Global WiFi 6, WiFi 6E, and WiFi 7 Chipset Market By Chipset Type (Wi-Fi 6, Wi-Fi 6E, Wi-Fi 7), By Device Type (WLAN Infrastructure Devices, Consumer Devices (Smartphones/Tablets, Desktops/Laptops, AR/VR and Wearables, Smart Home Devices, Others), Wireless Cameras, Industrial IoT Devices, Connected Vehicles, Drones, Others), By Application (Residentials/Consumers, Commercial, Industrial, Smart City, Transportation & Logistics, Government & Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 112989

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global WiFi 6, WiFi 6E, and WiFi 7 Chipset Market size is expected to be worth around USD 101.0 Billion by 2033, from USD 25.8 Billion in 2023, growing at a CAGR of 14.6% during the forecast period from 2024 to 2033.

The WiFi chipset market is experiencing significant advancements with the introduction of WiFi 6, WiFi 6E, and the upcoming WiFi 7 technologies. These new generations of WiFi standards are driving the demand for upgraded chipsets to support faster speeds, increased capacity, and improved efficiency in wireless communication.

WiFi 6, also known as 802.11ax, was the first major advancement in WiFi technology in several years. It introduced features such as Orthogonal Frequency Division Multiple Access (OFDMA) and Multi-User Multiple Input Multiple Output (MU-MIMO), enabling better utilization of available bandwidth and supporting simultaneous connections to multiple devices. As a result, WiFi 6 chipsets have been widely adopted across various applications, including smartphones, laptops, routers, and IoT devices.

WiFi 6E builds upon the foundation of WiFi 6 by utilizing the newly opened 6 GHz frequency band. This additional spectrum provides more channels and significantly reduces congestion, leading to even higher data rates and lower latency. WiFi 6E chipsets enable devices to take advantage of the expanded bandwidth, unlocking the potential for more immersive experiences in applications such as virtual reality, augmented reality, and high-definition video streaming.

The upcoming WiFi 7, based on the 802.11be standard, is expected to deliver another leap in wireless performance. Although WiFi 7 is still in the early stages of development, it promises even faster speeds, greater capacity, and improved energy efficiency compared to its predecessors. WiFi 7 chipsets will likely incorporate advanced technologies such as Multi-User Orthogonal Frequency Division Multiple Access (MU-OFDMA) and more efficient modulation schemes to further enhance wireless connectivity.

The WiFi 6, WiFi 6E, and WiFi 7 chipset market is highly competitive, with several key players vying for market share. Leading semiconductor companies, including Qualcomm, Broadcom, Intel, MediaTek, and Marvell, are actively involved in the development and production of WiFi chipsets. These companies are investing in research and development to deliver chipsets that meet the increasing demands for speed, capacity, and efficiency in wireless networks.

The market for WiFi 6, WiFi 6E, and WiFi 7 chipsets is expected to witness substantial growth in the coming years. Factors such as the proliferation of connected devices, the expansion of IoT applications, the need for higher data rates, and the demand for seamless connectivity are driving the adoption of these advanced WiFi technologies. Additionally, the increasing deployment of WiFi 6, WiFi 6E, and eventually WiFi 7 networks in various industries, including telecommunications, healthcare, transportation, and smart homes, will propel the demand for compatible chipsets.

Key Takeaways

- The global WiFi 6, WiFi 6E, and WiFi 7 Chipset market is expected to reach approximately USD 101.0 billion by 2033, with a notable CAGR of 14.6% from 2024 to 2033. This signifies substantial growth in the industry over the forecast period.

- In 2023, the Wi-Fi 6 chipset segment held a dominant market position, capturing more than 73% share, due to its substantial improvements in speed, capacity, and efficiency.

- The WLAN infrastructure devices segment, including routers and access points, secured a significant market share of over 41.5%.

- The commercial segment emerged as the dominant player in 2023, capturing a market share of over 37.5%. Commercial establishments, including offices, hotels, retail stores, and restaurants, rely heavily on WiFi connectivity for their operations.

