Global Organic Shampoo Market Size, Share, Growth Analysis By Product (Non-Medicated and Regular, Medicated and Special-Purpose), By Form (Liquid, Solid, Foam, Others), By Application (Household, Commercial), By Price Range (Medium, High, Low), By Consumer Group (Female, Male), By Distribution Channel (Hypermarket and Supermarket, Online Retail, Company Website, Speciality Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143393

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

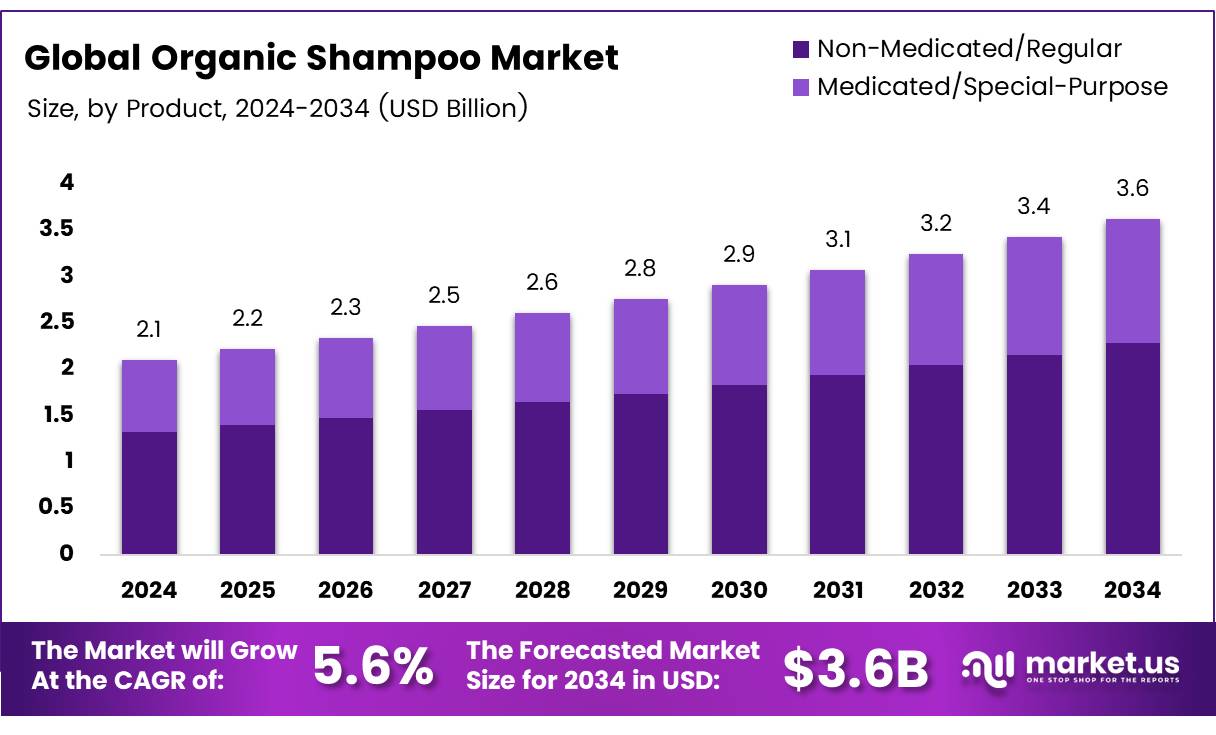

The Global Organic Shampoo Market size is expected to be worth around USD 3.6 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The Organic Shampoo Market caters to a growing segment of consumers seeking natural and environmentally friendly hair care solutions. According to allthingshair, mobile searches for shampoo have surged by 130% over the past two years, signaling a robust consumer interest that organic shampoo brands can capitalize on. Annually, over 548 million shampoo units are sold in the United States, as per allthingshair, underscoring a substantial market base for organic variants.

