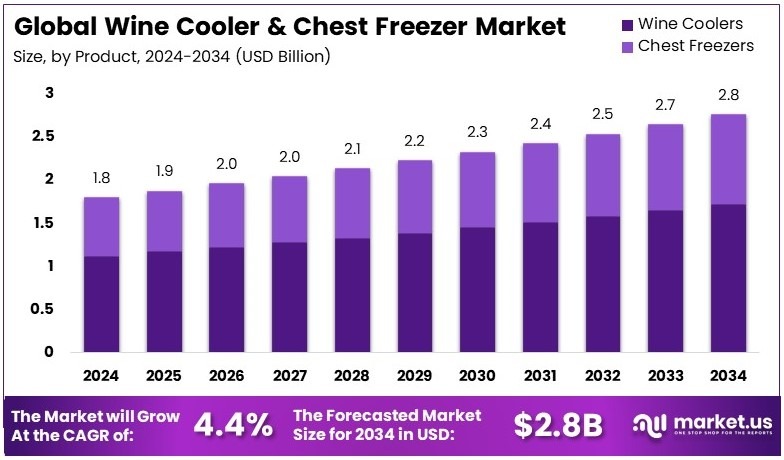

The Global Wine Cooler and Chest Freezer Market size is expected to be worth around USD 2.8 Billion by 2034, from USD 1.8 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

A wine cooler and chest freezer are appliances designed to store wine at optimal temperatures. Wine coolers maintain a stable temperature to preserve wine, while chest freezers are used to freeze wines or store them for longer periods. Both products ensure the wine remains in perfect condition for consumption.

The wine cooler and chest freezer market includes products used for storing and preserving wine. As wine consumption increases globally, so does the demand for these storage solutions. The market features various models, including both small wine coolers for personal use and larger systems for commercial purposes.

The wine cooler and chest freezer market is seeing significant growth due to rising home wine consumption. According to a 2023 report, 42% of homeowners in the United States upgraded their kitchens, with wine coolers being one of the top five integrated appliances. This indicates a growing demand for home wine storage solutions.

As wine tourism continues to thrive, there are further opportunities for wine coolers and chest freezers. In Italy, the value of wine tourism reached €2.9 billion in 2024, with a 16% increase from the previous year. Consumers’ willingness to spend on wine-related experiences drives demand for wine storage solutions, especially in tourism-heavy regions.

The market is becoming more competitive, with both large and small players vying for consumer attention. On one hand, larger brands invest in advanced cooling technologies. On the other hand, smaller, more affordable wine storage options appeal to individual consumers. This competition drives innovation in product features and affordability, creating a dynamic marketplace.

Key Takeaways

- The Wine Cooler and Chest Freezer Market was valued at USD 1.8 Billion in 2024, and is expected to reach USD 2.8 Billion by 2034, with a CAGR of 4.4%.

- In 2024, Wine Coolers dominate the product type segment with 62.4%, due to increased consumer interest in wine storage solutions.

- In 2024, 100–200 Liters leads the capacity segment with 45.3%, offering the ideal volume for residential wine cooling needs.

- In 2024, Freestanding dominates the installation type with 53.2%, favored for its flexibility and ease of integration into homes.

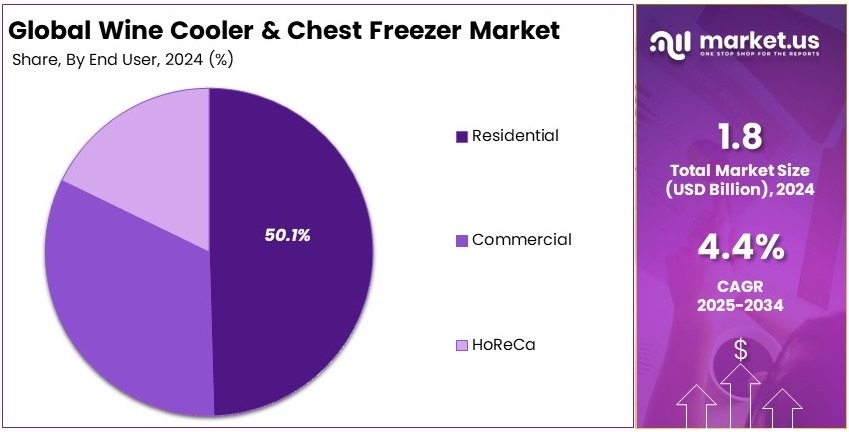

- In 2024, Residential leads the end-user segment with 50.1%, reflecting the growing home consumption trend for wine.