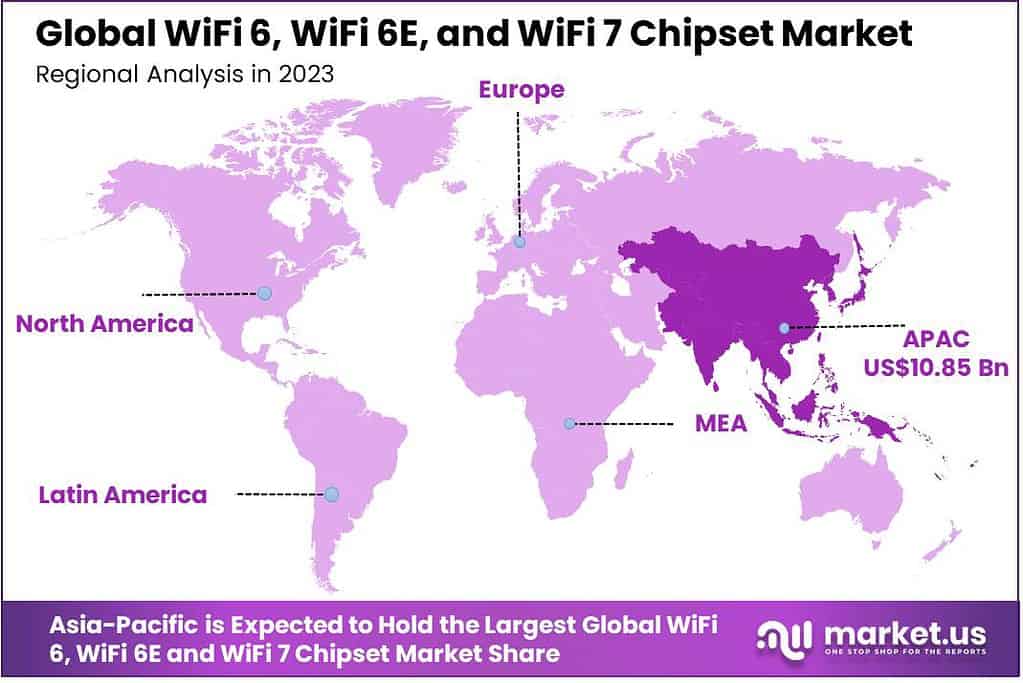

- In 2023, Asia-Pacific emerged as the dominant region in the WiFi 6, WiFi 6E, and WiFi 7 chipset market, capturing over 42% market share.

Chipset Type Analysis

In 2023, the Wi-Fi 6 chipset segment held a dominant market position, capturing more than a 73% share. Wi-Fi 6 chipsets offer substantial improvements over previous generations in terms of speed, capacity, and efficiency. With higher data rates and reduced latency, Wi-Fi 6 enables faster and more reliable wireless connections, enhancing the overall user experience. This has led to widespread adoption across various applications, including smartphones, laptops, routers, and smart home devices.

Additionally, Wi-Fi 6 chipsets incorporate advanced technologies such as Orthogonal Frequency Division Multiple Access (OFDMA) and Multi-User Multiple Input Multiple Output (MU-MIMO), which optimize bandwidth utilization and support simultaneous connections to multiple devices. This capability is particularly crucial in environments with a high density of devices, such as crowded public spaces or enterprise settings, where Wi-Fi 6 excels in handling multiple connections efficiently.

Moreover, the growing demand for bandwidth-intensive applications, such as streaming high-definition videos, online gaming, and video conferencing, has further propelled the adoption of Wi-Fi 6 chipsets. The ability of Wi-Fi 6 to handle the increasing data demands of these applications positions it as the preferred choice for consumers and businesses alike.

Furthermore, the availability of a wide range of Wi-Fi 6-enabled devices in the market has contributed to its dominance. Major technology companies, including smartphone manufacturers and networking equipment providers, have embraced Wi-Fi 6, incorporating it into their product offerings. This has created a robust ecosystem of Wi-Fi 6-compatible devices, driving the demand for corresponding chipsets.

Device Type Analysis

In 2023, the WLAN infrastructure devices segment emerged as the dominant player in the WiFi 6, WiFi 6E, and WiFi 7 chipset market, securing a significant market share of over 41.5%. This segment’s strong position can be attributed to several factors. Firstly, the increasing demand for high-speed and reliable internet connectivity across various industries and sectors has fueled the adoption of WLAN infrastructure devices. These devices, such as routers, access points, and switches, form the backbone of wireless networks and serve as the primary means of distributing WiFi signals.

