Global Compaction Equipment Market By Type (Heavy compaction machines, Pneumatic roller, Light compaction machines), By Application (Soil Compaction, Asphalt Compaction, Earthmoving, Construction), By Power Source (Diesel, Electric, Hydraulic), By Size (Walk-Behind, Ride-On), By End user (Construction, Mining, Waste Management, Agriculture), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134605

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

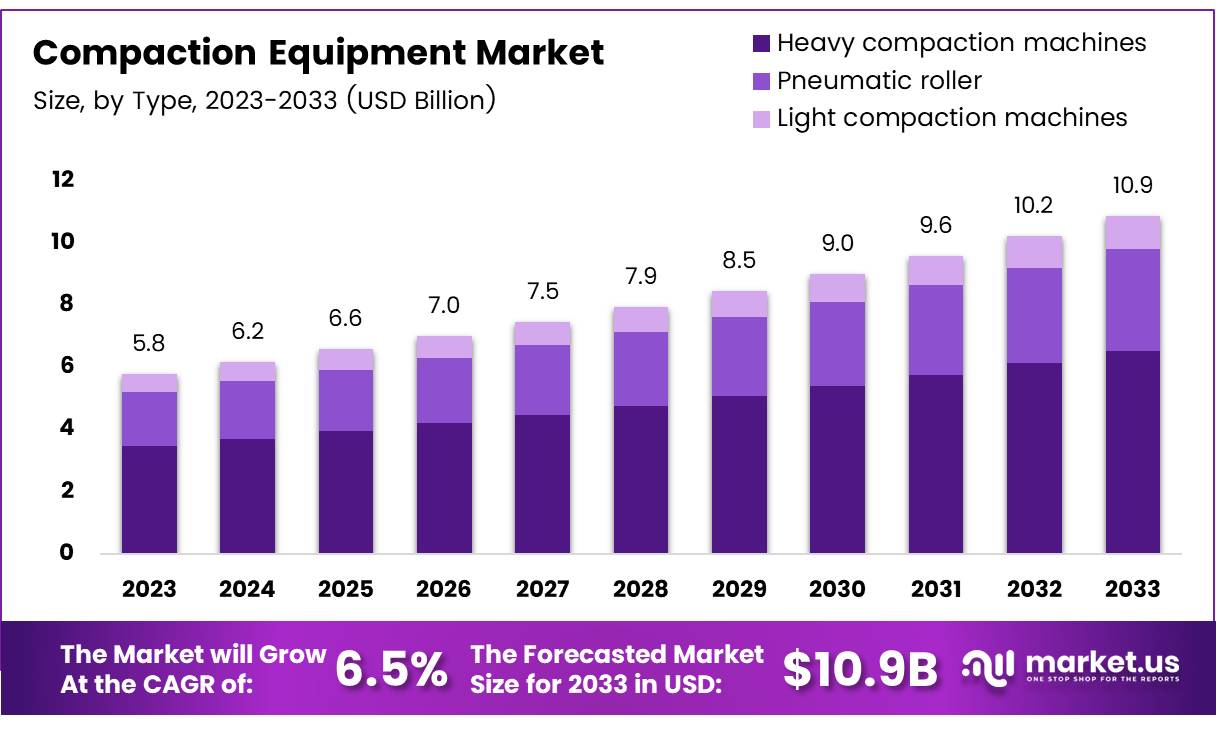

The Global Compaction Equipment Market size is expected to be worth around USD 10.9 Billion by 2033, from USD 5.8 Billion in 2023, growing at a CAGR of 6.5% during the forecast period from 2024 to 2033.

Compaction equipment refers to machines and tools designed to increase the density of materials such as soil, gravel, or asphalt, through mechanical force. These machines are widely used in construction, road building, and civil engineering projects to ensure that the ground is stable and can support structures.

The primary types of compaction equipment include road rollers, compactors, plate compactors, and rammers, each serving a specific purpose depending on the type of material and the desired outcome.