Organic shampoos differentiate themselves by excluding harmful chemicals and synthetic ingredients, focusing instead on natural extracts and organic compounds that promise to nourish hair while being gentle on the scalp and the environment.

The organic shampoo market is poised for significant growth, driven by increasing consumer awareness and a preference for sustainable products. This sector is also bolstered by government support for organic products through stringent regulations and potential subsidies for organic ingredient farming.

The rising trend of ethical consumerism enhances market opportunities, as more customers are willing to invest in higher-priced but environmentally responsible products. Furthermore, the shift towards e-commerce platforms offers additional revenue channels and broader market reach for organic shampoo brands.

Government investment and regulations play pivotal roles in shaping the organic shampoo market. Regulatory frameworks ensuring the authenticity and safety of organic products build consumer trust and encourage market participation.

Investments in sustainable practices and the promotion of organic ingredient production are crucial for the continuous supply and innovation in this sector. These governmental efforts not only support market growth but also align with broader environmental goals, making organic shampoos a key player in the green movement within the personal care sector.

Despite the noted enthusiasm for natural and organic personal care, it’s important to recognize varying consumer priorities across demographic segments. For instance, according to industry report, 52% of Black hair care users prioritize the effectiveness of the product over whether it is natural or organic.

This highlights the importance of product performance in market strategies and suggests that organic shampoo brands must not only focus on the organic appeal but also on delivering high-quality and effective results to capture a broader consumer base.

Key Takeaways

- The Global Organic Shampoo Market is projected to reach USD 3.6 Billion by 2034, growing at a CAGR of 5.6% from 2025 to 2034.

- The Non-Medicated/Regular segment led the market in 2024, with a 62.4% share, driven by demand for chemical-free daily hair care.

- Liquid Organic Shampoo captured 35.2% of the market in 2024, maintaining dominance due to its popularity and ease of use.

