Global White Biotechnology Market By Type (Biofuels, Biochemicals, Biomaterials and Industrial Enzymes) By Applications (Pharmaceuticals, Chemicals, Feed, Bioenergy, Personal Care & Household Products and Food and Beverages) by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 84188

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

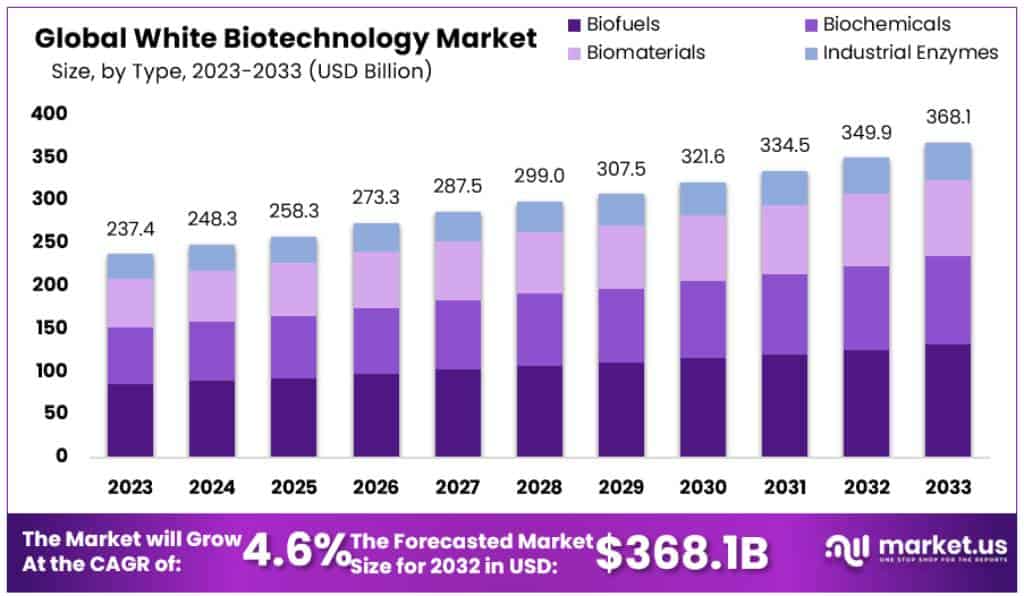

The Global White Biotechnology Market size is expected to be worth around USD 368.1 Billion by 2033, from USD 237.4 Billion in 2023, growing at a CAGR of 4.6% during the forecast period from 2023 to 2033.

White Biotechnology, or synthetic biology, is the application of biochemistry and molecular biology to the high-throughput manipulation of DNA. Synthetic Biology is a type of genetic engineering that utilizes DNA molecules that have been assembled in the laboratory rather than being extracted from their natural sources.

Microorganisms and their enzymes are used in white biotechnology, also known as industrial biotechnology, to produce items for industry such as chemicals, polymers, pharmaceuticals, food, and energy carriers.

These renewable raw materials, as well as forestry and agricultural waste, are used in the production of industrial goods. White biotechnology is only used in industry to replace polluting technologies with non-polluting ones. This technology synthesizes easily degradable goods using live cells from mold, bacteria, plants, and yeast.

It uses less energy and produces fewer waste by-products. White biotechnology is utilized in the synthesis of metabolites, waste treatment, biocontrol agent manufacture, and bio-based fuel and energy, among other applications.

All microorganism products could eventually replace a large number of natural oil thanks to white biotechnology. Non-biodegradable paper and plastic can be substituted to a large extent with biodegradable alternatives. Who knows, maybe one day every department store will sell garments manufactured from plant waste.

White biotechnology has significant economic and environmental benefits. However, this necessitates a diverse set of applications. White biotechnology is a significant contender because of growing environmental concerns and the promise of cheaper fuel in the future.

Key Takeaways

- Market Value and Growth: By 2033, the White Biotechnology Market is expected to reach around USD 368.1 billion. Starting from USD 237.4 billion in 2023, it’s growing at a rate of 4.6% each year.