These equipment solutions are essential for the preparation of foundations, highways, and other infrastructure projects where strong, stable ground is required. The compaction equipment market, therefore, involves the production, distribution, and sales of these machines, along with the accessories and parts needed for their maintenance and operation.

The growth of the compaction equipment market is closely tied to the expansion of the construction and infrastructure sectors, which have experienced strong momentum due to urbanization, increased government spending on infrastructure projects, and industrialization, particularly in emerging markets.

As countries invest in highways, airports, and other public infrastructure, demand for compaction equipment is expected to remain robust. Additionally, with the push towards sustainable development and green building practices, the market for electric and eco-friendly compaction equipment is anticipated to grow.

According to a report by WebFX, Caterpillar, a leading manufacturer of construction equipment, commands a 16% share of the global market, a testament to the strong presence of industry leaders in this space. The compound growth in construction-related investments can also be linked to the fact that every $1 spent on manufacturing generates $2.79 in economic activity, highlighting the significant multiplier effect on economies.

Opportunities in the compaction equipment market also emerge from the increasing focus on reducing environmental impact and adhering to regulations on emissions. In particular, diesel-engine heavy machinery, which currently accounts for 32% of nitrogen oxide and 37% of fine particle emissions from mobile sources (according to WebFX), faces rising pressure to adopt cleaner technologies.

As governments, especially in the U.S., push for a carbon-neutral future by 2050, the demand for electric heavy construction equipment, including compaction machines, is expected to rise.

The U.S. government’s push toward carbon neutrality provides a clear opportunity for manufacturers to innovate and shift toward producing equipment that meets new environmental standards, while also aligning with growing consumer demand for sustainable solutions.

The labor market for heavy machinery operators also presents a valuable insight into the compaction equipment sector’s growth. With over 412,000 people working as heavy machinery operators in the U.S. alone, the demand for skilled operators continues to grow alongside the need for new and efficient machinery.

Key Takeaways

- The global compaction equipment market is projected to reach USD 10.9 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033.

- Heavy compaction machines dominated the market in 2023, accounting for 72.2% of the market share.

- Soil compaction equipment led the market in 2023 due to its widespread use in construction and infrastructure projects.

- Diesel-powered compaction equipment held the largest share in 2023, preferred for its power, reliability, and cost-effectiveness.

