Global Wind Turbine Automation Market Size, Share Analysis Report By Component (Hardware (Sensors, Controllers, Others (Drives, etc.)), Software, Services (Maintenance Services, Installation Services)), By Application (Onshore Wind Farms, Offshore Wind Farms), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150992

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

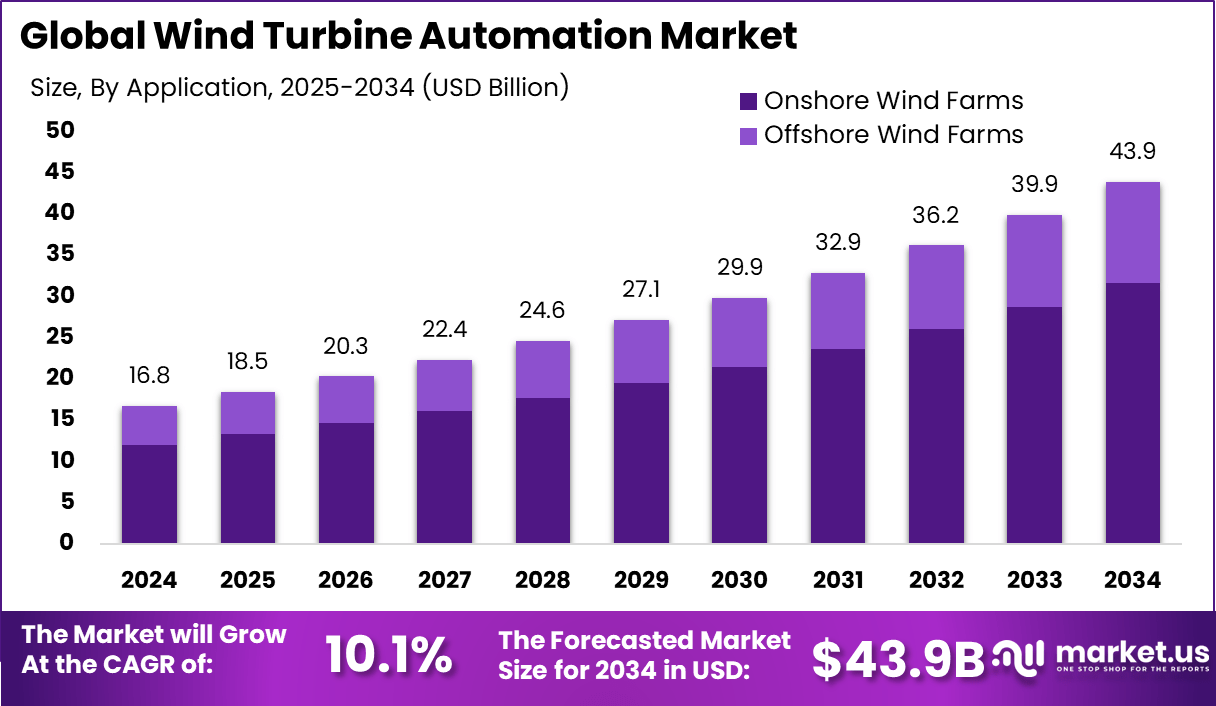

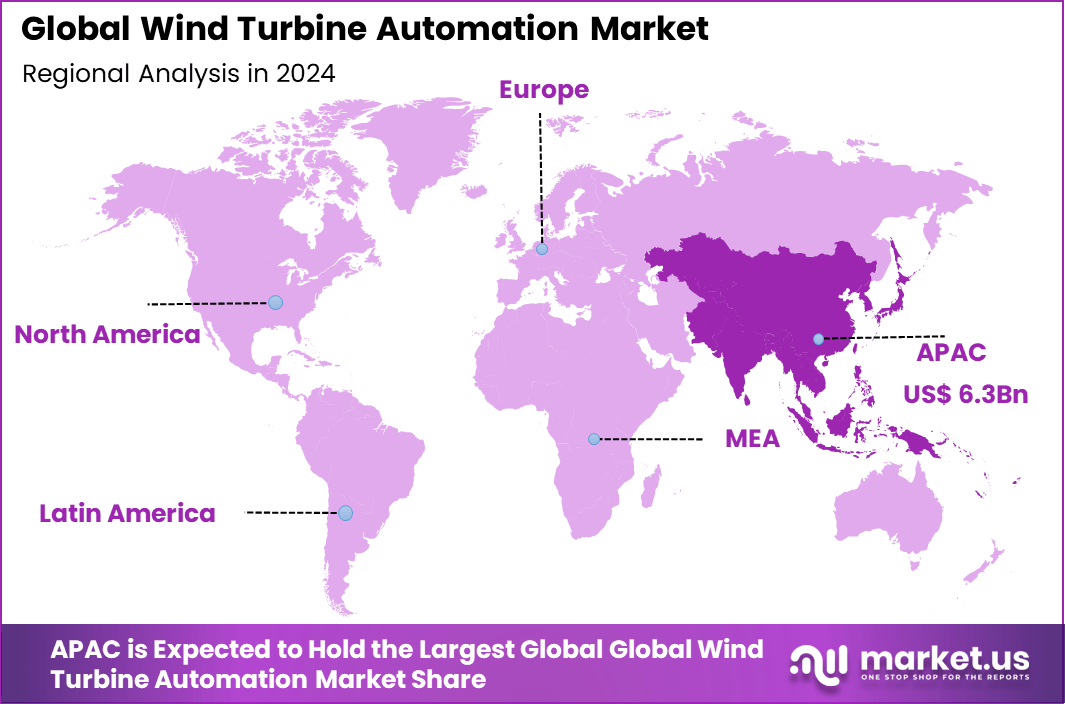

The Global Wind Turbine Automation Market size is expected to be worth around USD 43.9 Billion By 2034, from USD 16.8 billion in 2024, growing at a CAGR of 10.1% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 38% share, holding USD 6.3 Billion revenue.

Wind turbine automation refers to the integration of intelligent control systems, sensors, and communication networks to manage turbine operations without constant human intervention. These systems regulate blade pitch, yaw, rotational speed, and power output in real time to maintain optimal performance.

The Wind Turbine Automation Market is undergoing robust transformation as the global shift toward renewable energy accelerates. Automation platforms – encompassing SCADA systems, condition monitoring, predictive analytics, and advanced control architectures – are now central to maximizing output, enhancing safety, and reducing costs across wind assets.

The primary driver of this market is the increasing focus on renewable energy as a sustainable alternative to fossil fuels. Wind energy, being clean and widely available, is gaining momentum globally. Automation plays a key role in optimizing energy generation, reducing unplanned outages, and lowering human dependency in large-scale and offshore projects.

The demand for wind turbine automation is being fueled by the need to improve turbine performance and reduce operational costs. Operators are increasingly deploying automation technologies to monitor system health, manage grid integration, and enable predictive maintenance. Remote access capabilities and real-time data analysis are becoming essential features for managing both onshore and offshore installations.

Increasing Adoption of Technologies is evidenced by the integration of edge computing, AI-powered predictive maintenance algorithms, LiDAR-assisted wind measurement, and UAV-based blade inspection . These technologies transform data into operational insights – anticipating component failures, optimizing control parameters, and ensuring swift intervention without human presence.

There is a growing opportunity for investment in software platforms that support predictive maintenance, digital twin modeling, and energy optimization. Companies specializing in autonomous monitoring systems, AI-based diagnostic tools, and integrated cloud-based platforms are expected to benefit from rising interest in digital infrastructure. Investment in offshore wind automation solutions, particularly those that reduce the need for on-site intervention, is gaining strong investor attention.

Key Takeaways

- The Global Wind Turbine Automation Market was valued at USD 16.8 Billion in 2024 and is forecasted to grow significantly, reaching USD 43.9 Billion by 2034, expanding at a CAGR of 10.1%, supported by increasing demand for renewable energy and efficient turbine operations.