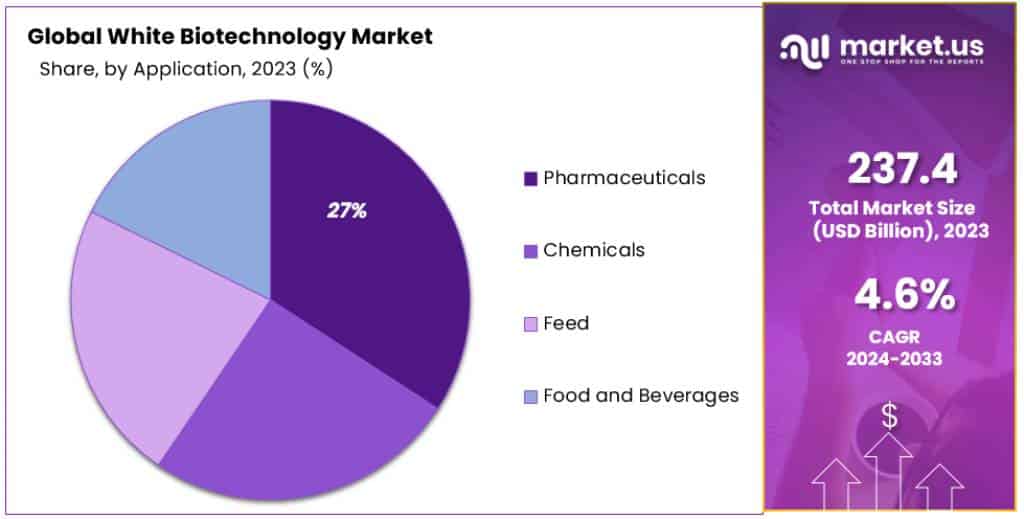

- Leading Segments: In 2023, biofuels were a big part of the market, making up over 36%. Pharmaceuticals were also significant, holding more than 27% of the market.

- Chemicals Segment on the Rise: The market for chemicals within white biotechnology is growing notably.

- Benefits in Animal Feed: White biotechnology is really important for making animal feed better in terms of nutrition.

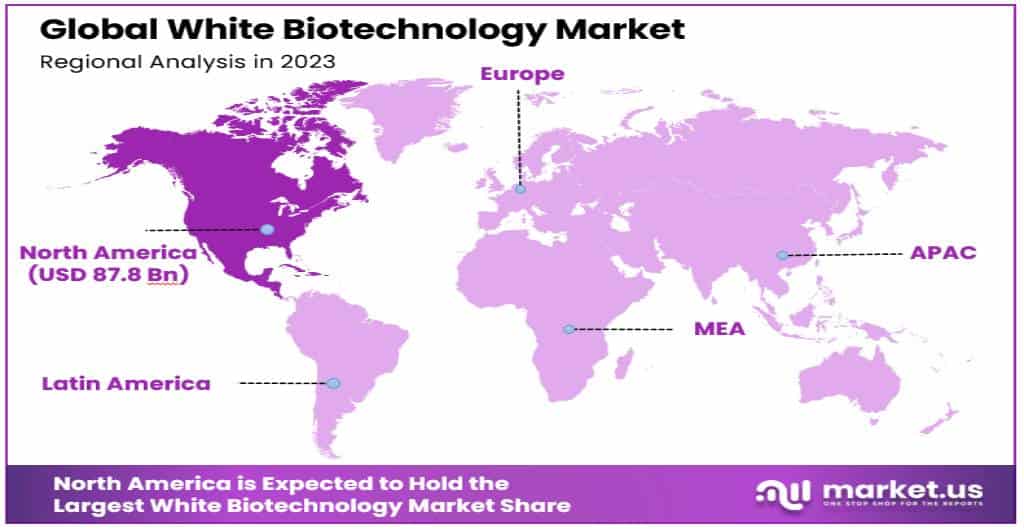

- Regional Market Leaders: North America is at the forefront, holding a 37% share of the market, valued at USD 87.8 billion in 2023. Meanwhile, the Asia-Pacific region is quickly catching up, mainly due to its need for renewable resources.

Type Analysis

In 2023, Biofuels held a dominant market position, capturing more than a 36% share. This segment’s strength is largely due to rising global demand for sustainable energy solutions. Biofuels, derived from biological processes, offer a renewable alternative to fossil fuels. Their adoption is further supported by government policies aimed at reducing carbon emissions. The market sees continuous innovation in production methods, enhancing efficiency and environmental friendliness.

The Biochemicals segment represents a significant portion of the white biotechnology market. This segment includes organic compounds produced by biotechnological processes. Key factors driving its growth include the demand for eco-friendly chemicals and the shift towards sustainable manufacturing practices. The market benefits from advancements in bioprocessing technologies, enabling the cost-effective production of high-quality biochemicals.

Biomaterials in white biotechnology are gaining traction due to their extensive applications in healthcare, such as in drug delivery systems and regenerative medicine. This market segment thrives on the increasing demand for biocompatible materials in medical implants and tissue engineering. Innovations in this field are enhancing material properties, opening new possibilities for medical applications and driving market growth.

The Industrial Enzymes segment is a dynamic part of the white biotechnology market. These enzymes, used in various industries such as detergents, food & beverage, and textiles, are valued for their specificity and eco-friendly nature. Market growth in this segment is propelled by the rising demand for sustainable industrial processes and the ongoing discovery of novel enzymes with enhanced capabilities. The segment benefits from continuous research and development efforts, aimed at improving enzyme stability and efficiency.