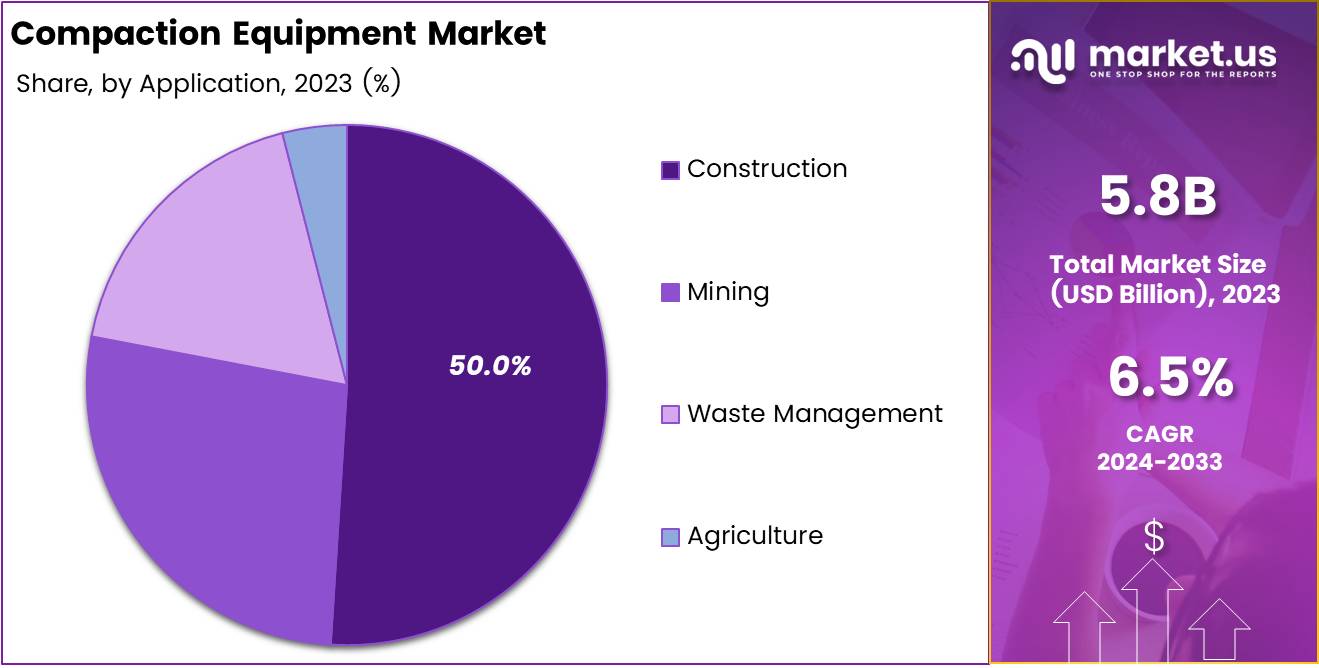

- The construction sector was the leading end-user in 2023, representing 50% of the market share.

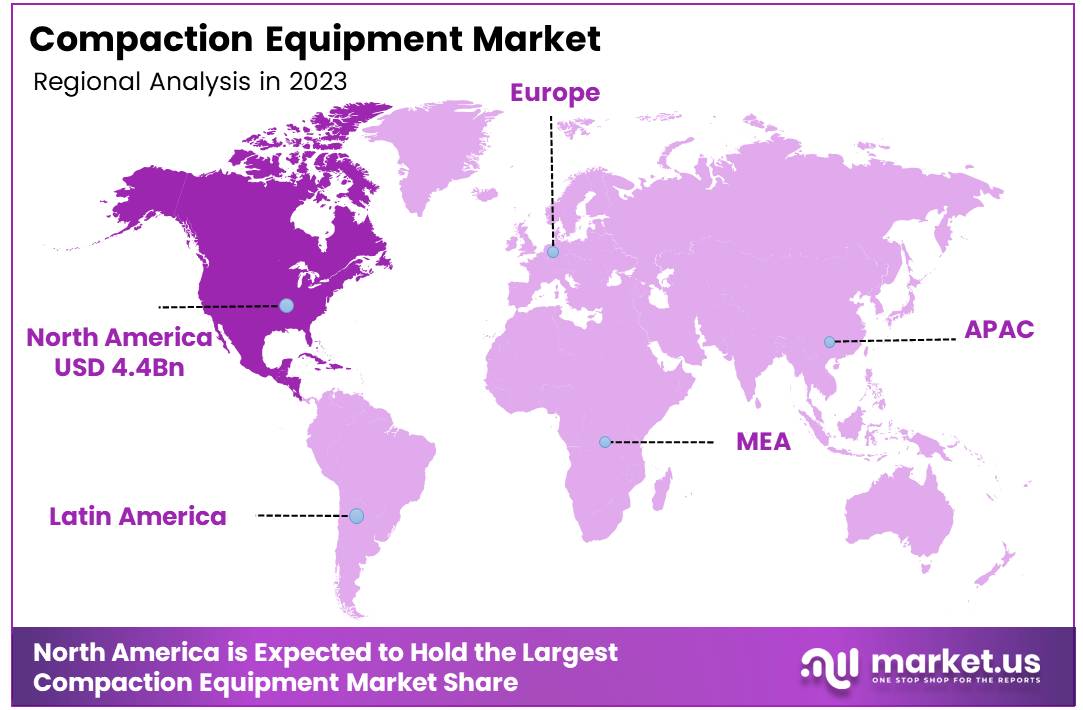

- North America held the largest market share in 2023, accounting for 76.8%, valued at approximately USD 4.4 billion.