- Asia-Pacific (APAC) led the global landscape in 2024, contributing over 38% of the total market and generating USD 6.3 Billion, backed by large-scale wind energy deployments and government-backed clean energy policies.

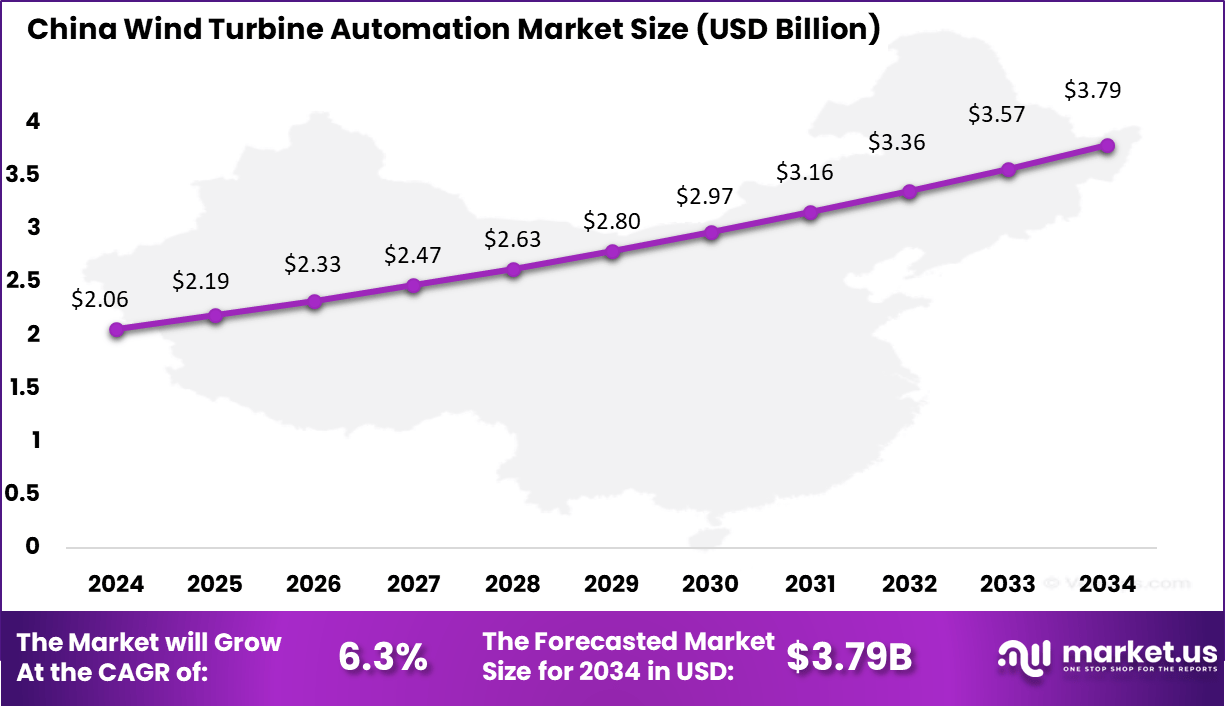

- China emerged as a key player within APAC, with a market value of USD 2.06 Billion in 2024 and a projected CAGR of 6.3%, driven by ongoing investments in wind infrastructure and domestic manufacturing capacity.

- By component, hardware accounted for 56% of the market in 2024, reflecting the critical role of sensors, controllers, and SCADA systems in automating turbine performance and reliability.

- By application, onshore wind farms dominated with a commanding 72% share in 2024, attributed to lower installation costs, easier maintenance access, and widespread land-based wind energy projects.

Role of AI

Artificial Intelligence (AI) plays a transformative role in wind turbine automation by enabling data-driven decision-making, improving system reliability, and enhancing operational efficiency. Through the use of machine learning models and predictive analytics, AI allows for early detection of faults, optimization of turbine settings, and adaptive maintenance scheduling.