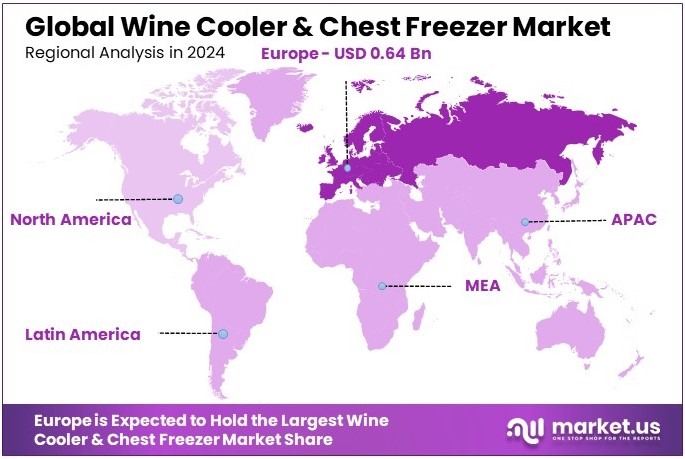

- In 2024, Europe leads with 35.8% and USD 0.64 Billion, supported by high wine consumption rates and demand for wine preservation appliances.

Product Type Analysis

Wine Coolers sub-segment dominates with 62.4% due to high demand in residential and commercial settings.

The By Product Type segment in the wine cooler and chest freezer market includes Wine Coolers and Chest Freezers. Among these, Wine Coolers hold the largest market share at 62.4%. Wine coolers are designed specifically to store and chill wine at optimal temperatures.

The demand for wine coolers has increased in both residential and commercial settings as people become more wine-conscious and want to preserve the quality of wine. Residential wine coolers cater to wine enthusiasts, offering a sleek and temperature-controlled storage solution for home use. In commercial settings, wine coolers are used in restaurants and bars, ensuring wines are kept at the ideal serving temperature.

On the other hand, Chest Freezers make up the remaining 37.6%. Chest freezers are used primarily for long-term storage of wine, particularly in regions where wines need to be stored in colder environments for preservation.

While they have a smaller share, chest freezers are still popular for storing bulk wine or for wineries that need to store large quantities. These freezers are known for their large capacity and efficiency in freezing and storing products at low temperatures. They are commonly used in commercial spaces but have less appeal for residential use compared to wine coolers.

Capacity Analysis

100-200 Liters sub-segment dominates with 45.3% due to its versatility in both commercial and residential applications.

In the By Capacity segment, the 100–200 Liters sub-segment holds the dominant share at 45.3%. This capacity range offers a perfect balance between size and space efficiency, making it ideal for both commercial and residential settings.

For homes, a 100–200 liter wine cooler is large enough to store an impressive collection of wine bottles while still fitting comfortably in most living spaces. In commercial establishments like restaurants and hotels, these units offer an efficient solution for storing a variety of wines without taking up excessive space. This versatility has driven the segment’s dominance in the market.

The Less than 100 Liters category holds 30.2%. These smaller coolers are mostly used in residential settings, where space is limited. They cater to casual wine drinkers who do not need to store large quantities.

200–300 Liters capacity coolers account for 15.5%, appealing to larger households or small commercial setups. They offer more storage but may require larger spaces. Above 300 Liters holds the smallest share at 8.9%, mainly used for high-volume commercial purposes or wineries that require significant storage capacity. These large units are less common in residential environments due to their size and power consumption.

Installation Type Analysis

Freestanding sub-segment dominates with 53.2% due to flexibility and ease of installation in various settings.