Type Analysis

Heavy Compaction Machines Dominated the Compaction Equipment Market with a 72.2% Share in 2023

In 2023, heavy compaction machines held a dominant market position in the By Type Analysis segment of the compaction equipment market, commanding a 72.2% share. This segment’s dominance can be attributed to the increasing demand for robust machinery capable of handling large-scale construction projects, including roadwork, infrastructure, and mining applications.

Heavy compaction machines, known for their ability to compact various soil types effectively, are essential for achieving high-density compaction required in major civil engineering projects.

Pneumatic rollers, while accounting for a smaller share of the market, remained a critical segment due to their versatility in applying uniform compaction pressure.

These machines are particularly preferred for projects requiring minimal surface disruption, such as asphalt paving, and are utilized in medium-to-large construction projects where a balance between performance and cost is required.

Light compaction machines, though possessing a limited market share compared to heavy machines, continue to show steady growth. Their ease of use, compact size, and suitability for smaller construction sites and residential projects contribute to their sustained demand. This segment is expected to benefit from the increasing number of urban infrastructure projects, particularly in emerging markets.

Application Analysis

Soil Compaction Leads in Application Analysis of Compaction Equipment Market

In 2023, Soil Compaction held a dominant market position in the By Application Analysis segment of the Compaction Equipment Market. This segment’s supremacy can be attributed to the extensive demand for soil compaction equipment across multiple construction and infrastructure projects worldwide.

As urbanization accelerates and infrastructural developments expand, the need for robust soil compaction equipment to ensure ground stability and strength becomes paramount.

The significance of soil compaction equipment extends to various sectors, including residential construction, commercial development, and transportation infrastructure. These tools are essential for achieving desired soil density and strength, prerequisites for the longevity and safety of construction projects.

The market’s growth is further supported by advancements in technology that enhance the efficiency and effectiveness of compaction equipment. Manufacturers are increasingly incorporating intelligent compaction technologies, which allow for real-time monitoring and adjustments, thereby optimizing the compaction process and reducing operational costs.

Moreover, regulatory standards emphasizing construction quality and environmental sustainability are pushing the demand for advanced compaction equipment. These regulations ensure that projects adhere to strict guidelines, promoting the use of equipment that meets the latest emissions and efficiency standards.

As the global construction industry continues to expand, the soil compaction segment is expected to maintain its leading position, driven by technological innovation and regulatory frameworks.

Power Source Analysis

In 2023, Diesel Dominated the Compaction Equipment Market by Power Source

In 2023, diesel-powered compaction equipment maintained a dominant position in the By Power Source Analysis segment of the global compaction equipment market. Diesel engines are widely preferred due to their high power output, reliability, and cost-effectiveness, making them particularly suitable for heavy-duty applications in construction, roadwork, and other large-scale infrastructure projects.

The market share of diesel-powered compaction equipment was substantial, driven by the growing demand for machinery that can handle demanding tasks in rugged environments. Additionally, diesel engines are often seen as more fuel-efficient for larger machines, providing a balance of performance and operational cost-efficiency.

Electric-powered compaction equipment, while gaining traction due to increasing environmental concerns and stringent emission regulations, holds a smaller but steadily growing share. This segment is expected to see continued growth, driven by advancements in battery technology and the rising demand for low-emission equipment in urban and environmentally sensitive areas.

Hydraulic power, typically used for specific compaction machines such as rollers and plate compactors, also occupies a significant portion of the market. Hydraulic-powered equipment is valued for its high precision and capability to generate substantial force, which makes it an ideal choice for fine-tuning compaction in certain applications.