Applications Analysis

In 2023, Pharmaceuticals held a dominant market position in the white biotechnology market, capturing more than a 27% share. This prominence is driven by the sector’s innovative use of biotechnology in drug development and production. The segment has capitalized on the growing demand for advanced therapeutic solutions and biopharmaceuticals, bolstered by increasing global health challenges. The market is further enhanced by continuous advancements in bioprocessing technologies, leading to more efficient and high-quality pharmaceutical production.

The Chemicals segment has shown significant growth in the white biotechnology market, driven by the rising demand for sustainable and environmentally friendly chemical products. This shift towards greener chemistry practices has made biotechnological processes increasingly important, offering a viable alternative to traditional chemical synthesis. The segment benefits from innovation in biotechnological methods, contributing to cleaner and more efficient chemical production processes.

In the Feed segment, white biotechnology plays a vital role in enhancing the nutritional value and quality of animal feed. This market segment responds to the increasing demand for improved feed products, a need stemming from the expanding global livestock industry. Biotechnological advancements here are key in developing more nutritious feed additives and supplements, contributing to better animal health and productivity.

The Bioenergy segment, including biofuels, remains a significant part of the white biotechnology market. Its growth is propelled by the global shift towards renewable energy sources. The segment benefits from biotechnological innovations that have made the production of bioenergy more efficient, positioning it as a sustainable alternative to fossil fuels and strengthening its market presence.

White biotechnology’s impact in the Personal Care & Household Products segment is marked by the development of environmentally friendly and sustainable products. This segment is growing due to consumer preference for natural and bio-based products in personal care and household items. Biotechnological advancements in this area have led to the production of safer, eco-friendlier products, catering to the evolving consumer consciousness about health and the environment.

In the Food and Beverages segment, white biotechnology plays a key role in improving food quality, safety, and shelf life. This segment has seen growth driven by consumer demand for healthier, more sustainable food options. Biotechnological processes are integral in developing food additives, flavorings, and nutritional enhancements, making this segment an essential part of the white biotechnology market.

Кеу Маrkеt Ѕеgmеntѕ

By Type

- Biofuels

- Biochemicals

- Biomaterials

- Industrial Enzymes

By Applications

- Pharmaceuticals

- Chemicals

- Feed

- Bioenergy

- Personal Care & Household Products

- Food and Beverages

Drivers

- Growing Eco-Conscious Consumer Base: Consumers worldwide are increasingly aware of environmental impacts. For example, a South Korean survey found over 72% of consumers influenced by eco-friendly labels. This shift drives demand for sustainable products, boosting white biotechnology’s appeal.

- Broad Market Applications: White biotechnology’s appeal spans various industries due to its eco-friendly nature, efficient production, and low waste. Particularly in North America and Europe, there’s a strong push for green chemicals. The technology’s versatility, evident in its use for biofuels, biochemicals, and biomaterials, is a key market driver.

- Technological Advancements: Innovations in white biotechnology, especially in polymer development from biomass, offer lucrative opportunities. The technology’s application in personal care, food, coatings, and textiles accelerates market growth.

Restraints

- Agricultural Land Fertility Issues: Declining soil fertility, overuse of fertilizers, and uncertain crop yields pose challenges. For instance, the Indian Institute of Soil Science reports declining nutrient-use efficiency, affecting bio-crop production and potentially hindering market growth.

Opportunities

- Surging Demand for Bioplastics: The bioplastics market is growing rapidly, with a demand of 960,000 metric tons in 2017. Innovations like the UK’s graphene-reinforced bioplastic and consumer preferences for eco-friendly materials are major growth drivers.

- High Agricultural Yields Needs: With the world population expected to reach 9.7 billion by 2050, the need for increased agricultural yields presents an opportunity for white biotechnology, especially in developing biological pesticides and gene-edited crops.

Challenges

- Competition with Traditional Practices: Despite its benefits, white biotechnology faces competition from established chemical production methods, particularly in markets less inclined towards eco-friendly practices.

Trends

- Rising Environmental Concerns: The global push towards sustainability, driven by climate change and resource depletion, positions white biotechnology as a key player in eco-friendly industrial processes.

- Government Regulations and Incentives: Supportive policies and incentives from governments worldwide encourage the adoption of bio-based technologies, fostering market growth.

- Consumer Demand for Green Products: The trend towards sustainable consumption reinforces the shift towards white biotechnology, as consumers seek products with minimal environmental impact.