In the By Installation Type segment, Freestanding wine coolers dominate with 53.2%. These units are standalone and do not require special installation, making them highly versatile. Freestanding wine coolers are easy to move, which is an attractive feature for both residential and commercial customers.

Their flexibility allows them to be placed anywhere in a home or business, providing wine enthusiasts with convenient storage. Additionally, freestanding models come in various sizes, allowing customers to choose one based on their specific needs. This ease of use and placement has made freestanding coolers the most popular choice.

Built-in / Integrated units make up the remaining 46.8%. Built-in coolers are designed to be integrated into cabinetry or kitchen units, offering a sleek, seamless look. They are more commonly found in high-end residential kitchens or commercial settings where aesthetic appeal is important.

These units take up less floor space, offering a cleaner, more organized look but require precise installation. Although they are popular in upscale environments, their higher cost and the need for specialized installation limit their market share compared to freestanding units.

End-User Analysis

Residential sub-segment dominates with 50.1% due to the increasing popularity of wine storage at home.

In the By End-User segment, Residential wine cooler and chest freezer use holds the dominant share at 50.1%. The growing interest in wine among consumers has led to a rise in home wine storage solutions. As more people develop a taste for wine, they seek ways to store it properly.

Residential wine coolers are often designed to fit in kitchens, living rooms, or wine cellars, providing homeowners with an efficient and stylish way to store wine at the perfect temperature. This trend is fueled by the increasing number of wine enthusiasts who prefer keeping their wine at home rather than purchasing it at a bar or restaurant.

Commercial use accounts for 30.8%, as wine coolers are commonly found in restaurants, bars, and hotels. These establishments need wine coolers to store wine at optimal temperatures for serving. HoReCa (Hotel, Restaurant, and Café) establishments also use wine coolers to maintain the quality of their wine offerings.

Finally, HoReCa accounts for 19.1%, as these locations need reliable cooling systems to store large quantities of wine in busy commercial environments. While residential use dominates, commercial spaces play an important role in ensuring consistent demand for wine coolers and freezers.

Key Market Segments

By Product Type

- Wine Coolers

- Chest Freezers

By Capacity

- Less than 100 Liters

- 100–200 Liters

- 200–300 Liters

- Above 300 Liters

By Installation Type

- Freestanding

- Built-in / Integrated

By End User

- Residential

- Commercial

- HoReCa

Driving Factors

Rising Wine Consumption Drives Home Cooler Demand

The growing consumption of wine at home is one of the main factors driving the Wine Cooler and Chest Freezer Market. As wine culture continues to expand, more consumers are seeking ways to store and chill wine at the ideal temperature in their homes. This trend is especially evident among wine enthusiasts who prefer maintaining the quality of their wine for personal enjoyment. As a result, there is increasing demand for consumer-grade coolers that can offer the right temperature and storage conditions.

In addition, the demand for temperature-controlled wine storage is rising among connoisseurs who value the preservation of their wine collection. These wine lovers seek advanced cooling systems that can maintain precise temperatures to protect the integrity and flavor of their wines. With a growing number of people becoming wine collectors, there is an increasing preference for high-quality, specialized wine coolers.

The growth of wine tourism and cellar-door retail also plays a role in expanding commercial installations. As more wineries invest in visitor experiences and on-site wine purchases, they need proper storage solutions. Commercial wine coolers and chest freezers are essential for these wineries to store and showcase their products, ensuring quality while accommodating customer needs.

Restraining Factors

High Costs and Space Limitations Restrict Market Growth

While the demand for wine coolers is increasing, several factors restrain the market’s growth. One of the major constraints is the high product cost compared to regular refrigeration appliances. Wine coolers, especially those with advanced features, can be significantly more expensive, making them less accessible for price-sensitive consumers. This high cost can deter potential buyers, especially those who do not see a strong need for specialized wine storage.

Space limitations in urban homes further restrict the adoption of wine coolers. Many city dwellers live in smaller apartments with limited space for large appliances. This makes it challenging to place wine coolers, especially larger models. As urbanization continues to grow, the need for compact and space-saving units will increase.