End-User Analysis

In 2023, Construction Led the End-User Segment of the Compaction Equipment Market with a 50% Share

In 2023, the construction sector held a dominant market position in the By End-User Analysis segment of the Compaction Equipment Market, with a significant 50% share. This growth can be attributed to the rising demand for compacted soil and materials in road construction, building foundations, and infrastructure projects.

As urbanization accelerates globally, the need for reliable, durable compaction equipment to ensure quality and safety in construction sites has grown, contributing substantially to the market’s expansion.

Following construction, the mining industry accounted for a notable share, driven by the need for efficient compaction in the preparation of mining sites and the stabilization of roads within mining operations. Compaction equipment is integral to controlling dust and improving the efficiency of mining operations, particularly in mineral-rich regions.

The waste management sector also exhibited steady growth, with compaction equipment being essential in landfills, waste treatment, and material recycling processes. The increasing emphasis on sustainable waste management practices has further boosted demand for specialized compaction machinery.

The agriculture sector, while smaller in comparison, continues to drive demand for compaction equipment used in soil preparation, particularly in regions with heavy agricultural activity. The need for effective soil compaction for optimal crop production remains a key factor in this segment’s growth.

Key Market Segments

By Type

- Heavy compaction machines

- Heavy tandem roller

- 5 to 8 Tonne

- 8 to 11 Tonne

- > 11 Tonne

- Single drum roller

- 3 to 5 Tonne

- 5 to 8 Tonne

- 8 to 12 Tonne

- 12 to 15 Tonne

- > 15 Tonne

- Heavy tandem roller

- Pneumatic roller

- Light compaction machines

- Hand operated machines

- Rammer

- Vibratory plates (forward)

- Vibratory plates ( reverse)

- Walk behind roller

- Light tandem roller

- < 1.8 Tonne

- 8 to 3 Tonne

- 3 to 5 Tonne

- Trench roller

- Hand operated machines

By Application

- Soil Compaction

- Asphalt Compaction

- Earthmoving

- Construction

By Power Source

- Diesel

- Electric

- Hydraulic

By Size

- Walk-Behind

- Ride-On

By End user

- Construction

- Mining

- Waste Management

- Agriculture

Drivers

Key Drivers of Compaction Equipment Market Growth

The compaction equipment market is primarily driven by the continuous growth in infrastructure development worldwide. Increased investments in large-scale infrastructure projects, such as road construction, highways, and urban development, have created a strong demand for compaction equipment.

As countries focus on improving transportation networks and urban spaces, the need for efficient and effective soil compaction machinery has risen. Rapid urbanization, particularly in emerging economies, further fuels this demand.

Growing populations and the expansion of cities lead to increased construction and civil engineering projects, all of which require reliable compaction equipment. In addition, government spending on infrastructure projects plays a significant role in driving market growth, especially in emerging regions where governments are making substantial investments in road networks, public buildings, and utility infrastructure.

Furthermore, technological advancements have also contributed to the market’s expansion. The integration of technologies like GPS, telematics, and automated compaction systems has improved the efficiency and precision of compaction equipment, making it more attractive to contractors and construction firms.

These innovations help in reducing operational costs, enhancing performance, and ensuring better results, which in turn drives the demand for more advanced compaction machinery. The combined effect of these factors is expected to continue shaping the market’s growth trajectory in the coming years.

Restraints

High Initial Costs Challenge Market Expansion

The compaction equipment market faces significant challenges that can restrict its growth. Firstly, the high initial investment required for advanced compaction machinery presents a substantial barrier, particularly for small and medium-sized enterprises (SMEs). This financial burden can deter new entrants and limit the market’s expansion as these companies may struggle to allocate substantial capital towards such expensive equipment.

Secondly, there is a notable lack of skilled labor, which further complicates the landscape. The scarcity of trained operators and technicians capable of effectively managing and maintaining compaction equipment can impede operational efficiency and market growth.

