Global Slitting Machine Market By Type (Manual, Semi-Automatic, Fully Automatic), By Product Type (Roll Slitting, Rewinding), By Material (Paper, Polymer, Foil, Others), By End Use (Packaging, Healthcare and Pharmaceuticals, Pulp and Paper, Textile, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133635

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

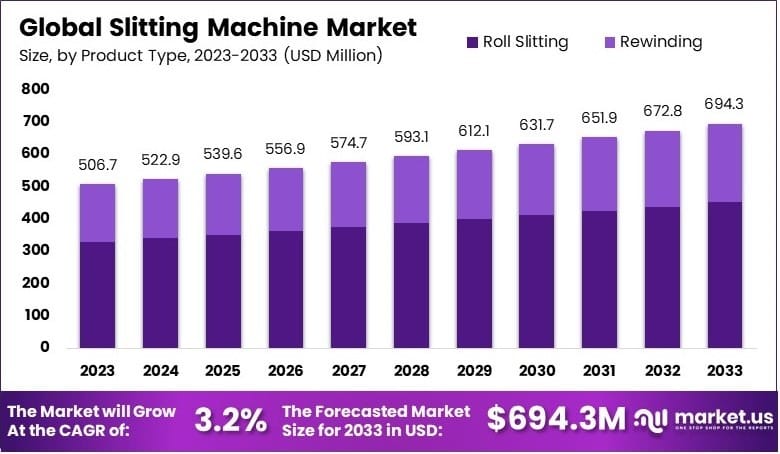

The Global Slitting Machine Market size is expected to be worth around USD 694.3 Million by 2033, from USD 506.7 Million in 2023, growing at a CAGR of 3.2% during the forecast period from 2024 to 2033.

A slitting machine is an industrial tool used to cut large rolls of material, such as paper, metal, or plastic, into narrower strips. It ensures precision and efficiency in processing materials for further use in manufacturing. These machines are vital in industries like packaging, printing, and textiles.

The slitting machine market focuses on the production, sale, and service of machines designed for material slitting. It serves industries like packaging, automotive, and construction, offering solutions for high-speed and accurate cutting. This market highlights the need for advanced, durable, and customized machinery for diverse applications.

Slitting machines are essential for cutting large rolls of materials like paper, plastic, and metal into smaller strips. They ensure precision and efficiency in manufacturing processes. These machines are widely used in industries such as packaging, printing, and automotive, offering solutions for high-speed, accurate, and cost-effective material processing.

The slitting machine market is driven by increasing demand for efficient material processing equipment. With the packaging industry growing globally, especially in regions like Asia-Pacific, the market presents significant opportunities. The rise in e-commerce has also boosted the demand for packaging materials, creating further growth potential for slitting machine manufacturers.

Advancements in technology, such as automated controls and precision cutting features, have increased the adoption of slitting machines. Governments investing in infrastructure and manufacturing sectors further fuel demand. Additionally, the trend toward sustainable and lightweight materials has led to higher adoption of specialized slitting machines designed for eco-friendly materials.

The market is moderately saturated, with key players dominating through innovation and product quality. Emerging companies face challenges in penetrating the market. However, niche demands for customized slitting machines and government incentives for local manufacturing provide entry points for new competitors looking to establish a presence.

On a local scale, slitting machines support small and medium manufacturers by increasing production efficiency. On a broader scale, they play a critical role in global supply chains, ensuring high-quality material processing for industries worldwide. These machines drive operational excellence and contribute significantly to the growth of various manufacturing sectors.

Key Takeaways

- The Slitting Machine Market was valued at USD 506.7 million in 2023 and is projected to reach USD 694.3 million by 2033, with a CAGR of 3.2%.

- In 2023, Fully Automatic machines dominated the type segment due to their operational efficiency and reduced manual intervention.

- In 2023, Roll Slitting led the product type segment, driven by its versatility in handling diverse materials.

- In 2023, Polymer dominated the material type segment, attributed to its widespread use in flexible packaging and industrial applications.