Energy efficiency concerns are another issue, particularly with older or budget models. These units may not be as energy-efficient as regular refrigerators, leading to higher electricity bills. Consumers seeking eco-friendly solutions might opt for alternatives that are more energy-efficient, limiting the growth of the market. Lastly, limited awareness of proper wine storage practices in some regions means that consumers may not prioritize investing in specialized wine coolers, hindering market potential in certain areas.

Growth Opportunities

Innovation and Customization Drive Market Expansion

The Wine Cooler and Chest Freezer Market presents several growth opportunities due to innovation and the rising demand for customized solutions. One notable opportunity is the expansion of built-in and under-counter models for modern kitchens. These units are designed to fit seamlessly into kitchen cabinetry, catering to consumers looking for a more integrated and aesthetically pleasing solution for wine storage. As kitchen designs become more customized, built-in coolers are becoming a popular choice.

Smart wine coolers with app-based temperature and inventory management are another exciting opportunity. These coolers allow consumers to control and monitor the storage conditions of their wine remotely via smartphones, offering convenience and peace of mind. This trend aligns with the growing demand for connected home appliances and smart technology.

The development of dual-zone cooling systems is also gaining traction. These systems provide separate temperature zones for red and white wines, allowing consumers to store different types of wine at their ideal temperature. Retail partnerships offering bundled wine + appliance promotions offer a new opportunity to boost sales, especially during holidays or special events, while catering to wine enthusiasts looking for convenience and value.

Emerging Trends

Eco-Friendly and Aesthetic Trends Shape Consumer Preferences

The Wine Cooler and Chest Freezer Market is shaped by several trending factors that reflect evolving consumer preferences. One important trend is the demand for noise-free, vibration-minimized storage for aged wines. Wine connoisseurs understand that excessive vibrations and noise can negatively impact the aging process, making quiet, vibration-free coolers more desirable.

Another growing trend is the aesthetic integration of wine coolers into luxury furniture designs. As wine coolers become a staple in modern homes, many consumers are seeking units that not only perform well but also complement their home décor. This trend is driving manufacturers to design wine coolers that blend seamlessly with upscale furniture and kitchen layouts.

The rise of solar-powered and energy-star-rated cooling units is also noteworthy. With sustainability becoming a key focus for many consumers, wine cooler manufacturers are responding by developing energy-efficient units that reduce environmental impact and lower utility costs. Finally, consumer preference for display-style glass door units with LED lighting is increasing. These units allow consumers to showcase their wine collection while ensuring optimal storage conditions, catering to both functional and aesthetic needs.

Regional Analysis

Europe Dominates with 35.8% Market Share

Europe leads the Wine Cooler and Chest Freezer Market with a 35.8% share and a valuation of USD 0.64 Billion. The region’s dominance is driven by its strong wine culture, advanced infrastructure, and growing demand for both residential and commercial wine storage solutions. Major wine-producing countries, such as France, Italy, and Spain, rely heavily on wine coolers to maintain the quality and temperature of their wine.

Key factors behind Europe’s high market share include the region’s deep-rooted tradition of wine production, particularly in the Mediterranean. Wine coolers and chest freezers are essential for preserving and storing wine at optimal temperatures, ensuring quality during transportation and storage.

The demand is further driven by European consumers’ growing preference for premium and imported wines, which requires proper storage. Additionally, Europe’s advanced distribution and retail networks also contribute to the demand for wine coolers and freezers, particularly in commercial sectors like hotels, restaurants, and wineries.

Regional Mentions:

- North America: North America holds 28.5% of the market share. The U.S., a major wine consumer and producer, drives demand for efficient and advanced wine storage solutions, especially in the residential and commercial sectors. The region’s growing focus on luxury wine storage further boosts its market position.

- Asia Pacific: Asia Pacific accounts for 20.3% of the market. Countries like China and Japan have seen a rise in wine consumption and production. With growing interest in wine culture, there is an increasing demand for high-quality wine coolers and chest freezers, especially in urban areas.