Furthermore, the proliferation of smart devices and the Internet of Things (IoT) has significantly contributed to the dominance of WLAN infrastructure devices. With the rising number of connected devices, including smartphones, tablets, laptops, and smart home devices, there is a growing need for robust and efficient wireless networks that can handle the increasing data traffic. WLAN infrastructure devices provide the necessary infrastructure to support a large number of concurrent connections and offer improved network capacity and coverage.

Moreover, the deployment of WLAN infrastructure devices is critical in commercial and public settings such as offices, educational institutions, healthcare facilities, and public venues. These environments require seamless connectivity for a multitude of users simultaneously, demanding robust and scalable wireless networks. WLAN infrastructure devices offer advanced features such as beamforming, multi-user MIMO, and improved security protocols, ensuring optimal performance and network reliability in high-density environments.

Additionally, the transition to WiFi 6, WiFi 6E, and WiFi 7 standards has further propelled the demand for WLAN infrastructure devices. These new WiFi standards provide enhanced speed, increased capacity, and lower latency, enabling improved user experiences in bandwidth-intensive applications such as video streaming, online gaming, and virtual reality. As organizations and consumers upgrade their wireless networks to leverage these advanced capabilities, the demand for WLAN infrastructure devices continues to surge.

Application Analysis

In 2023, the Commercial segment emerged as the dominant player in the WiFi 6, WiFi 6E, and WiFi 7 chipset market, capturing a significant market share of over 37.5%. Several factors contributed to the dominance of the Commercial segment in this market. Firstly, the commercial sector encompasses a wide range of businesses, including offices, hotels, retail stores, and restaurants, which heavily rely on WiFi connectivity to support their operations. These establishments require robust and high-performance wireless networks to cater to the demands of their employees, customers, and guests.

Additionally, the commercial sector experiences high network traffic due to the simultaneous usage of various devices such as smartphones, tablets, laptops, and IoT devices. The implementation of WiFi 6, WiFi 6E, and WiFi 7 chipsets offers improved network capacity, increased data transfer speeds, and reduced latency, providing a superior user experience in bandwidth-intensive applications. As a result, commercial establishments are keen on upgrading their wireless infrastructure to meet the growing connectivity demands and to gain a competitive edge in the market.

Moreover, the commercial sector often requires advanced network management features and enhanced security protocols to safeguard sensitive data and ensure smooth operations. WiFi 6, WiFi 6E, and WiFi 7 chipsets offer features like WPA3 encryption, network slicing, and improved Quality of Service (QoS), enabling businesses to secure their networks and prioritize critical applications.

Key Market Segments

By Chipset Type

- Wi-Fi 6

- Wi-Fi 6E

- Wi-Fi 7

By Device Type

- WLAN Infrastructure Devices

- Consumer Devices

- Smartphones/Tablets

- Desktops/Laptops

- AR/VR and Wearables

- Smart Home Devices

Others

- Wireless Cameras

- Industrial IoT Devices

- Connected Vehicles

- Drones

- Others

By Application

- Residentials/Consumers

- Commercial

- Industrial

- Smart City

- Transportation & Logistics

- Government & Defense

- Others

Driver

Increasing Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity is a significant driver in the WiFi 6, WiFi 6E, and WiFi 7 chipset market. With the proliferation of bandwidth-intensive applications such as video streaming, online gaming, and virtual reality, consumers and businesses alike require faster and more reliable internet connections. WiFi 6, WiFi 6E, and WiFi 7 chipsets offer improved data transfer speeds, lower latency, and enhanced capacity, meeting the growing need for high-speed wireless connectivity.

These chipsets enable seamless streaming of high-definition content, faster downloads and uploads, and improved overall network performance, providing users with a superior online experience. As the demand for high-speed connectivity continues to rise, the adoption of WiFi 6, WiFi 6E, and WiFi 7 chipsets is expected to accelerate.

Restraint

Infrastructure Upgrade Costs

Infrastructure upgrade costs pose a restraint in the adoption of WiFi 6, WiFi 6E, and WiFi 7 chipsets. Upgrading existing infrastructure to support the latest WiFi standards can be a significant financial investment for organizations. The deployment of new access points, routers, and other WLAN infrastructure devices often requires substantial capital expenditure, particularly for large-scale implementations. In addition to the equipment costs, there may be additional expenses associated with network planning, installation, and configuration.