These capabilities are essential in managing the complex variables associated with wind energy production, such as fluctuating wind speeds, turbine wear-and-tear, and real-time grid demands. One of the most critical contributions of AI is in predictive maintenance, where historical and real-time data from sensors are analyzed to forecast equipment failures before they occur.

This reduces unplanned downtime and extends the life of critical components. AI algorithms are also used in power output forecasting, helping operators anticipate wind patterns and manage energy distribution more effectively. Furthermore, AI enhances remote monitoring and autonomous control, allowing wind farms – especially those located offshore – to operate with minimal human intervention.

China Market Expansion

The China Wind Turbine Automation Market is valued at approximately USD 2.06 Billion in 2024 and is predicted to increase from USD 2.8 Billion in 2029 to approximately USD 3.79 Billion by 2034, projected at a CAGR of 6.3% from 2025 to 2034.

In 2024, APAC held a dominant market position, capturing more than a 38% share and generating approximately USD 6.3 billion in revenue in the global Wind Turbine Automation Market. This regional leadership can be attributed to the rapid deployment of renewable energy projects across China, India, and Southeast Asian countries.

Government-led initiatives focused on reducing carbon emissions and achieving net-zero targets have significantly increased investments in wind energy infrastructure. In particular, China’s expanding offshore wind farms and its ongoing commitment to industrial automation are playing a pivotal role in driving adoption.

By Component Analysis

In 2024, the Hardware segment held a dominant market position, capturing more than a 56 % share of the Wind Turbine Automation Market. This dominance stems from the essential role that hardware components – such as sensors, controllers, and drives – play in enabling real-time turbine monitoring and operational control.

Critical systems like blade position sensors, vibration and temperature monitors, and programmable logic controllers are foundational for continuous, reliable energy generation. The hardware layer supports the higher-level software modules and services, making it indispensable in both onshore and offshore settings.

The hardware’s leadership is reinforced by its integration with advanced technologies. Edge computing units and ruggedized controllers are increasingly embedded directly in turbines, enabling local decision-making and reducing latency.

Additionally, the surge in IoT-enabled sensors and robust connectivity solutions equips turbines with fine-grained data for condition-based maintenance and autonomous alerts. Offshore environments, in particular, benefit from sensor-rich nacelles and durable drives that reduce human intervention and ensure continuous uptime.

Comparison Summary – Component Analysis

Component 2024 Share Strengths & Drivers Hardware > 56% (dominant) Core sensors, controllers, and drives essential for automation; large nacelle share; investment in ruggedized components Software Moderate–high Enables SCADA, analytics, predictive maintenance, remote monitoring Services Emerging growth Supports installation, commissioning, upkeep, upgrades, and retrofits By Application Analysis

In 2024, the Onshore Wind Farms segment held a dominant market position, capturing more than a 72 % share of the Wind Turbine Automation Market. Onshore installations remain more prevalent due to lower capital expenditure, simpler logistics, and easier maintenance access compared to offshore sites.

The maturity of onshore infrastructure – ranging from sensor-equipped turbine fleets to well-established SCADA networks – supports immediate scalability of automation technologies. As a result, operators can benefit from improved energy yield and reduced downtime through condition-based controls and real-time diagnostics without bearing the complexity and cost associated with marine environments.

The leadership of the onshore segment is reinforced by continuous enhancements in sensor accuracy and controller responsiveness. Modern edge-enabled controllers and vibration, temperature, or blade-pitch sensors are being widely deployed across onshore farms, enabling precise monitoring and predictive maintenance at a fraction of offshore implementation costs.

Comparison Summary – Application Analysis

Application 2024 Share Drivers Onshore Wind Farms > 72% (dominant) Lower costs; established grid/logistics; rising turbine size; retrofit demand Offshore Wind Farms < 28% High-cost deployment; complex logistics; harsh environments Key Market Segments

By Component

- Hardware

- Sensors

- Controllers

- Others (Drives, etc.)