These factors collectively create a constrained environment, making it difficult for the market to realize its full potential, especially in regions where the cost of skilled labor and capital is disproportionately high.

Growth Factors

Growth Opportunities in the Compaction Equipment Market

The compaction equipment market is poised for significant growth, particularly in emerging markets such as Asia-Pacific, Latin America, and Africa. These regions are experiencing rapid infrastructure development and urbanization, driving increased demand for construction equipment. In addition to this, the development of autonomous and semi-autonomous compaction equipment presents an important opportunity for the market.

These advanced machines are expected to enhance operational efficiency, reduce labor costs, and improve safety, making them increasingly attractive to construction companies. Furthermore, the rising trend of renting rather than purchasing equipment is becoming more prevalent, especially as businesses look to optimize capital expenditures. This presents a favorable environment for companies that offer construction equipment rental services.

Finally, the growing emphasis on sustainability and green construction practices is creating demand for eco-friendly compaction solutions. As environmental concerns and regulations around construction waste management increase, there is a shift toward adopting equipment that minimizes environmental impact. Together, these factors offer promising growth opportunities, positioning the compaction equipment market for substantial expansion in the coming years.

Emerging Trends

Trending Factors Shaping the Compaction Equipment Market

The compaction equipment market is evolving due to several emerging trends that are reshaping the way these machines operate. One significant factor is the growing use of telematics and GPS systems, which enable real-time tracking and performance optimization of equipment. By integrating telematics, operators can monitor machine health, location, and fuel consumption, leading to enhanced productivity and lower operational costs.

Another notable trend is the rise of smart and connected equipment, which provides real-time data analytics and insights. This technology helps to improve operational efficiency by enabling remote monitoring and predictive maintenance.

The demand for eco-friendly equipment is also increasing, driven by stricter environmental regulations and the push for sustainability. Manufacturers are developing low-emission and energy-efficient compaction machines that comply with new environmental standards.

Additionally, vibration compaction technology is gaining traction in the market, with innovations that reduce energy consumption while improving soil stabilization. These advancements not only lead to better compaction results but also contribute to cost savings and operational efficiency.

Collectively, these trends reflect a shift towards smarter, greener, and more efficient compaction solutions, addressing both environmental concerns and the increasing demand for operational excellence.

Regional Analysis

North America dominates the global market, accounting for 76.8% of the market share

North America dominates the global market, accounting for 76.8% of the market share, valued at approximately USD 4.4 billion. This market leadership can be attributed to the strong presence of key players, advanced infrastructure development, and the growing demand for compaction solutions in construction, roadwork, and industrial waste management sectors.

The United States, in particular, remains a significant contributor to market growth, driven by governmental investments in infrastructure, increasing construction activities, and the adoption of technologically advanced compaction equipment.

Regional Mentions:

Europe holds a considerable share in the market, with a strong demand for compaction equipment driven by ongoing urbanization, infrastructure projects, and a focus on sustainability. The market in this region is expected to grow moderately, with Germany, France, and the UK being key markets. The emphasis on eco-friendly and energy-efficient equipment is a growing trend among European consumers, influencing the demand for advanced, environmentally conscious compaction machinery.

Asia Pacific is witnessing the fastest growth in the compaction equipment market, propelled by rapid industrialization, infrastructural development, and urbanization, especially in countries like China, India, and Japan. The region is expected to see an increased demand for both light and heavy compaction equipment as urban construction projects, such as road building, are on the rise. The growth rate in this region is also supported by government-backed initiatives to improve transportation and public infrastructure.

In Middle East & Africa, the market is primarily driven by large-scale infrastructure and construction projects in countries such as the UAE and Saudi Arabia. However, market growth in this region is expected to be slow due to economic fluctuations and political instability in certain areas.