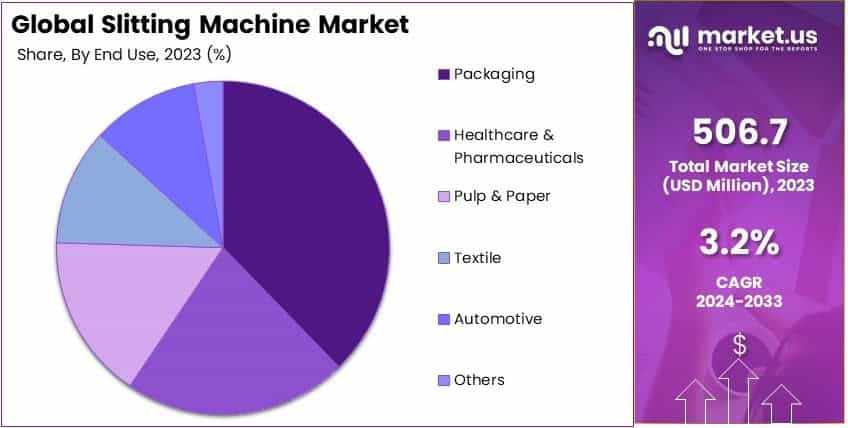

- In 2023, Packaging emerged as the leading end-use segment, reflecting the growing demand for precise slitting solutions in the packaging industry.

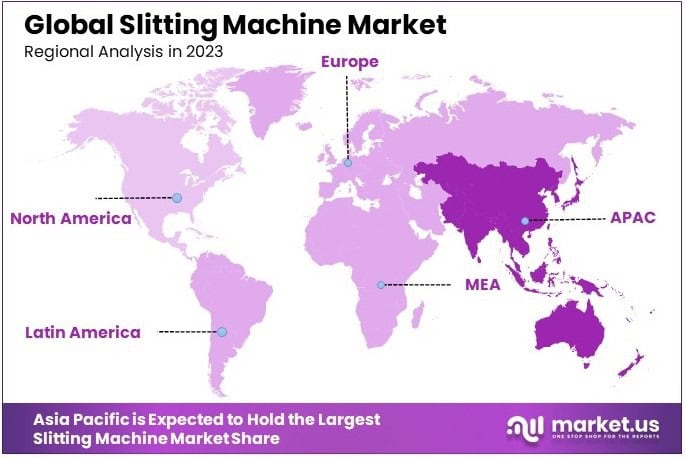

- In 2023, Asia Pacific held the largest market share, supported by rapid industrialization and strong growth in the packaging and manufacturing sectors.

Type Analysis

Fully Automatic machines dominate due to their efficiency and precision in operations.

In the Slitting Machine Market, the Type segment includes Manual, Semi-Automatic, and Fully Automatic machines. Fully Automatic machines lead this segment, primarily because they offer high efficiency and precision, crucial for mass production environments. These machines reduce labor costs and minimize errors, making them highly sought after in industries that value speed and consistency.

Manual slitting machines are important for small-scale operations or specialized applications where a high degree of control is required. They remain relevant in markets where the investment in fully automatic systems is not feasible.

Semi-Automatic machines serve as a middle ground, offering a balance of automation and cost-effectiveness. They are preferred by medium-sized enterprises that need efficiency but are not ready to fully invest in complete automation.

Product Type Analysis

Roll Slitting dominates due to its versatility in handling various materials.

The Product Type segment of the Slitting Machine Market comprises Roll Slitting and Rewinding. Roll Slitting holds a dominant position with a major market share, attributed to its versatility in handling a variety of materials and its ability to produce precise cuts. This method is particularly effective for large-scale production runs where uniformity and speed are key.

Rewinding is primarily used for quality control purposes, allowing for inspection and correction of rolled materials. This process is crucial in maintaining high standards, particularly in the printing and packaging industries.

Material Analysis

Polymer materials lead due to their widespread use in various industries.

In the Material segment, the choices include Paper, Polymer, Foil, and Others. Polymer materials dominate this category with a major share. Polymers, such as plastics and synthetic rubbers, are extensively used due to their durability and flexibility, making them ideal for a wide range of applications from packaging to automotive parts.

Paper is a critical material in the packaging and publishing industries, valued for its recyclability and cost-effectiveness. Foil materials are used primarily in packaging applications for food and pharmaceutical products, offering excellent barrier properties against light, moisture, and contaminants.