- Middle East & Africa: Middle East & Africa holds 6.4% of the market share. The region’s growing interest in wine, particularly in South Africa and the UAE, is driving the demand for wine storage solutions, aided by expanding hospitality sectors and wine tourism.

- Latin America: Latin America accounts for 9.0% of the market share. Wine-producing countries such as Argentina and Chile continue to expand their wine exports, increasing the need for efficient storage and cooling solutions to maintain wine quality during distribution.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Wine Cooler and Chest Freezer Market is shaped by several key players, each offering innovative products designed to meet the growing demand for wine storage solutions. Among the top companies, Haier Group, Danby, NewAir, and Vinotemp are the most prominent, providing a wide range of wine coolers and chest freezers.

Haier Group is a leading global brand in home appliances, known for its reliable wine coolers and freezers. The company offers a diverse selection of products, ranging from small, compact wine coolers for home use to larger, commercial-grade models. Haier’s products are highly rated for their energy efficiency, sleek designs, and advanced temperature control features, making them a top choice for both residential and commercial wine storage.

Danby is another major player, particularly recognized for its affordable and space-efficient wine coolers and freezers. Danby’s products are designed with both functionality and style in mind, catering to the needs of consumers who want reliable and compact storage solutions. Their wine coolers are known for their user-friendly features and ability to store wine at optimal temperatures, making them a popular choice in the consumer market.

NewAir specializes in premium wine coolers and chest freezers that provide excellent temperature regulation. Their wine coolers are designed with advanced technology, offering features like digital controls, adjustable shelves, and built-in temperature alarms. NewAir’s focus on high-performance and stylish designs makes their products ideal for consumers looking for both functionality and aesthetic appeal.

Vinotemp stands out for its high-end, customizable wine coolers and storage solutions. Known for their craftsmanship, Vinotemp’s products cater to wine enthusiasts who require temperature-controlled environments for their wine collections. The company’s wine coolers are highly regarded for their durability, sophisticated design, and precise temperature control, making them a favorite among wine connoisseurs.

These companies are key players in the Wine Cooler and Chest Freezer Market, providing a wide range of products that cater to both residential and commercial customers, ensuring optimal storage conditions for wine across various needs and price points.

Major Companies in the Market

- Haier Group

- Danby

- NewAir

- Avanti Products

- Vinotemp

- Whynter

- Electrolux

- LG Electronics

- Whirlpool Corporation

- Hisense

Recent Developments

- HILKNIGHTLY India: On January 2023, HILKNIGHTLY India launched CellarsDivine.com, a platform offering designer wine enclosures and cellars tailored for the Indian market. In collaboration with international brands such as TheWineSquare Canada, Expo Srl Italy, and Caveduke Spain, the company aims to provide bespoke wine storage solutions for affluent Indian residences. This initiative addresses the growing demand for sophisticated wine preservation and presentation in luxury homes across India.

- Samsung Electronics: On January 2023, Samsung Electronics announced the global launch of the Bespoke Infinite Line Refrigerator in select markets. This premium built-in refrigerator is available in fridge, freezer, and wine cellar models, featuring a modular design that seamlessly integrates into various interiors. The Bespoke Infinite Line aims to enhance both the aesthetic and functional aspects of modern kitchens with high-quality materials and user-centric features.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Billion Forecast Revenue (2034) USD 2.8 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Wine Coolers, Chest Freezers), By Capacity (Less than 100 Liters, 100–200 Liters, 200–300 Liters, Above 300 Liters), By Installation Type (Freestanding, Built-in or Integrated), By End User (Residential, Commercial, HoReCa) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Haier Group, Danby, NewAir, Avanti Products, Vinotemp, Whynter, Electrolux, LG Electronics, Whirlpool Corporation, Hisense, Liebherr, Samsung Electronics, Miele Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wine Cooler and Chest Freezer MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Wine Cooler and Chest Freezer MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Haier Group

- Danby

- NewAir

- Avanti Products

- Vinotemp

- Whynter

- Electrolux

- LG Electronics

- Whirlpool Corporation

- Hisense