Regional Analysis

In 2023, North America dominates the White Biotechnology Market, holding a 37% share with a market value of USD 87.8 billion. This dominance is fueled by substantial government funding for research and development in white biotechnology and a growing consumer preference for green products. The diverse applications of white biotechnology across sectors like energy, food, pharmaceuticals, and feed are set to further boost the market in North America.

Asia-Pacific is witnessing a swift growth in the white biotechnology market. The demand for renewable resources in emerging economies, notably India and China, is a significant driver. The region’s abundance of raw materials for white biotechnology product manufacturing also contributes to its growth momentum.

China is particularly notable for its commitment to sustainability and technological advancements, making it a key market for white biotechnology. Strategic investments by companies like BASF Venture Capital in local firms, such as Bota Biosciences, exemplify the region’s potential. The Asia-Pacific market is marked by a strong demand for bio-products, especially in the biotech industry. In Japan, the functional food and beverage segment is increasingly focused on white biotechnology due to consumer preferences for nutritionally enhanced products.

Europe is fostering innovation in sustainable production of medicines, chemicals, materials, and energy. Investments by companies like BASF in biotech firms such as LanzaTech highlight Europe’s focus on sustainable biochemicals. The German market, in particular, is poised for rapid growth with an increasing demand for biofuel and biopharmaceutical products. This growth is underpinned by a burgeoning chemical industry seeking high-performance chemicals from renewable feedstock.

The Middle East is emerging as a significant market for white biotechnology, driven by increased government funding and innovation in biochemical products. The region’s high meat consumption rate and a growing consumer preference for natural preservatives are leading to novel product introductions in the market. Biofuels, with their environmental benefits, are attracting more industry partnerships in the Middle East.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Koninklijke DSM N.V. holds the largest market share in the White Biotechnology Market, followed by Merge Healthcare Incorporated (IBM), DuPont, Fujifilm Holdings Corporation, and GE Healthcare. BASF SE, Corbion N.V., Siemens Healthcare, Cargill, Inc., and Medtronic plc also hold significant market shares. These players are at the forefront of innovation in the White Biotechnology Market and are driving the development of new products and technologies.

Key Market Players

- Koninklijke DSM N.V.

- Merge Healthcare Incorporated (IBM)

- DuPont

- Fujifilm Holdings Corporation

- GE Healthcare

- BASF SE

- Corbion N.V.

- Siemens Healthcare

- Cargill, Inc.

- Medtronic plc

- Codman & Shurtleff

- Medallion Therapeutics

- Tricumed GmbH

- Arrow International Inc.

- Other Key Players

Recent Developments

- October 2023 – Corbion N.V. Opens New Facility: Corbion N.V. has started a new lactic acid plant in Thailand. They plan to make 100,000 tons of lactic acid yearly, used in foods, drinks, medicines, and beauty products.

- September 2023 – DuPont’s Bio-Jet Fuel Project: DuPont is working with LanzaTech to create bio-based jet fuel. They are turning waste biomass into ethanol, which then becomes jet fuel.

- August 2023 – DSM Expands Bio-Based Chemical Production: Koninklijke DSM N.V. is increasing how much bio-based succinic acid they make. This chemical is key for creating different plastics, polymers, and chemicals.

- July 2023 – Merge Healthcare (IBM) Buys Evotec SE: Merge Healthcare, part of IBM, bought Evotec SE, a German company focused on discovering new drugs. This move helps Merge Healthcare use white biotechnology to develop new medicines and treatments.

- June 2023 – Fujifilm Invests in R&D Facility: Fujifilm Holdings Corporation is putting money into a new research and development center for white biotechnology. The center will work on creating new enzymes and catalysts for various industrial uses.

Report Scope

Report Features Description Market Value (2023) USD 237.4 Billion Forecast Revenue (2033) USD 368.1 Billion CAGR (2023-2032) 4.6% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Biofuels, Biochemicals, Biomaterials and Industrial Enzymes) By Applications (Pharmaceuticals, Chemicals, Feed, Bioenergy, Personal Care & Household Products and Food and Beverages) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Koninklijke DSM N.V., Merge Healthcare Incorporated (IBM), DuPont, Fujifilm Holdings Corporation, GE Healthcare, BASF SE, Corbion N.V., Siemens Healthcare, Cargill, Inc., Medtronic plc, Codman & Shurtleff, Medallion Therapeutics, Tricumed GmbH, Arrow International Inc. Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Koninklijke DSM N.V.

- Merge Healthcare Incorporated (IBM)

- DuPont

- Fujifilm Holdings Corporation

- GE Healthcare

- BASF SE

- Corbion N.V.

- Siemens Healthcare

- Cargill, Inc.

- Medtronic plc

- Codman & Shurtleff

- Medallion Therapeutics

- Tricumed GmbH

- Arrow International Inc.

- Other Key Players