Lastly, Latin America represents a smaller market share, but it shows potential due to growing investments in infrastructure projects, particularly in Brazil and Mexico, as part of regional development initiatives. However, the region’s growth is somewhat constrained by economic uncertainties and limited access to advanced technologies.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global compaction equipment market remains characterized by intense competition, with several key players dominating the landscape. Notable among these are AB Volvo, Caterpillar Inc., XCMG Co. Ltd, Atlas Copco, Wirtgen Group, and others, each contributing to the sector’s growth through technological advancements, product innovation, and strategic market expansion.

AB Volvo continues to hold a significant market share, capitalizing on its reputation for durable and fuel-efficient compaction equipment. The company’s focus on sustainability through electric and hybrid solutions has positioned it well to meet increasing environmental regulations, particularly in Europe and North America.

Caterpillar Inc., a leading name in construction and mining equipment, maintains its stronghold in the compaction sector with a broad product portfolio that caters to diverse customer needs. Its continued investment in autonomous and smart technologies further strengthens its competitive edge.

XCMG Co. Ltd and Sany Heavy Industries Co. Ltd have emerged as formidable players from China, leveraging their cost-effective solutions to expand rapidly in both developing and mature markets. These companies’ aggressive R&D and localized manufacturing capabilities contribute to their growing global footprint.

Atlas Copco and Wirtgen Group are particularly strong in the road construction segment, offering compactors with cutting-edge features, such as integrated GPS and intelligent compaction systems. The trend towards higher automation and precision in compaction processes supports their market expansion.

The competitive dynamics in the global compaction equipment market are also shaped by companies like AMMANN Group, Terex Corporation, BOMAG GmbH, and Wacker Neuson SE, each bringing a unique mix of innovation, market adaptability, and sustainability in their offerings. As these players continue to innovate, the market is expected to witness ongoing consolidation, particularly in the high-end, technology-driven segments.

Top Key Players in the Market

- AB Volvo

- XCMG Co. Ltd

- Caterpillar Inc.

- Atlas Copco

- Wirtgen Group

- Sany Heavy Industries Co Ltd

- AMMANN GROUP

- Terex Corporation

- BOMAG GmbH

- Wacker Neuson SE

Recent Developments

- In January 2024, Conplant, a leading provider of compaction equipment, successfully acquired High Energy Impact Compaction Specialists, strengthening its portfolio with advanced technologies and expanding its footprint in the compaction industry.

- In November 2024, Impact Environmental Group acquired FleetGenius Compactors, a strategic move aimed at enhancing its service offerings and expanding its capabilities in the waste management and environmental solutions sector.

- In June 2024, the Ammann Group completed the acquisition of Volvo CE’s ABG Pavers, solidifying its position as a key player in the global road construction and paving equipment market, while enhancing its product portfolio with high-performance machinery.

- In January 2023, Komar Industries, a leader in compaction and waste management solutions, acquired PTR Baler and Compactor Company, broadening its product range and reinforcing its market presence in the waste handling and recycling industry.

Report Scope

Report Features Description Market Value (2023) USD 5.8 Billion Forecast Revenue (2033) USD 10.9 Billion CAGR (2024-2033) 6.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Heavy compaction machines, Pneumatic roller, Light compaction machines), By Application (Soil Compaction, Asphalt Compaction, Earthmoving, Construction), By Power Source (Diesel, Electric, Hydraulic), By Size (Walk-Behind, Ride-On), By End user (Construction, Mining, Waste Management, Agriculture) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AB Volvo, XCMG Co. Ltd, Caterpillar Inc., Atlas Copco, Wirtgen Group, Sany Heavy Industries Co Ltd, AMMANN GROUP, Terex Corporation, BOMAG GmbH, Wacker Neuson SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Compaction Equipment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Compaction Equipment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AB Volvo

- XCMG Co. Ltd

- Caterpillar Inc.

- Atlas Copco

- Wirtgen Group

- Sany Heavy Industries Co Ltd

- AMMANN GROUP

- Terex Corporation

- BOMAG GmbH

- Wacker Neuson SE