End Use Analysis

Packaging industry dominates due to the increasing demand for sustainable and efficient packaging solutions.

The End Use segment includes Packaging, Healthcare and Pharmaceuticals, Pulp and Paper, Textile, Automotive, and Others. The Packaging sector leads with a dominant market share, driven by the global push towards more sustainable and efficient packaging solutions.

As consumer awareness of environmental issues grows, industries are seeking advanced slitting machines that can support the production of recyclable and eco-friendly packaging materials.

Healthcare and Pharmaceuticals rely on slitting machines for the precise cutting of sterile packaging and labels, which require high accuracy to maintain cleanliness and product integrity.

The Pulp and Paper industry uses slitting machines for the size reduction and reprocessing of paper products, an essential step in both recycling and initial manufacturing processes.

Textiles and Automotive sectors utilize these machines for cutting and preparing materials that are integral to their production lines, reflecting the broad applicability and necessity of advanced slitting technology in modern manufacturing.

Key Market Segments

By Type

- Manual

- Semi-Automatic

- Fully Automatic

By Product Type

- Roll Slitting

- Rewinding

By Material

- Paper

- Polymer

- Foil

- Others

By End Use

- Packaging

- Healthcare and Pharmaceuticals

- Pulp and Paper

- Textile

- Automotive

- Others

Drivers

Flexible Packaging and Automation Drive Market Growth

The Slitting Machine Market is witnessing substantial growth, primarily driven by the rising demand for flexible packaging materials. Flexible packaging is increasingly used across industries such as food and beverages, pharmaceuticals, and consumer goods, which require precise cutting and efficient material handling.

Additionally, the integration of automation in manufacturing processes significantly drives market expansion. Automated slitting machines enhance productivity, reduce human errors, and offer consistent quality, making them a preferred choice for large-scale manufacturers.

The ability of automated systems to handle high-speed production lines has been instrumental in meeting the rising global demand for packaging solutions. Their role in optimizing production workflows has made automation an essential feature in modern slitting machines.

The growth of the paper and pulp industry, driven by the need for sustainable packaging, further contributes to the market. With increasing global demand for recyclable materials, slitting machines play a critical role in achieving efficient material utilization.

Restraints

High Costs and Complexity Restrain Market Growth

Despite its advantages, the Slitting Machine Market faces several restraints. High initial investment costs deter adoption, particularly among small and medium enterprises. These machines require significant capital, making it challenging for smaller industries to justify the expense.

The complexity of machine operation and maintenance further limits widespread adoption. Skilled operators are often necessary to manage advanced slitting machines, and their unavailability in certain regions hampers market growth.

In areas lacking training facilities, businesses face difficulty in finding personnel capable of operating these machines efficiently. Maintenance issues, including the need for frequent servicing, also add to operational challenges and costs.

Environmental concerns also pose a challenge, as the waste generated during slitting processes leads to increased scrutiny from regulatory bodies. Stricter environmental regulations demand that manufacturers adopt cleaner and more efficient technologies, which may increase costs further. Additionally, limited adoption in small-scale industries reduces the potential growth of the market, especially in cost-sensitive regions.

Opportunity

Customization and Energy Efficiency Provide Opportunities

The development of energy-efficient slitting machines offers a promising opportunity for market players. Manufacturers are increasingly focusing on creating machines that consume less power while maintaining high operational efficiency.

Energy-saving features not only reduce operational costs but also help industries meet environmental compliance standards. Such innovations appeal to eco-conscious businesses looking to align with sustainability goals while maintaining profitability.

Expanding applications in renewable energy sectors also open new avenues for the market, as precise cutting of materials like solar films and battery components is essential. These materials demand high precision to ensure optimal functionality and performance.

Moreover, the demand for customized slitting solutions is growing. Industries require machines tailored to their specific material and production needs, creating opportunities for manufacturers to innovate. Customization allows businesses to meet unique production demands, enhancing their competitive advantage in niche markets.

Emerging markets, driven by rapid industrialization, provide further growth potential. Countries in Asia and Africa are adopting advanced manufacturing solutions, creating a fertile ground for the slitting machine market. Governments in these regions are also encouraging industrial upgrades, which boosts demand for modern equipment.