- Software

- Services

- Maintenance Services

- Installation Services

By Application

- Onshore Wind Farms

- Offshore Wind Farms

Market Dynamics

Category Insight Impact Emerging Trend AI-driven predictive maintenance using machine learning models and SCADA data Improves fault detection accuracy, reduces unplanned downtime, and optimizes energy generation Driver Record global wind capacity additions of 116.6 GW in 2023; automation market projected to grow from USD 9.12 B (2024) to USD 14.67 B by 2033 Accelerated wind deployment creates strong demand for automated control and monitoring solutions Restraint High capital investment required for automation hardware and system integration Limits adoption among small operators and increases complexity when upgrading legacy systems Opportunity Asia Pacific offshore expansion, led by China targeting 52 GW by 2030 and regional policy support Offers growth potential for full-suite automation technologies in maintenance, diagnostics, and offshore performance optimization Challenge Data reliability, AI model transparency, and limited infrastructure scalability Creates barriers to deploying advanced analytics and predictive tools across large turbine fleets Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Emerson reported control over approximately 65,000 wind turbines globally and completed its acquisition of AspenTech in March 2025 to bolster software‑driven turbine analytics and optimization. Its portfolio now integrates valves, measurement tools, SCADA, and advanced modeling – positioning the firm as a software‑enabled leader in turbine automation.

Rockwell Automation continued to position itself as a major provider of wind‑farm control systems. In 2025, it promoted its scalable Wind Farm SCADA and Condition Monitoring platforms – highlighting its role in real‑time supervisory control and predictive maintenance systems for turbines. These launches reinforced Rockwell’s emphasis on integrated asset management across dispersed turbine fleets.

Top Key Players Covered

- Axiomtek

- B&R Industrial Automation

- Beckhoff Worldwide

- Emerson

- Inox Wind

- Pliz

- Prima Automation

- Rockwell Automation

- Siemens

- ABB

- General Electric

- Schneider Electric

- Mitsubishi Electric

- Honeywell

- Siemens Gamesa

- Other Key Players

Recent Developments

- In March 2025, Siemens Energy divested 90% of its wind turbine operations in India and Sri Lanka to a TPG‑led climate investment group. The move, which includes two manufacturing plants and about 1,000 employees, aims to sharpen the company’s focus on core markets. Shares rose about 3% following this transaction.

- In May 2024, ABB agreed to acquire Siemens’s wiring accessories business in China. This move extends ABB’s distribution reach across 230 Chinese cities and enhances its automation portfolio – which includes wind turbine systems – by leveraging greater access to control and monitoring solutions.

- In April 2024, GE separated its energy‑focused divisions from General Electric to form GE Vernova, consolidating GE Wind, GE Offshore Wind, GE Power and related segments into one energy‑centric company. It offers a platform for concentrated innovation in turbine automation and grid integration.

Report Scope

Report Features Description Market Value (2024) USD 16.8 Bn Forecast Revenue (2034) USD 43.9 Bn CAGR (2025-2034) 10.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware (Sensors, Controllers, Others (Drives, etc.)), Software, Services (Maintenance Services, Installation Services)), By Application (Onshore Wind Farms, Offshore Wind Farms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Axiomtek, B&R Industrial Automation, Beckhoff Worldwide, Emerson, Inox Wind, Pliz, Prima Automation, Rockwell Automation, Siemens, ABB, General Electric, Schneider Electric, Mitsubishi Electric, Honeywell, Siemens Gamesa, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wind Turbine Automation MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Wind Turbine Automation MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Axiomtek

- B&R Industrial Automation

- Beckhoff Worldwide

- Emerson

- Inox Wind

- Pliz

- Prima Automation

- Rockwell Automation

- Siemens

- ABB

- General Electric

- Schneider Electric

- Mitsubishi Electric

- Honeywell

- Siemens Gamesa

- Other Key Players