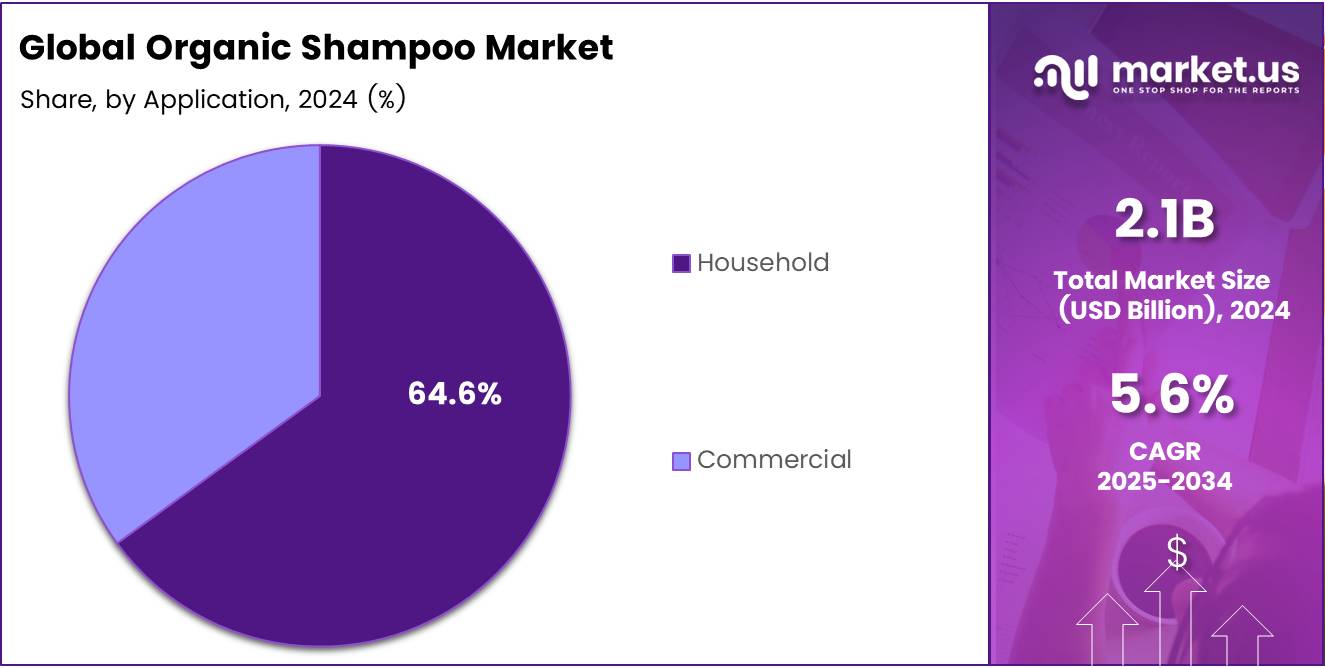

- The Household segment held a 64.6% market share in 2024, driven by increasing consumer preference for organic personal care products.

- The Medium price range segment dominated the market in 2024 with a 46.7% share, balancing quality and affordability.

- Female consumers represented 56.3% of the organic shampoo market in 2024, highlighting their influence on market demand.

- Hypermarkets/Supermarkets led distribution channels in 2024, holding a 34.5% market share due to broad consumer reach and convenience.

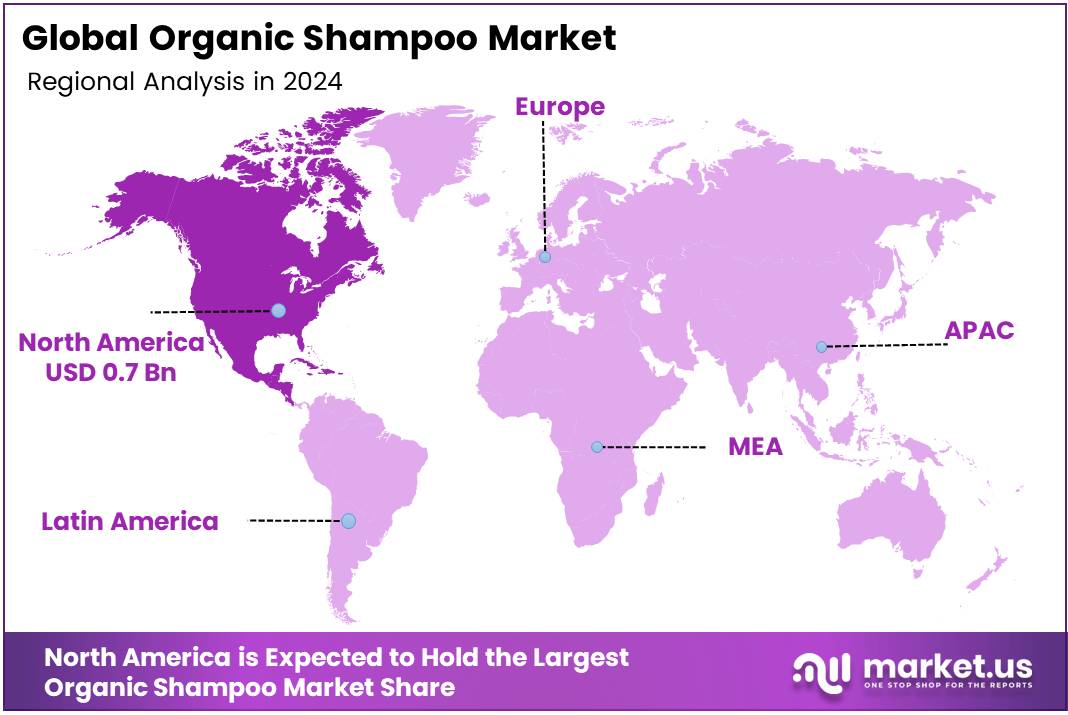

- North America held the largest market share in 2024, with 35.2%, valued at USD 0.7 billion, driven by increased consumer awareness and regulatory support.