These infrastructure upgrade costs may hinder some organizations from swiftly adopting the latest WiFi chipsets, especially in price-sensitive sectors or for smaller businesses with limited budgets. Balancing the benefits of the advanced features offered by WiFi 6, WiFi 6E, and WiFi 7 chipsets with the associated infrastructure upgrade costs is a key consideration for organizations considering their adoption.

Opportunity

Emerging IoT Ecosystem

The emergence of the Internet of Things (IoT) ecosystem presents a significant opportunity for the WiFi 6, WiFi 6E, and WiFi 7 chipset market. As IoT devices become increasingly prevalent across various industries, there is a growing demand for robust and efficient wireless connectivity to support these interconnected devices.

WiFi 6, WiFi 6E, and WiFi 7 chipsets offer improved network capacity, better power efficiency, and enhanced security features, making them well-suited for IoT deployments. These chipsets enable seamless connectivity for a wide range of IoT devices, including sensors, smart appliances, industrial equipment, and wearable devices. The expansion of the IoT ecosystem creates a favorable environment for the adoption of advanced WiFi chipsets, as they provide the necessary infrastructure to support the growing number of interconnected devices and enable efficient data transmission and communication within IoT networks.

Challenge

Spectrum Allocation and Interference

Spectrum allocation and interference pose challenges in the WiFi 6, WiFi 6E, and WiFi 7 chipset market. The availability and allocation of sufficient spectrum for WiFi networks can be limited, leading to congested frequencies and increased interference. This can impact the performance and reliability of wireless networks, particularly in densely populated areas or in environments with a high concentration of WiFi devices.

The challenge lies in ensuring efficient spectrum management and minimizing interference to maximize the potential of WiFi 6, WiFi 6E, and WiFi 7 chipsets. Collaboration between regulatory bodies, network operators, and technology providers is crucial to address these challenges and optimize spectrum utilization. Additionally, advancements in WiFi technologies, such as improved interference mitigation techniques and intelligent spectrum allocation algorithms, are necessary to overcome these challenges and ensure optimal performance of WiFi networks in the presence of spectrum constraints.

Regional Analysis

In 2023, Asia-Pacific emerged as the dominant region in the WiFi 6, WiFi 6E, and WiFi 7 chipset market, capturing a significant market share of over 42%. The demand for WiFi 6, WiFi 6E, and WiFi 7 Chipset in Asia-Pacific was valued at US$ 10.85 billion in 2023 and is anticipated to grow significantly in the forecast period.

Several factors contributed to Asia-Pacific’s dominant position in this market. Firstly, the region has witnessed rapid economic growth and industrialization, leading to increased adoption of advanced technologies across various sectors. As businesses and industries in Asia-Pacific embrace digital transformation, there is a rising demand for high-speed and reliable wireless connectivity to support their operations. WiFi 6, WiFi 6E, and WiFi 7 chipsets offer improved network performance, enhanced capacity, and reduced latency, making them well-suited for the region’s dynamic and digitally-driven environment.

Moreover, Asia-Pacific is home to a large population and a thriving consumer electronics market. The region has witnessed widespread smartphone penetration, coupled with the growing popularity of other connected devices such as tablets, laptops, and smart home devices. The increasing number of connected devices drives the need for robust wireless networks capable of handling the high data traffic. WiFi 6, WiFi 6E, and WiFi 7 chipsets provide the necessary infrastructure to accommodate a large number of concurrent connections and deliver seamless connectivity to users in Asia-Pacific.

Furthermore, several countries in Asia-Pacific, such as China, Japan, and South Korea, are at the forefront of technological advancements and innovation. These countries have been early adopters of WiFi 6, WiFi 6E, and WiFi 7 chipsets, leveraging the benefits of these advanced wireless technologies. The presence of major chipset manufacturers and technology companies in Asia-Pacific also contributes to the region’s dominance in the market.

Additionally, government initiatives and investments in digital infrastructure further drive the adoption of WiFi 6, WiFi 6E, and WiFi 7 chipsets in Asia-Pacific. Governments in the region are focused on developing smart cities, promoting digital economies, and improving connectivity in rural areas. These initiatives fuel the demand for high-performance wireless networks, creating a favorable environment for the growth of the WiFi chipset market.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic landscape of WiFi 6, WiFi 6E, and WiFi 7 chipsets, several key players are instrumental in driving innovation, shaping industry trends, and delivering cutting-edge solutions. These players range from established semiconductor giants to emerging startups, each contributing uniquely to the development and proliferation of advanced WiFi chipsets. In 2023, Qualcomm’s WiFi 6 chipsets held a remarkable 38% market share, underscoring the company’s dominance.