Challenges

Technical and Competitive Challenges Impact Market Growth

Several challenges hinder the growth of the Slitting Machine Market. Intense competition among manufacturers leads to price wars, affecting profit margins. Smaller players often struggle to compete with established brands, which dominate the market through economies of scale and better resource availability.

Additionally, technical difficulties in processing high-strength and composite materials pose significant operational hurdles. High-strength materials require advanced machines capable of handling their properties without compromising on precision.

The shortage of skilled labor further complicates machine operation, especially in developing regions where training facilities are limited. Operating and maintaining slitting machines require technical expertise, which is often unavailable in underserved areas.

Rising costs of raw materials also add to the challenges, increasing overall production costs and reducing affordability for end-users. Fluctuations in material prices can disrupt supply chains and make it harder for manufacturers to maintain competitive pricing. Addressing these challenges requires investments in training, research, and development to enhance machine efficiency and reduce operational barriers.

Growth Factors

Advanced Equipment and Digitalization Are Growth Factors

The Slitting Machine Market is benefitting from growing investments in advanced manufacturing equipment. Industries are prioritizing high-speed and precision machines to meet the rising demand for quality and efficiency. The push for automation across sectors has further accelerated investments in modern slitting machines, ensuring faster production cycles and reduced labor costs.

Digitalization in production processes further drives this growth, enabling better machine integration and enhanced productivity. Digital tools, such as data analytics and remote machine monitoring, ensure optimal operation and early detection of potential issues.

The expansion of high-performance material industries, such as aerospace and automotive, necessitates advanced slitting solutions. Manufacturers are investing in R&D to develop machines capable of handling innovative materials.

These advancements help cater to the growing demand for lightweight, high-strength components in various applications. Additionally, the rising demand for precision and high-speed machines underscores the importance of continuous technological advancements.

Emerging Trends

Industry 4.0 and Eco-Friendly Solutions Are Latest Trending Factors

The integration of Industry 4.0 technologies into slitting machines is a key trend shaping the market. Advanced features such as IoT-enabled monitoring, predictive maintenance, and real-time data analysis are making machines smarter and more efficient.

Eco-friendly cutting solutions are gaining traction, aligning with global sustainability goals. Machines designed to minimize material waste and utilize recyclable components are increasingly preferred. This trend is particularly prominent in regions with stringent environmental regulations, where companies face pressure to adopt greener practices.

The trend toward compact and portable machine designs also reflects the market’s adaptation to space-constrained production environments. Smaller machines offer the same level of efficiency as larger models, making them ideal for small and medium enterprises.

Lastly, real-time monitoring systems provide enhanced operational control, ensuring precision and efficiency, making them a sought-after feature in modern slitting machines.

Regional Analysis

Asia Pacific Dominates with Major Market Share

Asia Pacific leads the Slitting Machine Market with a dominant market share. This is driven by the region’s rapid industrialization, growing demand for high-speed production equipment, and a robust manufacturing base. The presence of major manufacturers in China, India, and Japan supports large-scale production and cost efficiency, strengthening the region’s global position.

Key factors include affordable labor, abundant raw material availability, and strong infrastructure for industrial equipment production. The rising demand for flexible packaging materials, especially in the food and beverage and electronics sectors, further propels the market. Additionally, government support for industrial growth and initiatives in emerging economies enhance the region’s competitiveness.

Asia Pacific benefits from increasing exports of slitting machines due to high international demand. The region’s manufacturers offer competitive pricing and technological advancements, making them preferred suppliers globally. Furthermore, the rapid adoption of automation and digital solutions in manufacturing enhances efficiency, boosting market performance.

Regional Mentions:

- North America: North America holds a significant share of the Slitting Machine Market, driven by advanced manufacturing technologies and a strong focus on automation. The region benefits from high demand in packaging, automotive, and aerospace industries.

- Europe: Europe maintains steady growth in the Slitting Machine Market, supported by its focus on sustainability and advanced material processing. The region emphasizes precision cutting technologies for high-performance applications, particularly in automotive and industrial sectors.

- Middle East & Africa: The Middle East & Africa are emerging markets for slitting machines, with growing investments in industrialization and packaging solutions. Rising demand for flexible packaging in food and healthcare sectors drives regional growth.