Product Analysis

Non-Medicated/Regular Segment Leads Organic Shampoo Market with 62.4% Share in 2024

In 2024, the Non-Medicated/Regular segment dominated the Organic Shampoo market with a substantial 62.4% share in the By Product Analysis category. This segment’s dominance is driven by a growing preference among consumers for everyday, chemical-free hair care solutions.

Non-medicated organic shampoos offer a broad appeal, catering to consumers seeking gentle, natural hair cleansing products without the need for specific treatments. The emphasis on wellness, along with rising awareness about the harmful effects of synthetic chemicals, continues to fuel the demand for these products, positioning them as the go-to choice for everyday hair care routines.

On the other hand, the Medicated/Special-Purpose segment, while holding a smaller share, is witnessing steady growth. This segment caters to consumers seeking targeted solutions for specific scalp issues, such as dandruff, hair thinning, or sensitivity. With increasing consumer awareness regarding the importance of personalized hair care, medicated organic shampoos are gaining traction, albeit at a slower pace than their regular counterparts.

Form Analysis

Liquid Organic Shampoo Holds 35.2% Share in 2024s By Form Analysis Segment

In 2024, Liquid Organic Shampoo maintained a dominant position in the By Form Analysis segment of the organic shampoo market, capturing a notable 35.2% share. This strong presence can be attributed to its longstanding popularity and broad consumer acceptance, driven by its ease of use and effective application for a wide variety of hair types.

Liquid shampoos offer convenience and consistency, making them a go-to choice for everyday hair care routines. Moreover, liquid formulations are often perceived as more versatile in terms of mixing with other ingredients or added benefits such as essential oils, which contributes to their strong market appeal.

Solid organic shampoos, while growing in popularity due to their eco-friendly packaging and travel convenience, held a smaller portion of the market in comparison. Foam products also continue to attract attention due to their light texture and ease of use but remain a niche within the broader shampoo segment.

Other forms, such as gels and powders, show potential for niche market growth but have not yet posed a significant challenge to the liquid format. Liquid organic shampoos remain a key driver in the industry, leading with a substantial market share and consumer preference in 2024.

Application Analysis

Household Application Leads Organic Shampoo Market with 64.6% Share in 2024

In 2024, the Household segment captured a dominant position in the By Application Analysis category of the Organic Shampoo Market, holding a substantial 64.6% share. This is largely due to the increasing consumer preference for organic personal care products, driven by rising health-consciousness and growing awareness of the harmful chemicals in conventional shampoos.

Households are increasingly shifting towards organic alternatives to prioritize the safety of their family members, especially with the rising concerns over scalp health, hair damage, and environmental sustainability.

In comparison, the Commercial segment, which includes spas, salons, and hotels, accounted for the remaining market share. While this segment is witnessing steady growth due to the increased demand for organic products in professional settings, it still lags behind the household segment. The shift toward natural, chemical-free grooming solutions in commercial applications is gaining momentum as more establishments focus on sustainability and eco-friendly products to cater to their environmentally aware clientele.

The dominance of the Household segment reflects a broader trend towards self-care, environmental awareness, and preference for organic, non-toxic products in everyday life, which are expected to continue driving growth in the organic shampoo market over the coming years.

Price Range Analysis

Medium Price Range dominates Organic Shampoo Market with 46.7% Share in 2024

In 2024, the Organic Shampoo Market saw the Medium price range holding a dominant position in the By Price Range Analysis segment, with a significant 46.7% market share. This surge in popularity can be attributed to the balanced offering of quality and affordability that appeals to a wide range of consumers. Medium-priced organic shampoos provide a compelling value proposition, with premium ingredients and effective formulations, yet remain reasonably priced for the average consumer.