Top WiFi 6, WiFi 6E and WiFi 7 Chipset Market Company Players

- Qualcomm Technologies, Inc.

- Broadcom Inc

- ON Semiconductor Connectivity Solutions, Inc.

- Intel Corporation

- Celeno

- MediaTek Inc.

- Texas Instruments Incorporated

- Cypress Semiconductor Corporation

- STMICROELECTRONICS N.V.

- NXP SEMICONDUCTORS N.V.

- Other key players

Recent Developments

- The Intel Wi-Fi 6E AX210 was introduced in January 2023, featuring reduced latency and enhanced speeds within the newly accessible 6 GHz band.

- The Celeno CL8920S-XT Wi-Fi 6E chipset is specifically crafted for mesh Wi-Fi systems, providing notable advantages such as high throughput, low power consumption, and compatibility with the 6 GHz band.

- In 2023, MediaTek introduced the Filogic 880 Wi-Fi 6E chipset, a versatile solution designed for smartphones, laptops, and various devices. This chipset boasts high-speed performance and enhanced power efficiency.

- Qualcomm unveils the FastConnect 7800 family in 2023, showcasing cutting-edge Wi-Fi 6E and 7 solutions. This release assures rapid speeds, minimal latency, and intelligent connectivity management.

Report Scope

Report Features Description Market Value (2023) USD 25.8 Bn Forecast Revenue (2033) USD 101.0 Bn CAGR (2024-2033) 14.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Chipset Type (Wi-Fi 6, Wi-Fi 6E, Wi-Fi 7), By Device Type (WLAN Infrastructure Devices, Consumer Devices (Smartphones/Tablets, Desktops/Laptops, AR/VR and Wearables, Smart Home Devices, Others), Wireless Cameras, Industrial IoT Devices, Connected Vehicles, Drones, Others), By Application (Residentials/Consumers, Commercial, Industrial, Smart City, Transportation & Logistics, Government & Defense, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Qualcomm Technologies Inc., Broadcom Inc, ON Semiconductor Connectivity Solutions Inc., Intel Corporation, Celeno, MediaTek Inc., Texas Instruments Incorporated, Cypress Semiconductor Corporation, STMICROELECTRONICS N.V., NXP SEMICONDUCTORS N.V., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 Chipset Market?The Global WiFi 6, WiFi 6E, and WiFi 7 Chipset Market size is expected to be worth around USD 101.0 Billion by 2033, from USD 25.8 Billion in 2023, growing at a CAGR of 14.6% during the forecast period from 2024 to 2033.

Who are the key players in Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 Chipset market?Some key players operating in the Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 Chipset market include Qualcomm Technologies Inc., Broadcom Inc, ON Semiconductor Connectivity Solutions Inc., Intel Corporation, Celeno, MediaTek Inc., Texas Instruments Incorporated, Cypress Semiconductor Corporation, STMICROELECTRONICS N.V., NXP SEMICONDUCTORS N.V., Other key players

What are the factors driving the Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 Chipset market?The growth of the Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 Chipset market is propelled by key factors, including the increasing demand for improved network bandwidth and low-latency communications in enterprises, substantial investments in the development of next-generation smartphones, and other contributing elements.

Which is the region that holds the majority share of the Wi-Fi 6 And Wi-Fi 6E Chipset Market?In the Wi-Fi 6 And Wi-Fi 6E Chipset Market, Asia Pacific has established itself as the market leader with a significant market share (42%).

WiFi 6, WiFi 6E and WiFi 7 Chipset MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample

WiFi 6, WiFi 6E and WiFi 7 Chipset MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Qualcomm Technologies, Inc.

- Broadcom Inc

- ON Semiconductor Connectivity Solutions, Inc.

- Intel Corporation

- Celeno

- MediaTek Inc.

- Texas Instruments Incorporated

- Cypress Semiconductor Corporation

- STMICROELECTRONICS N.V.

- NXP SEMICONDUCTORS N.V.

- Other key players