- Latin America: Latin America is progressively adopting slitting machines, supported by increasing demand in the agriculture and packaging industries. Economic recovery and industrial modernization in countries like Brazil and Mexico are key contributors to market growth.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Slitting Machine Market is dominated by leading players emphasizing precision, efficiency, and technological advancements. The top contributors include Bosch Packaging Technology, BOBST Group, Comexi Group, and Atlas Converting Equipment Ltd.

Bosch Packaging Technology is a global leader known for its advanced slitting machines catering to diverse industries. The company focuses on automation and high-speed operations, ensuring productivity and reliability. Its strong research and development initiatives make it a pioneer in innovative solutions.

BOBST Group stands out with its commitment to quality and cutting-edge technology. Specializing in high-performance slitting systems, BOBST supports industries such as packaging and printing. Its global network and comprehensive after-sales services enhance its position as a market leader.

Comexi Group is renowned for its sustainable and efficient slitting solutions. The company focuses on reducing energy consumption and material waste, appealing to eco-conscious clients. Comexi’s expertise in flexible packaging makes it a preferred choice in the food and beverage sectors.

Atlas Converting Equipment Ltd. provides high-speed and durable slitting machines tailored to various materials. The company’s emphasis on innovation and robust machinery ensures consistent market demand. Its global presence and customer-focused approach solidify its reputation.

These companies collectively drive the Slitting Machine Market by delivering advanced solutions tailored to industry needs. Their focus on sustainability, innovation, and customer satisfaction ensures long-term market growth.

Top Key Players in the Market

- Bosch Packaging Technology

- Comexi Group

- Parksons Packaging Ltd.

- BOBST Group

- Kampf Schneid- und Wickeltechnik GmbH

- Atlas Converting Equipment Ltd.

- MAX Innovation

- Fuji Machinery Co., Ltd.

- Goebel Schneid- und Wickelsysteme GmbH

- Somas Group

- ASHE Converting Equipment

- Universal Converting Equipment

- Menzel Maschinen GmbH

- Kuka Robotics

- Slitter Rewinder

Recent Developments

- Re:Build Manufacturing and CFRTP Production Equipment: In September 2024, Re:Build Manufacturing introduced a line of customizable equipment to enhance the production efficiency of continuous fiber-reinforced thermoplastic (CFRTP) composite parts. This equipment enables manufacturers to slit tapes to specified widths and pre-stack them into tailored laminates with varying ply orientations, facilitating faster and more cost-effective market entry for thermoplastic composite components.

- FAM STUMABO and SureTec 240P: In November 2024, FAM STUMABO unveiled the SureTec 240P, a robust potato cutting machine equipped with the SureCut Unit (SCU) for precision and ease of use. The SureTec 240P is designed to produce high-quality French fries and diced potatoes, offering versatility and efficiency in potato processing operations. The machine was showcased at Interpom 2024 in Kortrijk, Belgium.

Report Scope

Report Features Description Market Value (2023) USD 506.7 Million Forecast Revenue (2033) USD 694.3 Million CAGR (2024-2033) 3.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Manual, Semi-Automatic, Fully Automatic), By Product Type (Roll Slitting, Rewinding), By Material (Paper, Polymer, Foil, Others), By End Use (Packaging, Healthcare and Pharmaceuticals, Pulp and Paper, Textile, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bosch Packaging Technology, Comexi Group, Parksons Packaging Ltd., BOBST Group, Kampf Schneid- und Wickeltechnik GmbH, Atlas Converting Equipment Ltd., MAX Innovation, Fuji Machinery Co., Ltd., Goebel Schneid- und Wickelsysteme GmbH, Somas Group, ASHE Converting Equipment, Universal Converting Equipment, Menzel Maschinen GmbH, Kuka Robotics, Slitter Rewinder Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bosch Packaging Technology

- Comexi Group

- Parksons Packaging Ltd.

- BOBST Group

- Kampf Schneid- und Wickeltechnik GmbH

- Atlas Converting Equipment Ltd.

- MAX Innovation

- Fuji Machinery Co., Ltd.

- Goebel Schneid- und Wickelsysteme GmbH

- Somas Group

- ASHE Converting Equipment

- Universal Converting Equipment

- Menzel Maschinen GmbH

- Kuka Robotics

- Slitter Rewinder