High-priced organic shampoos, although offering top-tier ingredients and exclusive benefits, account for a smaller portion of the market. This segment caters mainly to premium consumers seeking luxury and advanced haircare solutions. Meanwhile, the Low price range, continues to appeal to budget-conscious buyers who prioritize cost-efficiency but may be more selective in terms of ingredient sourcing and brand reputation.

Overall, the Medium price range remains the most dominant category, driven by its ability to cater to a broad consumer base seeking a balance of quality and affordability in organic haircare solutions.

Consumer Group Analysis

Female Consumers Dominate Organic Shampoo Market with 56.3% Share

In 2024, the organic shampoo market witnessed significant segmentation by consumer group, with female consumers holding a dominant market position. Female buyers accounted for 56.3% of the market share, underscoring their pivotal role in driving the demand for organic shampoo products. This predominance can be attributed to heightened awareness among female consumers regarding the benefits of organic ingredients and their preference for sustainable and health-conscious choices in personal care products.

Contrastingly, male consumers represented a smaller portion of the market, which signals a potential area for growth and expansion. Companies within the industry might benefit from strategizing targeted marketing campaigns and developing products that appeal to the male demographic, aiming to increase their market engagement and share.

The sustained interest of female consumers in organic shampoos is likely driven by the growing social advocacy for natural and environmentally friendly products, coupled with an increasing preference for non-toxic ingredients in beauty and personal care regimes. Moving forward, the organic shampoo market is expected to see an increasing integration of product offerings tailored to diverse consumer needs, potentially narrowing the current gender disparity in market shares.

Distribution Channel Analysis

Hypermarket/Supermarket Leads Distribution Channels with 34.5% Market Share in Organic Shampoo Sector

In 2024, the By Distribution Channel Analysis segment of the Organic Shampoo Market saw Hypermarkets/Supermarkets securing a commanding presence, holding a 34.5% market share. This segments dominance is attributed to the extensive consumer reach and the convenience of accessing a wide range of organic products under one roof.

Hypermarkets and supermarkets are strategically located to cater to a diverse demographic, providing ease of access and the advantage of physical verification of product quality and ingredients, which is particularly valued in the organic market.

Following closely, Online Retail channels marked their significant impact by offering consumers the flexibility to shop from various brands at competitive prices. This channel benefits from the growing trend of digitalization and the increasing consumer preference for shopping from the comfort of their homes.

Company Websites, serving as a direct sales channel, also play a crucial role in distribution. They offer detailed product information, customer reviews, and exclusive promotions, enhancing consumer engagement and brand loyalty.

Specialty Stores, focused on health and wellness products, provide tailored customer service and expert advice, making them a vital component of the distribution network. The Others category, which includes various smaller retail formats and direct sales, also contributes to the market, ensuring that organic shampoos are accessible across different consumer segments and geographical areas.

Key Market Segments

By Product

- Non-Medicated/Regular

- Medicated/Special-Purpose

By Form

- Liquid

- Solid

- Foam

- Others

By Application

- Household

- Commercial

By Price Range

- Medium

- High

- Low

By Consumer Group

- Female

- Male

By Distribution Channel

- Hypermarket/Supermarket

- Online Retail

- Company Website

- Speciality Stores

- Others

Drivers

Rising Consumer Awareness Fuels Organic Shampoo Market Growth

The growth of the organic shampoo market can be attributed to several key factors. Firstly, increasing consumer awareness regarding the adverse effects of synthetic chemicals in conventional shampoos is propelling a shift towards organic alternatives. This awareness is coupled with a broader health and wellness trend that emphasizes natural and chemical-free personal care products, further driving demand.

Additionally, rising environmental concerns have led consumers to prefer sustainable and eco-friendly products, which includes organic shampoos that often use biodegradable ingredients and eco-conscious packaging. Moreover, stringent government regulations and the establishment of certifications for organic products are reinforcing consumer confidence and supporting market expansion.

These drivers collectively enhance the market’s potential for substantial growth in the near future, as consumers increasingly opt for safer, healthier, and more sustainable personal care options.

Restraints

Limited Shelf Life Challenges Organic Shampoo Market Competitiveness

In the organic shampoo market, several key restraints are impacting its growth and market penetration. One significant challenge is the limited shelf life of these products. Due to the absence of synthetic preservatives commonly found in traditional shampoos, organic shampoos tend to deteriorate faster, which can deter retailers from stocking them and consumers from purchasing them, fearing they may not use the product before it expires.

This factor directly affects their competitiveness in the market as it limits the attractiveness of organic shampoos to potential buyers who prioritize product longevity. Additionally, in developing regions, there is a noticeable lack of consumer awareness regarding the benefits of organic shampoos.

Many potential customers in these areas remain uninformed about the advantages such as fewer chemicals and environmental friendliness, which slows down the adoption rates. This gap in consumer education further hinders the market’s expansion, as awareness is a critical driver for the adoption of new products.

Together, these factors pose substantial restraints on the growth of the organic shampoo market, making it crucial for manufacturers and marketers to address these issues to enhance market acceptance and competitiveness.

Growth Factors

Innovative Formulations Boosting Organic Shampoo Market Growth

The organic shampoo market is poised for substantial growth, driven by innovative product formulations that cater to specific hair concerns such as dandruff, hair fall, and colored hair. These specialized products are gaining traction among a diverse consumer base seeking natural and effective solutions.

Additionally, the expansion into emerging markets such as Asia-Pacific, Latin America, and Africa is fueled by rising disposable incomes and a growing consciousness about organic products. This geographical expansion is expected to unlock significant opportunities for market growth.

Moreover, the surge in demand for vegan and cruelty-free hair care products further enriches the market landscape, offering considerable growth prospects. Organic shampoo brands that embrace customization, allowing consumers to tailor products according to their unique hair type and scalp conditions, are especially positioned to capture a larger market share. This trend towards personalization enhances consumer engagement and loyalty, driving further market expansion.

Emerging Trends

Rising Popularity of Ayurvedic and Herbal Shampoos Fuels Market Growth

The organic shampoo market is witnessing significant growth, driven by various influential factors. Foremost among these is the rising consumer preference for shampoos containing Ayurvedic, herbal, and botanical ingredients, which are perceived as safer and more beneficial for hair health.

Additionally, there is an increasing shift towards waterless shampoo formats such as solid bars, powders, and concentrated liquids. These products are not only seen as innovative but also eco-friendly, appealing to environmentally conscious consumers.

Another emerging trend is the integration of CBD and hemp oils into organic shampoos, catering to the premium segment with their purported hair care benefits.

Lastly, organic shampoo brands are harnessing the power of influencer marketing and celebrity endorsements, which has significantly boosted their visibility and appeal among a wider audience. These trends collectively signify a robust trajectory for the organic shampoo market, reflecting a deepening commitment to sustainability and natural ingredients in hair care.

Regional Analysis

North America Leads Organic Shampoo Market with 35.2% Share, Valued at USD 0.7 Billion

The global market for organic shampoos is segmented into various regions, each displaying unique growth dynamics and market penetration. North America emerges as the dominating region, holding a substantial market share of 35.2%, valued at USD 0.7 billion. This prominence can be attributed to a heightened consumer awareness regarding the benefits of natural products coupled with stringent regulations promoting organic product usage.

Regional Mentions:

In Europe, the market for organic shampoos is driven by robust regulatory frameworks that advocate for sustainable and eco-friendly products. The increasing preference for vegan and cruelty-free beauty products among European consumers further fuels market growth. Europe’s market is characterized by a well-established presence of organic brands and high consumer purchasing power, particularly in countries such as Germany, France, and the UK.

The Asia Pacific region is witnessing rapid growth in the organic shampoo market, propelled by changing consumer lifestyles and rising disposable incomes. Countries like China and India are leading this surge, with an expanding middle class increasingly inclined towards health-conscious and environmentally sustainable choices. The market in this region benefits from a vast consumer base and growing retail sectors, offering significant opportunities for market expansion.

Middle East & Africa, and Latin America are emerging as potential growth territories for the organic shampoo market. In the Middle East & Africa, the demand is gradually rising due to an increasing awareness of product ingredients and their impacts on health. Latin America shows promising growth, driven by a burgeoning awareness of natural and organic products and a growing number of local manufacturers entering the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In assessing the competitive landscape of the global Organic Shampoo Market for 2024, several key players are poised to shape the industry dynamics. John Master’s Organic, renowned for its premium ingredients and eco-friendly practices, is expected to continue its dominance in the high-end segment, leveraging its established brand loyalty and extensive distribution network.

Vogue International LLC (OGX), with its broad product range that combines exotic ingredients with a sustainable approach, is likely to expand its market share. Its ability to innovate and adapt to consumer preferences makes it a formidable contender in the mass market sphere.

Real Purity Inc. remains a niche player, focusing on hypoallergenic organic shampoos that cater to a specific demographic concerned with health and wellness. This specialization in sensitive skin and allergy-free formulations is anticipated to drive its growth in specialized markets.

Rahua Classics and Aveda are positioned as luxury brands with a staunch commitment to environmental sustainability. Both companies are expected to capitalize on the growing consumer demand for ethical and environmentally responsible products, enhancing their market presence.

Giovanni Cosmetics, Inc. and Natulique offer a diverse range of products that align with professional salon standards and eco-conscious consumers. Their emphasis on non-toxic ingredients and cruelty-free certifications is likely to resonate well with informed consumers.

Kao Corporation stands out with its significant R&D capabilities, potentially introducing innovative products that could disrupt the market dynamics. Their scientific approach to natural ingredients might set new benchmarks for efficacy in organic shampoos.

Art Naturals and Medimix, with their focus on affordability and natural ingredients, are expected to perform well in price-sensitive markets. Their approach to combining traditional herbal remedies with modern hair care needs is likely to attract a broad customer base seeking economical natural options.

Top Key Players in the Market

- John Master’s Organic

- Vogue International LLC (OGX)

- Real Purity Inc.

- Rahua Classics

- Art Naturals

- Natulique

- Medimix

- Aveda

- Giovanni Cosmetics, Inc.

- Art Naturals

- Kao Corporation

Recent Developments

- In February 2025, Reliance Consumer acquired Velvette, the iconic shampoo brand that pioneered the sachet revolution in India, enhancing its portfolio in the fast-moving consumer goods (FMCG) sector.

- In December 2024, an emerging Indian hair care startup successfully raised $4 million in a Series A funding round, which will be used to expand its product offerings and boost its market presence.

- In January 2024, the hair and scalp care brand Jupiter secured a $3 million funding round, aiming to scale its innovative range of hair care products and grow its customer base.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Billion Forecast Revenue (2034) USD 3.6 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Non-Medicated/Regular, Medicated/Special-Purpose), By Form (Liquid, Solid, Foam, Others), By Application (Household, Commercial), By Price Range (Medium, High, Low), By Consumer Group (Female, Male), By Distribution Channel (Hypermarket/Supermarket, Online Retail, Company Website, Speciality Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape John Master’s Organic, Vogue International LLC (OGX), Real Purity Inc., Rahua Classics, Art Naturals, Natulique, Medimix, Aveda, Giovanni Cosmetics, Inc., Art Naturals, Kao Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- John Master’s Organic

- Vogue International LLC (OGX)

- Real Purity Inc.

- Rahua Classics

- Art Naturals

- Natulique

- Medimix

- Aveda

- Giovanni Cosmetics, Inc.

- Art Naturals

- Kao Corporation